Financial Statement Assignment: Performance Analysis OfJoe’s Motorbike Tyres

Question

Task:

Financial statement assignment TASK 1:

For a business you work in, have access to or a simulated business, in consultation with your Assessor, you are required to review the financial management of that business. In order to undertake budgeting, financial forecasting and reporting and to allocate and manage resources to achieve the required outputs for the business unit. You will need to access the business' financial data, relevant legislation and Australian Tax Office requirements and the business' business plans, profit and loss statements, cash flows and aging summaries. You must also refer to the business' organisational financial policies and procedures and the financial management software utilised by the business.

a) Explain the relevant legislation and Australian Tax office (ATO) requirements for business reporting. Outline how the business needs to comply with ATO reporting and the frequency of these reports

b) Create a report for management, analysing the financial performance and financial position of the organisation using relevant ratios to assess the profitability and the financial viability of the company. Use graphic representations wherever necessary.

Following ratios need to be used to analyse the performance of the organisation during the one-year period. You must clearly show the calculation of each ratio and interpret the result in order to analyse the financial performance and financial position of the organisation.

Financial Performance

- Gross profit margin %

- Net profit margin %

- Return on shareholder equity

- Return on Assets

Financial Position

- Working capital ratio

- Quick Asset Ratio

- Cash Conversion Cycle

c) Explain how bias, errors or material misstatement is to be avoided and how to ensure that the reports are checked for accuracy prior to release.

d) What is an audit trail? How do companies maintain an audit trail to ensure diligence in financial reporting?

e) Explain the benefits of using Accounting software available to businesses for the management of their financial operations.

f) Using the information available from your trainer, develop a financial budget for the business. Explain why it is important to communicate with different departments with regard to the budget. Also explain how you would communicate this budget information to other departments as well. A Contingency plan needs to be developed for any uncertain items.

Answer

Introduction

The report on financial statement assignment has been prepared taking into account the financial statements and management principles of the company. The evaluation has been done in order to forecast the business working and policies. The report starts with the description in relation to the legislation and ATO requirements for the business reporting (Wickramasuriya,2016). Further, the management report has been prepared for the assessment of the financial performance of the company. Afterwards the discussion in relation to the errors or material misstatements has been done and how the same could be avoided along with the explanation of the audit trail and how companies maintain audit trail for the ensuring of diligence in the financial reporting. Later the use of accounting software has been done and the financial budget is prepared along with its importance to be communicated to various departments has been described. At the end the financial statement assignmentis concluded with the insights derived from the preparation.

a. Legislation and ATO requirements for business reporting

The business reporting requirements are as follows:

1. As per the reuiements of the austalian taxation office, the businesses which have employed less than 20 employees shall submit reports with the help of the payroll software.

2. The ATO requires the businesses to submit the activity of the bsuiness statememts quarterly, monthly or annually. The report shall be used for the calculation and payment of the GST, PAY G instalments and other tax liabilities (Stannard, 2017).

3. The financial yaer in Australia runs from 1st jult to june 30th. It is required that the business shall report the return of income tax within this period.

b. Management report

JOE’S MOTORBIKE TYRES

The report provides an analysis of the financial performance and financial position of the company Joe’s Motorbike tyres. The report on financial statement assignment shall set out the description and analysis of the calculations made which are as follows:

Financial performance analysis:

The performance analysis has been done using the ratio analysis technique in which gross profit ratio, net profit ratio, return on asset ratio and return on equity ratio for the two years has been determined (Easton, et. al., 2018).

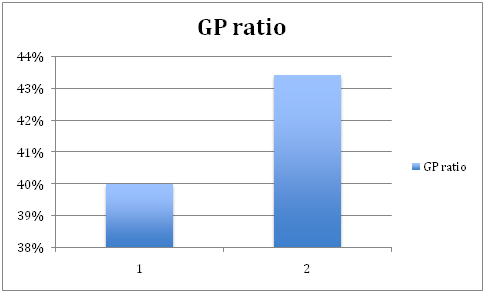

Gross profit ratio:

The company has recorded an increase in the gross profit ratio in the year 2, which is mainly due to the increase in the revenue recorded by the company through the sales made (Satria, 2019).

The Graph below shows the rise in the GP ratio.

(Figure 1: GP ratio)

(Source: Excel financial performance ratios)

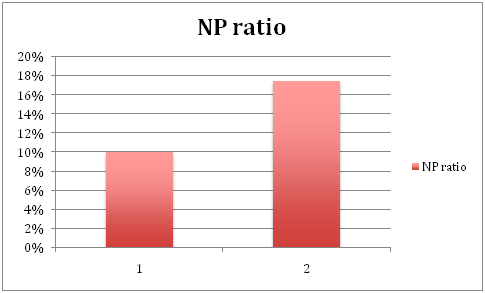

Net profit ratio:

Similar to the Gross profit there has been an increase in the net profit ratio of the company which has been recorded by the increased net profit and increase sales made by the company.

|

Net profit ratio |

||

|

Particulars |

Year 1 |

Year 2 |

|

Net profit |

5200 |

12250 |

|

Sales |

52000 |

70000 |

|

NP ratio |

10% |

18% |

The graph depicts the incremental Net profit ratio

(Figure 2: NP ratio)

(Source: Excel financial performance ratios)

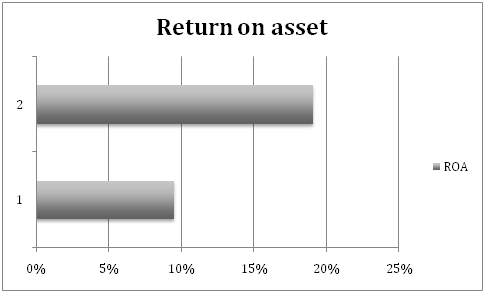

Return on asset ratio

The return on asset ratio tells the effective deployment of the assets in the revenue generating activity of the company (Khamidah, Gagah, &Fathoni, 2018). The ratio has recorded an increase, which shows the effectiveness of the company in the use of the assets for the generation of the revenue.

|

Return on asset ratio |

||

|

Particulars |

Year 1 |

Year 2 |

|

Net profit |

5200 |

12250 |

|

Total asset |

54820 |

64150 |

|

ROA |

9% |

19% |

The graphical presentation of the ratio is as below within this financial statement assignment:

(Figure 3: ROA ratio)

(Source: excel financial performance ratios)

|

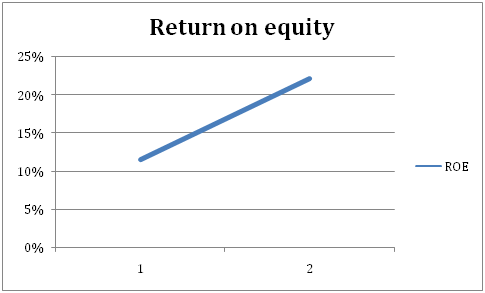

Return on equity ratio |

||

|

Particulars |

Year 1 |

Year 2 |

|

Net profit |

5200 |

12250 |

|

Total equity |

45200 |

55400 |

|

ROE |

12% |

22% |

The graphical depicts the incremental return on the equity of the company.

(Figure 4: ROE ratio)

(Source: excel financial performance ratios)

Analysis of financial position of the business:

For the assessment of the financial position of the business, the working capital has been calculated, quick ratio and the cash conversion cycle is evaluated (Batchimeg, 2017).

Working capital

The working capital is calculated by the subtraction of the current assets with the current liabilities. The working capital is used in the running of the business operations. The working capital has increased which shows that the company has enough amounts to meet the short-term obligations.

|

Working capital |

||

|

Particulars |

Year 1 |

Year 2 |

|

Current assets |

26220 |

35500 |

|

Current liabilities |

9620 |

8750 |

|

Working capital |

16600 |

26750 |

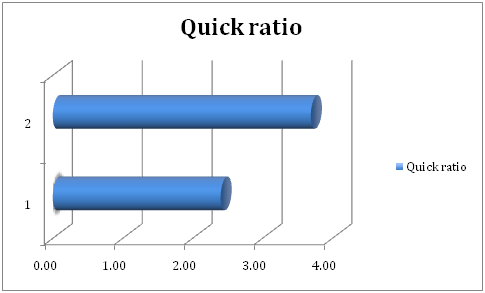

Quick asset ratio

Herein financial statement assignment, the quick assets are those assets which are readily convertible into cash i.e. it is obtained after subtracting the current assets from stock. The increased in the quick asset shows that the company has enough assets to meet the current obligations of the company. However, it also shows the fund blockage in the assets.

|

Quick asset ratio |

||

|

Particulars |

Year 1 |

Year 2 |

|

Quick assets |

23100 |

32300 |

|

Current liabilities |

9620 |

8750 |

|

Quick ratio |

2.40 |

3.69 |

The quick asset ratio has been depicted in the graph below:

(Figure 5: Quick ratio)

(Source: excel financial position)

Cash conversion cycle

The cash conversion cycle depicts the time within which the inventory is converted into cash. The lesser the number of days taken the better it shall be. Hence, the reduced number of days shows the company’s efficiency for converting the inventory into cash.

c. What is the importance of avoidance of material misstatements in this report on financial statement assignment? The risk of material misstatements can be defined as the risk which remains or persist in the financial statements which are being audited and the risk can be of material importance either in aggregate or individually. The misstatement can be in the form of difference in the amount, presentation, and classification or in the fulfillment of the requirements as per the accounting standards. The misstatements can arise either from errors or frauds. Therefore, it is evident for the auditors to assess the risk and see that the financial statements are free from bias and errors. For this, the auditor shall assess the risk at two levels:

- Assertion level: at this level the risk is asserted and this is sub divided into control and inherent risk. The inherent risk can be defined as the suspection of the assertion of the misstatement which arises due to frauds and errors before taking into account the considerable control. The control risk is the misstamnet risk which cannot be detected or preveneted by the internal control entity

- Financial statements level: this is related tio the whole of financial statemenst i.e. the risk arises when there is a fraud possibility.

Therefore, when material misstament risk is high, the detection level risk is low i.e. due to the increment in the amount of evidences that can be obtained by the tests of substantive procedures. Therefore, doing this the overall audit risk is reduced.

d. Explanation of Audit trail

An audit trail is a set of records that document each and every step of business transaction. They can be invoices for issued payments or sales contracts documenting revenue (Turner, et. al., 2020). An audit trail is mainly utilized when businesses needs to verified the accuracy of the items. The small businesses must pay close attention to maintain these records. A complete audit trail shows the stakeholders of the business the soundness of information on the financial statements, reports (Duncan, & Whittington,2017). These audit trails also helps businesses to meet the government/regulatory record keeping requirements for tax related purposes.

Maintenance of audit trails by the companies in order to ensure the financial reporting diligence

Audit trails are necessary for all the companies. Without an audit trail businesses may find themselves indulged in harmful situations that can damage the company including frauds, frequent audit investigations, refusal of funding and various compliance issues (Weir, et. al., August).

To avoid these situations, it’s very crucial to maintain an audit trail by recording all the financial transactions, creating a standardize database, frequent updates, and keep all the logs in a secured space.

Below are the steps followed by companies for maintaining an audit trail:

- Record All the Financial Transactions

Businesses should ensure that they have recorded all their financial activities in a log and also they have all the evidences of every payments, documents, invoices, etc., because without the correct logs, companies may not be aware of how much capital is incurred and whether they are following their spending with their pre defined budgets, financial planning (Machera, &Machera, 2017). - Create a Standardize Database

Businesses should prepare a single database system to record all of the paperwork secure. Most of the companies uses accounting software where they record all of the receipts and generates reports according to their purposes. - Frequent Updates

The business owners should appoint someone to monitor the database regularly. This should be done frequently to neglect the accidents. That person can help in finding errors or misjudgements, which could have an impact, the firm’s financial statements before an audit occurs. - Make Sure That the Logs are Secured

The businesses should keep the logs in a secured location. This can be done by encrypting the data with the password to access the files. Also the business owners hire a third party company to perform a half yearly or yearly audit as a way to prevent from happening of unknown errors.

e. Benefit of using Accounting software

As per the research on financial statement assignment, accounting software is a tool which helps you to record the in and out of your businesses capital and also examine the financial situation (Wang, Wang, & Wang, 2019). With the help of accounting software we can record the business transactions, create purchase, maintain vendor contacts, put orders, track stock levels, generate reports, bill and manage our customers and monitor account balances (Sampaio, & Bernardino, 2016).

The benefits of accounting software are as follows:

1. Continuous Financial Monitoring and can get in-depth reports at any time.

2. Minimizes Mistakes as there is very less manual activities are done

3. Management of Cash Flow is done very specifically which is very useful for management in their planning.

4. Scalable Solutions as these software provides cloud based accounting solutions, which can be very helpful for the businesses, which are present in different regions.

5. They can automatically track inventory and also they will tell when the business will run out of stock.

6. Computerized Invoicing helps the business to keep track on their customers as they can generate up to date reports to check they delay payments or estimated taxes etc.

7. Accounting software’s can calculate the taxes, which needs to be paid; also we can generate the reports to file taxation with the government.

8. This can help business to centralize their main business areas and tasks such as payroll, customer relationship management, inventory management, invoicing, and more.

f. Budgeting process

The budget of the company has been prepared taking into account the actual figures from which the figures are forecasted for further 3 years. The table below presented in the financial statement assignment shows the budget:

|

Company Budget |

|||||

|

Particulars |

Year 1(actual) |

Year 2(actual) |

Year 3(forecasted |

Year 4(forecasted) |

Year 5(forecasted) |

|

Income |

|

|

|

|

|

|

Sales |

51000 |

70000 |

89000 |

108000 |

127000 |

|

Other sales |

1000 |

2600 |

4200 |

5800 |

7400 |

|

Total income |

52000 |

72600 |

93200 |

113800 |

134400 |

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

Advertisement |

500 |

500 |

500 |

500 |

500 |

|

Bank services |

120 |

100 |

100 |

130 |

120 |

|

Insurance |

500 |

600 |

700 |

800 |

900 |

|

Rent |

3000 |

4000 |

5000 |

6000 |

7000 |

|

Payroll |

10000 |

11000 |

12000 |

13000 |

14000 |

|

Fees |

200 |

300 |

400 |

500 |

600 |

|

Utilities |

800 |

900 |

1000 |

1100 |

1200 |

|

Other expenses |

480 |

750 |

1020 |

1290 |

1560 |

|

Total expenses |

15600 |

18150 |

20720 |

23320 |

25880 |

|

Net income |

36400 |

54450 |

72480 |

90480 |

108520 |

The percentage growth forecast has been shown in the image below:

(Figure 6: Growth percentage)

(Source: Excel Budget sheet)

The importance of communicating budget can be expressed through the following points provided in this financial statement assignment:

- For addressing the needs of the various departments and individaulas.

- In order to recive inputs from various departments, communication is the key elements that can help in the production of the budget.

- For making any adjustemnts in the budget , it is evident to communicate the budget to various departments.

It is evident for organization to communicate the budget to each and every departments, the budget can be communicated by the following means:

- Through physical meetings : the budget can be comminicate through face to face mettings which is the most feasible way of discussion wherein the ouputs of all the individuals can be gathered instantenosly.

- Through technology: with the help of technology the busget can be communicated i.e. by Email, telephonically, Teleprsence and via text messages.

Conclusion

After the preparation of financial statement assignment, it is inferred that it is evident to assess the financial performance and position of the business in order to assess its future. It is necessary to understand the errors that arise in the misstatements and what can be done to avoid them in order to provide a true and fair view to the users. The financial statement assignmentdiscusses various other aspects, which have helped in the development of the knowledge in relation to the audit trail, budgeting process, and various legislative requirements of ATO.

References

Batchimeg, B. (2017). Financial performance determinants of organizations: The case of Mongolian companies. Journal of competitiveness, 9(3), 22-33.

Duncan, B., & Whittington, M. (2017). Creating and Configuring an Immutable Database for Secure Cloud Audit Trail and System Logging. Financial statement assignmentInternational Journal On Advances in Security, 10(3-4), 155-166.

Easton, P. D., McAnally, M. L., Sommers, G. A., & Zhang, X. J. (2018). Financial statement analysis & valuation. Boston, MA: Cambridge Business Publishers.

Khamidah, A., Gagah, E., &Fathoni, A. (2018). Analysis Of The Effect Of Gross Profit Margin (GPM), Earning Per Share (EPS), Debt To Equity Ratio (DER), Net Profit Margin (NPM) On Return On Assets (ROA)(Study On Property and Real Estate Companies listed on the Indonesia Stock Exchange Year 2012–2016). Journal of Management, 4(4).

Machera, R. P., & Machera, P. C. (2017). Computerised Accounting Software; A Curriculum That Enhances an Accounting Programme. Universal Journal of Educational Research, 5(3), 372-385.

Sampaio, D., & Bernardino, J. (2016). Open source accounting software for SMEs. International Journal of Business Information Systems, 23(3), 287-306.

Satria, R. (2019). PENGARUH CURRENT RATIO, DEBT TO EQUITY RATIO, RECEIVABLE TURNOVER DAN INVENTORY TURNOVER TERHADAP GROSS PROFIT MARGIN PADA PT HANJAYA MANDALA SAMPOERNA Tbk PERIODE 2008-2018. JurnalIlmiah Feasible (JIF), 1(2), 170-181.

Stannard, J. (2017). Updates on ATO reporting and insurance in super. Superfunds Magazine, (429), 10.

Turner, C. J., Emmanouilidis, C., Tomiyama, T., Tiwari, A., & Roy, R. (2020). Intelligent decision support for maintenance: A new role for audit trails. In Engineering Assets and Public Infrastructures in the Age of Digitalization (pp. 396-403). Springer, Cham.

Wang, S., Wang, H., & Wang, J. (2019). Exploring the effects of institutional pressures on the implementation of environmental management accounting: Do top management support and perceived benefit work?. Business Strategy and the Environment, 28(1), 233-243.

Weir, G., Aßmuth, A., Whittington, M., & Duncan, B. (2017, August). Cloud accounting systems, the audit trail, forensics and the EU GDPR: how hard can it be? Financial statement assignmentIn British Accounting & Finance Association (BAFA) Annual Conference 2017.

Wickramasuriya, T. (2016). Tax counsel's report: New tools of the trade. Taxation in Australia, 50(7), 365.