Corporate Finance Assignment Analysing Financial Scenarios Of Business Organisations

Question

Task:

The corporate finance assignment consists of the following tasks:

1. Contrast investment strategies and determine the factors that affect investment decision making in organisations:

1.1 Understand and critically assess the organisational and operational factors that affect investment decisions.

1.2 Critically evaluate how corporate strategy can determine investment decisions.

1.3 Apply a range of models that can influence investment strategy and decisions.

2. Evaluate and appraise the financial strategies of different organisations:

2.1 Critically understand the financial strategies of a range of different organisations across different business sectors.

2.2 Use case study information to evaluate the financial strategies of organisations in at least two different business sectors.

2.3 Critically appraise the financial strategies of governmental, charitable and private sector organisations.

3. Analyse the impact of foreign exchange risk on organisations:

3.1 Explain how the foreign exchange market works and how it can influence business and organisational decisions.

3.2 Understand the risks involved with foreign exchange and critically assess potential impacts on a range of different organisations in different sectors.

3.3 Critically assess whether foreign exchange markets can be a viable method for financing corporate restructuring.

4. Identify and critique systems employed to plan and control working capital:

4.1 Evaluate the importance of working capital to organisations and understand the systems and methods used to manage working capital.

4.2 Identify the risks where working capital management is not applied and the reasons why systems to monitor working capital management fail.

4.3 Critique the systems and methods used to plan working capital.

5. Assess and decide upon appropriate strategies for restructuring:

5.1 Critically assess the finance options available to corporations when looking to restructure their business including merger and acquisition strategies.

5.2 Identify the risks involved in pursing different financial options in pursuit of corporate re-structuring.

5.3 Critique the success of a range of organisations that have pursued different re-structuring options.

Answer

Corporate Finance Assignment Task 1

1.1 Comprehend and critically assess organisational and operational elements that impact investments

Any asset or item acquired with the objective of generating income or appreciation is regarded as the term investment. The word appreciation is directed towards increment in the asset worth. Hence, investment can be regarded as any kind of apparatus used for generating income for the forthcoming period (Finkler, Smith, & Calabrese, 2018). There are various elements of organisational and operational nature that impact the investment choice of any specific individual.

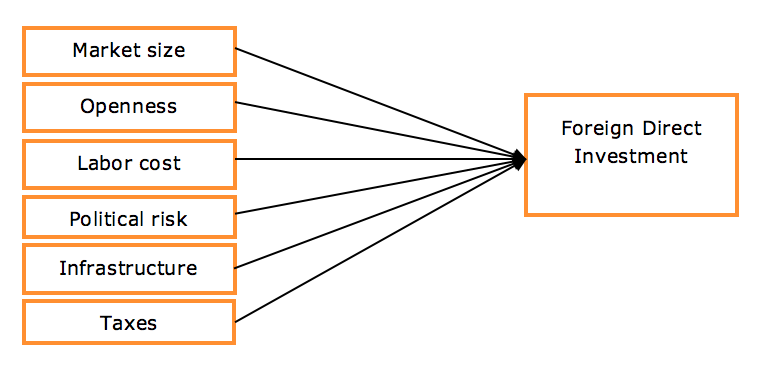

Figure 1: Factors impacting investment decisions

Figure 1: Factors impacting investment decisions

(Source: (Madura, 2020))

Interest rate is one such element that impacts the activity of investment in an organisation. Investment through finances can be functioned either with the help of current savings or through the amount of money received through the lending procedure. Due to this specific cause, the rate of interest produces an important impact on the investment actions. Another factor that affects the choice of investment is the growth of the economy. In the circumstances where the scenarios of the economy are improved, it has been noticed that the investment actions are inspired, and this is even considered as one of the reasons for the increase in demand. Thirdly, organisations like Walmart that is sure about its worth in forthcoming days would be able to commence with their actions regarding investment (Finkler, Smith, & Calabrese, 2018). The inflation rate is even the reason for impacting the actions of investment. When the inflation rate is high or variable in nature, the difficulties and unreliability in such a situation are quite great. It is essential to have liquid cash or funds for the performance of investment actions. Therefore, it can be termed as one of impacting elements for the objective of carrying out the activities of investment. To conclude, the progressing technologies even guide an organisation in increasing its investment actions because they are obligated for generating a high quantity of benefit.

The operational factors, such as the management's perception, even influence the actions of investment. If the administration in nature is advanced and broad-minded and believes in implementing aggressive marketing and growth outlook, it might push up the activities of innovations and promote capital tenders (Seifollahi & Shajari, 2019). Moreover, the investment grants and income generated from new income sources are free from taxes, and this allows new choices or decisions of investment to be made. The procedure of allowing deduction in depreciation also affects the investment choices.

1.2 Critically evaluate the ways in which the strategy of the company is able to support the decision of investment

Prior to assessment of the total scope of an organisation, it is evident that their approaches have the propensity to prohibit different types of investments schemes to which the superiors have unswerving admittance in the organisation (Madura, 2020). Moreover, it has also been specified that the organisation is in receipt of support through the corporate strategy in determining the different types of synergies in the context of merger and acquisition deals for the companies in an appropriate manner. Furthermore, planning, structuring, organising, controlling, implementation and evaluation have been produced to be performed with components of the organisation that is internal in nature (Fritz, Verhoeven, & Avenia, 2017). Besides, in corporations such as Netflix and prime, it has been termed as a technique or approach that has the propensity to provide the choice of decisions in the area of choices to be made in the field of capital budgeting. The business employers who decide on the choices are effectively required to be considered during the total business incidences in the long run circumstances (Karadag, 2015). This will include contrivance regulations for putting in or constructing effective strategies of corporations that have the propensity to have a positive impact on the choices regarding investment.

1.3 Execute models that can impact the investment strategies and decisions

In companies or organisations, one has a lack of time for taking proper decisions. Therefore, the application of models makes it likely to reach suitable decisions. During such circumstances, companies have the propensity of using models like the recognition primed model for stemming to decisions.

The model has three stages that would enable the organisation in adapting to an effective decision. The stages are mentioned below:

- Undergoing the circumstances

- Evaluation of the situation

- Enactment of the decision

In the early stage, the employer has to take into focus the circumstance as much as probable that needs a solution. In the absence of total information, it is not possible to move clear and suitable investment or business choices. One of the appropriate things that can be performed during this stage is to pay attention appropriately to all of the ones whose involvement in the technique is quite high, and it would aid in seeking out the issues, and those must be implemented for the purpose of setting it. Furthermore, it would allow the people obligated for making choices by assessment of the foundation of formation of certain circumstances, and if needed, decision making or immediate resolution can be executed in some time for the purpose of processing things in a proper way (Karadag, 2015). It is needed for avoiding any type of panic in such circumstances by being calm and taking proper moves towards the next stage while using the approach.

The second step is a central understanding of the incidences and the problems. Prior to this, it is required to take a step towards the procedures of analytical nature for the purpose of reaching an appropriate solution. For this requirement, various queries are posted for reaching suitable solutions on the basis of the prior adopted experiences. As the evaluation of the context begins (Finkler, Smith, & Calabrese, 2018), it is likely that certain different credible solutions would float in the thoughts, and it is necessary to hold calm during this circumstance that creates a feeling of a storm. This phase enables the company or its employers to have thought of numerous likely situations as conceivable. Therefore, this stage should not be shortened or jumped.

The last phase of this progression is the stage of execution. In this phase, the company is expected to have gotten to a decision, and it has to be implemented in timely ways for the objective of taking allowable definitive effects. This is regarded as the essential phase, and with the absence of this phase, no company would be able to execute or make choices regarding any investment decision and stay loyal to its functions (Karadag, 2015). This model would allow the company to make a decision of the appropriate option to enable modification of any kind of complex circumstance, and it would also inculcate assessment of the practical sections of the implementation for making the choice of perfect strategy or decision of investment. This kind of training is highly adept in the world of business for figuring out the investment strategies and decisions. It offers a high amount of awareness in the assessment of the situations that arrive at any companies in a situation of trouble with the concern to investment matters.

Task 2

2.1 Critically discuss the financial strategies of distinct companies in distinct areas of business

The financial strategy of any company is essentially concerned with fund application and procurement. The basic purpose is to ensure appropriate and regular fund supply sustaining the present and forthcoming needs of any company. It takes into consideration areas such as structure assessment, cost evaluation and financial resources, along with evaluation of accounting performance and profit probability. The purpose of such techniques is to take the financial value off a company or organisation to maximisation. Achievement of the desired ratio of debt and equity by generating cash flow internally and adoption for long term needs is a serious type of issue (Yuniningsih, Pertiwi, & Purwanto, 2019). Administration of surplus dividends is an additional section of the financial tactic. Fundamentally, the strategies of finance have the participation of four broad aspects, namely:

- Evaluation of the performance in the financial field

- Financial expectation

- Scheming of the structure of capital

- Other contemplations of financial nature

It aids the businesses in making choices of the types of funds for long term functions of the organisations and the volume of the same. It is the responsibility of the financial field to make acquisitions of the funds required for the forthcoming and current mechanisms and functions of the company (Siminica, Motoi, & Dumitru, 2017). Hence, the company has been able to establish a connection amidst the management and board's vision. All stakeholders of the company are on the same folio, and this has been a supporting factor in the adoption of innovation and technology. In the current scenario, the companies are required to make an investment in a huge amount for the purpose of enabling the companies to acquire proper and advanced technologies, and this is suitably administered through the support of the financial strategy.

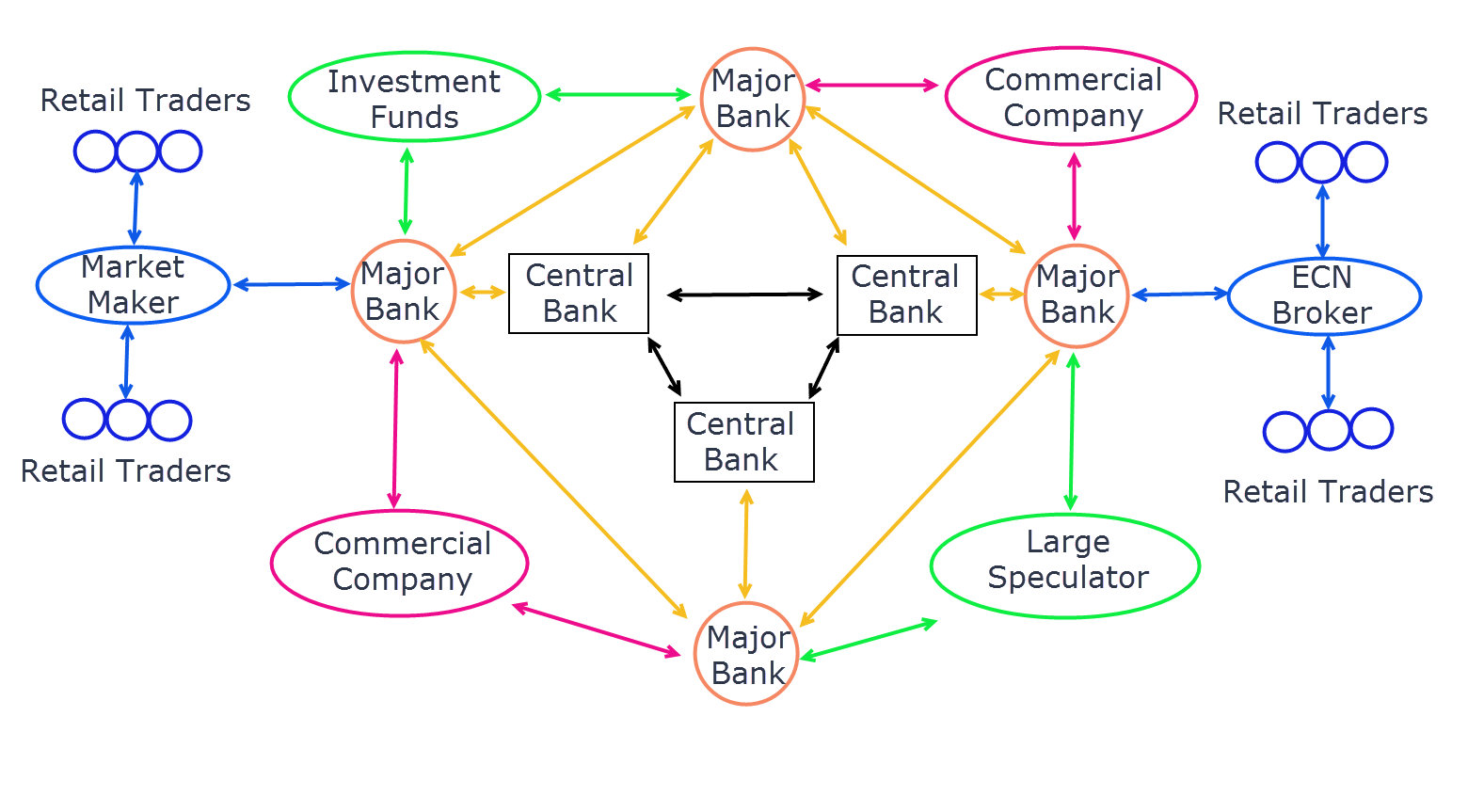

Figure 2: Investment decisions

(Source: (Yuniningsih, Pertiwi, & Purwanto, 2019)

On the contrary, advancement of financial strategy is not taken to be a kind of job that is easy, and it is not possible to be performed through the daily managers. Only professional capable of evaluating the prior results and predicting forthcoming requirements of financial nature. For advancing financial strategies to be used in the long term and for the purpose of establishing a connection, every strategy, the company is needed to perform for making a heavy investment (Ameliawati & Setiyani, 2018). Moreover, it is considered to be a time-consuming procedure to lay down such financial strategies of long-term nature.

2.2 Apply data from different cases to assess the financial strategy of any organisation in about two distinct areas of business

There are different business areas that have the involvement of telecommunication, pharmaceutical, aerospace, construction and computer industries. Different areas of companies or businesses use different strategies of finance for the purpose of fostering and betterment of their business technique (Tajti, 2018). In this area, two different case studies have been estimated for the evaluation purpose of the financial techniques of the airline manufacturing organisations along with telecommunication companies. These are two very different organisations with dissimilar structures.

The decision of applying an appropriate structure of capital for both companies in every section. The case studies indicate that the manufacturing organisations basically reach their principal capital through financial institutions like commercial and investment banks (Broyles, 2020). On the contrary, the telecommunication organisations chiefly hang on the capital amount that has been financed with the help of internal means in the later part of the business period. The acquisition and borrowing of working capital are more evident in the industry of aircraft manufacturing in contrast to the telecommunication sector. The other financial sources like reserve and surplus are even applied diversely by these business organisations (Lawson). The strategies of financial nature that are involved in the aircraft manufacturing and telecommunication industry are quite dissimilar if compared on the basis of financial, fixed and capital budgets. The programs of budgetary nature that are involved in both sectors are dissimilar to the company's objectives.

The manufacturing industry's budgets are more vulnerable to whacking insufficiencies and is not represented, subsequently deducing dissimilar strategies of financial nature. The strategy used for fund appropriation and for the purpose of administration is the same in both sectors. It encompasses investment, current assets and procurement of fixed assets. In accordance with the case studies, both sectors apply the capital investment technique for the setting of the business scheme of primary nature. The financial techniques primarily require regular evaluation of tax scheming, capital expenditure and controlling of cost in both chosen sectors (Loke, 2017). The manufacturing sector uses the technique of restricting debt capital while in circumstances of the presence of risk. On the other hand, the telecommunication sector seems to be dependent more on the generation of the maximum amount of return that is accumulated by the organisation on the employment of capital for the objective of maximising the wealth of the shareholders.

2.3 Be critical of the financial strategies of governments, charities and private sector organisations

The financial techniques of charitable companies and organisations are constructed in such a manner that they are able to assess the financial needs of the company by providing the most effective connection amidst amount of benefit and cost (Yap, Komalasari, & Hadiansah, 2018). They are constructed by the evaluation of the total cost of operation, focusing on the betterment of the forthcoming improvisations, moreover, during the development of the financial techniques of charitable organisations and government. Institutions have been performed with the thought of reducing the cost and bettering the efficiency level and profitability. On the contrary, the private institutions have not been successful in sustaining an appropriate balance amidst the business and personal aims. The most crucial phase is the setting of long- and short-term financial goals (Wolmarans & Meintjes, 2015). Their aims have not been successful in broadening their present market, and procurement of new factories influences the personal aims of the owners of the organisation.

Task 3

3.1 State the working mechanism of the forex market and how it influences the business and organisational decisions

The most active and largest market with a yearly turnover of millions and trillions of dollars is the forex market. Lots of people and companies join every day to make fortunes and get rich within no time. The forex market is not easy for beginners, and they should get proper knowledge before investing their money. The forex market is an enormous market where investors and trade companies can expand by trading cross bounders, and governments can function legally (Geromichalos & Jung, 2018). The forex market has its own language, so before starting the trade, there is a need to understand the concepts and terminology. For this trade, a trustworthy broker has to be chosen in which the company will perform transactions and give surplus financial services.

The Forex market is a platform where currencies are traded and exchanged. It is the world's largest financial market where every entity is involved and trades daily. It is liquid in nature and complex in the system. This forex market acts as the linkage between banks and non-banks. The dynamics of this market are very complex. The market is considered to be very volatile in its functioning (Korczak, Hernes, & Bac, 2017). It is extremely risky, and companies face a lot of difficulty in this stream. It is a place of networking for the trading of currencies. Forex market is quite huge in its establishment, not just because of tourism but also foreign direct investments and global interdependencies of one nation with the other for products. Most of these transactions are for the real purpose of portfolio investment. These transactions affect the functioning and decision making of companies in different ways. This transaction either weakens the business models of companies or strengthens them on the contrary.

Figure 3: Mechanism of the FOREX market

Figure 3: Mechanism of the FOREX market

(Source: (Munkhdalai, Munkhdalai, Park, Lee, Li, & Ryu, 2019)

When the rate of exchange with respect to the currency rises, that means the currency has appreciated or strengthened. When the rate of exchange falls with respect to a currency, then it is called depreciating or weakening. When the currency depreciates, it affects business in various dynamic good and bad ways. If the business is involved in the import of raw material, that will hugely impact that business since the worth and value of the currency in the global market is depreciating (Wang, Yuan, Li, & Wang, 2021). However, the important fact is that depreciation of the currency is not always harmful or adverse for the business. The government takes steps like devaluing their currencies' worth with the sole objective of making their export values cheaper in the international global marketplace. All business and organisational decisions have a direct influence on its stakeholders, access to leverage which helps to increase the velocity of the profits and losses of the transaction.

3.2 Evaluate the risk associated with foreign exchange and critically assess the potential impact of foreign exchange risk on different businesses in different industry

While trading with foreign currencies and companies, there is a lot of risks encountered, which has to be checked skillfully. Decrement of the local currency increases the cost of importing the goods, which directly depreciates the import volume. Foreign exchange rate directly influences the business person by changing the values of their supplies purchased from another country, in turn changing the marketability and charm of their products to overseas customers. The firms and companies that import raw materials and export their goods to foreign countries are heavily affected by the depreciation of the local currency. This depresses the economic growth of our trade industry (Sueshige, Kanazawa, Takayasu, & Takayasu, 2018). The increased foreign exchange has an effect on the trade surplus in which the imports become expensive, and the exports are cheaper, which leads to the depreciation of our business worldwide.

The currency exchange rate, interest rate and inflation play an important role in the economic health of businesses in different industries. A country with continuous lower inflation rate experiences increased currency value which increases the purchasing power compared to other currencies, which is associated with higher interest rates (Kembauw, Munawar, Purwanto, Budiasih, & Utami, 2020). Higher interest rates directly affect the economy of the lenders who have to pay higher returns compared to other countries. The current account deficit shows that there is an unbalanced trade between a country and their trading investors, showing excessive expenditure on foreign goods, interest and dividends rather than earning, which makes our domestic goods cheaper in the foreign market.

3.3 Explain critically whether the foreign exchange market is a suitable option for business restructuring

The Foreign Exchange Market is the largest liquid asset in the world, is a great option for corporate restructuring. All businesses require a structure for the proper execution of their goals and actions. Business reconstructing is a procedural technique that alters the current structure and creates a new structure (Kooli & Lock Son, 2021). A company restructures for efficient sales and better chances of gaining a stronger position in the market. The Forex Market provides the best way to achieve this goal. This market provides an apt understanding in pairing two non-identical currencies, allowing the business to purchase or sell for a stronger financial hold in the international market. Forex marketing is the largest market for finances, and it is greatly going to provide a better option for business reconstructing.

The forex market dominates all the single financial market exchanges. Business Reconstructing becomes essential by a nosiness entity when its financial position in the global market is in jeopardy. Forex market is the best alternative in providing a hand in finance will prove to be a good alternative. Business or corporate reshaping is essential when the company faces financial drawbacks (Munkhdalai, Munkhdalai, Park, Lee, Li, & Ryu, 2019). The forex marketing technique provides all-around trading flexibility with uncountable trading options. It also provides transactional costs at a very low price. Reconstructing a business requires a strict analysis of trading volume and a lack of restriction in marketing. The forex market also provides various currency pairs giving leverage to the market under reconstruction. The forex market provides an increased opportunity for any reshaping company on the global front to magnify its financial gains.

Task 4

4.1 Enlist the importance of working capital for a business and mention its systems and methods used to manage working capital

Working capital or commonly known as the networking capital, states the difference between the current assets and current liabilities of an entity (Pakdel & Ashrafi, 2019). The working capital measures the liquidity, operational efficiency and short-term financial health of the business. A positive WC suggests that the business has the potential to make investments and grow; on the other hand, a negative WC means the business might go into bankruptcy.

The importance of working capital is to manage the liquidity position of the entity. WC adequately analyses the expenses payables or likely to be incurred in the near future. Thus, it makes it easy for the financial team of the business to effectively plan for the funds through the information gained from WCM (Akgün & Karatas, 2020). Working capital serves as a financial metric to showcase how efficiently the business is operating and how financially stable it is in the short run. The working capital available to the business helps the manager in decision-making by correctly analysing the requirement of funds required for daily operations. The finance team can sufficiently manage the funds and make decisions according to the availability of funds and availability of funds as well. The working capital ratio is computed by the business to determine the liquidity and short-term solvency position of the entity wherein the current assets are divided by the current liabilities indicating whether the business has the adequate cash flow to cover its short-term debts and expenses.

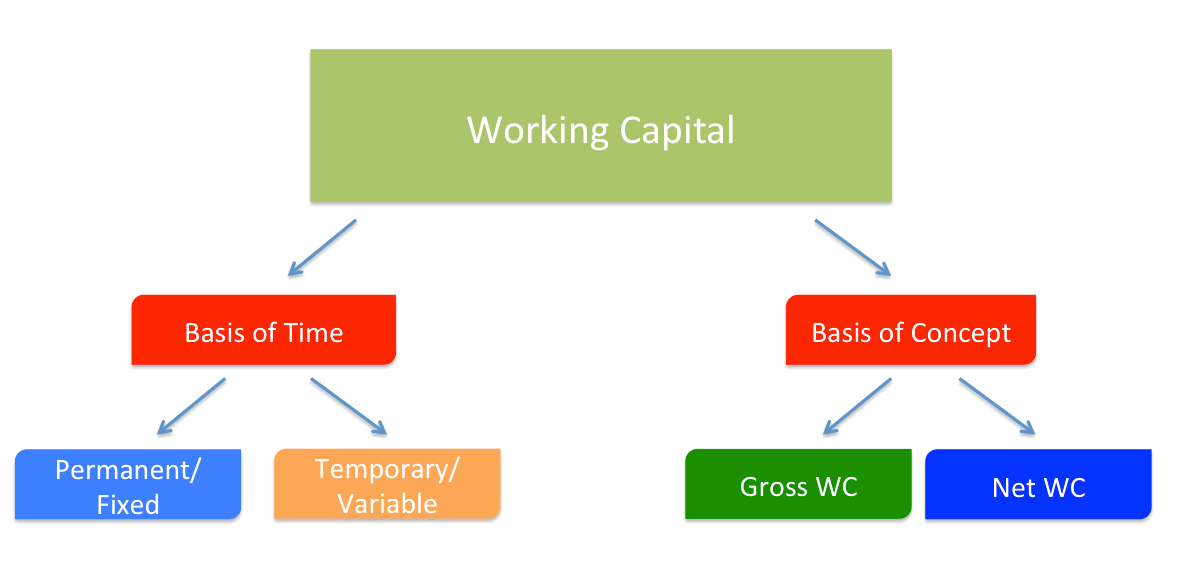

Figure 4: Working Capital Management

Figure 4: Working Capital Management

(Source: (Panda & Nanda, 2018)

Fundamentally, there are three strategies used for managing the working capital which are-

Hedging strategy: This strategy is implemented to meet the requirement of working capital for the business having limited profitability scope and risk. Under this strategy, all kinds of financial investments undertaken by the business on the purchase of assets are made through debt instruments having the same maturity period.

Conservative strategy: The conservative strategy is used by the business for managing its working capital having low risk and low profitability scope (Alvarez, Sensini, & Vazquez, 2021). According to this strategy, a part of the temporary working capital is used to fund finances of long-term nature along with non-current and current assets of permanent nature.

Aggressive strategy: The entire strategy revolves around earning higher profits along with higher risks. The long-term capital funding is used by the business only for funding non-current assets and a part of permanent working capital.

4.2 Identify the risks associated with working capital management that are not implemented and state the reasons why working capital management fails to monitor such risks

The credit risk in working capital leads to liquidity issues to the company, which in turn leads to the non-settlement of banking liabilities, suppliers and other creditors. Bank and other short-term credit institutions are known to be the major suppliers of finance working capital to the business. A company's definite risk usually have multiple sources, and one of such sources in the working capital strategy risks that are highly connected with the liquidity performance of the business. The greater the liquidity performance of the business, is lower the specific risk and vice versa, and the lower the company liquidity is, the higher its specific risk. Another prominent risk faced by businesses in managing working capital is to functional implementation of the marketing strategies for the company of adverse nature and its frequent fluctuations (Boisjoly, Conine Jr, & McDonald IV, 2020). Marketing requires a high investment of capital, and often businesses spend out more on marketing than it was budgeted. This hampers the equilibrium of cash availability in the business, and therefore, the working capital management mechanism could not cope with the unprecedented expenses as a failure of marketing management.

The following are the reasons resulting in the failure of working capital management systems. Most SMEs does not possess adequate technology resulting in a failure to determine the appropriate time limit within which the business should develop proper working capital management. The benefit from a well-defined working capital situation shall be withdrawn due to too much decision-making and the multiple perspectives of the stakeholders towards the company's operations (Le, Vu, Du, & Tran, 2018). Moreover, it is not always necessary that an existing working capital plan shall offer sufficient results. Due to stiff competition and fluctuation in the global markets, the companies need to make essential decisions within a limited time. As a result, it causes a negative impact on workforce performance.

4.3 Critically evaluate the systems and methods used in working capital planning. Evaluate a suitable restructuring strategy

The hedging system is one of the systems that is used for working capital planning applicable to turn into a loss-making situation to a profitable instance. The hedging system allows the investors in making an investment into a number of assets to improve the liquidity performance. As a disadvantage, the hedging system involves making huge expenses that wash away a large part of the profits. In an investment environment, risk and reward are two essential components that are related to each other to make an effort to reduce risk and, in turn, result in declining profits (Yap, Komalasari, & Hadiansah, 2018). However, the advantages of a hedging system can be gained when the market is susceptible to move sideward like trading of future or options frequently that demand higher requirements of capital.

On the other hand, the conservative system of working capital management is implemented to reduce the risk for investors who believe in conservative trading practices. Thus, the capital invested is attached to a low risk of incurring losses, as in the case of an aggressive system of working capital management (Darbisi, 2020). Due to stability available in the conservative system, it does not require too much monitoring of stocks. As a disadvantage, the conservative strategy is too slow and steady with minimal risk and therefore yields a low ROI. The frequent low and high ranking of the share market is absent in the conservative system of working capital management.

Company restructuring means re-venting the company's operations for the purpose of improving the performance of the business as well as satisfying the demand of the customers. The decision of company restructuring is undertaken by the business to survive strongly in the competitive business environment (Itoh & Konno, 2019). M&A is a kind of company restructuring wherein two independent companies join together or merge with each other to form a single entity. In addition to this, a joint venture requires two entities to jointly operate the entity and share the profits and loss according to the terms of the joint venture.

Task 5

5.1 Enumerate the financial options available to the company for restructuring the business

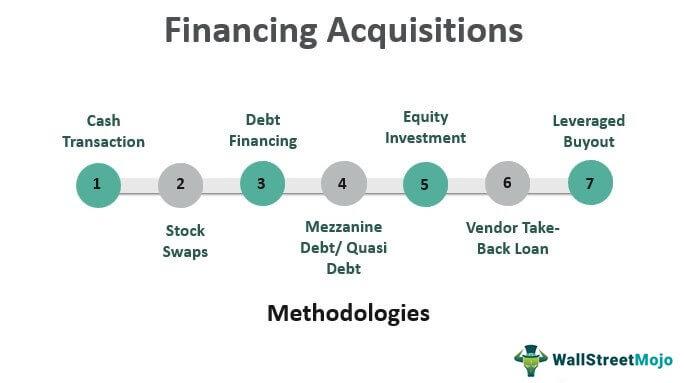

Acquisition finance is defined as the different capital sources that are used by an entity to fund for M&A. Usually, and it is a complicated mission for the entity to determine the perfect source of funding through planning since M&A structure often require a large variation and combinations, unlike another corporate restructuring.

Stock Swap Transaction: It is a type of acquisition finance when organisations own stocks that are traded on the recognised stock exchange; the acquirer can exchange its stock with the target company. It is a popular funding option for private businesses wherein the target company wants to retain its portion of stakes in the M&A new business since both the companies shall remain active in business operation.

Cash Acquisition: In all kinds of all-cash acquisition deals, the stocks are swapped for cash. The equity shareholders’ portion of the balance sheet in the parent company remains unchanged (Hanninen, 2018). Cash transaction during M&A occurs when the target company is acquired in smaller in size with low cash reserves than the acquirer.

Acquisition through equity: It is the most expensive funding option available to the business for restructuring its business using M&A. This type of financing is desirable for acquiring companies whose target companies operate in a highly fluctuating business and have unsteady free cash flows (NGUYEN, PHAM, & NGUYEN, 2020). It is flexible as there is an absence of commitment to making periodic payments to the target business.

Figure 5: Financing Acquisitions

Figure 5: Financing Acquisitions

(Source: (Broyles, 2020)

5.2 State the risks involved in pursuing various financial options

There are multiple risks faced by the business undergoing corporate restructuring to pursue a variety of financial options. Market risk is one of such kind that affects the business in selecting the desired mode of financing options. Market risk affects the business in bringing about changes in the business operations of the specific industry where the business has been functioning consequently (Rainone, 2017). Secondly, the credit risk is faced by businesses to define a favourable funding option required for corporate restructuring. Credit risk affected the business in lieu of deriving credit from banks and financial institutions to extend the terms of credit for corporate restructuring. Moreover, the suppliers and lenders shall verify the creditworthiness of the business before extending credit to the entity.

5.3 Mention the companies who have been successful in restructuring the business

A business undergoes restructuring for a variety of reasons. Sometimes, they are forced to restructure to adhere to the changes in the evolving markets, or it is required for growth. Facebook is one such company that announced its reorganisation in the year 2011. The company had successfully included successful growth opportunities, and it helped the business in streamlining the product development process (Baruník, Kocenda, & Vácha, 2017). The decision of restructuring for Facebook has been fruitful as the business went on to achieve global success and increased its number of users of the services. Again in the year 2018, Facebook announced another restructuring when the company was under scrutiny for handling cyber security attacks related to the US in the year 2016's presidential election. Facebook announced to restructure its product areas from five to three, although it was unrelated to security and data privacy issues.

Tesla is another example that recently announced a major restructuring of business and cost-reduction initiatives stating its need to achieve a flatter organisational structure and improve inter-communication. As a part of the business restricting strategy, Tesla laid off 3000 employees, which comprises 9% of the workforce, against facing pressure from the investors to increase the cash flow and improve the production of new cars. The laying off 9% of the workforce paid off the company's reorganisation, wherein the share price of the company recovered, and the market analyst predicted that the company should soon meet the goals of production and cash flow.

Hulu announced the company reorganisation for accommodating the growth of business and additional enhancement to expand its streamlining content for its customers (Hsieh, Cao, & Kohlbeck, 2018). The restructuring of the business shall revolve around four strategic priorities for the business that will result in the elimination of key managerial positions and the hiring of a new CTO and CDO. Since the announcement made by the company, Hulu has taken adequate steps for streamlining its business operations and consolidating small business units to add in 200 tech and product development employees.

Reference

Akgün, A. I., & Karatas, A. M. (2020). Investigating the relationship between working capital management and business performance: Evidence from the 2008 financial crisis of EU-28. International Journal of Managerial Finance.

Alvarez, T., Sensini, L., & Vazquez, M. (2021). Working Capital Management and Profitability: Evidence from an Emergent Economy. International Journal of Advances in Management and Economics, 32-39.

Ameliawati, M., & Setiyani, R. (2018). The influence of financial attitude, financial socialisation, and financial experience to financial management behavior with financial literacy as the mediation variable. . KnE Social Sciences, 811-832.

Baruník, J., Kocenda, E., & Vácha, L. (2017). Asymmetric volatility connectedness on the forex market. Journal of International Money and Finance, 39-56.

Boisjoly, R. P., Conine Jr, T. E., & McDonald IV, M. B. (2020). Working capital management: Financial and valuation impacts. Journal of Business Research, 1-8.

Broyles, J. (2020). Financial management and real options.

Darbisi, C. (2020). Determination Of Transfer Pricing. Curentul Juridic, The Juridical Current. Le Courant Juridique, 13-21.

Finkler, S. A., Smith, D. L., & Calabrese, T. D. (2018). Financial management for public, health, and not-for-profit organisations. London: CQ Press.

Fritz, V., Verhoeven, M., & Avenia, A. (2017). Political Economy of Public Financial Management Reforms.

Geromichalos, A., & Jung, K. M. (2018). An Over-the-Counter Approach to the FOREX Market. International Economic Review, 859-905.

Hanninen, A. (2018). Transfer pricing of business restructurings from the perspective of Russian. Finnish and US tax law.

Hsieh, H. Y., Cao, J., & Kohlbeck, M. (2018). CEO turnover and major business restructurings. In Advances in Management Accounting. Emerald Publishing Limited.

Itoh, Y., & Konno, Y. (2019). Research on Cross-border M&As by Japanese Construction Companies. ??????, , 107-115.

Karadag, H. (2015). Financial management challenges in small and medium-sized enterprises: A strategic management approach. EMAJ: Emerging Markets Journal, 26-40.

Kembauw, E., Munawar, A., Purwanto, M. R., Budiasih, Y., & Utami, Y. (2020). Strategies of Financial Management Quality Control in Business. TEST Engineering & Management, 16256-16266.

Kooli, C., & Lock Son, M. (2021). Impact of COVID-19 on Mergers, Acquisitions & Corporate Restructurings. Businesses, 102-114.

Korczak, J., Hernes, M., & Bac, M. (2017). Collective intelligence supporting trading decisions on FOREX market. In International Conference on Computational Collective Intelligence, 113-122.

Lawson, A. (n.d.). Public Financial Management. GSDRC Professional Development Reading Pack.

Le, H. L., Vu, K. T., Du, N. K., & Tran, M. D. (2018). Impact of working capital management on financial performance: The case of Vietnam. International Journal of Applied Economics, Finance and Accounting, 15-20.

Loke, Y. J. (2017). The influence of socio-demographic and financial knowledge factors on financial management practices of Malaysians. International Journal of Business and Society.

Madura, J. (2020). International financial management. London: Cengage Learning.

Munkhdalai, L., Munkhdalai, T., Park, K. H., Lee, H. G., Li, M., & Ryu, K. H. (2019). Mixture of activation functions with extended min-max normalisation for forex market prediction. IEEE Access, 183680-183691.

NGUYEN, A. H., PHAM, H. T., & NGUYEN, H. T. (2020). Impact of working capital management on firm's profitability: Empirical evidence from Vietnam. The Journal of Asian Finance, Economics, and Business, 115-125.

Pakdel, M., & Ashrafi, M. (2019). Relationship between Working Capital Management and the Performance of Firm in Different Business Cycles. Corporate finance assignment Dutch Journal of Finance and Management, em0057.

Panda, A. K., & Nanda, S. (2018). Working capital financing and corporate profitability of Indian manufacturing firms. Management Decision.

Rainone, S. (2017). The evolution of EU primary law and the Court of Justice's interpretation of workers' rights: Focus on workers' rights relating to business restructurings. In Labour Law Research Network (LRN) Conference.

Seifollahi, S., & Shajari, M. (2019). Word sense disambiguation application in sentiment analysis of news headlines: an applied approach to FOREX market prediction. Journal of Intelligent Information Systems, 57-83.

Siminica, M., Motoi, A. G., & Dumitru, A. (2017). Financial management as component of tactical management. Polish Journal of Management Studies, 15.

Sueshige, T., Kanazawa, K., Takayasu, H., & Takayasu, M. (2018). Ecology of trading strategies in a forex market for limit and market orders. PloS one, e0208332.

Tajti, T. (2018). Bankruptcy stigma and the second chance policy: the impact of bankruptcy stigma on business restructurings in China, Europe and the United States. China-EU Law Journal, 1-31.

Wang, H., Yuan, Y., Li, Y., & Wang, X. (2021). . Financial contagion and contagion channels in the forex market: A new approach via the dynamic mixture copula-extreme value theory. Economic Modelling, 401-414.

Wolmarans, H. P., & Meintjes, Q. (2015). Financial management practices in successful Small and Medium Enterprises (SMEs). The southern African journal of entrepreneurship and small business management, 88-116.

Yap, R. J., Komalasari, F., & Hadiansah, I. (2018). The effect of financial literacy and attitude on financial management behavior and satisfaction. BISNIS & BIROKRASI: Jurnal Ilmu Administrasi dan Organisasi,, 4.

Yuniningsih, Y., Pertiwi, T., & Purwanto, E. (2019). Fundamental factor of financial management in determining company values. Management Science Letters, 205-216.