Effective Risk management assignment for Deep Dive organization

Question

Task: How can Deep Dive organization effectively manage and mitigate various risks in its corporate training and team-building workshops?

Answer

Risk management assignment identification

1. Competition Risk:

There is a Risk management assignment of intense competition from other providers offering similar or alternative corporate training and team-building solutions. This competition could affect Deep Dive organization’s market share and profitability.

2. Operational Risks:

a. Resource Availability: The availability of necessary resources, such as LEGO sets and other materials, could pose a risk. If there are delays or difficulties in obtaining these resources, it may impact workshop delivery and the overall operations of Deep Dive organization.

b. Disruptions: Workshops and operations could be disrupted by events that could affect the physical location or the ability to gather.

3. Financial Risk:

At the beginning of Deep Dive organization’s existence, there is a possible Risk management assignment that revenue would not cover costs. This may be due to factors such as a slow uptake of clients, pricing issues, or higher costs than expected.

4. Reputation Risk:

Any negative client experiences or public relations issues could harm the reputation of Deep Dive organization. Negative feedback, poor reception to workshops, service issues, or negative comments about the organization can impact Deep Dive organization’s reputation.

5. Regulatory Risk:

Deep Dive organization may need to comply with legal or regulatory requirements, such as obtaining business licenses or adhering to data protection laws. Failure to comply with these requirements can lead to legal trouble, fines, or other consequences.

Risk management assignment

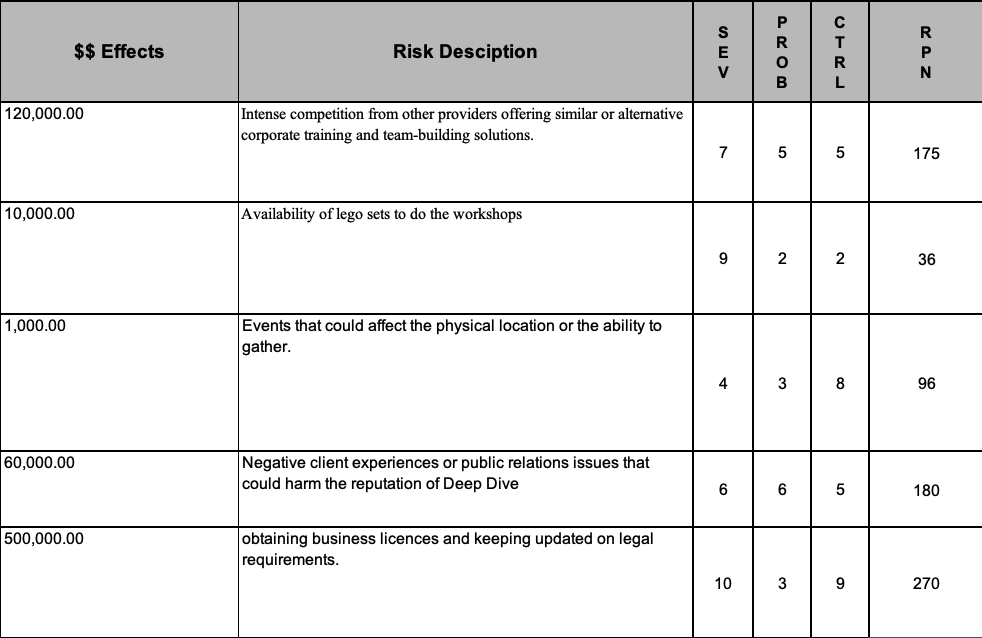

Based on the risks identified for Deep Dive organization, we developed a Risk management assignment analysis, as shown in Figure 1. By identifying, evaluating, and prioritizing potential risks, we were able to identify key points we need to be better prepared to navigate around possible challenges in the future. This with the whole purpose of increasing Deep Dive organization success rate.

Figure 1

Risk management assignment assessment

Note. Risk management assignment assessment for Deep Dive organization

The Risk management assignment analysis made it clear that our primary focus should be ensuring we have everything necessary to constitute our organization. The approval of our business license relies entirely on governmental institutions, but the least we can do is ensure we comply with everything they might expect from us. Once our organization is established, we must stay relevant and ensure we offer value. We need to focus heavily on creating a well-tailored and unique experience to help organizations and additionally create valuable partnerships to increase our business.

Risk management assignment response development

By proactively addressing potential risks and taking advantage of opportunities, we could protect our operations, deliver outstanding workshops, and maintain a strong reputation. As seen on Figure 2, we came up with response strategies to help us minimize Risk management assignment impact, boost efficiency, and keep clients happy. As a result, we're able to anticipate challenges, adapt to changing circumstances, and stay competitive. Our culture of Risk management assignment response development will help us achieve our business objectives, drive growth, and deliver impactful experiences.

Figure 2

Risk management assignment response analysis

Note. Risk management assignment mitigation analysis based on the Risk management assignment assessment of Deep Dive organization

1. Competition Risk:

a. Differentiation: Develop unique and innovative offerings that distinguish Deep Dive organization from competitors. This can be achieved by providing specialized programs, customizing workshops to specific client needs, or offering additional value-added services.

b. Target Niche Markets: Identify specific market segments or industries where Deep Dive organization can excel and focus efforts on effectively targeting and serving those niches. Small business that are emerging on new markets

c. Build Strong Relationships: Foster strong relationships with existing clients to encourage loyalty and repeat business. Additionally, actively engage in networking and partnerships to expand the client base and increase market penetration.

2. Operational Risks:

a. Resource Availability:

i. Diversify Suppliers: Establish relationships with multiple suppliers of essential resources, such as LEGO sets, to mitigate the Risk management assignment of supply chain disruptions. This ensures a backup option in case one supplier encounters difficulties.

ii. Maintain Buffer Stock: Maintain a buffer stock of essential resources to mitigate any temporary disruptions in the supply chain. This allows workshops to continue uninterrupted while alternative arrangements are made.

b. Disruptions:

i. Business Continuity Plan: Develop a robust business continuity plan that outlines procedures to be followed during natural disasters, pandemics, or other disruptive events. This plan should include remote workshop options, alternative locations, or virtual engagement strategies to ensure operations can continue despite the disruptions.

3. Financial Risk:

a. Thorough Financial Planning: Conduct a comprehensive financial analysis and forecasting to estimate costs accurately and set realistic pricing structures. This helps ensure that client revenue will cover expenses and sustain the organization.

b. Market Research and Pricing Strategy: Conduct thorough market research to determine competitive pricing strategies that attract clients while ensuring profitability. Regularly monitor and adjust pricing based on market dynamics to maintain a competitive edge.

4. Reputation Risk:

a. Deliver High-Quality Services: Focus on delivering exceptional and consistent services to clients. This includes ensuring workshops are well-prepared, facilitators are skilled and knowledgeable, and client expectations are met or exceeded.

b. Proactive Communication: Establish effective communication channels with clients to promptly address any concerns or issues. Actively seek feedback and take necessary steps to address any negative experiences to maintain a positive reputation.

c. Public Relations Management: Implement a proactive public relations strategy to highlight Deep Dive organization’s successes, positive client experiences, and unique offerings. This can be done through testimonials, case studies, and engaging with relevant media outlets.

5. Regulatory Risk:

a. Compliance Management: Assign a dedicated team or individual responsible for monitoring and ensuring compliance with all applicable legal and regulatory requirements. Stay updated with regulation changes and take necessary actions to maintain compliance, such as obtaining licenses and implementing data protection measures.

Through the project's lifecycle, it's important to monitor the effectiveness of mitigation strategies and adjust them as needed.

Contingency planning

Our contingency plan helps us address potential risks, like resource availability, financial constraints, reputation issues, and regulatory compliance. In this way, we can have alternative strategies, action plans, and resources ready to go when needed, reducing downtime and enabling us to navigate uncertainty (What Is a Contingency Plan in Project Management?, nod).

1. Competition: Design of an interactive website with customized programs and cutting-edge technologies for customer interaction. Additionally, promote webinars, blogs, and the latest accreditations by partnering with experts and gurus. By implementing a membership system, we could keep our clients informed, give those discounts and benefits, and keep them informed about the company's progress.

2. Operational: We can use technology like the meta-verse or online creative spaces to streamline the certifications, workshops, and events. We must monitor the educational and resources administration process to ensure the trainees are following the instructions. With the creation of online courses and the accessibility of schedules allows for performing a more extensive community.

3. Financial: Conduct a comprehensive Risk management assignment assessment by analyzing market trends and the economic landscape including expenses, cost estimation, revenue forecasting. In this case, it is essential to foresee the number of employees and clients' exponential growth.

4. Reputation: In the event of a negative client experience or a public relations issue, it could hurt our reputation. The Risk management assignment will be mitigated by establishing a dedicated customer feedback mechanism to make sure any concerns or issues raised by clients are addressed right away. In addition, we'll implement a solid quality assurance process to make sure our workshops are consistently good. We'll stay on top of client feedback by monitoring online platforms and social media channels. Our crisis communication plan will help us deal with any negative public relations issues.

5. Regulatory: It's crucial to comply with legal and regulatory requirements. As part of our comprehensive assessment, we'll identify the specific compliance requirements applicable to our operations and set up a dedicated compliance team or hire legal counsel to make sure we're following them. By reviewing and updating policies and procedures regularly, we'll stay on top of data protection laws, IP laws, and licensing requirements. We'll mitigate Risk management assignment of legal trouble, fines, and other consequences by staying informed about updates in relevant regulations.

Risk management assignment Response Control.

Having completed the first three Risk management assignment management steps, the necessary information is available to perform the Risk management assignment Response Control, detailing all identified risks and providing strategies to control risks and establish change management.

Based on the Risk management assignment assessment, only the risks with the highest Risk management assignment Priority Number will be considered and prioritized.

Risk management assignment Register.

Risk management assignment1.

Description: Obtained Business license and keep operating on legal Requirements.

Category Risk: Regulatory Risk

Probability of Occurring: 30%

Impact: Failure to comply with these requirements can lead to legal trouble, fines, or other consequences.

Risk management assignment Responses: Mitigate

Contingency Plan: Assign a dedicated team or individual responsible for monitoring and ensuring compliance with all applicable legal and regulatory requirements. Stay updated with regulation changes and take necessary actions to maintain compliance, such as obtaining licenses and implementing data protection measures.

Owners: Diego Lopez and Sukhpreet Kaur.

Current Status: In Process.

Risk management assignment2.

Description: Client Experiences or public relations issues that could harm the

reputation of Deep Dive organization.Category: Reputation Risk.

Probability of Occurring: 60%

Impact: Negative feedback, poor reception to workshops, service issues, or negative comments about the organization can impact Deep Dive organization’s reputation.

Responses: Avoid.

Contingency Plans: Deliver High- Quality Services, Proactive Communication, Public Relations Management.

Owners: Juan Fernando Correa.

Current Status: In Process.

Risk management assignment3.

Description: Intense Competition from other providers offering similar or alternative corporate training and team-building solutions.

Category: Competition Risk.

Probability: 50%

Impact: This competition could affect Deep Dive organization’s market share and profitability.

Response: Mitigate.

Contingency Plan: Differentiation: Develop unique and innovative offerings that distinguish Deep Dive organization from competitors. This can be achieved by providing specialized programs, customizing workshops to specific client needs, or offering additional value-added services.

Owners: Paulo Cifuentes and Jorge Gonzalez.

Current Status: In Process.

Risk management assignment Control.

For each of the risks, contingency plans must be put in place. In addition, all team members are responsible for identifying the triggers for each of the identified risks, i.e. assessing the events that could result in the consequence of the risk.

Risk management assignment1.

Regulatory Risk: Diego Lopez and Sukhpreet Kaur are in charge of executing the contingency plan and trying to mitigate this risk; both are responsible for keeping track of managing the licenses to operate; their trigger will be three months before the expiration of the license you have, they must start to work the next one, in addition, they must be aware of new changes or requirements according to the regulations.

Risk management assignment2.

Reputation Risk: The person responsible for executing the response strategy for this Risk management assignment will be Juan Fernando Correa. To avoid this; he will have to monitor the quality of the services being provided, identify opportunities for improvement and other aspects that may reduce the Risk management assignment of having a bad reputation; he will also have to monitor the reviews, the trigger for this Risk management assignments if two bad reviews are received in the same month, the contingency plan must be reevaluated, and a way must be found to avoid the risk.

Risk management assignment3.

Competition Risk: Paulo Cifuentes and Jorge Gonzalez will lead this contingency plan; they will develop strategies that differentiate the company from other businesses to offer services that differentiate us from our competitors and mitigate this risk.

Change Management.

All company members will carry out Risk management assignment assessments, and quarterly meetings will be held to repeat the assessments to evaluate whether the contingency plans for each Risk management assignment have been effective and to consider new potential risks.

Each member in charge of carrying out the Risk management assignment mitigation or avoidance plans shall present a report to the interested parties detailing the progress and results obtained.

Then all team members will evaluate if the contingency plan for each Risk management assignment has been effective; if the answer is yes, the Risk management assignment will be considered closed; if the answer is no, the contingency plan must be re-evaluated, and modifications must be made.

References

What is a Contingency Plan in Project Management? (nod). https://www.wrike.com/project-management-guide/faq/what-is-contingency-plan-in-project-management/

Cspo, E. a. P. P. &. (2022, December 2). Plan Risk management assignment Response for Your Projects. Project Management Academy Resources. https://projectmanagementacademy.net/resources/blog/plan-risk-response-in-projects/

Managing Risk management assignment- WorkSafeBC. (nod). https://www.worksafebc.com/en/health-safety/create-manage/managing-risk

Editorial team. (2021, May 21). Contingency Plan: What is it & How to Create it? (Steps and Format). Bit Blog. https://blog.bit.ai/contingency-plan/

Hall, H., & Hall, H. (2022). 7 Ways to Identify Risks. Project Risk management assignment Coach. https://projectriskcoach.com/7-ways-to-identify-risks/

Team, M. (2010, May 19). 4. Risk management assignment responses development: Reducing threats and exploiting opportunities. Your Guide to Project Management Best Practices. https://mymanagementguide.com/guidelines/project-management/risk-management/risk-responses-development-reducing-threats-and-exploiting-opportunities/