Finance Assignment Analyzing Financial Performance Of Kotak Mahindra Bank

Question

Task:

Using annual reports of ten years, other background information on the website of the selected company, Company database, fieldwork, as well as financial data of comparable companies, your task is to prepare a comprehensive report on finance assignment encompassing the following:

- Company’s business and financial strategy

- Reviewing Financial Statements and other published information

- Analysis of the Balance Sheet and Income Statement

- Analysis of Cash Flow Statement

- Analysis of Statement of Shareholders’ Equity

- Analysis of profitability

- Creating Accounting Value and Economic value

- Analysis of Growth and Sustainable Earnings

- Analysis of the Quality of Financial Statements

- Accounting Based Forecasting and Valuation

- Financial Reporting Issues in Valuation

- Any others that you feel to be included

Answer

Executive Summary

The current finance assignment aimed to discuss the financial performance of Kotak Mahindra Bank.

To conduct the study, relevant data were selected from the bank's annual report for the period 2010-2019. The report initiates with the introduction followed by the financial performance of the company. It discusses the financial strategy of the company with the last 10years financial highlight. The other part of the report reviews the financial statements in detail whereby it is noted that the company is trading at its highest levels in recent time and the chart shows the upward trend. Apart from the financial statement analysis, the report introspects regarding the growth and earnings followed by evaluating the financial statement. Lastly, the events happening after the balance sheet date deserve a special mention so that the shareholders can get a complete picture of the company.

Introduction

The financial performance can be measured by monitoring the way it uses its assets to earn revenues during a period. It measures an organization's overall health that can be utilized in conducting comparative analysis so that the strengths and weaknesses can be easily ascertained. This can be done by establishing a connection betwixt the items contained in the profit and loss account and balance sheet of the organization (Atril 2014). Overall, the long-term and short-term growth of an organization can be easily ascertained with financial performance analysis. There are various methods like ratio analysis, which can be utilized for ascertaining an organization’s market position and the overall creditworthiness of customers. The report aims to analyze Kotak Mahindra Bank's financial performance, a pioneer in the Indian banking sector. The report will revolve around the bank's financial strategy, followed by the analysis of the company's financial statement. Further, it introspects about the accounting value and economic value, sustainable earnings, and accounting-based forecast.

1. Company business and financial strategy

Kotak Mahindra Bank is a private sector bank of India headquartered in Mumbai, Maharashtra. Kotak Mahindra Finance Ltd is the flagship company permitted to operate in the banking sector by the RBI (Reserve Bank of India). These banking activities include a wide variety of financial services and other banking operations through specialized subsidiaries and delivery mediums like Life Insurance, General Insurance (Kotak Annual report 2019). The bank has approximately 1369 branches that are scattered across more than 650 locations, and with more than 2100 ATMs, it has ample diversification. As of 2018, the bank has been regarded as the second-largest bank based on market capitalization. Another flagship of the Kotak Group known as Kotak Mahindra Finance Capital Management Limited initiated its operations as a non-banking financial company by offering financial services for automobile procurement. However, in 2003, it successfully became the first NBFC to be transformed into a bank.

Currently, Kotak has become one of the fastest developing banks that are able to address the requirements of both corporates and individual customers. It offers commercial banking services, consumer banking services, and investment banking services through its fifteen subsidiaries scattered across India and other joint ventures. Further, the bank also has more than 600 operating branches that allow it to diversify its operations across the world. In the present scenario, the bank is promoted by Mr. Uday Kotak, who holds around 36.69% of the bank’s capital interest and is listed on the BSE, LSE, and NSE (Kotak Annual report 2019).

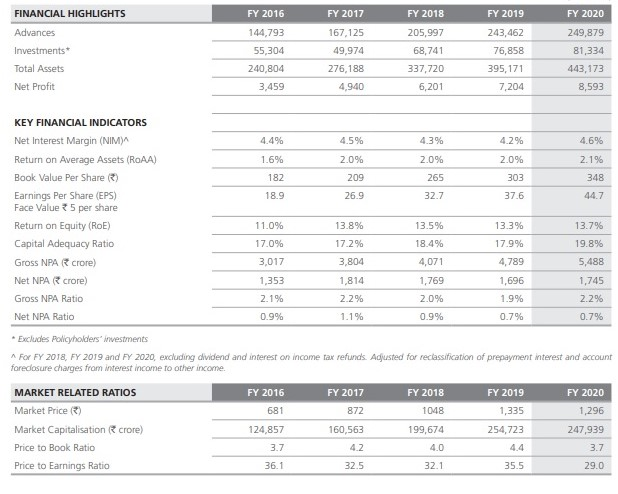

2. Financial Highlights

As of 31st March 2020, the Sensex closed at 29,468 compared to 38,673 on 31st March 2019 with a low of 25,638 and a high of 42,273. In contrast to this, the Nifty closed at 8598 as of 31st March 2020 compared to 11,623 on 31st March 2019 with a low of 7,511 and a high of 12,430. The bank plays a key role in offering a diversified range of services to its consumers, including stockbroking, asset management services, advisory services (Kotak Annual report 2019).

The bank’s subsidiaries and associates' financial outcomes for preparing its consolidated results are based on GAAP (Generally Accepted Accounting Principles) provided under section 133 and other relevant provisions of the Companies Act 2013. Further, these results are also prepared as per IAS (Indian Accounting Standards) based on Companies (Indian Accounting Standards) Rules, 2015 (as amended from time to time).

Strategy

Considering the near limited term and sharp market risk-reward, a breather is required. However, a sharp ~20% rectification's feasibility is low after accounting for the favorable decline in liquidity. Allocation to international markets through MF can be taken into consideration to complement Indian equities. The reason being these provide opportunities to invest in few international players. Nonetheless, it is difficult to anticipate prospective returns. Still, it can be believed that investors must scatter their resources in structural plans that are long-term in nature are not reflected in the Indian local markets. The most preferred allocation shall stand at fifteen percent (15%) of the equity portfolio in relation to international MF (Kotak Annual report 2019). However, this is best suited for Aggressive, Moderate, and Growth risk profiles only.

3. Analysis of the Balance Sheet and Income Statement

The Kotak Mahindra Company is a growing company, which is reflected over the years in the financial statements. The capital, assets, and liabilities are increasing over the years. The company is in the banking industry, so the largest asset is the company's advances, and the company's largest liability is the deposits taken. The company also has lots of assets in the form of investments, which is also the company's revenue source. A similar goes in the liabilities that the liability is in the borrowings' form, policyholders fund. The company also has the goodwill from consolidation since 2019 in its balance sheet. The company's profitability is also increasing over the years, and the rate of growth is also significant. The profitability increased from Rs.18,659,786 thousand in 2015 to Rs.86,070,849 thousand in 2020. Thus the company is trading at its highest levels in recent time, and the chart shows the upward trend. The downfall due to the Covid 19 pandemic can be seen from March to October 2020. After lifting of the lockdown and regularisation of the situations, the company has improved its results, and thus the shareholder's confidence in the company can be seen.

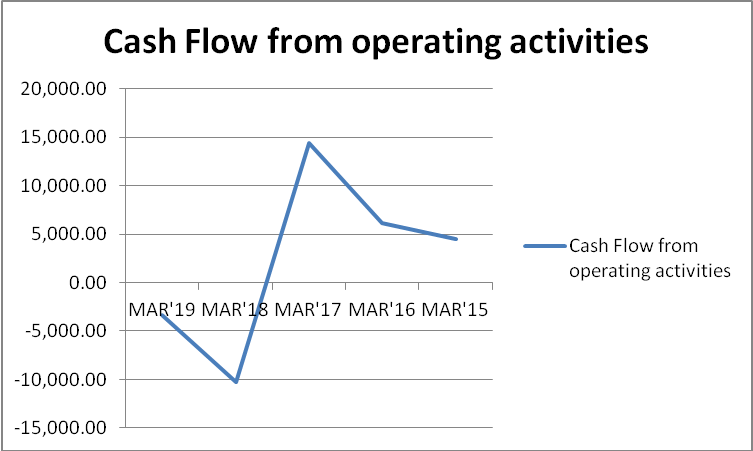

4. Cash flow statement analysis

The company's cash flow statement indicates that the company has used cash from operating activities, which indicates the movement of the business funds. The cash used from operating activities stands at -3,387.72 crore in 2019 as compared to -10,274.92 in 2018. The cash flow from operating activities in intact signifies that the business has ensured movement of funds (Kotak Annual report 2019). The cash flow from investing activities stands positive, meaning that the business has gained 798.11 crores from the utilization of the investing activities. Kotak Mahindra used the resources in the past years, and however, in 2019, the amount is positive, signifying the business had an influx of such amount. On the other hand, the cash flow from financing activities denotes positive movement implying the business gained financing activities. The trend is positive, and the business had a positive figure of 7,633.07 crores in 2019.

5. Analysis of Statement of Shareholder’s Equity

The company's equity investment is also showing an increasing trend as the issued, subscribed, and paid-up capital of the company is increasing over the years. The equity involves the shareholder's share in the company, consisting of both the equity and the reserves and surplus. The reserves and surplus are also part of the equity shareholders as it is the company's undistributed profit, which is payable to the real owners of the company, that is, the equity shareholders. The company is having various forms of reserves like statutory reserves, capital reserves, general reserves, security premium reserves, reserve under RBI, capital reserve on consolidation, foreign currency transaction reserve, investment reserve, reserve under income tax act, investment fluctuation reserve, capital redemption reserve, amalgamation reserve, investment allowance reserve and debenture redemption reserve. Thus a large part of the profit is appropriated in the form of the reserves, and the balance is available for distribution as dividends to the shareholders. The company constantly maintains this reserve to meet the opportunities and difficulties of the future.

6. Analysis of Profitability

The company has grown profits over the year with a compound annual growth rate of around 26% in the company's net profits. The net interest income of the company is having a compound annual growth rate of around 17%. The capital and reserves of the company are having a growth rate of 19%. The average return on the company's assets was lower than 2% before FY 2017, but since then, the rate has been maintained, and then in 2020, the return has increased to 2.1%. The income of the company includes interest earned and other incomes. The interest earned has two main components that are interest earned on advances and income from investments. The income from balance kept with RBI and funds also plays a major role in its revenue collection (Kotak Annual report 2019). Thus over the years, the main source of the revenue is the interest from the advances that is the operating income is higher which ensures the long term profitability and sustainability of the company, as the company which depends on the other sources which are not regular may face difficulties in the future years

|

Ratio (in %) |

FY 2020 |

FY 2019 |

FY 2018 |

FY 2017 |

FY 2016 |

|

Return on Equity |

12.89 |

12.46 |

12.28 |

12.83 |

10.36 |

|

Return on Assets |

1.93 |

1.82 |

1.83 |

1.78 |

1.43 |

|

Cost to Income |

51.34 |

51.48 |

52.04 |

51.72 |

48.08 |

|

Interest income to earnings assets |

7.55 |

7.57 |

7.44 |

8.08 |

8.47 |

|

Interest expense to earnings assets |

3.58 |

3.84 |

3.69 |

4.14 |

4.61 |

|

Price to earnings |

28.90 |

35.46 |

32.26 |

32.57 |

36.23 |

|

Price to Book |

3.72 |

4.41 |

3.96 |

4.17 |

3.74 |

|

Price to Sales |

7.41 |

8.52 |

7.95 |

7.19 |

6.12 |

|

Operating Profit margin |

-24.74 |

-29.81 |

-29.98 |

-30.05 |

-20.58 |

7. Creating Accounting Value and Economic value

Accounting valuation of the company is the valuation of the company's assets and liabilities done following the Generally Accepted Accounting Standards and used for financial reporting.

The asset's accounting value is the price paid by the company for acquiring the same, and it is usually referred to as historical cost. The price of the firm and valuation of assets is subjective, which confirms with the valuation standards. Thus, in the estimation of accounting value, there are three major elements: assets, liabilities, and capital (Pucheta-Martiinez & Garcia-Meca 2019). Hence it is necessary to take a closer look at each of these elements.

Upon reviewing and analyzing the financial statements, the assets and capital have increased straight over the last ten years, and the book value per share is also increasing at a steady rate. Thus, the company has been able to create a good accounting value for its shareholders.

Economic value added is the measure of the company's financial performance based on the residual wealth that is calculated by the deduction of the cost of capital from the operating profit after the adjustment of taxes on a cash basis (Shuli 2011). It measures the company's profitability and is the indicator of the success rate of the company’s projects and is a reflection of the company's management performance. The balance sheet figures are taken into calculation, and this also encourages the managers to think about the assets and the impact of expenses on their business decisions. It is a formula-based approach and serves as an indicator of profitability (Peirson et al 2019). The efficient utilization of the company's assets for the production of profits is measured in this approach. The value addition is measured in terms of the product price that the customers are willing to pay (Sherman 2015).

The company's financial statements revealed that the company has been able to generate significantly high economic value over the last ten years. Due to the company's steady management structure and the strategic decisions taken by the company in tapping the market opportunities at the right time (ET Times 2020).

8. Analysis of Growth and Sustainable Earnings

The company growth is measures in terms of revenue and profits. The total income growth over the past five years has been tabulated below:

|

Year |

Growth % |

|

FY 2016 |

30.56% |

|

FY 2017 |

21.23% |

|

FY 2018 |

14.21% |

|

FY 2019 |

18.46% |

|

FY 2020 |

9.54% |

The growth rate has been more than 10% for most of the years which is considerably good and this displays the good governance and financial structure of the company (ET Times 2020).

The Profit after tax has also increased considerably well over the past five years and the results are thus tabulated below:

|

Year |

Growth % |

|

FY 2016 |

11.94% |

|

FY 2017 |

44.27% |

|

FY 2018 |

24.19% |

|

FY 2019 |

15.82% |

|

FY 2020 |

20.89% |

Though the business goes through ups and downs, the company has been able to sustain in the market and generate a good growth percentage that is appreciable given the level of competition in the banking and financial sector.

The overall company growth has been good in terms of the return on assets, capital and profitability. The company has also grown in terms of the increase in the number of branches which has also resulted in increased employment opportunities for the nation. Thus, it has been a partner in creation and building of national wealth.

9. Analysis of the Quality of Financial Statements

The analysis of financial statements is done from the viewpoint of profitability, stability, and liquidity. There are various parameters for the measurement and analysis of the financial statements. The analysis of the financial statements has been done in terms of comparing the key ratios and the results of its selected peers.

The company's debt-equity ratio is 5.36%, which is good compared to its peers and is in the range. The company's liquidity position can thus be considered good, and the company is not having any cash flow difficulties (Palani 2019). The current ratio of the company is 1.01%, and the peer range is 0.33 to 4.29. A current ratio that is greater than 1 indicates the financial health of the company. It is also proof that the company's current assets are sufficient to repay its current liabilities and the company is financially well settled (Palani 2019).

The return on assets is 1.70%, which indicates that the company has been able to efficiently utilize its assets to generate profits. It is steady and is poised to grow in the coming years (Kotak Annual report 2019).

A summary of the various ratios over the last five years has been tabulated below:

|

Ratio (in %) |

FY 2020 |

FY 2019 |

FY 2018 |

FY 2017 |

FY 2016 |

|

Return on Equity |

12.89 |

12.46 |

12.28 |

12.83 |

10.36 |

|

Return on Assets |

1.93 |

1.82 |

1.83 |

1.78 |

1.43 |

|

Cost to Income |

51.34 |

51.48 |

52.04 |

51.72 |

48.08 |

|

Interest income to earnings assets |

7.55 |

7.57 |

7.44 |

8.08 |

8.47 |

|

Interest expense to earnings assets |

3.58 |

3.84 |

3.69 |

4.14 |

4.61 |

|

Price to earnings |

28.90 |

35.46 |

32.26 |

32.57 |

36.23 |

|

Price to Book |

3.72 |

4.41 |

3.96 |

4.17 |

3.74 |

|

Price to Sales |

7.41 |

8.52 |

7.95 |

7.19 |

6.12 |

|

Operating Profit margin |

-24.74 |

-29.81 |

-29.98 |

-30.05 |

-20.58 |

The above table reflects the company's steady growth across various parameters and the placement of the company among its peers. Kotak Mahindra Bank has maintained its position among the top 10 banks in the country due to its good performance and stability during challenging periods.

In times when the mergers of banks have become a common restructuring feature, Kotak Mahindra Bank has been able to independently stand alone and manage its debts and liabilities independently without taking much assistance from external parties or the regulatory authorities.

10. Accounting Based Forecasting and Valuation

The forecasting can be done either based on the results delivered by the company or based on the company's stock market performance.

The accounting-based valuation refers to the company's valuation based on the net realizable value of the company's assets, and it is a management decision-making process (Sherman 2015). Forecasting is one such technique used to estimate the future revenue and profitability trends of the company. There are various factors to be considered for the forecasting and analysis, and it also considers the global economic conditions and factors. This forecasting is a part of the decision-making process (Beaver, Correia and McNichols 2012).

Forecasting also takes into account time series analysis and financial projections and models. The revenue expectations that the company is willing to achieve over some time are quantified and translated into strategies for implementation by the company. The company goals are formulated to implement strategies to be implemented by the various departments and achieve the desired targets.

The banking sector is now witnessing newer opportunities in the form of personalized and customization of services. This wide array of functionalities has led to increased revenues and also increased the complexities of doing business. But Kotak Mahindra Bank has been able to set the right budgets and targets in specific sectors, due to which it has been able to keep pace with the changing customer requirements and serve their interests for mutual benefit (Kotak 2019).

Privatization of the banking sector has come a long way with the regulations, and also the autonomy allowed the banks to function and dictate their terms. This accounting-based forecasting involves estimating and planning numbers to be achieved across the various segments, branches, and sectors.

Valuation of the business is done to know the company's financial standing and position in comparison to its peers. It takes into account the market share and various other factors. It involves analyzing the competitive advantages that the company possesses and whether it can sustain and survive in the ever-changing and competitive market environment (Madura & Fox 2011).

From Kotak Mahindra Bank's analysis carried out by various private and independent valuation firms, the future looks promising, and currently, there are no alarming factors. The stock performance is also good, and hence it can generate long-term shareholder value and returns (Fiolleau & Kalpan 2016).

Thus, the valuation score and credit rating allotted to the company is favorable for further investments.

11. Financial Reporting Issues in Valuation

Financial reporting is the reporting of business transactions that have taken place during a specific time frame (Ferris et al 2010). The accounting year is decided for the company, and the annual reports are prepared to communicate the business performance to the stakeholders.

Corporate houses usually follow the accrual basis for accounting and financial reporting. Thus, the valuation is done on the historical cost concept or other permitted methods under the accounting standards. Valuation of the business is done in accordance with the various principles and the estimation of the fair value of the assets and liabilities as on a given date. As the fair value of all the assets and liabilities cannot be estimated with a reasonable level of certainty, there is a lot of judgment and estimation involved, usually at the discretion of the management (Carlon 2019). In many cases, the valuation is done based on similar assets or liabilities and the comparison of the market values of the same (Kotak 2019).

The management discussion and analysis list down all these assumptions based upon which the financial statements have been prepared and the valuation exercise is carried out. As every company wants to present a rosy picture of the company to its stakeholders, the reports are usually drafted so that the company's weaknesses are not brought into the picture. In case of serious or recurring losses, the management makes a note of these in the annual report.

Conclusion

The impact of the company's economic or global crisis cannot be estimated in financial terms, and hence the financial statements stand overstated to this extent. Events occurring after the balance sheet date deserves a special mention, which is another area the stakeholders can get some critical information if presented accurately by the company. The valuation of equity transactions and the estimation and payment of fair market prices in mergers and acquisitions are another grey area. The back door registrations, off market transactions, and the reporting of smaller subsidiaries are areas where stakeholders cannot verify the details in full. The strength of internal controls and efficient functioning of internal controls is also a subjective matter and cannot be analyzed until some fraud or mishappening takes place. Thus, there are many issues in the financial reporting of business, and ultimately, these are also linked with the valuation of the business in some way or the other. Kotak Mahindra bank is undoubtedly one of the major strong picks based upon the asset quality and the type of value contribution from the subsidiaries. Hence, from the discussion and the analysis, the bank must have strong potential to build a scalable model that will ensure strong momentum.

References

Atril, P. (2014). Financial Ratios. In: Financial Management for Decision Makers, (7th Edition). Pearson Education Limited, p. 70.

Beaver, W.H., Correia, M., McNichols, M.F. (2012). Do differences in financial reporting attributes impair the predictive ability of financial ratios for bankruptcy? Review of Accounting Studies, 17(4)

Carlon, S., 2019. Financial accounting: reporting, analysis and decision making. 6th ed. Milton, QLD John Wiley and Sons Australia, Ltd, https://eprints.qut.edu.au/125138/

ET Times. (2020). Stock Ideas: Edelweiss has a buy rating on Kotak Mahindra Bank, target price Rs 1,847, viewed 2 January 2021 https://economictimes.indiatimes.com/markets/stocks/recos/stock-ideas-edelweiss-has-a-buy-rating-on-kotak-mahindra-bank-target-price-rs-1847/articleshow/75730788.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Ferris, S.P., Noronha, G. & Unlu, E. (2010). The more, merrier: an international analysis of the frequency of dividend payment. Journal of Business Finance and Accounting, 37(1), 148–70

Fiolleau, K., & Kaplan, S. E. (2016). Recognizing ethical issues: An examination of practicing industry accountants and accounting students. Journal of Business Ethics, 1-18. DOI:10.1007/s10551-016-3154-2

Kotak Annual report. (2019). Kotak 2019 Annual report & account, viewed 2 January 2021 https://www.kotak.com/content/dam/Kotak/investor-relation/Financial-Result/Annual-Reports/FY-2020/kotak-mahindra-bank/Kotak_Mahindra_Bank_Limited_FY20.pdf

Kotak. (2019). Kotak Equity Market, viewed 2 January 2021 https://www.kotak.com/Equity_Debt_Strategy/

Madura, R., & Fox, J 2011, International financial management, South Western

Peirson, G, Brown, R., Easton, S, Howard, P. & Pinder, S. (2015). Finance, 12th ed. North Ryde: McGraw-Hill Australia.

Pucheta-Martiinez, M. & Garcia-Meca, E. (2019). Monitoring, corporate performance and institutional directors. Australian Accounting Review, 29(1), 208-219. doi:10.1111/auar.12262

Sherman, E. (2015). A manager's guide to financial analysis : Powerful tools for analyzing the numbers and making the best decisions for your business (6th ed) Ama Self-Study

Shuli, I. (2011). Earnings management and the quality of the financial reporting. Perspective of Innovation in Economics and Buisness (PIEB), 8 (2), 45- 48. doi: 10.15208/pieb.2011.28

Appendix

Ratios

|

Ratio (in %) |

FY 2020 |

FY 2019 |

FY 2018 |

FY 2017 |

FY 2016 |

|

Return on Equity |

12.89 |

12.46 |

12.28 |

12.83 |

10.36 |

|

Return on Assets |

1.93 |

1.82 |

1.83 |

1.78 |

1.43 |

|

Cost to Income |

51.34 |

51.48 |

52.04 |

51.72 |

48.08 |

|

Interest income to earnings assets |

7.55 |

7.57 |

7.44 |

8.08 |

8.47 |

|

Interest expense to earnings assets |

3.58 |

3.84 |

3.69 |

4.14 |

4.61 |

|

Price to earnings |

28.90 |

35.46 |

32.26 |

32.57 |

36.23 |

|

Price to Book |

3.72 |

4.41 |

3.96 |

4.17 |

3.74 |

|

Price to Sales |

7.41 |

8.52 |

7.95 |

7.19 |

6.12 |

|

Operating Profit margin |

-24.74 |

-29.81 |

-29.98 |

-30.05 |

-20.58 |