Economics Assignment on Oil and Gas Industry in Australia

Question

Task: Assignment consists of two essay questions (worth 10 marks each) based on Text material. Before attempting this assignment you are expected to have read Text chapters 1, 2, 3 and 4. Sources used in your answer should be fully referenced in APA 6th style. Answer the following questions ensuring that you apply economic principles or theory related to (a) the concepts of supply and demand for Question 1 and (b) the concepts of specialisation and exchange for Question 2 to inform your analysis and support your decisions. Communicate your ideas with correct grammar, spelling and writing style and support your answers with diagrams as necessary.

Question 1: Drawing on your knowledge of the theory of demand and supply – supplemented by appropriate media reports – explain what has been happening to the price of gas in Australia over the last ten years.

Question 2: Drawing on your knowledge of the theory of specialisation and exchange – supplemented by appropriate media reports – explain what the consequences of rising energy costs will be for heavy industry in Australia.

Answer

Question 1

Introduction

It was observed in this economics assignment that a few years back, the natural gas market of eastern Australia was kept isolated from the rest of the world. However, at the same time, it was observed that the Western Australian gas market was approaching the global market by the help of exporting liquefied natural gas. The domestic impact that was created by the export was limited in nature. Also, the development in this industry has helped to integrate this business and father makes several variations in the market. The export of liquefied natural gas by Australia is one of the most important links present between the domestic and international markets for the country. It has been stated in this economics assignment that Woodside discovered used gas resources off the Western Australian coast in early 1970. These offshore fields were having the capacity to meet the states domestic needs and also supplied Asian markets at the same time. The country started export production later in the 1980s. Also, it has been observed that the North West shore is having a group of 5 processing plants which are having a capacity of producing 16.3 million tones of gas. The top gas exporters of Australia are trying to expand their business because of which the industry was one of the most major sources of income for the growth. These developments have led to an annual increase in LNG capacity to 19.5 million tones (Janda, 2018). The LNG market of Australia can be easily integrated by making changes in the global market or any other similar event that may take place on the east coast.

Analysis

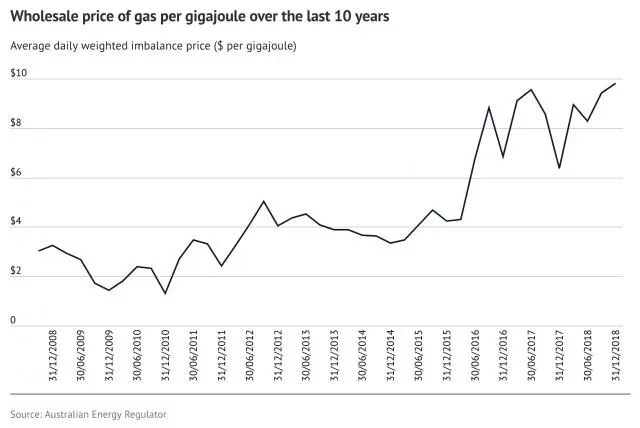

It was observed in this economics assignment that in the year 2002 to 2015 that the prices of the industrial gas in Australia increased drastically because of which many industries were facing problems while managing their business because of cost issues. The prices of gas in Tasmania and NWQ ranged from 15% to 116 %. Also, the wholesale prices of gas in the country had observed a considerable increase. There were also changes observed in the costs of transmission pipelines over a long period. One of the most important factors in the gas export business is the maintenance of equilibrium in the supply and demand of industrial gas, and at the same time maintains the transport and transmission of gas so that it can be made available at any point of time without any constraint (Janda, 2018). Generally, it is observed that an increase in the price of the wholesale gas component also leads to a decrease in the demand for the products. The east coast gas market is observed to need a new supply of gas source so that they can fulfill the future demand and further try to overpower the wholesale gas component and further maintain the prices of products in the market. It should also be observed that the introduction of new unconventional gas sources in the market will lead to an inflation of prices of the gas supplies present in the market (Fleetwood, 2014). The east and west part of the country have significantly highlighted the influence created by the transport and transmission facilities over the inconsistent gas prices (Braeutigam, 2010). From the above segments of this economics assignment, it was found that the relations with the eastern gas market has depicted that there is a significant pressure exerted over the southern states whereas a high netback price has been observed in the Queensland LNG prices. The Eastern Australia Gas market can be observed to have an unstable environment because of which there may be price variations observed and at the same time poor price transparency and high transaction costs will also be observed (Janda, 2019). There have been many structural deficiencies observed in the market because of the short term changes made in the GSA and the regular contractual markets. By improvising the efficiency of the industry, the business of the organizations can be improved and at the same time, homogenized prices can be attained (Chester & Morris, 2016).

There have been major challenges in the prices of gas and underlying gas price drivers since the Gas Price Trend Review 2015. The major movements in the gas price are owing to the gas supply and price sensitivity. As per the economics assignment the underlying gas price drivers comprises of supply// demand balance that is the development of LNG establishment and new capacity coming into action in Western Australia and Queensland. Other factors that can be traced are the liquidity and transparency in the spot markets. Policy statement like the Australian Domestic Gas Security mechanism and the guarantee by National energy plays a vital role. Incident like that of Basslink outage in December 2015 and SA load shedding event in 2017 have influenced the importance of energy in Australia.

(Swoboda, 2019)

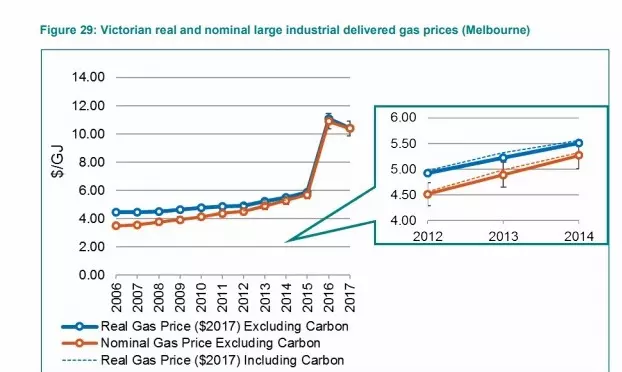

The figure below gives a clear indication of the components that added up to the industrial gas price in Victoria from 2006 to 2017. The Scope 3 emission heading under the carbon tax contained a minor influence on the effective price that the customer paid for the gas during that point of time. Till 2012, the price was having a flat structure. It can be said form the finding in this economics assignment that the slight increment started in the year 2013 and then continued till 2017. From 2015 to 2017 the prices doubled signaling an enormous pressure.

Key factors influencing industrial gas prices

The size base of the customers- This section is said to divide the industrial gas sector into two major segments- Large and Small industries. The large or more established industries are observed to purchase gas directly from the wholesale gas businesses (Mankiw, Gregoryand & William, 2011). There are generally no determined levels of demand but it has been observed in this economics assignment that the gas producers generally enter into deals with customers who are having average annual demand excess of 1. It is of common knowledge that the retailers are the primary suppliers to the small scale industries and customers. These retailers can provide various offerings ranging from GSA to other retail standard contracts. Customers or businesses having annual usage of less than 0.1 PJ are not considered as industrial customers but rather are mentioned as business customers.

The business customers are offered with different varieties of retail tariff by different General Sales Agent. As per this economics assignment there are also specified thresholds for determining the type of connection that is needed to be assessed by the industrial customers to take supply from. Generally, the large scale companies are observed to get gas delivered directly to high-pressure pipelines, which are more cost-effective and time-efficient. The small scale industries are observed to have low-pressure networks that provide them with fuel (AIP, 2018).

Load factor- it is also a very important factor that affects the price of the gas and also the supply of gas in the large scale industries. It was found in the economics assignment that it is also very important for industries to determine the average price of transmitting gasoline. The small scale industries are generally affected because of the peak in prices that are observed because of the load factors (Freedman, 2013). The customers are compelled to pay the high transmission costs as well as the other charges which are bundled up with the total cost. The gas industry generally requires determining the load ratio in terms of Maximum Daily Quantity and Average Daily Quantity. This can also be used to determine the total pipeline capacity booking.

MDQ can be defined as the total volume limit of gas that can be consumed by a customer during a given period in India. Where is, ready q is calculated by dividing the total annual income of the customer contracts by the number of days in the year. With a decline in the gas consumption of a customer, an increase in load factor is observed that peaks with time. Hence, the total load factor for the large scale industries and customers has been standardized at a value of 1.1 which is 10% greater than the value of ADQ. Generally, it is observed that the gas plants operate went for 24 hours a day because of which they are considered to have a relatively flat load. For the small scale industries, it can be observed from the economics assignment that the load factor is more variable because of the variations present in the type of business, business hours and weather conditions. Cold weather makes the prices of the gas products more variable then the hot weather in the electrical industry. Therefore it is observed in the economic assginment that the small scale industries are more vulnerable to the price of gasoline than the large scale industrial customers. For the small industrial customers, the customer group load factor is ranged from 1.2 to 5.9 and is generally having an average value of 1.9. This also tends to determine the differences present between the metropolitan and rural industries based on their food production, processing facilities and other factors that are present in the rural areas. An increase in the load factor will also tend to decrease the flexibility because of which additional cost may be added to the products which will make it inconvenient for the gas market (Mankiw & Taylor, 2011).

It has been a trend in the gasoline industry that the prices of the gas raise in the springtime and peak during the summers because people are observed to travel more frequently during that time. Gasoline prices are generally observed to be lower in the winter months because less fuel is consumed. As per the economics assignment the specifications and the formulations of gasoline’s chemical composition also change concerning the seasons. This clearly indicates that the demand of gas leads to price rise because the supply of the gas remains intact. In this economics assignment, the supply fails to remain adjusted to the demand and as a result the same incident can be observed every year. Some of the environmental regulations mention that the evaporation rate of gasoline increases in summers because of which they need to have low evaporating points during warm weathers. This clearly states that the refiners should try to replace the cheap evaporative compounds with less evaporative gasoline components. After comparing the average price of gasoline within the time range of 2000 to 2018 to the price of gasoline in August, it was observed that the price was 35 cents higher for each gallon.Seasonal demand and specifications for gasoline

Gasoline inventories are said to provide cushion

Major supply of the gasoline industry is affected by the refining process and supply of crude oil, imports of gasoline and also the inventories. The inventory or stock of the products is observed from this economics assignment to vary the total demand and supply imbalance. The inventory levels also play a major role while determining the price of gasoline (Mankiw & Taylor, 2011). If problems are arising in the refinery and pipeline industries, undetermined declines in the supply of products and stocks may be observed. This sudden decline in the value of inventories can affect the bid of wholesalers that may not be adequate for future supplies. Certain imbalances may also be noticed while changing the region for the gasoline sold (Rauch & Gronalt, 2011).

(Robertson, 2019)

Conclusion

Australian government actions are required to gain intergovernmental cooperation so that the regulatory outcomes can be altered and thus will influence the energy suppliers. The policy that can be taken is the gas reservation policy that will help in addressing the issue of price that are linked with LNG exports on the east coast. As seen from the economics assignment, Australia produced 2462 PJ of gas. Australia will be needed to lift the overall output by 50 percent to meet the expected exports in 2020. Even if the domestic consumption remains stagnant, it needs to pace up the gas output so that the export and local needs can be meet. Overall, it can be commented that the demand of the gas remains on a higher note while the supply is stagnant. Thereby, it is important that the government should come into picture and frame policies so that the deficit can be removed. It must ensure different policies that will help in the attainment of export goals and even justifies the demand of the citizens.

Question 2

Introduction

The Australia industry and community benefitted themselves with the low price of electricity and gas for a prolong time. However, in the present economics assignment, the steep increment in the price of gas and electricity has surprised the industrialists. The increment in the prices of electricity and gas has not only enhanced the competition on the international scenario but even forced them to increase the cost due to which immense problem is faced in terms of productivity and efficiency. The increment in prices has not influenced the standard of living of local people but also created immense difficulties for the heavy industries. The discussion on the problem will be dealt with the help of demand and supply mechanism. Further, the discussion will spread to energy policy framework of Australia and the decision taken by the department responsible for the same. The changes that happened in the energy sector will be discussed in the light of problem created by the high prices. The increment in the energy charges has not only led to huge competition between the large industrial consumers but also enhanced the problem due to the increment in the consumption charges of electricity (Robertson, 2019). Beyond question, energy is one of the most important elements that is required in every product and service and influences every business.

Analysis

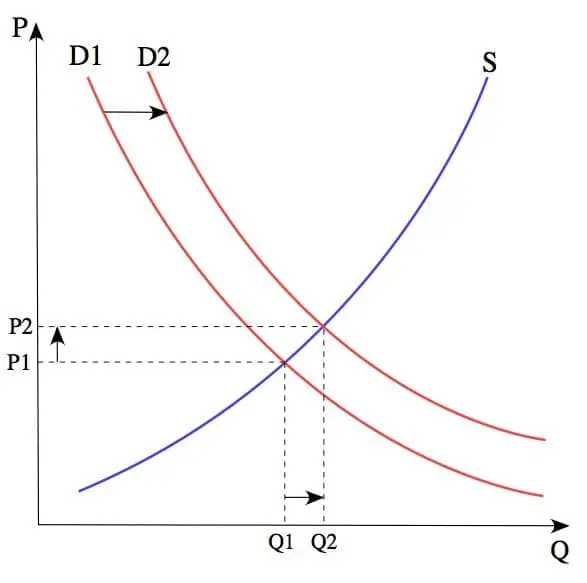

The price of any product is based on demand and supply function. We can also say that the price is set in this economics assignment based on the product price at a given quantity and the purchasing power of people demanding such good. In the diagram given below the ship from D1 to D2 shows an increase in price and quantity sold. The quantity of product sold and produced is highly influenced by the scarcity of energy and increase in price. If energy is scarce and they are obtained at a higher price then there will be a reduction in the production of such goods and also the wages of workers will be reduced. To deal with the high energy cost, some Industries located in Australia has started purchasing goods from other countries. This is also shown in the diagram provided below.

This process will have a huge impact on countries that have a low wage level as it would decrease the wages of workers who are not very skilled and are on the verge of finishing their education. If the age of the workers is less they won't be able to purchase goods which have been made using energy products. This demand deficit on the part of curse we lead to the fall of commodity prices like oil. In the long run, the prices can even fall below the production cost.

Impact on the Australian economy that is heavy industry

On carrying out proper economics assignment research, it was found that there was a permanent increase of 10% in the electricity generation prices as well as the domestic gas. This led to the fall of GDP of the country by 0.46 percent. Later it was studied from the economics assignment that if there was an increase of 25% in the prices of electricity and domestic gas then there would be a decrease of 27% in the plastic, rubber, chemical industry of Australia. This will have a huge impact on the country and its economy because there would be an economic loss of 19 billion dollars. Such a huge loss will surely impact the population of the country badly.

In Australia, the most popular company engaged in producing and manufacturing steel is known as Bluescope. The two major components required in the electricity and gas industry is wire manufacturing as well as the production of steel products. There are about 6500 people who are employed in this company. The company also has various manufacturing plants that are located in Victoria, New South Wales as well as Queensland. The company collects 70% of its revenues from domestic sales which are engaged in the building and construction sector. As per the reports it has also been observed that the energy cost which is paid by the company in the US is much lower than what it is in Australia. As per the economics assignment it was expected that the electricity cost would go up twice in the coming 2 years which in absolute terms amounts to 54 million dollars. So, we can conclude that the increase in energy prices is creating a used pressure on the heavy industry by increasing its cost of production.

Energy is required by the manufacturing sector when compared to a nonmanufacturing sector or a domestic sector. The industrial sector can be further categorized into energy-intensive manufacturing and non energy intensive manufacturing. The total fuel consumed by industry is highly dependent on the technological as well as economic development that is happening in various regions and countries (Sabateir, 2016). The industrial sector uses energy for many purposes which further increase the cost of the finished products. An increase in the price of the product is always considered to be negative because it harms the customers of the product. It is the most common fact of commerce that the customers are satisfied when they are provided best quality product at the most reasonable price (Braeutigam, 2010).

The companies in this sector used an economics assignment model to determine the impact of rising energy prices. These economic model not only help in anticipating the economic effects on a particular country but it also helps in finding out the sustainability of these increasing prices of energy cost. Two different scenarios were studied by the economist. The first scenario is a 10% increase in electricity price whereas the second scenario was a 25% increase in electricity price and domestic gases. These increasing prices would have a great impact on the domestic market because the exports of the country will be badly affected. It is expected that the company might observe and unstable situation in an economy before if the supply of electricity and the consumption of gas is not balanced properly (Cairney, 2011). To keep control over the manufacturing cost various proper models are needed to look upon the consumption of raw materials.

The sudden increase in the prices of electricity which has been causing problems in the manufacturing industry was followed by unnecessary interference by the state and Federal government. It was observed in this economics assignment that this problem was accompanied by a fall in the efficiency and quality of the acids that we use in the production by the companies. The inflation in the prices of electricity and gas not only lead to a change in demand but also various seasonal changes were observed. There was a decrease in demand for the goods because of which a company's seasonal business was badly affected.

It is the basic function of every production house to match its demand and supply by using minimum labor and resources most optimally and getting maximum revenue. The company needs to match demand with its supply because it would help them to see the resources which are scared and are getting expensive day by day. As per this economics assignment a company can improve its efficiency by updating its machines and technology rapidly. A New Machine always reduces resistance which will help them to save electricity. The company might have to work according to a particular model if there are an unpredicted demand in the organization for certain products. A company can reduce its cost of production by using renewable resources as its raw material because it is a source of energy which can be obtained at a low cost (ECTL, 2019). If a company improves its technology then the price of non-renewable source of energy will fall and along with the efficiency by which the production is carried out will increase.

The most common problem of producing energy using wind and solar energy is that the total amount of energy produced cannot be predicted and it is very fluctuating. This issue can be resolved by introducing large batteries and pumping hydro facilities which will help in a large-scale storage operation. However, the development of economics assignment mechanism encourages the company to be eco-friendly which will also affect the cost of the products. An eco-friendly product also shows that the company is very responsible towards the society and the environment which gives a positive impression of the company (Swoboda, 2019).

Australia should take certain steps to reduce the price of energy in the long run because a major industrial sector of the economy will be affected because of this inflation. A company should also strive to maintain its carbon emission level. The other policies that are set up by the US revolution will help in improving the infrastructure facility and would also help in reducing the energy and gas prices which are used by the industry and domestic sector (ECTL, 2019).

The national energy guarantee will appoint a marginal producer has allowed providing a uniform price auction in which all the builders will be provided a chance to give a market-clearing price. It becomes very difficult to provide energy at a low price because it is very important to generate energy through wind and solar power (Electric, 2016). Other factors remaining constant, the low-cost technology that has been introduced in the market a shift in the supply curve towards right it as the resources have become cheaper. No matter what it is very important for all the companies in the industry you understand the relevance of using renewable resources of energy. The obsolete technology and machines should be removed and an improved Technology and machine should be adopted by the company to improve its efficiency and reduce the cost of production for the company. It is a known fact that if the cost of raw materials increases then the price of the finished product also increases. This will increase the price that has to be paid by the consumers which will discourage them to use this product and switch to another. A company should always try to reduce its cost of production so that it can provide the product at a reasonable price to its customers and provide them satisfaction (Electric, 2016). The availability of resources is always scarce, so a company must use its resources in an optimum manner. If a company fails to do so then it will increase the price of the product which will further affect the profitability of the company in the long run. Every company should focus on satisfying its customers along with earning profits.

Conclusion

Heavy industries present in Australia will face immense challenges owing to the disturbance in the demand and supply of energy. Hence, it has become difficult to have a control on the cost of production. With a sharp increase in the prices of energy, the price of production has increased to a great extent thereby the production costs too have surged high. It is one of the major challenges for Australia because the economy depends on the functioning of the heavy industries. Hence as per this economics assignment, the regulators must look into the matter and device mechanism that will enable to maximize efficiency with the help of new product and processed. Considering the overall discussion and the total trend, it can be commented that an integrated solution is the need of the hour. This will helps the heavy industries to perform without depending on the energy. This will create beneficial result and help the heavy industries to flourish without depending entirely on the energy. Thereby, the government and regulators must ensure that the privatization of the state government owned electricity networks must be done, alteration should be introduced to the policies of the environment that influences energy costs, deregulation of the retail price and establishment of reliability standards, etc will create positive yield for the heavy industries, as well as entire economy as a whole.

Economics assignments are being prepared by our economics assignment help experts from top universities which let us to provide you a reliable assignment help online service.

Reference List

AIP. (2018). Facts About Petrol Prices. Retrieved from https://www.aip.com.au/resources/facts-about-petrol-prices-0

Braeutigam, R. (2010) Microeconomics (4th Ed.). Wiley.

Cairney, P. (2011). Understanding Public Policy: Theory and Issues. London, Palgrave

Chester, L. & Morris, A. (2016). A new form of energy poverty is the hallmark of liberalised electricity sector. Australian Journal of social issues, 46(4), 435-459. DOI: 10.1002/j.1839-4655.2011.tb00228.x

ECTL. (2019). Gas prices hit 10-year high. Retrieved from http://www.ectltd.com.au/gas-prices-hit-10-year-high/

Electric, S. (2016). The changing face of Australia’s Heavy Industry. Retrieved from: https://www.australianmining.com.au/news/the-changing-face-of-australias-heavy-industry-2/

Fleetwood, S. (2014). Do labour supply and demand curves exist?. Cambridge Journal of Economics. 38 (5): 1087–113. Doi:10.1093/cje/beu003

Freedman, L. (2013). Strategy. Oxford University Press

Janda, M. (2018). Oil price rise hit economy but KNG, coal exports soften the low: HSBC. Retrieved from https://www.abc.net.au/news/2018-10-29/oil-price-rise-hits-households-but-lng-exports-offset-the-blow/10441050

Janda, M. (2019). Gas prices will rise and there is not much we can do to stop it. Retrieved from https://www.abc.net.au/news/2017-03-09/gas-prices-will-rise-and-there-is-not-much-we-can-do-to-stop-it/8340536

Mankiw N., Gregoryand S and William M. (2011) Macroeconomics. Canadian ed., 4th ed. New York: Worth Publishers

Mankiw, N.G. and Taylor, M.P. (2011). Economics (2nd ed) Andover: Cengage Learning

Rauch, P., & Gronalt, M. (2011). The effects of rising energy costs and transportation mode mix on forest fuel procurement costs. Biomass and Bioenergy, 35(1), 690-699. DOI: 10.1016/j.biombioe.2010.10.015

Robertson, B. (2019). IEEFA update: The staggering cost of gas in Australia. Retrieved from http://ieefa.org/the-staggering-cost-of-gas-in-australia/

Sabateir, P. A. (2016). Analysis of the Policy. Comparing Government Activity

Swoboda, K. (2019). Energy prices—the story behind rising costs. Retrieved from https://www.aph.gov.au/about_parliament/parliamentary_departments/parliamentary_library/pubs/briefingbook44p/energyprices

Get Top Quality Assignment Help and Score high grades. Download the Total Assignment help App from Google play store or Subscribe to totalassignmenthelp and receive the latest updates from the Academic fraternity in real time.