Essentials of Corporate Finance and Gordon Growth Model

Question

Task: Consider the table provided below for the task of essentials of corporate finance. Three bonds require to be chosen which bears the maturity from ten to twenty years to fill the provided tables. The bonds should be carrying the rating of “A to AAA,” “B to BBB” and “C to CCC” by referring to the bond screener link provided in this task. The mentioned bonds would bear the future value up to $ 1000. For evaluating the annual coupon payment, it should be required to utilize the debenture rate of bond counting the nominal value. If required to compute the original period for maturity, just deduce the expiry date from the present year. The value of yield to maturity and the present value quote regarding the bond would be available on the above-mentioned website. While processing this please note down that the value of the bond quote should be multiplied with 10 to arrive at the value in the present market. After taking these measures, you must clarify if any concession, premium or par is being applied on the specified bonds.

|

Bond |

Company/ |

Face Value (FV) |

Coupon Rate |

Annual Payment (PMT) |

Time-to Maturity (NPER) |

Yield-to-Maturity (RATE) |

Market Value (Quote) |

Discount, Premium, Par |

|

A-Rated |

|

$1,000 |

|

|

|

|

|

|

|

B-Rated |

|

$1,000 |

|

|

|

|

|

|

|

C-Rated |

|

$1,000 |

|

|

|

|

|

|

- Provide a detailed account of the correlation of the detected values with those of yield to maturity and ratings.

- Give an account of why the method of trading the bond with discount, premium, and par is being affected by the debenture rate and income after maturity.

- As per the observations you have made in this phase of essentials of corporate finance, explain what is being anticipated to occur if the maturity would be yielded along with the market value of the respective bonds while keeping in mind whether the period of maturity would be changed by 5 years (Could be increased or decreased).

Answer

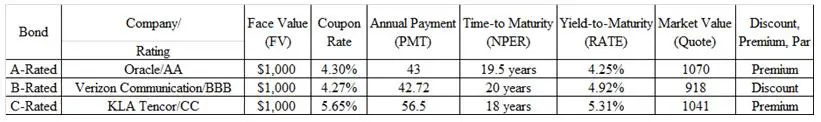

The finished table for essentials of corporate finance task is provided in the below section (Morningstar, 2016a, 2016b, 2016c)

If observed in the essentials of corporate finance table provided above, it could be noticed that the yield to maturity is inversely proportional to the credit rating. This inversely proportional relation exists because of the reason that the corporate bonds bearing smaller credit ratings are more susceptible to the default and thus this may pose a very higher risk to the investors. By the reason of which the concerned investors anticipate more profit from the above-mentioned bonds which would pay for the high risk, they are taking. If there is no such extra benefit in buying these bonds, they would choose other bonds with lesser risk and similar benefits (Damodaran, 2008). The major motive of buying the shares by an investor is to earn maximum money by spending a little time in it. The investors probably are more attracted towards the risky bonds since the stable bonds require comparatively large amount of money to get a substantial dividend. The dividends of small scale companies sometimes remain unpaid and thus comes under the category of risky investment.

By looking into the coupon rates besides keeping in mind the YTM you could tell if the said bond could be exchanged or traded at an exceptional, balanced, and a discounted price. Thus, the bonds of the company show an increased degree of the trade when the level of the debenture and YTM are alike because of the reason that the value of the debenture rate was similar to that of the anticipated results by the stakeholders. Because of the direct proportional relation, the instance when the debunture rate would be bigger than that of YTM, the selling rate of the bond would be at a premium level (roughly saying, the level above par value). Elaborating the reason for this process in a straight forward manner, it would be said that the value of coupon delivered by the bond is higher than the value of anticipated result from the bond because which has happened because of the high demand existing in the market. It should also be noted that whenever the value of coupon rate gets below the rate of YTM the bond would have to be sold at a lesser or discounted rate (i.e. below the par value). This is because the expectation of the stock investors would have been much higher than the value offered for the coupon (Kane & Marcus, 2013).

A substantial reduction in maturity would lead to a reduction in the value if YTM. The fall in the value of YTM consequentially leads in the reduction of bond prices. It should be noted that the maturity date, YTM, and bond prices display a directly proportional relationship (Parrino & Kidwell, 2011).

CAPM Approach

Below is provided the filled table as required in the essentials of corporate finance task (Yahoo Finance, 2016).

|

Company |

5-year Risk-Free Rate of Return |

Beta (?) |

5-Year Return on Top 500 Stocks |

Required Rate of Return (CAPM) |

|

Microsoft |

1.45% |

1.02 |

8.77% |

8.92% |

|

Apple |

1.45% |

1.06 |

8.77% |

9.21% |

|

IBM |

1.45% |

0.63 |

8.77% |

6.06% |

The available secure level is considered to be a benefit over the 5-year bond of the US treasury which bears interest of 1.45% interest per year. It is from the website of Yahoo Finance, that the estimation of the beta of various stocks was done by following the CAPM model (Brealey, Myers & Allen, 2008).

Needed scale of yield = Risk free rate + Beta*(Market return – Risk free rate)

Needed scale of yield (Microsoft) = 1.45 + 1.02*(8.77-1.45) = 8.92% per annum

Needed scale of yield (Apple) = 1.45 + 1.06*(8.77-1.45) = 9.21% per annum

Needed scale of yield (IBM) = 1.45 + 0.63*(8.77-1.45) = 6.06% per annum

The evaluation was done using the Gordon Model

|

Company |

Current Dividend ($) |

Projected Growth Rate (next year) |

Required Rate of Return (CAPM) |

Estimated Stock Price (Gordon Model) |

Current Stock Price |

Over/Under Priced |

|

Microsoft |

1.24 |

4% |

8.92% |

26.2 |

50.80 |

Over |

|

Apple |

2.08 |

4.5% |

9.21% |

46.2 |

96.30 |

Over |

|

IBM |

5.2 |

3.5% |

6.06% |

210.2 |

129.56 |

Under |

The required information to complete the table provided above in this essentials of corporate finance task was extracted from the website of Yahoo Finance (2016).

If referred to the dividend growth model of Gordon, the below equation could be indicated

Estimated stock price = Dividend next year/(Required return – dividend growth rate)

From this equation essentials of corporate finance task, it could be observed that the estimated stock price holds an inverse relation with the required reimbursement from the invested stock although it holds a progressive relationship with the rate of growth in the dividend. This relation occurs majorly because of the factor that the increase in the rate of growth in dividend would cause an increase in the variables given in numerator and decrease the value of variable provided in the denominator. From this, it would be deduced that the increased dividend growth would consequentially hike the level of anticipated stock price. Apart from this, the equation reveals that the level of dividend-paying stock would be higher maintaining that the denominator value is kept constant when the coupon paying bond increase by maintaining the value of YTM as constant. The value of the current stock would be the sum of the whole disbursements that have to be paid back till the lifespan of the share keeping the constant value of perpetual holding period and this thesis could be obtained from the Gordon dividend model (Kane & Marcus, 2013).

Benefits of implementing the Gordon Growth Model

The Gordon growth of the model is very user-friendly and thus is a very convenient way to calculate the worth of share stock of any concerned company whatever type of company it be (Parrino & Kidwell, 2011).

Demerits of implementing the Gordon Growth Model

- The method of the Gordon Growth Model could not be benefitted to calculate the value of shares or stocks of any company which doesn’t share its dividends (Marcus & Kane, 2013).

- No element other than dividend is given significance in this method to calculate the value of share worth exceptionally in the occurrence of incorporeal possessions which are very significant in the current economy (Parrino & Kidwell, 2011).

- The rate of progress of dividends would keep on varying especially when the mature stock fluctuates.

- The statement that the rate of growth displayed by the dividend remains always below the projected rate on equity doesn't hold always correct since the price of the stocks is very unpredictable (Damodaran, 2008).

- It is on the calculation of EPS for next year that the approach of P/E majorly depends upon. The probable value of the stock for the next year could be calculated by multiplying the current ratio of P/E with EPS by assuming that the P/E continues to be a constant (Parrino & Kidwell, 2011).As per the above-provided concept the Projected value of stock would be Estimated EPS for the next year * Current P/E ratio

- The calculation of the stock value would be more efficient and accurate with the help of the P/E model. The method of the Gordon dividend growth model is highly unreliable since the prices involved in it are very delicate concerning the development proportion of the disbursement. As mentioned earlier, the growth rate of disbursements is very unpredictable which may show high fluctuations concerning the time. This is the reason that the calculations and the results of the P/E are considered to be further correct and relevant to the present price in the market (Brealey, Myers & Allen, 2008).

- It is a known fact that the value of the stock or shares increases when the concerned company displays a significant development or growth rate. This context provided in the aforesaid section of this essentials of corporate finance task would signify the surge in the value of forthcoming disbursements while the worth of the variables provided in the denominator of the Gordon growth model reduces. Hence any significant hype in the value of returns would eventually decrease the value of the concerned shares. Similarly, an increase in the rate of dividends would consequentially lead to the surge in the rate of the stock price relevant to the Gordon growth model. It is also evident that the increase in the rate of EPS of the share would lead to a surge in the value of the stocks in the market. This case would result in the company making a high profit with relevance to the P/E method (Damodaran, 2008).

Reference List

Brealey, R., Myers, S. & Allen, F. (2008), Principles of Corporate Finance, New York: McGraw Hill Publications

Damodaran, A. (2008), Corporate Finance, London: Wiley Publications

Kane, B.Z. & Marcus, A.J. (2013). Essentials of Investment, Singapore: McGraw-Hill International

Morningstar (2016a), Verizon Communications Inc, MorningStar Website, Retrieved on January 12, 2016 https://quicktake.morningstar.com/stocknet/bonds.aspx?symbol=vz

Morningstar (2016b), KLA-Tencor Corp, MorningStar Website, Retrieved on January 12, 2016 ttp://quicktake.morningstar.com/StockNet/bonds.aspx?Symbol=KLAC&country=USA

Morningstar (2016c), Oracle Corp, MorningStar Website, Retrieved on January 12, 2016 https://quicktake.morningstar.com/StockNet/bonds.aspx?Symbol=ORCL&country=USA

Parrino, R. & Kidwell, D. (2011), Fundamentals of Corporate Finance, London: Wiley Publications

Yahoo Finance (2016), Historical prices, Yahoo Finance, Retrieved on January 12, 2016 https://finance.yahoo.com/