Management Assignment: Business Report on IDFC Bank

Question

Task: For this management assignment, you have to analyse the case of IDFC First Bank which was used in the first course. This time, you have to assume the perspective of a strategy consultant retained by the senior management of the organisation. Your brief is to provide an analysis of the company’s current strategy, evaluate its capacity, and recommend areas of improvement.

Your report should respond to the following questions:

1. What external environmental conditions is the organisation facing? Provide a brief overview from course 1 on this organisation in order to provide context.

2. What are the organisation's internal environmental conditions? Reflect on the organisations strategic and dynamic capabilities. You should refer to the value-chain. Capabilities may, but not necessarily, include culture, operations, marketing, service, logistics.

3. How does the organisation currently build a competitive advantage through its business and corporate-level strategies? Consider the type of business-level strategy that is being pursued, and whether this is sound given the current environment. Review any corporate-level strategies in place. Do these make sense, and are they working?

4. How does the organisation's design enable these strategies? You may want to consider recent organisational structural changes, level of centralisation, horizontal structural characteristics, and the appropriateness of the structure for the strategy being pursued.

5. What recommendations can you make to improve the organisation’s strategic prospects? Depending upon your analysis in the preceding questions, options could include strengthening or changing its business or corporate level strategies. You could consider recommendations arising from the application of the strategy clock. Your recommendations might also include building, leveraging or stretching capabilities if the organisation faces current weaknesses.

Answer

Introduction

In the modern era of banking industry there are two types of banking institutions in India, which are public sector banks, in which 50% of shares are held by the state, and central government of India, whereas the shares of the private bank are held by the Private Corporation, and individuals. Because of the market's competitiveness, better customer experiences, and better investment opportunities, both consumers and shareholders are increasingly favoring private banks over public sector banks in India these days, prompting the federal bureaucracy to reconsider holding a majority stake and selling those shares in the market in order to open up new opportunities for the government.

IDFC First Bank is a finance company with an integrated infrastructure, headquartered in Mumbai. In 2014, principle approval was granted to IDFC Limited by the Reserve Bank of India for setting up a new private sector bank. Consequently, a new entity emerged, IDFC Bank where the financial liabilities and assets were divested. IDFC is a private sector bank licensed by RBI which was founded by V. Vaidyanathan. He is both the Managing Director and CEO of IDFC First Bank Ltd. IDFC First Bank had its first registered office at KRM Tower, 8th Floor, No.1 Harrington Road, Chetpet, Chennai - 600 031 on April 9, 2014. On 1 October 2015 for the first time IDFC First bank started its operations. In the month of July of 2015 an universal license for banking was received by IDFC Bank from the RBI or Reserve Bank of India. In November 2015 through this divergence idfc bank was launched from IDFC Limited. The operational grounds of IDFC First Bank started from 19th of October in 2015, and had successfully opened over 600 branches by 2021 in India. In Madhya Pradesh it had around 23 branches and similarly in Delhi, Mumbai, Kolkata, Bangalore. Cities where there is a population of around 10,000 IDFC had settlements of only 15 branches. Thus by October of 2017, in the Honnali city of Karnataka, IDFC opened its 100th branch. On 30th of September 2020, the network of branches of IDFC first bank stood at 523 branches with a total of 509 ATMs all across India; by 31st of December 2020 the branches number of IDFC first bank increased to 576 branches along with the ATM number of 541 all over India. Though being a private sector bank, they have better penetration compared to public sector banks as they have different policies for rural banking unlike public sector banks.

Evaluation of external environmental condition of IDFC First bank

Over the last few years, there has been an increase in the awareness and responsiveness towards confronting environmental and social influence of stakeholders for differing causes. IDFC First Bank strictly conserves the fact that a healthy and safe reasons management system for tackling the environmental and social issues in an organization is crucial and helps to relieve such influences.

Political: IDFC FIRST Bank provides commitment and mobilization of capital to a wide range of organizations and their projects, which includes companies of different sectors like infrastructure, sectors of services and manufacture, and extractive industries that can be related closely with influences and risks of environmental and social issues. Economic: Prior to the reaching of a decision related to finance, assessment of the extension of these influences and its correlated risks should be done precisely for working with its clients, and for the same application of a clear set of policies which would make one accountable for their actions both in terms of environment and social values of IDFC and keep this accountability consistent by achieving international standardization and through better strategies involved. IDFC FIRST Bank identified delay in acquisition of land, social conflict, of land, and litigation due to time and overruns in cost. These issues recognize that these issues can influence quality of assets and hence, have the urgency of being addressed.

Socio-logical: Social Policy of IDFC

FIRST Bank committed to guidelines of Equator Principles that paved the road for the assessments of risks of the company based on Environmental and Social factors and along with aims at credit time of appraisal and monitors its loan period through its overall environmental performance. ESDD, known as Environment and Social Due Diligence of Projects is undertaken by ERG beforehand for the approval of the project and ensure to have credibility recognized the risks of E&S and have planned the structured of the management practices and techniques related to environment corresponding to the phases of project, its operational or constructional phases, in accordance with the needs of applied Indian Environmental Legislations and the Equator Principles.

The external environmental condition of IDFC First Bank can be analyzed and evaluated based on these following factors:

Technological: The introduction of technological advancements in the banking sector made online transactions easier in the last few years. Indian banks have been using communication and information technologies for providing better the customer’s experience and services. In the year 2015, IDFC First Bank after its in-principal approval, implemented TCS Bancs’ First Bank after its in-principal approval, implemented TCS Bancs’

Legal: IDFC First Bank provides assistance to the employment laws and consumer protection laws of India and specifically they follow the Equal Remuneration Act, 1976. With these legal considerations the bank provides paid up bloc holidays and medical leaves. Even unlike other banks, IDFC First bank allows prestige leaves and casual leaves and incentives for both. The bank established an ethical yet growth-oriented working environment.

Environmental: Environmental factors contain Corporate Social Responsibility or CSR, and climate issues occurring from business activities. IDFC First Bank has supported over four thousand beneficiaries in pan India by providing loans to women with the aim of women empowerment and they have conducted various programs related to sanitation, entrepreneurship and livelihood and education. Moreover, IDFC First bank took the initiative to organize the Shwetha program to increase the income of the rural families and women who are engaged with dairy farming. In partnership with Pune Municipal Corporation expiration and Pune City Connect the bank has conducted Lighthouse Program to educate and skilled the youths by providing professional training. These preserved and provided a healthy contribution to the social environmental factors.

Analysis of internal environmental condition of IDFC First bank

Over the last few years, there has been an increase in the awareness and responsiveness towards confronting environmental and social influence of stakeholders for differing causes. IDFC FIRST Bank strictly conserves the fact that a healthy and safe reasons management system for tackling the environmental and social issues in an organization is crucial and helps to relieve such influences. IDFC FIRST Bank provides commitment and mobilization of capital to a wide range of organizations and their projects, which includes companies of different sectors like infrastructure, sectors of services and manufacture, and extractive industries that can be related closely with influences and risks of environmental and social issues. Prior to the reaching of a decision related to finance, assessment of the extension of these influences and its correlated risks should be done precisely for working with its clients, and for the same application of a clear set of policies which would make one accountable for their actions both in terms of environment and social values of IDFC and keep this accountability consistent by achieving international standardardization and through better strategies involved.

Culture: The internal environment for employees is proven to be healthy for IDFC First bank because the environment promotes motivation, dedication and reliability of their employees towards the bank. This provides an ethical, clean and growth oriented work culture where the management team values the employees as the most important asset of the bank. The decision of every employee is valued and is respected regardless of their post and experience.

Marketing: Corporate presentation or marketing can play a pivotal role to attract customers. IDFC Bank launched “Always You First” campaign to showcase their offerings of new customer first approach and 7 percent p.a. savings account of minors. They involved famous social influencers such as television actors and cricket players to promote their bank name.

Logistics: Offering financial services to the customers are considered to be the logistics for banks. The bank offers services like insurance, deposits, savings account, loans, cards, forex, corporate salary account, savings account of minors and clients from abroad (NRIs). The bank has funded assets of about Rs 1,07,004Cr, retailization in funded assets is 54%, retail funded assets of about Rs 57,310 Cr, CASA deposits of Rs 20,661Cr, CASA Ratio (in percentage) of about 31.87%, Annual Gain After Tax is Rs 2,864Cr. The bank provides customized and easy services to its customers through use of information technology, which play a greater role in the value chain of the bank. Easy service availability of the IDFC First bank from anywhere around the world in a fraction of minutes is enabled for providing customers with the best service facility of bank servers. Moreover, the bank maintained and regulated detailed informative records of their customers to prioritize them and provide them banking benefits of IDFC.

Operations: IDFC Bank stands its operation with its twenty-three branches all across India from October 1st of 2015. The bank started its operation in the 23 branches in different cities with a loan book of almost 46381 crore currently the bank has more than 523 branches and 509 ATMs in pan India.

Service: With the aim to provide flexible banking experience, IDFC First Bank offers its customer personal tailored banking services at their doorsteps. They have special customer care services for their NRI customers from the UK, USA, Canada, Bahrain, Italy, Switzerland, UAE and from many other countries.

Assessment of the competitive advantage of through business, and cooperative strategies

With the plan to acquire benefits, the bank's principal centre should associate with its obligation system and resource technique. To produce higher net revenue, the IDFC First Bank attempts to build its CASA Ratio from 10.4% in 2018 to 30.7% within five years. The bank centers on retail term stores and retail CASA to broaden liabilities (Mahapatraet al., 2017)

. The bank likewise plans to build up 600-700 additional branches in the following not many years to acquire benefits. The bank applied the methodology of enhancement of resources by expanding the retail book organization from 34.62Vo to practically 70% in the following five years. In the principal quarter of FY 2020, the bank worked on its blend of retail resources, expanded in productivity and got a sharp ascent in stores and these three measurements end up being a contender's benefit for the bank (DANG et al,. 2018). Each industry including banking has a hidden design or a bunch of major financial and specialized qualities which bring about serious powers. A firm can unmistakably improve or disintegrate its situation inside an industry through its decision system. The cutthroat system, then, at that point, reacts to the climate as well as endeavors to shape the climate in support of it. The tactician should thus try to situate their firm to adapt best inside its industry climate or to impact that climate in the firm’s favor another essential development of the bank is to bring India's most notorious character, Mr Amitabh Bachchan as their image face (Jayaprakash et al., 2020). The bank conducts numerous occasions identified with CSR which is one more corporate system to maintain their bank name as a CSR agreeable association. The changed monetary climate as referenced before needs to prompt the deluge of banks subsequently, the need to evaluate the viability of IDFC First Bank’s 14 cutthroat procedures. For this reason, the ideas of strategic advantage over different players, its significance and effect on corporate execution are currently thought of.

In this review, the expressive exploration configuration is utilized in which cross-sectional examination is finished by gathering auxiliary information. The auxiliary information was basically gathered from the bank's sites. Hypothetical parts of the review were gathered from Google Scholar and comparative refers to.

The Net Profit Margin of HDFC Bank shows a vertical pattern in the course of recent years. Then again, IDFC First Bank demonstrates a negative pattern though Axis Bank shows a fluctuating pattern all through the review. The EPS in regard to HDFC bank portrays a consistent positive pattern anticipates FY2020. Though the other two banks have a fluctuating pattern particularly the Axis Bank has perceptible varieties. Substitute high points and low points in ROE can be found on account of HDFC Bank. For the past 4 years, IDFC First Bank's ROE is showing a negative pattern. In the meantime, an ordinary variance in ROE can be found on account of Axis bank. The dissolvability position of both HDFC Bank and Axis bank shows a consistent to progressive development. IDFC First Bank's dissolvable position isn't good. HDFC Bank is having a superior resource quality and it is monetarily solid. Hub Bank's resource quality is beneath the acceptable level. What's more, IDFC First Bank has the potential for working on its monetary sufficiency.

Identification, and discussion of organizational structure of IDFC First bank The authoritative design alludes to the framework which traces the manner by which certain activities should be coordinated with the goal that the ideal hierarchical objectives can be accomplished. 1n instance of the chosen association, which is IDFC First Bank, the hierarchical design ought to obviously diagram the tasks of the bank. The exercises to be consolidated in the authoritative construction incorporate the principles, obligations and jobs of the representatives and the executives. The authoritative design should characterize and decide the manner by which the data should stream across the different levels of the bank. The IDFC First Bank follows an order in its hierarchical design. The authoritative construction of the bank incorporates 82 primary leaders (Seethalakshmiet al,. 2020). MrVernbu Vaidyanathan is the CEO and Managing Director of the bank. Madhivanan Balakrishnan and Sudhanshu Jain are two of the significant leaders of the bank. The association was established in the year 20 I S in the period of December. The establishment of IDFC First Bank depended on a consolidation between IDFC First Bank and Capital First. Since its establishment, the bank has been following the various leveled hierarchical design which is going by the CEO and helped by the Board of Directors. The dynamic and the executives of the bank are in the possession of the Board of Directors. However the chiefs and lower rank staff are educated regarding every one of the fundamental choices and their input is additionally acknowledged, an official conclusion is made by the Board. The CEO has the help of the chief's who handle different parts of the financial activities. The fundamental leaders handle the obligations of CFO, COO, consistency, human asset and correspondence, hazard the executives, review, and so on There are different leaders who manage the computerized stage, business banking, individual banking, lawful issue, retail resources and liabilities, discount bank and abundance the executives. Beneath the leaders heading every division, are the financial authorities (Batra et al,. 2020). The representatives and officials are on the cutting edge and meet the clients on a consistent schedule. They are essentially the substance of the IDFC First Bank. The bank staff impacts the client relations as they handle the customers and clients consistently. The relationship of the clients with the bank relies upon the administrations the bank staff gives them. The business staff and the client care agent's need to guarantee that they offer the most ideal types of assistance to their customers so they are happy with the bank and would need to connect with them over the long haul. In banking, the principal perspective is a trust which ties the keep money with the clients. Through a very much organized and deliberate authoritative construction across the IDFC First Bank, every single staff is all around educated regarding the hierarchical objectives, their jobs and obligations and the assumptions for the bank from the staff.

Recommendation

IDFC First Bank is another bank that has been shaped in 2018. The perch of a significant and fundamental part of a bank is acquiring the trust of the clients and customers. Individuals really reconsider partners with another bank. The client's methodology of the bank for well-being purposes. They need to trust that they are keeping money with their bank. Indeed, even on account of taking credits, the cast proprietors need a bank that is dependable so that there are no secret expenses behind an advance. The focal point of IDFC First Bank ought to be on acquiring the trust of the clients. They need to make decent market notoriety. The informal exchange for the bank would draw in numerous clients to the bank. Clients would need to store their cash and open different records with the bank. The large business houses will need to connect with the bank.

According to the monetary records, IDFC First Bank has an extremely impressive base of the supported resources, the sums to more than 10,400 cores. The bank has 37% of the subsidized resource in the retail portion. The net revenue edge of the bank which is quarterly annualized has now extended to 3.0 per cent from 1.9 per cent post their consolidation (IDFC First Bank, 2021). However the worth of the portions of the bank has fallen as of late because of the pandemic and worldwide downturn, it is probably going to get a lot back in structure. Consequently, IDFC First Bank should utilize its monetary ability to subsidize organizations and broaden more credits so their cash course could expand their business.

Different proposals which could work on the general business and execution of IDFC First Bank incorporate permitting their clients to contact the bank at whatever point required. The clients ought to have the option to finish all their financial exchanges through the application of IDFC First Bank.

The clients and customers should be furnished with an unrivalled degree of safety and accommodation. The bank needs to bring together its client encounters across different channels. The bank ought to likewise help banking changes by offering progressed help to its customers.

Conclusion

The inward climate of the IDFC First Bank has been dissected utilizing Porter's worth chain. Then again, the outer climate of the bank has been dissected with the PESTLE technique. Subsequent to dissecting the business climate, examining the hierarchical design of the bank and assessing its corporate procedures and complete benefit, it may very well be inferred that as a recently framed bank, it is performing great. The bank is confronting exceptional rivalry in the market from State Bank of India, HDFC, Bank Mumi and A U Small Finance Bank. Be that as it may, by offering appealing loan fees on stores the IDFC First Bank is attempting t o draw in more clients. By acquiring the trust of the clients and making decent market notoriety, the bank can advance its market position.

Appendices

Task 1

https://learn.upgrad.com/course/1646/segment/11405/70756/208692/1105052

1. Which capabilities does the company have that are dynamic? Indicate whether you believe that they are most suited to sense, seize, or reconfigure.

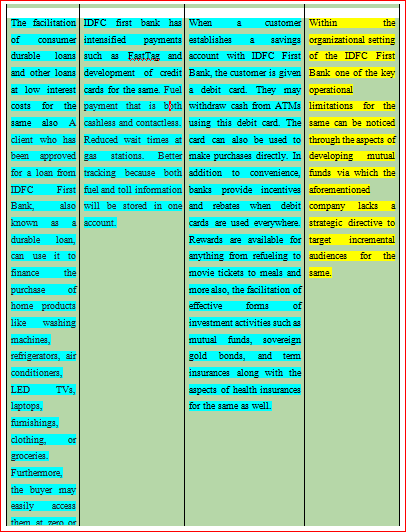

One of the major implications within the organizational framework of IDFC First Bank caters to the fact that the management caters to incremental forms of managerial and operational services pertaining to the aspect of facilitating effective forms of financial services in the long haul (IDFC, 2021). The management adheres to incremental forms of services pertaining to the notions of consumer durable loans through which they earn its most of the revenue aspects for the same. The management of the aforementioned business community caters to incremental forms of managerial and operational activities for the same through notions of collaborative and participative notions through which notions of ethical business practices can be portrayed within the organizational setting for the same.

The aspect of developing consumer durable loans within the organizational setting of the workforce community caters towards the notions of incremental forms of revenues for the management through which they can aim to portray a sense of customer focused business practices through which the individual preferences of the target audiences can be portrayed in the long haul as well.

2. Does the company have any gaps? If so, note these down

One of the major gaps that can be portrayed within the organizational setting of the workforce community of IDFC First Bank caters to the fact that the management can aim to cater to instances of incremental forms of training and development notions within their respective business communities through which the innate employability skills of the collection workers in various loan departments can be improved in the long haul.

Task 2

https://learn.upgrad.com/course/1646/segment/11405/70757/208695/1105060

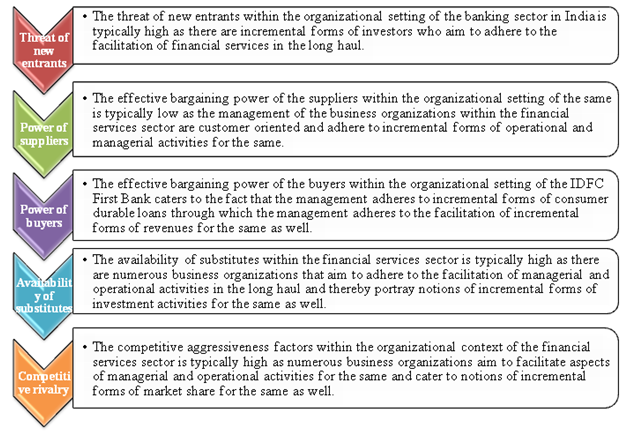

Porter’s five forces

Figure- Porter’s five forces analysis

(Source: Self- made)

Figure: Porter’s Five Forces

(Source: Chesula and Kiriinya, 2018)

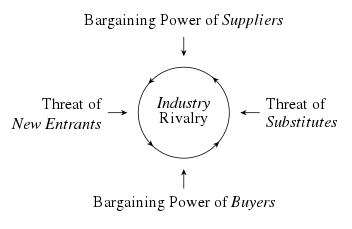

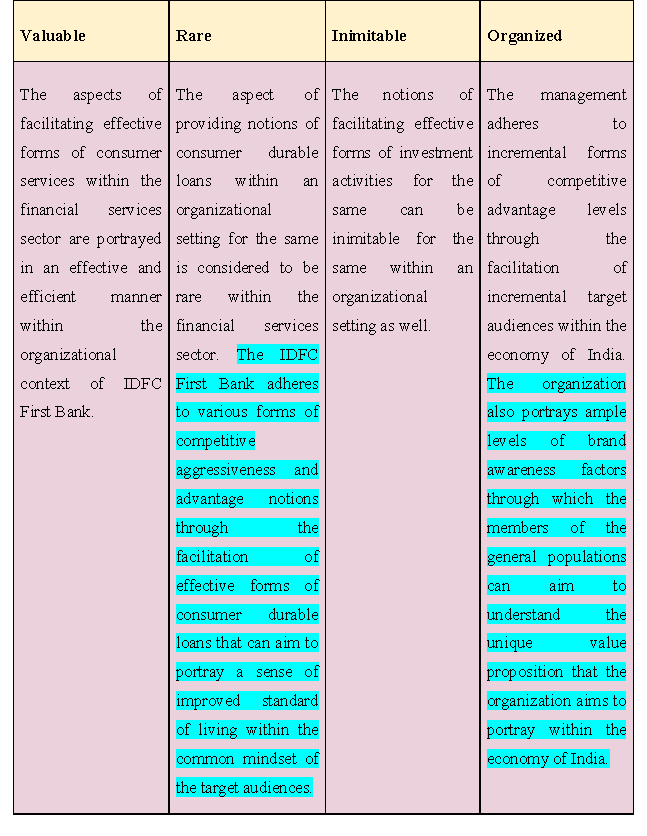

Value chain analysis

Primary activities

? Inbound logistics: The aspect of inbound logistics catered by the management of IDFC First Bank adheres to the facilitation of various forms of business process systems through the implementation of interdepartmental heads within their effective organizational structure for the same.

? Operations: The effective mode of operations catered by the management of the business organization caters to the facilitation of various forms of investment activities through which the business organization can aim to adhere to their core business processes for the same as well. The effective operations for the same pertain to the development of various forms of support activities pertaining to the notions of various forms of fund management practices and a customized and personalized service for the same.

? Outbound logistics: The aspect of outbound logistics is catered towards the incremental target audiences catered by the aforementioned bank through which the management can aim to earn incremental profits through the investment activities that are facilitated in the long haul. The management offers their financial products within the economy of India and thereby focuses on the notions of various forms of product expansion processes for the same as well.

? Marketing and Sales: The management adheres to integrated forms of marketing processes within their organizational context through which instances of strategic alliances can be portrayed through the development of #AlwaysYouFirst campaign thereby developing an effective value proposition that targets the groups of individuals at an incremental rate for the same.

? Services: The effective services portrayed by the management of the IDFC First Bank caters to incremental forms of follow up services pertaining to the investment activities that are facilitated by the target audiences and thereby develop a sense of customer relationship management as well. Hence, the management of IDFC First Bank adheres to the development of various forms of customer retention practices by developing instances of interpersonal relationships within the workforce community and provides an outlook as to how the management operating within the financial services sector can aim to meet the needs of the audiences incrementally.

Secondary activities

Company infrastructure: The infrastructural outlook of the same caters to the fact that the management adheres to incremental forms of investment activities pertaining to the fact that the management caters savings and deposits, instances of provision of loans, developing investment notions through mutual funds and term insurance practices and intensified payments systems for the same as well.

Human Resource Management: The HRM activities catered by the management of the IDFC First Bank caters to the facilitation of collaborative and participative approaches of managerial and operational activities through which they aim to improve the motivational levels of the workforce community at an incremental rate for the same. The effective forms of Human Resource Management aspects for the same also pertains to the development of the fact that the aforementioned organization aims to incrementally improve the employability skills of the workers through which various forms of competitive aggressiveness notions can be portrayed within the economy of India.

Research and development: The management of IDFC First Bank caters to the development of technological innovations and developmental factors to adhere to instances of research and development practices in the long haul pertaining to the market demand and analytic factors for the same.

Procurement: The management caters to the facilitation of their necessary goods and services pertaining to the investment activities through the notions of incremental forms of strategic alliances in the long haul.

Figure: Porter’s Value Chain analysis

(Source: Eling and Lehmann, 2018)

Task 3

https://learn.upgrad.com/course/1646/segment/11405/70757/208695/1105060

1. Identify the organization’s distinctive capabilities.

The major distinctive capabilities that can be portrayed within the organizational context of the IDFC First Bank caters to the notions of facilitating effective forms of managerial and operational services within the financial services sector through which instances of funding and investment activities can be portrayed in the long haul (IDFC, 2021). The management offers incremental forms of operational services pertaining to the aspects of consumer durable loans through which various forms of investment activities for the same can be portrayed incrementally in the long haul.

2. Identify the activities that support its delivery.

One of the major implications of the aforementioned aspects of support delivery services of consumer durable loans within the organizational setting of the IDFC First Bank caters to the instances of facilitation of positive word of mouth practices and instances of developing and implementing 0% interest loans for the same.

3. Draw similarities between the

capabilities and activities of the organisation to create a map of how all the activities are interlinked

The facilitation of effective forms of consumer durable loans within the organizational setting of the aforementioned workplace community caters to the fact that the groups of individuals can aim to adhere to the facilitation of various forms of operational activities through the development of savings bank accounts as well (IDFC, 2021). The management caters to various forms of strategic alliances with the management of various investment organizations through which the notions of consumer durable loans can be portrayed through a communal outlook for the same as well.

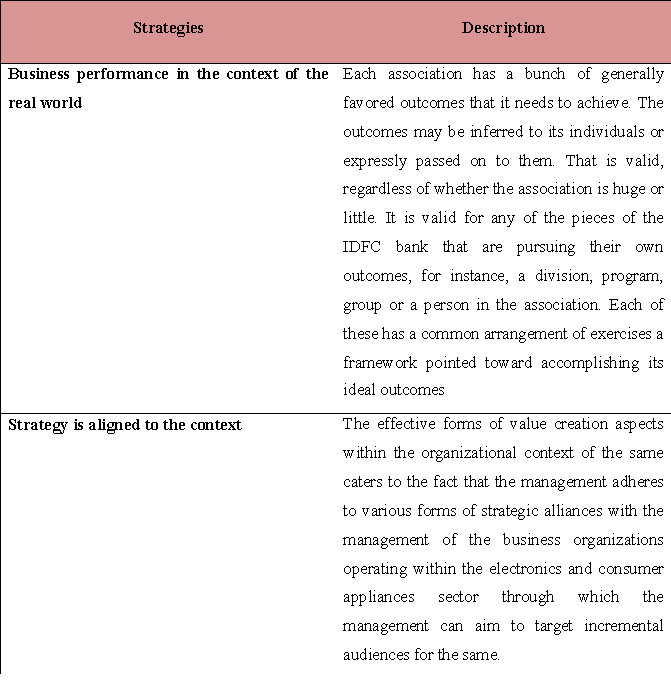

Task 4

The effective forms of value creation aspects within the organizational context of the same caters to the fact that the management adheres to various forms of strategic alliances with the management of the business organizations operating within the electronics and consumer appliances sector through which the management can aim to target incremental audiences for the same. The management aims to facilitate aspects of payments, savings, and notions of managerial and operational activities for the same through the facilitation of the aforementioned forms of strategic alliances for the same as well.

Task 5

https://learn.upgrad.com/course/1646/segment/11405/70757/208696/1105066

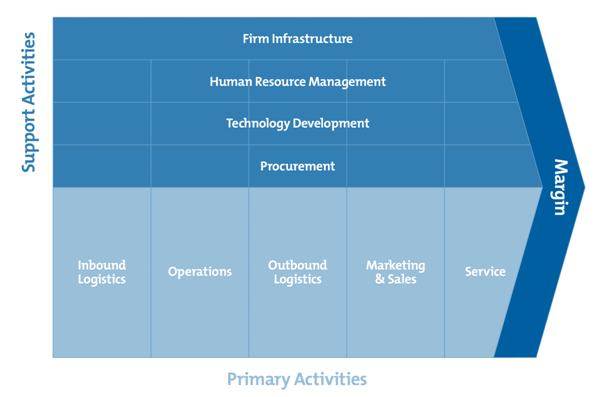

1. Consider each of the capabilities that you have identified about your assignment company; you can refer to the value-chain exercise. Ask yourself whether these are Valuable, Rare, Imitable and Supported by the Organization.

Table: VRIO analysis

2. What does this tell you about your organisation’s capabilities and their ability to deliver a strategic advantage? Does your organisation have some clear distinctive capabilities? Or, do you need to build, develop and nurture some new ones?

The management caters to the facilitation of incremental forms of target audiences within their organizational setting of the aforementioned workforce community caters to the fact that the management adheres to the development of incremental products within the financial services sector through which the management can aim to adhere to a high market share for the same. The distinctive capabilities of the same adheres to the incremental facilitation of investment activities within the financial services sector through which the management can aim to offer 0% interest consumer durable loans towards their target audiences for the same.

Task 6

Low-price Strategies: The management of IDFC First Bank caters to the development of low pricing strategy notions through the incremental facilitation of various forms of consumer durable loans often at 0% interest rates through which the management can aim to target incremental audiences within their respective workforce communities.

Differentiation Strategies: The management adheres to the development of integrated modes of marketing processes through which the organization can aim to improve the awareness levels of the target audiences within their respective workforce communities. The management adheres to the facilitation of various forms of strategic alliances with other business organizations within the consumer goods sector through which aspects of incremental forms of financing activities for the same can be portrayed in the long haul.

Hybrid Strategies: The management of the aforementioned workforce community adheres to the development of integrated technological platformsthrough which the target audiences within their respective workforce communities can aim to cater to their financial services and needs in the long haul. For example, the development of operational activities that supports the target audiences to remotely transfer funds, invest in mutual funds and instances of facilitating loans as well.

Non-Competitive Strategies: The management aims to adhere to the development of various forms of interpersonal relations within their respective workforce communities through which the workforce community for the same can aim to adhere to the notions of customer relation management aspects and development of instances of positive experiences as well.

Task 7

https://learn.upgrad.com/course/1646/segment/11405/70752/208675/1104985

Market penetration: The management of IDFC First Bank caters to incremental forms of market penetration factors through the implementation of the strategic decision-making process in order to cater to the notions of the needs of the target audiences at an incremental rate for the same. The management adheres to the development of incremental target audiences through their strategic alliances with various business organizations in the long haul.

Product Development: The management of IDFC First Bank caters to the incremental facilitation of newer services and products within the financial services sector through which the management can aim to improve the feasibility aspects of their effective forms of managerial and operational services for the same.

Market Development: The management aims to adhere to the incremental facilitation of newer services such as the development of consumer services (FastTag) within an organizational context and development of the incremental forms of services pertaining to investment activities, payment services, and online tax payments amongst others.

Diversification: The aspect of diversification can be portrayed within the organizational context of the IDFC First Bank catering to the fact that the management adhered to operate within the financial services sector known as Capital First and thereby facilitated the same through the development of IDFC First Bank; enlisting the management within the banking sector in alignment with the financial services sector as well.

Task 8

https://learn.upgrad.com/course/1646/segment/11405/70752/208677/1104996

The management of IDFC First Bank caters to incremental forms of strategic alliances with the management and administration of the business organizations operating within the consumer services sector through which the aforementioned organization can aim to improve the feasibility aspects for the same at an incremental rate. For example, the management adheres to the facilitation of strategic alliances with various retailers such as Khosla Electronics through which the consumers can aim to select a product such as TVs, phones and computers and thereby portray the investment activities of the same in the long haul as well.

Task 9

https://learn.upgrad.com/course/1646/segment/11405/70753/208680/1105003

Task 10

https://learn.upgrad.com/course/1646/segment/11405/70753/208682/1105013

The organizational structure of the same can be portrayed through the analysis of the fact that the marketing, sales and logistics teams enable the formation of various forms of incremental forms of investment activities for the same at an incremental rate. For example, the management offers financial services aspects through the facilitation of effective forms of loans within an organizational setting for the same and thereby outline notions of marketing activities such as #AlwaysYouFirst through which a customer centric business model for the same can be portrayed in an effective and efficient manner. The logistical services of the same cater to the fact that the management maintains a sense of security through the insurance services through their diverse teams and groups and facilitation of NRI savings account as well.

Task 11

https://learn.upgrad.com/course/1646/segment/11405/70754/208685/1105020

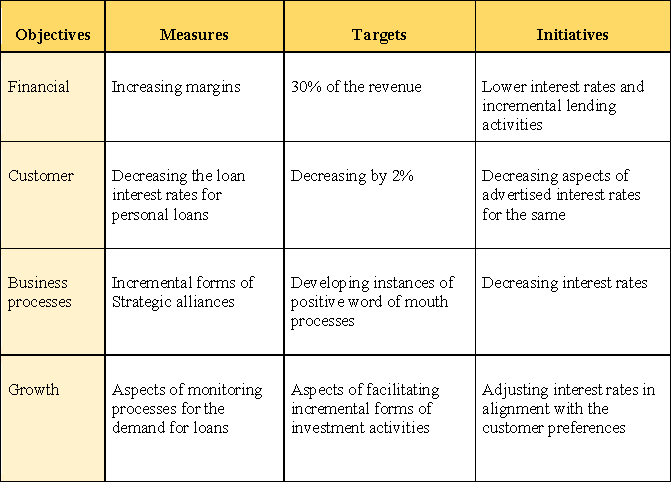

Table: Balanced scorecard:

Task 12

https://learn.upgrad.com/course/1646/segment/11405/70754/208685/1105021

1. Using what you learn about benchmarking, propose a model for the business that you are studying, incorporating a list of companies that you will benchmark yourself against and a list of capabilities that you will compare

The management of the aforementioned business organization within an organizational setting of the same caters to the facilitation of the fact that the management can aim to adhere to the facilitation of incremental forms of strategic alliances with the management of firms such as Bajaj Finance Limited, Ebix Cash World Money India Ltd, and LIC Housing Finance Ltd. through which the management can aim to target incremental audiences for the same in the long haul. Hence, the management will adhere to the development of the strategic decision-making process in the long haul.

2. Consider whether you think this is a good model for judging your performance

The strategic decision-making model for the same caters to the fact that the management can aim to identify various forms of problem statements within an organizational setting of the same through which the management can aim to identify the individual needs and preferences of the target audiences at an incremental rate. The management can thereby develop various forms of solutions for the same and thereby develop incremental forms of alternative solutions for the same in order to depict notions of positive experiences in the long haul as well. The management can finally aim to develop effective forms of solutions for the same through which the management can aim to satisfy the needs of the customers incrementally within their respective workforce communities in the long haul. Hence, the management can aim to adhere to incremental forms of strategic alliances through which the individual needs of the target audiences can be managed in the long haul.

Task 13

https://learn.upgrad.com/course/1646/segment/11405/70754/208686/1105026

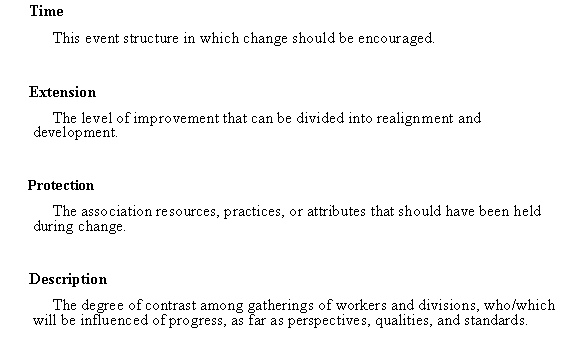

Change Kaleidoscope Change Management Models

Reason for the improvement of globalization, state of the art advancement, and progressive mix, change is these days transformed into a crucial piece of IDFC bank to get by in changing business environment. To manage the change, change the leaders is required in advancing for both definitive and individual levels to achieve future needed change. Change at the progressive level is related to a technique that will show definitive courses and activities. In cultivating a reasonable legitimate framework, both internal and external conditions should be contemplated.

Association Contextual Features

Figure- Association contextual features

(Source: Self- made)

Task 14

Mention in - https://learn.upgrad.com/course/1646/segment/11405/70754/208686/1105029

1. Find a strategic initiative being proposed by your business. Design a communications plan for this initiative based on everything that you have learnt so far. Consider short, medium- and long-term activities and note who will deliver these initiatives as well as any key tactics that will need to be implemented to make them effective.

Table: Strategies initiatives

Reference list

Batra, R. and Bahri, A., 2018. Financial PerFormance and corPorateSocialreSPonSibility (cSr): emPirical evidence From bankS in india. International Journal of Business Ethics in Developing Economies, 7(2), p.37. Retrieved From: https://www.academia.edu/download/60685141/620190923-48145-16mtfm2.pdf[Access at 24 august 2021]

Berrou, R., Ciampoli, N. and Marini, V., 2019. Defining green finance: Existing standards and main challenges. In The Rise of Green Finance in Europe (pp. 31-51). Palgrave Macmillan, Cham. https://link.springer.com/chapter/10.1007/978-3-030-22510-0_2

Berrou, R., Ciampoli, N. and Marini, V., 2019. Defining green finance: Existing standards and main challenges. In The Rise of Green Finance in Europe (pp. 31-51).

Palgrave Macmillan, Cham. Available at: https://link.springer.com/chapter/10.1007/978-3-030-22510-0_2 DANG, T.T. and NGUYEN, T.T., 2021. Developing Green Bank Operation In India And Vietnam: Comparison And Evaluation. Asian Journal of Business Environment, 11(3), pp.33-43. Retrieved From: https://www.koreascience.or.kr/article/JAKO202118748169313.pdf [Access at 24 august 2021]

Jayaprakash, R. and Nair, D.S., Implications & Opportunities of Prompt Corrective Action on Private sector Banks. Retrieved From: https://www.researchgate.net/profile/Rinu-Jayaprakash/publication/347508550_Implications_Opportunities_of_Prompt_Corrective_Action_on_Private_sector_Banks/links/5fdf082a299bf140882a392a/Implications-Opportunities-of-Prompt-Corrective-Action-on-Private-sector-Banks.pdf[Access at 24 august 2021]

Kumar, K. and Prakash, A., 2019. Examination of sustainability reporting practices in Indian banking sector. Asian Journal of Sustainability and Social Responsibility, 4(1), pp.1-16. https://ajssr.springeropen.com/articles/10.1186/s41180-018-0022-2

Kumar, K. and Prakash, A., 2020.

Managing sustainability in banking: extent of sustainable banking adaptations of banking sector in India. Environment, Development and Sustainability, 22(6), pp.5199-5217. https://link.springer.com/article/10.1007/s10668-019-00421-5

Mahapatra, D.M. and Patra, S.K., 2018.

Electronic Payment Adoption In India: Development And Policy Issues. Aweshkar Research Journal, 24(1). Retrieved From: https://www.welingkar.org/sites/default/files/pdf/we-research-aweshkar-research-journal/aWEshkar_March_2018.pdf#page=51 [Access at 24 august 2021]

Sama, H.R., Kosuri, S.V.K. and Kalvakolanu, S., 2020. Evaluating and ranking the Indian private sector banks—A multi?criteria decision?making approach. Journal of Public Affairs, p.e2419. Available at: https://onlinelibrary.wiley.com/doi/abs/10.1002/pa.2419

Seethalakshmi, S. and Shyamala, K., 2019. Digital transformation of Indian Business-An analysis. GIS Business, 14(6), pp.116-123. Retrieved From: https://www.researchgate.net/profile/Manjunath-B-R/publication/341944994_An_Analysis_of_pre_and_post-merger_of_Indian_banks_An_Event_Analysis_Approach/links/5eda7e70299bf1c67d421a8c/An-Analysis-of-pre-and-post-merger-of-Indian-banks-An-Event-Analysis-Approach.pdf[Access at 24 august 2021]

Sehgal, M. and Gupta, S., 2021. Stock Markets in Changing Times: A Study of Select Global Market Indices and Indian Banks. International Journal of Business Analytics (IJBAN), 8(3), pp.14-25. Available at: https://www.igi-global.com/article/stock-markets-in-changing-times/279627