Corporate Accounting Assignment Discussing Income Tax Issues Of Ansell Limited

Question

Task:

Corporate Accounting Assignment task:

Collect the latest annual report of an ASX listed company for the last 2 financial years. Please read the financial statements (balance sheet, income statement, cash flow statement) and notes attached to financial statements on income tax issues very carefully. Please remember some aspects of your firm’s treatment of its tax – can be a very complicated area, particularly for some firms. Based on your understanding of the topic “accounting for income tax” and based on your reading of the collected annual reports, do the following tasks.

- Briefly explain the concepts of accounting profit, taxable profit, temporary difference, taxable temporary difference, deductible temporary difference, deferred tax assets and deferred tax liability.

- Briefly explain the recognition criteria of deferred tax assets and deferred tax liability.

- What is your firm’s tax expense in its latest financial statements?

- Is this figure the same as the company tax rate times your firm’s accounting income? Explain why this is, or is not, the case for your firm highlighting the reasons for differences.

- Identify the deferred tax assets/liabilities that is reported in the balance sheet articulating the possible reasons why they have been recorded.

- Is there any current tax assets or income tax payable recorded by your company? Why is the income tax payable not the same as income tax expense?

- Is the income tax expense shown in the income statement same as the income tax paid shown in the cash flow statement? If not, why is the difference?

- Briefly explain the concepts of temporary difference and permanent difference. Identify any permanent differences that your company may have.

- What do you find interesting, confusing, surprising or difficult to understand about the treatment of tax in your firm’s financial statements? What new insights, if any, have you gained about how companies account for income tax as a result of examining your firm’s tax expense in its accounts?

Answer

Abstract

The aim of the corporate accounting assignment is to discuss regarding the income tax issues relating to company. To conduct the study, Ansell Limited has been selected a leading manufacturer of health care and safety products. The report deals with the concept of accounting for income tax and taxable profit of the company. The report initiates with the introduction followed by the discussion of accounting concepts related to Ansell Limited. Furthermore, the report articulates the reason as to why deferred tax assets and liabilities has been recorded in the books. It even elucidates upon the concept of temporary and permanent difference followed by a conclusion

Introduction

The aim of the corporate accounting assignment is to discuss regarding the income tax issues relating to company. To conduct the study, Ansell Limited has been selected a leading manufacturer of health care and safety products. The report deals with the concept of accounting for income tax and taxable profit of the company. The report initiates with the introduction followed by the discussion of accounting concepts related to Ansell Limited. Furthermore, the report articulates the reason as to why deferred tax assets and liabilities has been recorded in the books. It even elucidates upon the concept of temporary and permanent difference followed by a conclusion

i. Discussion of accounting concept dealing with Ansell Limited

Accounting profit- in case of a company or any other entity, when the expenditure incurred by a company is deducted from the revenue earned, the resultant amount is termed as accounting profit (Coetsee 2010). Most of the companies use the accrual method of accounting instead of cash method and hence all the revenue earned is included in the total income whether received during the year or not. For instance if the business invested a sum of $200 million and earned a profit of $250 million then the accounting profit of the business will be $50 million for the specified period. Similarly, the expenses whether paid or unpaid till the year-end are included in the total expenditure.

Taxable profit- when we calculate accounting profit, the unearned income, and the accrued expenses are adjusted afterward to calculate taxable profits. The taxable profits are calculated for calculating the tax of the taxpayer company (Shuli 2011). For instance accounting profit of Ansell stands at $200 million however accumulated depreciation has made the taxable profit to $150 million and tax rate is set at 30% then the taxable profit is $105 million.

The temporary difference- there are some items in the financial statements which are treated differently as per the accounting and different in case of tax returns (Foreman 2013). When there are such said differences, these are termed as temporary differences. For example, a company may have incurred an expense but has not paid it yet. As per the accounting treatment, such expenses will be shown in Income Statement but the same will not be considered as deduction while filing tax returns.

Taxable Temporary Difference- certain timing differences arise in financial statement figures due to a difference in accounting and tax treatment. Those timing differences which lead to lower tax in the current period but higher tax in the coming year are termed as taxable temporary differences (Cohen & Karatzimas 2017). For example- depreciation maybe $5 as per accounting rules and $7 as per tax rules. $ 2 will reduce tax in the current year but will result in more tax in the coming year as depreciation will be lesser in the coming year. This shall lead to a deferred tax liability which shall be recognized in the current year.

Deductible Temporary difference- these are the timing differences that result in higher taxable income and ultimately higher income tax payable during the current year (Cohen & Karatzimas 2017). But the income tax shall be reduced for later years due to this timing difference. Such timing difference creates a deferred tax asset and is termed as a deductible temporary difference. An apt example is the Provisions for employee benefits like long-service leave.

Deferred Tax Liability- when due to timing differences, the current period tax becomes less but the liability to pay tax in the future becomes more, in such a case a tax liability is deferred for future (Kiron 2012). This usually happens when the company has paid a lesser advance tax in comparison to the actual liability of tax for the current year.

Deferred Tax Liability Formula = Income Tax Expense – Taxes Payable + Deferred Tax Assets. Hence if the income tax expense of the company stands at $400 and the tax payable is $300 with deferred tax asset of 0 then deferred tax liability will be $400-$300+0 = $100

Deferred Tax Asset- when due to timing differences, the current period tax becomes more but the liability to pay tax in the future becomes less, in such a case a tax asset is deferred as an asset for the future. This usually happens when the company has paid more advance tax in comparison to the actual liability of tax for the current year (Kiron 2012). For instance the tax rate applicable on the company is 30% and depreciates the machine that contains a value of $20,000 with a useful life of 5 years. In second yeat the SLM records at $4000 and taxation of $10,000. Normally, the company will pay $6000 as tax. The difference that lies between the accounting value and the payment of tax is the deferred tax.

ii. Recognition of DTA & DTL in the financial statements of the company.

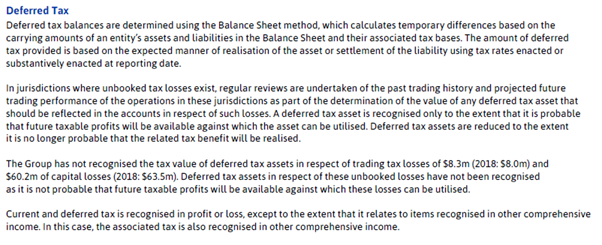

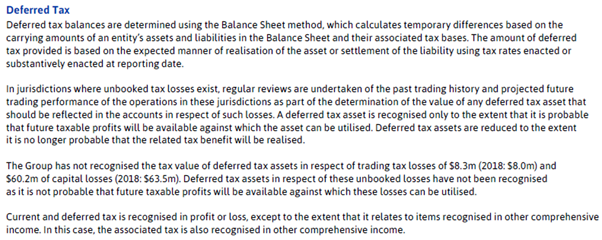

The company Ansell Limited follows the Balance Sheet Method to determine deferred tax and its recognition into DTA and DTL. According to this method, the carrying amounts of liabilities and assets as shown in the balance sheet are compared with the values as per the tax base (Haller & Chris 2014). The timing differences that arise are then recognized as DTA or DTL as the case may be.According to the relevant Accounting Standards of Australia, a deferred tax asset should be recognized in the financial statements only if there is a probability that there will be the availability of future profits which would be used for utilization of the deferred tax assets (Shuli 2011). Hence, the company undertakes reviews at regular time intervals for past profits and projection of the financial performance of the company. by doing so the company adheres to the AASB so that the deferred tax assets can be created only to the extent of probability of their utilization in the future (Bagienska 2016).

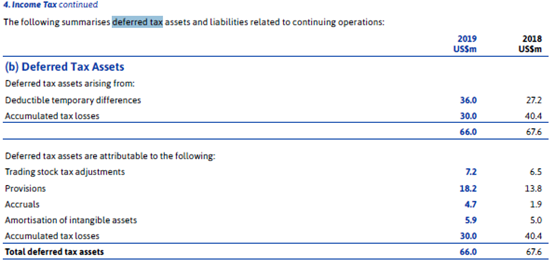

From the above extract taken from Page No.-81 of the Annual Report of the company, it is clear how the deferred tax assets are recognised. Deferred tax liabilities are also recognised by calculating timing differences in accounting and tax base and when the current tax expense is reduced leading to increase in tax of future periods, then deferred tax liability is recognised in the balance sheet

(Page-80 of Annual Report).

iii. Tax Expense of the company

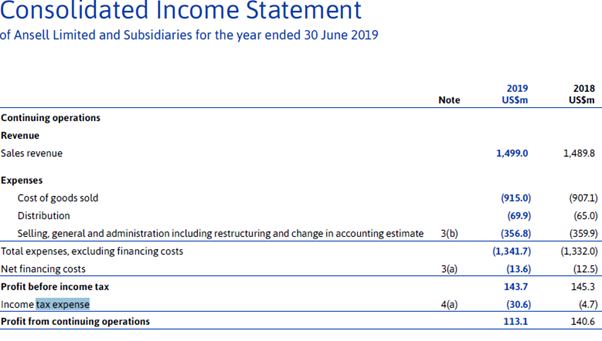

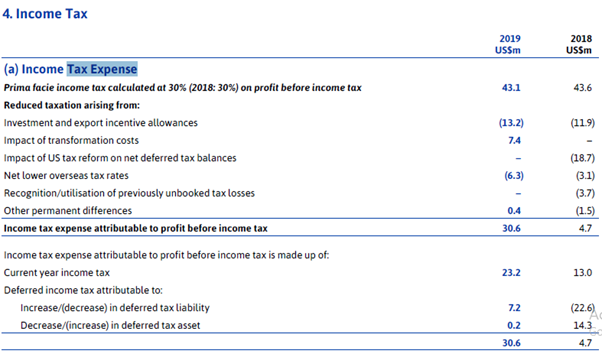

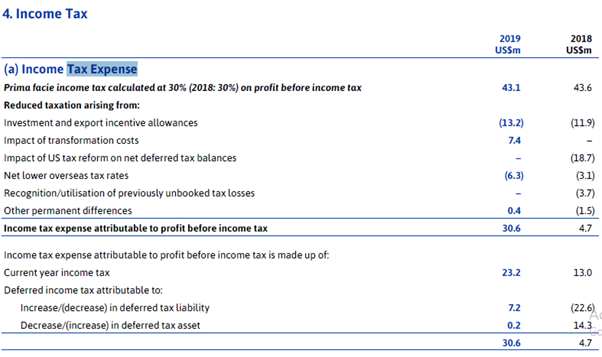

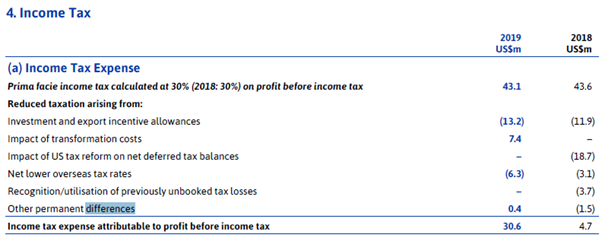

As per the latest financial reports of the company, the tax expense of the company as booked in Income Statement is $30.6m for the year ended 30th June 2019. Income tax expenses pertain to the tax calculated on Profits of the company before Income Tax. Income Tax is calculated at 30% on profits before tax, but few adjustments have been done by the company to arrive at actual tax payable such as permanent difference, transformation costs impact on taxes (Ansell 2019).

(Extract taken from Page-67 of Annual Report)

iv. Comparison in tax on accounting profit and actual tax.

Income tax is calculated at 30% on the accounting profits or we say profits before tax as per Australian tax rules. If we simply calculate tax on profits before tax for Ansell Limited for 2019, it will be $43.1m as the profits before tax is $143.7m. But the tax expense as shown in Income Statement is $30.6m (Ansell 2019). The reason for the difference in both the figures is that various adjustments have been done from the tax on accounting profits. The adjustments done are as under:

- The taxes on allowances on export incentives and related investments of $13.2m have been deducted from the tax on accounting profit.

- Overseas tax rates must have been overbooked and hence reduced from the tax on accounting profits. Such taxes were $6.3m (Ansell 2019).

- The impact of taxes on certain transformation costs has been added back amounting to $7.4m (Ansell 2019).

- The tax effect of some other permanent differences of $0.4m has been added back to arrive at actual income tax payable (Ansell 2019)

(Extract taken from Page-79 of Annual Report)

v. Deferred Tax Assets and Deferred Tax Liabilities of Ansell Limited:

The company Ansell Limited has disclosed deferred tax assets and deferred tax liabilities in its Balance Sheet. Deferred Tax Assets are those assets that have arisen as a result of timing difference and the income tax paid in advance during the relevant year is greater than the income tax payable for the current year. The company has recorded deferred tax assets which are attributable to various items of financial statements which are as under:

Deductible temporary differences arising from Tax adjustments for Trading stock of the company, certain provisions, and accruals made which were over-accrued hence considered as deferred tax assets, temporary differences due to amortizing of intangible assets and deferred tax assets arising due to accumulation of tax losses. The total amount of deferred tax assets in the balance sheet is $66m. (Page No.-80 of Annual Report)

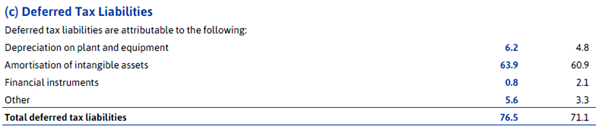

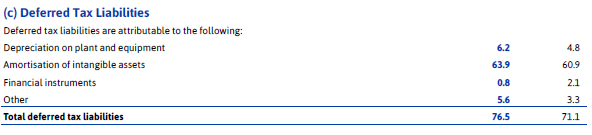

The company Ansell Limited has disclosed deferred tax liabilities in its Balance Sheet amounting to US$76.5m. When due to timing differences, the current period tax becomes less but the liability to pay tax in the future becomes more, in such a case a tax liability is deferred for future (Ansell 2019). The company has recorded deferred tax liabilities which are attributable to various items of financial statements which are as under:

Deductible temporary differences arising from Tax adjustments for depreciation provided on Plant & Equipment, intangible assets amortization, timing differences in financial instruments treatment, and some other factors as mentioned in the annexures to Annual Report. (Page No.-80 of Annual Report)

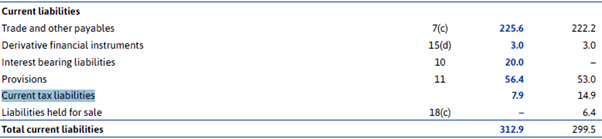

vi. Current Tax Liabilities of the company

The company has shown current tax liabilities for the year 2019 in its Balance Sheet amounting to $7.9m. This amount pertains to the liability of Income Tax which is payable shortly and which pertains to the current financial year and is the amount that is left after adjustments done for tax payable or receivable for earlier years. Hence, this amount is different from the income tax expenses shown in the Income Statement of $30.6m as the Income Tax expense (Ansell 2019).

(Extract on Page No.-69 of Annual report)

vii. Current income Tax Expenses and Income Tax paid:

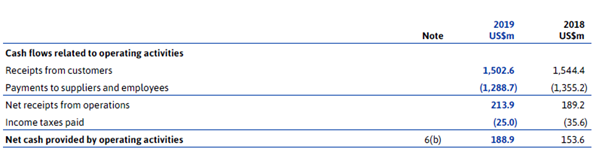

As per the Annual Report of Ansell Limited, the income tax expense reported in Statement of Profit & Loss and income tax paid reported in Cash Flow Statement is different amounts. Income Tax paid is $25m whereas Income Tax expense is $30.6m as shown in below tables extracted from the Annual Report:

There is a difference in both the amounts due to various reasons. When we calculate income tax expenses, we have to take into account all the adjustments related to timing differences, currency fluctuation effects, tax rate changes, permanent and temporary differences, (Haller & Chris 2014). The net amount of Income Tax Expense is shown in Income Statement. It is not the final amount that is to be paid for the current year and shown in cash flow, rather the amount paid during the year which includes the previous year tax payable and any advance tax for the current year are shown in Cash Flow. This means that the cash flow statement includes only those outflows which have been paid by the company in cash or cheque in the financial year (Schipper 2010).

viii. Concepts of Temporary and Permanent Differences:

Temporary Differences- As discussed earlier in this report, there are some items in the financial statements which are treated differently as per the accounting and different in case of tax returns (Chen & Gong 2019). When there are such said differences, these are termed as temporary differences. For example, a company may have incurred an expense but has not paid it yet. As per the accounting treatment, such expenses will be shown in Income Statement but the same will not be considered as deduction while filing tax returns (Kiron 2012). The reasons for temporary differences may include depreciation effects, any expenses that have not been paid but accounted for in Income Statement, any revenue that has not been received but has been shown in Income Statement, etc. Such items are treated differently for tax purposes and accounting purposes sometimes. Hence these create timing differences. Temporary differences are either deductible or taxable. The deductible temporary difference leads to the creation of deferred tax assets and taxable ones create deferred tax liabilities (Cheney 2013). These are called temporary differences as their effects are reversible in the future.

Permanent Differences- these are not reversible in the future hence known as permanent differences. When as per accounting treatment, an item is included in the financial statements but the same is not considered in financial statements for tax calculations, then such difference is called the permanent difference (Madura & Fox 2011).

Yes, there are permanent differences as shown in Financial Statements of Ansell Limited. (Pg 79 of Annual Report). These have been mentioned as 'Other Permanent Differences' and do not disclose further details.

ix. Insights into the tax treatment by Ansell Limited.

The method of the tax treatment of the company is interesting yet difficult to understand. The income tax expense as shown in the Income Statement is $30.6m, Tax as a percentage of Accounting Profits is $43.1m, current tax liabilities as shown in Balance Sheet are $7.9m, Income Tax paid as per Cash Flow Statement is $25m. Now, it may be easy for a financial analyst or a person with taxation background to understand the implication of tax and the treatment of tax done by the company (Ansell 2019). But, for other users such as a common investor, it is difficult to understand the difference in all these items. It would have been beneficial to common people if the company would have laid down the reasons for differences in these items such as why there is a difference in income tax paid and income tax expense shown in Income Statement. The recognition and measurement of DTA and DTL is in itself a confusing task as there might be uncertainty in the achievement of future profits and DTAs should be recognised only if there is a probability that there will be future profits available to utilise the deferred tax assets (DTAs).

(Page No.-81 of Annual Report)

For instance, we can see from the above extract that the group company could not recognize deferred tax assets for the unbooked losses which pertained to trading tax loss and capital loss as the probability of future profits was less. Hence, it is very difficult to analyze such probabilities and follow such a complex tax structure.

Further, the company has its trade transactions with various other countries such as the US, China, Thailand, etc. This required consideration of varying tax rates and adjustments concerning different jurisdictions. To assess the accuracy of the cross-border tax adjustments, the auditors need to hire tax specialists as it is not easy to understand such complex calculations and adjustments (Abeysekera 2013).

Conclusion

From the report, we can conclude that the company Ansell Limited has a global tax base as it trades with numerous other countries having different jurisdictions. The tax calculations are dependent on various tax rate fluctuations. Hence, the calculations and recognition of tax expenses need vast experience and judgment by a professional. The deferred tax assets are also considered vital as their recognition is dependent upon the probability of availability of future profits so that the deferred tax assets can be utilized. Hence, the prediction of future profits also requires correct estimation and judgment keeping in mind the past performance of the company, projected investments, and projects available to the company and such other factors. Also, it is clear that for determining the actual cash expenses, the temporary differences should be calculated with maximum accuracy as these are used in calculating the income tax expense. The recognition and measurement of temporary and permanent differences is a very important segment for such global companies and for carrying out this task, knowledgeable and experienced personnel need to be hired.

References

Abeysekera, I 2013, A template for integrated reporting. Journal of Intellectual Capital, vol. 14, no. 2, pp. 227-245. Retrieved from https://ro.uow.edu.au/cgi/viewcontent.cgi?article=3928&context=commpapers

Ansell 2019, Ansell 2019 annual report & accounts, viewed 28 May 2020, https://www.ansell.com/col/es/about-us/investor-center/annual-report-2019-microsite

Bagienska, A. 2016, Value added statement - a relevant instrument for integrated reporting, e-Finanse, vol. 12, no. 4, pp. 92-104. Retrieved from https://search.proquest.com/docview/1927238143/5026E31111564F8CPQ/2?accountid=30552

Chen, A., & Gong, J 2019, Accounting comparability, financial reporting quality, and the pricing of accruals. Advances in Accounting, Incorporating Advances in International Accounting, vol. 45. Retrieved from https://e-tarjome.com/storage/panel/fileuploads/2019-10-08/1570541101_E13728-e-tarjome.pdf

Cheney, G. A 2013, Is integrated reporting: Worth the extra work? Financial Executive, vol. 29, no. 4, pp. 83-85. Retrieved from https://search.proquest.com/docview/1428802449/3A4D7C5464984C82PQ/1?accountid=30552

Coetsee, D 2010, The role of accounting theory in the development of accounting principles. Meditari Accountancy Research, vol. 18, no. 1, pp. 1-16. Retireved from https://search.proquest.com/docview/1030937237/40841D5A832D4BD2PQ/1?accountid=30552

Cohen, S. & Karatzimas, S. 2017, Accounting information quality and decision-usefulness of governmental financial reporting: Moving from cash to modified cash, Corporate accounting assignment Meditari Accountancy Research, vol. 25, no. 1, pp. 95-113. Retrieved from https://search.proquest.com/docview/1876463815/51D1D026B6A443BAPQ/1?accountid=30552

Foreman, P 2013, Accounting history: Publication list 2012, Accounting History, vol. 18, no. 2, pp. 281-284. Retireved from https://search.proquest.com/docview/1366013548/9FEC38B1785E4B55PQ/1?accountid=30552

Haller, A., & Chris, v. S 2014, The value added statement – an appropriate instrument for integrated reporting. Accounting, Auditing & Accountability Journal, vol. 27, no. 7, pp. 1190-1216. Retireved from https://search.proquest.com/docview/2076270471/5026E31111564F8CPQ/1?accountid=30552

Kiron, D 2012, Get ready: Mandated integrated reporting is the future of corporate reporting. MIT Sloan Management Review, vol. 53, no. 3, pp. 1-3. Retireved from https://search.proquest.com/docview/963965382/FB8543DCD6804D2CPQ/1?accountid=30552

Madura, R., & Fox, J 2011, International financial management, South Western. Retrieved from https://www.semanticscholar.org/paper/Student's-Solutions-Manual-to-Accompany-Atkins'-Trapp-Cady/b3ba09ad4b3a530fbc745df8beeb9efcae17ed8a

Schipper, K. 2010, How can we measure the costs and benefits of changes in financial reporting standards?, Accounting and Business Research, vol. 40, no. 3, pp. 309-327. Retrieved from https://search.proquest.com/docview/726391189/51D1D026B6A443BAPQ/4?accountid=30552

Shuli, I 2011, Earnings management and the quality of the financial reporting. Perspective of Innovation in Economics and Buisness (PIEB), vol. 8, no. 2, pp. 45- 48. Retrieved from https://econpapers.repec.org/scripts/redir.pf?u=http%3A%2F%2Fageconsearch.umn.edu%2Frecord%2F128647%2Ffiles%2F08_PIEB_V8_ Ingrid%2520Shuli_Earnings_Management.pdf;h=repec:ags:jrpieb:128647