Business Management Assignment Evaluating Organisational Strategy of AGL

Question

Task: Individually, you are required to write a 2000-word business report in which you must apply learnings from the capstone topics to the organisation by undertaking additional research.

Assuming the role of an organisational consultant, you are to write a business management assignment report that clearly articulates the organisation’s strategy and business model and outlines a detailed approach to Competition Strategy, how the chosen organisation’s performance is/can be measured against their strategies. You will also be required to prepare a Balanced Scorecard for their chosen organisation. Attention should be paid to the use of secondary research and insights

Answer

Executive summary:

It is seen in this business management assignment that through the strategic decision making, firms are now focused to do more with less and at the core of them modern business ecosystem lies the organisational strategy analysis, performance measurement and depending upon the same continuous development. Through the present study an analysis has been done for the AGL, which is one of the largest Australian energy company. As the key customer of the brand, it focused on the residential, small business, large business as well as industrial sectors. As the strategic approach to succeed in the market, AGL provides much importance on customer service, maintaining communication with customer and providing cost effective energy solution to the customers. Through focusing on the key value creators, the brand makes values at different level of its business. Though the operating market is competitive in nature, yet with higher market share, highly skilled workforce and good brand positioning, AGL has been able to enhance its business performance in recent time. As the performance measurement tool, AGL considers 8-way financial performance measurement and sustainability report. To enhance its business performance following has been recommended:

• Reduce employee attrition rate

• Making green energy primary focus of business

• Value creation at different stage of business

• Better social engagement

1. Introduction:

Changing business world has become demanding in terms of the company performance with special focus on the innovation and continuous development. Keeping aside research and innovation, firms are also indulged in retrospective analysis of their operation and performance to bring in required change through strategic decision making (Gürel and Tat 2017). One such company that thrives to consider their organisational strategy to enhance future performance is Australian Gas Light Company (AGL) from Australia. Through the present study an analysis has been done for the AGL, which is one of the largest Australian energy company. For the purpose of the analysis, business strategy of AGL has been demonstrated and organisational approach towards competition strategy, performance measurement has been done. Lastly, balance scorecard for the firm has been made and based no the finding recommendation has been produced.

2. Organisation strategy:

2.1 Strategic approach:

AGL is one of the largest energies providing company of Australia and the firm operates with vision to bring in biggest change in the energy sector. With more than 180 years of experience, the brand provides sustainable and affordable energy to the consumers (Agl.com.au 2021). Key business of the brand is Electricity & Gas production and distribution, Solar Energy production and distribution; as the secondary business, brand is also indulged in Mobile & Internet service providing, and Electric Vehicles production. AGL also aims to promote them as the most affordable, reliable and sustainable energy brand in Australia. As the strategy towards sustainability, the brand focus on lower carbon production and utilisation of innovative technology to produce green energy.

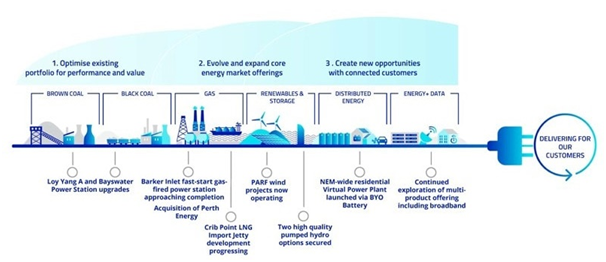

As per the growth strategy the brand has three simple strategic priorities, which are as follows(Agl.com.au 2021):

• Optimisation of the existing business portfolio for value creation

• Expanding core energy market offerings

• Developing new business opportunities with connected consumers

Figure 1: Growth strategy of AGL

Source: (agl.com.au 2021)

Figure 1, demonstrates the process of achieving the strategic priorities where production to distribution aids the brand to create value.

Figure 2: Key value creator for AGL

Source: (agl.com.au 2021)

As per the figure 2, it can be seen that key value driver depending upon which AGL creates value are customers, communities, people, environment, infrastructure, system and process and finance(Agl.com.au 2021). AGL focus on these key group to promote and enhance their business allowing better sustainability and operational development.

2.2 Business model:

In order to understand the organisational strategy and business strategy of AGL better, business model canvas has been utilised here (Joyce and Paquin 2016). Business model canvas of AGL is as follows:

Table 1: Business model canvas of AGL

|

Key partners |

Key activities |

Value proposition |

Customer relationship |

Customer segments |

|

· National Electricity Market (NEM) · Suppliers · Investors · Employees · Customers |

· Electricity & Gas production and distribution · Solar Energy production and distribution · Mobile & Internet service providing · Electric Vehicles production |

· Optimisation of the existing business portfolio for value creation · Expanding core energy market offerings · Developing new business opportunities with connected consumers |

· Online customer service · Two-way communication · Easy problem solving through chat bot · Site visit on request · Customer support 24*7

|

· Residential · Small business · Large business · Industrial sector |

|

Key resources |

Channels |

Cost structure |

Revenue |

|

|

· Customers · Communities · People · Environment · Infrastructure · System and process · finance |

· Social media platform · Traditional media · Company website · Sales executive |

· Employee salaries · Production cost · Fixed cost · Marketing cost · Employee maintenance and resource planning |

· Sales · Investment · Finance |

|

Underpinning the business model canvas, business model of AGL demonstrates that the key partners of the brand is NEM; besides, it always does business considering the involvement of the investors, customers, suppliers; hence they are also the key partners of the brand. Through three key strategies, AGL creates value and in this regard as per table 1, it can be seen that brand keeps good customer relationship to enhance its business performance(Agl.com.au 2021).

3. Competition strategy of organisation:

3.1 Porter five force analysis:

To analyse the market forces power to influence the business, Porter five force model is a useful tool. Porter five force analysis of AGL is as follows:

|

Bargaining power of buyer (low) |

As the buyers has limited scope to shift from one brand to another and the availability of alternatives are limited with fixed cost of service thus the bargaining power is low (Onerenet al. 2017). |

|

Bargaining power of seller (high) |

As the buyers are price maker and the charges cannot be changed for the consumer, thus the bargaining power of seller is high |

|

Threat of new entrant (low) |

Cost of infrastructural development for providing energy service in Australia is high. Thus, no new firm can enter the market easily. Hence the threat is low. |

|

Threat of substitute (low) |

As the technological upgradation in energy sector is low, thus substitute is not available in the market. Hence threat is low here. |

|

Market competition (Moderate) |

Due to oligopoly nature of market where many firms operate, market competition is moderate. |

3.2 SWOT analysis:

In order to analyse the Strength, Weakness, Opportunity and Threat of the business SWOT analysis is a crucial tool (Gürel and Tat 2017). Using the tool, outcome of the SWOT analysis is as follows:

|

Strength |

Weakness |

|

· AGL has strong performance in every market wherever it operates · Automation in the business operation and use of Auto Intelligence has made the service and business operation consistent (agl.com.au 2021) · With economies of scale in conventional energy production and innovation in green energy production brand has strong brand portfolio · Workforce of the AGL is highly skilled |

· Workforce of AGL has high attrition rate as the training and work process is critical to follow · Business model has not considered transforming to green energy; thus, sustainability in business operation in future is a major weakness · Investment in research and development is not very high compared to its objective of gaining sustainability(agl.com.au 2021) · Investment for gaining economies of scale in green energy production is low |

|

Opportunity |

Threat |

|

· Considering higher market capitalisation as opportunity to introduce green energy alternatives · Stability of the Australian market is a major opportunity in business endeavour for AGL · Entering new market is a good opportunity for AGL with free trad agreement from government of Australia(agl.com.au 2021) |

· Changing demand of consumer · Focusing of government initiative to produce more green energy than conventional coal powered energy · Lack of innovation in the green energy production from the company · Entrance of the new brand like Adani in the Australian market |

3.3 Competitive positioning:

AGL is one of the renowned energy brands in Australia that has been providing service for over 180 years. With the economies of scale in producing conventional energy and focus on gaining expertise in green energy production, AGL has always been in forefront of the energy innovation in Australia. With its presence in various states of Australia, it has produced a great market size for energy production and distribution in the state. As per the Mullane (2021), AGL has 3.7 million users in residential and business sector and it provides service at 18% less price than reference price of $1142 per year. As the major competitor of the brand, there is Delta electricity, Origin energy and Integral energy; however, with 36.7% market share AGL is one of the largest energy producers in Australia. Market being oligopoly in nature faces moderate competition, however, with focus to service consumer in most sustainable way, AGL keeps their price lower than reference price always(agl.com.au 2021). Thus, the brand has been able to capture larger market share compared to its competitors and its presence in major cities as well as distant places makes it most preferred energy brand in Australia also.

4. Performance measurement:

When it comes to performance measurement, then AGL considers bicameral approach towards the same. Through the eight-path initiative, AGL measure the financial performance and based on the sustainable development goal achievement measurement, AGL measures the social performance of the firm. As per the agl.com.au (2021), it can be seen that the firm focuses on the optimising cash flows, reducing cost of generating power, checking EBIT per consumer, determining cash flow benefit, gaining new energy break even, smart connection, revenue growth and return on investment to measure its financial performance (Hamdy 2018). Underpinning the sustainability report of AGL, it can be seen that the firm focuses on the climate action, affordable and clean energy and industry, innovation and infrastructural goal to enhance its social performance (Winston et al. 2017). With the focus to become carbon neutral firm, AGL relentlessly works on the innovation of modern technologies that produce less greenhouse gas while energy production. On the other hand, with the vision and mission to produce sustainable, affordable and reliable energy, AGL focuses on production of the green energy that enables the brand to provide energy to its consumer at affordable rate (Shujahatet al. 2017).

5. Balanced scorecard:

In order to analyse the business performance, balance scorecard approach is a beneficial tool as it aids the business to identify the issue and improve the performance through controlling the various function of a business (Hamdy 2018). For the AGL, balance scorecard can be formed as below:

|

Description |

Objectives |

Measures |

Targets |

Initiatives |

|

Financial |

· Management of return on investment · Operation cost management · Checking cash flow · Examination of earning per share |

· Increasing return on capital employed · Gain economic of scale in green energy production for cost reduction · Gaining higher revenue and investment for better cash flow · Increasing statutory earning per share |

· Gaining 10% growth in return on investment · Gaining 100% economies of scale by 2025 · Gaining 10% increased cash flow by 2022 · Achieving 15% increase in statutory earning per share |

· Contracting with new consumer · Consumer and society focused business approach · Financial stimulus package from government post Covid19 |

|

Customer |

· Enhancing consumer engagement rate · Enhance online presence of AGL for better communication with consumer (csus.edu 2020) · Reduction in rate of customer churn out rate |

· Social media ads, conventional media campaigns · Promoting brand through the social media handles of the brand; publishing informative blogs regarding energy sector of the state · Providing hassle free service to consumer |

· 100% engagement ratio with consumer by 2025 · 100% increase in page views by 2025 · Customer complaint management and reduction of the same by 50% by 2025 |

· Customer reward program for keeping attached with services from AGL · Customised mobile app creation by brand to communicate with consumer 24*7 |

|

Internal process |

· Reduction of employee turnover rate · Enhance employee performance through training · Providing sustainable working place for workers · Gaining economies of scale |

· Revenue per employee enhancement · Increasing employee satisfaction score · Making collaborative working space · Doing more with lower input at cost effective price |

· Increasing 20% revenue per employee by 2025 · Gaining 4.5 employee satisfaction score in overall by 2025 · Providing collaborative and diversification in workforce · Gaining economies of scale by 2025 in production line |

· Creating two-way internal communication channel · Focusing on the employee satisfaction factors to gain higher overall satisfaction score for employees · Developing employee training for collaborative workspace · Contracting with new suppliers |

|

Learn and innovate |

· Market influencing skill · Efficacy in leadership · Enhancing employee satisfaction |

· Market capitalisation · Skill profiling of the employee · Leadership efficiency training |

· 25% increase in market capitalisation by 2030 · 10 hours of skill profiling training · 5-star Leadership score achievement by 2025 |

· Profiling of skill of the employees · Performance measurement of the employees and leaders · Training program for leadership practice |

6. Recommendations:

- Reduce employee attrition rate: though the employees of AGL are skill, however, attrition rate is high here. Firm need to focus on keeping employee’s satisfaction and limit the attrition rate.

- Making green energy primary focus of business: With the changing focus of government and consumer towards green energy, AGL should urgently shift its focus on green energy production. It will enable the business to become sustainable

- Value creation at different stage of business: creating value at different stage of business is crucial in present day to have sustainable business. With the value creation at different level of business, AGL can enhance its business performance and brand value

- Better social engagement: AGL should bring in their Corporate Social Responsibility and sustainability report in frequent interval. It will enable the brand to demonstrate how it does business and how it engages society for greater cause.

7. Conclusion:

Underpinning the above analysis, it can be seen that AGL is one of the largest energy producing companies in the Australia having largest market share. Through focusing on the key value creators, the brand makes values at different level of its business. Though the operating market is competitive in nature, yet with higher market share, highly skilled workforce and good brand positioning, AGL has been able to enhance its business performance in recent time. As the performance measurement tool, AGL considers 8-way financial performance measurement and sustainability report. Lastly, it has been recommended that the brand should focus on creating values and demonstrating it through frequent publication of CSR. Moreover, moving towards green energy production should be done urgently.

Reference:

Agl.com.au 2021. Our Company | About AGL, Agl.com.au. Available at: https://www.agl.com.au/about-agl/who-we-are/our-company

Agl.com.au 2021. Our Strategy.https://www.agl.com.au/about-agl/who-we-are/our-strategy Agl.com.au. 2021.Annual report 2021.https://www.agl.com.au/content/dam/digital/agl/documents/about-agl/investors/2021/210812_fy21annualreport.pdf

Agl.com.au. 2021.Performance measures & outlook.https://www.agl.com.au/-/media/aglmedia/documents/about-agl/investors/webcasts-and-presentations/2015/10_performance-measures--outlook.pdf?la=en&hash=899DA37729E351ECB2CFA48B0C933C60

csus.edu 2020.Electricity utiliy balance scorecard. Available at: https://www.csus.edu/indiv/h/hattonl/documents/ElectricUtilityBalancedScorecardExample.pdf

datapine.com 2020.KPIS examples for the energy industry.Available at: https://www.datapine.com/kpi-examples-and-templates/energy

Gürel, E. and Tat, M., 2017. SWOT analysis: a theoretical review. Journal of International Social Research, 10(51), pp.994-1006.https://demo.dspacedirect.org/bitstream/handle/10673/792/swot%20pdf.pdf?sequence=1

Hamdy, A., 2018. Balance scorecard role in competitive advantage of Egyptian banking sector. The Business & Management Review, 9(3), pp.424-434.https://cberuk.com/cdn/conference_proceedings/2019-07-14-11-02-37-AM.pdf

Joyce, A. and Paquin, R.L., 2016. The triple layered business model canvas: A tool to design more sustainable business models. Business management assignmentJournal of cleaner production, 135, pp.1474-1486.https://www.researchgate.net/profile/Raymond-Paquin/publication/304026101_The_triple_layered_business_model_canvas_A_tool_to_design_ more_sustainable_business_models/links/5a072299a6fdcc65eab3a65c/The-triple- layered-business-model-canvas-A-tool-to-design-more-sustainable-business-models.pdf

Mullane, J. 2021. Largest Energy Companies in Australia – Canstar Blue, Canstar Blue. Available at: https://www.canstarblue.com.au/electricity/largest-energy-companies-australia/ Öneren, M., Arar, T. and Yurdakul, G., 2017. Developing

competitive strategies based on SWOT analysis in Porter’s five forces model by DANP. Journal Of Business Research-Turk, 9(2), pp.511-528. https://www.isarder.org/index.php/isarder/article/download/421/418

Shujahat, M., Hussain, S., Javed, S., Malik, M.I., Thurasamy, R. and Ali, J., 2017.Strategic management model with lens of knowledge management and competitive intelligence. VINE Journal of Information and Knowledge Management Systems, 47(1), pp.55-93.

http://eprints.hud.ac.uk/31075/1/Revised-manauscript.pdf

Winston, A., Favaloro, G., and Healy, T., 2017.Energy Strategy for the C-Suite.Available at: https://hbr.org/2017/01/energy-strategy-for-the-c-suite