Business Intelligence Assignment: Benefit Of BI In Commonwealth Bank Of Australia

Question

Task: Prepare a report on business intelligence assignment to critically evaluate the role of Business Intelligence or BI to improve profitability in banking and financial sector of Australia.

Answer

Introduction

The aim of the report on business intelligence assignment is to evaluate the scope of Business Intelligence (BI) to improve profitability. The industry chosen for the topic is the banking and financial sector of Australia. The specific company would be the Commonwealth Bank of Australia (CBA).

The reason for choosing this particular sector or industry and company to prepare this business intelligence assignment is that the business intelligence (BI) can benefit this sector to a great extent especially in terms profitability. Also, BI applications can help to manage the various types of risks involved, improve operational efficiencies, increase profits, allow proper segmentation of customers, and enhance the level of satisfaction of the customers by improving transparency and providing a better understanding of the services being extended. It would also help to enhance the level of security [11]. Most important of all, BI can help the banking and financial sector to reduce the rate of churn.

Use of Business Intelligence (BI) in Financial and Banking Sector To Improve Profitability

It is evident herein business intelligence assignment that technology has been changing a lot of things across a lot of industries in the world, and the same applies to the banking and finance sector as well. The internet, proliferation of the various mobile gadgets and applications, the increasing level of competition in the banking institutes, the varying preferences of the customers and an urgent need to manage multiple threats effectively along with a strict controlling mechanism has led this sector to adopt BI [9]. The other reason for choosing BI is the rising dynamicity of this sector.

Apart from this, advancements in technology have led to the development of powerful BI applications that this sector and banks like CBA can use to leverage data for crucial insights. It can help to derive significant insights to enable intelligent business practices and better management decisions [4]. The various ways discussed in the present business intelligence assignment in which CBA, along with the banking sector as a whole, have adopted business intelligence solutions to improve profit, enhance competitive advantage and bring down risks are as given below:

Improvements In Operational Efficiency:

The banking and financial sector is fast becoming competitive. As a result, there is a strong need for companies like CBA to be efficient and lean to the maximum extent possible [5].

Improvements In the Various Types of Financial Offerings:

BI allows tracking of the various revenue streams in order to understand better what products and services are more profitable.

Marketing Improvements:

BI enables analysis of CRM data based on numerous criteria.

Improvements in Customer Retention:

BI can help to identify prospects who would provide maximum return [6].

Development of Innovative Investment:

Asset managers use BI for developing new business strategies [3].

Reduction In Risk:

BI extends solutions that are actionable to mitigate risks on several aspects.

What is the Scope and Boundary of BI in regards to the business intelligence assignment?

Scope:

There has been an increase in the popularity of BI and analytics in the finance domain. The major factors that have contributed to its popularity are the changing financial business scenario along with the competencies that are associated [2]. There has been an alarming growth of data in the finance sector. As a result, there has been a rising preference for BI to counter the cut throat market competition. These are the reasons illustrated in the business intelligence assignment why the banking sector has embraced BI [6].

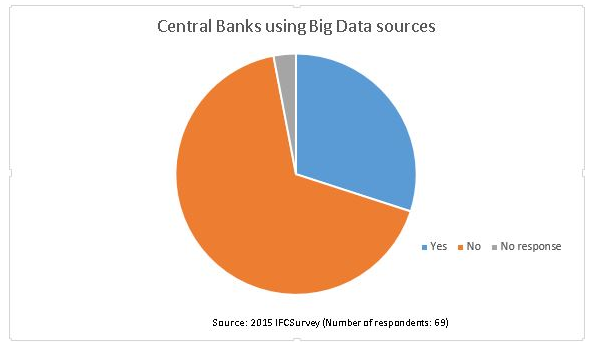

In order to stay ahead in the competition, banks like CBA will need to depend on BI applications to detect frauds, reduce cost and mitigate risks [5]. As per the survey done by IFC in 2015 concerning BI in banking, it was found that all of the central banks were not using BI yet.

Source: [7]

The above image provided in the business intelligence assignment indicates that there exists a lot of scope in the future for BI applications.

Boundaries / Limitations:

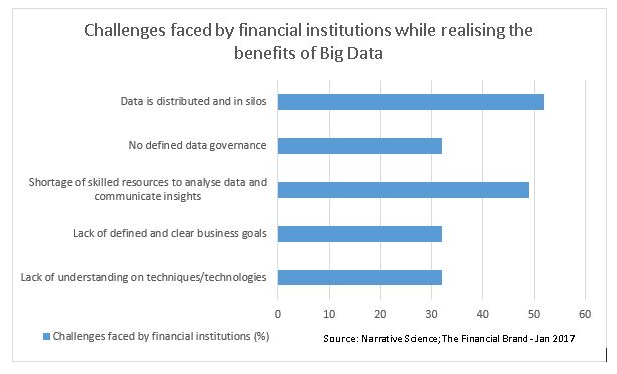

However, there are a few challenges that need to be addressed for proper implementation of BI by banks in Australia. These are in terms of:

- Data Distribution.

- Data Governance.

- Short-fall of skilled resources.

- Lack of clearly defined business objectives.

- Lack of technical understanding.

Source: [9]

Business Functions of BI To Improve Profitability

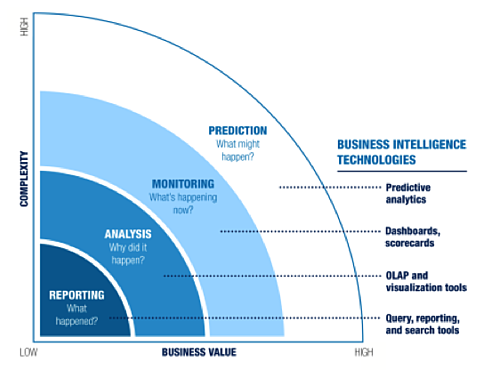

The business functions of BI in the banking domain are many. BI solutions allow transforming huge data that is largely scattered to well-organized information [3]. It is done using various types of interactive and intuitive dashboards and modules [10]. The various business functions depicted in the business intelligence assignment that BI can touch for CBA are:

Source: [2]

Reporting:

The study developed in the business intelligence assignment claims that it is the first and the most straightforward business function of BI related to banking. It gives an overview of what has happened already [5]. The most important aspect of reporting is, it is static in nature. The limitation of financial reports is that most are parameter dependent. Aa a result, it is not possible at times to dig deep, resulting in limited commercial insights [7]. BI applications help to overcome this limitation. It would also provide crucial insights of past or current state.

Analysis:

After reporting, the next activity mentioned herein business intelligence assignment happens to be analysis of the complexity ladder. Since analysis focuses on factors like the reasons why something happened, it is immensely valuable in financial decision making. Moreover, this is the age of OLAP (Online Analytical Processing) therefore, graphs and infographics are a must to ensure that the various financial data elements and their implications become clear [2].

Monitoring:

BI can help to understand the various financial issues and allow correcting those in real time. It will eliminate the need to wait for a report to indicate what did not work out well. The other way round, it helps to prevent bad performance before it becomes chronic. It can further improve the daily activities, particularly of the front line employees [10].

Prediction:

BI helps to process data to come up with practical predictions about what might happen in the future in the banking and financial domain, especially related to bad debt and management of revenue [6]. It would allow understanding the future better so that opportunities can be identified or at least a financial action plan can be drawn.

Possible Scenarios

Reporting:

BI can play an important role in designing and scheduling of a financial performance report of CBA. Other than this, it can play a pivotal role in generating reports related to sales along with a reconciliation of the various other financial reports relevant to the business operations of the bank [8]. It can also help to prepare the different management reports that CBA can use to develop the planning and the decision making process. The daily, weekly, monthly and annual statistics are prepared using BI applications.

Analysis:

As per the research on business intelligence assignment, the finance and the banking sector need to follow a time dimension. These are usually in terms of sales, phone calls, electronic follow-up, the various types of pay-outs, the status of loans, and so on. It is essential to understand the various financial changes happening over a period of time at CBA. Based on these changes, the management can accordingly draw up trends and predictions related to the status of the business in the days to come [4].

Monitoring:

Use of BI illustrated in this section of business intelligence assignment to monitor the changes related to financial performance at CBA helps to create additional certainty about business. It also helps to decide what are the short term decisions and what would be long term ones [1]. It further helps to maintain a healthy business and to maintain a high growth rate. Monitoring the changes enables the bank to use the collected data for driving the business forward. It is crucial for the financial success of the bank.

Prediction:

Predictions based on the applications of BI considered in the present aspect of business intelligence assignment in CBA helps to have a clear forecast of the various financial elements. It helps to access the efforts necessary for success in business. It gives an idea to the company regarding long term viability or the value of a particular financial activity [9]. It allows extending a better control on the cash flow so that operations can be directed in a more purposefully. It also allows benchmarking for future use in forecasting.

Role of BI Practices To Improve Profitability

Planning and Analysis:

BI practices at CBA helps to forecast future financial trends. It helps to analyze the current state of the financial performance of the company along with planning which is a vital part of any financial set-up [12]. These practices noted in the business intelligence assignment assist in compiling the various financial metrics and allow sharing those in the form of visual representation.

Expense Management:

BI practices help to reduce the delays related to expense management. It allows the various departments of CBA to collect data and implement collaboratively on real-time basis [5]. It makes it easy to bifurcate work among the various teams and keep a trach of all out-goings.

Profitability Management:

BI practices allow CBA to consolidate financial data while keeping the focus on profitability. This allows to make data driven decisions that are fast enough.

Other possible Usages and Outcomes of BI

BI can be used by banking and financial institutes like CBA to further develop intelligence tools for creating easy to interpret visualizations to enable the company to discover actionable possibilities. Usage can also be in terms of extending greater visibility to better understand the financial trends for implementing goals and objectives [5].

Conclusion

Based on the above analysis on business intelligence assignment, it is clear that the future of the economic health of CBA depends on the implementation of BI (Business Intelligence) to improve the profitability of the company. It can be achieved by having a centralized database in place so that the required information can be accessed anytime. Various BI tools can be used to accumulate disparate data from various sources to come up with an information Centre that any employees of the bank can use anytime. It will allow eliminating tedious activities and extending more visibility into the business.

References:

- Adams, M., Borsellino, G., McCalman, J., & Young, A. (2017). Australia's proposed banking executive accountability regime: Regulatory panopticon or fail-safe?. Governance Directions, 69(9), 528.

- Agarwal, P. (2019, March). Redefining Banking and Financial Industry through the application of Computational Intelligence. In 2019 Advances in Science and Engineering Technology International Conferences (ASET)(pp. 1-5). Business intelligence assignment

- Bandara, W., Meredith, J. C., Techatassanasoontorn, A., Mathiesen, P., & O'Neill, D. (2019). Mechanisms for creating successful BPM governance: Insights from Commonwealth Bank of Australia.

- Barber, S., Bennett, D. R., & Graham, C. (2016). Market (ing) the small. How does marketing work for UK SMEs?. LSBU Summer School 2016.

- com.au. (2020). Personal banking including accounts, credit cards and home loans - CommBank. Retrieved 18 March 2020, from https://www.commbank.com.au/

- Fourie, L., & Bennett, T. (2019). Super intelligent financial services. Journal of Payments Strategy & Systems, 13(2), 151-164.

- Hussain, S., Ryan, M., Cripps, H., & Lambert, C. (2017). Role of social media in handling a crisis situation: A case study of Commonwealth Bank of Australia (CBA). In The proceedings of 2nd Business Doctoral and Emerging Scholars Conference(p. 98).

- Locke, N., & Bird, H. L. (2020). Perspectives on the Current and Imagined Role of Artificial Intelligence and Technology in Corporate Governance Practice and Regulation. Perspectives on the Current and Imagined Role of Artificial Intelligence and Technology in Corporate Governance Practice and Regulation (February 9, 2020). Australian Journal of Corporate Law.

- Mann, M. (2017). New public management and the ‘business’ of policing organised crime in Australia. Criminology & Criminal Justice, 17(4), 382-400.

- Mitrovic, S. (2017). Specifics of the integration of Business Intelligence and Big Data technologies in the processes of economic analysis. ??????-???????????, (4 (42) eng).

- NI?U, C. V. (2016). Predictive Analytics-the Future of Data-Driven Social Marketing. Business intelligence assignmentQuality-Access to Success, 17.

- Scott, B., & McGoldrick, M. (2018). Financial intelligence and financial investigation: opportunities and challenges. Journal of Policing, Intelligence and Counter Terrorism, 13(3), 301-315.