International Finance Assignment: Analysing Current Economic Environment Of A Business Case

Question

Task:

International Finance Assignment Task: You work for firm XYZ situated in Britain, and your boss has become concerned about the current economic environment, especially as it is related to the different types of exposures that your firm may face in the near future. You are asked to provide a report, which evaluates how your firm is exposed, the risk management implications for your firm, and possible hedging strategies. You are also required to provide a recommendation for what your firm should do.

Information about Firm XYZ:

- The firm imports high quality wool to Britain from foreign suppliers located in Australia and the New Zealand.

- The firm exports Jewellery to USA from Britain.

- The firm exports designer clothes from Britain to Australia, New Zealand and Singapore.

- The firm has a payment of 8,000,000 AUD due in 3 months to their supplier in Australia, a payment of 6,000,000 NZD due in 2 months to their supplier in New Zealand.

- The firm is due to receive 9,000,000 AUD from their customer in Australia in 2 months, 4,000,000NZD from their customer in New Zealand in 2 months, 700,000 SGD from their customer in Singapore in 1 months, and 9,000,000 USD from their customer in USA in 2 months

- The firm is concerned with the impacts of the potential high inflation rate due to the recent expansionary monetary policy globally in their exporting and importing business.

You are required to prepare a report, which should contain the following information:

- Use the information above to consider the types of exposure your firm may face.

- Discuss the firm’s risk management implications given their exposure and design hedging strategies for the firm. You also need to evaluate the hedging outcome – what will the outcome be if exposure is hedged and what will the outcome be if exposure is not hedged.

- You should consider the effect of the current economic environment on foreign exchange market, demand for exports/imports, supply of exports/imports and other relevant economic indicators, and relate this to how this may impact the firm. Particularly, you need to discuss the potential impacts of high inflation in the relevant countries for the firm on the firm’s exporting and importing business.

Answer

1. Firm’s Exposure

As per the given case of international finance assignment, XYZ is heavily invested in the import and export business. With dealings in 3 different commodities, i.e., Wool, Jewellery and Designer Clothes, the firm is exposed to the fluctuations in the demand and supply of the commodities. Apart from it, the company XYZ deals with 4 countries, i.e., Australia, USA, New Zealand and Singapore. This goes to show that all the Accounts Payable and Receivable linked to these countries will be exposed to the exchange rates fluctuations. XYZ has accounts receivable of 9 million AUD, 4 million NZD, 700K SGD and 9 million USD. All of these due receivables are exposed to British Pound appreciation in the foreign exchange market. To calculate the total exposure of XYZ company, the exchange rates with each country has been used (data as of 26/10/21).

- AUD/GBP – 1.83

- NZD/GBP – 1.92

- SGD/GBP – 1.85

- USD/GBP – 1.38

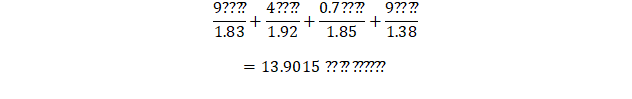

On conversion, we have –

Therefore, the company is yet to receive 13.9015 mn GBP in revenue from different customers all across the globe. With the GBP appreciation against each currency, it will take more units of each currency to buy one unit of GBP which will ultimately result in lower units of GBP. This will decrease the receivable revenue and can seriously reduce the profits for the company. With the help of derivatives, this exposure can be hedged and any fluctuation in the currency rates can be dealt with.

On the other hand, the company has due payment of 8mn AUD and 6mn NZD in 3 months and 2 months respectively. These payments are beneficial with an appreciation in the GBP currency in the foreign exchange market. With the GBP appreciation, lesser units of GBP will be required to buy 1 unit of foreign currency ultimately reducing the cost to company. The payments and receivable related to NZD offsets each other up to the mark of 6 mn NZD leaving an ultimate exposure of 2mn NZD in payments. However, the receivables and payments related to AUD is not offset properly due to the difference in the transaction dates. However, if the company plans to clear the 8mn AUD payment in 2 months, a net exposure of 1mn AUD receivables will be left.

At the end, the company deals in raw materials like wool and gold (jewellery). These commodities are highly dependent on the global demand and the price of these raw materials can fluctuate with time. The company should enter into a forward agreement and lock the price at which they are willing to buy the raw materials to mitigate the risk related to rise in price.

The risk management policy for the company should be to hedge against home currency appreciation.

2. Economic Environment

An expansionary monetary policy by the local government goes to show the need for the increase in imports and exports of the country. With an expansionary monetary policy, the country’s currency weakens in the currency exchange market making it cheaper for other countries. This leads to an increase in exports and decrease in imports. With a huge accounts receivable under company XYZ, an expansionary policy benefits the company with currency depreciation. Speaking of the high inflation rate, it doesn’t affect a country’s import and export directly. High inflation rate has pressure on the exchange currency rate which ultimately affects the import and export of the country.

Currently, UK and Australia entered into a tax-free trade deal where the goods can be exported without any excise duty on the same. This deal opens up windows for different traders as it includes all consumable goods. XYZ company will benefit from the deal as well because the price of wool will be significantly affected (The Guardian, 2021). Similarly, the trade will open up windows for cheap labour as well reducing the overall cost for the company. The Covid-19 pandemic shook every country. With the rise in death tolls, the economies came to a halt. However, the countries have shown fast recovery and everything is getting back on the track with the end of 2021.

On the other hand, the pandemic reduced the country’s GDP growth to -9.79% in 2020 (World Bank, 2021). The expansionary policy is a stimulating tool used by the government to increase the exports in comparison to the imports giving rise to the GDP. Ultimately, XYZ will benefit out of it and therefore, doesn’t have to take any risk measures against it.

3. Hedging Strategies and Outcomes

The firm has the following currency exposure in receivables –

While all of these transactions will benefit from a home currency depreciation, there is a risk related to GBP rising in the currency market. To mitigate the risk, XYZ should enter into a receive-fixed and pay-floating contract for each of the currency at the current exchange rate. Under this contract, XYZ will be receive fixed payments at the current exchange rate while it will pay at the floating rate prevailing in the upcoming 1 or 2 months.

In other words, XYZ will transfer the funds received from its customer to the dealer and received the fixed payment from dealer at today’s rate. XYZ will have to enter into 3 different contracts with the dealer with different expiry date and notional principle as mentioned below -

Contract 1 = Notional Principle – 1 million, Time to Expiry – 2 months, Fixed Rate –1.83 AUD/GBP

Contract 2 = Notional Principle – 0.7 million, Time to Expiry – 1 months, Fixed Rate – 1.85SGD/GBP

Contract 3 = Notional Principle – 9 million, Time to Expiry – 2 months, Fixed Rate – 1.38 USD/GBP

Similarly, the firm has exposure to accounts payable as well. The firm has to pay 2 million NZD in 2 months. This payment is exposed to home currency depreciation. Under the current economic environment, i.e., high inflationary pressure and expansionary policies, the GBP is likely to depreciate in the currency market. Therefore, the firm should enter into an agreement with the supplier at the current exchange rate of 1.92 NZD/GBP. However, this is unlikely to happen. A receive-floating and pay-fixed contract with the dealer at the current exchange rate will cover the risk related to GBP depreciation (contract 4).

All of the hedging strategies mentioned above have a zero cost to initiate and is 100% effective. A financial swap has zero value to start with. Apart from it, all the currency exposure has been 100% hedged, therefore, the revenues have been locked in at the exchanges rates as of 26/10/21. However, this financial swap exposes the firm to counterparty default risk as it is an Over-the-Counter derivative.

Hedging Outcomes

After 1 month –

Contract 2 expires after a month. Say the new exchange rate after a month is 2 SGD/GBP. While the customer paid XYZ 0.35mn GBP (700K/2), the firm will also receive 0.378mn GBP (700K/1.85) from the dealer and pay him 0.35mn GBP. The contract helped to mitigate the risk of 28000 GBP.

After 2 months –

All the remaining contracts expires at the end of 2nd month.

Contract 1 – Say, new exchange rate = 2.1 AUD/GBP. Therefore, risk mitigation of 70257 GBP.

The same goes for contract 3. However, contract 4 is exposed to currency depreciation and the price has been locked for the same as well.

4. Conclusion

XYZ dealing in imports and exports have huge exposures related to currency exchange rates. With the help of the hedging strategies and 4 different contracts, all the related risk has been mitigated. However, the risk related to the rise in price of gold and wool is not touched upon. Both the commodities can see a slight decrease in the price which is beneficiary for the company. The fall in price will be funded via the cheap labour provided via the UK-Australia trade deal. Whatsoever, no hedging strategy was chosen for designer clothes since it is not considered as a commodity over any exchange market and therefore, a ready market isn’t available for the same.

References

The Guardian . (2021, JUNE 15 ). UK-Australia trade deal: what does it mean? Retrieved from The Guardian : https://www.theguardian.com/politics/2021/jun/15/uk-australia-trade-deal-what-does-it-mean-brexit

World Bank. (2021). GDP gorwth (Annual %) - United Kingdom. international finance assignment Retrieved from Data.World Bank: https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?locations=GB&start=2010