Tahlia And Newcastle Financial Statement Assignment

Question

Task:

PART A

Tahlia Corporation is one of the prominent and fastest-growing event management

company based in Sydney, Australia. This company has clients from Australia, Hong

Kong, U.S.A, Singapore, England, Malaysia, Russia and Europe. In 2019, this company

appointed Miss Tahlia as the CEO of Tahlia Corporation to look after the business. Tahlia

has appointed you as the company's chief financial officer (CFO) to look after the

company's financial matters and help Tahlia to make strategic decisions. As per the

corporation act 2001, this company is required to comply with Australian accounting

standards. Hence, Tahlia called for a business meeting with you to discuss the financial

compliance matters with you. As a CFO, you have advised the Tahlia that to comply with

accounting standards, the company is required to prepare a complete set of financial

statement which includes a statement of financial performance, statement of change of

equity, statement of financial position, statement of cash flows as well as notes to the

accounts. The CEO (Thalia) questions the usefulness of the cash flow statement as she

has stated that all she needs to know is if the company has made a profit and has a healthy

balance sheet. However, Tahlia has asked you prepare a full set of financial statements

including the statement of cash flows. After you prepare the cash flows statement, it

revealed a poor cash position, whereas the statement of financial performance was

showing a profitable result for the year. The CEO restated his opinion that the cash flow

statement did not give a good indication of the activities of the company. Tahlia also

heavily depends on statement of financial position and statement of financial performance

to make most of her business decisions.

Required:

1. Prepare a response (no more than 500 words) for Tahlia (CEO) explaining the

purpose and usefulness of the cash flow statement and why it can report a negative

cash flow position while the company is making a profit. (6 Marks)

2. Write a report (no more than 300 words) to the CEO about the limitation of a

statement of financial position and financial performance as a source of

information for users of general-purpose financial statements (discuss at least two

major limitations in your report (4 marks).

PART B

Newcastle Ltd, has been manufacturing and selling swimming suits for men and women for the

last two years. The company commenced its operations on 1 July 2018 by issuing 350 000, $5

shares fully paid. There was no other cost related to the share issue.

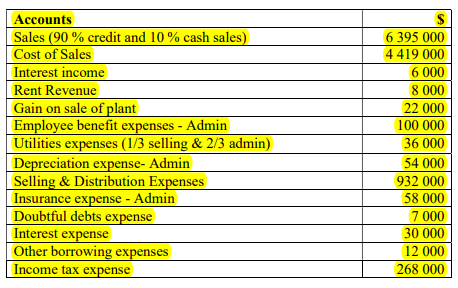

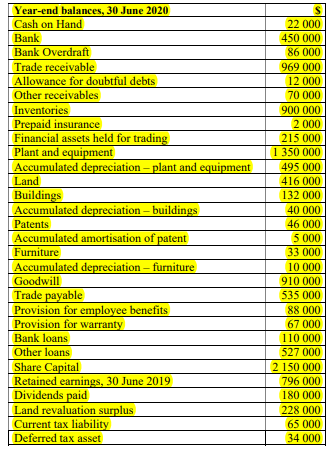

For the year ending 30 June 2020, the company recorded the following aggregate transactions:

The following additional information was noted during the preparation of financial statements

for the year ended 30 June 2020:

• Additional 80 000 @ $5 fully paid shares were issued On 1 July 2019.

• A cash dividend of $180 000 was declared and paid during the 2020 financial year

and a final dividend for 2020 of $75 000 was proposed but not recognised in the

financial statements.

• Inventory was measured at the lower of cost and net realizable value.

• Buildings, plant and equipment were measured at cost. The benefits were expected to

be received evenly over the useful life of the asset.

• Land was revalued upward by $100 000 (related income tax for this transaction was

$30 000). The revaluation gain will not be reclassified and has been recorded in the

'Land Revaluation Surplus'. The valuation was conducted by the registered valuer,

Abbey Valuations Pty Ltd.

• Financial assets held for trading are equity investments that are held for the purpose of

selling and short-term profit taking.

• $127 000 of other loans are repayable within six months. The remaining amount is

payable in full at the end of 2022

• $30 000 of bank loans are repayable within one year. The remaining amount is payable

in full at the end of 2024.

• The provision for employee benefits includes $47 000 payable within one year.

• The warranty provision is in respect of a 12-month warranty given on certain goods

sold.

• The bank loan is for 5 years and repayable in full at the end of the term. The interest

rate is 9% and it is secured over the land.

• Newcastle Ltd uses the single statement format for the statement of profit or loss and

other comprehensive income and classifies expenses by function within the statement.

Summarised account balances are provided below:

Required:

For the year ending 30 June 2020 (Note: comparative financial statements are not required),

1. Using the pro forma table supplied in appendix B, prepare a preliminary trial balance for

Newcastle Ltd; (5 Marks)

2. Prepare a statement of comprehensive income for Newcastle Ltd in accordance with the

requirements of AASB 101. Newcastle Ltd uses the single statement format for the

statement of profit or loss and other comprehensive income and classifies expenses by

function within the statement; (15 marks)

3. Prepare a statement of changes in equity for Newcastle Ltd in accordance with the

requirements of AASB 101; (8 marks)

4. Prepare a statement of financial position for Newcastle Ltd in accordance with AASB

101. Use the current/non-current presentation format; (12 marks)

5. Prepare appropriate notes to the accounts. (You do not need to prepare notes related to

income taxes. Include the following note as note 1. You may optionally add accounting

policies to this note): (20 marks).

"1. Summary of significant accounting policies

Basis of accounting

The financial report is a general-purpose financial report which has been prepared on the

historical cost basis, except where stated otherwise.

Statement of Compliance

The financial statements have been prepared in accordance with the requirements of the

Corporations Act, Australian Accounting Standards which include Australian equivalents

to International Financial Reporting Standards (AIFRSs) and AASB Interpretations.

Compliance with AIFRSs ensures the financial statements and notes comply with

International Financial Reporting Standards"

6. After preparing and analysing the Newcastle Ltd.'s financial statements, prepare a brief

report (no more than 500 words) for the CEO explaining the company's financial

performance and position. (5 marks)

7. Many investors as well as public are now concerned about organisation's social and

environmental impacts. Therefore, more and more organisations are now providing various

social and environmental information. Tahlia has asked you to identify what types of social

and environmental information Newcastle ltd should provide to their stakeholders? Identify

five important types of social and environment information/indicators (such as "Total

amount of GHG emissions") related Newcastle Ltd and explain briefly the reason for

selecting each of them (no more than 500 words).

Answer

PART A

1. The usefulness of the Cash Flow for Tahlia Corporation: The concept of cash Flow Statement discussed in the present financial statement assignment shows the cash utilization of the organization. It bi-furcates the inflow and outflow of cash between the cash flow from Operational Activities, Investing Activities, and Financing Activities. Thus cash flow shows from which activities of the company the cash has been generated and from which cash has been utilized (Carlon 2019).

The cash flow statement assumes a place of vital importance in financial statement because functioning of any company needs sufficient amount of cash balance is required. The low cash balance or negative cash balance shows the liquidity position of the company and its ability to meet its regular expenses, loans, taxes, and other investment activities. The cash flow statement helps in cash planning and supports all other activities of the organization.

As per the investigation conducted on this financial statement assignment, the cash flow statement does not have much importance in the small concern as the non-cash transactions in such an organization are less and not material. The preparation of cash flow statements involves time and cost which the small organization is not willing to incur. Whereas on the other hand, the preparation of the cash flow statement becomes vital for a big organization as it involves more amount of non-cash transactions, and analysis of the same becomes necessary for the smooth running of the business (Deegan 2016). The organizations having a large number of credit sales than the income statement will show the revenue but cash flow will show the real receipt of cash and the actual position of the company.

Thus, it is clear on this financial statement assignment that with the cash flow statement, the company can maintain the optimum level of the cash balance that is if any excess cash is available than investment may be done and in case of shortage of cash proper arrangement for cash should be done.

The company might profit but still there can be an involvement of negative cash flow because income statement and cash flow is prepared using different principles. The income statement is prepared using accrual concept and cash flow is prepared using actual position. Thus income statement involves items that are not earned or paid but becomes due in the current year but cash flow involves only those transactions which are already paid or received (Deegan 2016). The example of negative cash flow with profit provided in the financial statement assignment is the existence of credit sales, investment in fixed assets, repayment of debentures or loans, etc. This transaction does not affect the income statement but involves the outflow of cash from the organization leading to negative cash flow. This helps to plan future expansion and growth of the organization and how and from were to finance the investment activities of the company.

- Limitation of Statement of Financial Position and Financial Performance.

The financial position and financial performance statement both are prepared on an accrual basis and are very useful for various stakeholders for various decision making purpose. This also has some limitations for the user as discussed below within this financial statement assignment.

The financial statement does not involve nonfinancial matters. The nonfinancial matters involve the impact of the operations of the business in the environment, local community development, work culture of the company, etc. This impacts the long-run profitability of the company and has gained importance in recent years (Edwards 2018).

Another point mentioned in the financial statement assignment is that the financial statements are more likely to be manipulated and window dressed as per the needs of the management. The chances of fraud are higher and to curb this regular audits are done and various other regulatory restrictions are being imposed (Herz 2016).

It is prepared based on the historical cost concept and most of the assets are measured at their cost price and the actual current value may much high or low than the reported amount thus the actual picture of the items of the balance sheet is not there. The reports are also prepared for a specific period and thus any exceptional item during the year may change the whole statement does not give a true and fair view of the financial statements (Edwards 2018).

The finances of different companies are generally not comparable as different accounting practices are followed by companies in different geographical areas and industries.

Thus various steps are being taken to combat this drawback and reduce its limitation so that the confidences of the various stakeholders are still kept on such statements and important decisions can be taken based on it.

PART – B of Financial statement assignment

- Preliminary trial balance

|

Newcastle Ltd - Trial Balance as at 30 June 2020 |

||

|

Accounts |

DR ($) |

CR ($) |

|

Sales |

6395000.00 |

|

|

Interest income |

6000.00 |

|

|

Gain on sale of plant |

22000.00 |

|

|

Rent revenue |

8000.00 |

|

|

Cost of sales |

4419000.00 |

|

|

Employee benefit expenses- Administration |

100000.00 |

|

|

Depreciation expense - Administration |

54000.00 |

|

|

Selling & Distribution expenses |

932000.00 |

|

|

Insurance expenses |

58000.00 |

|

|

Doubtful debts expense |

7000.00 |

|

|

Interest expense |

30000.00 |

|

|

Utilities expenses |

36000.00 |

|

|

Other borrowing expenses |

12000.00 |

|

|

Income tax expense |

268000.00 |

|

|

Bank Overdraft |

86000.00 |

|

|

Cash on hand |

22000.00 |

|

|

Bank |

450000.00 |

|

|

Trade receivable |

969000.00 |

|

|

Allowance for doubtful debts/ impairment |

12000.00 |

|

|

Other receivables |

70000.00 |

|

|

Inventories |

900000.00 |

|

|

Prepaid insurance |

2000.00 |

|

|

Land |

416000.00 |

|

|

Buildings |

132000.00 |

|

|

Plant and equipment |

1350000.00 |

|

|

Furniture |

33000.00 |

|

|

Accumulated depreciation – plant & equipment |

495000.00 |

|

|

Accumulated depreciation – buildings |

40000.00 |

|

|

Accumulated depreciation – Furniture |

10000.00 |

|

|

Patents |

46000.00 |

|

|

Accumulated amortisation of patent |

5000.00 |

|

|

Goodwill |

910000.00 |

|

|

Financial assets held for trading |

215000.00 |

|

|

Bank loans |

110000.00 |

|

|

Other loans |

527000.00 |

|

|

Accounts payable -Trade |

535000.00 |

|

|

Provision for employee benefits |

88000.00 |

|

|

Provision for warranty |

67000.00 |

|

|

Current tax liability |

65000.00 |

|

|

Deferred tax asset |

34000.00 |

|

|

Retained earnings, 30 June 2019 |

796000.00 |

|

|

Dividends paid |

180000.00 |

|

|

Land revaluation surplus |

228000.00 |

|

|

Share capital |

2150000.00 |

|

|

Totals |

11645000.00 |

11645000.00 |

- Statement of comprehensive income for Newcastle Ltd provided in the financial statement assignment

|

Newcastle Ltd |

||

|

Statement of Comprehensive Income |

||

|

For the year ended 30th June 2020 |

||

|

Particulars |

Notes |

Amount ($) |

|

Revenue |

6395000.00 |

|

|

Cost of Sales |

4419000.00 |

|

|

Gross Profit |

1976000.00 |

|

|

Other Income |

8 |

36000.00 |

|

Distribution Costs |

9 |

944000.00 |

|

Administrative Expenses |

10 |

243000.00 |

|

Finance Costs |

11 |

42000.00 |

|

1229000.00 |

||

|

Profit before Tax |

783000.00 |

|

|

Income Tax Expense |

268000.00 |

|

|

Profit for the Year |

515000.00 |

|

|

Other Comprehensive Income |

||

|

Items not to be Classified to Profit or Loss: |

||

|

Gains on Property Revaluation |

100000.00 |

|

|

Income Tax relating to item that will not be classified |

-30000.00 |

|

|

Provision for Warranty |

-67000.00 |

|

|

Provision for Employee Benefits |

-47000.00 |

|

|

-44000.00 |

||

|

Items to be Classified to Profit or Loss: |

||

|

Financial Asset held for Trading |

-215000.00 |

|

|

Other Comprehensive Income for the Year |

-259000.00 |

|

|

Total Comprehensive Income for the Year |

256000.00 |

|

- Statement of changes in equity for Newcastle Ltd

|

Newcastle Ltd |

|||

|

Statement of Changes in Equity |

|||

|

For the year ended 30th June 2020 |

|||

|

Particulars |

Share Capital |

Retained Earnings |

Total |

|

As at 01st July 2019 |

1750000.00 |

796000.00 |

2546000.00 |

|

Issued during the year |

400000.00 |

400000.00 |

|

|

Profit during the year |

515000.00 |

515000.00 |

|

|

Dividend paid during the year |

-180000.00 |

-180000.00 |

|

|

Dividend payable for the year |

-75000.00 |

-75000.00 |

|

|

As at 30th June 2020 |

2150000.00 |

1056000.00 |

3206000.00 |

- Statement of financial position for Newcastle Ltd provided in the financial statement assignment

|

Newcastle Ltd |

||

|

Statement of Financial Position |

||

|

For the year ended 30th June 2020 |

||

|

Particulars |

Notes |

Amount ($) |

|

ASSETS |

||

|

Non Current Assets |

||

|

Property, Plant and Equipment |

2 |

1386000.00 |

|

Intangible Assets |

3 |

951000.00 |

|

Deferred Tax Asset |

34000.00 |

|

|

TOTAL NON CURRENT ASSETS |

2371000.00 |

|

|

Current Assets |

||

|

Cash and Cash Equivalents |

4 |

472000.00 |

|

Trade and other receivables |

5 |

1027000.00 |

|

Inventories |

900000.00 |

|

|

Prepaid Insurance |

2000.00 |

|

|

Financial Asset held for Trading |

215000.00 |

|

|

TOTAL CURRENT ASSETS |

2616000.00 |

|

|

TOTAL ASSETS |

4987000.00 |

|

|

EQUITY AND LIABILITIES |

||

|

Capital and Reserves |

||

|

Share Capital |

2150000.00 |

|

|

Retained Earnings |

1056000.00 |

|

|

Land Revaluation Surplus |

228000.00 |

|

|

TOTAL CAPITAL AND RESERVES |

3434000.00 |

|

|

Non Current Liabilities |

||

|

Long Term Debts |

6 |

480000.00 |

|

Provisions |

7 |

41000.00 |

|

TOTAL NON CURRENT LIABILITIES |

521000.00 |

|

|

Current Liabilities |

||

|

Current Tax Liability |

65000.00 |

|

|

Dividend Payable |

75000.00 |

|

|

Bank Overdraft |

86000.00 |

|

|

Trade Payable |

535000.00 |

|

|

Provisions |

7 |

114000.00 |

|

Long Term Debts |

6 |

157000.00 |

|

TOTAL CURRENT LIABILITIES |

1032000.00 |

|

|

TOTAL EQUITY AND LIABILITIES |

4987000.00 |

|

- Appropriate notes to the accounts.

|

Newcastle Ltd |

||

|

Notes to Account |

||

|

For the year ended 30th June 2020 |

||

|

Note 1 : Summary of Significant Accounting Policy |

||

|

Basis of Accounting |

||

|

The financial report is a general purpose financial report which has been prepared on the historical cost basis, except where stated otherwise. |

||

|

Statement of Compliance |

||

|

The financial statement has been prepared adhering to the Corporation Act, AAS and other interpretations of AASB. |

||

|

Measurement of Inventories |

||

|

Inventory was measured at the lower of cost and net realizable value. |

||

|

Note 2 : Plant, Property and Equipment |

||

|

Particulars |

Amount |

Amount |

|

Land |

||

|

(Land is charged against the Bank Loan of the company) |

||

|

(Land was revalued upward by $100 000. The valuation was done by the registered valuer, Abbey Valuation Pty Ltd.) |

416000.00 |

416000.00 |

|

Building |

132000.00 |

|

|

Accumulated Depreciation |

-40000.00 |

92000.00 |

|

Plant and Equipment |

1350000.00 |

|

|

Accumulated Depreciation |

-495000.00 |

855000.00 |

|

Furniture |

33000.00 |

|

|

Accumulated Depreciation |

-10000.00 |

23000.00 |

|

TOTAL |

1386000.00 |

|

Note 3 : Intangible Assets |

||

|

Particulars |

Amount |

Amount |

|

Goodwill |

910000.00 |

910000.00 |

|

Patents |

46000.00 |

|

|

Accumulated Amortisation |

-5000.00 |

41000.00 |

|

TOTAL |

951000.00 |

|

Note 4 : Cash and a Cash Equivalents |

||

|

Particulars |

Amount |

Amount |

|

Cash in Hand |

22000.00 |

|

|

Bank |

450000.00 |

472000.00 |

|

TOTAL |

472000.00 |

|

Note 5 : Trade and Other Receivables |

||

|

Particulars |

Amount |

Amount |

|

Trade Receivables |

969000.00 |

|

|

Allowance for Bad Debt |

-12000.00 |

957000.00 |

|

Other Receivables |

70000.00 |

70000.00 |

|

TOTAL |

1027000.00 |

|

Note 6 : Long Term Debts |

||

|

Particulars |

Amount |

Amount |

|

Bank Loans |

80000.00 |

|

|

( Total bank loan outstanding $110 000 out of which $30 000 is payable witin 12 months and rest at the end of 2024.) |

||

|

(Bank Loan is for the period of 5 years, repaybale full at the end of the term. The interest rate is 9 % and secured over the Land) |

||

|

Other Loans |

||

|

( Total loan amount outstanding $ 527 000 out of which $ 127 000 is payable within 6 months and remaining payable at the end of 2022 ) |

400000.00 |

480000.00 |

|

TOTAL |

480000.00 |

|

Note 7 : Provisions |

||

|

Particulars |

Amount |

Amount |

|

Provision for Employee Benefit |

||

|

Payable within one year |

47000.00 |

|

|

Payable after one year |

41000.00 |

88000.00 |

|

Provision for Warranty |

||

|

(In respect of 12 months warranty on goods sold) |

67000.00 |

67000.00 |

|

TOTAL PROVISONS FOR CURRENT LIABILITY |

114000.00 |

|

|

TOTAL PROVISONS FOR NON CURRENT LIABILITY |

41000.00 |

|

Note 8 : Other Incomes |

||

|

Particulars |

Amount |

Amount |

|

Interest Income |

6000.00 |

|

|

Rent Revenue |

8000.00 |

|

|

Gain on Sale of Plant |

22000.00 |

|

|

TOTAL |

36000.00 |

|

Note 9 : Distribution Cost |

||

|

Particulars |

Amount |

Amount |

|

Utilities Expenses |

12000.00 |

|

|

Selling and Distribution Expense |

932000.00 |

|

|

TOTAL |

944000.00 |

|

Note 10 : Administrative Expenses |

||

|

Particulars |

Amount |

Amount |

|

Doubtful Debts Expense |

7000.00 |

|

|

Insurance Expense |

58000.00 |

|

|

Depreciation Expense |

54000.00 |

|

|

Employee Benefit Expense |

100000.00 |

|

|

Utilities Expenses |

24000.00 |

|

|

TOTAL |

243000.00 |

|

Note 11 : Finance Cost |

||

|

Particulars |

Amount |

Amount |

|

Other Borrowing Expense |

12000.00 |

|

|

Interest Expense |

30000.00 |

|

|

TOTAL |

42000.00 |

- Analyzing the Newcastle Ltd.'s financial statements

The financial statement of Newcastle Ltd presented in the financial statement assignment shows that the company is earning a gross profit of 31% and profit after tax of 8%. This is a good source of return and the company is earning around the expected return of the shareholders. The major head in the income statement is the selling and distribution costs. Since it’s the second year of operation this cost is justified for penetrating the market, gradually this cost should be controlled to increase the rate of return to the shareholders. The company is having a good margin on its sale and thus cost reduction would increase the overall return on capital of the company (Carlon 2019).

The company explored in the financial statement assignment is increasing its capital base by issuing new equity shares that denotes the shareholders have faith in the company and thus further investing in the company can be expected (Bellandi 2017). The company is focusing more on external borrowing as it would increase the company burden by creating a fixed charge on the profit. In the inception, the flow of cash is slow so taking equity investment is a good source of finance. The company has been paying dividends during the year of more than 10% that is approx 3% on the issued share capital. This is an alarming sign as the dividends paid consist of around 50% of the profit. The company is having low retention ratio and on the other hand, it is using its various loans and overdraft facilities on which finance charges are required to be paid (Bellandi 2017). The good cash flow raises confidence that the company will be able to pay its liabilities as when it becomes due and not default any payments.

The statement of financial position calculated in the above sections of financial statement assignment shows the goodwill of $910,000 which might be purchased goodwill as it is just 2 years of operation and creating goodwill takes time. The goodwill should be properly valued and recorded in the books to give a clear picture of the affairs of the company. The company is also having the large blocked in trade and other receivables which raise the risk of bad debts and already an allowance has been made for bad debt. The company should control its credit facilities and reduce the risk of bad debt as if the company is not able to collect its earned profit than ultimately the liquidity problem will arise and hamper the smooth running of the company. The company is having a current ratio of around 2.5 times that means the current assets are sufficient to meet the current liabilities and the company will not face any liquidity problem in the short term. The company capital structure developed in the financial statement assignment consists of both equity and debt in the form of loans which is a good combination of capital structure.

- What are the five major social and environment information/indicators provided in the financial statement assignment?

The importance of sustainable development has increased many folds in recent times with such effects on the environment due to large scale emission and the use of harmful substances. The company is manufacturing the swimming suits. This involves the use of plastic which is non- biodegradable and harms the environment in various ways.

The company should report the total amount of emission of GHG over the years and steps taken to reduce such emission via the use of improved and advances technology or the use of some alternative environmentally-friendly substitutes. The stakeholders will also learn about the harmful gases and reduce the use of the product with a higher level of emissions (Junior, Cottler & Best 2014).

As per the analysis provided in the above sections of financial statement assignment, it can be stated that the company should disclose the investment done in research and development to use alternative materials and make the products produced to be reused and recycled. The stakeholders will have a concern and sense of investing in the betterment of the environment and this will promote the company creating goodwill of social concern (Hitchner 2016).

It is also depicted herein financial statement assignment that the company should also disclose the other environmental activities done by the company like planting more trees and recycling and reusing its waste, disposing of its waste in an environmentally friendly manner. Thus the local developments would take place and the associate business will also develop leading to the smooth running of the business. The support of the local authorities will be received. Thus the support of the locals will help in facing adverse situations if any.

The compliance with prescribed legal guidelines and regulations for conserving the environmental impact and its assessment should be reported. The requirements of such laws and corresponding compliance have done should be given in detail (Morecroft 2015). The compliance procedure should be followed and if any certification received for the same should be shared. This will increase the support of the governmental authorities.

The information depicted in the financial statement assignment illustrated that the company should mention its initiative to use waste plastics or recycled plastic for its production process as this would help reduce the already contaminated environment to get free from waste materials and use them for the current production (Vernimmen 2016). This will help in cleaning the environment, like using waste plastic from oceans has become a cause of concern, and using this will clean oceans. The plastic that is used for manufacturing is reusable and leads to the least harm to the environment. This will give a competitive advantage to the company over its competitors and customers will prefer the company’s product over other similar products of the other manufacturers.

Thus, from the overall evaluation presented in the financial statement assignment signifies that the social and environmental reporting is very essential, it creates goodwill and priority among various stakeholders and smooth running of the business and attaining the business objective.

References

Bellandi, F. (2017). Materiality in financial reporting. Bingley: Emerald Publishing Limited.

Carlon, S (2019). Financial accounting: reporting, analysis and decision making. 6th ed. Milton, QLD John Wiley and Sons Australia, Ltd

Deegan, C. M. (2016). Financial accounting. North Ryde, N.S.W.: McGraw-Hill Education.

Edwards A (2018). The Deferred Tax Asset Valuation Allowance and Firm Creditworthiness, Journal of the American Taxation Association 40(1), 57–80. doi: 10.2308/atax-51846.

Herz, R. H. (2016). More accounting changes : financial reporting through the age of crisis and globalization. Financial statement assignment Bingley, UK: Emerald Group Publishing Limited.

Hitchner, J. R. (2016). Financial valuation. 4th edn. Somerset: John Wiley & Sons

Junior, M.R., Cottler, J & Best, P.J. (2014). Sustainability Reporting and Assurance: A Historical Analysis on a World-Wide Phenomenon. Journal of Business Ethics, 120, 1-11

Morecroft, JD. (2015). Strategic modelling and business dynamics: A feedback systems approach. John Wiley & Sons, Hoboken.

Vernimmen, P. (2017). Corporate finance : theory and practice. Fifth edn. Hoboken: Wiley.