Finance Assignment: Tasks on Budgeting, Financial Forecasting & Reporting

Question

Task:

Project Assessment Task 1

When completing this task of finance assignment, you can refer to your current workplace, a previous workplace or any publicly listed company. You will need access to company data including financial performance, profit and loss statements, cash flow and elements of the business plan. For publicly listed companies, this information can typically be found in the ‘Annual Report’. Your Trainer will also provide you with annual reports from a number of companies or you can work from a report of your own choice.

Part A: You are required to review the profit and loss statement for two comparable periods. For example, the current reporting year and the previous reporting year. When reviewing the information, identify which areas of the business made a profit and which areas of the business made a loss (if any).

Part B: Using your response for Part A, research company information and explain the reasons for achieving the profit and/or loss.

Part C: Refer to the business plan and forecasts for the next reporting cycle, (the current year) and identify critical dates and/or events that will have an impact on company resources.

Part D: Refer to the business cash flow information and identify any trends that may arise.

Part E: Explain the legal and statutory compliance elements that are applicable to the company. Be sure to review information in relation to Australian Accounting Standards, the Australian Tax Office and any other international regulators that may have an impact on the company.

Part F: Having reviewed the legal and statutory compliance requirements, and any other relevant information, explain the probability of the company’s current financial software to be able to meet the immediate and future needs of financial record keeping and reporting cycles.

Project/Role Play Assessment Task 2

Project:

When completing this task, please refer to the information in Appendix 1 for Brewed Better Coffee Shop. Brewed Better Coffee Shop is an independently owned chain of cafés with plans for expansion. Your role in the business is that of Financial Manager and you are to complete the tasks below.

Part A: Using the information provided on current performance (the first 6 months of the year) prepare a budget for the remaining 6 months of the year. In preparing the budget:

- The business will be closed for 2 weeks of holidays in January

- Easter holidays will be in April

- For the first three months the sales will decrease by 5% consistently and then will increase by 2.5%

- The general administrative expenses will increase by 1% every month

- The operating expenses, employment expenses and occupancy costs will remain consistent Your response will require the use of Microsoft Excel (or similar) spreadsheet programs or a suitable accounting software package to develop a budget.

Part B: The owner of Brewed Better Coffee Shop is considering expanding the business by taking over the lease from the shop next door. It is expected that the combined floor space should allow the business to serve twice as many customers as before. With all things considered, the business should be ready to expand by May. In order to make an informed decision about taking on the expanded lease you are required to modify the budget to include:

- An initial one-off expense for shop fit out of $120,000

- Trading to commence May 1

Your response will require the use of Microsoft Excel (or similar)

spreadsheet programs or a suitable accounting software package to develop a revised budget.

Part C When preparing budgets; describe any organizational requirements and statutory requirements that should be considered during the process.

Part D Explain how Brewed Better Coffee ensures that none of the funds are used inappropriately. What systems are in place to ensure that all transactions are being properly recorded?

Report Assessment Task 3

Based on the budgeting process and the review of the financial statements for Brewed Better Coffee shop, prepare a report by using the following guidelines.

1. The structure and format of the report must be clear, follow the structure advised by your Trainer and conform to the organisational requirements and statutory requirements.

2. Identify and prioritise significant issues in statements, including comparative financial performances for review and decision making.

3. Prepare recommendations to ensure financial viability of the organisation. These may include:

- Cash flow

- Changes in business activity, including markets, goods or services traded

- Consolidation

- Expenses and overheads

- Labour costs, including decisions to move production to other locations or sites

- Loss

- Profit

- Write-offs

4. Evaluate the effectiveness of your organization’s financial management processes.

Written Questions Assessment Task 4

1. Identify the requirements for financial probity.

2. Describe the principles of accounting and financial systems.

3. Explain Australian, international and local legislation and conventions that are relevant to financial management in an organization.

4. Outline the requirements of the Australian Tax Office, including Goods and Services Tax, Company Tax, Pay As You Go.

Answer

Assessment 1

Introduction

The company on which the analysis has been done herein finance assignment is Woolworths Group Limited. It is one of the oldest companies listed on the Australian Stock Exchange and has been in operation since the last 96 years. The company has an extensive retail chain in Australia as well as New Zealand and is the largest company in Australia and 2nd largest in New Zealand in terms of revenue. It employs approximately 215000 employees and is the largest takeaway liquor company Australia. The company also deals extensively in the gaming poker machine and hotels as well. The company suffered one of its biggest losses in the last 20 years in 2016 majorly due to the losses incurred in Big W business and the write down of the assets of the Masters business(Woolworths, 2020).

Part A

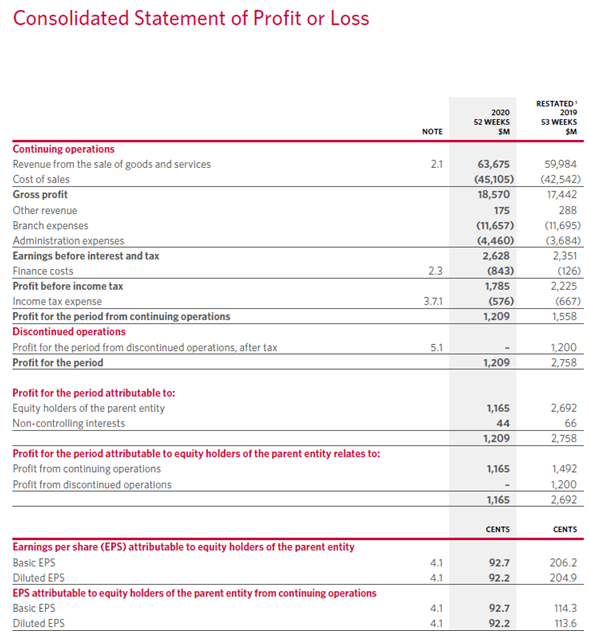

The analysis and interpretation have been done for the profit and loss account for Woolworths for the last 2 years ended 30thJune 2020 and 30th June, 2019. The extract of the same has been shown below. The annual report of the company has been referred for all the financial data.

The company has major sales from the in-store goods sales and the same has increased from $54720 Mn in 2019 to $ 57796 Mn in 2020. The online sales of the goods also saw a rapid growth and was up from $2534 Mn in 2019 to $3523 Mn in 2020. The company also offers the leisure and hospitality services and the revenue from same has decreased from $1671 Mn in 2019 to $1320 Mn in 2020 majorly due to the COVID impact which has had a huge negative impact on the hospitality industry(Woolworths, 2020). The effect of the pandemic has been widespread on the industry as well as the country and economy as a whole and it is one of the major reasons for decrease in turnover in the last quarter.

The cost of goods sold has also increased by 6.02% against the sales increase of 6.15% which clearly indicates that there is a savings in the direct costs. As a result of this, the gross profit has increased by 6.47% from $17442 Mn in 2019 to $18570 Mn in 2020. Some of the other components which can be seen in the profit and loss account of Woolworths is other revenue, branch expenses and administration expenses(Woolworths, 2020). The earnings before interest and tax has increased from $2351 Mn in 2019 to $2628 Mn in 2020 which clearly indicates the organic growth for the company. The finance costs have increased drastically during the year from $126 Mn in 2019 to $843 Mn in 2020.This has been majorly due to raising of the borrowings valued $1500 Mn during the year. It is due to this reason that profit for the period from continuing operations has decreased from $1558 Mn in 2019 to $1209 Mn in 2020, a decline of 22.4%(Woolworths, 2020).

(Figure 1: Annual Report 2020, Woolworths Limited, Pg. 76)

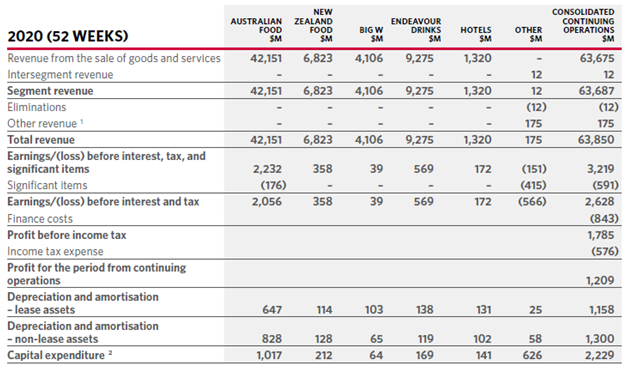

(Figure 2: Annual Report 2020, Woolworths Limited, Pg. 90)

The segmental revenue of the company for 2020 has been shown below in Figure 2 above. All the segments of the company have been profitable during the year. However, the business of the company has been impacted hugely in the second half of the year and the management of the company is still uncertain on the future revenues due to COVID(Verma & Prakash, 2020).

Part B

The profit has declined during the year 2020 to $1209 Mn from $2758 Mn in 2019. There are several reasons for the drop in profitability which has been enumerated below:

- The pandemic has had a huge negative impact on the business for the last 2 quarters of the year and the major impacted business has been the hotels business as the hotels were closed during the lockdown period imposed by the government. The higher cost for the customers and additional costs for the safety measures of the employees has further lead to lowering down of the EBIT.

- The additional cost in the last 4 months due to COVID particularly under the head cleaning, protective clothing, safety, incremental supply chain costs to meet increased demand and the Better together Award for employees for support during COVID has hit the EBIT.

- Furthermore, in 2019 there was a sale of the Petrol business by Woolworths to the EG Group for $1682 Mn which resulted in profit from discontinued operations amounting to $1200 Mn. The same was not the case in 2020(Woolworths, 2020).

- The company also introduced the application of new standard on lease accounting AASB 16 which also resulted in increase in the expenses booked in profit and loss account.

All these reasons cumulatively have resulted in decrease in the profitability of the company in the current year.

Part C

The company has pointed out certain areas which they would like to focus upon in FY21. The company’s chairman Gordon Cairns that he would like to focus firstly on the safety and well being of the employees amidst the pandemic as they are most important resource of the company. The company also targets to focus on customer obsessiveness as the customer do expect continuous improvement in the customer experience and that is how business can increase. The Chairman also focused on new ways of working amidst pandemic and not to lose focus of work and create new opportunities for the employees with change in shopping patterns. The company made a special reference to increased focus on Sustainability and reduce the carbon emissions and become carbon neutral by 2050(Jefferson, 2017). Amidst one major strategic announcement, the company has decided to invest over $700 Mn in NSW supply chain over the coming 4 years together with focusing on new and existing store renewal program and broad investments in e-commerce business. The company has also made investment in the PFD food services in August 2020. Lastly the Chairman mentioned on the need to develop the leaders for better tomorrow and thus increased training in next years.

The company also mentioned in the F21 outlook that the company will focus on the much broader measure of working capital days instead of the average inventory days for the short term incentive purposes. This has been done to focus on non-retail businesses of the Group as well. As per the announcement on 24th March 2020, the company has deferred the separation of EGL from Woolworths Group. The business plan which has been approved for FY21 incorporates the impact of the COVID on business.

agreements

Part D

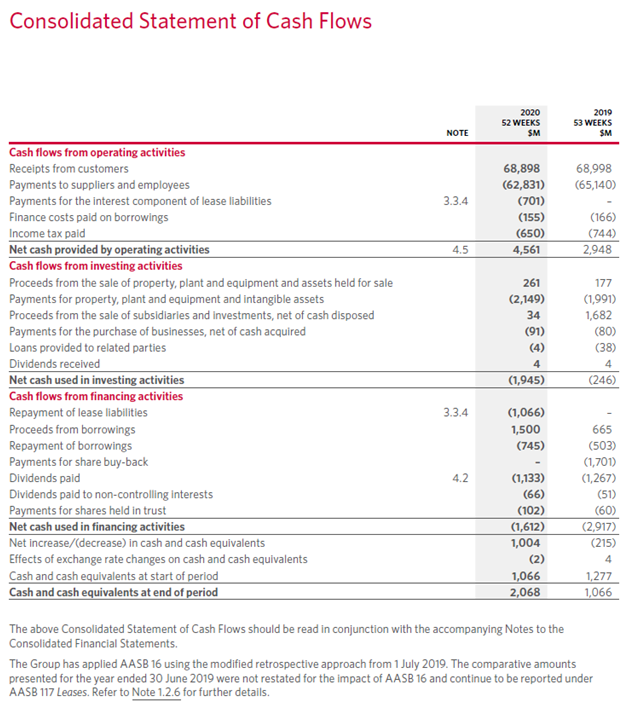

The cash flow statement of the company for the last 2 years has been shown below:

(Figure 3: Annual Report 2020, Woolworths Limited, Pg. 80)

During the year, the receipts from customers has remained more or less constant as in 2019. However, the payments to the creditors and the employees has declined indicating positive cash flow. The payment of interest component on the lease liabilities is one of the newer items ofcash outflows due to introduction of AASB 16 on leases. All this has contributed to positive cash flow from operating activities in both the years and with an increase of over 50% in 2020(Langley & Ravasi, 2019).

In terms of the investing cash flows, the company continues to invest in the PPE and is expected to do that in years to come by as well,but the quantum of investment may decrease due to COVID. One of the abnormal line items which can be seen in the investing activities is the proceeds from the sale of the subsidiaries and investments in 2019 when the company sold the Petrol business. This was a one-timer which is not expected in 2020.

From the perspective of cash flow from financing activities, the company continues to pay dividend share to the shareholders out of its profits ($1267 Mn in 2019 and $1133 Mn in 2020). However, the company raised a major borrowing during the year amounting to $1500 Mn ($665 Mn in 2019) and this may give rise to higher interest cost in PnL in the coming years. The company also made a repayment of the lease liabilities during 2020 amounting to $1066 Mn and the loan repayment amounting to $745 Mn during the year and these outflows are expected to continue in 2021 as well(Linden & Freeman, 2017).

Overall, the company was cash positive during the year and it is a good measure for the company.

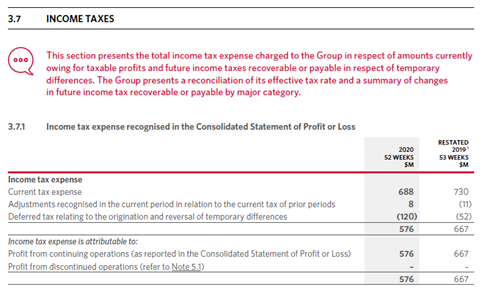

Part E

The company is complying various legal and statutory compliances which are applicable to the company. Some of the taxes applicable to the company includes the income tax on the profit earned, the GST on the sale of goods sold and services rendered, payroll tax on the payroll expenses incurred by the company. The company is also required to make calculation of the deferred tax asset and liabilities based on the temporary and permanent disallowances.

(Figure 4: Annual Report 2020, Woolworths Limited, Pg. 105)

The company is required to comply with Australian Accounting Standards and the Corporations Regulations 2001 while preparation of the financial statements. There is a strong legal and regulatory compliance team which oversee the requirements of the domestic as well as international regulators and government bodies. The relevant tax authority in case of Woolworths for disbursement of GST as well as income tax is Australian Tax Office(Knechel & Salterio, 2016).

Part F

Woolworths Limited uses Xero/MYOB for accounting and book-keeping purposes. It is available in 2 forms – customized as well as commercially available. The advantage of using this software is that it is easy to use and reliable. It saves a lot of time and it no very costly. The customized version comes with a lot of additional features which generates reports and the MIS for the company on a periodical basis. It is a user-friendly software with meets the auditing criteria as well. It can be suitable for short term to medium term but there are a lot of new ERPs which are available in the market, one of which is SAP and it can help in automation. Some of the reports which are generated by both these tools are cash report, ageing report for accounts payables and accounts receivable, the profit and loss account as well as the balance sheet. Some of the disadvantages of MYOB are the inbuilt reports and templates are not easy to change, the cloud based option was once not available which made it difficult to back up data. The updates are expensive at times and remote support from the technicians is also challenging. With Xero, there is a constant issue of integration with the bank software and furthermore, there are no simple and easy to understand customer sales reports available in this software(Marques, 2018).

Assessment 2

Part A

Budget - Refer to the excel spreadsheet.

Part B

Budget - Refer to the excel spreadsheet.

Part C

The organization and statutory requirements that needs to be considered during the budgeting process has been enumerated below:

- Reviewing and updating the budget assumptions: The assumptions which were used by the company during the last budgeting process needs to be reviewed and updated accordingly based on the business environment of the company. For example, in the present scenario, the budget assumptions needs to be revised and revised keeping COVID impact on the business(Prideaux, et al., 2020).

- Reviewing the bottlenecks: During preparation of budget, the bottlenecks in terms of capacity needs to be assessed and checked in terms of how this constraint will lower the sales and how this will have an impact on the overall revenue growth.

- Determination of the nature of the costs and expenses: Some of the expenses may be fixed, some may be variable, some may be semi variable and then some of them may in the nature of step costs which keeps on changing with the change in the level of activity. Thus, in such a scenario, variable budget must be prepared. Example: Rent cost may be stepped depending on the agreement with the landlord.

- Accurate forecast for the sales and revenue: The revenue forecast needs to be discussed with the sales head, the delivery team, the marketing team and the same should be validated by the CEO of the division and then distributed and allocated amongst the department managers. Various assumptions like organic growth, increase in product line and customers, new products, etc. needs to be appropriately factored in.

- Preparing and reviewing the budget model: The budget needs to be documented in a standard model and then needs to be reviewed by the individual departments heads before final consolidation and upload in the system. All the comments from the senior management and the limitations posed by funding problems should be appropriately noted and documented for future reference(Marques, 2018).

- The company must document all the assumptions and the final budget for the upcoming year. This is required by the statutory auditors during the statutory audit.

Part D

Brewed Better Coffee does ensures that the funds are being appropriately used. Some of the systems and processes being used to ensure that the transactions are appropriately recorded are:

- Segregation of duties and reviewing the cheques being issued: There is segregation of duties such that different personnel are being allotted different work and that the cheques are reviewed before issuance, they are printed and signed by the authorised signatory and it is taken care that blank cheques are not being issued.

- Identification of the double dipping: The accounting software should be such that it identifies duplicate payment entries in case any of the employee is trying to double tip the payment.

- Avoiding fake vendor payments: The practice of accepting the manual invoices should be avoided. This is one of the techniques by which the fake vendor payments by employees can be avoided.

- Using the company credit card for personal use by the employee: In case the company credit card is being used by any of the employees, the same should be monitored periodically by another employee or the custodian of cash such that only office related expenses are being incurred(Meroño-Cerdán, et al., 2017).

- Stealing and misappropriation of the sales return goods: A system should be put in place such that there is no theft or misappropriation of the goods coming back from the customer. The same should be supported by the gate pass and appropriate documentation.

ROLE PLAY

1. Meeting with the operations manager and owner for discussion on the Budget

|

MINUTES OF THE MEETING |

|||

|

MEETING VENUE : Conference Room, Head Office, Brewed Better Coffee Shop

|

MEETING TIME : 25th October, 2020, 3 pm

|

||

|

MEETING TYPE: Formal Meeting |

ATTENDEES: Adam (Operation Manager) Ami (Finance Manager) Dale (Commercial Manager) Shawn (Owner) Liam (Supervisor)

APOLOGIES:Nil |

||

|

FACILITATOR -: James D |

MINUTE TAKER -: Adam |

Time Keeper -: Liam |

|

|

SNO. |

Agenda Item |

Action Plan |

Presenter |

|

1 |

Introduction and welcome

|

The introduction to the meeting was started with introduction of everyone present and the agenda of the meeting and that the meeting has been called for discussion and presentation on the annual budget |

Ami |

|

2 |

Discuss the budget in detail

|

The different aspects of the budget were discussed in this section. The type of budget, the changes as compared to the last year, the variables being considered, the impact of COVID, the discussion points with the department heads, the CEO and sales heads. The type of budget, the annual plan and goal was also discussed. Lastly the assumptions considered in the current year budget were also being presented. The budget was presented in the sequence of overall company budget followed by the department wise budget(Lessambo, 2018). |

Adam |

|

3 |

Questions on the budget

|

Once the budget highlights were being presented, then the QnA session was opened where the stakeholders from different team asked several question and appropriate answers were given.

|

Ami |

|

MEETING CONCLUSION |

|||

|

How did the stakeholders react to the budget? The stakeholders took interest in listening to the budget, the assumptions, the one-timers and the variables which have been considered. There were ready to give inputs from there end as well and quick to raise questions in case of any doubts. During the QnA session, they came up with various questions and the same were answered by the panelists one by one. One of the major questions was on how to control the costs and what the measures which needs to be employed in the organization for long term wealth creation and cost control to which Adam, the operations manager replied that all the costs should first be divided in 2 categories – discretionary and non-discretionary and discretionary costs should then be looked upon for savings measures(Ehalaiye, et al., 2018).

|

|||

2. The process of cash register management can be rectified in the following way

This is one of the common errors which leads to cash mismanagement and fraud in the long run but this can be corrected using the automated cash management softwares’ available in the market. The software is linked to the cash box and will open and close the cash box once the amount is collected. In case the invoicing is done and the cash is not collected, the cash box will remain open and will not proceed to the next transaction. Another possible way in which this could be avoided is the segregation of duty where one person will be responsible for managing the cash counter and another person for invoicing and the third person for cash reconciliation – this would avoid such practices like taking cash without permission or records. Lastly, the CCTV can be installed in the organization which will create and element of psychological fear in the minds of employees who do it intentionally.

3. Comment on the different trends on profit and loss account, cash flow and the ageing summary of Brewed Better Coffee company.

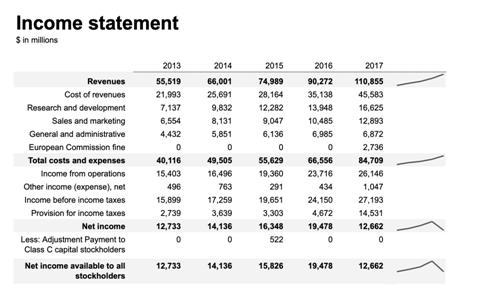

- From the above shown profit and loss statement, it can be seen that the revenues of the company has grown incrementally from 2016 to 2020, with the last 2 years growth in excess of 20%. The cost of revenues has also increased proportionately and the gross profit has been in and around 60%. The company also incurs several variable expenses like research and development expenses, sales and marketing expenses and general and administrative expenses as well, all of which has increased steadily during all these years. Expense as a percentage of sales has gone up from 72.25% in 2016 to 76.41% in 2020 and thus the same needs to be controlled(Vercio, 2018). The company also has other income (net of expenses) which has marginally increased from $496000 to $1047000 in 2020. The provision of income tax is computed based on several adjustments and the same has increased staggeringly in 2020 to $14,531,000 from $4,672,000 in last year. This has resulted in decrease of the net profit after taxes from $19,478,000 to $12,662,000 in 2020.

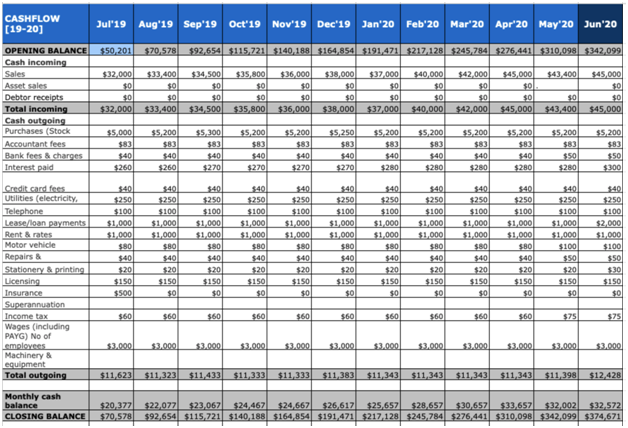

- In case the cash flow of the company is being reviewed during the year, it can be seen that the company started with $50201 as opening balance and incoming cash from sales increased in the second half of the year. The major line items constituting the cash outflows were purchases, accountants’ fees, bank fees and charges, interest payment, credit card fees, electricity and utilities expenses, telephone bills, rent and rates, motor vehicle expenses, repairs and maintenance and printing and stationary. The company also incurred expenses on account of wages, superannuation, insurance and income tax. The company made a loan and lease payments throughout this period. The overall cash outflow has been ~11k – 12k during this period. The closing balance of cash has increased to $374671 during this period ended June 2020(Dumay & Baard, 2017).

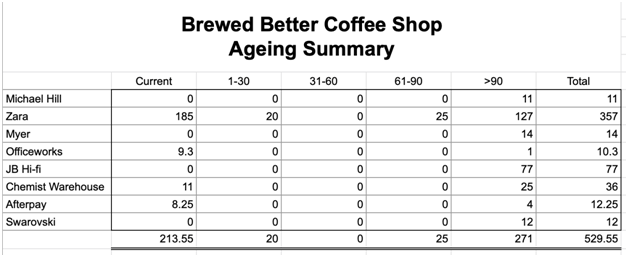

- The above shown aging summary shows that almost 213.55 is within the credit period and has still not become due. Almost 20 falls with the outstanding period of 1-30 days and it is from customer namely Zara. There is no outstanding in the bracket 31-60 days. In 61-90 days, again the outstanding of 25 is from Zara. There is a lot of outstanding receipts which are aged more than 90 days and the major contributors to it are Zara (127), JB Hi-Fi (77), Chemist Warehouse (25), etc. The overall outstanding as on date is 529.66 out of which customers – Zara and JB Hi-Fi needs to be focused as it constitutes nearly 82% of the overall receivables(Delone & Mclean, 2004).

4. Contingencies are the buffer which may be added to budget to counter the element of risk and uncertainty. There can be instances where the company is in a situation when it may not be achieving the revenue or income targets which have been set or it may be spilling over in terms of the expenses budget which has been allocated to the department. It may be due to some unforeseen events like floods, business loss, COVID, etc. and in such a scenario, contingency fund helps in overcoming this one-timers. The contingencies should also be factored in the budget and that’s why the budgets should be revised.

The procedure for revision of budget has been mentioned below:

- The initial request for the change in the budget should go to the owner of the budget as to why the changes and revisions are required in the budget.

- The budgets need to be revised once the approval is given for change in the budget.

- The revised budget highlighting the change in variable, the change in assumptions and reason for the changes should be sent to the owner.

- The owner may then send the revised budget to the accountantfor recommendations on the changes made(Fukukawa & Mock, 2011).

- The respective finance manager will then review all the changes and the recommendations made and provide the review comments as to whether the changes are acceptable or not.

- Once the changes and recommendations are given effect to in the budget, the final version of the budget is then circulated with the respective stakeholders and departments.

5. The statement of discrepancy for the month of Feb 2020 in the company’s bank account and cash account has been shown below:

Balance as per Bank Account as on 29th Feb 2020 528,948.76

Add: Woolworths expense for 3rd Feb 2020 100.00

Add: Coffee beans from XYZ on 20th Feb 2020 240.00

Balance as per Cash Account (General Ledger) as on 29th Feb 2020 529,288.76

From the above summary, the discrepancies can be easily spotted for audit trail purposes.

Assessment 3

Introduction

Brewed Better Coffee Shop is one of the widely known coffee shops in Australia’s Melbourne town. The address where the café is situated is 360 Little Bourke St, Melbourne VIC 3000, Australia. The café is famous for serving different types of coffee and has bene in business for the last 10 years. The customers, the area of service, the business and the revenue have grown manifold during this period. The purpose of writing this report is to identify and prioritize the significant issues in the financial statements of the café, the financial performances over the years and how can the financial management process of the organization can be made more effective. The report also highlights the key recommendations to ensure the financial viability of the organization in terms of incomes, expenses, profit, loss, cash, assets and liabilities(Gill, et al., 2018).

Review of financial documents

On reviewing the financial statements of the Brewed Better Coffee Shop, it can be seen that the company has grown both in terms of topline as well as bottomline over the years. However, in 2020, the net income declined due to increase in expense ratio as well as increase in taxes. In terms of cash flow of the company, the company started with ~$50K cash and with the monthly net cash inflow of ~20-32k, the closing balance of the cash increased to ~375k. Thus, it can be said that the company is cash rich.

In case budget is analysed, the company has missed the profit and revenue target in most of the months and in the month of September, the utilities cost increased staggeringly to $6625 as against the monthly fixed expenses of $625 which is not explainable. Likewise, the expenses have not been categorized into fixed and variable expenses and hence, it is difficult to understand and interpret for the users as to what is changing with sales and what is fixed for the month. The cash flow is healthy but month on month the same is cumulating and it is lying idle. The company’s management can employ the funds for growth of business or can use it for expansion purposes as well. In terms of the balance sheet, the company’s current ratio was 6.29 times in 2019 and 5.14 times in 2020 and it clearly shows that the company is not using its resources effectively and efficiently. It is blocking a lot of funds in the idle cash. The shareholder’s equity has increased constantly year on year which means there has been constant profit for the company which is a positive indicator. Lastly, it was found that the bank statement and the cash ledger were not matching, and a bank reconciliation statement was to be made in order to reconcile the balances(Michaela, 2017). It is thus recommended to put the system in place like variance analysis, monthly review of financials, preparation of bank reconciliation statement on a monthly basis so that the decision making can be made effective and efficient.

Recommendations(Just one or 2 sentences is more than enough)

- Cash flow: The cash flow should be divided category wise between operating activities, investing activities and financing activities so that it is easy to understand what the sources of cash and where it is being utilized.

- Changes in business activity, including markets, goods or services traded: A risk control matrix so that all the risks and opportunities with respect to the market, the products and services, competitors and economy can be consolidated and appropriate actions can be planned for the future.

- Consolidation: This is a very important aspect to look at the big picture and thus it is important to look at the consolidated results and performance of the division or department.

- Expenses and overheads: The expenses and overheads should be bifurcated into variable and fixed both in budgets as well as in financials so that it is easy to understand and interpret.

- Labour costs, including decisions to move production to other locations or sites: For this, scenario modelling should be done before making any decision or conclusion as to what the cost and benefit for different location or sites will be.

- Loss: The loss should be calculated period wise (monthly) as well as department wise to enable better decision making.

- Profit: The profit should be calculated period wise (monthly) as well as department wise to enable better decision making.

- Write-offs: The write-offs if any with respect to receivables or payable should be approved by the management and the reason for writing off should be documented well for audit trail.

Effectiveness of financial management

Brewed Better Coffee shop has a relatively strong accounting and management system however there are few areas of improvement where the company can improve. The company should be strategizing to improve the allocation of working capital and resources within the business to achieve synergy. The company should also come with system improvement like segregation of duties, bank reconciliation system, maker, reviewer and checker system, etc. to avoid errors(Kew & Stredwick, 2017). The company may also come with some measures to improve the budgeting and forecasting process with close alignment with different teams. The company can also come up with a dashboard consisting of monthly MIS and ratios and the reasons for the variances with budget and previous year which will enable decision making and quick summary. For the purposes of funding, the company can look for both internal as well as external funds and this is required for business expansion purposes.

Conclusion

From the above discussion and analysis, it can be concluded that the company has performed well both in terms of revenue as well as profitability. The company has also increased the asset base however there are various areas and systems where they shop can improve upon and this will be required for long term growth.

Assessment 4

A1 Identify the requirements for Financial Probity

The requirements of financial probity have been mentioned below:

- The officials should act ethically as per the prescribed rules and litigations under the APS Values (set out in section 10 of the Public Service Act 1999) and Code of Conduct (set out in section 13 of the Public Service Act 1999), and should not make any improper use of its position.

- The officials should not place themselves in any position in which any kind of self-benefits or personal motives are involved.

- All the information that is private should be treated appropriately during and after the process of procurement. In case it is needed as per the nature of the procurement in that case external probity specialists must be appointed in that case(Raiborn, et al., 2016).

- The agencies should be honest and ethical and should treat all the tenders on an equitable basis which means due consideration should be given to all the agencies.

- Effective probity measures help in making sure that there is value for money for the work that is done, and the outcome is genuine.

A2 Describe the principles of accounting and financial systems

The principles of accounting and financial systems have been explained below:

Principles of Accounting-

1. Accrual basis of accounting – It states that as and when the transactions occur, they should be recorded in the books of account and not when the cash flow associated with them is paid or received. For example- Rent should be recorded in the month it was accrued and not when it was paid.

2. Conservatism Principle – It states that as soon as the company has any indication of any expense that may occur in the future then they should record it then and there like the companies record the provision for bad debt, repairs etc, in case such expense occurs in the future. In case of income it should be recorded only when the company receives the same.

3. Going Concern Principle – It states that the company will continue its business for an infinite period and there will not be any chances that the company will shut down in the new future so investors can invest in the company(Arnott, et al., 2017).

4. Cost Principle – It states that the company should record all its assets liabilities and expenses at the cost it was incurred and not at any other cost like market value or net value.

5. Consistency Principle – It states that once the company adopts any accounting principle or method then the same should be followed without changing it until there is any better accounting principle or method found.

6. Full Disclosure Principle- The company should provide all the information related to its finances to the best of knowledge and all the facts should be stated correctly in the notes to account of the company so that the stakeholders have all the knowledge related to the company.

7. Matching Principle – It states that in case the company is recording income related to any item then expenses related to the same item should be recorded consistently. For example, with the sale of goods, the cost of goods also needs to be recorded.

8. Materiality Principle – It states that the transactions or items should be recorded in the books of the company only when it is material which means it can alter the decisions of the company.

9. Reliability Provision- It states that the transactions that are correct and reliable should be recorded in the books of the company and not on a doubt basis.

10. Time period principle – It states that the business should follow a standard time period for which it should record its expenses and income. For example – every company follows a financial year which is from April to March or Jan to Dec. All the transactions that accrues in that particular selected period should be recorded in that period only.

A3 Explain AUSTRALIAN, International And Local Legislation And Conventions That Are Relevant To Financial Management In An Organisation

- Financial Management and Accountability Act 1997- This act helps in understanding the differences between public property and private property and managing both of them. This Act provides a framework for the same and has provided proper deviation of public and private property in section 5 of the stated Act.

- Financial Corporations (Transfer of Assets and Liabilities) Act 1993- This Act contains the provisions that guides the transfer of assets and liabilities to and from a financial corporation and provides information related to the same.

- Financial Sector (Collection of Data) Act 2001 – It controls the collection of data from the financial sector and retention and use of the same in other sectors. It guides how the data collected would be used and also kept safe and secure(Gooley, 2016).

- Financial Framework (Supplementary Powers) Act 1997- An Act that provides supplementary power that can be used to make rules related to spending of money, providing commitment related to the same and management of the same.

- Financial Transaction Reports Act 1988- This act guides how certain transactions would be recorded in the financial sector in their given books of account and also impose certain obligations in relation to accounts and manage the same.

- While preparation of the financial statements, the Corporations Act, 2001 and the Australian Accounting Standards have to be applied.

A4 Outline The Requirements Of The Australian Tax Office, Including Goods And Services Tax, Company Tax, Pay As You Go.

As per the ATO (Australian Tax Office) every business has to submit a monthly report of all its business activities known as the business activity statement (BAS) on a monthly, quarterly and annual basis. It has to file a GST report if eligible for the same. It serves the purpose for reporting of GST, paying the instalments, paying off the withholding tax and suffice other tax related obligations.

It is necessary that the companies must pay for GST in case their earnings are more than $75,000. It is also mandatory to register for GST and provide necessary cooperation during all the audits that are performed.

All the company tax related obligations must be calculated and paid on quarterly basis. Mostly businesses shall pay the instalments that are calculated on their earnings and the rates of instalments are calculated by the ATO. These will be considered as cash outflow from the business affecting the cash flow statement as these will be paid out in cash(Zlokazov, 2020). In case any business is providing any non-monetary employment benefits then the business needs to pay FBT. It should be recorded as needed by the FBT law.

As an employer the company is required to deduct withholding taxes in order to help the employees remit their year-end liabilities on time. This is collected using pay as you go withholding amounts from payments made to employees, contractors and businesses who don’t quote Australian business number on invoices.

References

Arnott, D., Lizama, F. & Song, Y., 2017. Patterns of business intelligence systems use in organizations. Decision Support Systems, Volume 97, pp. 58-68.

Delone, W. & Mclean, E., 2004. Measuring e-Commerce Success: Applying the DeLone & McLean Information Systems Success Model. International Journal of Electronic Commerce, 9(1). Dumay, J. & Baard, V., 2017. An introduction to interventionist research in accounting.. The Routledge Companion to Qualitative Accounting Research Methods, 1(1), p. 265.

Ehalaiye, D. et al., 2018. Are Financial reports useful? The views of New Zealand Public vs Private Users. Australian Accounting Review.

Fukukawa, H. & Mock, T., 2011. Audit risk assessments using belief versus probability. Auditing: A Journal of Practice & Theory, 30(1), pp. 75-99.

Gill, A. Q., Henderson-Sellers, B. & Niazi, M., 2018. Scaling for agility: A reference model for hybrid traditional-agile software development methodologies.. Information Systems Frontiers, pp. 315-341.

Gooley, J., 2016. Principles of Australian Contract Law. 2 ed. Australia: Lexis Nexis.

Jefferson, M., 2017. Energy, Complexity and Wealth Maximization, R. Ayres. Springer, Switzerland. Technological Forecasting and Social Change, pp. 353-354.

Kew, J. & Stredwick, J., 2017. Business Environment: Managing in a Strategic Context. 2nd ed. London: Chartered Institute of Personnel and Development.

Knechel, W. & Salterio, S., 2016. Auditing:Assurance and Risk. 4th ed. New York: Routledge.

Langley, A. & Ravasi, D., 2019. Visual artifacts as tools for analysis and theorizing. The Production of Managerial Knowledge and Organizational Theory: New Approaches to Writing, Producing and Consuming Theory, Volume 59, pp. 173-199.

Lessambo, F., 2018. Audit Risks: Identification and Procedures. Auditing, Assurance Services, and Forensics, 3(1), pp. 183-202.

Linden, B. & Freeman, R., 2017. Profit and Other Values: Thick Evaluation in Decision Making. Business Ethics Quarterly, 27(3), pp. 353-379.

Marques, R. P. F., 2018. Continuous Assurance and the Use of Technology for

Business Compliance. Encyclopedia of Information Science and Technology, pp. 820-830.

Meroño-Cerdán, A., Lopez-Nicolas, C. & Molina-Castillo, F., 2017. Risk aversion, innovation and performance in family firms. Economics of Innovation and new technology, pp. 1-15.

Michaela, R., 2017. Contemporary Issues in Accounting. 2nd ed. London: Wiley.

Prideaux, B., Thompson, M. & Pabel, A., 2020. Lessons from COVID-19 can prepare global tourism for the economic transformation needed to combat climate change. Tourism Geographies, pp. 1-12.

Raiborn, C., Butler, J. & Martin, K., 2016. The internal audit function: A prerequisite for Good Governance. Journal of Corporate Accounting and Finance, 28(2), pp. 10-21.

Vercio, A., 2018. Process Costing: The Most Important Subject in the Management Accountant's Curriculum. Journal of Corporate Accounting & Finance, 29(2), pp. 141-150.

Verma, A. & Prakash, S., 2020. Impact of covid-19 on environment and society. Journal of Global Biosciences, 9(5), pp. 7352-7363.

Woolworths, 2020. Annual Report, s.l.: Woolworths Group Limited. Zlokazov, D. V., 2020. Project Management vs Systems Engineering Approach to Project Risks Management.. KnE Engineering, pp. 208-212.