Derivatives Assignment On The Instruments Used By Hertfordshire Petroleum Plc

Question

Task: Prepare a derivative assignment in not more than 2000 words discussing about the different aspects of the different derivatives instruments used by Hertfordshire Petroleum Plc.

Answer

Introduction

In this derivatives assignment, the different aspects of the different derivatives instruments which are used by Hertfordshire Petroleum Plc will be discussed.

Description of the derivative instruments

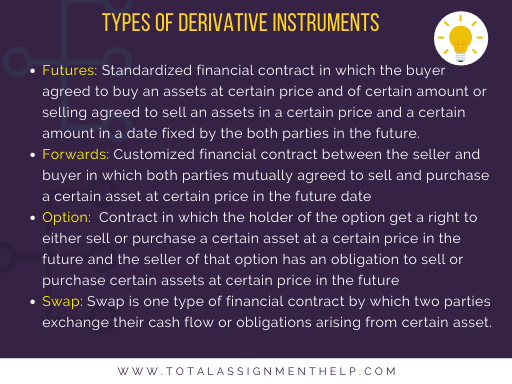

Futures are one type of standardized financial contract in which the buyer agreed to buy an assets at certain price and of certain amount or selling agreed to sell an assets in a certain price and a certain amount in a date fixed by the both parties in the future.

Forwards is one type of customized financial contract between the seller and buyer in which both parties mutually agreed to sell and purchase a certain asset at certain price in the future date.

Option is contract in which the holder of the option get a right to either sell or purchase a certain asset at a certain price in the future and the seller of that option has an obligation to sell or purchase certain assets at certain price in the future (Bacha and Mirakhor, 2019).

Bond with option means which gives different type of rights.

As per the research on derivatives assignment, Swap is one type of financial contract by which two parties exchange their cash flow or obligations arising from certain asset.

The principles of the futures or forwards pricing and valuations

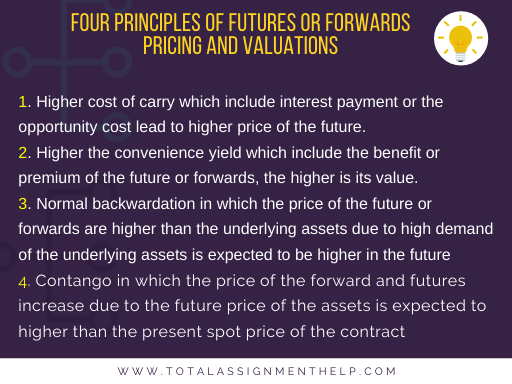

The first principle discussed herein derivatives assignment is higher cost of carry which include interest payment or the opportunity cost lead to higher price of the future. The second principle is higher the convenience yield which include the benefit or premium of the future or forwards, the higher is its value. The third principle is normal backwardation in which the price of the future or forwards are higher than the underlying assets due to high demand of the underlying assets is expected to be higher in the future. The fourth principle is contango in which the price of the forward and futures increase due to the future price of the assets is expected to higher than the present spot price of the contract (Abd Wahab et al., 2019).

Difference between the futures and forwards

Difference is that futures contracts are standardized, which are traded in a highly regulated way in public exchanges, whereas the forwards contracts are customized contract which is traded through the private contract between two parties. As the futures contract are more regulated and standardized compared to foreward which are customized and privately traded, therefore, the risk of these futures contracts are low, which lead to lower fluctuation in their pricing or valuation compared to forwards contracts (Shin and Pyo, 2019).

Hedging through different derivative instruments

The futures and forwards are used by firms such as Hertfordshire Petroleum Plc to hedge as it helps the parties fix the price at which it is selling or buying an asset in the future creating a fixed return from the sell or fixed cost of the purchase from this contract.

The option helps in hedging risk as the business can get a right from purchasing this option to sell or purchase an asset at a specific price in the future (Almgren and Li, 2016).

The concept of Swap outlined in the contents of derivatives assignment helps the business limit its risk by exchanging its obligation or cash flow with another party. For example, if the interest rate is forecasted to be increased in the future, then the swap can help to mitigate the risk by swapping its variable interest rate with a fixed interest rate.

Explain how options are valued and demonstrate through the use of models and concepts in the case of derivatives assignment?

There are two relevant models examined in the derivatives assignment by which the option valuation can be done. The first method is the binomial tree under which the value of the option is calculated as the discounted value of the probability-weighted future payoffs of the options. The second model which is Black Scholes Merton Model and under this model, the option present market value is calculated based on six variables which are risk-free rate, underlying stock price, volatility, strike price, option type and its risk or volatility in the market.

There are two concepts which are also help in the option pricing. The first concept is delta which calculates option value by assessing the expected change in the option price based on the change of the underlying stock per unit price change (Hull and White, 2017). The second concept is gamma which asses the rate of change in delta of the option as per the unit move in the underlying stock.

The most important determinants of the option value and the way by which it affect it option valuation

The most important determinant is the underlying stock price value. This has a direct and positive relationship with the option value meaning that with the increase in the price of the stock, the option value increase and vice versa. The second most important determinant is strike price of the option. This affects the price of the option as if it is a call option, then the lower strike price increase the option price and vice versa. On the other, if it is put option, the higher strike price results in the price of the option being higher and vice versa.

The third important determinant noted herein derivatives assignment is the type of option. This affects the option pricing as when an option position is long or put option is short, then the option price increase if the market moves higher and if the option position is short or put option is long, then the option price decrease if the market moves higher and vice versa. The fourth important determinant is the time to expiration, and as the time to expiration of the option decreases, the option value also decreases and vice versa.

The explanation of the pros and cons for Hertfordshire Petroleum Plc of using option instead of futures and forwards when hedging or limiting risk exposures

The first advantage illustrated within the derivatives assignment is that options are less risky for the business as when the business purchases an option, it limits its risk whereas, in the case of the options, the loss cannot be estimated. The second advantage is that the when Hertfordshire Petroleum Plc, it is getting a right, but no obligation is formed, and this helps the business is both limiting its risk exposures but also keeping itself open to any situation in which it can earn high profit from market situation which does not happen in the case of futures and contract as both forms obligations for the business.

The first con of the using option instead of future is that futures include daily cash settlement which does not happen in the option. The second con is that the business has to pay a premium for the option even if it does not use it, but that is not the case in term of the future and forwards. Therefore, the option creates sink cost for the business when it tries to hedge or limit its risk exposure with it.

Explanation of the principle behind the valuation of swaps and its use within this derivatives assignment

The principle of swap is that it is valued at zero at the initiated data and then in the end or otherwise, one party will be an advantage, and there will create an arbitrage. Its value increase or decreases with increase in the time after the initiation due to time value of money. It is used by firm as Hertfordshire Petroleum Plc to remove those cash flow or liabilities which has high volatility by exchanging it with lesser volatile factors.

Explanation of the different types of bonds with embedded options

There are different types of bonds with embedded options. The first type is the callable bond in which allows the issuer of the bond to redeem the bond after a certain period in the future. The pro of this derivative instrument is that issuer gets to reduce its interest payment by redeeming it earlier, but this is a con for the bondholders they may not get as much return as they have predicted and this makes this asset less attractive for the investors.

The second type is the puttable bond in which bondholder gets a right to redeem the bond earlier than its maturity date. The pro is that the liquidity of the bond increases but the con is that bondholder gets a lower total amount of return from it.

The readings developed in the derivatives assignment mentions that the third type is the convertible bond, and under this asset, the bondholder can convert this bond into the stock of the business. The advantage of this asset for issuer has to pay a lower amount of interest investor, but the disadvantage is that it can increase the equity of the business significantly.

The fourth type is the extendible bond in which the bondholder can extend the period of the bond maturity. The advantage of this asset for an investor can increase his return from the bond, but the disadvantage is that the cost of the debt for the issuer increases (BARNES et al, 2019).

Conclusion

In this derivatives assignment, the different aspects of the different derivative instruments had been discussed.

References

Abd Wahab, M.A., Mohamad, A. and Sifat, I., 2019. On Contango, Backwardation, and Seasonality in Index Futures. The Journal of Private Equity, 22(2), pp.69-82.

Almgren, R. and Li, T.M., 2016. Option hedging with smooth market impact. Market microstructure and liquidity, 2(01), p.1650002.

Bacha, O.I. and Mirakhor, A., 2019. Derivative Instruments: Products And Applications. Derivatives assignment World Scientific Book Chapters, pp.243-273.

BARNES, C.J., GUPTA, G. and ABINANTI, J.F., 2019. Bonds with Embedded Options. Debt Markets and Investments, p.283.

Hull, J. and White, A., 2017. Optimal delta hedging for options. Journal of Banking & Finance, 82, pp.180-190.

Shin, Y.J. and Pyo, U., 2019. Liquidity hedging with futures and forward contracts. Studies in Economics and Finance.