International finance assignmenton the financial performance and the impact of two recent developments of Good year Tire & Rubber

Question

Task: Which two recent developments in the international financial environment which appear to have impacted on your chosen Multinational Enterprise’s recent performance and development? Analyze the financial performance of the Multinational Enterprise in this international finance assignment.

Answer

Introduction

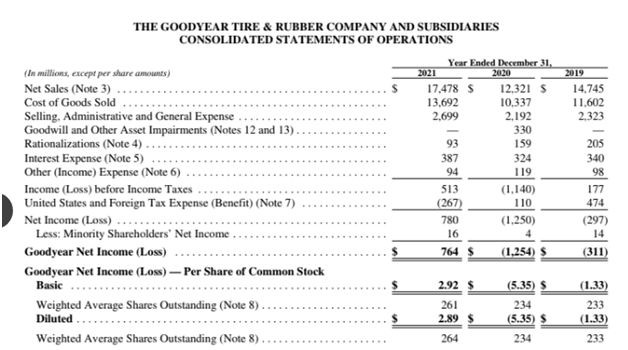

Good year Tire & Rubber is a multinational manufacturing organization of American origin. It was founded by Frank Seiberling in the year 1898. It is headquartered in Akron, Ohio. It is a public limited company for manufacturing tires for SUVs, commercial trucks, automobiles, aeroplanes and light trucks (Goodyear.co.in, 2022). The company has earned a net income of $764 million in the financial year 2021 (corporate.goodyear.com, 2022). This international finance assignmentdiscusses the financial performance of Good Year Tire. Moreover, advancements impacting the financial operations and performance of the organization are drawn and include the way the organization administers the risks connected with its financial sources and policy of dividend payment or distribution.

Section A of the international finance assignment: Two recent development

Recent developments and their impacts

Development 1: Significant progress of the company in becoming sustainable

On Jan 5, 2022, the company announced the release of demonstration tires composed of content that is about 70% sustainable and has the inclusion of industry-leading advancements In the international finance assignment this is considered to be a considerable advancement of the company towards its aim of moving towards materials that are 100% sustainable (annualreports.com, 2022). The sustainable material has the inclusion of 13 ingredients that were featured across nine distinct tire constituents.

Silica is an item frequently applied in tires to support better grip and decrease fuel consumption. The new tire of Goodyear consists of a sole diversity of silica generated from the ash of rice husk, a derivative of rice processing that is frequently superfluous and placed into landfills as per the finding of the international finance assignment. High-value silica has been generated from the ash of waste. Polyester is a material recycled from other wastes of plastic and plastic bottles by degenerating the polyester and changing them into polyester of technical grade that is viable for tire cords.

Impact of the development

The company traditionally has been dependent upon a variety of high influence raw materials and has been following production procedure that is highly energy intensive and produced end products that are generally hard to reprocess. This tire developed by Goodyear as per the international finance assignmentis a specially concocted airless tire articulated to enhance the life of the tire and decrease activities relating to maintenance. The organization is on record to accomplish their aim of making 100% maintenance-free and sustainable material by the year 2030 and complete replacement of petroleum oil in its products by the year 2040(annualreports.com, 2022).

Development 2: Acquisition of Cooper Tire

In the year 2021, on June 7, as per the international finance assignmentthe organization completed the acquisition of Cooper Tire as per plans and agreement terms of the merger between Goodyear, Cooper Tire and Vulcan Merger Sub Inc (a subsidiary of Goodyear which is wholly owned). As per the terms of the agreement of Merger mentioned in the international finance assignment, upon the transaction's close, the stockholders of Cooper's received cash of $41.75 per share along with 0.097 shares from the common stock of Goodyear(annualreports.com, 2022). The consideration of the Merger was apportioned temporarily to the assets' evaluated fair value and assumption of the liabilities as of the closing date from Cooper Tire.

Impact of the acquisition

The operating results of Goodyear improved considerably during the pandemic in comparison to the year 2020. The overall financial performance of the company in comparison to the year 2020 improved considerably due to the addition of Cooper's financial implications as per the international finance assignment. The net sales of the company in the year 2021 were registered as $ 17,478 million in comparison to $12321 in the year 2020. Out of these, the sale amount of Cooper's was $2,126 million(annualreports.com, 2022). Further, the company incurred a net income of $764 million in the year 2021 in comparison to a net loss of $1,254 million in the year 2020 as per the international finance assignment. This favourable modification in the net income of Goodyear was mainly because of a higher section of operating profit, lower income expenditure of tax and a reduction in goodwill.

Section B: Risk management strategy in the international finance assignment

Dividend policy

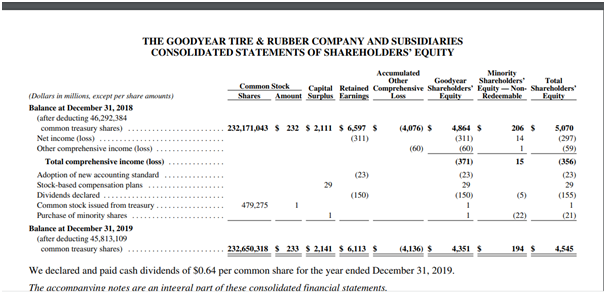

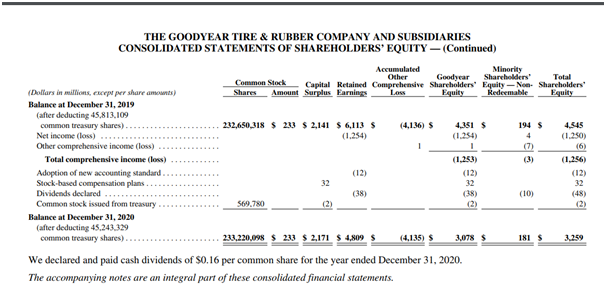

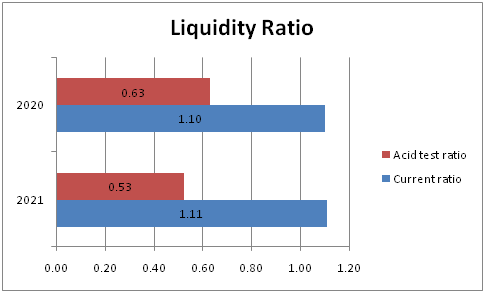

The policy used by the organization to design its payout of dividends to its investors is termed dividend policy (Bakerand Weigand, 2015).The company seems to have been following the relevance theory of dividendas per the international finance assignmentwhich implies that a well-developed dividend policy of the organization can impact the position of the firm positively in the stock market(Paramasivan, 2016). As per this theory, the stock price of the company has increased with a higher amount of dividend. Hence, the opposite will be the result if the company pays a low dividend. The company has paid a regular dividend for the last three years (2019 – 2021).As per the analysis in the international finance assignment the company has declared and paid cash dividends despite the challenges it was facing during the emergence of a pandemic. In the years 202, 2019 and 2018 same amount of dividend has been paid of $0.16. In the previous year, the company has paid fewer dividends. However, no cash dividend was paid during the year 2021.

The company has paid a stable dividend for three consecutive years from the year 2018 to the year 2020 of $0.16 on common stocks. According to the international finance assignment the company by following a stable dividend policy has paid out a regular dividend each year irrespective of the volatility it has faced in the market during the emergence of covid 19, the acquisition of Cooper and achieving 70% sustainability out of 100% (Baker and Weigand, 2015). Through this dividend policy, the company has been able to make payments of constant dividends. It enables the company to have a huge deal of suppleness for adding the income of the investors only when the organization is earning is making a profit that is higher than what it makes in the normal course of business without making any commitment to make a large amount of payment irrespective of the struggles the organization is facing in its business (Sukandaniet al., 2021).

Source of finance

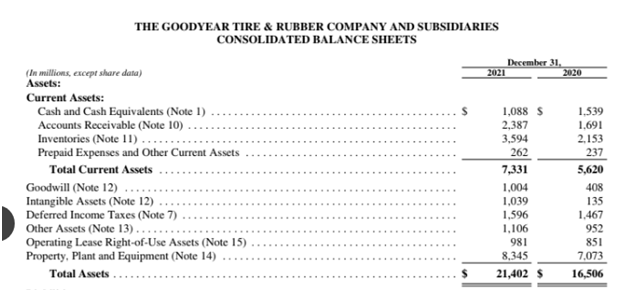

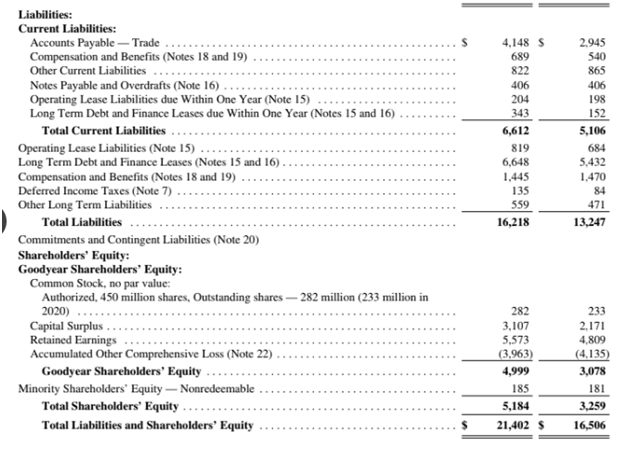

According to the international finance assignment the source through which a business acquires money for carrying out its business activities is termed a source of finance (YapaAbeywardhana, 2017). Goodyear follows a traditional capital structure wherein this method asserts that the cost of capital is a function of the capital structure without defining any hard and fast truths. This strategy is distinctive in that it advocates for an ideal capital structure. A firm's value will be at its highest and the cost of capital will be at its lowest when its debt to equity ratio is optimal. It is seen in the international finance assignment that Goodyear makes use of debt and equity financing for its business activities. The total assets of the company for the years 2020 and 2021 are $ 21402 and $16506 respectively. The liabilities of the company consist of both long-term and short-term liabilities. Shareholder's equity in the year 2021 has been recorded as $21402 which in the year 2022 was $16506. The increase is due to an enhancement in additional capital and retained earnings.

The calculation of capital gearing ratio for the years 2020 and 2021 has been calculated to be 71.41% and 64.94%. This calculation represents that the organization is highly leveraged and has an aggressive structure of capital.

|

Gearing ratio |

2021 |

2020 |

|

Non-current liabilities/(Non-current liabilities+ total equity) *100 |

9606/(9606+5184)*100 |

8141/(8141+3259)*100 |

|

|

9606/14790*100 = 64.949% |

8141/11400*100 = 71.412% |

It is seen in the international finance assignment that the organization uses a high amount of debt to conduct its operations by application of borrowed funds rather than that owned funds or equity. The level of debt of the company in the year 2020 is 71% and in the year 2021, it has decreased to 65%. The gearing ratio is an indicator of risk. The high gearing ratio of Goodyear for the years 2020 and 2021 implies a higher degree of debt in comparison to equity. Hence, the risk is high as the company uses more amount from the debts and less from the owners. It cannot entirely be considered a red flag when looking at the two recent developments that the company has experienced. The advancements prove that the company has made the right use of the debts. The high amount of debt mentioned in the international finance assignmentimplies the presence of the net income theory (Bakerand Weigand, 2015). The theory was put up by David Durand in the year 1952. It signifies that enhancement in financial leverage reduces the capital cost that gives rise to the value of the company. However, the increased risk signifies that the capital structure of the organization is not optimal.

Section C: Ratio Analysis

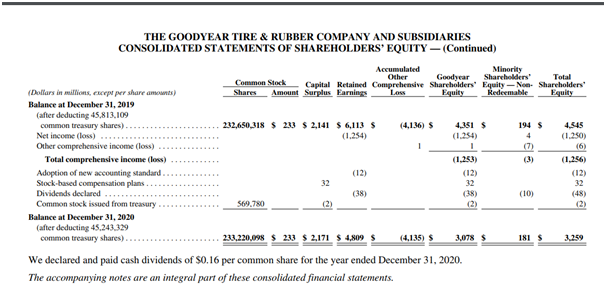

Profitability Ratio

ROCE

Return on capital employed is a profitability ratio that depicts how well the company is generating its profits from the capital invested (Walmsleyet al., 2018).

|

Ratio |

Formula |

2021 |

2020 |

|

Return on Capital Employed |

Operating Profit/Capital Employed |

(17478-13692-2699-93)/(21402-6612) |

(12321-10337-2192-330-159)/(16506-5106) |

|

7% |

-6% |

The international finance assignmentmentions that significance of this ratio is that it shows an overall profitability baseline for the company's financial performance. The ROCE for Goodyear Tires for the years 2020 and 2021 were -6% and 7%, respectively (Corporate.goodyear.com, 2021). There has been a positive movement of the ROCE for the company from 2020 to 2021, wherein in 2020, the company generated an operating loss due to high operating expenses in the form of low GP and high selling, administrative and general expenses. In the following year, Goodyear Tires managed to secure an operating profit and better capital employed, causing the ROCE to reach 7%.

Operating profit margin

According to the international finance assignmentthe operating profit margin calculates the amount of profit a business makes on $ of sales post repaying the variable cost, however, before payment of interest or taxes (Kurniani, 2021).

|

Ratio |

Formula |

2021 |

2020 |

|

Operating Profit Ratio |

Operating Profit/Sales |

(17478-13692-2699-93)/21402 |

(12321-10337-2192-330-159)/12321 |

|

5% |

-6% |

This ratio is significant for assessing the efficiency of the company on the basis of its core business activities. Goodyear Tires reported its operating profit margin as 5% in 2021 and -6% in 2020 (Annualreports.com, 2020). A negative operating profit margin is recorded for the company in 2020 as the business failed to drive profit from its operations due to excessive operating expenses. Hence, the core operations could not secure profits for the business. However, in the following international finance assignment, Goodyear Tires managed to earn a substantial operating profit in terms of higher sales and low operating costs, allowing the business to report 5% as the operating profit margin. Although a good operating profit margin is 10%, Goodyear Tires is on the path to making a better profitability scenario in the forthcoming years.

Gross Profit margin

The gross profit margin is a type of profitability ratio depicting the relationship between the gross profit and sales for the specified year (Otekunrinet al., 2018).

|

Ratio |

Formula |

2021 |

2020 |

|

Gross Profit Ratio |

Gross Profit/Sales |

(17478-13692)/17478 |

(12321-10337)/12321 |

|

22% |

16% |

It is important as the GP margin acts as a good yardstick measuring the efficiency of the company making money from selling its products and services. The GP margin for Goodyear Tires for the years 2020 and 2021 were 16% and 22%, respectively (Annualreports.com, 2020). It is seen in the international finance assignmentthat there has been an appreciation of the GO margin for Goodyear Tires within a year by 6% due to a simultaneous increase in sales as well as gross profit in 2021. Hence, the company could fetch more profitability by its cost of goods sold in 2021. A high gross profit margin in 2021 suggests that Goodyear Tires is successful in producing profits over and above its costs.

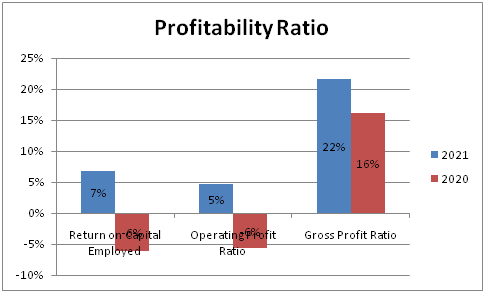

Liquidity Ratio

Current ratio

The current ratio as per the international finance assignmentis a liquidity ratio which measures the ability of the company to pay off the short-term debt that is due within a year (Dempsey, 2019).

|

Ratio |

Formula |

2021 |

2020 |

|

Current ratio |

Current asset/Current liabilities |

7331/6612 |

5620/5106 |

|

1.11 |

1.10 |

This ratio is significant in measuring the liquidity and short-term solvency of the company, which is used by the creditors in order to evaluate whether the company can be offered any short-term credit. Goodyear Tires's current ratios for the years 2020 and 2021 were 1.10 and 1.11 (Corporate.goodyear.com, 2021). It is seen in the international finance assignment that there has not been much change in the current ratio performance of the entity as the proportionate rise of current assets, and current liabilities remained equal in 2021. However, Goodyear Tires did not qualify for a good current ratio as the industry benchmark is 2. This depicts that in both years, the company could somehow meet its short-term obligations using its current assets.

Acid test ratio

The acid test ratio, also known as the quick ratio, is a liquidity measure signifying the company's ability to pay off the current liabilities within the year (Karale, 2020).

|

Ratio |

Formula |

2021 |

2020 |

|

Acid test ratio |

Current asset-Inventory-Prepaid Expenses/Current liabilities |

(7331-3594-262)/6612 |

(5620-2153-237)/5106 |

|

0.53 |

0.63 |

The importance of the acid test ratio is to examine whether the business has enough liquid assets or not to pay off its current liabilities and is treated with caution when the value is less than 1. The quick ratio of Goodyear Tires was 0.63 in 2020 and 0.53 in 2021 (Annualreports.com, 2020). Herein the international finance assignment, there has been a decline in the quick ratio performance due to an increase in inventory and prepaid expenses in 2021, leading to a decline in the quick assets. This shows that the liquidity performance of the business is not efficient and marks a warning to improve its liquidity performance in the forthcoming years by decreasing its current liabilities (Islamiand Rio, 2019).

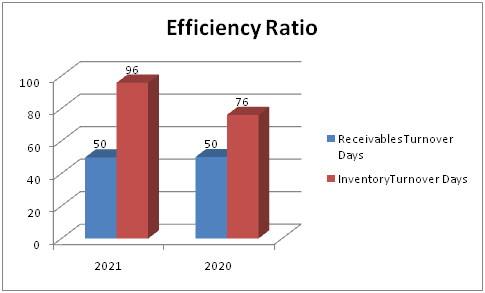

Efficiency Ratio

Receivables turnover days

The receivable turnover days are the number of days that the debtor takes to meet their outstanding invoices against the credit sales (Aya and Hariyanti, 2022).

|

Ratio |

Formula |

2021 |

2020 |

|

Receivables Turnover Days |

Accounts Receivables/Net Sales*365 |

(2387/17478)*365 |

(1691/12321)*365 |

|

50 |

50 |

This ratio narrates whether the company is able to collect its debtors efficiently as well as examines the quality of customers who are paying off its debt to avoid bad debts (Kourtiset al., 2019). AS per the finding of the international finance assignmentthe receivable turnover days for Goodyear Tires for 2020 and 2021 were 50 days each (Annualreports.com, 2020). There has not been any change in the receivable days irrespective of the change in the debtors and net sales made by the company in both years. This signifies that the company did not bring about any change in its credit policy prevailing since 2020, leaving the company in a considerably good situation to receive payments from its debtors. 50 days as receivable turnover days is suggested to be good, allowing the company to avoid bad debts as much as possible.

Inventory turnover days

The inventory turnover days are an efficiency ratio which indicates the average time that the business takes to convert its inventory into sales (Maheshwari et al., 2021).

|

Ratio |

Formula |

2021 |

2020 |

|

Inventory Turnover Days |

Inventory/Cost of Goods Sold*365 |

(3594/13692)*365 |

(2153/10337)*365 |

|

96 |

76 |

This ratio is important as it is mentioned in the international finance assignmentfor the market analyst to determine the efficiency of sales that is contributed by the inventory of the business. The stock turnover days for Goodyear Tires for the years 2020 and 2021 were 76 days and 96 days, respectively (Corporate.goodyear.com, 2021). This depicts an increase in the inventory turnover days, which is not appreciable for the company. A low stock turnover day depicts that the company is adequately managing its stock to be converted into finished goods and ready for sales. There has been an increase in the turnover days due to an increase in the stock as well as purchases made by Goodyear Tires in 2021, making the effectiveness of the conversion period slower in comparison to 2020.

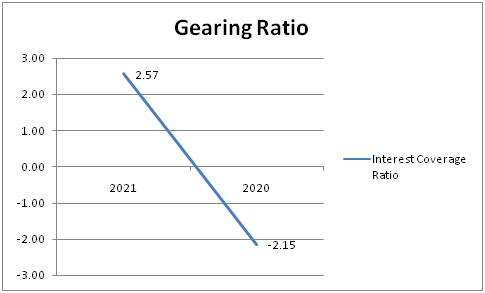

Gearing Ratio

Interest coverage ratio

The interest coverage ratio is a type of debt as well as profitability ratio which is used for determining how quickly the business can pay out its interest on the outstanding liability (Dance and Imade, 2019).

|

Ratio |

Formula |

2021 |

2020 |

|

Interest Coverage Ratio |

Operating Profit/Finance Cost |

(17478-13692-2699-93)/387 |

(12321-10337-2192-330-159)/324 |

|

2.57 |

-2.15 |

This ratio in the international finance assignmentis useful in understanding the current risk of the business for extending loans in the future years by the creditors, lenders and banks. The interest coverage ratio for Goodyear Tires for 2020 was -2.15 times and 2.57 times in 2021 (Corporate.goodyear.com, 2021). A negative interest coverage ratio was administered by the company depicting that in 2020; the company failed to pay any interest on its outstanding debt due to no operating profit. However, in the followinginternational finance assignment, the company could only pay 2.57 times during the year as interest payment which is very poor.

Conclusion

Hence as per the international finance assignment, the company is working on the positive and negative impacts of the high leverage ratio by working on the complete integration to deliver superior products by the year 2023. The organization is already on its way to matching and mixing strengths, improving efficiency and enhancing agility. With this kind of momentum as mentioned in the international finance assignment, the company can enhance its confidence to deliver about $250 million of collaborations, around 50% enhancement from its basic initial plan.

Reference List

(2020) Annualreports.com. Available at: https://www.annualreports.com/HostedData/AnnualReports/PDF/NYSE_GT_2020.pdf (Accessed: 29 June 2022).

(2021) Corporate.goodyear.com. Available at: https://corporate.goodyear.com/content/dam/goodyear-corp/documents/annualreports/2021-annual-report.pdf (Accessed: 29 June 2022).

Aya, K.L. and Hariyanti, W., 2022. The Effect of Financial Ratio Analysis, Transfer Pricing And Corporate Social Responsibility on Tax Avoidance in Manufacturing Companies Listed on the Indonesia Stock Exchange in 2015-2019. Accounting and Finance Studies, 2(2), pp.79-94.

Baker, H.K. and Weigand, R., 2015. Corporate dividend policy revisited in international finance assignment. Managerial Finance.

Brigham, E.F. and Daves, P.R., 2018. Intermediate financial management. Cengage Learning.

Dance, M. and Imade, S., 2019. Financial ratio analysis in predicting financial conditions distress in indonesia stock exchange. Russian Journal of Agricultural and Socio-Economic Sciences, 86(2), pp.155-165.

Dempsey, M., 2019. Accounting statements and ratio analysis. In Investment Analysis (pp. 77-107). Routledge.

Islami, I.N. and Rio, W., 2019. Financial ratio analysis to predict financial distress on property and real estate company listed in indonesia stock exchange. JAAF (Journal of Applied Accounting and Finance), 2(2), pp.125-137.

Karale, U., 2020. Financial Statement Analysis: Definition, Meaning and Multi-step Income Statement; Methods of Financial Statement Analysis Continued..; Ratio Analysis: Definition, Meaning, Importance and Limitations; Ratio Analysis: Types of Ratios: Liquidity Ratios and Interpretation; international finance assignment, Turnover or Activity or Efficiency Ratios; Profitability Ratios; Solvency or Leverage Ratios; Ratio to Balance Sheet: Simple Sum on Preparation of Balance Sheet; How to Prepare Balance Sheet from Accounting Ratios: Simple and Easy Sums ....

Kourtis, E., Kourtis, G. and Curtis, P., 2019. An integrated financial ratio analysis as a navigation compass through the fraudulent reporting conundrum: international finance assignment.

Kurniani, N.T., 2021. The effect of liquidity ratio, activity ratio, and profitability ratio on accounting profit with firm size as a mediation. Journal of Economics and Business Letters, 1(3), pp.18-26. Maheshwari, S.N., Maheshwari, S.K. and Maheshwari, M.S.K., 2021. Principles of Management Accounting. Sultan Chand & Sons.

Otekunrin, A.O., Nwanji, T.I., Olowookere, J.K., Egbide, B.C., Fakile, S.A., Lawal, A.I., Ajayi, S.A., Falaye, A.J. and Eluyela, F.D., 2018. Financial ratio analysis and market price of share of selected quoted agriculture and agro-allied firms in Nigeria afteradoption of international financial reporting standard. The Journal of Social Sciences Research, 4(12), pp.736-744.

Paramasivan, C., 2016. Financial management.

Sukandani, Y., Istikhoroh, S. and Widodo, U.P.W., 2021. The role of accounting conservatism as a moderate of debt ratio effect on financial DISTRESS in the international finance assignment. International Journal of Economics, Business and Accounting Research (IJEBAR), 5(2).

Walmsley, T.G., Walmsley, M.R., Varbanov, P.S. and Klemeš, J.J., 2018. Energy Ratio analysis and accounting for renewable and non-renewable electricity generation: A review. Renewable and Sustainable Energy Reviews, 98, pp.328-345.

YapaAbeywardhana, D., 2017. Capital structure theory in the international finance assignment: An overview. Accounting and finance research, 6(1).

Appendix: Financial Statement of Goodyear Tires