Statistics Assignment: Quantitative Analysis for Economics and Finance

Question

Task:

Statistics Assignment Brief

Part 1 (40%): Discussion of sampling methods and data handling (1,000 words).

You are required to examine financial characteristics of UK non-financial firms in 2018. To do that, you need to select a sample of 100 UK publicly listed non-financial firms from FAME Database.You need to use a sampling method that you believe is appropriate in this assignment’s context. All your selected companies should be firms in FTSE All Share Index and should exclude firms in the financial sector (such as banks and insurance companies. These can be found under BvD Sectors:32 - Banking, Insurance & Financial Services).

Collect data from each selected company in 2018 for the following variables:

1. Company Name

2. BvD Sector - sector a company operates in

3. UK SIC Code - Primary UK SIC (2007) code

4. One Measure of Firm Profitability:

Return on Total Assets (ROA)

OR

Return on Capital Employed (ROCE)

OR

Profit Margin

Collect data from each selected company for any TWO of the following variables ONLY:

5. Firm Size: Turnover (Sales)

6. Asset Growth: Total Assets in 2017, Total Assets in 2018

7. Liquidity (Current Ratio): Current Assets, Current Liabilities

8. Tangibility: Tangible Assets, Total Assets

9. Debt Ratio: Long-Term Debt, Total Assets

Perform the following tasks in IBM SPSS Software – IF YOU ARE USING THE (SPSS OR EXCEL) FILES ABOVE, then these ratios have already been calculated for you:

1. Import the data you collected into IBM SPSS Software

2. Make necessary transformation of your data in SPSS.

- Firm Size = Natural Log of Turnover (Sales)

- Asset Growth = ((Total Assets2018 – Total Assets2017)/ Total Assets2017)*100

- Liquidity (Current Ratio) = Current Assets/Current Liabilities

- Tangibility = Tangible Assets/Total Assets*100

- Debt Ratio = (Long-Term Debt/Total Assets)*100

3. Produce histograms and descriptive statistics (min/max, mean/median, standard deviation, skewness and kurtosis) for profitability and the other two variables you have.

4. Produce a Short Report in MS Word.

Your report should contain the following:

a) Introduction, where you specify the aim of the report and the variables you have selected.

b) Explanation of the process of sample selection with reference to an appropriate sampling method.

c) Explanation of the variables you have selected.

d) Discussion of the main statistics for your variables from histograms and descriptive statistics (min/max, mean/median, standard deviation, skewness and kurtosis), including comments on the distribution of each variable.

e) Conclusion of the report including the key findings of the descriptive statistics.

Part 2 (60%): Statistical Analysis using SPSS (1,500 words).

You are required to examine factors that can influence firm profitability using statistical analysis in IBM SPSS software. To do that, you need to use the dataset you created in Part 1 of the Portfolio.

Use the dataset you have created in Part 1. Select the profitability measure and two variables that can be related to profitability from Part 1.

Perform the following tasks in IBM SPSS:

1. Use your descriptive statistics in Part 1 to identify outlying observations. Make appropriate adjustments to your variables to ensure that there are no extreme outliers.

2. Conduct statistical analysis in SPSS to examine what factors can influence firm profitability. Depending on the variables you selected, test any two hypotheses below:

H1: Firm Size is Significantly Related to Profitability

H2: Asset Growth is Significantly Related to Profitability

H3: Liquidity is Significantly Related to Profitability

H4: Asset Tangibility is Significantly Related to Profitability

H5: Debt Ratio is Significantly Related to Profitability

To test your hypotheses, you need to perform the following:

a) Perform Correlation Analysis to check whether there is linear association between profitability and each of the other two variables. Check whether there is any potential problem of multicollinearity.

b) Perform either Simple or Multiple Regression Analysis to identify factors that can influence firm profitability.

3. Produce a Report in MS Word (see below for details).

Your report should contain the following:

a) Introduction, where you clearly state the aim of this section and the method you selected to conduct the analysis.

b) Explanation and justification of the adjustments that were made to your variables (e.g. outliers or natural logarithm).

c) Discussion of the results from the correlation analysis (coefficients and their p-values).

d) Discussion of the results from either simple or multiple regression analysis (coefficients and their p-values; results from the overall model such as R2 and Adjusted R2).

You should clearly state whether your results show evidence in support of the hypothesized relationship.

e) Discussion of the main limitations of your study.

f) Conclusion on what factors can be related to firm profitability.

Answer

Part 1:

Introduction:

The purpose of this statistics assignmentis to analyse financial characteristics of non-financial firms in UK for the year 2018. For doing this research, the researcher selects 100 firms that are publicly listed and they are in FTSE All Share Index. Here, financial firms like insurance companies or banks are not considered. For analysis, the study considers some variables that are of both qualitative and quantitative types. At first, company name, company sector and primary UK SIC (2007) code are considered. Followed by it, the study considers variables on firm profitability and these are return on total assets (ROA), return on capital employed (ROCE) and Profit margin. Moreover, the study also considers firm size, assert growth, liquidity, tangibility and debt ratio of these banks. The following section will discuss the process of sample selection, description of selected data and their interpretation. IN addition to this, the study also measures histograms and descriptive statistic to understand the pattern of data distribution.

Sampling method:

In a research process, the researcher needs to select effective and suitable sampling techniques for getting the desired outcome. Here, the target of the study is to examine financial characteristics of 100 non-financial companies in UK in 2018. Hence, non-financial public-listed UK companies that have FTSE All Share Index are the target population for this study. For the purpose of the study, the researcher takes 100 publicly-listed non-financial firms from FAME Database in a random way. The database has 109 firms among which the researcher selects 100 firms by sorting them with the help of appropriate formula in MS Excel. In this context, it is essential to mention that the 109 firms are selected by applying simple sampling technique that can provide unbiased outcome to the researcher. The main advantage of selecting this method is that each firm has equal chance to be selected in the sample (Sharma 2017). In the dataset, each company is specified with corresponding random sampling number that are sorted from the smallest to the largest order for getting 1 to 100 companies in a systematic way. However, it is observed that M&G PLC and PHOENIX GROUP HOLDINGS PLC have missing data of asset growth. Moreover, focusing on firm size, it is seen that PREMIER OIL PLC, TP ICAP PLC and ESSENTRA PLC have missing data regarding their firm size. Hence, these 5 companies are omitted from the data series and the researcher considers next 5 new companies from 101 onwards.

Data and Variables:

For the purpose of the study, the researcher considers 6 variables that are already mentioned. In excel file, sector in which the company operates is mentioned as BvD Sector. Moreover, Primary UK SIC (2007) code is mentioned as UK SIC Code in the raw excel file. For study, the researcher selects these 3 qualitative data. Moreover, return on total assets (ROA) has been considered of the selected companies to measure firm profitability. In addition to this, the firm also considers two variables which are firm size and asset growth for further research. The following table represents the main variables along with their formula and explanation.

Table 1: Definitions of the main variables

|

Variables |

Measure/Formula |

|

Profitability |

ROA: Formula: Net income of business / total asset |

|

Another variable |

Firm size: Formula = the natural log of turnover (Sales) |

|

Another variable |

asset growth: Formula = ((Total Assets2018 – Total Assets2017)/ Total Assets2017) *100 |

Histograms and descriptive statistics:

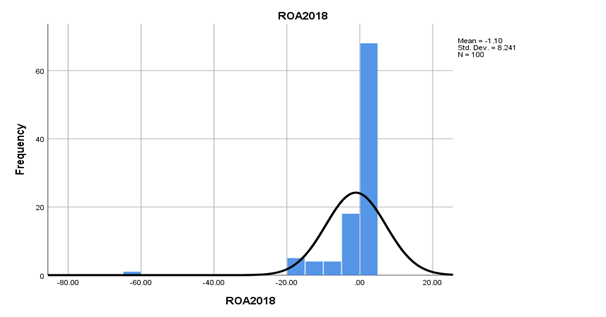

Figure 1: Histogram for ROA 2018

The histogram is left skewed. The graph has an outlier in (-63.25 to -57.15) class boundary (Luczak et al. 2019).

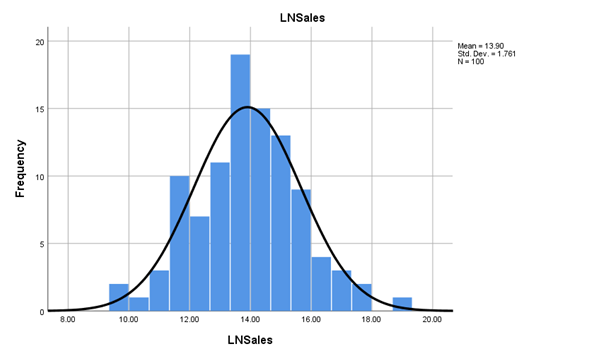

Figure 2: Histogram for LN Sales

The maximum companies have firm size between 13.60 to 14.90 £ Xm of Sales in 2018 that is obtained from LN sales. This histogram is distributed normally and does not have any outlier.

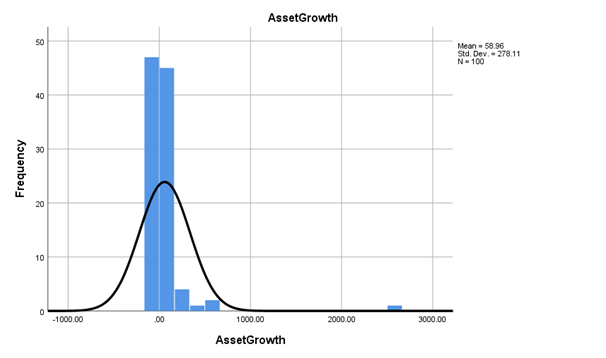

Figure 3: Histogram for Asset Growth

The histogram for Asset growth is negatively skewed as its tail is towards the negative direction. Moreover, the graph has outlier in 2494.56 to 2664.96 class boundary.

Descriptive Statistics:

Table 2: Descriptive statistics of 3 main variables

|

|

ROA2018 |

LNSales |

AssetGrowth |

|

|

N |

Valid |

100 |

100 |

100 |

|

Missing |

0 |

0 |

0 |

|

|

Mean |

-1.1004 |

13.9005 |

58.9567 |

|

|

Median |

1.6600 |

13.9000 |

1.4450 |

|

|

Mode |

-2.79a |

11.07 |

-65.04a |

|

|

Std. Deviation |

8.24057 |

1.76121 |

278.11014 |

|

|

Variance |

67.907 |

3.102 |

77345.250 |

|

|

Skewness |

-4.834 |

.080 |

8.034 |

|

|

Std. Error of Skewness |

.241 |

.241 |

.241 |

|

|

Kurtosis |

32.515 |

.159 |

71.962 |

|

|

Std. Error of Kurtosis |

.478 |

.478 |

.478 |

|

|

Percentiles |

25 |

-2.0850 |

12.7450 |

-6.7300 |

|

50 |

1.6600 |

13.9000 |

1.4450 |

|

|

75 |

2.8550 |

14.9650 |

20.6100 |

|

The mean of profitability variable that is ROA in 2018 is -1.0107. Mean of other two main variables are 13.9005 and 58.9567 for LNsales and asset growth, respectively. The mode is -2.79, 11.07 for ROA and LN sales (Mishra et al. 2019). However, Asset growth does not have any mode value. Standard deviation of ROA, LN sales and Asset growth are 8.145, 1.761 and 278.11, respectively.

The finding states that the average ROA of 100 companies in 2018 is negative which means firms have financial loss or get comparatively small returns on an investment. The average size of firms is 13.9005 £ Xm in terms of sales. The asset growth is positive on an average for firms which implies that the firm performs better in 2018 compared to last year.

Conclusion:

The study conducts statistical analysis of non-financial firms in UK considering their data of 2018. Here, variables are considered to conduct histogram and descriptive analyses to obtain mean, median, mode, standard deviation and skewness of the data set. Simple random technique is used to collect data. Here, 100 companies are selected which are public-listed. For the purpose of the study, ROA 2018 is considered as profitability variable. Moreover, the study also considers LN sales and Asset growth as other two important variables to understand the firm size and growth of the firm over the years. From the finding, it is obtained that firms perform in a better way in 2018 compared to 2017 though ROA remains negative in 2018.

Statistics AssignmentPart 2

Introduction:

Through the present study it was aimed to examine the financial characteristics of the UK non-financial firms during 2018. In order to do so, here 100 random sample has been considered from the given dataset and screened for the further analysis. For the better understand regarding the association between the chosen variables, here inferential statistical analysis outcome of the 100 chosen firms’performance has been presented. For the analysis, ROA of the chosen firms during 2018, asset growth of the firms and the firm size depicted through sales values has been considered as the major variables. SPSS has been considered for the inferential statistical analysis and outcome of the same has been presented in tabular and graphical format.

Discussion on outliers:

Underpinning the table 2, it can be seen that there are outliers in case of the asset growth and considering the data, it can be seen that there are almost 20 data which are outliers. These outliers have strong effect on the overall mean value of the asset growth and variance as well. Considering the table 2, it can be seen that variance for the asset growth is too high and the skewness and kurtosis value is high too. from the skewness value, it can be seen that there is a left tail, though their distribution is normal for the asset growth data (Domingues et al. 2018). On the other hand, for the profitability data, there is right tail as there are certain points which are outliers. With the quartile ranges it can be seen that Inter Quartile Range (IQR) for the asset growth is 27.34 and within this range 80 data points are available and rest are outliers constituting 20% of the data. Considering the amount of data and its impact on the asset growth, outliers has not been omitted for the present study (Chen et al. 2017). Lastly, it can be mentioned that there are no outliers in case of the company size as all the variables are within IQR range.

Scatter plot and correlation analysis:

In order to analyse the degree of association and whether there is any linear association between the profitability and the asset growth and firms’ size, correlation analysis has been done.

Table 3: Correlation of profitability, firm size and asset growth

|

Correlations |

||||

|

|

ROA2018 |

LNSales |

AssetGrowth |

|

|

ROA2018 |

Pearson Correlation |

1 |

-.089 |

.046 |

|

Sig. (2-tailed) |

|

.378 |

.651 |

|

|

N |

100 |

99 |

100 |

|

|

LNSales |

Pearson Correlation |

-.089 |

1 |

.081 |

|

Sig. (2-tailed) |

.378 |

|

.423 |

|

|

N |

99 |

99 |

99 |

|

|

AssetGrowth |

Pearson Correlation |

.046 |

.081 |

1 |

|

Sig. (2-tailed) |

.651 |

.423 |

|

|

|

N |

100 |

99 |

100 |

|

Through considering correlation analysis in SPSS, outcome obtained has been presented in table 3. As per the same, it can be observed that there is no significant relation between the profitability of the firm, firm size and the asset growth (Aggarwal and Ranganathan 2017). Besides, it has also been observed that profitability is negatively associated with the firm size, though the level of association is very weak. In between firm size and asset growth too, there is no significant association, however, they have a positive level of correlation.

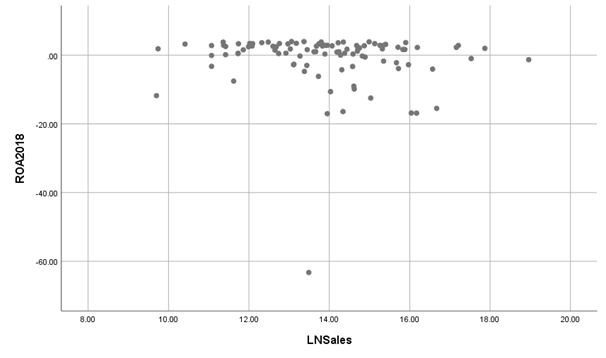

Figure 4: Scatter plot of firm size and profitability

In order to explain the association between the profitability and firm size scatter plot has been drawn and it has been presented in figure 4. As per the same it can be seen that there is linear association between these two variables, however it is not significant and very weak.

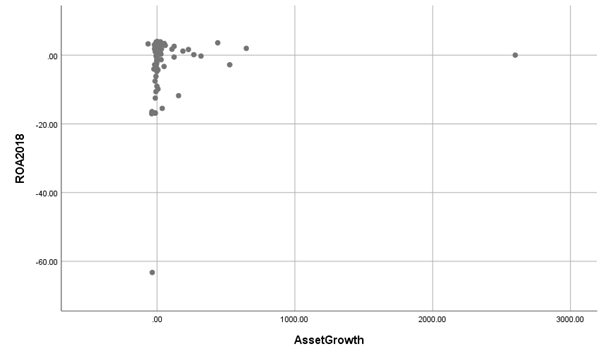

Figure 5: Scatter plot of firm size and profitability with outliers

In order to explain the association between the profitability and asset growth scatter plot has been drawn and it has been presented in figure 5. As per the same it can be seen that there is linear association between these two variables, however it is not significant and very weak (Bakdash and Marusich 2017). It is also important to mention that due to presence of outliers in asset growth, scatter plot has not been able to represent the association properly.

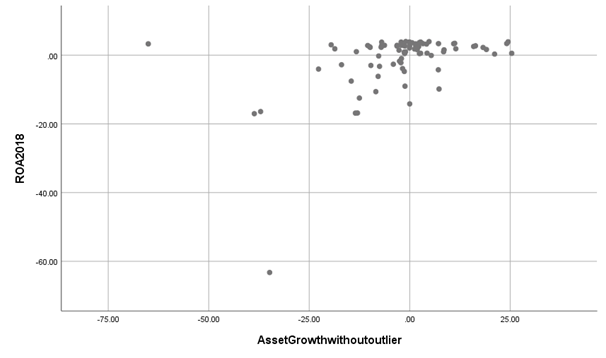

Figure 6: Scatter plot of asset growth and profitability without outliers

In order to explain the association between the profitability and asset growth without outlierscatter plot has been drawn and it has been presented in figure 6. As per the same it can be seen that there is linear association between these two variables, however it is not significant and very weak. It is also important to mention that compared to figure 5, presentation of the scatter plots has been clearer in figure 6 as the outliers has been omitted here.

Table 4: Multicollinearity analysis

|

Coefficientsa |

|||

|

Model |

Collinearity Statistics |

||

|

Tolerance |

VIF |

||

|

1 |

AssetGrowth |

1.000 |

1.000 |

In order to analyse multicollinearity between the variables, regression has been done and it has been observed that VIF is 1, which is lower than 3. Thus, it can significantly be mentioned that there is no multicollinearity issue is present.

Regression analysis:

In order to analyse the association between the firm size and asset growth with the profitability of the chosen firms, regression analysis has been done. For this purpose, researcher has considered two hypothesises as well, which are as follows:

Hypothesis 1:

H0: Firm size is not significantly related to the profitability

H1: Firms size is significantly related to the profitability

Hypothesis 2:

H0: Asset growth is not significantly related to profitability

H1: Asset growth is significantly related to profitability

Hypothesis 1 testing:

For testing first hypothesis, considering profitability (ROA2018) as the independent variable and Firm size (LNSales) as dependent variable, linear regression has been done.

|

Model Summary |

|||||

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

|

|

1 |

.089a |

.008 |

-.002 |

1.77186 |

|

|

a. Predictors: (Constant), ROA2018 |

|

||||

a. Predictors: (Constant), ROA2018

As per the model, it can be seen that model is not a good fit model as it cannot explain the variability in the dependent variable. With adjusted R Square value of -.002, it defines that independent variable can explain variability of the dependent variable by 0.2%.

|

ANOVAa |

|||||||

|

Model |

Sum of Squares |

df |

Mean Square |

F |

Sig. |

||

|

1 |

Regression |

2.457 |

1 |

2.457 |

.783 |

.378b |

|

|

Residual |

304.529 |

97 |

3.139 |

|

|

||

|

Total |

306.986 |

98 |

|

|

|

||

|

a. Dependent Variable: LNSales |

|

||||||

|

b. Predictors: (Constant), ROA2018 |

|

||||||

a. Dependent Variable: LNSales

b. Predictors: (Constant), ROA2018

As per the ANOVA table it can be seen that F value is .783, which is lower than 4 defining model is not a good fit model for explaining the relationship between the two variables.

|

Coefficientsa |

|||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

|||

|

B |

Std. Error |

Beta |

|||||

|

1 |

(Constant) |

13.885 |

.179 |

|

77.424 |

.000 |

|

|

ROA2018 |

-.019 |

.022 |

-.089 |

-.885 |

.378 |

||

|

a. Dependent Variable: LNSales |

|

||||||

a. Dependent Variable: LNSales

As per the coefficient table it can be seen that p value is .378, which is higher than the 0.05. Thus, null hypothesis has been accepted here and alternative hypothesis has been rejected. This defines that there is no significant relationship between the firm size and the profitability of the same.

Hypothesis 2 testing:

For testing second hypothesis, considering profitability (ROA2018) as the independent variable and Asset growth (AssetGrowth) as dependent variable, linear regression has been done.

|

Model Summary |

|||||

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

|

|

1 |

.046a |

.002 |

-.008 |

279.27184 |

|

|

a. Predictors: (Constant), ROA2018 |

|

||||

a. Predictors: (Constant), ROA2018

As per the model, it can be seen that model is not a good fit model as it cannot explain the variability in the dependent variable. With adjusted R Square value of -.008, it defines that independent variable can explain variability of the dependent variable by 0.8%.

|

ANOVAa |

|||||||

|

Model |

Sum of Squares |

df |

Mean Square |

F |

Sig. |

||

|

1 |

Regression |

16062.786 |

1 |

16062.786 |

.206 |

.651b |

|

|

Residual |

7643290.803 |

98 |

77992.763 |

|

|

||

|

Total |

7659353.590 |

99 |

|

|

|

||

|

a. Dependent Variable: AssetGrowth |

|

||||||

|

b. Predictors: (Constant), ROA2018 |

|

||||||

a. Dependent Variable: AssetGrowth

b. Predictors: (Constant), ROA2018

As per the ANOVA table it can be seen that F value is .206, which is lower than 4 defining model is not a good fit model for explaining the relationship between the two variables.

|

Coefficientsa |

|||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

|||

|

B |

Std. Error |

Beta |

|||||

|

1 |

(Constant) |

60.162 |

28.110 |

|

2.140 |

.035 |

|

|

ROA2018 |

1.564 |

3.447 |

.046 |

.454 |

.651 |

||

|

a. Dependent Variable: AssetGrowth |

|

||||||

a. Dependent Variable: AssetGrowth

As per the coefficient table it can be seen that p value is .651, which is higher than the 0.05. Thus, null hypothesis has been accepted here and alternative hypothesis has been rejected. This defines that there is no significant relationship between the asset growth of the firm and the profitability of the same.

Though this study has demonstrated that there is no association between the profitability with the firm size and asset growth, yet previous literary evidence by Dang et al. (2019) clearly showcase positive relation among these variables.

Limitations:

Present study was aimed to examine the financial characteristics of the UK non-financial firms during 2018. For this purpose, 100 random sample has been considered from the given dataset and screened for the further analysis. Outcome of the analysis has been presented and explained above, however in order to doing so some limitations has been observed. Primary limitation can be seen in case of data selection. From the database of FAME for the non-financial firms, 100 sample size is very small to reflect its actual characteristics. Besides this, in case of the asset growth data, there has been higher number of outliers and this cannot be omitted as they constitute a significant portion of total sample (20%). Hence, for the 2018 non-financial firms, general characteristics has not been clearly assessed through the analysis due to presence of higher number of outliers. In addition to this, in absence of the multicollinearity, it has been observed that the defined model of regression was not best fitted and there was no significant impact of the independent variables on the dependent variable.

Conclusion:

From the finding of the present analysis, it can be seen that there is no association between the profitability with asset growth and firm size. However, the deviation of this empirical study to the previous literary evidences regarding the relation between the profitability with asset growth and firm size can be explained through the limitations. With lower number of sample size outcome has been different in case of the present study compared to related theories. Moreover, as there has been no significant and strong association of the chosen variables, thus it can be explained the there are some other factors that has certainly influenced the profitability of the UK non-financial firms, which needs to be assessed for better understanding.

Reference

Aggarwal, R. and Ranganathan, P., 2017. Common pitfalls in statistical analysis: Linear regression analysis. Perspectives in clinical research, 8(2), p.100.

Bakdash, J.Z. and Marusich, L.R., 2017. Repeated measures correlation. Frontiers in psychology, 8, p.456.

Chen, J., Sathe, S., Aggarwal, C. and Turaga, D., 2017, June. Outlier detection with autoencoder ensembles. In Proceedings of the 2017 SIAM international conference on data mining (pp. 90-98). Society for Industrial and Applied Mathematics.

Dang, H.N., Vu, V.T.T., Ngo, X.T. and Hoang, H.T.V., 2019. Study the impact of growth, firm size, capital structure, and profitability on enterprise value: Evidence of enterprises in Vietnam. Statistics assignmentJournal of Corporate Accounting & Finance, 30(1), pp.144-160.

Domingues, R., Filippone, M., Michiardi, P. and Zouaoui, J., 2018. A comparative evaluation of outlier detection algorithms: Experiments and analyses. Pattern Recognition, 74, pp.406-421.

Luczak, B.B., James, B.T. and Girgis, H.Z, ‘A survey and evaluations of histogram-based statistics in alignment-free sequence comparison’, Briefings in Bioinformatics, vol.20, no.4, 2019, pp.1222-1237.

Mishra, P., Pandey, C.M., Singh, U., Gupta, A., Sahu, C. and Keshri, A, ‘Descriptive statistics and normality tests for statistical data’, Annals of cardiac anaesthesia, vol. 22, no. 1, 2019, p.67.

Sharma, G., ‘Pros and cons of different sampling technique’, International journal of applied research, vol. 3, no. 7, 2017, pp.749-752.