Consultancy Assignment: Self-Reflection On Work Experience At Deloitte

Question

Task:

Write an essay/report on consultancy assignment of 2000 words (+/- 10%) on your individual research topic. Your task is to define the topic and explain its relevance to the discipline of consultancy, reflect on its relevance to your own practices and critically analyze the topic.

You do NOT need to define other topics, but you can refer to them within the context and relevant flow of your own topic. Your research should draw on AT LEAST 8 articles from peer-reviewed academic journals and textbooks and 5 articles from other reliable sources (e.g. World Bank datasets, Government reports, established media outlets, corporate documents etc). All source materials must be fully and consistently referenced as per RMIT’s guidelines and policies.

Answer

Introduction

In the context of the modern-day corporate environment as outlined herein consultancy assignment, there has been a significant increase in demand for consultancy practices because businesses around the world tend to hire the services of management consultants for solving issues along with executing strategies where they lack the relevant knowledge and skill set (Nanda & Das 2021). However, management consultants often face resistance that makes the assigned work or project complicated and challenging. Thus, it is important for management consultants to have expertise in terms of countering the challenges associated with resistance so that they can use all the relevant strategies and approaches to mitigate the issues of their clients. In addition to that, management consultants also face the risk of damaged reputation if their consultancy service does not prove to be effective due to certain resistance (Srinivasan 2014).

The following report on consultancy assignment will be a reflection of my work experience as an Audit Consultant at Deloitte. The aim of this report is to define the resistance that is encountered from the client’s end along with recommending ways to deal with the resistance so that the consulting work is efficient and effective. Overall, it is a well-known fact that business enterprises hire the services of audit consultants to ensure that their financial statements reflect the actual financial position of the company, which is extremely important for the investors to know.

The concept of resistance

One of the most important skills to possess as an Audit Consultant is to be able to effectively identify and address the resistance from the clients (Van Twist et al. 2015). Thus, in terms of consulting projects, resistance occurs when the client (an individual or a group) reacts against the recommendations or services that can allegedly threaten their practices. There are various types of resistance from clients and some of them tend to create tremendous difficulties in the auditing profession, which can be major setbacks (Birhan 2016). During my tenure as an Audit Consultant at Deloitte, I have encountered the following types of resistance:

Lack of cooperation: This is a major resistance that has been encountered in several projects related to external audits. I have experienced that in certain organizations, the internal auditors are hesitant to cooperate with external auditors, and thus it creates challenges for the external auditors to identify the relevant materials and resources associated with the audit process. It has been observed that the internal auditors feel inferior and less valued when the organization that they are employed with hires the services of external audit consultants (Khaled Endaya 2014). Therefore, they do not prefer to cooperate properly with external auditors based on the feeling of being less valued and trusted. In addition to that, in situations where the financial statements are misleading or fraudulent, there is also a level of fear among the internal auditors of being charged with unethical audit practices (Fontaine & Pilotti 2016).

Time: This is a common form of resistance faced by audit consultants that can delay the audit work. I have encountered situations where the client postpones meetings related to financial discussion and sometimes questions the information that has been requested by me as an Audit Consultant. In addition to that, sometimes the client also delays the processing of the requested documents that is crucial for the audit process (Khaled & Qatamin 2020). Overall, the resistance related to time comes in the form of excuses such as workload and other official meetings.

Poor internal control: Effective and efficient internal control minimizes the risk of asset loss as well as ensures that the financial statements are reliable (Younas & Kassim 2019). During my work as an Audit Consultant, I have encountered situations where the internal control of a company is extremely weak because the financial data has got unauthorized access and this makes it extremely difficult to track the loopholes in the financial statements.

Change: This form of resistance occurs when the client resists the transformation by thinking that the suggested change is irrelevant (Angonese & Lavarda 2014). I have experienced that as an Audit Consultant when I suggest some improvement in financial reporting practices, the client considers by suggestion as irrelevant or impractical. In addition to that, the client also thinks that the suggestion does not connect to the purpose of their issue regarding the audit of financial statements. Therefore, this form of resistance makes it difficult to make the financial statements comply with the relevant accounting standards.

Recommendation to deal with resistance

In the profession of being a management consultant, different approaches are required to address different forms of resistance. Thus, in the context of an Audit Consultant, there are certain ways of addressing the resistance from clients, so that the audit work does not get disrupted and effectively delivers the best results. Therefore, the following measures can be suggested to address the client resistance during external audits:

Overcoming opposition: One thing that I have learned during my stint as an Audit Consultant at Deloitte is that resistance is bound to occur regardless of how efficient a company is in terms of managing change. It is thus, important for audit consultants to engage with those who create resistance (Kelchner 2019). This approach can ensure that the consultants actively understand the concerns of the clients that can potentially help in alleviating the problem in a timely manner. In addition to that, as an Audit Consultant, communicating often and early is mandatory while trying to convey the information related to audit work to the clients. There needs to be continuous communication between the client and external auditor regarding the day-to-day audit work along with predicting the future work. All these factors indicate that the best approach for an auditor is to be straightforward, truthful, and timely in terms of implementing changes in the financial statements. In addition to that, as an Audit Consultant, it is also beneficial to explain the reasons for the changes in the financial statements, so that the client can understand the importance of change. The client based on the explanation can see the bigger picture and benefits of the change, which is not possible to understand based on a narrow explanation about the future happenings. Improvement and innovation are two elements that occur on a daily basis in the context of a business environment and it is the factor of new ideas generated by management consultants that helps a company to improve (Blount & Carroll 2017). Overall, the client must be reminded on a regular basis that the main purpose of an Audit Manager is to provide assistance and improve the opportunities regarding financial reporting. Therefore, the alignment of clients' daily responsibilities with the compelling vision of the audit work can mitigate the resistance to a large extent as the client will be able to witness the effectiveness of audit work in terms of gaining the confidence of the investors.

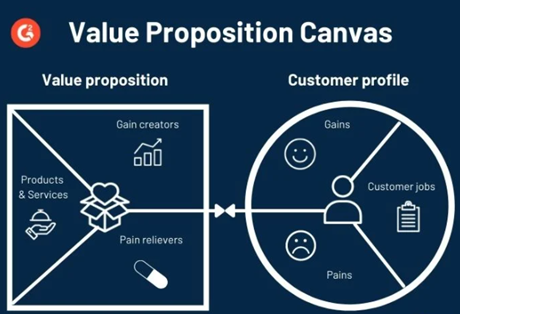

Emphasize the strategies to clients’ requirements: The process of audit work can be quite challenging and lengthy, so the main focus of an external auditor must be to ensure that the audit practices are well-equipped with relevant tactics and strategies (de Kleijn & Van Leeuwen 2018). Thus, an Audit Consultant representing Deloitte can use a strategic tool such as a customer value proposition that can play a significant role in terms of identifying the weak internal controls of the client. In addition to that, this tool can also ensure that the audit strategies structures around the needs of the client. One of the most crucial aspects of addressing potential resistance is to indulge in receiving and responding to the feedback that is provided by the clients. In addition to that, as an audit consultant, it will also be important to consider the feedback of the employees as they are the one who makes the client happy by their work. The employees associated with accounting activities can be ask probing questions based on the accounting procedures of the company along with asking their suggestions to potentially improve the company's accounting practices. I have observed that most of the resistance comes from those who feel less valued despite their involvement in the process, so as an Audit Consultant it will be important to make all the individuals associated with accounting feel involved. Therefore, the best way to ensure such practice for addressing resistance is to communicate as much as possible by using a blend of informal and formal communication that can enable every individual associated with financial reporting to receive the news regarding the changes (Dhu 2018). Overall, the concept of emphasizing the alignment of the audit strategies to that of the client’s requirements will be based upon understanding the lacking aspects of the client for which they have hired the services of an external auditor. Therefore, by ensuring this approach, an Audit Consultant can effectively minimize the occurrence of resistance from the client.

Figure 1: Value Proposition Canvas

Source: (Farooq, 2021)

Figure 1 demonstrates the value proposition canvas that can be used by Deloitte to identify the weak internal controls of the client, which can ultimately lead to better financial reporting and reduction in resistance.

Emphasize on emotional intelligence: In the context of audit practices, it has become essential for auditors to possess higher emotional intelligence so that along with effective client interaction it is also possible to effectively interact with internal auditors (Ling 2013). Emotional intelligence can be defined as the ability to be aware of, express, and control emotions along with handling interpersonal relationships empathetically and judiciously. I have experienced that during the time of questioning internal auditors or other accounting professionals, the most important aspect that can be gained by an external auditor or an Audit Consultant is trust. Thus, implementing emotional intelligence during questioning sessions can effectively bring out the issues and concerns, which is an important way to minimize resistance. During the session of questioning, an Audit Consultant must clearly explain the purpose of the questioning along with the outcomes that are expected from the process. The next step is to consider how individual emotions can potentially interfere in terms of effective communication. The third step must be to bring the emotions under control along with proceeding with a calm mental state. During my stint as an Audit Consultant at Deloitte, I have realized that while conducting meetings based on a client's audit work, it is important to explain to the attendants the expectations from the meeting. In addition to that, balancing the reactions of the participants is also an effective way to minimize resistance as balancing the emotions can ensure that the negative emotions do not derail the objective of the meeting. Overall, as an Audit Consultant, it is crucial to anticipate and prepare for the reactions that every individual can understand. Understanding the emotional intelligence concepts makes the audit work relatively easier as it helps in the alignment of auditing approaches with the client's requirements that ultimately lead to reduced negative reactions along with building better relationships (Jacka 2018). Therefore, by emphasizing on emotional intelligence, external auditors or Audit Consultants can drastically reduce the potential of resistance from a client that can act as major obstacles in the audit process upon which the investors will rely.

Conclusion

In the end, it can be concluded that the role of an Audit Consultant is to evaluate the effectiveness and adequacy of internal controls along with reporting on the audit findings and providing suggestions to improve the accounting issues. Thus, the audit process involves various aspects such as surveys and interviews, which makes the auditing process prone to resistance. The resistance faced by audit consultants can create severe disruptions in the audit work that ultimately delays the outcomes and sometimes makes it ineffective. Therefore, it has become increasingly important for audit consultants to consider resistance as an important part of their learning process so that their work does not get disrupted due to various types of resistance. Overall, the role of a consultant is based on giving recommendations and suggestions that can help the client to transform for a better purpose. This report is a reflection of my personal experience of working as an Audit Consultant at Deloitte and thus the recommendations suggested for dealing with resistance aim at strengthening the external auditors' relationship with clients. Therefore, the recommendations made in this report can enable external auditors to understand the concept of resistance that can also potentially motivate them in terms of performing audit duties efficiently.

References

Angonese, R & Lavarda, CEF 2014, “Analysis of the Factors Affecting Resistance to Changes in Management Accounting Systems,” Revista Contabilidade & Finanças, vol. 25, no. 66, pp. 214–227, viewed 13 August 2021,

Birhan, W 2016, “The Challenges of Management Consultancy Profession in Ethiopia (The Case of Addis Ababa),” Imperial Journal of Interdisciplinary Research (IJIR), vol. 2, no. 10, viewed 13 August 2021,

Blount, S & Carroll, S 2017, “Overcome Resistance to Change with Two Conversations,” Harvard Business Review, viewed 13 August 2021,

de Kleijn, R & Van Leeuwen, A 2018, “Reflections and Review on the Audit Procedure,” International Journal of Qualitative Methods, vol. 17, no. 1, p. 160940691876321, viewed 13 August 2021,

Dhu, V 2018, “6 Communication Strategies To Help Overcome Resistance To Change,” Corporate Communication Experts, viewed 13 August 2021,

Farooq, M 2021, “How to Create a Compelling Value Proposition That Converts,” www.g2.com, viewed 13 August 2021,

Fontaine, R & Pilotti, L 2016, “(PDF) Audit Clients Want to Cooperate with their External Financial Auditor, but also Remain at Arm’s Length: a Canadian Survey Study,” ResearchGate, viewed 13 August 2021,

Jacka, M 2018, “Emotional intelligence can help auditors build and maintain positive, productive relationships throughout the organization.,” iia.nl, viewed 13 August 2021,

Kelchner, L 2019, “What Methods are Effective in Overcoming Opposition and Resistance to Business Changes?,” Small Business - Chron.com, viewed 13 August 2021,

Khaled Endaya, A 2014, Coordination and Cooperation between Internal and External Auditors, viewed 13 August 2021,

Khaled, I & Qatamin, A 2020, “The Impact of Time Pressure on the Audit Quality: A Case Study in Jordan,” consultancy assignment IOSR Journal of Business and Management (IOSR-JBM, vol. 22, no. 1, pp. 8–16, viewed 13 August 2021,

Ling, Y 2013, The Impact of Emotional Intelligence on Auditor Judgment The Impact of Emotional Intelligence on Auditor Judgment, viewed 13 August 2021,

Nanda, A & Das, N 2021, “What Professional Service Firms Must Do to Thrive,” Harvard Business Review, viewed 13 August 2021,

Srinivasan, R 2014, “The management consulting industry,” IIMB Management Review, vol. 26, no. 4, pp. 257–270, viewed 13 August 2021,

Van Twist, MJW, Van Der Steen, M, De Korte, RWA & Nuijten, A 2015, Consulting & Auditing, viewed 13 August 2021,

Younas, A & Kassim, M 2019, “(PDF) Essentiality of internal control in Audit process,” ResearchGate, viewed 13 August 2021,