Finance Essay: Financial Analysis of Telstra Corporation

Question

Task: Select a company that is currently listed on the ASX. Write a Financial Analysis Report on finance essay that interprets the company’s most recent annual report. This report will need to be written for a stakeholder (external investor or internal manager).

Answer

Executive Summary

The following finance essay is related to financial analysis that is done for the internal and external stakeholders of the company. It helps them in taking effective decisions whether they want to invest in the company or not. This report not only discusses the financial aspect but also considers the non-financial aspects that affects the position of the company in some way or the other. A leading Australian company that has been selected for this assignment is Telstra Corporation that belongs to the telecommunication sector. It has a wide presence through the country and helps in building telecommunication business.

Analysis

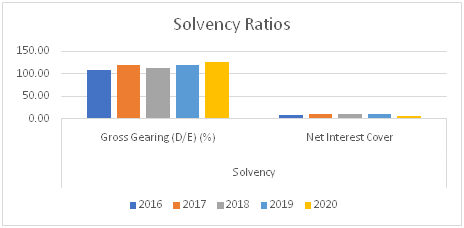

In order to do the financial analysis four different ratios has been calculated considering the financial data of the company that has been collected from the books of the company.

Interpretation

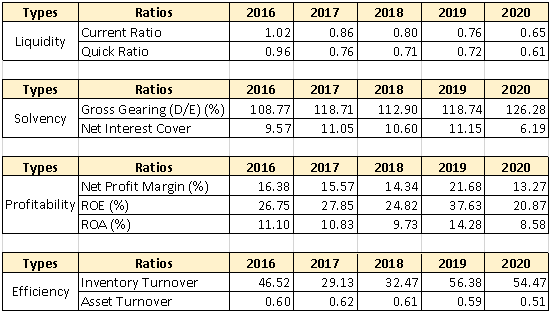

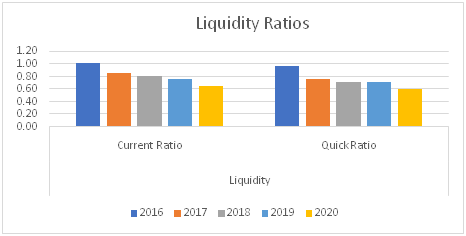

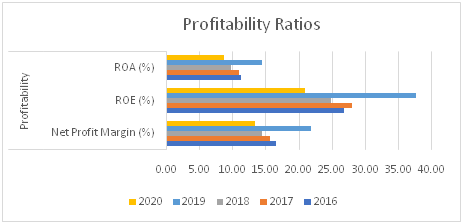

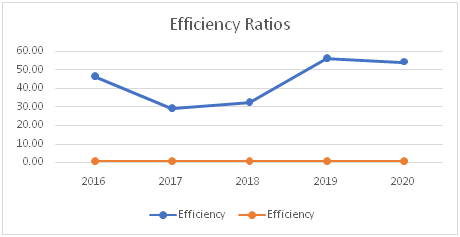

The above ratios have been shown in form of graphs –

Liquidity Ratios – It showcases that the company is liable to pay off its short-term liabilities with the help of assets. In case of Telstra it can be seen that there is a decrease in the overall liquidity ratio of the company, it was 1.02 times in 2016 and 0.65 times in 2020. The company is having liquidity issues as the quick ratio of the company has reduced over the years. It shows that the company does not have enough assets to pay off its liability. It indicates that the current assets have decreased, and current liabilities have increased(Wang, 2019).

Profitability Ratios – Due to the coronavirus we see that there is a decrease in the profits of the company in 2020, as it has impacted the business a lot. We see that the net profit of the company was 13.27% in 2020 in comparison to 21.68% in 2019. The overall return on equity has also reduced from 37.63% in 2019 to meagre 20.87% in 2020(Michaela, 2017). This has also resulted due to the application of AASB 16 related to leases that has caused an increase in the rights of use the assets and liabilities and in turn has led to an increase in the total asset base. The overall return on assets has also reduced from 14.28 times in 2019 to 8.58 times in 2020(Sherwood, 2019).

Solvency Ratios – It represents the overall mix of equity and debt in the capital structure of the company and indicates the overall position of the same with relation to risk assessment. It can be seen that in comparison to equity the overall position of debt has increased over the years and showing that the debt is 1.28 times of the equity currently(Mclaney & Atrill, 2020). It is in line with the trends of the industry however in case the overall debt keeps on increasing and does not stabilises the company will face issues of repayment and there will be issue with regards to the ownership dilution. The overall interest related expenses have increased over the years and there is a decrease in the overall profitability and because of that the interest coverage ratio has decreased drastically to 6.19 times. In 2019 it was 11.15 times.

Efficiency Ratio – It showcases the operational efficiency of the company and in case of the given company we see that there is a very minimum decrease in the overall inventory turnover, it has decreased from 56 times in 2019 to 54 times in 2020, showing that there is a conversion of inventory to sales every 6th day. The overall asset turnover has decreased from 0.59 times in 2019 to 0.51 times in 2020.

The company is competing in a highly growing sector, it faces stiff competition from several companies like Vodafone, Aussie Broadband, TPG Telecom, Virgin Media, Foxtel and Optus. Even though we see that the company is performing well even though the pandemic is there. The company focuses on improving the experience of the customer and also has worked on lowering of the overall cost and that has also affected the profitability of the company in comparison to its customer. With regards to the recent strategies the company is trying to enter the digitalisation era by widely investing its capital into such projects and reducing the overall dependence on infrastructure(Karlsson & Tavassoli, 2015). The company will require to have good skilled labour in order to face the pandemic and invest in its business in the future.

The company faces threats from the local competitions, difficult lawsuits and the current situation of the pandemic. The major strengths of the company will include strong distribution network, strong supplier network. The company have many merger and acquisition option and will also receive great return on investments. The overall remuneration trend of the company has been constant over the years, the CEO has a fixed remuneration $2,390,000 followed by CFO of the company, Vicki Bradywith FR of $1,200,000. The company has very highly skilled labour and also provides many non-wage benefits to its employees(Bosi, et al., 2018).

Conclusion

Based on the overall analysis it can be said that Telstra is a leading telecommunication company based on the overall analysis of its financial and non-financial aspects and has been able to maintain this position during the pandemic also. Even though there is a decrease in the net profit and the overall revenue of the company, the company is expanding consistently and that will contribute to its progress in the future. With the help of its skilled labour the company has expanded and is also investing largely in developing a digital business model. The overall share prices of the company has been stable even in the pandemic and that can be contributed to the many merger and acquisition deals that the company deals in. The company now needs to invest in research and development so that they can grow in new areas and give stiff competition to their competitors. Overall based on the provided ratio analysis and other non-financial aspect it can be said that it is recommended to invest in the company as in the near future the company will only grow.

References

Bosi, F., Esposito, M. & Kiviniemi, A., 2018. Social Paradigms in Contemporary Airport Design. Advances in Informatics and Computing in Civil and Construction Engineering , 56(1), pp. 471-477.

Karlsson, C. & Tavassoli, S., 2015. Innovation strategies of firms: What strategies and why. J Technol Transf, pp. 20-30.

Mclaney, E. & Atrill, P., 2020. Accounting and Finance: An Introduction. 10th ed. Harlow: Pearson.

Michaela, R., 2017. Contemporary Issues in Accounting. second ed. London: Wiley.

Sherwood, R., 2019. Intellectual Property And Economic Development. Newyork: Routledge.

Wang, D., 2019. Association between technological innovation and firm performance in small and medium-sized enterprises: The moderating effect of environmental factors. International Journal of Innovation Science, pp. 20-28.