Financial Reporting Assignment Analysing Financial Situations of Business Scenarios

Question

Task: Your task is to prepare a financial reporting assignment answering the following questions:

Question 1) Consider Pfizer annual reports, and review financial statements and its associated notes and answer following question:

1. What categories of inventory does Pfizer has

2. Calculate cost of finished goods using information from income statement, balance sheet and associated notes.

3. Identify elements of manufacturing overheads from annual reports.

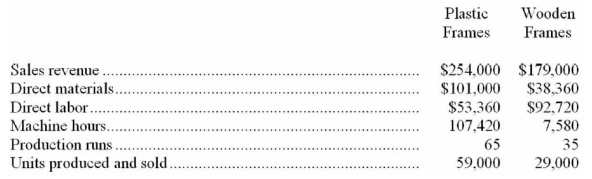

Question 2) Nano Corporation makes plastic and wooden picture frames. The company has assigned $137,000 in monthly manufacturing overhead costs to two cost pools as follows: $87,000 to power costs and $50,000 to production set-up costs. Power costs are allocated to products using machine hours as an activity base. Set-up costs are allocated to products based on the number of production runs each product line requires.

a) Allocate manufacturing overhead from the activity cost pools to each product line.

b) Compare the total per-unit cost of manufacturing plastic frames and wooden frames.

c) On a per-unit basis, which product line appears to be most profirable

d) Citing this examples, explain the merits and demerits of pre-determined overhead application rate (POHR) and Activity Based Costing (ABC).

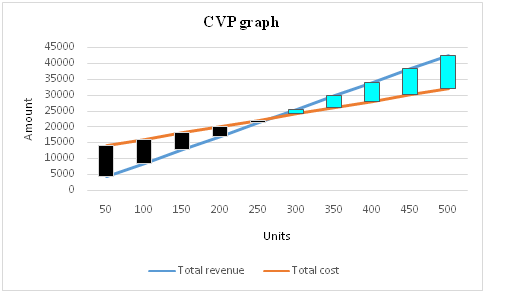

Question 3) Jenna Manufacturers produces flooring material. The monthly foxed costs are $12,000 per month. The unit selling price is $85 and variable cost per unit is $40. If Jenna’s managers create a CVP graph, at what sales level (in units) will the revenue and total cost lines intersect Show the workings and the graph clearly, along with the Break-even point.

Answer

Answer to question 1

Financial position and financial performance review of PFIZER INC

This section of the financial reporting assignmentshows the review of the financial statement of PFIZER INC. The previous year's financial statement was used here to check the financial performance and the financial position of the company. Ratio analysis is used here as an analytical tool. Profitability, liquidity and efficiency are shown here.

The financial statement of the company shows that the profitability position of the company is good enough. As the financial statement, the net profit margin of the company is high as compared to any other companies that are also operating in the same region. Howe ever the profitability of the company has reduced as compared to the past financial year. Thus the company's financial performance is reducing year to year. However, the company faced the challenges of the world pandemic situation.

|

Profitability ratio |

2020 |

2019 |

|

Revenues |

41,908 |

41172 |

|

Cost of revenue |

8692 |

8251 |

|

Gross profit |

33,216 |

32,921 |

|

gross profit ratio |

79.26% |

79.96% |

|

|

|

|

|

Net profit |

9616 |

16273 |

|

Revenues |

41908 |

41172 |

|

Net profit margin |

22.95% |

39.52% |

|

|

|

|

|

Shareholder's equity |

63473 |

63143 |

|

Net profit |

9616 |

16273 |

|

Return on equity |

15.15% |

25.77% |

Return on equity of the company has reduced as compared to 2019. As the net income margin has reduced, thus the return has also reduced. The company must have to improve their return on equity to keep its goodwill to its equity holder (Nota et al., 2020). Thus the overall profitability position of the company is moderate.

The liquidity position of the company is also good. PFIZER INC company management has kept enough liquidity to their company to pay off their short-term liabilities. Even the quick ratio of PFIZER INC is comparatively high. Thus the company management does not have to lose their stock at the time of paying their debt (Duran and Afonso, 2020).

|

Liquidity ratio |

2020 |

2019 |

|

Total current assets |

35,067 |

32803 |

|

Total current liabilities |

25920 |

37304 |

|

current ratio |

1.35 |

0.88 |

|

|

|

|

|

Total current assets |

35,067 |

32803 |

|

Total current liabilities |

25920 |

37304 |

|

Inventories |

8046 |

7068 |

|

Quick ratio |

1.04 |

0.69 |

The efficiency ratio is the factor that suggests the operational efficiency of the company. The stock turnover ratio of the company is low. Even the value of the ratio has reduced as compared to last year. Further, the assets turnover ratio of the company is also too low. All the factors suggest lower efficiency of the company management. The management team must have to improve their operational efficiency in using every resource.

The leverage position of the company is also a measure of the financial position and operational efficiency. The debt-equity ratio of the company is high. As the capital structure of the company follows its equity base, thus they have lower capital risk. even, the company can use the leverage position to improve their revenue as well as income level (Wiese et al., 2021). The total assets to debt ratio is a ratio through which debt percentage can be calculated in total assets. In other words how many levels of assets have been found with the help of debt capital. It will be acceptable when the percentage will be lower than 50%. As the value of the ratio is lower than 50 %, thus the company's financial position is comparatively good. They can make their assets debt free up to, 75%.

|

Efficiency ratio |

2020 |

2019 |

|

Inventory turnover ratio |

1.080288 |

1.167374 |

|

Assets turnover ratio |

0.271726 |

0.245665 |

|

Receivables turnover ratio |

5.284741 |

6.07974 |

The financial statement of the company can show its investors. Mainly the company follow the cost basis raw materials to follow the recent cost. Mainly the company wants to complete stock valuation at a reasonable low price. Also, the company is highly sanguine about the level of stock. It is highly important to maintain the proper amount of raw materials. Otherwise, due to shortage, their production can be hampered. Safety stock is also in existence to the company to create a safe level of stock to follow up the production.

Cost of Finished Goods

|

leverage ratio |

2020 |

2019 |

|

Debt equity ratio |

0.58502 |

0.585259 |

|

Total assets to debt ratio |

0.240765 |

0.220503 |

The cost of finished goods is the total cost of production and operation cost that a raw material and its complete transformation to finished goods. The above table is showing the cosy distribution for each of the steps towards the completion of final goods. Selling, informational and administrative expenses are taken as overheads that are also important to the production process. Similarly, research and development is also a part of overhead and also integrated art of their cost. Hence the total cost of finished goods is 29712.

Manufacturing overheads

Manufacturing overheads are the factors that are related to the conversion of raw material to finished goods. These are called overheads, as these factors have no direct influence on the product.

From the financial statement of the company, some of the factors can be identified, that have an indirect influence on the product (Wiese et al., 2021). These are selling administrative and information overheads. All the factors that are related to the direct process of mandating are called direct expenses and included as a prime cost. Selling and distribution are taken as overhead as the costs are indirectly related to the manufacturing process.

The research and development are also taken as overhead. The cost that the company has to incur for the process is before starting the production or after the production. Hence this is also an overhead.

Answer to question 2:

The Nano Corporation manufactures plastic and wood frames. The monthly manufacturing overhead costs which the organisation is assigned is $ 137,000, in which the power costs are $87,000 and the production setup cost is $50,000.

To allocate the manufacturing overhead from activity cost to each of the product lines is stated here.

In the activity-based, there is the use of several costs that can be organised by activity, allocating overhead costs (Nota et al., 2020). In this costing, the main thing is that the activities are carried out to produce the products that will include the activities like purchasing of materials, machinery, assembling of product, and inspection of finished goods. Sometimes, the activities can get costly, so activities cost will be allocated to products upon using products for these activities. In implementing the activity-based costing, some of the steps are to be followed and the total amount will be divided into several activities that can include departments and an overhead rate can be established for each of those activities.

An activity is considered as the process or procedure which can consume overhead resources. The main goal is to have an understanding of all the activities which are needed at the time of manufacturing the products (Brierley, 2017). Nano Corporation has selected activity-based costing as several activities need to be performed. It is important to narrow down activities in choosing the impact upon overhead costs.

In allocating manufacturing overhead from activity cost to each product line, it can include cost for the items which can be salaries of personnel, deprecation of machinery and equipment. At this point, the identification of activities are done which are required to make the products, and the assigned overhead cost is listed as activities (Wortmann et al., 2020). The cost driver is considered as an action in which costs are associated with the activity. The identification of cost drivers does require gathering information from several areas of an organisation that can include purchase, production, accounting, and quality control.

|

Prime cost |

8692 |

|

Selling, informational and administrative expenses |

11615 |

|

Research and development expenses |

9405 |

|

The total cost of sales |

29712 |

From the above table, it can be observed that the total cost of a plastic frame is 327125.57 and for the wooden frame is 183314.43 According to the per-unit cost, it is 5.54 for a plastic frame and 6.32 for a wooden frame.

The overhead costs which are to be paid to products through increasing the predetermined overhead rate for every activity are through the level of cost driver activity in using the product. In assuming the annual cost driver activity for Nano Corporation, is for plastic frames and wooden frames. The total activity level that is presented will match the estimated activity level which is presented and is done to avoid complications of over-applied and underapplied overhead. Moreover, in this scenario, it will provide actual activity levels which are quite different compare to the activity levels that are estimated, which can be done through over-applied and underapplied overhead.

The allocation of the overhead cost will show the allocation of overhead with the cost drover activity that is presented and the overhead rate will be evaluated. In implanting the activity-based costing it helps in providing a much-refined way in allocating the overhead cost to products.

As per the per unit basis, the plastic frame is considered to be much more profitable.

Merits and demerits of predetermined overhead application rate

The predetermined overhead application rate will be set to manufacture the overhead cost of the work-in-progress. The rate can be determined easily before it will begin and it indicates that it is not a necessary and accurate presentation of the actual cost of overhead. However, the managers certainly prefer using the predetermined overhead rate due to the advantages in a consistent way. The predetermined overhead rate is usually based upon the estimated overhead cost to the estimated total activity base.

The merits of a predetermined overhead rate are used in smoothing out variations in the overhead costs. The variations are usually used to a large extent due to cooling and heating cost, while it is quite high in both the months of summer and winter, but relatively low in fall and spring. Thus, the actual cost for a particular project will not be evaluated in an independent way of season and is completed. Another advantage that a predetermined overhead rate has is using the plan for costing future projects. If the organisation will use the actual overhead rate to evaluate the project costing, then it is not possible to do it as the project is not completed and the true costs are not known. Thus, estimated costs are quite relative to the activity base will allow managers in budgeting for future projects.

Some of the disadvantages of a predetermined overhead rate are discussed here. Sometimes at the time of calculating the figures are not accurate as it is not estimated, so it will not reflect actual overhead, but there can be an impact upon management decision making. As the variance is used in predetermined rate and actual, if resulted significant then there will be the huge impact upon the financial statement. Further, there will be an impact on inventory and the cost of goods sold. As the method depends on the management team, they will try in making the financial statement look better. Thus, they will try to provide positive information in ensuring that the bottom line will be high.

Merits and demerits ofactivity-based costing

The advantage of activity-based costing is that it will bring reliability and accuracy in the product cost determination through focusing upon the reason and effect relationship. It further recognises the activities that will cause costs and products that will consume activates (Keel et al., 2017). In advanced environments and technology used for manufacturing, there are support function overheads that will establish a large share of the total costs. The activity-based costingis quite dependable and can correct the cost data of the product at the time of greater diversity as the product is factory-made in low or high-volume products (Cidav et al., 2020). The activity-based costing can able to identify the cost behaviour and will help in cost reduction and identification of activities that will not add value to the product. In activity-based costing, the administrators will not able to control the fixed overhead costs over activities.

The activity-based costing has several cost pools and cost drivers are multiple, so is much more complex than the traditional product cost system. It does state that activity-based costing is quite costly to manage. Some difficulties can emerge in implementing activity-based costing that will include cost driver selection, varying cost driver rates, and common costs (Areena, 2019). The activity-based costing has several levels of utility in different organisations that will include large manufacturing organisations which can be quite useful compared to smaller organisations. It is quite likeable that the organisations will depend upon cost-plus pricing as they can able to take advantage of activity-based costing as it provides accurate product cost. The organisations that use market base prices will not favour activity-based costing (Duran and Afonso, 2020). The technology level and manufacturing environment which are used will affect the application of activity-based costing. The activity-based costing system will require management in estimating the cost of activity pools and in identifying and measure cost drivers in serving the cost allocation base.

|

|

|

Plastic frame |

|

Wooden frame |

|

Units produced and sold |

|

59000 |

|

29000 |

|

Direct materials |

|

101000 |

|

38360 |

|

direct labour |

|

53360 |

|

92720 |

|

Overhead |

|

|

|

|

|

Power costs |

81265.57 |

|

5734.43 |

|

|

Production set up cost |

32500 |

113765.57 |

17500 |

23234.43 |

|

Total cost |

|

327125.57 |

|

183314.43 |

|

Per unit cost |

|

5.54 |

|

6.32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total machine hour |

115000 |

|

|

|

|

Production runs |

100 |

|

|

|

Break-even point= (Total fixed cost)/( sales per unit-variable cost per units)

Jenna manufacturer is a company, produces flooring materials. Using the above-mentioned formula BEP has been calculated.

|

Total fixed cost |

$ 12,000.00 |

|

Selling price per unit |

$ 85.00 |

|

Variable cost per unit |

$ 40.00 |

|

Breakeven points in Units |

266.666667 |

The breakeven point is the financial metric that can be used at any kind of business to understand the number of units to be produced to reach a profit zone. Thus it expresses the level of position, in which a company can manage to cover production cost (Brierley, 2017). In other words, break-even points are the relation between the cost volume and profitability at a different level. This is the point where a company gets neither profit nor loss.

If a company uses Break-even point to their company then they can avail certain advantages such as:

It helps to predetermine the profit and loss in different levels of operation.

It helps in showing the products and selling to ensure profit.

It can show whether the product is worth selling or it can be too risky.

It will show the revenue amount which the organisation which organisation can make for each level of output.

It shows whether the cost can be needed to lower the break-even point.

Further, it can use the investors or banks to finance the business and is quite easy to analyse.

If a company uses Break-even point to their company then they can avail certain disadvantages such as:

The breakeven will assume that organisation will set the stock at the same price.

The organisation can be quite unrealistic in calculations.

The variable cost will change regularlywhich can indicate the analysis is not accurate.

The whole process of breaking even a point can be time-consuming.

Jenna manufacturing house has the break-even point at 267 units. the company has to produce 267 units to achieve no loss zone. CVP graph is a financial metric that is used to show the level of production or investment from where certain investments can start gaining. The above graph is created to show the level of production in which the company can make sure to have profit. This metric is important for a company or an investor when they are making decisions regarding investing in a particular project. CVP graph is the process by which a company can show how the cost or the investment will work in different levels of activity or rates of investment. Total revenue and the total cost are the two main factors that should be identified for each level of activity to get the CVP point. For Jenna manufacturing house, here several levels of units are shown to understand the total cost and total revenue in each level of investment. In a manufacturing company at the time of calculating the cost at a first total foxed cost is to be identified. Then the variable cost per unit is to be multiplied with per unit cost. Variable cost and the fixed cost shows the total cost. At the same time, the sale price for each unit s to be multiplied by the number of units. total revenue can be calculated like this. Then these two items are to be visualised using the graph. The output will be the CVP graph where the cost and profit will be the same.

Conclusion

Financial position analysis of PFIZER INC. express that the company management has a moderate level of operating efficiency. However the company has a poor assets management. They have to umprove the level of operating efficiency. Also they have to aware about overheads related to their production system. In the second problem, overheads allocation sytem are mentioned. Based on the type of overhead all are allocated to different cost centre. Proper allocation will help the company to monitor all the costs. In the third problem, Jenna manufacturing house should have to consider the BEP level to maintain cost and profitability. Also, the impact of the variable cost and fixed cost are also shown and their operatbility as per different level are discussed. Proper cost allocation mention to the company.

Reference List

Areena, S.N., (2019) A review on time-driven activity-based costing system in various sectors. Journal of Modern Manufacturing Systems and Technology, 2, pp.15-22. http://journal.ump.edu.my/jmmst/article/view/1795

Brierley, J.A., (2017) Identifying the Influences on the Inclusion of Non-Manufacturing Overhead Costs in Product Costs. Advances in Business and Management, 11, pp.141-158. https://eprints.whiterose.ac.uk/105558/

Cidav, Z., Mandell, D., Pyne, J., Beidas, R., Curran, G. and Marcus, S., (2020) A pragmatic method for costing implementation strategies using time-driven activity-based costing. Implementation Science, 15, pp.1-15. https://link.springer.com/content/pdf/10.1186/s13012-020-00993-1.pdf

Duran, O. and Afonso, P.S.L.P., (2020) An activity-based costing decision model for life cycle economic assessment in spare parts logistic management. International Journal of Production Economics, 222, p.107499. https://www.sciencedirect.com/science/article/pii/S0925527319303196

Keel, G., Savage, C., Rafiq, M. and Mazzocato, P., (2017) Time-driven activity-based costing in health care: a systematic review of the literature. Financial reporting assignmentHealth Policy, 121(7), pp.755-763. https://www.sciencedirect.com/science/article/pii/S0168851017301240

Nota, G., Matonti, G., Bisogno, M. and Nastasia, S., (2020) The contribution of cyber-physical production systems to activity-based costing in manufacturing. An interventionist research approach. International Journal of Engineering Business Management, 12, p.1847979020962301. https://journals.sagepub.com/doi/abs/10.1177/1847979020962301

Wiese, M., Kwauka, A., Thiede, S. and Herrmann, C., (2021) Economic assessment for additive manufacturing of automotive end-use parts through digital light processing (DLP). CIRP Journal of Manufacturing Science and Technology, 35, pp.268-280. https://www.sciencedirect.com/science/article/pii/S1755581721001127

Wortmann, N., Frölich, A.M., Kyselyova, A.A., Guerreiro, H.I.D.S., Fiehler, J. and Krause, D., (2020) September. Aortic Model in a Neurointerventional Training Model–Modular Design and Additive Manufacturing. In International Conference on Additive Manufacturing in Products and Applications (pp. 437-454). Springer, Cham. https://link.springer.com/chapter/10.1007/978-3-030-54334-1_31