Disney And Pixar Marvel Strategic Management Essay

Question

Task:

In a short academic essay evaluate ways in which organisations may successfully implement strategic change. Discuss this via reference to an organisation with which you are familiar. This may be an organisation you work for, have worked for or any organisation in the public domain

In answering this question you will need to apply academic theory and models to your chosen organisation.

You are required to produce

- Work that demonstrates your ability to apply relevant academic theory when exploring strategic change and its implementation

- Critical analysis of the strategic development including how to overcome any potential resistance to it , including recommendations/justifications based upon your analysis

- Work that is underpinned by academic references from a range of academic journals and textbooks. You need to attach a reference list, which covers only the references used in your work.

- Work that it is an essay format (ie no headings) that is written in the third person

Answer

Introduction

The reason outlined in the present context of strategic management essay why strategic changes are crucial is because of its responses the enables corporations in maintaining co-alignment with shifting social, competitive, and technological environment (Rothaermel 2016). Besides, strategic changes provide an opportunity for the workforce to learn new and advanced professional and cognitive skills that results in improving overall productivity of the corporation. The study build on this strategic management essay aims in discussing impact of strategic changes in both positive and negative along with neutral perspectives. Many studies considered to prepare this strategic management essay stated that strategic changes define as a reframing of the organizational structure in aspects to management, cultures, and so on.

What is the significance of merger and acquisition in the context of strategic management essay?

According to Wasko (2020), it is stated herein strategic management essay that mergers and acquisitions occur when two companies willing to join their forces to gain a competitive edge and massive profitability from the market. There are diverse advantages along with disadvantages situated in stimulating mergers and acquisitions. In the context of advantages, economies scale of the huge industries become more efficient, more profit earned the lead in encouraging more research and development along with the struggling corporation gets benefits from the management of the strong corporations. Opposing to discuss advantages, any firm formulated with monopoly power may become inefficient in collaborating with the changes. Supporting the context Vedd and Liu (2017), mentioned two completely different firms when merge can encounter massive struggle or complete failure. Additionally, diseconomies of scale are even evidenced. In the study, the famous merger and acquisition occurred between Disney and Pixar Marvel is discussed. The purpose of the study mentioned in this strategic management essay is to explain influential strategic changes, leading to structural reframing for both the merger and merging companies in both positive and negative perspectives.

As stated by Venzin, Vizzaccaro & Rutschmann, (2018), Disney and Pixar always shared a close relationship. DePamphilis (2019), mentioned that after Disney acquired Pixar shares worth $7.4 billion, making it Disney’s subsidiary, Disney benefited itself achieving the most innovative computer animation studio. On the other side, Pixar was benefited from Disney’s first-class distribution network along with its cushy financial safety net (Narayanan 2019). After the merger, diverse changes in the operation management process of both the companies were noticed as Steve Jobs become a major shareholder in Disney along with its membership of the board. As stated by KOCHNEV (2019), Catmull became the president of both Pixar Animation Studios and Walt Disney. It has been observed in the present context of strategic management essay that before the merger, Disney was demoralized, failing as a corporation. The gaps due to which the corporation encountered such a disastrous moment faded after its merger with Pixar, as the major issues of inappropriate management system in Disney were addressed by innovative studio experts in Pixar. As depicted by Kumar and Sharma, (2019), strategic alliance management was major strategic changes noticed within Disney and Pixar after their merger.

Application of academic theory while exploring strategic change and its implementation

The reason for and impact of the merger held between Disney and Pixar can be explained with the help of inefficient management theory within this strategic management essay. As mentioned by Tjemkes, Vos & Burgers, (2017), inefficient management theory highlights the major reasons due to which two companies decide to uphold mutual understanding while collaborating entire business activities. As discussed before popularity of Pixar was poor as compared to Disney, whereas, innovation studio of Disney is not accurate as compared to Pixar. As opined by Bhattacharya (2016), after the establishment of a merger, CEO of Disney Jobs become main director of both the company and has prioritized strategic changes by emphasizing on inefficient management (one component of inefficient management theory) of Disney by the assistance innovative studio team of Pixar. The popularity of Imagineering Project managers is popular for their animated creation and theme Parks and attraction parks. The execution of all such theme parks and attraction park was possible with the mutual support of the innovative and creative department of Pixar.

Strategic management alignment changes that occurred after the establishment of a merger between Disney and Pixar reframed managerial concepts within the workforce. Both the company was identified in improving their professional and imaginative skills. These changes stated in the strategic management essay were identified with the growing scale of profitability of both the companies. According to Yang (2019), the management and control in managing the efficiency of the asset while integrating with the necessary supply of managerial capabilities were found lacking in Pixar. This issue of managerial and control in Pixar was addressed after Job took entier control of the Pixar under his assistance (Scott 2017). Besides, as per the inefficient management theory of merger, the replacement of incompetent managers after the merger is replaced. In both the case of Disney and Pixar presented in the strategic management essay, the main directorship was handled by Steve Jobs.

Critical analysis of the strategic development including how to overcome any potential resistance to it

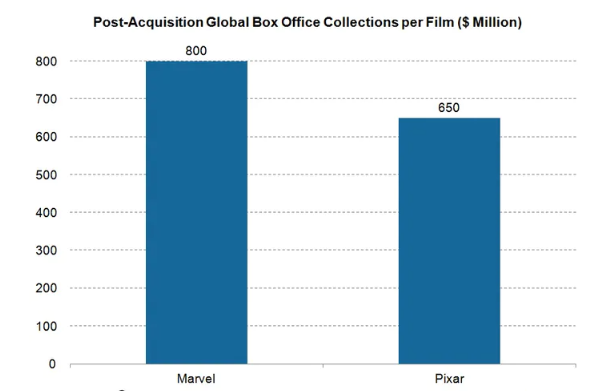

As opined by Sturgill (2019), after the merger between Disney and Pixar established, both the company rendered huge profitability which can be examined by reviewing the averaged revenue generated by both the company which is approximately $650 million. This can be evaluated that before this merger Disney was identified to be lacking financial support and shareholders’ trust in the market due to which the market price of Disney shares was not desirable. This $650million earned was the result of 13 films on which both Disney and Pixar produced post-acquisition. After reviewing the survey record, Krafczyk (2019), mentioned that these films were rated 85% in the international box office on Rotten Tomatoes. Opposing the fact Kumar, Anand & Song, (2017), stated that with the acquisition of Disney, Marvel was benefited more as compared to Pixar as Marvel earned $800 million in the global box office.

Figure 1: Results from post-acquisition in aspect to Pixar and Marvel

(Source: Kumar, Anand & Song, 2017)

It has been stated by Kumar et al., (2017) in regards to the case scemario of strategic management essay, that after the establishment of post-acquisition, Pixar was identified as majorly benefited. The popularity of Pixar as compared to Disney before the acquisition was not identified as massive in the entertainment market. However, after the establishment of post-acquisition Pixar was benefited as its rendered opportunity to improve its brand recognition in the entertainment market implementing Disney sources like Media Networks, Customers Products, Interactive segment along with enormous promotion in Disney Resorts and Parks. Throughout the year after the merger of Disney Pixar, the problems faced by both the companies were still somehow identified. Despite both Disney and Pixar were endured massive changes that helped both the companies in creating best-animated production which raised revenue scale and profitability of Pixar and Disney.

As stated by all the social and economic profits sustained by Pixar and Disney was easily rendered. Both the companies compromised something or other during the time of acquisition. To achieve their targeted goals of a strong position in the entertainment market and to be successful and leading brand in international, combined and formulated into Disney Pixar. On the contrary, it is also stated herein strategic management essay that the major issues after the merger were evaluated a lack of trust. The co-founder of Pixar, Steve Jobs and head worker of Disney Michael Eisner never believed that they can rely on each other and can take Disney Pixar into such a highly competitive position in the entertainment market, for which they always wish and targeted. However, the major strategic changes in the managerial development, strategically aligned management, eliminated the strained issues of both the companies by just agreeing into the partnership. After the acquisition of two top animated productions house Disney and Pixar, it became easy for both the companies to eliminate challenges and threats that arise from the external factors as the strategic alignment management approach had enhanced the professional and cognitive skills of the workforce.

On the contrary, it is noted in this strategic management essay that stakeholders of Disney were worried about the acquisition as they assumed that the Disney culture of movies would be compromised after collaborating with Pixar’s movies innovative generation techniques. The culture created by Walt Disney for its workforce was vital to creativity and innovation which accentuated Disney as a leading and successful entertainment business in the market. In the context of strategic management essay, Kumar et al., (2017), stated that the four believes of Disney that leads to interconnect its cultural process, employees recruiting, care, communication, and training were replaced from the innovative and advanced technological aspect for improving managerial process and control. This chance was identified due to the strategic alignment management that was integrated after the merger of Disney and Pixar. Merging of two leading companies rendered potential in creating barriers in organizational changes. However, the issues and conflicts of Disney with its corporate partners and workforce were addressed only after changing the managerial structure of the company, which occurred after the merger.

The idea of Pixar merging with Disney was ideal because Disney’s animated movies were failing back-to-back before the year 2005, and this chance helped Imagineering project managers of Disney to reboot their managerial system. The merger rendered Disney ownership of the world-leading computer animation studio which was solely owned by Pixar. The merger between Disney and Pixar also helped Disney in improving its partnership with Apple which helped in opening different competitive opportunities for Disney in improving its popularity and market shares in the international market. Even after the merger, both Disney and Pixar were independent of one another. Disney stays tuned solely with 2D movies, and music for their fans, whereas, Pixar created another brand that emphasizes on actions and storylines. As a result conflict between the two companies was identified as workers of both the companies were chasing different vision and goals, although producing under the same name (Kumar et al., 2017). Disney wanted to embrace standard hand-drawn, princess style, and musical movies of Pixar, except the Pixar concept of storyline techniques. Rather than this, after the merger, Disney acquired Pixar’s animation techniques and has embraced it into its film. This resulted in the diminishing of Disney’s cultures which can be identified from the pictures like the Princes and the Frog. Hence, it has been evaluated from the entire information developed in this section of strategic management essay that Pixar Studio has majorly supported Disney’s production in diverse ways by generating eye-catching moments animated motioned movies. These movies were named under the production house of Disney which lite the entertainment market with the leading brand name Disney.

Recommendation/ Justification

Analyzing the contemporary situation of Disney Pixar, it is suggested in this section of strategic management essay that the executive associates of both the companies must set standard goals, objective and policies which would be mandated to be followed by both the corporate associates of Pixar and Disney. Besides, Disney Pixar can integrate Diff Tool in all the production houses as this tool is evidenced to be proficient in spotting trouble potential trouble in both the merger companies. Both the company is required to collaborate with the three governing principles that accentuate the foundation and reason behind the acquisition of Disney and Pixar, which ensures an effective flow of communication while eliminating conflict and disrupts due to cultural differences. Disney and Pixar can also collaborate with the McKinsey change management theory in order to avoid contemporary issues and conflicts. This would help the executive associates of both the companies in eliminating the limited integrated under complex managerial structure in the corporation. Hence, an effective leadership style like situational would help in encouraging and motivating employees of both the companies in following common goals and strategies of the company. This would help in generating an ethical working environment which would increase job satisfaction level within Disney Pixar.

Conclusion

From the above discussion on strategic management essay, it is evaluated that strategic alliance determined as a cornerstone for many companies like Disney and Pixar for sustainable competitive advantages. The merger between Disney and Pixar rendered both negative and positive implications. Both the companies were identified to encountered issues and benefits after the merger sue to strategic alignment changes, which impacted and reframed the managerial system of both the countries. Notwithstanding the above discussion on strategic management essay, Disney, after the acquisition has majorly benefited, as the leading computer animation studio, Pixar, came under it which helped Disney enhance its technological theme movies with diverse innovative ideas.

References

Bhattacharya, P. (2016). Integrating Mergers and Acquisitions with Enterprise Systems: Towards an Explanation. Case Studies Journal ISSN (2305-509X)–Volume, 5.

DePamphilis, D. (2019). Mergers, acquisitions, and other restructuring activities: An integrated approach to process, tools, cases, and solutions. Strategic management essay Academic Press.

KOCHNEV, M. (2016). Companies ‘mergers and acquisitions in example of The Walt Disney Company and Pixar (Doctoral dissertation, Masaryk University, Faculty of Economics and Administration).

Krafczyk, M. P. (2019). A media and entertainment colossus: the acquisition of 21st Century Fox by The Walt Disney Company (Doctoral dissertation).

Kumar, V., & Sharma, P. (2019). Why Mergers and Acquisitions Fail?. In An Insight into Mergers and Acquisitions (pp. 183-195). Palgrave Macmillan, Singapore.

Kumar, V., Anand, A., & Song, H. (2017). Future of retailer profitability: An organizing framework. Journal of Retailing, 93(1), 96-119.

Narayanan, S. (2019). Analysis of merger & acquisition frameworks from a deal rationale perspective in technology sector (Doctoral dissertation, Massachusetts Institute of Technology).

Rothaermel, F. T. (2016). Strategic management: concepts (Vol. 2). McGraw-Hill Education.

Scott, J. (2017). Disneyizing Home Entertainment Distribution. In DVD, Blu-ray and Beyond (pp. 15-33). Palgrave Macmillan, Cham.

Sturgill, J. (2019). Beyond the Castle: An Analysis of the Strategic Implications of Disney+.

Tjemkes, B., Vos, P., & Burgers, K. (2017). Strategic alliance management. Routledge.

Vedd, R., & Liu, D. (2017). The Effect of Cultural Integration on Financial Performance Post-Merger. Global Journal of Business Research, 11(1), 71-84.

Venzin, M., Vizzaccaro, M., & Rutschmann, F. (2018). Strategy', Making Mergers and Acquisitions Work (pp. 37-79). Strategic management essay Emerald Publishing Limited.

Wasko, J. (2020). Understanding Disney: The manufacture of fantasy. John Wiley & Sons.

Yang, J. (2019, August). Analysis of Business Operation Management under the Harvard Analytical Framework: A Case Study of the Walt Disney Company. In 1st International Symposium on Economic Development and Management Innovation (EDMI 2019). Atlantis Press.