Strategic management assignmentanalysing the strategies and competiveness of Commonwealth Bank of Australia

Question

Task: Choose an organisation that has an existing vision, mission, and value statements for your strategic management assignment. Briefly describe your organisation and industry context. Analyse the alignment of the vision, mission and values statements against the existing strategic objectives of your organisation. Discuss the implications and make recommendations on how they can be improved. Applying Porter's Five Forces framework, assess the organisation's industry and competitive environment. Apply the VRIN framework to assess the organisation's resources, capabilities, and competitiveness. Present your VRIN analysis in a table and discuss the key points. Perform a SWOT analysis to identify the organisation's strengths, business opportunities, threats and competitive deficiencies. Using the insights from your analysis, identify the critical strategic issues the organisation needs to address to be competitive.

Answer

1 Introduction

A strategy is a plan of action that is put together to achieve a particular objective. This outcome is determined by a series of decisions that set the organization apart from its rivals, resulting from the unique traits of the organization, and are difficult to reproduce. Commonwealth Bank of Australia offers financial services and banking.It is found in this strategic management assignment that the organizationhas the authority to carry out both savings and general banking operations.

1.1 Aim of the strategic management assignment

• To highlight the background of the Commonwealth Bank and its goal.

• To highlight the Poster’s five forces framework and the SWOT analysis of the Commonwealth Bank.

• To highlight the vision, mission, and value statement of the commonwealth bank’s goals

• To show the alignment with existing strategic objectives.

2 Background of Commonwealth Bank analysed in the strategic management assignment

Commonwealth bank is the most reputed bank in Australia. This organization operates a wide range of services in New Zealand, Asia, the US, and the UK. This organization provides different services regarding finance such as Retail, commercial services for investing, insurance, and broking, as well as institutional banking and funds management (Hill 2022). It is found in the strategic management assignmentthat Commonwealth Insurance is the largest Australian firm listed among the three strategic influences implemented by commonwealth bank.

2.1.1 Geographic location: Offering a variety of financial services, Commonwealth Bank has locations acrossNew Zealand, Asia, Europe, and North America.

[Probability of purchasing vehicles, equipment, or other property to support development opportunities]

|

Company turnover |

December 2020 |

July 2020 |

Difference |

|

<$2m |

14% |

9% |

+5% |

|

$2m - <$10m |

24% |

8% |

+16% |

|

$10m - <$100m |

43% |

13% |

+23% |

|

$100m plus |

39% |

24% |

+15% |

3 Commonwealth Bank Goals

Commonwealth bank addressed in the strategic management assignmentis the most reputed bank in Australia. The main objective of the commonwealth bank is to help customers to control and increase their wealth (Bandaraet al. 2019).

3.1 Vision Statement

• Give consumers excellent service and assist them in achieving their financial objectives

• To make empower and sustainable people’s and communities forbalanced and transparent business ideas.

3.2 Mission statement

• To provide outside services to the customers.

• To promote economic development and stability in the community.

• To generate profit for the investors of Commonwealth bank.

• Retaining and training staff with exceptional abilities.

3.3 Value statement

• As part of an efficient governance system, provide real chances for directors and other stakeholders to contribute to deciding the direction of the bank.

• Give consumers excellent service and assist them in achieving their financial objectives.

• Make sure that working at Commonwealth Bank is a fantastic experience.

3.4 Alignment with existing strategic objectives

The objective of the business strategy of Commonwealth Bank is to bring position and sustainable results for their purchasers, shareholders, community, and people(Ungureanu 2019). They are aligned with the company goals in the ways mentioned in thestrategic management assignment:

1. Training and learning objectives

To increase the staff knowledge and capabilities companies design strategic objectives, which are co-related with the company goals. It is claimed in thisstrategic management assignmentthat a company can invest in staff in order to achieve its overall performance goals for training.

2. Growth strategic objectives

Business employees’ strategic goals are to make decisions about growing and boosting their organizationby Increasing market share and revenue, acquiring assets, and customer engagement.

3.4.1 Achievable

The Commonwealth Bank of Australia should be able to achieve its goals by building a brighter future for all. They should have the materials and funding available to enable the long-term achievement of organizational objectives.

3.4.2 Simple communication

The objectives established by the Commonwealth Bank of Australia as per the strategic management assignmentshould also be simple to explain. The banking industry is utilizing modern communication technologies to provide its services to customers in a convenient way. It is found in the strategic management assignment that the use of mobile banking and its closest technologies has expanded over the past year all around the world.

3.4.3 Pragmatic

The objectives established by the Commonwealth Bank of Australia ought to be attainable(Ranjbaret al. 2022). This means that all of the Commonwealth Bank of Australia's strategic goals mentioned in the strategic management assignment should consider not just its internal financial situation and resources but also its workers' skill sets and the broader macro environment as well.

3.4.4 Relation to job duties

The employees of the Commonwealth Bank of Australia are related to all objectives by focusing on retaining and attracting the best talent in the organization. All objectives mentioned in the strategic management assignmentmust be related to the responsibilities and nature of employees' jobs, either directly or indirectly. This will prevent employees from feeling unnecessary and will encourage them to use their expertise to advance the company.

4 Porter’s Five Forces Framework

Michael E. Porter proposed a model in a paper published in the Harvard Business Review in 1979. This model, often known as Porter's Five Forces Model, is a strategic management tool that aids in assessing the level of competition in a certain sector.

Five competitive forces that have an impact on businesses are examined and identified inthe strategic management assignment. A common method for determining corporatestrategy is to assess vulnerabilities and strengths.

The poster’s Five Forces Framework discussed in the strategic management assignmentis as follows

4.1 New Entrant Threats

Innovation and new operating procedures are brought about by the new entrant into the banking industry that puts pressure on the Commonwealth Bank of Australiaby using a reduced pricing strategy, reducing expenses and presenting clients with fresh value offerings (Comerton-Forde et al. 2018). The Commonwealth Bank of Australia considered in the strategic management assignmentmust overcome each of these challenges in order to keep its competitive edge.

Solution

• New items provide existing consumers another reason to purchase Commonwealth Bank of Australia's goods in addition to attracting new ones.

• In order to reduce the fixed cost per unit, through establishing economies of scale.

4.2 Power of Buyers

The clientele of the Commonwealth Bank of Australia as per the strategic management assignmentis smaller and more influential.Most buyers have high standards. The customers want to spend as little money as they can while still getting the greatest things.

Solution

• Through establishing a sizable consumer base.

• Additionally, the launch of innovative products will prevent current Commonwealth Bank of Australia customers from migrating to its competitors.

4.3 Power of suppliers

Suppliers in a monopoly position have the authority to lower Commonwealth Bank’s margins and impact its earnings (Bruijl and Gerard 2018).Generally speaking in the strategic management assignment, increased supplier negotiating strength has a negative impact on banks’ total profitability.

Solution

• By establishing effective supply chains with a variety of vendors.

• By testing out various material combinations for product designs.

4.4 Availability of substitutes

When a new product or service meets a similar client need in a different way, industry profitability falls. The existence of a threat of replacement as per the strategic management assignmenthas an impact on the profitability of Commonwealth Bank since customers may choose to purchase the substitute instead of the Commonwealth Bank product.

Solution

• By emphasizing services rather than just items.

• By increasing the cost for consumers to switch brands.

4.5 Competitive rivalry

Bank of Commonwealth of Australia operates in a very competitive market for banks.This competition has an impact on the long-term profitability of the organization. It is found in thestrategic management assignment that price decreases and a decline in the overall profitability of the industry will result from the intense competition between the current companies.

Solution

• By creating a long-lasting distinction.

• Instead of just battling for a tiny market, collaborating with competitors to enlarge it.

5 VRIN Framework

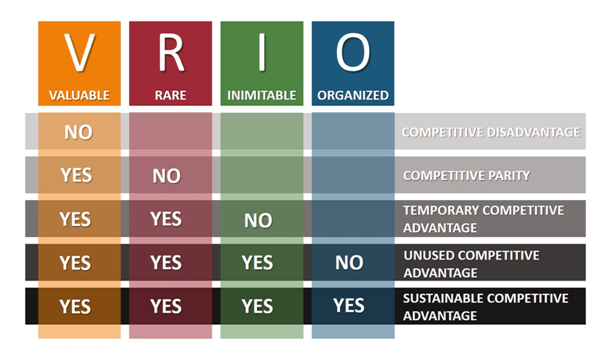

The term "VRIO" refers to a framework with four questions that considers value, imitability, rarity, and organization when assessing an organization's resources and skills. Between the VRIN and the VRIO analysis, there is no real difference. The Commonwealth Bank of Australia addressed in the strategic management assignmentused VRIN/VRIO analysis to create competitive strategies based on the cores of organization strengths and available resources to provide it a competitive edge over rivals in the market(Musa, Ghani, and Ahmad 2022). To determine whether a company can utilize its resources for growth and competition, the VRIO considers organizational characteristics.

The VRIN framework to evaluate resources and competencies uses the following characteristics mentioned in thestrategic management assignment:

1. Valuable

2. Inimitable

3. Non-organization

4. Rare

Fig.1 (Harvey, 2022)

5.1 1. Valuable

• Valuable competencies support the Commonwealth Bank of Australia in seizing Taking advantage of opportunities and addressing threats from the environment both internally and externally. These competencies mentioned in the strategic management assignmentallow a business to grow, develop, and succeed.7.

• Commonwealth Bank's financial resources are very valuable to it since they give it the possibility to respond to external threats.

• Given that its production practices result in higher costs than those of its rival companies and so have an impact on the overall profit, its cost structure is not valuable to it.

5.2 2. Rare

The uncommon competencies that give the Commonwealth Bank of Australia an advantage over competitors are unique and are only found in a small number of businesses in the field(Murcia, Ferreira and Ferreira 2022).

• The research that resulted from the strategic management assignmentlooked at the Commonwealth Bank's few financial resources, which are only found in a small number of businesses.

• The Commonwealth Bank of Australia has expanded its customer base and diversified its sources of income because of its global presence.

5.3 3. Inimitable

Thedistinctive abilities contribute to an organization's competitive advantage and long-term viability.

• A strong financial position has been acquired by the bank as a result of consistent profits, thus it is common for other businesses to copy this strategy.

• Employees can also be easily duplicated by giving existing staff members training and career development opportunities.

5.4 4. Non-organization

These tools were specifically created for the Commonwealth Bank of Australia and cannot be utilized by other business competitors.Along with its strong reputation, the Commonwealth Bank of Australia addressed in the strategic management assignmentalso has significant financial strength.

• The Commonwealth Bank uses its financial resources carefully and constantly invests in the right areas, which can assist create opportunities and eliminate weaknesses.

• According to VRIO, the bank's distribution system is well-organized because it enables numerous clients to simply contact them.

6. SWOT analysis of Commonwealth bank in the strategic management assignment

|

S strength

|

W weakness

|

O Opportunities

|

T Threats

|

|

· Available at any time · Saves a lot of time · Quick transaction with a lower price |

· Digital mode strategic issues · Receptive to the overall analysis · Can only focus on specific customers |

· Population · Interest · Low inflation rate

|

· Currency Fluctuations · Pandemic · Increased Marketing Efforts |

(Benzaghta 2021)

7. Strategicissue in Commonwealth bank.

Commonwealth Bank considered in the strategic management assignment is currently facing A strategic issue. A strategic management assignmentreport was written by experts from APRA that focused on current issues and prospective solutions for Commonwealth Bank. The final report is broken up into chapters that describe various problem categories and discusses a variety of results in detail. Within the first group of internal issues are problems with governance.They include the board members' "overconfidence" in their capacity to make judgments, the absence of effective nonfinancial risk supervision methods,and the poor application ofbenchmarking tools.According to APRA, in the case of CBA, these issues result from managers’ poor “ability to self-reflect” and learn from the results of their choices.

One of the difficulties noted in thestrategic management assignment research is the lack of a clear structure for risk responsibility at the top level. A clear structure for risk ownership at the top level is one of the issues mentioned in the report. Due to the unique internal organizational structures of businesses, the division of work and responsibility for risks can be problematic. The organization’s unfavorable cultural qualities, such as “a sense of complacency,” a reactive approach to risk management, and an inability to reflect on past errors, are indicative of these problems.

8. Conclusion

In the above discussion of thestrategic management assignment about the strategic management in Commonwealth Bank this report concludes that Commonwealth bank is the most reputed bank in Australia. The main objective of the commonwealth bank is to help customers to control and increase their wealth. This organization is facing Issues with governance and separation of duties and authorities among the organization. This strategic management assignmentdiscussed the Poster’s five forces framework and the SWOT analysis of the Commonwealth Bank, they mention the objective, vision, and values, emphasise the key objectives, and give an overview of the planning process.

References

Bandara, W., Merideth, J.C., Techatassanasoontorn, A.A., Mathiesen, P. and O'Neill, D., 2019. Mechanisms for creating successful BPM governance: insights from Commonwealth Bank of Australia. In BPM (Industry Forum) (pp. 49-60).http://ceur-ws.org/Vol-2428/paper5.pdf

Benzaghta, M.A., Elwalda, A., Mousa, M.M., Erkan, I. and Rahman, M., 2021. SWOT analysis applications: An integrative literature review. Journal of Global Business Insights, 6(1), pp.55-73. https://digitalcommons.usf.edu/globe/vol6/iss1/5/

Bruijl, D. and Gerard, H.T., 2018. The relevance of Porter's five forces in today's innovative and changing business environment. Available at SSRN 3192207. https://papers.ssrn.com/sol3/papers.cfmabstract_id=3192207

Comerton-Forde, C., Ip, E., Ribar, D.C., Ross, J., Salamanca, N. and Tsiaplias, S., 2018. Using survey and banking data to measure financial wellbeing. Commonwealth Bank of Australia and Melbourne Institute Financial Well-being Scales Technical Report, (1). https://fbe.unimelb.edu.au/__data/assets/pdf_file/0010/2839429/CBA_MI_Tech_Report_No_1.pdf

Hill, C., 2022. BACKGROUND INFORMATION FORMER COMMONWEALTH BANK BUILDING (BLOCK 2 SECTION 13, CITY).https://www.environment.act.gov.au/__data/assets/pdf_file/0020/2014481/Background-Information-Former-Commonwealth-Bank-Building.pdf

Murcia, N.N., Ferreira, F.A. and Ferreira, J.J., 2022. Enhancing strategic management using a “quantified VRIO”: Adding value with the MCDA approach. Technological Forecasting and Social Change, 174, p.121251. https://www.sciencedirect.com/science/article/abs/pii/S0040162521006855

Musa, D., Ghani, A.A. and Ahmad, S., 2022. Resource Based-View Theory On Business Performance And Firm Strategic Orientation. INTERNATIONAL JOURNAL OF EDUCATION, ISLAMIC STUDIES AND SOCIAL SCIENCE RESEARCH, 7(1), pp.89-97. https://myjms.mohe.gov.my/index.php/IJEISR/article/view/19861

RanjbarKermany, N., Pizzato, L., Min, T., Scott, C. and Leontjeva, A., 2022, September. A Multi-Stakeholder Recommender System for Rewards Recommendations. In Proceedings of the 16th ACM Conference on Recommender Systems (pp. 484-487). https://dl.acm.org/doi/abs/10.1145/3523227.3547388

Ungureanu, S., 2019. Stategy, Business and Information Sistem´ s Alignment: A Review of Literature.http://repositori.uji.es/xmlui/handle/10234/185718