Economics Assignment: Case Analysis Based On Microeconomics & Macroeconomics

Question

Task:

The economics assignment consists of the following parts:

Part I. Microeconomics

Question 1

Consider the residential property market (i.e. buyers and sellers of houses) in Dublin, and the mortgage market for those properties.

A. Describe and explain the type of market structure in which mortgage suppliers operate, including a critical characterisation of the key underlying market characteristics/assumptions.

B. Two lenders announced that they will leave the Irish market next year. Use the demand and supply model to predict and explain how such decision of exit can affect competition in the market for mortgages, and how the residential property market might be affected. Make any extra assumption you deem appropriate. Use diagrams to support your arguments.

Part II. Macroeconomics

Question 3

Consider the IS-LM model to represent the economy in the short run.

The development of new variants of SARS-CoV-2, the virus that causes covid-19, has challenged the idea amongst many economists that the effects of the early 2020 shock to an economy can be treated as a one-time shock (i.e. the economy is affected by a temporary shock and then would eventually return to the levels pre-pandemic). Consider a new scenario in which the coronavirus pandemic persists over the next few years (e.g. three-five) on a significant scale and, as a consequence, there will be recurrent outbreaks leading governments to oscillate between imposing and lifting sanitary measures. Suppose that people are very likely to change their consumption behaviour due to the perceived risk of infection, even for those who have been vaccinated and/or infected in the past.

A. Suppose no government intervention for the moment. Discuss the possible effects of the new scenario of recurrent outbreaks over the next few years on the composition of both aggregate supply and aggregate demand. Use the IS-LM diagram to show the effect of this new scenario on output and the interest rate.

B. Consider now government intervention with the aim not only to protect people and firms but also to sustain the economy. Discuss the role of fiscal policy to sustain demand. Use a diagram to support your arguments.

C. According to the last release of the Quarterly Bulletin, October 2021, the Central Bank of Ireland has announced a positive outlook for the economy out to 2023, with domestic activity back to prepandemic levels by end-2021, despite that uncertainty remains high. Domestic demand is forecast to grow by 5.5% in 2021, and by 7.1% next year. A recovery in consumption will play a substantial role, as household spending relative to incomes normalises (i.e. return to pre-pandemic ratio). Consumption is forecast to grow by 6.2% this year, and by 8.3% and 5.1% next year and in 2023, respectively.

i) Critique the assumption that households will return to the pre-pandemic consumption levels.

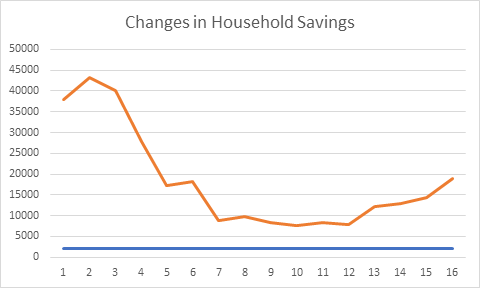

ii) Go to the Central Statistics Office website https://www.cso.ie/en/ and find the data on household saving from 1995. Calculate and create a graph (e.g. using Excel) showing the household saving rate from 1995. Discuss how the data may, or may not, support your critique in C i).

Answer

Economics Assignment Part 1

Answer 1

A.The evaluation into the residential property market in Dublin and Irish market effectively provides that the type of market structure in which the model is applied effectively undertake business operations is the oligopoly market structure. The oligopoly market structure is the one under which there is a significant number of buyers within the industry, and the selling power of the production services is primarily restricted to a handful of suppliers. Mortgage suppliers are mostly individuals or institutions capable of providing appropriate financial assistance to many borrowers depending on their creditworthiness and repayment capabilities (Ukav, 2017). The evaluation into the supplier mortgage market in economic terms in respect to the residential property market of Dublin and Ireland effectively provides that Institutions within this industry primarily undertake business operations within the money market. Therefore, business operations within this market structure are primarily dependent on a small group of sellers and an extensive group of buyers who do not have appropriate power to change market conditions. Therefore, an evaluation of the key characteristics along with critical evaluation into the type of market structure within which model suppliers effectively undertake business operations is effectively provided below.

The critical evaluation of the characteristics and assumptions used within the oligopoly market structure is effectively discussed below.

Significant barriers to entry: within the oligopoly market structure, there are significant barriers to entry within the industry as no outsider can undertake business operations within the industry independently and has to comply with various norms and regulations (Romagnoli et al., 2018). To effectively undertake business operations within the mortgage supply industry, complying with financial regulations and maintaining a huge capital outlay is very important.

Nonprice competition: Competition within an oligopoly market structure is not primarily based on competitive pricing. Many factors provide a competitive edge to a business organization within such a market condition (Lee et al., 2018). Many market supplies effectively develop new and better services to provide appropriate satisfaction to the customers at similar prices and take nonprice competition for enhancing organizational revenue and market share.

Interdependence of businesses: within the oligopoly market structure, business organizations have to directly or indirectly depend on competitors as the entire market is well regulated by a governing authority (Hiessl, 2018). Therefore, actions undertaken by a specific business organization must be effectively incorporated by other businesses within the industry to ensure efficient business operation.

B. The exit of two eminent leaders from the mortgage supplier market will have a significant impact on the overall supply of mortgage Services within the industry and have a serious impact on market equilibrium. Within the oligopoly market setup, the supplies within the industry have a significant power to control the level of demand and supply within the industry, along with impacting prices and the overall level of competition. Under such a market condition, the exit of two eminent leaders will significantly impact the market equilibrium as the total supplier of mortgage Services within the industry will be proportionately reduced, providing restricted access to customers.

Figure 1: demand supply model

(Source: Wörner, 2019)

Demand supply model can be effectively identified as the structure that helps to effectively evaluate the level of demand in respect to specific products and services within the industry in correspondence to the willingness of the supplier to make effective supplies. Therefore, it can be effectively identified as the combination between the buyer’s preference to purchase specific products and services and the seller’s preference to supply the same at a given price and specific point of time.

The mortgage supplier industry is identified to have very stiff competition primarily due to the limited number of suppliers and the significant presence of customers within the industry. After the exit of this to business organizations from the market competition within the industry will be significant for a specific period as other competitors will be more likely to attract the customer base of the retiring companies to enhance their revenue-generating capacity and market share within the industry (Wörner et al., 2019). Therefore, the evaluation effectively provides that competition within the industry will be enhanced for a specific period after the exit of these two business organizations. After the market share is effectively stabilized, the competition will baby proportionately reduced by the level of competition with which the retiring business undertook operations within the industry.

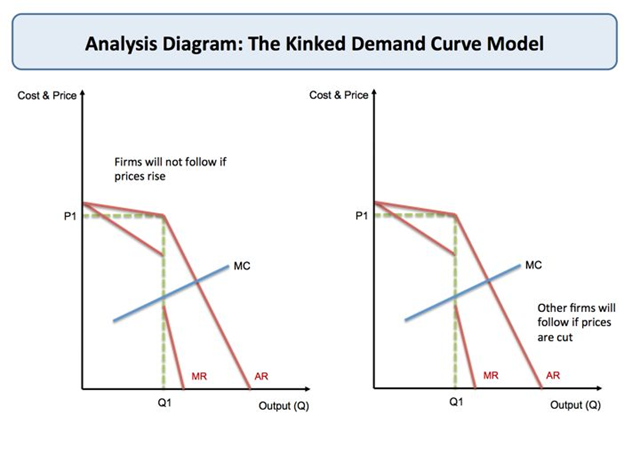

Figure 1: impact of market exit in Oligopoly market structure

(Source: Wörner , 2019)

Concerning the residential property market, there will be a proportionate reduction in the level of service availability as the retiring business organizations will not be able to effectively provide the existing services to the existing consumer base. The market created by these two business organizations within the industry will be significantly hampered for a specific period of time until they are effectively attracted by other competitors within the industry (Price, 2017). Therefore, others completed within the residential property industry will have to effectively enhance their operating capabilities to effectively cater to the customers of the retiring business organizations to ensure adequate stability within operations of the industry, under a situation where the competition within the industry is unable to cater to the customers of the retiring business organization. There will be a significant gap within the operating efficiency of the industry as a large number of customers will not be able to effectively get the services network to create dissatisfaction among the customer group.

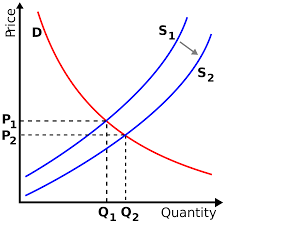

Figure 2: increase in supply due to market exit

(Source: Price, 2017)

Therefore, under a situation where two lenders announce to leave the market, the competition within the industry will be significantly relaxed as the customer base of these two business organizations will be effectively distributed among the other competitors within the industry, providing them with appropriate scope of business development and enhanced revenue-generating capacity (Poyrazoglu, 2021).

Part 2

Answer 3

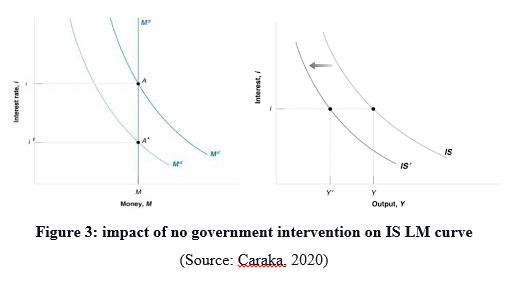

A. Aggregate demand can be effectively identified as the total demand of a specific good or service within a particular market, and aggregate supply can similarly be identified as the total supply of the specific good or service to the industry to meet the aggregate demand effectively. The situation is identified as a market equilibrium at which aggregate demand and supply intersect one another under favorable market conditions. At this position where aggregate demand is equal to aggregate supply, effectively implies that the supply can effectively meet the demand within the industry under a specific point of time and at a given price. During the covid-19 pandemic, the aggregate demand of individuals within the society was significantly reduced as the total amount of consumption and investment within the household has reduced considerably, and household primary is saved funds for meeting future contingencies (Caraka et al., 2020). Aggregate demand can be effectively identified as the total of consumption investment government spending, and net export. Their food has all these elements of aggregate demand witnessed a significant reduction during the covid-19 pandemic, the total aggregate demand of the economy significantly reduced.

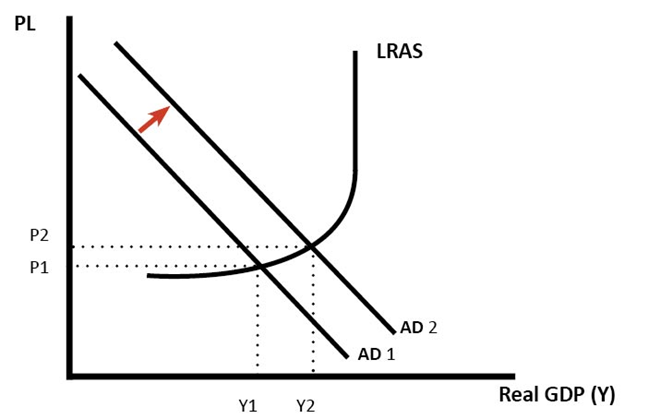

Figure 3: impact of no government intervention on IS LM curve

(Source: Caraka, 2020)

As a significant decrease in the aggregate demand for specific products and services within the industry during my covid-19 pandemic, there was a substantial reduction in aggregate supply within the economy. The significant decrease in aggregate supply and aggregate demand leads to a situation of the market in equilibrium during the covid-19 pandemic creating significant problems for government organizations to ensure appropriate economic Revival.

Evaluation of the possible effect of a significant reduction in aggregate supply and demand during the covid-19 pandemic effectively provides that the total output and level of production within the economy had significantly reduced considering the prolonged effect of a covid-19 pandemic. The total GDP of both developing and developed Nations reduced considerably, primarily due to inefficient economic activity within the economy (Dev and Sengupta, 2020). The per capita income and spending power of individuals within the society also decreased primarily due to a lack of employment opportunities and a significant decrease in the revenue-generating capacity. As aggregate demand also reduced significantly during the financial year of the covid-19 pandemic and now as the covid-19 pandemic is identified to have a prolonged effect, suppliers of various nonessential commodities suffered significant losses, which consequently had a very serious impact on economic growth and development. Supplies within Industries were also hampered as goods and services being produced by organizations engaged in producing nonessential commodities were not in demand within the economy. Therefore, undertaking the same would be ineffective and loss-making (Açikgöz and Günay, 2020). Thus, the evaluation effectively provides that the covid-19 pandemic seriously impacted various macroeconomic factors such as the decrease in GDP growth, increase in the unemployment rate, reduced revenue-generating capacity within the society, and reduced per capita income decreased consumption expenditure, and many more.

Furthermore, the evaluation into the significant decrease in aggregate demand and aggregate supply within the economy primarily due to the prolonged effect of the covid-19 pandemic is a significant increase in inflation that has significantly impacted economic growth and revenue-generating capacity of individuals within the economy. The increase in the inflation rate has dramatically led to the increase in the specific commodity prices within the market. It has a significant impact on the increase in borrowing rates from Financial Institutions (Bardey et al., 2021). The rate of interest from Financial Institutions is significantly increased as there is a significant reduction in the level of economic activity within ignoring me, which will have a considerable impact on the revenue-generating capacity of business organizations.

B. Fiscal policies can be effectively identified as the Strategies and regulations implemented by the government to ensure balanced sustainable growth and development within the economy. Under the fiscal policy process, the government effectively utilizes taxation and government spending to boost economic growth within the economy with the primary objective of solving financial problems such as poverty, unemployment, reduced revenue-generating capacity, and per capita income (Ozili and Arun, 2020). With the help of effectively euthanizing fiscal policies, the government can provide appropriate stimulus to economic growth to ensure sustainable operations within the economy in the long run.

During the covid-19 pandemic, as there was a significant economic breakdown within both developing and developed Nations, fiscal policies play a very important role towards economic Revival and provide appropriate stimulus to businesses to undertake favorable business operations. It is evident that fiscal policies play an essential role in economic growth and development and ensure sustainable economic operations during economic contingencies (Susilawati et al., 2020). Fiscal policies are therefore identified to create sustained demand within the economy effectively. The creation of demand stimulates economic activity such as product sales and operations that provide an appropriate opportunity for creating revenue within a wide variety of economic sectors and provide scope for economic Revival. The role of Fiscal policies towards sustained demand is effectively discussed below.

Figure 4: Expansionary Fiscal policies

(Source: Susilawati, 2020)

Mobilization of resources: fiscal policies help towards efficient and economic mobilization of resources within both the public and the private sector of the economy based on the level of efficiency with which they are operating. The efficient channelization and mobilization of resources within the economy sector help increase the rate of investment and capital formation. It consecutively results in access to the letting the rate of economic growth and development as there is economic growth and development within the economy—the earning ability of individuals increases along with the significant reduction in the unemployment rate and inflation. Therefore, fiscal policies have played an important role in solving economic problems and ensuring sustained growth and development.

Encourage optimal social investment: under a situation where individuals' earning capability within a society increases, the spending power also increases considerably. Fiscal policies effectively provide appropriate avenues of effectively channelizing the increased earning capacity of individuals so that increased earnings can be effectively utilized towards profitable away news rather than being wasted towards unproductive investment (Grima et al., 2020). The fiscal policy effectively facilitates the investment of funds towards developing social and economic infrastructure capable of enhancing economic growth and development in the long run.

Increased employment opportunities: with the help of Fiscal policies, in government effectively makes specific investments towards the development of infrastructure and other activities of social interest. Towards these activities effectively creates demand for employment that creates significant employment opportunities within the economy. With the help of creating employment opportunities, fiscal policies help to word in average growth and development as individuals earning capability increases and a decrease in the unemployment rate.

Before the process of Fiscal policies can be effectively identified as the primary measures used by the government to ensure sustained growth and development within the economy and provide an appropriate opportunity for economic Revival during contingencies.

C.The evaluation into the Global Trends of the covid-19 pandemic and the impact of the same towards economic operations of Ireland effectively provide that the household consumption is not likely to effectively reach the level of Pre pandemic ratio by the end of the financial year 2023 and will therefore require additional time for Revival. The primary reason behind the assumption that the household consumption and expenditure will not return to the pre-pandemic level of consumption is that all sectors of economic cooperation are significantly hampered due to the negative impact of the covid-19 pandemic. Even currently, Ireland has not completely overcome the negative impact of the covid 19 pandemic and is still facing the consequences of the pandemic at a severe scale (Chaudhary et al., 2020). The pandemic is presently at an unidentifiable stage, and assumptions cannot be made that the pandemic is entirely over from the world. Therefore, a steep increase in the cases of covid-19 within one economy across the globe will significantly impact economic operations in various other related countries, hampering the overall level of consumption.

Furthermore, during the covid-19 pandemic, unemployment was identified to be at its all-time high in Ireland creating significant stress towards the consumption expenditure of individuals. The covid-19 pandemic also allows individuals to save funds for future contingencies effectively. Therefore, as the covid-19 pandemic is still not over from the world, the level of consumption is not likely to return to the pre-pandemic period in the coming period primarily in respect to Ireland. Therefore, the covid-19 pandemic will have a profound effect on economic growth and development in the world and the level of consumption in Ireland. Consumption levels are not likely to affect the return to the pre-pandemic consumption level primarily due to the significant harm caused by the covid-19 pandemic towards the revenue-generating capacity of individuals and business operations.

|

Years |

Household savings |

Growth |

|

2004 |

37986 |

- |

|

2006 |

43314 |

14.02622 |

|

2007 |

40021 |

-7.60262 |

|

2008 |

27893 |

-30.3041 |

|

2009 |

17309 |

-37.945 |

|

2010 |

18171 |

4.980068 |

|

2011 |

8746 |

-51.8684 |

|

2012 |

9829 |

12.3828 |

|

2013 |

8356 |

-14.9863 |

|

2014 |

7654 |

-8.40115 |

|

2015 |

8293 |

8.348576 |

|

2016 |

7810 |

-5.82419 |

|

2017 |

12244 |

56.77337 |

|

2018 |

12894 |

5.308723 |

|

2019 |

14456 |

12.11416 |

|

2020 |

18974 |

31.25346 |

Evaluation

The evaluation into the Trends of household savings effectively provides that in the recent financial years, the level of household savings has significantly increased, which effectively signifies economic growth and development as savings will be effectively channelized towards profitable avenues. But during the current period of the covid-19 pandemic, savings are not primarily undertaken for investment purposes but for meeting contingencies in the future. The savings during the financial year 2019 have effectively increased by approximately 12%, and in 2020, the savings have officially increased by approximately 31%. It is effectively implied that individuals within the society are more focused on generating savings to meet contingent situations in the future, primarily due to the prolonged effect of the covid-19 pandemic. Therefore, this also justifies that consumers cannot reach the free pandemic level in the coming few years of business operations as individuals within society are more focused on generating savings for meeting contingencies rather than using the savings towards consumption expenditure.

References

Açikgöz, Ö. and Günay, A., 2020. The early impact of the Covid-19 pandemic on the global and Turkish economy. Turkish Journal of medical sciences, 50(SI-1), pp.520-526.

Bardey, D., Harker, A. and Zuluaga, D., 2021. Price cap regulation in the Colombian pharmaceutical market: An impact evaluation.

Caraka, R.E., Lee, Y., Kurniawan, R., Herliansyah, R., Kaban, P.A., Nasution, B.I., Gio, P.U., Chen, R.C., Toharudin, T. and Pardamean, B., 2020. Impact of COVID-19 large scale restriction on environment and economy in Indonesia. Global Journal of Environmental Science and Management, 6(Special Issue (Covid-19)), pp.65-84.

Chaudhary, M., Sodani, P.R. and Das, S., 2020. Effect of COVID-19 on economy in India: Some reflections for policy and programme. Journal of Health Management, 22(2), pp.169-180.

Dev, S.M. and Sengupta, R., 2020. Covid-19: Impact on the Indian economy. Indira Gandhi Institute of Development Research, Mumbai April.

Grima, S., Dalli Gonzi, R. and Thalassinos, E., 2020. The impact of COVID-19 on Malta and it’s economy and sustainable strategies.

Hiessl, C., 2018. FLEXICURE LABOUR MARKET STRUCTURES. Zbornik Pravnog fakulteta Sveu ilišta u Rijeci, 39(4), pp.1883-1905.

Lee, H.C., Kim, H. and Yoon, Y.T., 2018. Optimal ESS investment strategies for energy arbitrage by market structures and participants. Journal of Electrical Engineering and Technology, 13(1), pp.51-59.

Ozil, P.K. and Arun, T., 2020. Spillover of COVID-19: Impact on the Global Economy. Available at SSRN 3562570.

Poyrazoglu, G., 2021. Determination of Price Zones during Transition from Uniform to Zonal Electricity Market: A Case Study for Turkey. Economics assignment Energies, 14(4), p.1014.

Price, R., 2017. The modernization of rural France: communications networks and agricultural market structures in nineteenth-century France (Vol. 13). Taylor & Francis.

Romagnoli, F., Molina, J. and Parrado, Á., 2018. How to improve smallholder market access: Evaluation of Mercados Campesinos in Colombia. Agronomía Colombiana, 36(1), pp.79-87.

Susilawati, S., Falefi, R. and Purwoko, A., 2020. Impact of COVID-19’s Pandemic on the Economy of Indonesia. Budapest International Research and Critics Institute (BIRCI-Journal): Humanities and Social Sciences, 3(2), pp.1147-1156.

Uk, I., 2017. Market structures and concentration measuring techniques. Asian Journal of Agricultural Extension, Economics & Sociology, pp.1-16.

Wörner, A.M., Ableitner, L., Meeuw, A., Wortmann, F. and Tiefenbeck, V., 2019. Peer-to-peer energy trading in the real world: Market design and evaluation of the user value proposition. In 4th International Conference on Information Systems (ICIS 2019).