The Bus Decision: Capital Budgeting Case Study

Question

Task: The assignment is designed for students to practice the Capital Budgeting Process in project management by studying real case study.

Answer

1. Introduction

The concept of capital budgeting decisions explored in the capital budgeting case study analysis is one of the important aspects for project management methodologies. Managing investment decisions in different project phases are major challenge for the management and project management team as well. The objective of the current discussion is to the understand capital budgeting processes and associated decision-making methodologies to facilitate successful completion of the chosen project within due time. The objective of the capital budgeting processes in project management process is to maximize the output and value for the stakeholders. In the current context the bus decision: a capital budgeting case studyand creative thinking case study has been chosen for the understanding of the capital budgeting process and factors associated with the decision-making process such as cash outlays and potential business ventures.

2. Chosen case study: The bus decision: a creative thinking andcapital budgeting case study

a. Background of the capital budgeting case study

The capital budgeting case studydescribes the challengesencountered by Valley university employees living in Midtown. University employees have been travelling for 25 miles on daily basis which is quite challenging for Midtown residents. Anita Night took an initiative to introduce a commute for the employees of Valley University in order to reduce the communitive cost of traveling and carbon foot print as well. Geoff Newman, vice president of the business affairs turned down the proposal for the introduction of dedicate commute for Valley employees due to lack of expertise and financial issues. Geoff Newman came up with an alternative proposal for the purpose that is arranging a bus for Midtown to Valley Universityin association with MARTS (Midtown authority regional transit service). It is a public transit service provider and charges $1.25 per ride. The financial resource for MARTS is public funding and regional taxes which helped MARTS to run the services in subsidised rate. As per Penny Kekel, introducing dedicated bus service for Valley university would be out of regional jurisdiction due to lack of public funding constrains in the region. Subsidised rates could not be possible in this context but bus service could be introduced on for profit basis. Geoff Newman proposed a culminating fare structure for the bus service where Valley university management, MARTS controlling body and Midtown commuters would be benefited(McCartney, et al., 2016).

3. Capital budgeting process

Primarily capital budgeting is the process of investigating potential expenditures and associated investment processes for a selected project. The analysis involves situation analysis of the current finding and fund allocation and modification or disposition of the fixed assets. In the current capital budgeting case study, Midtown residents proposed a common commute for Valley university authority but the initial capital budgeting process signifies financial loss for implementing dedicated bus for Midtown commuters. There are various processes associated with the capital budgeting methodology as mentioned in the below section(De Souza & Lunkes, 2016).

|

Capital budgeting process (deploying commute for Valley university employees residing in Midtown) |

|

|

Identification of the project (generation) |

In the current scenario of capital budgeting case study, Valley university employees those are residing in Midtown, identified a major challenge associated with travelling to university premises due to distance issue. The project has been identified in this case is to deploy a dedicated commute for the Valley university employees to reduce cost and carbon foot print. |

|

Screening of the project (evaluation) |

The 1st screening or evaluation of the proposed project has been done by Valley university management and identified potential financial loss due to lack of expertise and financial constraints. The 2nd screening has been done by MARTS where a culminating fare structure has been decided for MARTS dedicated bus service for Valley employees from Midtown(McCartney, et al., 2016). |

|

Selection of the project |

A project has been selected in the current context where MARTS would be deploying a dedicated bus service from Midtown to Valley university on basis of a culminating fare structure in association with Midtown residents and Valley university.

|

|

Implementation of the project |

There are 464 staffs and 116 employees residing in Midtown. The project could be implemented after the analysis of the daily demand and possible bus services from Monday to Friday. |

|

Performance review of the project |

Based on the capital budgeting techniques deployed in current project identified from the capital budgeting case study, the factual performance could be measured with the project output for adjustments and maximizing value(Malenko, 2019). |

a. Cost structure

A cost structure in the current context of capital budgeting case study could be determined based on fixed and variable costs associated with the establishment of commute from Midtown to the University premises. For the understanding of the cost projection, there are various methodologies could be deployed in the current context such as determination of payback period for the deployment of the establishment of the bus route from Midtown to university(Kengatharan, 2016).

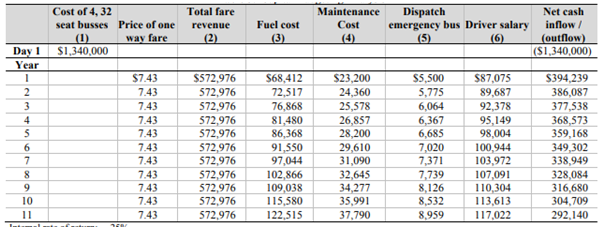

Figure 1: cost and cash flow for the capital budget analysis for the current project (McCartney, et al., 2016)

Fixed cost: the fixed cost in the current project is $134000 which is the cost of four buses at initial phase of the project initiation.

Variable cost: there are four major variable costs associated with the current project that is fuel cost, maintenance cost, dispatch of emergency bus and driver salary. The above-mentioned table describe projected variable costs from project initiation till end of 11th year(Schönbohm & Zahn, 2016).

4. What are the factors affecting decision beside the costfrom the given capital budgeting case study?

There are various factors affecting the decision-making process considering the readings of capital budgeting case study as mentioned in below table.

|

Factors |

deploying commute for Valley university employees residing in Midtown |

|

Availability of the funds |

MARTS investing $134000 for four buses at initial phase and due to lack of public funding a reasonable fare has been decided for profit and project objectives (McCartney, et al., 2016) |

|

Management decision |

Management decision has been taken based on capital budgeting analysis methodologies such as cash payback, net present value, and internal rate of return. |

|

Taxation policy |

MARTS considered the local taxation policy as it has been running by tax dollars and public fund allocation for subsidised commute(Graham & Sathye, 2017). |

|

Significance of the project |

The project has a huge significance in case of controlling cost due to huge distance that has been covered by Valley university staffs and students residing in Midland and to reduce carbon footprint.

|

|

Economic valuation of the project |

The project has 25% internal rate of return whereas the net present value for this project is $ 2456. The payback period for the project is 4 years which signifies economic value of the project(Batra & Verma, 2017) |

a. Managerial considerations

The objective of the current project discussed in the capital budgeting case study is to provide commute from Mainland to Valley University with a reasonable fare. The decision-making process involved

a. Accepting/ rejecting decision making process:

The acceptance or rejection process depends upon capital budgeting analysis of the current project. The capital budgeting analysis output helps MARTS to determine the project viability and financial output in long term perspective(Schönbohm & Zahn, 2016).

b. Mutually taken project decision:

In the current scenario, MARTS, Valley University and staffs residing in Midland decided upon a culminating fare for the Valley university staffs commuting from Midland to the university premises.

c. Rationing decision making based on capital funding:

MARTS restricted the decision-makingprocess as the commute fund allocation is linked to public funding and dollar tax. In the present scenario, the funding allocation is restricted due to jurisdiction issue. The final decision is based on the above-mentioned fact and decided upon a culminating fare(Lima, et al., 2017).

b. Complications

There is various complication associated with the current project which has been arise due to below mentioned complexities basis the given capital budgeting case study.

Project specific complication: MARTS could encounter project specific complications due to jurisdiction issues associating taxes, compliances and fare structure in comparison with regional fare structure(McCartney, et al., 2016).

Complication due to cash flow: the estimated cash could be altered due to variation in change in commuter’s number, increasing demand and rapid variation in fuel value or taxes. Complications due to time horizon: the project estimation, cash flow has been developed by MARTS on the basis of current valuation and scenario which could be varied with time due to significant delay in project process(Lima, et al., 2017).

5. Critical review and evaluation on capital budgeting case study:

Payback period: the payback period helps to determine the payback period for the investment amount for the current project. The payback period for MARTS to implement the project is 4 years.

The cash flow and cost structure has been projected in the above picture for four-year span which shows positive outcome in case of implementing commute from Midland to university.

The cost structure of the current project is based on variable costs such as fuel cost, maintenance cost, dispatching emergency cost and driver costs. There is a fix cost of four buses that is $134000 and net cash flow has been presented in the above-mentioned table within the capital budgeting case study analysis. Internal rate of return: the internal rate of return for the current project is 25% that is IRR is more than cost of project in this case. As per theory of capital budgeting, in any case when the IRR is more than cost of capital the project has viability and that could be implemented successfully(McCartney, et al., 2016).

Net present value: In case of capital budgeting methodology, evaluation of the project is accurately determined by net present value. A positive NPV presents acceptability of the project. The NPV for the current project is $ 2456 which shows a positive value for MARTS and hence approved the acceptability of the project that has been proposed by Valley University and Midland residents(Kengatharan, 2016).

6. Conclusion

a. Findings

There are major findings associated with the current project as mentioned in below section of capital budgeting case studyanalysis that has been acquired from capital budgeting analysis of the current project

Payback period: 4 years

Internal rate of return: 25%

Net present value: $ 2456

b. Recommendations

- Considering the various aspects of capital budgeting case study, it is recommended that deployment of an extra bus would increase the internal rate of return and Net present value for the current project.

- Deployment of extra bus would increase the life span for rest of the buses which would contribute to value generation for the stakeholders.

7. References

Batra, R. & Verma, S., 2017. Capital budgeting practices in Indian companies. Capital budgeting case studyIIMB Management Review, 29(1), pp. 29-44.

De Souza, P. & Lunkes, R. J., 2016. Capital budgeting practices by large Brazilian companies. Contaduría y Administración, 61(3), pp. 514-534.

Graham, P. J. & Sathye, M., 2017. Does national culture impact capital budgeting systems?. Australasian Accounting, Business and Finance Journal, 11(2), pp. 43-60.

Kengatharan, L., 2016. Capital budgeting theory and practice: a review and agenda for future research. Applied Economics and Finance, 3(2), pp. 15-38.

Lima, A. C., da Silveira, J. A. G., Matos, F. R. N. & Xavier, A. M., 2017. A qualitative analysis of capital budgeting in cotton ginning plants. Qualitative Research in Accounting & Management.

Malenko, A., 2019. Optimal dynamic capital budgeting. The Review of Economic Studies, 86(4), pp. 1747-1778.

McCartney, M. W., Pierce, E. M. & Mackie, W., 2016. The Bus Decision: A Case Study Employing Capital Budgeting And Creative Thinking. Journal of Business Case Studies (JBCS), 12(4), pp. 169-176.

Schönbohm, A. & Zahn, A., 2016. Reflective and cognitive perspectives on international capital budgeting. Capital budgeting case studycritical perspectives on international business.