Taxation law assignment: Case Analysis of Dominic

Question

Task:

Mr Dominic Supreme owns a pizza restaurant. However, for public health reasons he has now closed the

restaurant side of the business and is currently operating on a takeaway basis only. He has several employees

working in the kitchen and delivering pizzas. He also owns various assets, including a rental property.

Enzo is Dominic’s head chef and he is provided with the use of a Toyota RAV4 motor car as well as his salary of

$100,000 per year. The car was purchased by Dominic on 1 April 2018 for $55,000. Dominic has not made the

election under section 10 of the Fringe Benefits Tax Assessment Act. Enzo travelled 10,000 km in the car during

the FBT year ended 31 March 2019 and, of this, 4,000 km were for business purposes. Enzo paid for the petrol

for the car and this amounted to $900 for the FBT year ended 31 March 2019. Enzo was not reimbursed for the

petrol.

Maria is Dominic’s store manager and she was given an interest free loan of $500,000 by Dominic on 1 January

2019. Maria used the loan for two purposes: 60% for the purchase of an investment property and 40% to pay

off her home mortgage.

Because of the current health crisis, Dominic pays the private health insurance premiums of all his staff and

these premiums were $55,000 for the year ended 31 March 2019.

Dominic purchased a rental property on 1 July 2018 for $1,200,000. To finance this purchase, he borrowed $1

million from Megabank at an interest rate of 5%. To arrange for the loan Dominic paid a total of $4,000 for a

loan application fee, a valuation fee and legal fees on 1 July 2018. He also paid stamp duty of $52,000 and

$3,200 in legal fees in connection with the purchase of the property.

In August 2018 Dominic fixed the door to the rental property which was broken at the time of his purchase for a

cost of $900. He also purchased new refrigerator for the rental property of $3,000 on 1 November 2018. The

useful life of the refrigerator is 10 years. Dominic replaced the entire roof of the rental property in October

2018 at a cost of $35,000 after it was severely damaged in a hailstorm in September 2018. He used substantially

the same type of material that was there before.

On 10 June 2019 he sold the rental property for $1,500,000. The costs he incurred on the sale were $30,000 for

real estate agent’s commission and $2,000 for advertising. He also sold the refrigerator on 10 June 2019 for

$2,000. With the proceeds of the property sale, Dominic repaid his loan from Megabank on the date of sale.

Dominic purchased some BHP Billiton Limited shares in May 1990 for $50,000 and then sold them in May 2019

for $100,000. He purchased an antique clock for $600 in June 2000 and sold it in June 2019 for $4,000. Dominic

also sold his Mercedes sports car in April 2019 for $60,000 which he purchased in April 2001 for $20,000.

Dominic wants to maximise his deductions at all times. Assume that Dominic can claim GST input tax credits for

the provision of all fringe benefits he provides apart from the loan.

Required:-

Part 1 (10 marks)

What fringe benefits tax (FBT) must Dominic pay for the year ended 31 March 2019?

Part 2 (10 marks)

What is Dominic’s net capital gain or net capital loss for the year ended 30 June 2019?

Part 3 (10 marks)

What income tax deductions can Dominic claim for the year ended 30 June 2019?

Answer

Part 1

As per ss. 136 -1 considered in this taxation law assignment, fringe benefits are defined as non-cash benefits which are extended from the employer to employee but are meant for personal use of the employee. The appropriate tax treatment of the resultant benefits is carried out as per Fringe Benefit Tax Assessment Act 1986 (FBTAA 1986). The taxation burden for these benefits provides on the employer and not the employee despite the benefit being derived by the latter (Woellner, Barkoczy and Murphy, 2020).

Car Fringe Benefit (Division 2)

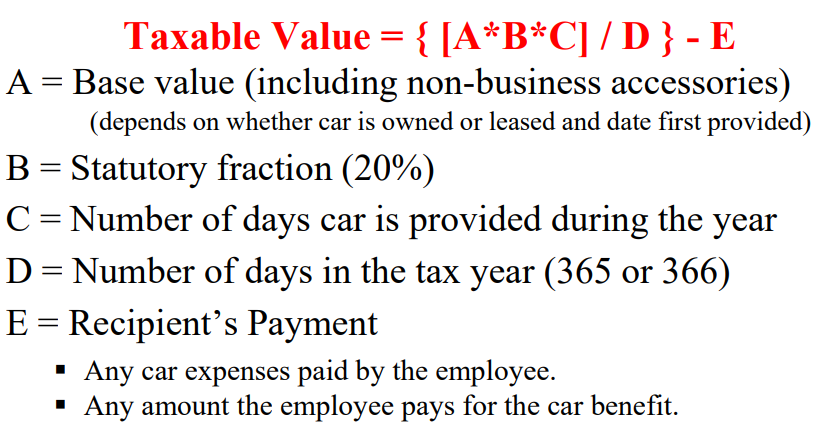

The head chef Enzo has been provided car by employer whose use is not restricted to profession use and allows personal use thereby resulting in Car Fringe Benefit (CFB). Even though it is discussed in this taxation law assignment that there are two methods to compute taxable value, the statutory approach under s. 9 has been considered for this since s. 10 approach has been ignored by Dominic as per the information provided (Austlii, 2020).

Here, A = $ 55,000, B =0.2, C = 365, D = 365, E = $ 900

CFB taxable value as per s. 9 = [0.2*$55,000*(365/365)] - $900 = $10,100

The applicable gross up value would be 2.0802 considering car is Type 1 good while FBT rate is 47%.

FBT payable by Dominic = $10,100*2.0802 *0.47= $9,874.70

Loan fringe benefit (Division 4)

The loan taken by Maria has been given at zero interest rate by Dominic. However, the minimum interest rate charged should have RBA rate of 5.2% for 2018-2019. The interest savings realised by Maria reflects Loan Fringe Benefits (LFB). Also, it is noticeable in this taxation law assignment that only 40% of the loan amount is for personal use by Maria and the remaining 60% is for investment. Thus, based on otherwise deductible rule, the LFB would be computed only on 40% of the total loan (Austlii, 2020).

The duration of loan is 90 days and interest over this period has been saved in 2018-2019 period.

LFB taxable value = 0.4*$500,000*(5.20%)*(90/365) = $2,564.38

The applicable gross up value would be 1.8868 considering loan is Type 2 good while FBT rate is 47%.

FBT payable by Dominic =$2,564.38 *1.8868*0.47 = $2,274.09

Expense payment fringe benefit

Expense of private nature ought to be borne by the employees themselves. However, it is stated in this taxation law assignment that Dominic has paid insurance for all employees thereby resulting in expense payment fringe benefit (EFB). In accordance with s. 23 FBTAA 1986, the taxable value of EFB is the amount of expenditure that is done by the employer (Austlii, 2020).

The applicable gross up value would be 2,0802 considering health insurance premium is Type 2 good while FBT rate is 47%.

FBT payable by Dominic = $55,000*2.0802*0.47 = $53,773.17

Dominic FBT liability for 2018-2019 = CFB + LFB + EFB =$9,874.70 + $2,274.09+ $53,773.17 = $65,921.26

Part 2

For the 2018-2019 tax year, Dominic has liquidated a host of assets which would lead to A1 CGT event and require computation of any potential capital gains or losses consequences.

Rental property

Based on the various elements of cost base highlighted in s. 110-25 ITAA 1997, the cost base computation is shown below within this taxation law assignment (Gilders et. al., 2014).

- Purchase price of the property = $ 1,200,000. (1st element)

- Incidental costs while property purchase = $52,000 (stamp duty) +$3,200(legal fees) = $55,200 (2nd element)

- Overhead costs for loan issuance = $4,000 (3rd element)

- Initial repairs to property = $ 900 (4th element). This is capital cost as has been explained in TR 97/23 which segregates it from normal repairs.

Incidental costs while property sale = $ 2,000 (Advertising) + $30,000(Commission of agent) = $32,000 (2nd element)

Interest on mortgage for period in 2018-2019 = $1,000,000*(345/365)*5% = $47,260.27 (3rd element)

Total cost base of underlying asset = $ 1,200,000 + $55,200 + $32,000 + $4,000 + $47,260.27 + $ 900 = $1,339,360.27

Selling price of underlying asset = $ 1,500,000

Hence, as per s. 105-10 ITAA 1997, capital gains = $1,500,000 - $1,339,360.27 = $160,639.73

No concession on the above capital gains is available under Division 115 since holding period of property is not atleast one year (Woellner, Barkoczy and Murphy, 2020).

Refrigerator

Capital gains/(losses) on this asset = Selling price – Book value at sale

Book value at sale = Purchase price – Decline in value

The decline in value on refrigerator would be computed using the s. 40-75 prime cost method. For the refrigerator, useful life is 10 years, base value is $ 3,000 and days of ownership are 222.

Hence, it is calculated in this taxation law assignment that refrigerator related decline in value = $3,000*(222/365)*(100%/10) = $182.47

Book value at sale = $3,000 - $182.47 = $2,817.53

As the selling price ($2,000) is lower than book value, hence capital loss to the tune of $ 817.53 would arise on liquidation of this asset (Deustch et. al., 2013).

BHP Billiton shares

Capital gains derived from sale of shares = Sale price – Purchase price = $100,000 - $ 50,000 = $50,000

Since, the shares were bought in 1990 and sold in 2019, hence ownership period is more than 1 year which implies that s. 115-25 ITAA 1997 deduction of 50% is applicable here (ATO, 2019).

Thus, taxable capital gains arising from shares = (1/2)* $50,000 = $ 25,000

Antique

For capital losses or gains arising from antique to be considered, the purchase price needs to meet a minimum threshold of $500 as per s. 118-10 ITAA 1997 (Woellner, Barkoczy and Murphy, 2020). The antique sold by Dominic fails to meet this and therefore no implications of the sale for taxation.

Sports Car

For capital losses or gains arising from sale of cars, these are always ignored from CGT perspective in line with s. 118-5 ITAA 1997 (Gilders et. al., 2014). The sale of sports car by Dominic would have no implication for taxation.

Capital gains derived by Dominic which would be levied CGT = $160,639.73 + $25,000 - $817.53 = $184,821. 20

PART 3

The taxation law assignment examines that one key deduction which Dominic is eligible for is with regards to the input tax credit which he would derive on account of GST paid during the purchase of the car and also the health insurance premium for the employers (Deutsch et. al., 2013).

Another deduction which Dominic could avail is the decline in value on the refrigerator before it was liquidated. The decline in value amounts to $182.47 and would attract a tax deduction under general deduction clause (s8-1 ITAA 1997) since the refrigerator has been used in rent income generation (Woellner, Barkoczy and Murphy, 2020).

Also, Dominic has incurred an expense of $ 35,000 for roof replacement. The key aspects to note in this part of taxation law assignment is that roof have been replaced after getting damaged and there has not been any change in character and efficiency even by replacement. As a result, with reference to TR 97/23, the underlying expense would be revenue expense and categorised as repair. This would imply full deduction for this amount in tax returns of 2018-2019 for Dominic as per s. 25-10 TIAA 1997 (Gilders et. al., 2014).

References

Austlii (2020), FRINGE BENEFITS TAX ASSESSMENT ACT 1986, [Online] Available at http://classic.austlii.edu.au/au/legis/cth/consol_act/fbtaa1986312/

Austlii (2019), Income Tax Assessment Act 1997, Sect 115-25, [Online] Available at http://www5.austlii.edu.au/au/legis/cth/consol_act/itaa1997240/s115.25.html

Deutsch, R., Freizer, M., Fullerton, I., Hanley, P., and Snape, T. (2013), Australian tax handbook 8th ed., taxation law assignment Pymont: Thomson Reuters,

Gilders, F., Taylor, J., Walpole, M., Burton, M. and Ciro, T. (2014), Understanding taxation law 2014, 9th ed., Sydney: LexisNexis/Butterworths,

Woellner, R, Barkoczy, S and Murphy, S (2020), Australian Taxation Law 2020, Melbourne.: Oxford University Press