Financial Accounting Assignment: Annual Report Analysis Of Smartgroup Corporation Ltd

Question

Task: Select a company and consider the latest annual report for the company. Now, prepare a financial accounting assignment report undertaking the following tasks:

Apply relevant knowledge that you have learned from this course, examine the annual report of your subject company and other relevant information that you have obtained via your research and undertake the following tasks:

1- From the annual report of your allocated company and in respect to the general-purpose financial statements, describe the scope and objectives of the conceptual framework for financial accounting, including qualitative characteristics.

2- Identify and discuss if your allocated company is a reporting entity or not, provide specific and detailed examples / factors from your allocated company to support your argument and indicate the implications of being deemed to be a reporting entity.

3- Describe, discuss and comments on the recognition and measurement policies of your allocated company in relation to revenue and expenses.

4- Describe, explain and comments on impairment assessment policy of your allocated company.

Answer

INTRODUCTION

This particular report on financial accounting assignment is drawn on the Sydney-based Australian organisation, Smartgroup Corporation Ltd which is dedicated to workforce optimisation and employee benefits. For the report, the latest financial statement of the administrative services organisation will be exploited. It is to evaluate the standard-setting procedures, alongside the theoretical models of accounting like that of corporate governance and regulations. The report will also come forth with recognition and measurement policies for Smartgroup in the context of its revenues and expenses. Lastly, the report will draw an explanation of the impairment assessment policy of the aforesaid company.

1. Scopes and Objectives of the Conceptual Framework for Financial Accounting

The General Purpose Financial Statement (GPFS) serve as the effective conceptual framework for financial accounting. GPFS comprises the fundamental financial statements that the Board of Smartgroup Corporation can use to contemplate effective financial decisions. It takes into purview the relevance of different financial statements like the income statement, balance sheet, statement of owner’s equity, and cash flow statement (Cascino, et al., 2021, p.84). The mentioned financial statements are used to showcase the financial performance of the company. It helps the stakeholders like the Board as well as the investors get to know the financial prowess of Smartgroup.

The purpose of GPFS is to deliver adequate information regarding the operations, financial efficiency, and cash flow proficiency of the company. Accordingly, the stakeholders, say the Board of Directors go through the income statement of the organisation and understand its capability to generate suitable profitability in the upcoming future (Maynard, 2017, p.52). So the income statement provides a trove of information to the shareholders like the company revenues and its corresponding expenses, alongside the sales volume, business trends, and profitability.

Similarly, the balance sheet of the organisation informs the Board as well as the investors of the current financial position of the business. Hence it is necessary to develop an idea of the organisational liquidity, debt holdings, and capital structure. Likewise, there is the statement of cash flows that provides important information on the various movements of cash resources like cash receipts and cash expenditures (Warren & Jones, 2018, p.101). The information derived from the cash flow statement is extremely important as it shows distinctive information on cash resources that are fairly different from the income statement. Again, referring to the statement of the owner’s equity, the stakeholders can learn about the movement in capital from the beginning to the end of the period.

Qualitative characteristics of the Conceptual Framework for Financial Accounting

The GPFS supports a conceptual accounting framework that provides a piece of comprehensive financial information on various financial matters (Vishny & Zingales, 2017, p.1810). It enables the stakeholders to contemplate effective business decisions on the following aspects, such as –

- Credit decisions – The lenders use the financial statements to evaluate the credibility of the company, say whether Smartgroup can pay off the loan efficiently. Through the different financial statements, the lender can develop an idea of whether the business is in an effective position to repay the loan and pay the loan interest timely.

- Investment decisions – The financial statements are well researched by the existing and potential investors before contemplating the investment decisions (Kliestik, et al., 2020, p.74). The investors must understand what will be the ideal price of the stock and accordingly, plunge into the decision.

- Taxation decisions – The financials are important to understand the profitability aspect of Smartgroup and impose suitable taxation (Sippel, et al., 2017, p.257).

- Bargaining decisions – The sorts of financial statements are effective to place the company in a bargaining position. The support of the financial statements can draw suitable support for Smartgroup to entail favourable support.

- Subsidiary evaluations – The sorts of financial statements can be segregated to find out the distinctive financial prowess of the different business subsidiaries apart from the parent company (Yüksel, et al., 2019, p.431). This sort of evaluation provides transparency in the process to contemplate an effective financial decision for the firm.

Thus the GPFS is used to discern the financial conditioning of the firm to understand the unique positioning of the business in the existing market. Accordingly, the different financial statements present various facets of the business finances necessary to provide attention to different business segments to deliver an effective business decision.

2. Implications of GPFS on Smartgroup Corporation

The GPFS strives to be an effective pillar to establish a suitable conceptual framework of financial accounting in various financial spheres to contemplate suitable business decisions.

Evidence of reporting entity through the Income statement –

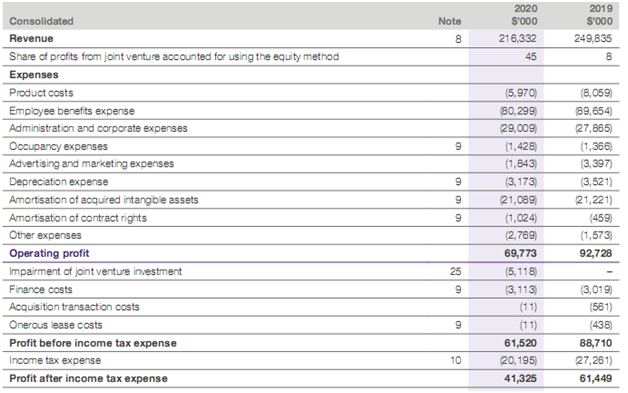

The income statement of Smartgroup pointed out that in 2019, the organisation earned revenue worth $249.83 million while in 2020, the figure reduced marginally to $216.33 million. The obvious reason is the curb of COVID-19 in the business that led to the decline in the figure (Metcalf & Gupta, 2021, p.38). The phenomenon has led to the control of certain costs like the product costs reduced from $8 million in 2019 to $5.97 million in 2020. Similarly, the advertising and marketing expenses have reduced from $3.39 million in 2019 to $1.84 million in 2020, but other expenses have risen tremendously. The phenomenon led to a decrease in operating profit from $92.72 million in the last year to $69.77 million in the current year (Ir.smartgroup.com.au, 2021). Similarly, the pre-tax profit reduced from $88.71 million in 2019 to $61.52 million in 2020. It tends to lower taxability as the tax incurred by Smartgroup reduced from $27.26 million in 2019 to $20.19 million in 2020.

Evidence of reporting entity through the Balance sheet –

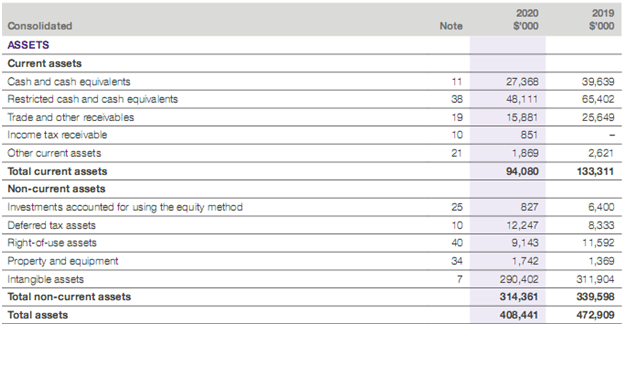

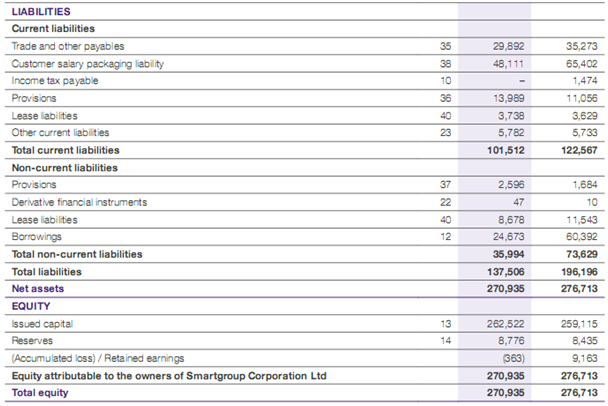

The balance sheet of Smartgroup presents a glimpse of the firm’s financial position. The current asset balance shows that the cash resources have decreased substantially from $39.63 million in 2019 to $27.36 million in 2020. So does other items like trade receivables, restricted cash balance, and other current assets have suffered a reduction in value (Ir.smartgroup.com.au, 2021). The striking aspect of the non-current asset section is the investments that reduced drastically from $6.40 million in 2019 to $827,000 in 2020. The same fate has been for the intangible assets of the company like its goodwill reduced from $311.90 million in 2019 to $290.40 million in 2020. The current liability section also shows certain aspects of reduction to keep tandem with the prevailing scenario (Cascino, et al., 2021, p.97). The presentation of the balance sheet has been apt to present the liquidity aspect of the firm to show its ability to meet the current obligations.

Evidence of reporting entity through the Statement of owner’s equity –

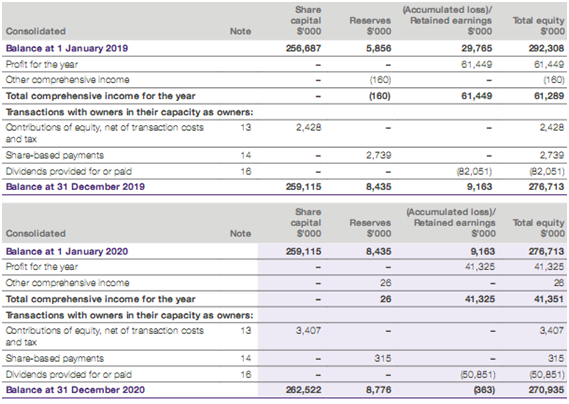

The statement of owner’s equity presented a comprehensive picture of the equity movement of Smartgroup. The figures show the opening and closing equity balance of Smartgroups that are prepared following the International Financial Reporting Standards (IFRS) (Metcalf & Gupta, 2021, p.38). The figures are carried out effectively along with the notes of the consolidated statement to justify each corresponding entry. It also shows the amount of dividend paid say worth $82 million in 2019 that reduced to $50.85 million in 2020 (Ir.smartgroup.com.au, 2021). Therefore from the figures displayed in the statement, the users can estimate the impact of the pandemic on the business operations of Smartgroup.

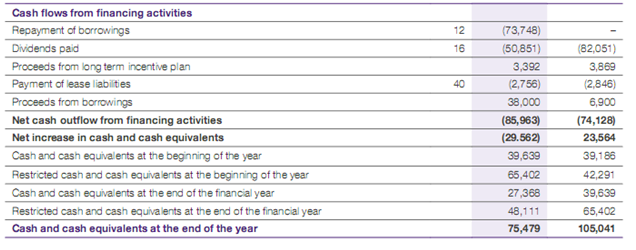

Evidence of reporting entity through the Cash flow statement –

The cash flow statement is an effective piece of GPFS that provides useful information on the movement of cash resources in the business. The statement has been subdivided into three main sections – operating activities, investing activities, and financing activities. Each section highlights specified cash usage of Smartgroup to serve distinctive purposes like payment to suppliers, interests on lease liabilities, and payment of income taxes in the business operations segment (Kliestik, et al., 2020, p.74). Then the investing activities of the cash flow statement show the payment for business acquisitions, receipt of interests, and dividends, alongside payment for the fixed assets. Lastly, there is the section on financing activities that depicts the dividend amount or loans paid by Smartgroup to the investors and lenders respectively. Thus the distinctive sections of the cash flow statement show how the cash resources have accelerated the business operations effectively.

Status of Smartgroup as a reporting entity

Hence the various financial statements form an integral part of GPFS that Smartgroup prepares and presents to the stakeholders annually. Accordingly, Smartgroup comes under the purview of a reporting entity that enables the stakeholders to have a lucid understanding of the financial position of the firm (Potter, et al., 2019, p.111). It helps to evaluate the finances and allocate the resources effectively for better business decisions in terms of investment, delivering loans, dividend payments, and bonuses to employees.

3. Recognition and measurement of revenue and expenses

Recognising revenue is an important aspect of the corporate activities of a business. Smartgroup strives to recognise its revenue as and when it transfers the particular service or product to the targeted customers (Ir.smartgroup.com.au, 2021). Subsequently, the revenue is determined based on the contract with the customers and may contain elements like trade discounts, refunds, and collection from third parties. Thus the revenue recognition principle is aligned with the accrual accounting policy. In this case, the revenue is recorded as and when the transaction takes place and is not necessary to have the cash receipts to record the revenue. The realisable aspect of revenue is the scenario wherein the customers get the requisite services from the business and the payment is scheduled for a later date (Potter, et al., 2019, p.95). Smartgroup provides the targeted customers with a bouquet of services like outsourced administration, vehicle services, and software services. These kinds of services are generally scheduled for a later payment owing to their intangible nature upholding the accrual accounting concept.

The standard revenue recognition policy is kept uniform over the years to provide a better representation of the revenues earned in the process. Again, this sort of practice is even followed by other companies leads to an effective comparison of the entities. It helps to understand the financial trends of the companies alongside the inconsistencies that come into the light (Bennedsen & Zeume, 2017, p.1260). Smartgroup abides by the AASB 15 Revenue to recognise the sorts of revenues earned and record those for proper business conditioning. Accordingly, the organisation strives to go through the following revenue recognition principles, such as –

- Identifying the contract with the particular customers.

- Identifying the obligations owing to the contractual performances.

- To determine the worth of consideration against the transaction.

- Allocation of the determined worth of the consideration.

- Identifying the revenue while the performing party addresses the performance obligation.

Besides the revenue, the sorts of expenses also play an intrinsic role in determining the financial aspect of the organisation. Entities like Smartgroup to maintain a suitable harmony identify the revenue proposition in line with the business expenditures. The treatment of the expenses goes well with the revenue as it gets recognition with its incurring. Again, there are certain expenses like utilities, salaries, and administrative costs that do not necessarily result in revenue generation. These are the period costs and Smartgroup charges those accordingly in the particular period, it’s been generated (Ademola, et al., 2019, p.40). Thus the entity follows the accrual basis of accounting by recording the expenses as it occurs in the corporate scenario. For instance, payments of suppliers is recorded in the books of account although the payment may be delayed to another period.

Again, the expenses incurred in the particular period may relate to a previous year or the one expended in the upcoming future. For instance, if Smartgroup pays some expenses related to the previous year, it tends to reflect in the current year as it gets deducted from the current financial balance (Sippel, et al., 2017, p.260). This is the cash basis of accounting as Smartgroup records the transaction as it occurs like payment of the suppliers. So the expenditure proposition is a combination of both the accrual and cash basis of accounting and the entity provides proper justification for the corresponding entries. For instance, Smartgroup pays income tax worth $24.25 million in 2020 and is under the cash basis of accounting (Ir.smartgroup.com.au, 2021). This is because the entity is required to pay the expenses as it incurred in the current year. So there are certain aspects of accrual and cash basis of accounting that the business ought to identify in its process and treat accordingly to deliver transparency in its due course.

4. Impairment assessment policy of Smartgroup Corporation

Impairment of assets stands for the valuation of assets whose worth is less than the value depicted in the balance sheet (Yüksel, et al., 2019, p.431). The impairment policy tends the organisation to write off the assets in the balance sheet to the existing market worth. Accordingly, Smartgroup carries out its impairment policy to derive the apt financial figure of different assets in the organisational scope.

Smartgroup considers an impairment policy for its goodwill that is valued at $275.7 million (Ir.smartgroup.com.au, 2021). Impairment of goodwill is an important aspect of any company and so does for Samrtgroup. It takes into consideration the existing value of the goodwill and also considers whether the particular asset requires any sort of impairment. Again, the relevance of COVID-19 strives for a rethinking of the impairment of goodwill in tandem with the Australian Accounting Standards (Metcalf & Gupta, 2021, p.40). For goodwill, impairment is crucial as the asset has an indefinite period of existence and it needs to be carried forth with a relevant value. Further, for non-intangible assets like goodwill, impairment is necessary to justify any such amount that cannot be recovered in the due process of business. Accordingly, the goodwill undergoes the test of impairment annually to present a trustworthy value in the organisational scenario.

Smartgroup considers impairment of assets for the property and equipment which is generally stated as per the historical costs. From such costs, the accumulated depreciation and impairment costs are deducted to provide a suitable picture of such assets. Again, the entity uses impairment for evaluating investments as well to provide an apt picture of the financials (Asic.gov.au, 2019). This is quite relevant while determining the investments for the subsidiaries to shed off the supplements provided by the holding companies.

In 2020, Smartgroup had an impairment for a joint venture for $5.11 million using the equity method (Ir.smartgroup.com.au, 2021). So the investment in joint ventures is subjected to impairment testing to keep up with the changing market dynamism. The phenomenon helps to provide a suitable picture of the suitable values derived for the joint venture investment. Smartgroup also considered the receivables for impairment standing at $248,000 in 2020 against $99,000 in 2019. The organisational practice tends the receivables to be treated at their fair worth considering the effective interest method for amortisation (Ademola, et al., 2019, p.41). Again, the item will undergo the provision of impairment that is generally settled within 14 days. In this case, the impairment of the assets stands as the difference between the carrying amount of the assets and the present worth of the anticipated future cash flows. The latter is discounted at the existing interest rates to deliver the most effective value. Impairment of assets also plays a pivotal role in assessing the credit risk of the company.

CONCLUSION

The report concludes that the conceptual framework of financial accounting serves as a fundamental aspect to showcase the financial prowess of the entities. The relevance of the different financial statements like the income statement, balance sheet, statement of owner’s equity, and the cash flow statement shows how different sorts of information can be derived from those. The annual report of Smartgroup shows that it is a reporting entity and the various financial statement are in line with the relevance of GPFS. It shows that the entity has prepared the financial statements under the presiding regulations of the Australian Accounting Standards. The sorts of information are quite crucial for various stakeholders to derive kinds of financial information in terms of profitability, business trends, and taxation that helps to contemplate effective business decisions. Then Smartgroup follows the accrual basis of accounting to recognise its revenue while the combination of both accrual and cash basis of accounting to recognise and record the business expenses. The company also provides a thorough impairment testing to present the value of the non-financial assets with greater transparency and relevance.

REFERENCES

Ademola, S., Musa, A. & Innocent, I., 2019. Moderating effect of risk perception on financial knowledge, literacy and investment decision. American International Journal of Economics and Finance Research, 1(1), pp. 34-44.

Asic.gov.au, 2019. Impairment of non-financial assets: Materials for directors | ASIC - Australian Securities and Investments Commission. [Online]

Available at: https://asic.gov.au/regulatory-resources/financial-reporting-and-audit/directors-and-financial-reporting/impairment-of-non-financial-assets-materials-for-directors/#matters-considered

[Accessed 19 January 2022].

Bennedsen, M. & Zeume, S., 2017. Corporate tax havens and transparency. The Review of Financial Studies, 31(4), pp. 1221-1264.

Cascino, S. et al., 2021. The usefulness of financial accounting information: Evidence from the field. The Accounting Review, 96(6), pp. 73-102.

Ir.smartgroup.com.au, 2021. Smartgroup Investors. [Online]

Available at: https://ir.smartgroup.com.au/Investors/page=Financial-Reports

[Accessed 19 January 2022].

Kliestik, T. et al., 2020. Remaining financially healthy and competitive: The role of financial predictors. Journal of Competitiveness, 12(1), p. 74.

Maynard, J., 2017. Financial accounting, reporting, and analysis. Financial accounting assignment London: Oxford University Press.

Metcalf, B. & Gupta, P. C., 2021. FINANCIAL FORECASTING AMID COVID-19. Strategic Finance, 102(10), pp. 36-41.

Potter, B., Pinnuck, M., Tanewski, G. & Wright, S., 2019. Keeping it private: financial reporting by large proprietary companies in Australia. Accounting & Finance, 59(1), pp. 87-113.

Sippel, S., Larder, N. & Lawrence, G., 2017. Grounding the financialization of farmland: perspectives on financial actors as new land owners in rural Australia. Agriculture and Human Values, 34(2), pp. 251-265.

Vishny, R. & Zingales, L., 2017. Corporate Finance. Journal of Political Economy, 125(6), pp. 1805-1812.

Warren, C. & Jones, J., 2018. Corporate financial accounting. London: Cengage Learning.

Yüksel, S., Dinçer, H. & Meral, Y., 2019. Financial analysis of international energy trade: a strategic outlook for EU-15. Energies, 12(3), p. 431.

APPENDIX

Income statement of Smartgroup Corporation Ltd.

Balance Sheet of Smartgroup Corporation Ltd.

Statement of Equity of Smartgroup Corporation Ltd.

Cash Flow Statement of Smartgroup Corporation Ltd.