Analyzing The Shoe Zone PLC Financial Performance

Question

Task: This assessment requires students to produce an individual report analyzing the performance and operations of a company listed onthe Alternative Investment Market (AIM)of the London Stock Exchange within a selected sector.A list of companies is provided for students to select from.This assessment represents 50% of the total marks.

Answer

Introduction

This study sheds light on the various aspects contributing to the Shoe Zone PLC financial performance. E commerce is a global industry which has very big players across the various types of products. However, platforms catering to specific niches, owing to their expertise with the product line, have also been experiencing success in the market which justifies a study of the companies in this industry. This report will study Shoe Zone PLC financial performance, a designer shoe manufacturer and retailer and operates in various regions of Ireland and United Kingdom. At present, the business owns more than 500 outlets with over 4000 employees working under its roof. Currently, Shoe Zone PLC financial performance has a market capitalization of 42.5 million, and some of its significant competitors include Scarosso, Caleres and Greats and Viking Outdoor footwear. In addition, the report will also examine the company's corporate governance compliance measures and provide recommendations which will help it to become a dominant player in the industry, and potentially an FTSE 100 stock in the medium term.

Section A

Financial Ratio Analysis

Financial ratios are measures which are generated by analyzing the different heads under a company’s income statement and balance sheet. Certain financial ratios also use the data relating to its stock price and are known as investment ratios. Together these ratios help to analyse the liquidity, profitability, efficiency and the value of a company. Ratio Analysis for Shoe Zone PLC financial performance is an important aspect of fundamental analysis and is used to determine whether a stock is undervalued or overvalued (Sari, Nurlaela and Titisari, 2018).

Liquidity Ratios

Liquidity Ratios helppredictif a company is strong enough to cover its short term financial obligations with its short term assets. If the liquidity position of a company is satisfactory, it indicates that the company is capable of handling its day to day operations without taking any major losses or piling up liabilities. The liquidity ratios used herein Shoe Zone PLC financial performance are the Current Ratio and Quick Ratio.

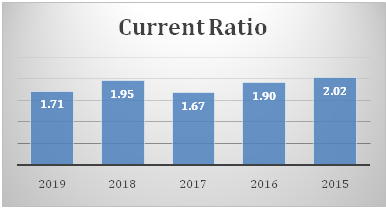

Current Ratio

Current Ratio for Shoe Zone PLC financial performance is the simple proportion of short term assets to liabilities. In other words, it measures how much of a company's short term liabilities can be fulfilled with its short term assets, or how many times over can the short term liabilities be paid off with short term assets. Thus, the current ratio is the simplest liquidity ratio (Saputra, 2019). A low ratio means that the company is very vulnerable in the event of a liquidity crunch, that is, a situation wherein it cannot redeem its short term liabilities. However, if this ratio is too high, it means that the company is tying up a lot of its assets without generating any returns from them, and thus the company is inefficient. During the period between 2015 and 2019, Shoezone’s current ratios fluctuated greatly between 2.02 in 2015 and1.71 in 2019 (Shoezone.com. 2019). The current ratio kept declining considerably over the years. This should be of serious concern to the management as it may not be able to sustain its daily operations with such low current ratios. In situations like the ongoing COVID-19 pandemic, it will be extremely difficult for them to pay off their liabilities without enough current assets to tap into. However, what should be of more concern to the company is the fact that the current ratio is low despite it holding a large amount of Inventory.

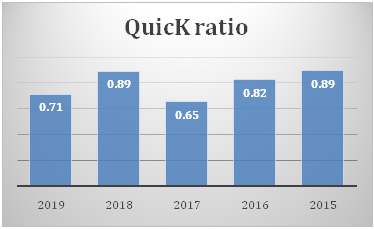

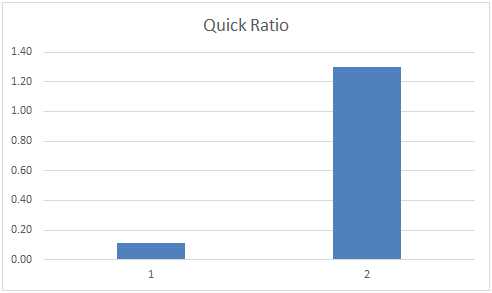

Quick Ratio

The quick ratio for Shoe Zone PLC financial performanceis a stricter measure of liquidity which measures a company's ability to redeem short term debt using only the most liquid of its assets like cash and accounts receivable. This ratio is calculated because a company might not always be able to realize a predetermined amount of revenue from sale of inventory due to measures like discounts which are necessary to make the sale in the first place. This also means that certain other assets like prepaid expenses, whose conversion to cash is also unpredictable is not included in the calculation. However the amount of current liabilities considered remains the same. Shoe Zone PLC quick ratio saw a sharp decline from 0.89 in 2015 to 0.71 in 2019 (Shoezone.com. 2019). This should be extremely concerning to the management as such low levels of liquidity will lead to issues for the company, especially with regard to paying its fixed expenses in cash. In fact, in the current situation of Shoe Zone PLC financial performance, the quick ratio is a more realistic measure of liquidity as any amount of sales is highly speculative and may not occur as per projections. This means that inventory holds much less value than its book value thus forcing the company to tap into other sources to meet its current liabilities (Sari, 2020).

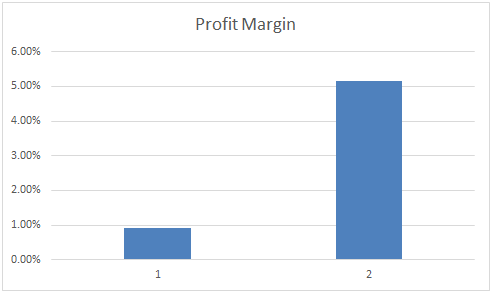

Profitability Ratios

Profitability refers to the capacity of a company to earn profits consistent with the size and scale of its operations. Often, companies will make profits but the margins may be so low that the investors may not realize any value out of it. Thus, it is a priority for the management to increase a company's profitability so as to improve its position as an investment prospect. The profitability ratios used herein Shoe Zone PLC financial performance are Operating Margin, Net Profit Margin and Return on Total Assets (Prasetio and Suryono, 2016).

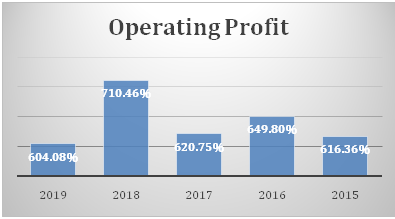

Operating Margin

Operating Margin is the simplest measure of profitability as it considers only the sales and cost of sales. Thus, this measure helps to determine if the company has adequately priced its products and is able to make adequate sales and whether it is able to consider the cost of sales and control it to make effective operating gains (Wahyuni and Hafiz, 2019). This ratio ignores all the expenses not related to the sale of products like administration expenses. Operating Profit is an expression of what percentage of revenue is realized as operating profit. Companies try to keep this ratio as high as possible. The Operating Margin of Shoe Zone PLC financial performancedeclined from 616.36% in 2015 to 604.08% in 2019. However, it has been fluctuating as it decreased sharply in 2017 but rose again in 2018 before declining in 2019 (Shoezone.com. 2019). The company should focus on increasing this ratio as much as possible by streamlining the product acquisition procedures to reduce cost of sales. This is because the lower this ratio is, more pressure is exerted on the other non-operating expense items to reduce losses.

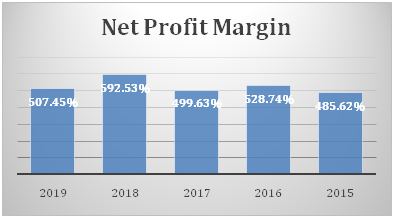

Net Profit Margin

Net Profit Margin considered for Shoe Zone PLC financial performance is the standard measure of profitability and is more stringent than operating margin because it accounts for every item of income and expense in its calculation. Thus it is generally relied upon by investors as a measure of profit margin as it is more comprehensive than operating margin. The net profit margin is generally lower than the operating margin due to non-operating expenses exceeding non-operating incomes. The inferences from net profit margin and operating margin are generally the same and companies try to keep it as high as possible.

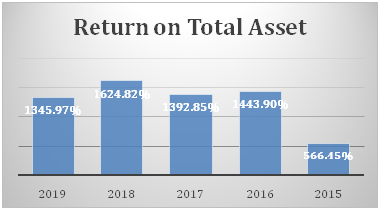

Return on Total Assets

Return on total assets measures what percentage of the total assets of a company is it making in net income during a year. This helps in comparing companies of varying sizes by scaling their earnings down to relative measures. For Shoe Zone PLC financial performance, the higher the ratio the better it is for the company but if the ratio is too low, it may suggest that the company has a lot of idle assets not being used to generate returns or simply a deterioration of its earnings performance. The ratio was highest at 1624.82% in 2018 but lowest at 1345.97% in 2019 (Shoezone.com. 2019). This means that the company has experienced a severe deterioration to its earnings performance as evidenced by both the operating margin and the net profit margin (Zhang, 2016).

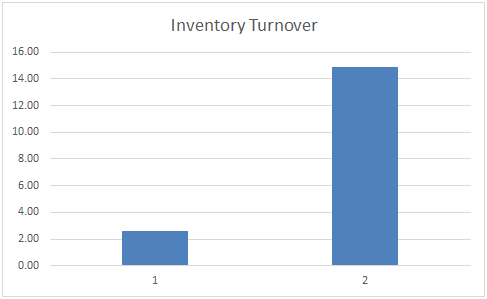

Efficiency Ratios

The Efficiency Ratios for Shoe Zone PLC financial performance provide a measure of the extent to which a company is utilizing its assets and liabilities in its internal business processes. These ratios can be used to find out if the income generated by the company is justified for the amount of assets it holds, and are thus directly quantifying the business' operations. These ratios can also be used to identify if there are any shortfalls in the utilization of assets which the company can look into and rectify so that it becomes a dominant force in the market. The Efficiency Ratios used in this analysis of Shoe Zone PLC financial performance are Inventory Turnover Ratio, Total Assets Turnover Ratio, and Accounts Receivable Turnover Ratio.

Collectively the three efficiency ratios indicate that the company has been able to maintain a reasonable level of operational efficiency in the period of analysis, improving over the years in terms of asset turnover and receivables turnover but experiencing slight declines in Inventory turnover (Wang and Huang, 2019).

Investment Ratios

Investment Ratios are ratios used to analyze the performance of the stock of a publicly listed company in the stock market. The stock price is an important metric for the company as it represents all the discounted cash flows the company is expected to make. Thus, a higher stock price implies that investors are confident about the company's ability to earn more, which can happen only if the company reports strong Shoe Zone PLC financial performance consistently. Thus by assessing the investment ratios of a company, one can know if a company is a fundamentally strong investment or not. The investment ratios used here are Price to Earnings Ratio and Earnings per Share.

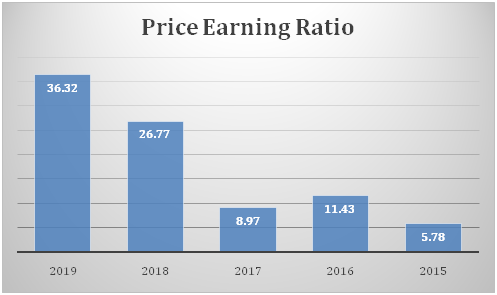

Price to Earnings Ratio to measure Shoe Zone PLC financial performance

The Price to Earnings Ratio is a measure of how many times the earnings per share has to be paid to buy the stock. It is an indicator of whether a stock is undervalued or overvalued. As this is subjective, different analysts may interpret the PE Ratio differently. The company's PE ratio increased considerably from 5.78 to 36.32 during the period of analysis (Shoezone.com. 2019). While this represents investors' confidence in the company, it can also be seen as a suggestion that the company is overvalued. This could mean that small changes to performance results can have a considerable impact on the stock price, thus making it more volatile.

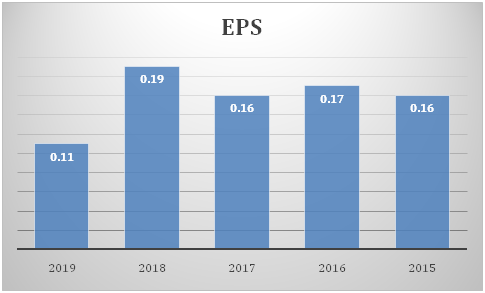

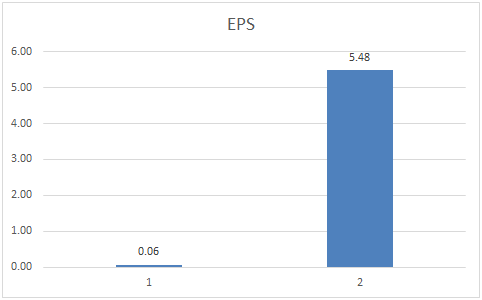

Earnings per Share

Earnings per Share measures how much if a company's income can be attributed to the number of outstanding shares. It is also used in the calculation of price earnings ratio described earlier. Although not all of the EPS may reach the shareholder as dividend, it is still a helpful indicator of Shoe Zone PLC financial performance (Wei, 2016). Reduction in EPS generally signifies a deterioration of earnings or a fresh issue of shares. The ratio was highest at 0.19 in 2017 and lowest at 0.11 in 2019 (Shoezone.com. 2019). A fresh issue of shares happened during this time that contributed to this decline. However, the company's earnings have also been falling and this should be of concern to the management.

Non-Financial Analysis

(Refer Appendix for SWOT Analysis)

Shoe Zone Plc's primary strengths lie in their strong vertical integration, which helped consolidate their supply chain, as well as the wide variety of brands whose products it sells, which reduces the possibility of a supply crisis. As the supply chain has proved to be extremely reliable for the company, it can leverage it to make better growth strategies. However, poor marketing strategies and a lack of brand image are pressing concerns for the company. Its problems are exacerbated by a board whose members are largely inexperienced in the specific industry. The Brexit situation and the COVID-19 pandemic create a set of opportunities and threats for the company as the influence of EU players in the British market is expected to diminish while the company's exports to EU markets is expected to take a hit as well. The lower interest rates due to the pandemic allow for cheaper borrowings but drastically affect sales and the operational efficiency of the company. Furthermore, the apparel industry is also affected by concerns relating to climate change and animal rights which would force Shoe Zone PLC to remove unsustainable and animal-based products from their inventory, leading to major losses. However, quick action in this regard can significantly boost their public image as well(Pavlovich et al., 2020).

Competitor Analysis

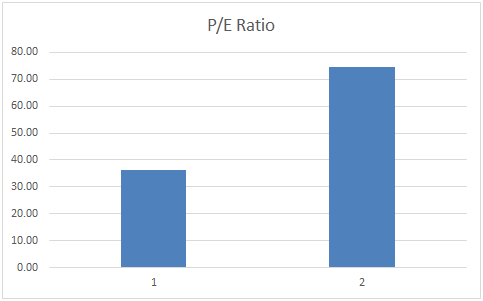

The following charts illustrate the Shoe Zone PLC financial performance and position in relation to its competitor Scarosso Plc, an e-commerce fashion retailer who focus on their own brand of apparel. Scarosso significantly outperforms SHOE Zone PLC in terms of liquidity, profitability, and efficiency. However, the high PE Ratio of Boohoo may indicate that their stock is overvalued and thus a less viable investment prospect. Boohoo also outperforms Shoe Zone PLC in terms of Ratios like EPS.

(1-Shoe Zone PLC, 2-Scarosso in the charts)

Source: Yahoo.finance., 2019

Source: Yahoo.finance., 2019

Source: Yahoo.finance., 2019

Source: Yahoo.finance., 2019

Source: Yahoo.finance., 2019

Section B

Corporate Governance

Shoe Zone PLC is counted among the top shoe manufacturers of UK and its business model revolves around strategies that focuses on providing maximum benefit and satisfaction for customer. Further, it also aims at consolidation the core values using the pillars of Big Boz Expansion, Digital Growth and Town Centre Renewal. The management has put in lot od dedication and hard work for growing the business and expanding its operation within and outside the country and has proven highly successful both in terms of value creation and Shoe Zone PLC financial performance.

The CEO and CFO are accountable to hold annual meeting with shareholders and discuss the short- and long-term goals of the business. They are also required to disclose the announcement of annual and interim results. Increased scrutiny of government in industrial performance and its impact on overall health of the environment have made the management focus on adding innovative line of products such as replacement if plastic shoe shaper with biodegradable cardboard one. The dedication and disciplined operation of the business along with maintaining transparency with internal and external shareholders is one of the major reasons behind its success within short time.

Strategic Recommendations

Based on the analysis given above, the following recommendations are given to the management of Shoe Zone Plc, which if implemented, can accelerate their growth to market dominance and become a part of the FTSE 100.

- Leverage the supply chain to improve the operational efficiency and reduce cost of sales.

- Focus more on the external brands in the short term but build a market base for their own brand over a long term

- Improve the marketing strategies and capture public attention towards the brand.

- Include board members with experience in the retail industry, preferably e commerce.

Conclusion

This report was a study of the financial and non-financial aspects of the business of Shoe Zone Plc, which included an analysis of their liquidity, profitability, efficiency and their prospect as an investment. These were then compared to a competitor, Scarosso Plc, which appears to be performing better than Shoe Zone PLC. The report also examines the corporate governance structure of the company and provides certain recommendations to improve the company's growth trajectory.

Appendix

SWOT Analysis

|

Strengths |

Weaknesses |

|

Strong vertical integration Large collection of brands Reliable supply chain |

Poor profitability ratios Poor marketing strategies Lack of industry experienced board members |

|

Opportunities |

Threats |

|

Lack of influence of EU players in the British market due to Brexit Reduced interest rates due to COVID-19 pandemic allows for cheaper borrowings Relaxed taxation policy of the UK government |

Brexit restricting access into major European markets COVID-19 pandemic leading to a drop in sales and operational capabilities Climate change and animal rights concerns might lead to drop in sales of certain products |

References

Pavlovich, K., Bowden, S.C., Simnadis, T., Connolly, H., Collins, E. and Gibb, J., 2020. Allbirds: Sustainable innovation disrupting the casual shoe industry. Shoe Zone PLC financial performanceSAGE Publications: SAGE Business Cases Originals.

Prasetio, D.A. and Suryono, B., 2016. Pengaruh Profitabilitas, Free Cash Flow, Investment Opportunity Set Terhadap Dividend Payout Ratio. Jurnal Ilmu dan Riset Akuntansi (JIRA), 5(1).

Saputra, A.J., 2019. THE EFFECT OF LIQUIDITY RATIO LEVERAGE RATIO AND ACTIVITY RATIO IN PREDICTING FINANCIAL DISTRESS. Management and Economic Journal, pp.581-592.

Sari, M., 2020. [HASIL TURNITIN] The Influence of Problematic Financing, Liquidity Ratio and Operational Efficiency Ratio (OER) on Profitability of Sharia Commercial Banks. Kumpulan Penelitian dan Pengabdian Dosen.

Sari, R.K., Nurlaela, S. and Titisari, K.H., 2018, August. The Effect of Liquidity Ratio, Profitability Ratio, Company Size, and Leverage on Bond Rating in Construction and Real Estate Company. In PROCEEDING ICTESS (Internasional Conference on Technology, Education and Social Sciences).

Shoezone.com. 2019. Shoe Zone | Men's, Women's & Kids’ Shoes At Cheap Prices.Shoe Zone PLC financial performance [online] Available at:

Wahyuni, S.F. and Hafiz, M.S., 2019, August. The Effect of Return on Equity and Investment Opportunity Set to Price Earnings Ratio with Current Ratio as a Moderating Variable in Metal Companies Listed in Indonesia Stock Exchange (Bursa Efek Indonesia). In First International Conference on Administration Science (ICAS 2019). Atlantis Press.

Wang, M. and Huang, H., 2019. The design of a flexible capital-constrained global supply chain by integrating operational and financial strategies. Omega, 88, pp.40-62.

Wei, L., 2016. Decision-making Behaviours toward online shopping. International Journal of Marketing Studies, 8(3), pp.111-121.

Wijayaa, J.H. and Yudawisastrab, H.G., 2019. Influence of Capital Adequacy Ratio, Net Interest Margin and liquidity Ratio against Profitability Ratio. International Journal of Innovation, Creativity and Change, pp.268-277.

Zhang, S., 2016. Optimal scheduling of chemical process industry for better operability and profitibility.Shoe Zone PLC financial performance Lamar University-Beaumont.