Corporate Finance Assignment: Dividend Payout Policy of Microsoft

Question

Corporate Finance Assignment Task:

The Dividend Payout Controversy is one of the 10 unsolved problems in finance, according to Brealey, Myers and Allen (2014). Many people believe dividends are good; others think that dividends attract more tax and therefore it is better for firms to repurchase stocks; still others believe that, as long as the firms’ investment decisions are unaffected, the payout decision is irrelevant. Rather than inquiring whether dividends are good or bad, Brealey, Myers and Allen (2014) suggest that perhaps we should be asking when it makes sense to pay high or low dividends. In this regard, they admit that we don’t know enough yet about how payout policy varies or should vary from firm to firm. We also lack an understanding of how firms’ dividend payout policy changes over time, and how that policy change affects firm value.

1) Support your discussions of the following questions based on empirical evidence for Microsoft.

i. How does Microsoft finance their dividend or repurchase? I.e., does Microsoft raise new capital or use their internal capital to finance their payout?

ii. Are agency conflicts between shareholders and managers at the core of Microsoft payout policy?

iii. Do payouts reflect attempts by the (Microsoft) firm’s insiders to signal firm quality to the market?

Answer

Question 1

How does Microsoft finance its dividend or repurchase? Does it raise new capital or use its internal resources?

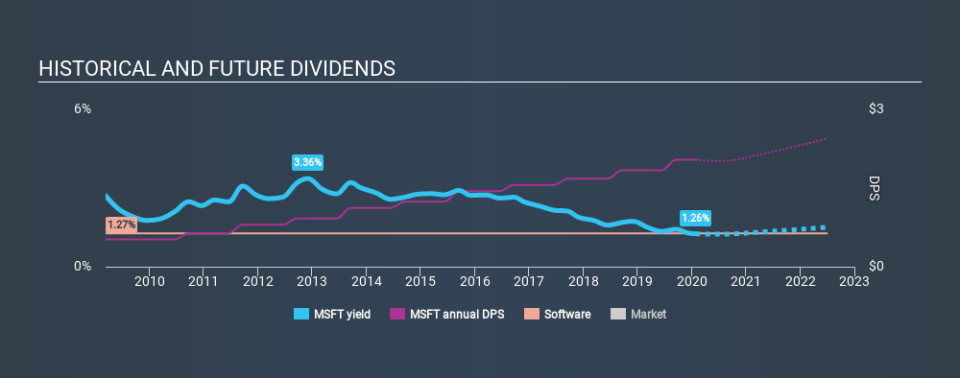

It is evident herein corporate finance assignment that Microsoft is considered to be a safe stock with assured dividends. The dividend growth has also been considerably strong. Microsoft has strong fundamentals and the right balance of reserves and surpluses. Microsoft has been developing new strategies in business segments, which enables it to retain the top position and also a market leader (Yahoo finance 2020). Apart from just being a good dividend stock, it is also a good stock for long term investment. The free cash flow available with the company has been used at various instances for the dividend payout and also for the repurchase of its shares. An analysis of the same has been presented below

Source: Yahoo finance 2020

The dividend payout consumes approximately one third of its available cash balance and hence the company is in a balanced position to meet the investor expectations. It is due to the foundation upon which the stock has been built. The business model is such that a lot of investors are also having this stock on their retirement portfolio. As times are changing, Microsoft has evolved and changed its business models which are the key to its constant revenue growth. The quick adaptability and the customer focus have helped Microsoft achieve competitive advantage. The company has also been accelerating its dividend rate annually. The share repurchase program is also one such initiative of the company that has been introduced in the recent years. The share repurchase history of the company has been tabulated below:

|

Year |

Shares repurchased |

|

2017 |

$ 11.8 billion |

|

2018 |

$ 10.7 billion |

|

2019 |

$ 19.5 billion |

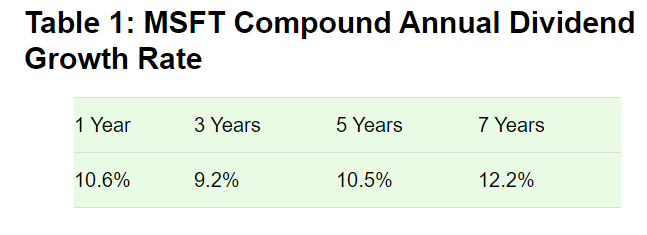

Microsoft has been financing the above from its free cash flows and has returned billions to its shareholders by a combination of dividends and shares repurchase programs. The company is poised and well placed to authorize more share repurchases in the years to come. It enjoys a strong leadership position in the tech industry and has excellent financials which have helped the company serve its shareholders well (Yahoo finance 2020). It is such a quality stock that has built up strong partnerships across the world and is present in almost every country. The company’s products are customized in a way to serve every industry it does business with. The revenues are predictable as every client is charged a modest upgrade fee annually. Though transition is difficult, Microsoft has got it right and has helped gain and retain investor confidence by ensuring a healthy payout ratio. The dividend appreciation has been steady over the previous years and has been tabulated below:

(Dividend Diversify 2020)

The Board communicates effectively with the shareholders about their track record of returning money to their shareholders and have also indicated that they shall continue to do so at an attractive rate. The substantial annual dividend growth rate makes Microsoft one of the top picks by most advisors. Thus Microsoft has been able to manage its cash flows efficiently and provide returns to its business partners and stakeholders.

Question 2 - Are agency conflicts between shareholders and managers at the core of Microsoft payout policy?

Answer 2

The agency problem pertains to the interest conflict that happens in any relationship whereby one party is required to act in the interest of another (Mersland & Urgeghe 2013). In the case of Microsoft, the conflict appears to be between the management and the stockholder.

The managers’ acts as the shareholders' agent are needed to undertake decisions that will enhance the wealth of the shareholder even though it would be the best interest of the manager to enhance the wealth (Carlon 2019). The managers are always eager to gain predominance in comparison to the benefits to the shareholders. As seen, Microsoft is paying a dividend, which means insiders return the earnings to the investors and thereby not able to use the earnings for their benefit. The dividend can be commented as better in comparison to retained earnings because the later can never come up in terms of future dividend. Further, the dividend payment has provided a great exposure to Microsoft that has helped the company in terms of exposure. Such exposure has helped to raise external funds and provide the outside investors to gain central control over the insiders. Since the company pays divided, it is well implied that the funds are used for the company’s benefit and the shareholders at large. The conflict is always inherent in the system; however, the intensity determines the scope. As seen from the common parlance that the company does not have a higher conflict level because the benefit is adequately transferred to the shareholders and the management.

The dividend can further be stated as part of an effective system that provides legal safeguard to shareholders. Coming to an effective system, minority shareholders utilize the legal powers to force the company to expel cash hence avoiding the insiders to use the earnings of the company for their interest (Peirson et al 2015). Since the shareholder has voting power, they utilize the power to select the director that can offer lucrative dividend policy. Hence, as per the dividend policy of Microsoft, it can be commented that the dividend policy of Microsoft is on the increasing trend over the past five years. With the increment in the revenue, the company has increased the dividend for the shareholders. The company is utilizing the policy of repurchase followed by the dividend repayment . The repurchase policy is still under practice, and hence as per the overall consideration, it can be commented that the agency conflict is not at the core of Microsoft payout policy. This is because both the management and the shareholder is benefitting from the payout policy. The payout policy of Microsoft indicates that the company efficiently uses its capital as it distributes the capital in the form of a dividend. Thereby considering this prospect, it is implied that the agency conflict is not severe in the case of Microsoft as the company balances the prospect of dividend payment and capital utilization. The nature of agency conflict is low in the case of Microsoft and thereby stresses better capital management.

Question 3

Do payouts reflect attempts by the (Microsoft) firm’s insiders to signal firm quality to the market?

The dividend per share of Microsoft is increasing over five years, along with the revenue. The insiders of Microsoft do not require showing the shareholders how strong is the company’s position; the financial shows it and is well supported by the dividend payout policy of the government. The company is using both the repurchase policy as well as dividend payments regularly. The dividend per share, as stated, is showing an increasing trend, and the company has approved repurchase policy in 2016, which completed on Feb 2020. After that, a new repurchase policy is again approved with no expiry date, and the repurchase is continuing every quarter.

The company is having the return higher than the average return of the S&P 500 index as well as the NASDAQ Computer index over the five years. Thus the company has higher returns, and after fulfilling its investment requirement, the company is paying the shareholders their share of profit from the company. The investment requirement of the company is also high, and it is only through these various investment in new and improved products as well as its security. The dividend policy is excellent as it provides both the options to the shareholders to sell their shares or retain and get the continuous dividend over the years. This is also reflected in the pricing of the shares as the price of the shares or valuation of the company in the form of market capitalisation is increasing over the years (Sherman 2015). The prices of the shares have fallen during March 2020 but after that have again started increasing, which not only gained its earlier position but also improved and reached its highest levels during August 2020.

The management decision regarding the dividend payout is helping to boost the shareholder's confidence as only strong financials without actual benefit to the shareholders in the form of dividend or buyback of shares at a higher price would instigate a doubt on the working of the company and thus policies well support the position as reflected in the books and annual report of the company (Pucheta-Martiinez & Garcia-Meca, 2019). The increase in the revenue and margin of the company is the key to such a strong market position of the company. Thus the policy of the regarding the dividend payout should be continued so that the trust of the various stakeholders of the company keeps on increasing. This is helping in creating and maintaining the goodwill of the company. Further it will give an insight into the ability of the management in transferring the benefits to the stakeholders which in turn will attract more investors.

References

Carlon, S. (2019). Financial accounting: reporting, analysis and decision making. 6th ed. Milton, QLD John Wiley and Sons Australia, Ltd

Dividend Diversify. (2020). Microsoft Stock Analysis & Dividend Review (MSFT). Retrieved from https://dividendsdiversify.com/microsoft-dividend/ Mersland, R., & Urgeghe, L . (2013). International Debt Financing and Performance of Microfinance Institutions, Strategic Change. 22, 36-47

Peirson, G, Brown, R., Easton, S, Howard, P. & Pinder, S. (2015). Finance, 12th ed. North Ryde: McGraw-Hill Australia.

Pucheta-Martiinez, M. & Garcia-Meca, E. (2019). Monitoring, corporate performance and institutional directors. Australian Accounting Review, 29(1), 208-219.

Sherman, E. (2015). A manager's guide to financial analysis : Powerful tools for analyzing the numbers and making the best decisions for your business (6th ed) Ama Self-Study

Yahoo finance. (2020). Microsoft Corporation (NASDAQ:MSFT) Has Got What It Takes To Be An Attractive Dividend Stock. Retrieved from: https://finance.yahoo.com/news/microsoft-corporation-nasdaq-msft-got-144852143.html