Corporate Strategy Assignment: Tesla Vs Ford

Question

Task:

1.Conduct an environmental analysis of the motor vehicle industry as at December 2019.

2.Discuss the competitive position of Tesla with comparison to Volkswagen Group.

3.Identify, discuss and contrast the strategies being used at Tesla and Volkswagen using standard frameworks.

4.Discuss how Tesla’s current market capitalisation may be justified.

5.Discuss possible strategies for Tesla to become a significant industry firm by 2040 measured by volume of vehicles.

Answer

Introduction

The purpose of corporate strategy assignment is to critically evaluate the business strategy that is incorporated by the business to secure the financial management assimilated decisions. The selected entity of the study is Tesla and Ford the well-established entities in the motor vehicle industry. The conducted study will analyze the financial performance assimilated to the functions, corporate strategy, and business management of the entities. The focus of corporate strategy assignment will be made on the wide application assimilated to the financial decision making in the business to ensure the shareholder value and management control within the business. The SWOT, PESTLE, and Value chain analysis will be incorporated to gain a better understanding of the entities’ capabilities. The discussion will be made regarding the selected entities’ capabilities to solve issues that are multifaceted. A range of various information will be evaluated to develop the strategies in response to the business environment and changing dynamics. This corporate strategy assignment sheds light on determining the significance of corporate strategy in the business.

i. Environmental analysis of the motor vehicle industry as at December 2019

Global perspective

The global perspectives are known to be a comprehensive lens through which the industries are able to see and learn the demands of the world. The demands and preference of the customers and clients across the world is being figured and measured with the help of the global perspective.

Importance of Global perspective on the motor vehicle industry

It is stated in this corporate strategy assignment that global perspective helps in shopping the thoughts and ideas of the more vehicle industries in or to make the customers satisfied with the products and services that are being prodded to them. The identification of the people or the clients with whom the motor vehicle industry is required to communicate and interact with (Zhikang, 2017). The interaction and communication process with the customers and clients of the motors industry plays the most effective significant role as it helps in understanding the demands and preferences. The shaping of the culture of the business-related and connected over the motor vehicle industry and maintains the business of the motor vehicle companies and organizations.

SWOT Analysis

Table 1: SWOT Analysis of the Motor Vehicle Industry

|

S |

W |

O |

T |

|

Strength |

Weakness |

Opportunity |

Threats |

|

Automobile industry outlined in this corporate strategy assignment helps in the growth over the rate of the economy within the operating nations |

The major controversy in the industry over the recalling vehicles on reference to the some technical dis-functionality (Wang et al. 2017). |

The injuries are over the verge of introducing the vehicles that are based on fuel-efficient vehicles and attract most of the customers |

The major growth of stiff competitors in the automobile industries across the world. |

|

Customers of the automobile industry are being able to experience the different changes and innovation in products |

The shift of the automobile industry from the demand to the supply markets |

Evaluation of the smart strategies such as the strategic alliances for the selling of better quality vehicles to the customers, clients, and partners (Aamodt, 2016). |

Random increase in the price of the fuels which are not affordable by all the economic standard people of the various nations. |

|

Continuous advancement process of the automobile industry helps in attracting most of the customers |

The lack of growth in the instructors of the automobile all across the nation due to the regulation and strict policies of the government of the nations |

The lifestyle of the people is being able to get changes over the evaluation and introducing various kinds of vehicles to the people. |

The sluggish economy of the industry has been leading to increasing the unemployment rate in the various sectors of the automobile companies. |

|

Across the Asian Markets, the most common industries are the automobile industry due to the services and the satisfactory services |

Automobile companies are intended to be suffering and facing challenges by a large number of variants and stiff competition |

Expansion of the market over the nation as well as over the international markets in terms of selling and providing the customers with most of the automotive services. |

The fixed cost of the vehicles and the investments is known to be a greater threat that is not helping the companies to be growing. |

Critical Analysis of SWOT Analysis

The SWOT analysis provided in this corporate strategy assignment has been effectively used by the both Tesla and Ford Company in order to identify the strength, weakness, opportunity and threats. With the help of the analysis the company has been able to identify the problems that are involved within the business functions and operation of both the companies. The measuring of weakness and threats of the company, Tesla and Ford Company are being able to overcome the weakness and threats in order to achieve success over the business operations. The analysis provided in this corporate strategy assignment has helped in the better identification and comparison of the SWOT between the Tesla and Ford Company.

PESTLE Analysis

|

Political |

• Automobile industry includes the major risk of occurring of accidents and faced by the employees • The management is responsible for the safety and occurring od hazards to the employees of the automobile industries • Emission policies of the nation to be followed by the industries as most of the pollution are being created by the automobile industries • The random and vigorous release of the carbon emission that leads to polluting the air of the environment around the location of the automobile factories (Izzaty and Sastra, 2019) |

|

Economical |

• This factor of corporate strategy assignment mentions that the economy of the automobile industries includes more and more of money that leads to purchasing of luxury items • The demand for automobile vehicles has been found to be more attracting the customers and clients over the various nation • With the demands of the customers on the purchasing of the vehicles items has been leading to be increasing the economy on the motors vehicle industries • The development into the economy of the nation is being affected by the economy and revenue of the automobile industries into the operating countries |

|

Social |

• Selling and producing of more of the products and vehicles that includes the most of attention of the customers • Producing and selling of the vehicles products to the customers and clients according to the affordable prices of the economic standards of the local people • Discounts and offers to be provided to the customers over the range of the harms to be created due to cultural phenomenon • Producing more of the vehicles that are based on the concepts of the cultural phenomenon |

|

Technological |

• Applying and introducing of the new motors into the vehicles in order to attract the male figures (Lugtu Jr, 2019) • Applying of new function over the driving the cars in order to attract the attention of the customers as well as clients • Introducing autonomous motors into the cars and other vehicles that includes more attention of the customers |

Critical analysis of PEST Analysis

The factors of the PEST analysis as mentioned in the corporate strategy assignment has helped in the identification of the difference and different management led in between the Tesla and Ford Company. The political factors of that are being used by the automobile industry includes different rules and regulation for various different companies. For example, the policies and regulations being used by the Tesla Company is different in relation to Ford Company. Even the economical, technological and social factors also vary in comparison between the Tesla and Ford Company.

ii. Critical discussion of the competitive position of Tesla with comparison to Ford

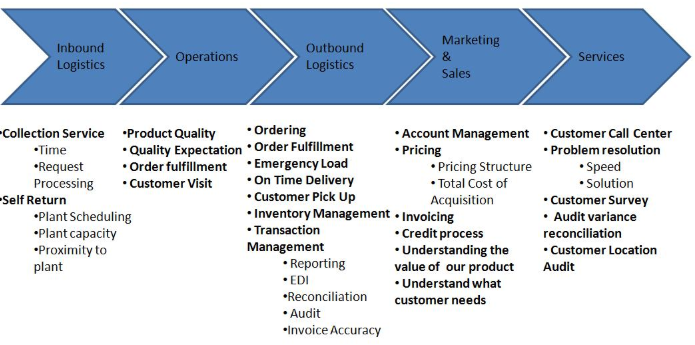

The value chain analysis performed in the present context of corporate strategy assignment is regarded as an efficient analytical framework that is highly beneficial in determining business operations that are efficient in creating competitive advantage by straining on the creation of value to the electric automaker (Aaijet al. 2016). The figure below provided in this corporate strategy assignment represents the essence specifically of Tesla value chain analysis in details:

Figure 1: Value chain analysis of Tesla and Ford

Source:(Kileluet al. 2017)

Tesla value chain analysis

Tesla primary activities

Inbound logistics

As specified in this corporate strategy assignment, the inbound logistics of the Tesla consists of storage and receipt assimilated to the raw materials to efficiently build solar panels, electric vehicles, and energy storage. The use of standard raw material is integrated by the entity by utilizing the scarce materials involving copper, aluminium, cobalt, lithium, and steel mainly. The entity provided in this corporate strategy assignment has electric automaker leases that involve around two to three warehouses that are approximately 1.3 million sq feet assimilated to the Oaks logistics centre situated in Livermore, Califf. Further, the storage is maintained of raw materials in the Fremont factory. In the current time, inbound logistics are not regarded as the main sources assimilated to value creation related to electric automakers (Kim, 2020). The entity functions mainly on a build to order basis that reflects bottlenecks in the section of parts supply can be a rather huge issue. Thus it can be said in this corporate strategy assignment that it is crucial that Tesla strains on the long term strategic relationships mainly with the supplier’s group to benedict the business.

Outbound logistics

The concept of outbound logistics explored in this corporate strategy assignment mainly consists of distribution and warehousing assimilated to the electric vehicles, solar panels, and energy storage systems generated by the entity. The entity mainly ships the electric vehicles to its own galleries and stores mainly in the US and worldwide. Further, it is also clear on this corporate strategy assignment that the entity is responsible for making direct delivery assimilated to the electric vehicles to the clients (Chen and Perez, 2018). The entity ensures to maintain a rather small inventory assimilated to vehicles at its stores to promote on-time sales. The clients of the entity prefer getting customized services for their vehicles through online orders. Tesla avoids dealing with the resellers and dealers and secures to make direct sales and reach end-users. This is identified as an important source assimilated to the value creation by Tesla in terms of outbound logistics for a few reasons. Firstly the aspect of direct sales reduces the costs for the entity cars from the factor of further increases. The cars are already expensive and selling cars with accommodation resellers and dealers would have pushed the prices even higher as a result. Secondly, the higher demand for electric vehicles and direct sales reduces the time incurred in the delivery of cars to clients.

Tesla operations

The Tesla operations can be divided into two groups assimilated to energy generation and efficient storage and automotive are mentioned below in this corporate strategy assignment:

- Energy generation and storage: This sphere consists of the installation, design, lease or sale, and manufacturing of stationary energy assimilated storage products. Further, the solar energy system is involved and the sale assimilated to the electricity that is produced by Tesla solar energy system to the end-users.

- Automotive: The areas assimilated to autosave consist of sales, design and manufacturing of electric cars. The company has produced 101,420 Model X and Model S cars and 1,764 Model 3 cars in the year 2017.

The information provided in this corporate strategy assignment illustrates that this entity is utilizing the robots in the process assimilated to manufacturing processes that are the main sources related to value creation for tesla. It ensures timely delivery by performing the operations faster.

Tesla services

There are evident cases of higher numbers of customer complaints as the customer services of the entity were negligent (Gianeselloet al. 2017). The clients have to wait for a long time due to entities refuting emails and calls assimilated to the repairs of the Model X in the year 2016. The steps were taken to involve the executive to directly manage customer complaints. The centers were built for customer services worldwide.

Marketing and sales

The entity areas of sales and marketing are recognized to be unconventional and rather the same as other motor business practices. The entity highly depends upon the word of mouth rather than endorsement in advertisements. It has expanded the scope of alluring extensive media coverage as a result of the global scale and acts as the main source of value assimilated to increasing levels of brand awareness worldwide. The entity avoids dealership networks to conduct the business operations. Further, the readings provided in this corporate strategy assignment mentions that the entity offers the aspect of opportunities to efficiently finance their solar roof by home mortgages. The loan amount is rather similar to the total solar incurred costs that are estimated at a lesser 30% federal tax credit mainly.

Ford value chain analysis

Outbound logistics

The aspect of logistics is an integral part of the Ford supply chain to efficiently maintain the supply chain (Kileluet al. 2017). The gathered cars are shipped from the entity manufacturing plants directly to the dealers. The entity utilizes a rather balanced mix assimilated to transport solutions that strings on enhancing road miles and further optimizing to attain environmental sustainability. The entity outlined in this corporate strategy assignment further collaborates mainly with the logistics partner and further with industry to effectively measure and enhance the significant impact of transport down related to the supply chain.

Inbound logistics

Ford has a global manufacturing network; the entity assembly and manufacturing plants are situated throughout China, the U.S, and Africa. The entity assembles raw materials mainly from the supplier’s group from worldwide. Further, the raw material is obtained in the assembling plants with the integration of third-party logistics-related providers. Ford's main logistics partner is recognized as DHL. The logistics partner's assistance has played a pivotal role in the management of European supply chain. It is the reason Ford was awarded a series of new contracts mainly to DHL. The contract addressed the DHL providing the freight management assimilated services as it governs the logistics partner solutions (Rao, 2018). The contact further stated the DHL supply chain to manage the movement related to prototype parts from suppliers to Fords research and development related locations globally.

Product and services

The company chosen in this piece of corporate strategy assignment has a wide range of assimilated into the services and products that are offered in the worldwide market. The entity is continuously enhancing the product range and variations by primarily focusing on the R&D. The entity is further engaged in Lincoln brand products that are sold to higher valued customers. The entity has sold around 5,386,000 cars at wholesale around the world. The entity sells vehicles such as Lincoln luxury cars, SUVs, electrified cars and trucks in the worldwide market. The major market and revenue are gained from the U.S in which around 2,422,698 car units are sold in the year 2019. The entity is further changed in delivering financial assimilated services through Ford Motor Credit Company.

Operations

Ford is recognized as a well-established brand and has huge sales worldwide each year and has its assembly plants and the dealership networks that operate around the world. The business is spotted in five parts South America, Middle East & Africa, Asia Pacific, Europe, and North America (Kovalet al. 2019). The company main operation consists of assembly facilities and manufacturing, engineering centers, administering offices or sales, and warehouses. Further, the company owns non-U.S and U.S assembly and manufacturing facilities. The main parts are distributed centers that are not in the U.S and are obtained by vendors or leased.

Sales and marketing

The increasing competition in the automobile castors has expanded the scope assimilated to the investment in marketing to promote offline and online sales revenue in the business. The entity is highly engaged in sales promotions and advertising and spends a lot of money to generate sales each year. The expenditure assimilated to advertising is $4 billion and further incorporates the auto shows for the efficient promotions of its brands and products. The total number related to Ford's dealership is accounted to be 10,921 consisting of Lincoln and Ford.

Can you perform a critical analysis and comparison of both entity value chain in the context of corporate strategy assignment?

Both entities’ comparison of the value chain makes it clear that Tesla has a rather huge market capitalization compared with Ford. Tesla has $93 billion and Ford has $50 million in terms of general motors. In terms of valuation Tesla has surpassed the benchmark of $100 billion and attained a milestone for an entity that generates a variety of cars compared with Ford. Tesla Model 3 now has the strongest sales-related number over the years. The major issues were accounted for in the management of the customers. This led to huge customer complaints affecting the brand image. On the other hand, Ford highly values the customer’s feedback and provides efficient customer services. Tesla has attained 40% range performances and costs assimilated enhancement over the years on the other hand Ford is lagging to achieve this position. Tesla is counted in producing the world's most efficient and largest electric car sellers in the global market. Thus it can be said that the Tesla entity has incorporated an efficient corporate strategy to retain its financial positioning with accurate decision making.

iii. Identification, discussion and contrast of the strategies used at Tesla and Ford using standard frameworks

Halifax Theory Z

The performance Halifax was being introduced over the performances of branch 5446. The functions that were found to be on the against side are the human resources, operations, markets, finance and accounting. The information has been playing one of the significant roles as it includes all the information related to the strategies applied by the Tesla in comparison to the Ford Company. The strategic functions used by the Tesla Company are more effective than Ford Company. The selling of the vehicles across the globe and nation by the Tesla and Ford Company are recommended to be using and applying the theory of Halifax. All the functions of both of the companies that are applied with the strategies are known to be following the scorecards of the Halifax’s Balanced scorecards quadrants and the theory of ‘Z’. The main concern to be focused over the study of Halifax is the evaluation of the process that is being performed by the HR management and information flow. The Hr management and information of flow of the Tesla Company are being found to be operating successful in comparison to the Ford Company. The information and data related to the strategies that are being measured and results reflects on the effectiveness and management of the Tesla to be successful. Other areas of the organization such as the expectation of the HR management and information flow are in need to be improved for the better management of the organizations.

Industry life cycle

The industry life cycle is known to be one of the most effective processes that helps in the better evolution of the whole process that is being performed within the motors vehicle indy roses. The various stages of the motors business is being affected by the industry life cycle. The industry life cycle includes the managing the business and functions of the motor vehicle companies and rest of the operating industries with the managing of operators, progress and prospects. The businesses that are being managed by Tesla as well as by the Ford Company are intended to be marinated with the help of involving the theory of the industry life cycle. The whole process of both of the companies will be marinated with the help of the study evaluation. The industry life cycle includes the evaluation of the different five stages such as the startup, growth, shakeout, maturity and decline. All the process and stages of the industry life cycle helps in the better management of the business that are found to be related to the motors vehicle industries.

iv. Discussion of the market capitalisation of Tesla

Market capitalisation or market cap can be termed as the total value of the all of the shares outstanding of a firm in a certain period of time. In general for estimating the market capitalisation of a firm the current market price of each share is multiplied with its total number of outstanding shares in the market. In this respect, it needed to be said that the market cap of an organisation mainly helps in measuring its total worth in the open market. Along with that, it also helps in understanding the perception of the market for the future prospects of the firm. This is because it reflects the amount of money that the investors are willing to pay for owning its stocks. In this process, based on the total market capitalisation the firms can further be categorised as large, medium or small cap firms.

In the past few years Tesla has changed the concept of the motor industry through its innovative product line and electric car vehicles. Modern design and unique features have helped the company to draw attention to the world. Presently the market cap of the firm is worth USD 278.331 billion. In this process, through the evaluation of the below highlighted figure (Figure 1) it can be witnessed that the price of each stock has not shown any remarkable movement till the end of 2019. However, after that a strong upward price movement can be witnessed. On 14 Oct 2019 the price of each stock of the company witnessed to be $256.95 whereas on 6 July 2020 the price for each stock witnessed an all time high of $1,228. On 13 July 2020 the price touched a new high of $1,794.99 and closed on $1,500.64. Thus a huge upward trend in the market capitalisation can be witnessed in the past 7-8 months whereas the world economy has observed a tremendous blow due to the growing threat of COVID-19 pandemic. Considering the financial revenue of the company a steady upward movement can be observed. In 2018, the revenue of the company had been estimated to be USD 21.46 billion and in 2019 it raised to USD 24.58 billion. Although the earning of the company has provided a negative balance of USD 976 million in 2018 which has been reduced to USD 862 million. This positive upward trend in the financial position can be identified as a major driver for the price movement of the firm. Along with that, it is also needed to be stated that Tesla had developed a strong hold in the electric motor vehicle market. These factors can be considered as justifiable factors for the current market capitalisation of the company. However, witnessing the market trend a certain amount of correction can also be expected to occur in the share price of the organisation.

Figure 1: Share price movement in the past Five years

(Source: In.finance.yahoo.com, 2020)

v. Discussion of the possible strategies for Tesla to increase its volume of vehicles in the industry by 2040

In any type of organisation developing a proper business strategy is required to ensure the business sustainability. In this process, the companies mainly focus on setting a long term goal and develop its short term goals accordingly to attain the same. In the electric motor vehicle market Tesla has surged past its competitors with a very wide margin due to its innovative and feature loaded vehicles. The growing demand of the electric vehicle in the domestic and world market can be highlighted as a wide opportunity for Tesla to cash in. Considering that fact presented in the corporate strategy assignment, it is inevitable for the company to enhance or increase its manufacturing volume of vehicles to capture a significant portion of the industry by 2040. In this context, the following strategies can be implemented by the management of the firm to achieve the same-

- One of the major steps that can be taken by Tesla is to work on its pricing strategy and manufacturing process. This is because the price of each unit is significantly higher than its market competitors and conventional petrol or diesel cars. As a result of this, a major market portion is getting left out for the company. Through developing a mid-range commuter vehicle the company will be able to uplift its overall market demand and the lower operating cost will help in securing a higher net profit in the coming periods.

- The company has also witnessed significant issues in the workplace safety procedures in 2018 (Business Insider, 2020). As a result of this it may become an issue for the company to hire expert technicians to work with the firm. Hence, the second strategy that can be highlighted is to promote a higher work safety. This in turn will help in hiring experienced as well as new talents to develop innovative vehicle range in an affordable price range.

iii. Along with the developed nations the company should also manufacture cars for the developing markets like India. In India an entry level Tesla is composting around INR 40 lakh which is higher than other premium segment vehicles like Audi, BMW and Mercedes Benz (Bhagat, 2020). Thus, it is required for the firm to develop proper marketing and supply chain processes to enhance the overall selling volumes of its vehicles.

- Along with that it is also required for the firm to set up higher super speciality charging points in its targeted markets before commencing to sell its vehicles. These higher conveniences will not only help in expanding the earning but also work as a convenient factor for the customers’.

Conclusion

From the above critical evaluation conducted in this corporate strategy assignment, it is clear that Tesla and Ford are focusing on efficient financial decision making. Financial management has ensured the financial positioning of the business is retained in the market position. A better understanding is gained regarding the development and formulation of strategies for efficient financial management in the business. The analysis of the business provides a brief overview of the ways strategies are formulated to manage the business and its market positions. The significance of the financial management and corporate strategy in the business is determined by evaluating the operations undertaken by the selected entity. Thus it can be said that financial management is highly crucial in the business.

List of references

Aaij, R., Amato, S., Anderlini, L., Benson, S., Cattaneo, M., Clemencic, M., Couturier, B., Frank, M., Gligorov, V.V., Head, T. and Jones, C., 2016. Tesla: an application for real-time data analysis in High Energy Physics. Corporate strategy assignment Computer Physics Communications, 208, pp.35-42.

Aamodt, I., 2016. Impacts of import-substitution on the automobile industry in Brazil: a SWOT analysis of repercussions of the policy 1990-2014 (Master's thesis, Norwegian University of Life Sciences, Ås).

Bhagat, H., 2020. Tesla: Tesla’S India Plans: Challenges And Hurdles That They Must Face - The Economic Times. [online] The Economic Times. Available at:

Business Insider. 2020. Tesla Is Having Another Chaotic Year - These Are The Biggest Challenges Tesla Has Faced So Far In 2019. [online] Available at:

Chen, Y. and Perez, Y., 2018. Business model design: lessons learned from Tesla Motors. In Towards a Sustainable Economy (pp. 53-69). Springer, Cham.

Gianesello, P., Ivanov, D. and Battini, D., 2017. Closed-loop supply chain simulation with disruption considerations: A case-study on Tesla. Corporate strategy assignment International Journal of Inventory Research, 4(4), pp.257-280.

In.finance.yahoo.com. 2020. In.Finance.Yahoo.Com. [online] Available at:

Izzaty, N. and Sastra, H.Y., 2019, June. The implementation of graphene composites for automotive: an industrial perspective. In IOP Conference Series: Materials Science and Engineering (Vol. 536, No. 1, p. 012133). IOP Publishing.

Kilelu, C., Klerkx, L., Omore, A., Baltenweck, I., Leeuwis, C. and Githinji, J., 2017. Value chain upgrading and the inclusion of smallholders in markets: reflections on contributions of multi-stakeholder processes in dairy development in Tanzania. The european Journal of development research, 29(5), pp.1102-1121.

Kim, H., 2020. Analysis of how Tesla Creating Core Innovation Capability. International Journal of Business and Management, 15(6).

Koval, V., Duginets, G., Plekhanova, O., Antonov, A. and Petrova, M., 2019. On the supranational and national level of global value chain management. Entrepreneurship and Sustainability Issues, 6(4), pp.1922-1937.

Lugtu Jr, R.C., 2019. Tesla: Testing a Business Model at its (R) Evolutionary Best (Doctoral dissertation, DE LA SALLE UNIVERSITY-MANILA).

Rao, S., 2018. Leveraging global value chains to bridge the gap between rural and global economies: Case of North Carolina’s Appalachian automotive industry. Journal of Rural and Community Development, 13(1).

Wang, X., Li, C., Shang, J., Yang, C., Zhang, B. and Ke, X., 2017. Strategic choices of China’s new energy vehicle industry: An analysis based on ANP and SWOT. Corporate strategy assignment Energies, 10(4), p.537.

Zhikang, L., 2017. Research on development strategy of automobile reverse logistics based on SWOT analysis. Procedia engineering, 174, pp.324-330.