Economics Assignment: Impact on Vegetable Prices In Australia During COVID-19

Question

Task: You are required to prepare the report on economics assignment analyzing the below scenario and answer the given question:

NEWS ARTICLE

The Guardian Alyx Gorman

Fri 27 Mar 2020 13.16 AEDT

Empty fruit and vegetable shelves in an Australian supermarket after panic buying due to the coronavirus outbreak.

Wholesale prices of some vegetables have risen dramatically but the coronavirus isn’t to blame for everything.

“$11.50 for a kilogram of broccoli and $8 a bunch for fresh celery” The price of some vegetables in Australia has gone up considerably recently.

These price increases have led many people to take to social media, accusing major supermarkets and independent retailers of profiteering and price gouging at a time of crisis.

However, Shaun Lindhe, the communications manager for peak vegetable growers body AusVeg, suggests that the price increases have more to do with another story, one that has fallen from the headlines in recent weeks: the ongoing, devastating droughts and bushfires that ravaged Australia over the summer.

“There’s been a reduced supply as a result of drought,” Lindhe says. “There are also seasonal fluctuations in supply, as production regions transition.” The reduced supply has coincided with panicked shoppers clearing shelves, driving prices even higher. Vegetables are so expensive in Australia at the moment.

On 24 March, ACCC chair Rod Sims directly attributed grocery price hikes to “unnecessary panic buying”, saying: “Australia’s supermarkets have experienced unprecedented demand for groceries in recent weeks, both in store and online, which has led to shortages of some products and disruption to delivery services.

“In order to meet that demand growers and retailers have been working to try and keep that supply on supermarket shelves,” says Lindhe, “and as a result some of the production costs in terms of labour and transport have gone up.”

In January, well before the novel coronavirus crisis hit Australian shores and shifted consumer behaviour, growers warned of a 50% increase in vegetable prices. Now a supply shortage is coinciding with a spike in demand.

A Woolworth’s spokesperson, meanwhile, says: “Due to pressures throughout the horticultural supply chain caused by drought, unseasonal weather and an unprecedented spike in demand, we’re currently seeing an impact on the availability of some fresh fruit and vegetable lines. This has led to higher wholesale costs for some fruit and vegetable lines across the market.”

“The price of vegetables, like many commodities, is set by supply and demand,” says Lindhe.

Q1. Using the demand and supply model, explain and illustrate graphically, the statement made in the news article, “why vegetables are so expensive in Australia at the moment”.

Q2. (a) Assume vegetables are sold in a perfectly competitive market and firms are making zero economic profit. Explain and illustrate graphically, the effect of increase in price on the short run position of a single firm selling vegetables.

(b) Based on the short run position identified in Q2 (a) explains and illustrates graphically effect of entry/exit on the long run position of the firm.

Answer

Demand and Supply affecting Price Determination

The current economics assignment revolves around the concept of demand and supply which are the two very significant determinants of market price. In an economic model, the price determination depends on these two factors. Demand refers to the effective desire of a consumer to buy a particular commodity or service at a given price during a specific period of time (Lingcheng et al., 2019). When all other factors are taken to be constant the quantity demanded of a commodity rises with a fall in its price and vice versa. Supply on the other hand refers to the quantity of commodities or services that are offered for sale in the market by the producer at a given price during a particular period of time. When all other factors are taken to be constant the quantity supplied of a commodity rises with a rise in its price and vice versa. These demand and supply factors interact among themselves to determine the equilibrium price. In a market place, when the supply of a commodity or service increases, the price for the commodity or service decreases and vice versa. On the contrary, when the demand for a commodity or service increases, the price for the commodity or service also increases and vice versa. To determine the equilibrium price and quantity, the market factors are adjusted. As stated by Behzadi et al. (2018), when the demand for a commodity or service is high and its supply is constant, the equilibrium price will be set at a higher rate along higher level of quantity. On the other hand, if the demand falls and supply still does not change, the equilibrium price will be lowered along with a lower level of quantity. In this report on economics assignment, the principles of economics will be implemented to analyze the given scenario.

Background of the Current Scenario

The Covid-19 pandemic has impacted the entire world. The people are losing their lives, jobs and loved ones. The entire world economy has been shrinking due to the adverse effects of coronavirus. The Great Lockdown has ceased many economic activities which have led to a severe economic crisis against which every nation around the globe has been fighting. In this current scenario, most of the people are panic stricken. Over the last six months people have been under immense pressure, panic and anxiety. Many people have been fearing food crisis and started hoarding huge quantities of food itemsunnecessarily at home. This has led to food shortage for many who could not manage to purchase the goods on time. As per The Guardian (2020), Australian supermarkets and retailers have been facing such a situation. The panicked customers have been purchasing fruits and vegetables in bulk quantities which have led to emptying the shelves in the supermarkets. This high demand from the customers is said to have resulted in the rise of the wholesale prices. People have been anticipating that due to coronavirus, the prices are increasing as supermarkets are taking advantage of the high demand. As per the reports, the current prices of vegetables are like $11.50 per kilo of broccoli, $8 per bunch of fresh celery, etc.There are other vegetables as well whose prices have increased recently in the Australian market.

1. Why vegetables are so expensive in Australia at the moment?

The vegetables are very highly priced in Australia at this moment. The mass is of the opinion that the supermarkets have resorted to unfair pricing. The common people of Australia have been accusing the retailers as well as supermarkets for being profit oriented in their business approach even during a crisis. They are being vocal about this on various social media platforms. However, there is another side to this story. The price hike is a result of the inadequate supplies. The supply has fallen in the recent times in Australia because of the bushfires and droughts which are ongoing (The Guardian., 2020). These natural disasters have been ravaging Australia during the summers of 2020 and have resulted in food shortages. The other associated reason identified in this section of economics assignment behind this shortage in supply is the seasonal fluctuations in food supply. The production regions go through some transition which affects the quantity being supplied. As the reduction in the quantity supplied has coincided with the outbreak of the global pandemic, the prices have been pushed higher by the market forces. There are some proponents who suggested that the prices of vegetables and fruits have risen in Australia because the customers are going with the flow and giving in to panic buying, which is unnecessary. The independent retailers and the supermarkets have been facing very high demand for groceries which has led to shortage in supply. This high online and in store demand across the country has also resulted in delivery disruptions. In order to fill up the empty grocery shelves of the supermarkets or retail stores, the labour and transportation costs are also increasing. This is adding up to the production cost and ultimately getting reflected in the prices.

Although people are blaming the pandemic for this price hike, the predictions about the rise in vegetable prices were made back in January (The Guardian., 2020). The supply shortage is therefore, not an outcome of changed consumer behaviour alone. The sudden and unprecedented rise in demand has coincided with the shortage in food supply but the actual reasons behind the shortage are seasonal changes in weather conditions and droughts. Even if the pandemic had not broken out leading to panic buying and further shortage in supply, the other natural conditions would result in supply shortage. Therefore, for the Australian market the price hike in groceries was an unavoidable phenomenon.

Determination of Equilibrium Price and Quantity

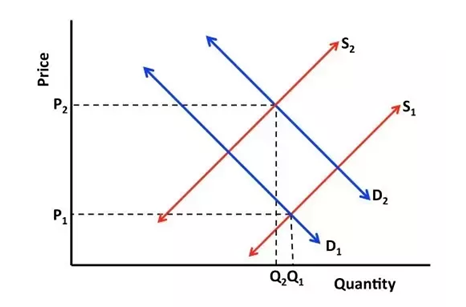

(Source: Azevedo and Leshno, 2016)

In the above diagram provided in this economics assignment, it can be seen that the initial demand curve was D1 and the initial supply curve was S1. The original equilibrium price was P1, with Q1 being the equilibrium quantity. However, the shortage in supply was caused due to the droughts, bushfires, transition of production areas and unseasonal changes in weather of Australia.

Therefore, the supply curve shifted leftwards to S2, showing a fall in supply. To worsen the situation, the panic buying led to very high demand. Thus, the demand curve also shifted rightwards from D1 to D2, showing a rise in demand. This results in shift of the equilibrium price from P1 to P2 and equilibrium quantity from Q1 to Q2. Thus, the price hike takes place. This inflationary effect on the price is due to the high demand coinciding with short supply (Azevedo and Leshno, 2016). The lack of availability of many fruits, vegetables and other grocery items is leading to fall in supply. This results in price hike. Moreover, due to the coronavirus the spree of buying and hoarding is on a rise. Thus, there is a gap between the quantity demanded and quantity supplied. Therefore, the people are forced to pay a higher price for the purchases they make. Thus, the price and quantity equilibrating process is determined by the market forces of demand and supply.

2. Effect of increase in price on the short run position of a single firm selling vegetables

In case of the perfectly competitive market structure, all the firms offer identical products for sale. The commodities that are sold in a perfectly competitive market are homogeneous in nature. Therefore, if the vegetables are sold in a market which is perfectly competitive it implies that the goods are perfectly identical. The firms that operate in a perfectly competitive market structure are all price takers. None of the firms have the power to influence the market price of the commodity. The market share that a firm holds in such a perfectly competitive market has no impact on the price. The perfectly competitive market is known for its pure competition. There are a large number of sellers and buyers in a perfectly competitive market. The market structure allows free entry as well as exit to the firms. Another basic characteristic of perfectly competition is that everyone has perfect and complete knowledge about the market. According to Boitier (2020), the factors of products as well as goods have perfect mobility across the market. The price control is completely missing in a perfectly competitive market.

When there are economic profits in an industry, firms will be attracted to enter the industry. On the contrary, when the industry faces economic losses, the firms will want to exit from such an industry. In the long run, the firms which operate in a perfectly competitive industry will be earning zero economic profits. In a perfectly competitive market, in the long run, firms are induced to enter or exit from the industry. This will result in changes in the price which is required to adjust the overall outcome of the perfect competition. Eventually in the long run, the firms will be left with zero economic profit earnings. The price changes act as the adjusting factor in this case of economics assignment.

In case the vegetables are sold in a perfectly competitive market, in the long run, the vegetable selling firms will earn zero economic profits. The reason behind this phenomenon is that the new firms will enter the market which would lead to a fall in the overall market price.

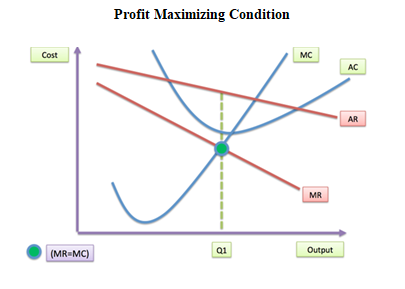

Imperfectly competitive markets can however, earn profits because they have barrier to entry of new firms, the power to control the market price and the absence of pure competition. The profit maximizing condition states that the total profit will be maximized when the marginal revenue equals to the marginal cost (Nawaz, 2020).

MR = MC

A firm can maximize its profit only when the marginal revenue of the firms equates with the marginalcost. In the short run, the profit maximizing price or output will not be affected by the changes in the fixed costs. The fixed costs over the short run are considered to be sunk costs by the firms. Therefore, without being affected by these changes in the fixed cost, the firm continues operating.

Profit Maximizing Condition

(Source: Nawaz, 2020)

As opined by Schiro, Hobbs and Pang (2016), a perfectly competitive firm is a price taker which means that no single firm can control the market price. If a vegetable selling firm is operating under perfect competition, an incraese in price can bring the firm profit in the short run. However, the firm will not be able to influence the price of the market in the long run. Therefore, the firm will have to accept and take the prevailing market price. As there are large number of sellers in a perfectly competitive market, if one firm tries to change the price, the other competiting sellers will create pressure on that firm to operate at the equilibrium market price that is prevailing. Therefore, if a single firm selling vegetables in a perfectly competitive market tries to increase the price of the goods even by a penny, the competitors will attract all the customers. The entire sales of the firms will be lost to the rival firms. In this situation, the single firm selling vegetables is likely to fall out of existence in the long run if it tries to increase its price as it is a price taker.

3. What is the effect of entry/exit on the long run position of the firm discussed within this economics assignment?

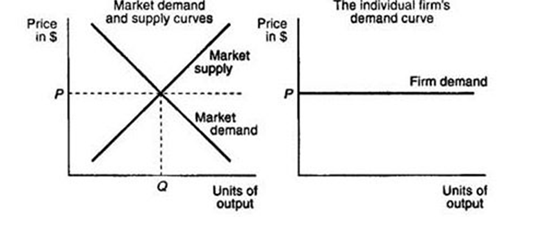

In case of a perfectly competitive market, the operating firms can earn profits or incur losses only during the short run. However, in the long run neither the profits nor the losses exist. The main reason behind this is that there are infinite firms which operate under a perfectly competitive market. The products they produce and sell are homogeneous and infinitely divisible. The single firm selling vegetables will not be able to influence the price under perfect competition (ZHANG and YANG, 2017). If a situation arises in the short run when a single firm affects the market price, the competing firms will either enter or exit from the market as required for adjusting the prices. In the long run, the price will be pushed down so that it reaches its minimum average total costs. At this level, all the firms operating in the perfectly competitive market will earn zero economic profits. The entry and exit of firms act as the driving forces in case of perfect competition, which make the price adjustments to leave the firms operating at zero economic profit.

Market Demand and Firm Demand Curve under Perfect Competition

(Source: Wang and Lu, 2016)

In the long run in a perfectly competitive market, the new firms enter the market when they see that the existing firms are making profit. On the other hand, the existing firms tend to leave the market when they start incurring losses. As stated by Wang and Lu (2016) with regards to the case scenario of economics assignment, when the price is greater than average total cost, the firms make profit.

References

Azevedo, E.M. and Leshno, J.D., 2016.A supply and demand framework for two-sided matching markets. Journal of Political Economy, 124(5), pp.1235-1268.

Behzadi, G., O’Sullivan, M.J., Olsen, T.L. and Zhang, A., 2018. Allocation flexibility for agribusiness supply chains under market demand disruption. International Journal of Production Research, 56(10), pp.3524-3546.

Boitier, V., 2020.Growth and ideas in a perfectly competitive world. Structural Change and Economic Dynamics, 53, pp.370-376.

Lingcheng, K., Zhenning, Z., Jiaping, X., Jing, L. and Yuping, C., 2019.Multilateral agreement contract optimization of renewable energy power grid-connecting under uncertain supply and market demand.Economics assignment Computers & Industrial Engineering, 135, pp.689-701.

Nawaz, N., 2020. Efficiency on the dynamic adjustment path in a financial market. Journal of Economics and Finance, pp.1-26.

Schiro, D.A., Hobbs, B.F. and Pang, J.S., 2016. Perfectly competitive capacity expansion games with risk-averse participants. Computational Optimization and Applications, 65(2), pp.511-539.

The Guardian., 2020. I’ve never seen it like this why vegetables are so expensive in Australia at the moment. Available at https://www.theguardian.com/food. [Accessed 13 September 2020].

Wang, Y.B. and Lu, J.R., 2016. A supply-lock competitive market for investable products. Asian Development Policy Review, 4(4), pp.127-133.

ZHANG, L. and YANG, J., 2017. Differences in Product Quality in a Perfectly Competitive Market and Intra-industry Trade Balance. Journal of Dongguan University of Technology, (4), p.11.