Finance Assignment: Financial Analysis Of Samsung PLC

Question

Task: Finance Assignment Task:

Pietro Yon, a local businessman, owns and manages a number of retail stores that sell a range of homewares. Pietro is a member of the local business Chamber of Commerce and has been asked to chair a committee to research and study the success of Samsung PLC. The Chamber believes that there may be some useful learning from this study which members of the Chamber could use. You have been asked to provide specialist support to the committee and you are required to produce a range of materials for members of the committee to use.

You have been provided with the following link to view Samsung PLC’s annual reports and investor information. https://www.samsung.com/global/ir/financial-information/audited-financial-statements/

Task 1 – Financial Data and Strategic Decision Making

You must produce a presentation for Pietro Yon to use at the next meeting of the Chamber of Commerce. The presentation should be based on your research of Samsung PLC and other relevant information. It must be accompanied by supporting notes.

Your presentation must include the following:

- An evaluation of the sources of financial data which can be used to inform business strategy.

- An assessment of the need for financial data and information in relation to the formulation of business strategy.

- An analysis of the risks related to financial business decisions.

- A review of methods that can be used for appraising strategic capital expenditure projects and strategic direction.

Task 2 – Discussion Paper

A meeting has been arranged with Pietro Yon and other members of the committee and you have been asked to produce a paper for discussion which provides:

- An interpretation of the financial statements of Samsung PLC to assess the current viability of the organisation.

- A comparative analysis of financial data using ratio analysis for Samsung PLC. You are advised to download consecutive year’s accounts from the Samsung PLC website.

Extension activities:

To gain a merit grade you must add further sections to your discussion paper that:

- Makes recommendations to Samsung PLC based on your analysis and interpretation of the financial position.

Task 3 – Information Leaflet

Extension activities:

To gain a merit grade you must produce an information leaflet for the Chamber of Commerce to distribute to the members. The leaflet should assess the following:

- The impact of ‘creative accounting’ techniques when making strategic decisions.

- The limitations of ratio analysis as a tool for strategic decision making.

- The importance of cash flow management when evaluating proposals for capital expenditure.

- To gain a distinction grade you must prepare an additional section for the leaflet that:

- Recommends, with justifications, methods and tools that allow businesses to analyse financial data for strategic decision making purposes.

Task 4 – Capital Expenditure Appraisal

Pietro Yon has been supplied with information from a component manufacturer who has asked for advice on the best project to accept for the purchase / replacement of a piece of machinery.

The company are considering selling their old machine that has a capital cost of £260 000 and replacing it with an up to date model costing £220 000. For immediate purchase the company will receive £120 000-part exchange allowance.

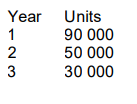

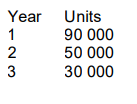

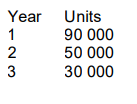

Both the current and new machines are able to meet the expected company demand, estimated at:

After three years, it is predicted that demand will be zero due to the technological developments in the industry.

The following data has been provided for the existing and new machine:

Additional information

(1) The selling price for each component is £5.00 and this will remain constant for the next three years.

(2) The company expect the cost of direct materials and direct labour to increase by 5% each year.

(3) The company predicts that repair and maintenance costs for the current machine will be £7000 per annum.

(4) The current machine is expected to have a zero-residual value at the end of year 3.

(5) The company predicts that repair and maintenance costs for the new machine will be £1000 per annum.

(6) The new machine is expected to have a £75 000 residual value at the end of year 3.

The company’s cost of capital is 15%.

Extract from the present value table for £1 at 15%

Pietro would like you to produce a business report that can be given to the company offering advice on the best course of action for the purchase / replacement machine.

REQUIRED

Prepare a report that evaluates the capital expenditure proposals using appropriate financial techniques.

Extension activities:

To gain a distinction grade you must include an assessment of the impact of the business proposal on the strategic direction of the organisation.

Answer

Task 1: Financial Data and Strategic Decision making

1. Evaluation of the source of financial data presented in the finance assignment

1. The balance sheet summarises the assets and liabilities that the company owns.

2. The income statement is used to manage the income and expenses of the company.

3. The cash flow statement is used to manage the cash inflow and outflow.

The balance sheet is used to get the value of assets and liabilities and use it to gauge the company's net worth (Kumhof and Noone, 2018). The company's liquidity can be assessed, which can be used to evaluate whether the company will be able to incur a loan in the long term and the short term. The income statement portrays the amount of revenue being generated by the company, which also assists in assessing the profit of the company (Charitou et al., 2018). The profit made by the company can be used to assess the amount of money the company can generate, and accordingly, the strategy to invest in a project can be made. The cash flow statement is used to evaluate the net cash with the company (Soboleva et al., 2018). The cash flow statement has a summary of the cash inflows and outflows. Therefore, information about the account receivables can be used to assess the number of credit sales the company makes the frequency of cash collected by the company.

2. Need for financial data for formulating business strategy

1. Ratio analysis is being used to assess the company's profitability, solvency, and liquidity.

2. The financial data can be used for capital budgeting.

Financial data is being used to calculate the financial ratio, which is very important for strategies. For instance, the profit margin or gross margin can be used to assess the organisation's profitability that the shareholders can use to gain confidence and invest in the company more often (Zavadskas et al., 2018). In addition, financial data is used for capital budgeting as well. This is very important as capital budgeting is used to calculate an investment's NPV and payback period.

3. Risk related to financial business decisions

1. Credit risk.

2. Operational risk.

3. Liquidity risk.

When a company tries to invest in a project, then the company might borrow money to finance the operations. Therefore, there might be a point where the company might not be able to repay the loan. Credit risk refers to customers who cannot pay for goods and services (Addo, Guegan and Hassani, 2018). Operational risk refers to the hindrances faced during the regular management of a firm. The operational risk can be split into model risk and fraud risk. Finally, the liquidity risk is the potential of the company to pay off the short-term debt. Therefore, the liquidity risk arises if the current debts are higher than the current assets.

4. Methods used for appraising CAPEX projects and strategic direction

1. Payback period.

2. Net present value.

3. Internal rate of return.

The payback period is the time taken by a company to generate sufficient cash flow to recover the initial amount of investment and generate a positive cash flow. The NPV of the company is the sum of the discounted future cash flow related to investment (Zativita and Chumaidiyah, 2019). The IRR is the rate of discounting that makes the discounted cash flow in the future equal to the initial investment of a company.

Task 2: Discussion paper

1. Interpretation of financial statements

The items from the financial statements of Samsung plc interpreted are discussed below:

• Cash: The cash was $22775 million that has increased to $24890 million (Images.samsung.com, 2021). The increase in cash by 9% implies that the firm has been able to generate high cash during the year (Images.samsung.com, 2021). Furthermore, the increase in cash implies that the firm's ability to invest in business operations has increased. Thereby, Samsung can invest in any kind of business strategy where the cash can be used.

• Total assets: The company's total assets were valued at $298667 million, which has increased by 7% (Images.samsung.com, 2021). The increase in assets implies that the company has invested in newer assets to generate higher cash flow in the future.

• Total liabilities: The company's total liabilities were $75974 million, which increased to $86650 million (Images.samsung.com, 2021). The increase in total liabilities by 14% implies that the company has increased the debt to finance its operations. Although it must have affected the company's solvency, the equity has increased as well and is way higher than the liability.

• Revenue: The company's revenue in FY2019 was $195179 million, which increased by 3% in FY2020, implying that the company's demand has increased (Images.samsung.com, 2021). The increase in revenue helps the company to increase the profit as well. In addition, the increase in profitability implies that the shareholders have enough confidence to invest in the company.

• Profit: The company's profit was $18415 million, which increased to $22370 million in FY2020 (Images.samsung.com, 2021). The rise in profit with the surge in revenue implies that the company's profit margin has increased; therefore, the company's profitability has improved. In addition, the increase in profitability encourages the shareholders to invest more in the company.

2. Ratio analysis

Gross profit margin: The gross profit margin of Samsung plc in FY2019 was 36% that increased to 29% in FY2020 (Images.samsung.com, 2021). The increase in gross profit margin implies that the company has been able to control the cost of goods sold. Therefore, it can be stated that the firm has been able to lower the manufacturing cost.

Current ratio: The ratio between the current assets and current liabilities is known as the current ratio. The current ratio in FY2019 was 2.84 that got reduced to 2.62 in FY2020 (Images.samsung.com, 2021). The reduction in the current ratio was 8%, which implies that Samsung plc's liquidity has declined. The reduction in the current ratio will make Samsung plc think about incurring high short-term debt in the future. However, it is fair to say that the firm has a high current ratio; therefore, the company might as well incur short-term debt.

Asset turnover: The asset turnover of Samsung Plc in FY2019 was 0.65 that fell to 0.63 in FY2020 (Images.samsung.com, 2021). The reduction in asset turnover was primarily due to the increase in total assets by a rate that is more than the revenue growth rate. The decline in asset turnover implies that the company's efficiency in generating revenue using the assets has declined. Therefore, in the future, it is advised that the company should try to reduce the investment in assets and instead focus on generating higher demand to generate higher revenue.

Debt-to-equity ratio: The D/E ratio of the company was 0.34 in FY2019 that has increased to 0.37 in FY2020 (Images.samsung.com, 2021). The increase in the debt-to-equity ratio is mainly due to the increase in total debt. Therefore, the increase in the debt-to-equity ratio implies that the company's solvency position has declined. However, the debt-to-equity ratio is way lower than 1. Hence, it is fair enough to state that the firm has ample breadth to incur long-term loans in the future.

Extension activities:

Recommendations to Samsung plc

The recommendations are discussed below:

• The company should try to find or negotiate with its suppliers to reduce the cost of raw materials. This will increase the company's gross profit margin higher than it is now. Therefore, the company's primary objective will be to control the cost of goods sold even more so that the gross profit of the company can increase even further (Zativita and Chumaidiyah, 2019).

• The company can control the short-term debts; however, its current ratio is high enough to encourage it to incur higher short-term debts in the future. This will help the company utilise the short-term assets and finance the operation to expand the business.

• The company can incur long-term debt as well. This will increase the debt-to-equity ratio. However, the ratio is very low, and thus the company will be able to finance its operations without hampering the company's liquidity. This will help the organisation expand its operations and thus promote the generation of higher revenue which will further increase the asset turnover of Samsung plc.

Task 3: Information leaflet

1. Impact of creative accounting techniques

The organisations must adopt creative accounting that uses technology to help the company increase the organisation's productivity and help the firm maintain its uniqueness. This will help the company to save time, money, and cost. Therefore, while making any kind of strategic decision, the company will be using technology that will increase accuracy by eliminating prominent errors in traditional accounting (Soboleva et al., 2018). Since creative accounting is a kind of exploitation of the loopholes in the financial regulations to gain advantage or is misleadingly favourable. This kind of accounting is not illegal; therefore, accountants or financial analysts can manipulate data to make the company's financial position suitable to the general public. In the case of any strategic decision, it must be kept in mind that the company might have to lure the shareholders into investing in the strategy. Therefore, to lure the shareholders, it must be kept in mind that the company is required to show a healthy financial statement and attract the company's shareholders. Therefore, using creative accounting will be favourable to making a strategic decision.

2. Limitations of ratio analysis

The limitations of ratio analysis have been discussed below:

• The information used in the ratio analysis is based on the results of the company from the past. This implies that the ratio analysis is an activity that is based on historical figures. Hence, it does not necessarily project the future performance of the company. Therefore, the ratio analysis cannot guarantee the success of the strategic decision.

• Inflation is a macroeconomic concept that might impact a company's financial statement. However, if inflation has occurred in between periods, then the prices reflected in the financial statement are not accurate (Coibion et al., 2020). Therefore, when a strategic decision is required to be taken based on the ratio analysis, the financial achievement that the decision might project gets affected due to inflation. Hence, the ultimate goal in the end of the strategy is not accurate.

• Season effects: Ratio analysis does not consider any kind of season. Therefore, the information provided via the ratio analysis is constant throughout the year. For instance, if a company tries to invest in a hospitality business, it will consider the season as well because, during some seasons, the demand for hotels might be below at someplace, thereby impacting the firm's total revenue.

3. Importance of cash flow management

The reasons for cash flow management in the evaluation of the proposal of capital expenditure are discussed below:

• The use of cash flow in order to evaluate an investment project provides a verifiable measure. This helps in analysing the cost and benefits of the projects and then prioritising the project that will generate better returns.

• Cash flow management is a means for the company to easily evaluate the impact of a capital investment project, which is apparent to the parties (Ongpenga et al., 2019). In addition, the capital budgeting process is essential for a number of types of spending that includes spending for a physical asset and spending for renovations.

Additional:

Recommending methods and tools used to analyse financial data for making the strategic decision

The methods or tools to analyse the financial data for making the strategic decision has been discussed below:

• Value chain analysis: The value chain analysis clarifies the business processes for value creation for an organisation via both primary and secondary operations. This kind of analysis is an essential tool for an organisation as it helps in costing and benchmarking the major cost, resources, and areas that is required to be improved to increase the economic impact of the business (Pangestu and Setyorini, 2020).

• SWOT: The SWOT analysis is used to analyse and evaluate the maximum strength of the company to take a competitive advantage in the market. The financial data is being used to capitalise on the opportunities and strengthen the organisation's existing financial position (GURL, 2017).

Task 4: Capital expenditure appraisal

Introduction:

In the contents of this report, a detailed discussion about the use of capital budgeting techniques in case of any investment decision making will be analysed. In this report, Pietro Yon has supplied some critical financial data regarding the use of current machinery or the option to invest in updated machinery, which will increase the company's efficiency because of low raw material and direct labour requirements. However, the company is not required to purchase new machinery if it is willing to carry with its existing machinery; however, the cost of operation will be a bit higher in such cases. In this report, the critical factors which should be included in the discussion, such as the NPV, payback period, accounting rate of return and the IRR, will be discussed and analysed. In addition, the purpose of using those capital budgeting tools will also be discussed so that the user of the report can have a clear picture.

Use of Net present value

The NPV is one of the most common tools which is applied in the case of any capital budgeting decision-making process. The purpose of using the net present value as a key tool is because of the value of money that is dependent on time comparison and considering the investors' needs at a similar time. In the case of any capital investment, the investor needs a specific rate of return for carrying the investment-related risk (Alles et al., 2021). The rate of return is the minimum return that a project should generate over the period. However, in the case of a multi-period project, it becomes tough to calculate the profitability whether the investment generates the required returns or not. In the case of Net Present Value, a bridge is constructed for deficiencies in which the present value of the incomes is estimated by free cash flow discounting, which will consider the rate of return. If the NPV of the project is positive or zero, then it will indicate that a project is qualifying. The basic idea is to qualify the required return rate (Knoke, Gosling and Paul, 2020).

Payback period:

The Is a solvency measure that will indicate. The time required to get the investment collected. In the case of any capital investment, investors worry about the initial capital and it is always looking for the time at which the initial capital is reverted. It is not actually that they will disinvest the project somewhat. It is just looking for a time frame at which the actual investment is getting earned through the profits. If the payback period is low, the project's preferability gets increased.

Accounting rate of return:

The ARR is a measurement of profitability that will indicate the company's accounting profit over the period (Siziba and Hall, 2021). The account can be calculated by comparing the average revenue and the average investment. The higher accounting rate of return will indicate higher profitability, which will help select two mutually exclusive projects.

Internal rate of return:

There are certain loopholes in the case of applying the NPV to such as the discount rate of return cannot be predetermined, and there is no actual method that can be used to calculate the discounting rate. Furthermore, one cannot compare the profitability of the project just by looking at the net present value because, in the case of NPV analysis, the investment size is not considered (BASU, 2020). Hear the internal rate of return works as an accurate measure because it will discount the cash flows and indicate a rate at which the net present value will be zero. With the help of the internal rate of return, the actual earning capacity of the project can be identified.

If the company uses the Current machinery

If the company has decided to carry with its existing machine, then the NPV of the project after 3 years will be £244,428.98. Further, the payback period requirement will be within 1.38 years. There will be no initial capital outlay because the company already has the machinery. However, for a project evaluation, the current value of the machinery is that £240000 Is considered the initial investment. Therefore, if the current machinery is used, the accounting rate of return will be194%, and the internal rate of return will be 143%.

|

Capital cost of Current machinery |

|

|||||

|

cost |

£ 260,000.00 |

|

||||

|

less: Partial Allowance |

£ 120,000.00 |

|

||||

|

Carrying cost |

£ 140,000.00 |

|

||||

|

|

||||||

|

NET PRESENT VALUE OF CURRENT MACHINERY |

|

|||||

|

years |

0 |

1 |

2 |

3 |

||

|

Units sales |

|

90000 |

50000 |

30000 |

||

|

SALES PRICE PER UNIT |

|

£ 5.00 |

£ 5.00 |

£ 5.00 |

||

|

Total sales revenue |

|

£ 450,000.00 |

£ 250,000.00 |

£ 150,000.00 |

||

|

Less: variable cost |

|

|

|

|

||

|

Direct cost |

|

£ 0.75 |

£ 0.79 |

£ 0.83 |

||

|

Direct labor cost per Unit |

|

£ 0.75 |

£ 0.79 |

£ 0.83 |

||

|

VARIABLE COST PER UNIT |

|

£ 0.45 |

£ 0.45 |

£ 0.45 |

||

|

Total Variable cost per Unit |

|

£ 1.95 |

£ 2.03 |

£ 2.10 |

||

|

Total variable cost |

|

£ 175,500.00 |

£ 101,250.00 |

£ 63,112.50 |

||

|

Less: Depreciation |

|

£ 46,666.67 |

£ 46,666.67 |

£ 46,666.67 |

||

|

Less: Repair and maintenance cost |

|

£ 7,000.00 |

£ 7,000.00 |

£ 7,000.00 |

||

|

Total cost |

|

£ 229,166.67 |

£ 154,916.67 |

£ 116,779.17 |

||

|

Net Profit |

|

£ 220,833.33 |

£ 95,083.33 |

£ 33,220.83 |

||

|

Initial cost |

-£ 140,000.00 |

|

|

|

||

|

Add: depreciation |

|

£ 46,666.67 |

£ 46,666.67 |

£ 46,666.67 |

||

|

Free cash Flow |

-£ 140,000.00 |

£ 267,500.00 |

£ 141,750.00 |

£ 79,887.50 |

||

|

Discounting factor |

1.00 |

0.84 |

0.76 |

0.66 |

||

|

PV |

-£ 140,000.00 |

£ 224,700.00 |

£ 107,163.00 |

£ 52,565.98 |

||

|

NPV |

£ 244,428.98 |

|

|

|

||

|

payback Period |

||||||

|

Year |

0 |

1 |

2 |

3 |

||

|

cumulative cash flow |

-£ 140,000.00 |

£ 84,700.00 |

£ 191,863.00 |

£ 244,428.98 |

||

|

payback Period |

1+(84700/224700) |

1.38 |

|

|

||

|

Accounting rate of Return |

||||||

|

Average Income |

£ 116,379.17 |

|||||

|

Average Investment |

£ 60,000.00 |

|||||

|

Accounting rate of Return |

194% |

|||||

|

Internal rate of Return |

143% |

|||||

Conclusion

Based on the Calculation and detailed analysis of the financial factors, it is identified that the NPV of using the machinery might be higher, but the use of existing machinery will yield more return decided by the IRR factor. Therefore, it is suggested to carry on with existing machinery where the company will not require any further capital outlay.

References

Addo, P.M., Guegan, D. and Hassani, B., 2018. Credit risk analysis using machine and deep learning models. Risks, 6(2), p.38. https://www.mdpi.com/2227-9091/6/2/38/pdf

Alles, L., Jayathilaka, R., Kumari, N., Malalathunga, T., Obeyesekera, H. and Sharmila, S., 2021. An investigation of the usage of capital budgeting techniques by small and medium enterprises. Quality & Quantity, 55(3), pp.993-1006. https://www.academia.edu/download/73265790/10.1007_s11135_020_01036_z.pdf

BASU, U.K., 2020. IRR BASED DECISION CRITERIA FOR CAPITAL BUDGETING. Hyperion International Journal of Econophysics & New Economy, 13(2). http://search.ebscohost.com/login.aspxdirect=true&profile=ehost&scope=site&authtype=crawler&jrnl=20693508&

AN=150272544&h=jpTbvUm6APjPqjoAPA2VIYfsA8q2iv3si6eFB6v%2BvyHM3TZSJbW8s3DxdKu1xR5

OYC1BgDFbabh4fLZYIvH70w%3D%3D&crl=c

Charitou, A., Floropoulos, N., Karamanou, I. and Loizides, G., 2018. Non-GAAP earnings disclosures on the face of the income statement by UK firms: The effect on market liquidity. The International Journal of Accounting, 53(3), pp.183-202. https://e-tarjome.com/storage/panel/fileuploads/2019-03-09/1552129875_E10766-e-tarjome.pdf

Coibion, O., Gorodnichenko, Y., Kumar, S. and Pedemonte, M., 2020. Inflation expectations as a policy tool. Finance assignment Journal of International Economics, 124, p.103297. https://www.sciencedirect.com/science/article/pii/S0022199620300167

GURL, E., 2017. SWOT analysis: A theoretical review. https://demo.dspacedirect.org/bitstream/handle/10673/792/swot%20pdf.pdf?sequence=1

Images.samsung.com. 2021. [online] Available at:

Knoke, T., Gosling, E. and Paul, C., 2020. Use and misuse of the net present value in environmental studies. Ecological Economics, 174, p.106664. https://www.researchgate.net/profile/Thomas-Knoke/publication/341179912_Use_and_misuse_of_the_net_present_value_in_environmental_

studies/links/5eb294f745851523bd464444/Use-and-misuse-of-the-net-present-value-in-environmental-studies.pdf

Kumhof, M. and Noone, C., 2018. Central bank digital currencies-design principles and balance sheet implications. https://www.bankofengland.co.uk/-/media/boe/files/working-paper/2018/central-bank-digital-currencies-design-principles-and-balance-sheet-implications.pdf

Ongpenga, J.M.C., Avisob, K.B., Fooc, D.C. and Tanb, R.R., 2019. Graphical pinch analysis approach to cash flow management in engineering project. CHEMICAL ENGINEERING, 76. https://www.researchgate.net/profile/Jason-Ongpeng/publication/336691204_Graphical_Pinch_Analysis_Approach_to_Cash_Flow_Management_in_ Engineering_Project/links/5dada123a6fdccc99d9277b4/Graphical-Pinch-Analysis-Approach-to-Cash-Flow-Management-in-Engineering-Project.pdf

Pangestu, G.A. and Setyorini, R., 2020, July. Value Chain Analysis At Bank Sampah Bersinar In Bandung Regency As A Competitive Advantage Strategy. In Proceeding of International Conference on Management, Education and Social Science (Vol. 1, No. 1, pp. 8-21). https://proceeding.researchsynergypress.com/index.php/mess/article/view/9/6

Siziba, S. and Hall, J.H., 2021. The evolution of the application of capital budgeting techniques in enterprises. Global Finance Journal, 47, p.100504. https://repository.up.ac.za/bitstream/handle/2263/74586/Siziba_Evolution_2020.pdfsequence=1

Soboleva, Y.P., Matveev, V.V., Ilminskaya, S.A., Efimenko, I.S., Rezvyakova, I.V. and Mazur, L.V., 2018. Monitoring of businesses operations with cash flow analysis. International Journal of Civil Engineering and Technology, 9(11), p.2034. http://www.fa.ru/fil/orel/science/nir/Documents/Matveev+%20Scopus.pdf

Zativita, F.I. and Chumaidiyah, E., 2019, May. Feasibility analysis of Rumah Tempe Zanada establishment in Bandung using net present value, internal rate of return, and payback period. In IOP Conference Series: Materials Science and Engineering (Vol. 505, No. 1, p. 012007). IOP Publishing. https://iopscience.iop.org/article/10.1088/1757-899X/505/1/012007/pdf Zavadskas, E.K., Stevi, Ž., Tanackov, I. and Prentkovskis, O., 2018. A novel multicriteria approach–rough step-wise weight assessment ratio analysis method (R-SWARA) and its application in logistics. Studies in Informatics and Control, 27(1), pp.97-106. https://www.researchgate.net/profile/Zeljko-Stevic/publication/324091558_A_Novel_Multicriteria_Approach_-_Rough_Step-Wise_Weight_Assessment_Ratio_Analysis_Method_R-SWARA_and_Its_Application_in_Logistics/links/5abd443da6fdcccda6581c2a/A-Novel-Multicriteria-Approach-Rough-Step-Wise-Weight-Assessment-Ratio-Analysis-Method-R-SWARA-and-Its-Application-in-Logistics.pdf