Forensic Accounting Assignment: Solving Vexed Problems In Corporate World

Question

Task:

This assessment is designed to allow students to present and justify appropriate method(s) for a research project designed to address the research question posed. This assessment relates to Learning Outcomes a, b and d.

Based on the Research Question developed in Assessment 2, students should develop a research design aimed at providing insights and/or answers to the question. Students should make any recommended adjustments to the content of Assessment 2, based on feedback provided, prior to including it in Assessment 4.

This assessment requires students to choose and justify the most appropriate research design, clearly explaining WHY the chosen design will best answer the research question and is most appropriate in the specific circumstances. Students should clearly justify their recommended research and analysis methods.

Written Proposal : the proposal will contain the following information :

- Title page : including research title and student’s details

- Abtract : A brief summary of key information about the research (the research questions, the theory used and methodology plan).

- Research Background (revision version of Assessment 2)

- Research Questions and Research objectives (revision version of Assesment 2)

- Literature review minimum 20 peer-reviewd articles (including the four main articles used in Assessment 3)

- Research Design : describe type of research, research approach, type of data, data collection methods, data analysis methods and sampling plan.

- Ethical Consideration : address the five ethical consideration of human research

Note : Ethics Approval Form is not counted toward the word count of the assessment, only fill in this form if applicable. Include this form as appendices.

Answer

Abstract/Executive Summary

Introductory framework of the research

The objective of the current research framework explored within this forensic accounting assignment is to highlight and demonstrate the notion of forensic accounting in the modern world of business management (Kumar, 2019). The introductory structure of the current research findings will be competent towards highlighting the context based on the rationale, research questions and theoretical framework of the present results (Ledford &Gast, 2018). Well written instructions will set the tone for the current paper, which will create the interest of the readers along with communicating the thesis statement based on the research topic of Roles of Forensic Accounting in Solving Vexed Problems in Corporate World and Business (Fletcher, 2017). The subsequent part of the study developed within the forensic accounting assignment will address the findings, which will determine the required hypothesis, based on the aims and objectives of the research with the view towards formulating and adopting the required research methodologies.

All the above-described terms provided within this forensic accounting assignment will maintain a different and specific utility for the makeover of the current research findings. At the same point time, it will evaluate the required outcome. Structuring the aims and objectives based on the current research hypothesis will be crucial, which will define the theoretical framework along with the applied research design and methodology to conclude the best possible outcome connected with the applied research(Quinlan, Babin, Carr and Griffin, 2019).

Highlighting the area of investigation

The findings based on the current discursions obtained within this forensic accounting assignment proved to be very much sufficient where multiple areas of forensic accounting discussed in the required manner with the view towards meeting the required project outcome (Wiek& Lang, 2016). Describing its nature along with applying its fundamentals towards mitigating auditing scams and fraudulence and improving the quality of financial audit and reputing are some of the significant points of discussion, which described the process of auditing (Gray, 2019).

Nevertheless, with growing corporate scandals, the role of the forensic accounting evaluated the core objectives, where the nature of corporate governance proved to be very much sufficient with the view towards shed light on the problem-solving abilities in the corporate world of business management (Quinlan, Babin, Carr& Griffin, 2019). Highlighting the investigating matter associated with the current research proceedings summarises the objectives of doing this particular research. The selected topic in the present findings of forensic accounting assignment proved to be the most discussed areas of the modern business world, which indicated bright future aspects for the outcome of the developed research hypothesis (Kranacher&Riley, 2019).

Determining the required investigation design and methodology

Research Design and Methodology: The notion of the research design and research methodologies mentioned herein forensic accounting assignment outlined the outcome of the research findings with the applications of the best possible applied research methods (Alshurafat, Beattie, Jones & Sands, 2019).Selecting the desired research methods proved to be very much challenging for the on-going analysis towards getting the required desired outcome. However, there are few research parameters, which proved to be very much crucial with the view towards conceptualizing the framework of the applied research design and methodology (Rezaee& Wang, 2019). The notion of implementing the core concepts of the research design demonstrated the current topic with the view towards explaining its type and nurture. The three main sections of the contemporary research design illustrated in the forensic accounting assignment described the process about developing data collection procedure, measurements and analysis (Sahdan, Cowton& Drake, 2019).

Nevertheless, with the view towards meeting the required outcome, the findings of the study formulated the applications of the qualitative research, where a relationship between the collected data along with observation is established based on the core and extensive findings of secondary results (Eze& Okoye, 2019). Additionally, the notion of the best possible research methodology comprised in the way, which evaluated the conclusions required based on the current research topic explored within the forensic accounting assignment by using philosophy, approach and design in the best possible manner (Cugova&Cug, 2020).

Research Background

Introduction of the Research Topic examined in the forensic accounting assignment

The idea of applying the fundamentals as well as the core concepts of forensic accounting contribute as one of the important parts of modern business administration (Eze&Okoye, 2019). The applications of different kinds of theories and principle to hypothesis along with the facts on the legal dispute in accounting and financial management complete the modern concept of forensic accounting (Rezaee & Wang, 2019). There are several kinds of significant events and findings, which outlined the parameters connected with the core applications of judicial accounting procedure includes accounting legislation, rules, institutional requirements and investigative proficiency (Sahdan, Cowton & Drake, 2019). All these combined points utilized the core concepts of forensic accounting in the required manner, where it involves the use of accounting skills as well as principles for legal dispute resolution.

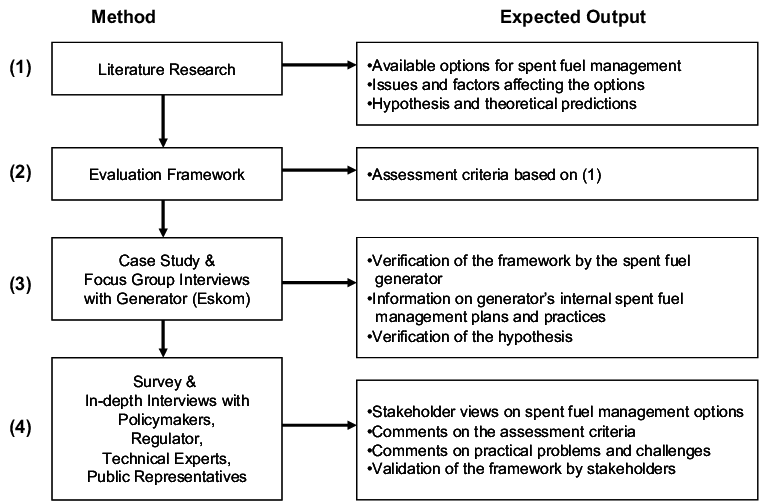

The nature of forensic accounting proved to be crucial with the view towards identifying the required areas like criminal study along with cases of carelessness settlement among partners and negotiation service (Alshurafat, Beattie, Jones & Sands, 2019). The overall discussions developed in the segments of forensic accounting assignment described the nature of forensic accounting, which proved to be productive while describing its utility towards Solving Vexed Problems in Corporate World and Business, where its applications proved to highlight accepted (Rezaee&Wang, 2019).

Figure 1: Forensic Accounting

(Sahdan, Cowton&Drake, 2019)

Overview of the Client Organization

The findings associated with the summary of the current research topic explored within this forensic accounting assignment will shape up its significance as a whole related to modern business operations (Sahdan, Cowton& Drake, 2019). There is no specific organizational background and issues will be highlighted in the framework of the present research procedures. The findings will be done on a global basis connected with the modern trends of business management and operations, where the notion of forensic accounting proves to be very much crucial towards finding the required solutions for multiple issues.

Identifying the Real Problem

Identifying the problem connected with the current research findings will prove to be very much crucial, with the view towards evaluating and conceptualizing the required framework of modern business management (Lakshmi and Menon, 2016). Business does not exist in isolated conditions, where the operational makeover is often complicated by nature. Due to this complexity, several issues are continuously identified based on the ongoing activities of modern business trends(Cugova&Cug, 2020). Fraud investigations, investigative accountant’s structure, and analysing forensic auditors or fraud auditor reports are some of the areas, where the nature of the forensic accounting proved to be very much crucial in the globalized business module. Nevertheless, the following part of the analysis done within the forensic accounting assignment with the sufficient application of core secondary research will address the role of forensic accounting along with its issues (Eze& Okoye, 2019).

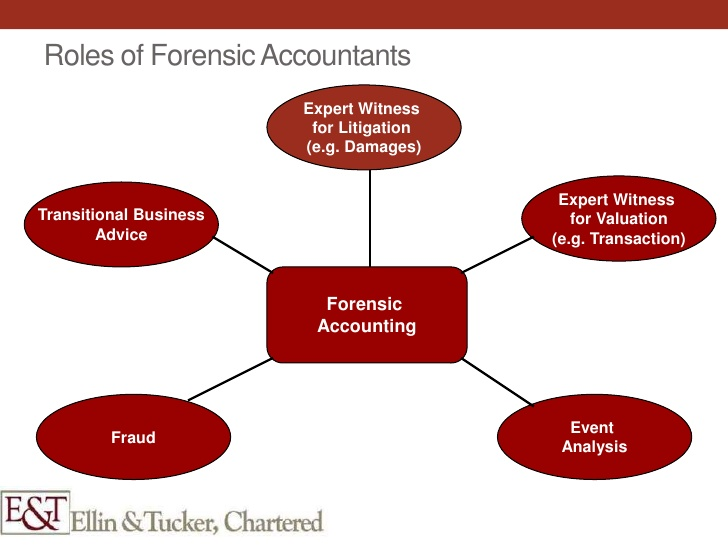

Research structure of the proposal

The structural outcome of the current research findings proved to be very much crucial towards evaluating the required result in a determined manner. The subsequent part of the study provided herein forensic accounting assignment determined the proceedings of the research outcome based on the structural framework in the following way:

Abstract and Executive Summary: This is the original part of the analysis, where the overall findings obtained in the context of forensic accounting assignment proved to very much essential with the view towards developing the initial framework of the current research. The process, as well as the results, identified the core and the fundamental areas of investigation, where the notion of forensic accounting contributes as one of the most significant aspects in modern trends of business administration.

Research Background: The current research background comprised the classifications of four crucial segmentations, where the initial framework of the current research topic described with its core utility in the modern trends of business management. A brief overview of the corporate world, along with identifying the issues in complex business situations and why it is essential for the present invetigation topic, is one of the fundamental points of discussions. Dealing with the real problem and identifying its best alternative solutions will be challenging. Finally, determining the necessary research structural makeover based on the current research proceedings concluded this section in the required manner.

Research Questions and Research objective: Determining the required research questions based on the investigative objectives is one of the complex areas of the research. However, formulating the necessary research objectives is a broad area of study and specifying the research questions is crucial. In the current findings of forensic accounting assignment, there will be multiple research questions covered with a single aim and purpose.

Hypothetical Background and Literature Review: Structuring the required theoretical background will define a broader picture of how the literature review associated with the topic based on forensic accounting supports the research hypothesis and theories. Nevertheless, associated with the current findings, the analytical framework of the literature review will reflect a precise scenario related to the current topic of forensic accounting assignment with extensive applications theories.

Research Designs and Methodology: Research design and research methodology are the two combined points, which outlined the structural framework of the best-applied research methodologies. Selecting the best research methodologies will be very much challenging, but in the present scenario of forensic accounting assignment, the analyst has done a remarkable job to address the required research methodologies.

Figure 2: Defined Research Structure

(Source: Cugova&Cug, 2020)

Research Questions and Research Objectives

The present analysis performed in the forensic accounting assignment coved multiple research questions based on the single topic of Roles of Forensic Accounting in Solving Vexed Problems inCorporate World and Business. Nevertheless. The current research proceedings will address the following research objectives:

- To investigate the objectives and the role of forensic accounting along with identifying its effectiveness in complex business situations of accounting aspects

- To determine the significance of forensic accounting in modern trends of business management towards strengthing the applications of predictable accounting system

- To evaluate the multiple utilities of contemporary elements of foreign accounting towards solving vexed issues in modern business management

- Developing recommending aspects with the view towards highlighting the role of forensic accounting along with its areas of improvement based on financial improvement and internal control over commercial operations.

However, based on the developed research objectives, the following part of the research on forensic accounting assignment note developed the required research questions, which proved to be very much sufficient with the view towards meeting the outcome of research needed.

Q1. What are the various ways, while applying the notion of forensic accounting to address the accounting fraudulence and frauds?

Q2. What are the specific ways to determine the importance of forensic accounting to strengthing the conventional accounting system?

Q3. What are the ways, which proved to be very much specific to evaluate the quality of the financial reporting along with determining the effective means to address the vexed issues based on corporate governance?

Q4. What are the best ways to address the difficulties faced by the auditors to apply the core and fundamental concepts of forensic accounting?

Theoretical Background/Literature Review

Introduction

In this research on forensic accounting assignment, article shall be selected for understanding the responsibility of forensic Accounting in managing problems in the businesses and business world. The selection of the research articles while preparing this forensic accounting assignment shall help in an in-depth investigation of the research problem.

Role of forensic accounting in managing corporate failure

It has been noted by Kingsly (2015) that there have been increased cases of accounting fraud that is one of the most common corporate failures. Kingsly (2015) has noted so as to forensic accounting cannot be treated as a process of the statutory audit; instead, it is an essential aspect of corporate governance. It is believed by Kingsly (2015) that organisations that have forensic Accountants with proper training in financial data, pieces of evidence, auditing skills and Accounting Information System Software, can help to address the risks of corporate failure. The importance of forensic accounting for handling cases of Corporate failure lies in the use of accounting skills, law procedures and professional judgments in an integrated manner so that the risks of Corporate liquidation can be addressed to avoid financial scandals.

Figure 3: Role of Forensic Accounting in Corporate World

(Source: Eze&Okoye, 2019)

Forensic accounting from the perspective of financial auditing

Financial markets are prone to loss of confidence if there are risks of financial frauds. Inaccuracy in the audit of the financial statements increases the chances of scams in an organization as noted by Kizil & Ka?ba?? (2018). The authors also indicated that most of the cases of frauds in countries such as us and Japan have been due to accuracy in auditing to be able to detect the risks of fraud. In this respect, Kizil & Ka?ba?? (2018) have noted the critical role of forensic accounting for adequate levels of Investigation for maintaining reliability and transparency in financial auditing system. The purpose of forensic accounting mentioned herein forensic accounting assignment has also been found to be essential for preserving standardization and objective investigation into the financial statements. It has been noted by Kizil & Ka?ba?? (2018) that the United States of America has implemented legislation for setting up public bodies for minimizing the possibilities of accounting scandals. It is assumed that through maintaining a higher level of efficiency in the financial auditing system risks of finance-related crimes can be avoided. Forensic accounting can be of immense value for investigations in the audit system for maintaining transparency and standardization of auditing.

Function of forensic accounting in managing fraud management

The investigation article by Bhasin (2015) has noted fraudulent practices in countries to be a significant challenge for the economy. It has been indicated by Bhasin (2015) that states set up anti-corruption institutes for handling economic crimes, but there is little success. Considering that financial crimes can have an immense impact not only on corporate organization but also on individuals, advanced research is necessary for efforts that go beyond the statutory audits. In this respect, it had been noted by Dubey (2016) that forensic accounting practices could help in the detection of fraud and even be used for controlling the risks of fraud that is one of the most significant financial crimes that cannot be easily detected by external auditors. Forensic accounting helps in the in-depth investigation and enhanced level of knowledge of judicial accounting procedures and financial reporting skills. Forensic accounting can hence be considered to be the best practices for harmonization of financial risk operation.

A theoretical framework to reflect upon forensic accounting and its advantages

The understanding of Skinner's Operant Conditioning Theory as noted by EhioghirenAtu (2016), forensic accounting can be considered as an environmental consequence that makes an individual commit any fraud. Other behaviourist theories suggest that financial scams as criminal activities can be viewed as rewarding in terms of money or prestige. This makes the need to commit fraud to be a recurrent process. Considering that financial crimes in the context of forensic accounting assignment are the result of the psychological underpinning of an individual to commit a crime given environment, behavioral patterns in terms of activities of individuals committing the crime can help to reduce the risks of the crime (Rathnasiri&Bandara, 2017). Such information has a vital role to play in the process of Investigation in forensic accounting by forensic Accountants.

Preventive role of forensic accounting in hazard aversion

Modugu and Anyaduba (2013) have provided another perspective regarding the role of forensic accounting, and that is in the form of its role in preventing any risk in organization or economy at large. They have noted an issue with forensic accounting to be taken as a causal action to minimise the impact of any financial crime. Modugu and Anyaduba (2013) have indicated that most of the crimes for cases of fraud in the organisation are due to no achievement of the power systems for corporate governance maturity. This can for the related to the Limited or no use of the forensic accounting system as a preventive measure in organisations to avoid frauds. It has been noted by MEKIC, Modugu and Anyaduba (2013) that forensic accounting and its capabilities of identifying the gap between the actual performance and planned performance had been undermined. Hence the need for the use of forensic accounting as a proactive and preventive system has been established. Ata?anand Kavak (2017) consider the assistance of the legal accounting system along with the use of the corporate governance maturity is useful for minimizing the control lapses that often leads to the increased risks of fraud. Forensic accounting measure examined in the segment of forensic accounting assignment has been promoted as a tool for elimination of performance-related fraud risk and the purpose of detective control.

What is the importance of forensic accounting for financial efficiency in the context of forensic accounting assignment?

Hitchcock (2018) has calculated the influence of forensic accounting training to be given and the consequence of forensic accountant involved in the commercial governance of organizations. It has been noted by Herbert et al. (2017) that the scientific investigation process and the proactive detection system that is part of the four accounting can help in better enforcement of a system that is secured. For Asset Management, the detection in the gaps of actual and perceived performances is essential that can be achieved through the defect investigation process of forensic accounting.

Conclusion

To contribute, it can be stated based on the research studies of the selected articles that forensic accounting can be used both as a preventive measure and fraud management tool. The use of research articles initiated in the case scenario of forensic accounting assignment has admired the importance of forensic accounting.

Research Design and Methodology

The notion of adopting the required research design will evaluate the way which will prove to be very much sufficient towards determining the outline of the current research framework.

Type of Research Framework

Exploratory research framework is the selected research framework for the proceedings, where the analyst will be able to identify the problem that has not been studied more clearly in the operational activities (Sahdan, Cowton& Drake, 2019). Along with the same point of time, the applied research methods proved to be very much sufficient towards developing the operational definitions and improve the final research design with the view towards identifying the effectiveness of the associated research topic.

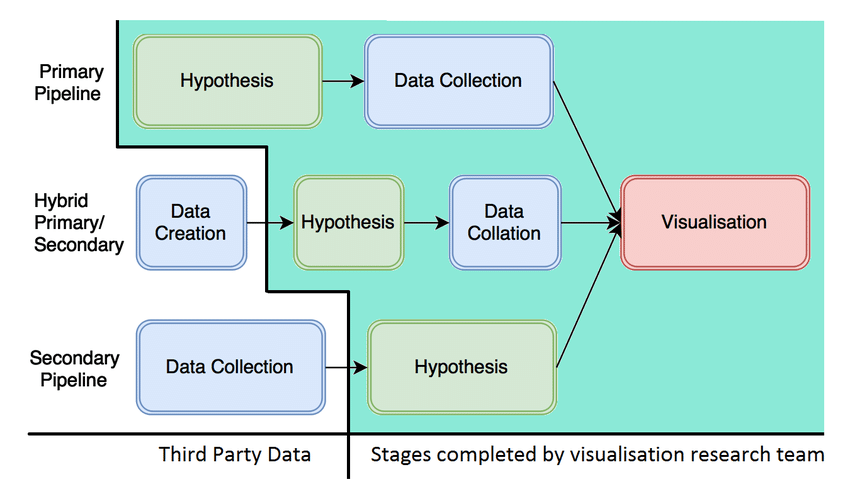

Data Collection Procedure

Based on the objectives and space associated with the current research operational framework illustrated herein forensic accounting assignment, the analyst evaluated the findings based on the core applications of both primary and secondary research work (Rezaee&Wang, 2019). The long-form of both primary and secondary research in the overall conclusions comprised the way with the view towards gathering the best possible outcome from the determined approaches (Alshurafat, Beattie, Jones & Sands, 2019). The combination of both qualitative and quantitative research approach is carried on this forensic accounting assignment and will be helpful for the analyst to meet the result of the research work with compelling facts. Interview the employees associated with any organization having some specific issues and gathering the feedbacks of the managers will complete the data collection procedure in the required manner (Kranacher and Riley, 2019).

Figure 4: Conceptual Framework of Data Collection Procedure

(Source: Rathnasiri&Bandara, 2017)

Sample size and Data Sampling

After completing the survey justifying the collected samples in the required manner is another crucial area of working for the analyst(Quinlan, Babin, Carr& Griffin, 2019). Determining the required sample space includes the applications of the proper sampling methods and techniques, which will allow the analyst in the study to find the best-identified results with from different kinds of alternatives, where various characteristics need to be considered (Gray, 2019). Probability sampling methods, along with non-probability sample methods at the same point of sampling, will allow the analyst to meet the required outcome of the current research findings obtained within the forensic accounting assignment in the best possible manner (Wiek& Lang, 2016). The finished sample size based on the requirements of the current research includes ten employees and five managers working in the same organization, where some issues have been identified in auditing (Quinlan, Babin, Carr& Griffin, 2019).

Data Analysis procedure

Theme based examination procedures along with statistical examination procedures are the two combined points, which defined the process to improve the skills and simplicity of the analyst to execute the required data breakdown procedure(Fletcher, 2017). Since the reason behind the findings of the research on forensic accounting assignment will be done with the application of both quantitative and qualitative research framework, the best way will define to have the desired results based on applying a mixed concept and approach (Ledford & Gast, 2018). Thematic analysis will meet the required procedures to implement the necessary set of text-based arranging several kinds of interview transcripts (Kumar, 2019). Topics, ideas and patters repeatedly come with effective utilization of the collected data's. On the other hand, is one of the vital comments of data analysis procedure, where statistical analysis involved in the direction towards collecting and scrutinizing every data sample in a set of items from which samples can be drawn and executed(Ledford & Gast, 2018). Therefore, with the view towards meeting the context of the research on forensic accounting assignment, the analyst comprised the way towards selecting thematic analysis for qualitative study and statistical analysis for quantitative study.

Ethical Concerns and Framework

The analyst has done a remarkable job towards meeting the ethical framework of the current research on forensic accounting assignment in the best possible manner. Maintaining the privacy of the present study was crucial where all the collected data's in the form of both primary and secondary research are done confidentially (Fletcher, 2017). The researcher, during the survey with all its participants, adheres to the stick polices of applications based on business-oriented operations(Quinlan, Babin, Carr& Griffin, 2019). By applying this ethical principle, the researcher will carry out the understanding and knowledge about information search(Wiek& Lang, 2016). Data protection act, along with dealing fairly with all the crucial findings based on the research work fundamental objectives.

Reference List

Aduwo, O. O. (2016). The role of forensic accounting in combating the menace of corporate failure. Forensic accounting assignment International Journal of Economics, Commerce and Management, 4(1), 640-649. https://pdfs.semanticscholar.org/471a/34ef65d83a8931d48ab2415ed222343b5b90.pdf

Alshurafat, H., Beattie, C., Jones, G. & Sands, J., (2019). Forensic accounting core and interdisciplinary curricula components in Australian universities: analysis of websites. Journal of Forensic and Investigative Accounting, 11(2-Special Edition), pp.353-365.

Ata?an, G. and Kavak, A., 2017. RELATIONSHIP BETWEEN FRAUD AUDITING AND FORENSIC ACCOUNTING. International Journal of Contemporary Economics & Administrative Sciences, 7. https://www.researchgate.net/profile/Guelsah_Atagan/publication/325130505_Relationship_Between_Fraud_Auditing_and_Forensic_Accounting/links/5bead0114585150b2bb35fc8/Relationship-Between-Fraud-Auditing-and-Forensic-Accounting.pdf

Bhasin, M.L., (2015). Contribution of Forensic Accounting toCorporate Governance: An Exploratory Study of an AsianCountry. International Business Management, 10(4), p.2016.

Crain, M.A., Hopwood, W.S., Gendler, R.S., Young, G.R. &Pacini, C.,( 2019). Essentials of forensic accounting. John Wiley & Sons.]

Cugova, A. &Cug, J., (2020). Motivation for the use of creative accounting techniques in the conditions of the globalized business environment. Forensic accounting assignment In SHS Web of Conferences (Vol. 74, p. 01004). EDP Sciences.

Dubey, M.P., 2016. Forensic Accounting. https://www.academia.edu/download/40815232/2596.pdf

Ehioghiren, E. E. &Atu, O. O. K. (2016). Forensic accounting and fraud management: Evidence from Nigeria. Forensic accounting assignment Igbinedion University Journal of Accounting, 2(8), 245-308. https://www.iuokada.edu.ng/journals/571E2E6407A9033.pdf

Eze, E. & Okoye, E.I., (2019). Forensic Accounting and Fraud Detection and Prevention in Imo State Public Sector.

Fletcher, A.J., (2017). Applying critical realism in qualitative research: methodology meets method. International journal of social research methodology, 20(2), pp.181-194.

Gray, D.E., (2019). Doing research in the business world. Sage Publications Limited.

Herbert, W.H., Onyilo, F., Ene, E.E. &Tsegba, I.N., (2017). Fraud and forensic accounting education: Prospects and challenges in Nigeria. International Journal of Business and Management, 12(7), pp.146-160. https://pdfs.semanticscholar.org/0197/ec0b9787ca98faec10ebc8afe09b74d24c5b.pdf

Hitchcock, M., (2018). The Importance and Implications of Forensic Accounting in the Financial World. https://digitalcommons.liu.edu/cgi/viewcontent.cgi?article=1026&context=post_honors_theses

Kingsly, M., (2015). The Role of Forensic InvestigationProfessionals in the Prevention of Fraud and corruption inDeveloping Countries. Available at SSRN 2605811.

Kizil, C. &Ka?ba??, B., (2018). Accounting Scandals and Eye-Catching Frauds: USA-Japan Comparison by Considering the Role of Auditing. Forensic accounting assignment Journal of Asian Research, 2(3). https://pdfs.semanticscholar.org/46b6/32331f49db67cf49eecb7e7ba2af7cca8a72.pdf

Kranacher, M.J. & Riley, R., (2019). Forensic accounting and fraud examination. John Wiley & Sons.

Kumar, R., (2019). Research methodology: A step-by-step guide for beginners. Sage Publications Limited.

Lakshmi, P. and Menon, G.,( 2016). Forensic Accounting: ACheckmate for Corporate Fraud. Forensic accounting assignment Journal of Modern Accountingand Auditing, 12(9), pp.453-460.

Ledford, J.R. & Gast, D.L., (2018). Single case research methodology: Applications in special education and behavioral sciences. Routledge.

MEKIC, A., Halilbegovic, S. &Huric, A., (2017). Forensic Accounting as a Solution to Manipulative Accounting of SME’s in Bosnia and Herzegovina. Ecoforum Journal, 6(2). http://www.ecoforumjournal.ro/index.php/eco/article/viewFile/634/396

Modugu, K.P. and Anyaduba, J.O., (2013). Forensic accountingand financial fraud in Nigeria: An empiricalapproach. International Journal of Business and SocialScience, 4(7), pp.281-289.

Quinlan, C., Babin, B., Carr, J. & Griffin, M., (2019). Business research methods. South Western Cengage.

Rathnasiri, U.A.H.A. &Bandara, S.,( 2017). The forensic accounting in Sri Lanka. https://www.survey.unitec.ac.nz/bitstream/handle/10652/4713/Rathnasiri.%20U.%20A.%20H.%20A.%20%282017%29.pdf?sequence=3&isAllowed=y

Rehman, A. & Hashim, F., (2018). Literature review: Preventive Role of Forensic accounting and Corporate Governance Maturity. Forensic accounting assignment Journal of Governance and Integrity (JGI), 1(2), pp.68-93. https://www.researchgate.net/profile/Ali_Rehman12/publication/325813347_LITERATURE_REVIEW_PREVENTIVE_ROLE_OF_FORENSIC_ACCOUNTING_AND_CORPORATE_GOVERNANCE_MATURITY/links/5b26a4590f7e9b0e374e54b1/LITERATURE-REVIEW-PREVENTIVE-ROLE-OF-FORENSIC-ACCOUNTING-AND-CORPORATE-GOVERNANCE-MATURITY.pdf

Rezaee, Z. & Wang, J., (2019). Relevance of big data to forensic accounting practice and education. Managerial Auditing Journal.

Sahdan, M.H., Cowton, C. & Drake, J., (2019). Forensic accounting services in English local government and the counter-fraud agenda. Forensic accounting assignment Public Money and Management.

Wiek, A. &Lang, D.J., (2016). Transformational sustainability research methodology. In Sustainability science (pp. 31-41). Springer, Dordrecht.

Appendix: Ethical Form

|

Student Details |

||

|

Name |

: |

|

|

Student Number |

: |

|

|

|

: |

|

|

Subject (Code/Name) |

: |

|

|

Supervisor Details |

||

|

Name |

: |

|

|

|

: |

|

|

Proposed Research Details : |

|

Topic: Applied Business Research (Forensic Accounting) |

|

Summary of the proposed research project, including brief description of methodology (bullet points where applicable) |

|

Ethics Checlist (Participants) |

|

How do you propose to select your participants? |

|

Will your research involve adults who might be identified by you or anyone else reading the research ? (Yes/No). If yes, how will you obtain their consent ? |

|

Does your research involve children under eighteen years old ? (Yes/No) |