Business Economics Assignment: Business Management Of Apple In USA & China

Question

Task:

A. Project question

A major multinational corporation has appointed you as an economic advisor. You are requested to compile a report on business economics assignment regarding the macroeconomic environment in two countries where the firm operates and explain how it might affect the company’s economic activity.

B. Project specifications

- You may choose to focus your analysis on any existing firm with an international activity that can be of different types in the two countries.

- The two countries must be chosen from section C below as follows: one country from List 1 and one country from List 2.

- Your report must include:

- A brief description of the company and the product/market it operates in for both countries.

- An analysis of the market structure in which your company operates for the two countries.

- A comparative analysis of all major macroeconomic indicators (see section D below, excluding 5 and 8) for the two countries and their overall impact on firm’s economic activity.

- An analysis of the monetary and fiscal policy (instruments) for the two countries and their impact on the firm’s economic activity. You must include here an analysis of the interest rates (Section D, indicator 5).

- An analysis of the foreign trade policy instruments (international trade agreements) for the two countries and their impact on firm’s economic activity. You should include here an analysis of the exchange rates (Section D, indicator 8).

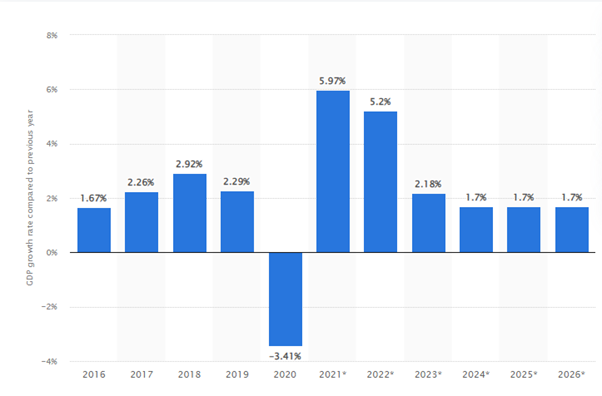

C. Country Lists

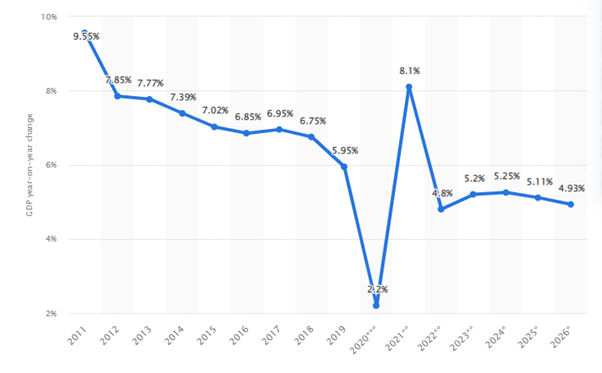

D. Macroeconomic indicators1 to be analysed (the last available 10 years):

Answer

Introduction:

Apple Inc. is the selected company for this assignment. The first section of the business economics assignment represented a brief description of Apple Inc. and its products and services in the United States and China. It also analyzed the market structure in the Apple Inc. operates its business for the United States and China. The second section of the report also represented a comparative analysis of major macroeconomic indicators for both the USA and China and its overall impact on the economic activity of Apple Inc. The third section of the report analyzed the monetary and fiscal policy for both the USA and China and its impact on the business financial condition of Apple Inc. It also included the information regarding analysis of interest rate of both countries USA and China and its impact on the economic activity of Apple Inc. The fourth section of the report analyzed foreign trade policy instruments and international trade agreements including the analysis of exchange rates for both countries USA and China and its impact on the economic activity of Apple Inc. in both countries.

Brief Description of Apple Inc. and analysis of market structure for the USA and China:

Apple Inc. is a renowned Multinational Technology Company. The company specializes in software related services and online related services, consumer electronic products. Apple is known as the largest information Technology Company and the revenue of the company is around $365.8 billion USD in 2021. The company is the most valuable company in the world and also the fourth-largest vendor of personal computers and the second-largest manufacturer of mobile phones (Apple. 2022). The company is known as the Big Five American Information Technology companies alongside other information technology companies like Amazon, Alphabet, Meta and Microsoft. Apple Inc. produce, designs, manufactures and markets personal computers, smartphones, accessories, tablets and wearables for their consumers. The product of the company includes Mac, iPhone, iPad, Home appliances tools and Accessories and Wearables. Wearables, Home appliances tools and Accessories include Apple TV, Airpods, Apple Watch, HomePod, Beats products, iPod touch and all other Apple-branded products and other third-party accessories. In the U.S.A., Apple Inc. is considered an oligopoly and monopolistic market structure (Hajiyev et al., 2021). In the U.S.A., the large customer base of the company is making it harder for other competitors and new entrants to get customers and to switch products from Apple to another. The strong competitors of Apple Inc. in the U.S.A. are Lenovo, Dell, Hewlett Packard, Sony, Microsoft, Asus, Samsung etc. Apple acquires 47% market share in the USA (Apple Statistics 2022). Apple employed 137000 employees in USA and generated $260.1 billion in 2019. The company is maintaining its strong position in the market which make it too costly and difficult for other potential competitors to enter into the market. It makes it harder for other companies to attract the attention of consumers.

In the Chinese market, Apple Inc. assembles all of the company’s products and earn around a fifth of its revenue in the region of China. China is also an important market for Apple Inc. After entering into the smartphone market of China in 2010, sales of Apple products in the region grew more than 20 times within the time of 5 years. In 2015, the revenue of Apple was $58.7 billion. Moreover, China accounted for 25% of the total revenue of Apple. In 2019, the growth rate of the revenue had declined to 17% due to the sudden impact of the Covid-19 crisis. In China, Smartphone sales declined by 9% in the third consecutive quarter in 2021 (counterpointresearch.com 2022). Moreover, Apple surpassed the Smartphone Company Vivo to become the number 1 smartphone company in China since 2015. Apple has its highest market size and share in China by 23% in Q4 2021. After releasing iPhone 13, the sale of Apple’s product increased and the company reached the leading position in China due to relatively lower starting price, 5G features, and new camera functions of the phone. Vivo and OPPO acquire second and third place respectively by applying an expansive product portfolio strategy and strong offline penetration (Apple. 2022). Apple is considered a monopolistic market structure by combining the elements of perfect competition and monopoly market structure. There are numerous competitors in the market of China including Vivo, OPPO, Xiaomi, HONOR, HUAWEI, REALME and others.

Comparative analysis of major macroeconomic indicators for USA and China:

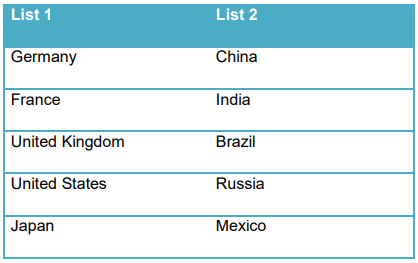

Fig 1: GDP growth rate at USA

Source: (Statista. 2022-a)

Based on the data by Statista, the GDP rate in the US was 5.97% in 2021 and currently, the GDP growth rate in the US is 5.2% (Statista. 2022-a). The benefits of the high and steady GDP growth rate of the country create a positive impact on the economic activity of Smartphone Organizations like Apple. The high and steady GDP growth rate in the US increases the value of national income, output and expenditure.

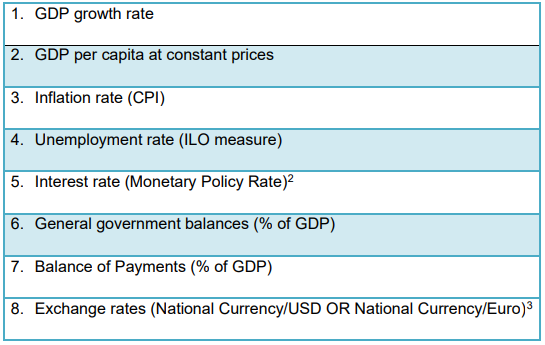

Fig 2: GDP growth in China

Source: (Statista. 2022-b)

The GDP growth rate in China was 8.1% in 2021and currently, the GDP growth rate in China is 4.8%. It is expected the GDP growth rate will increase by 5.2% in 2023 (Statista. 2022-b). It indicates high and standard economic growth in China. It also enhances the living standard of people, higher the real incomes of people improve the governmental financial services and reduces the poverty in both countries. As a result, the economic growth of the USA and China enables the citizens to consume more services and products from Apple. It increases the spending power of citizens to make their purchase from high standard and high cost products of Apple.

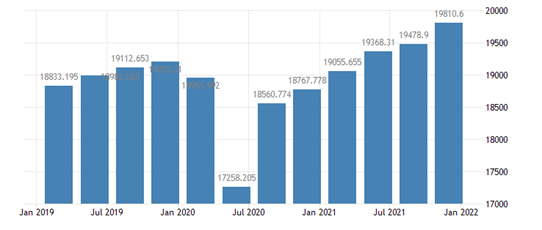

Fig 3: GDP per capita of USA

Source: (tradingeconomics.com 2022-a)

The GDP per capita is expected to reach 9020.00 USD in the year 2022. On the other hand, the GDP per capita in the USA is 19810.6 USD in 2022 (tradingeconomics.com 2022-a). It indicates the economy of the USA is stronger than the economy of China. The GDP per capita is obtained by dividing the GDP and adjusted by total population and inflation. It helps in translating the national wealth of the country. It helps measure the economic output of the county per person. The strong and higher GDP per capita indicates the growth of income per head of the citizens of the country.

The economic growth of the country increases the investment from foreign investors and third-party software developers. It also increases the investment in the research and development process that helps the company to develop and maintain its software services and applications for the company’s products. It concludes that a positive GDP growth rate helps in increasing the sale of products and services of Apple Inc. A strong economy determines higher earnings and stock prices that helps in increasing the profitability of the Company.

General government balances percentage of GDP of United States was at the level of -11.7% in the year 2020 and it is up from -6.1% from the previous year (tradingeconomics.com 2022-c). The general government balances percentage of GDP of China was -9.7% in 2020 (tradingeconomics.com 2022-d). It indicates that due sudden impact of Covid-19, both countries faced an economic crisis that creates an impact on the economic activity of large business organisations, the incoming ability of the general population of the country and an increased unemployment rate of the country. As a result, it creates a major impact on production of the device and sales of Apple’s device in both countries China and the United States. The overall impact of operating on reduced working hours, closing retail stores, quarantines, governmentally imposed restricts and travel restrictions and public fear led to less traffic and it significantly impacted the sales of the Apple products in both countries.

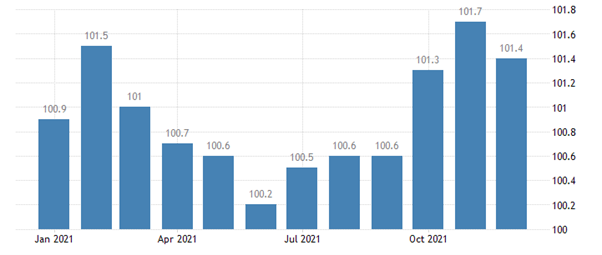

Fig 4: Consumer price index in China

Source: (tradingeconomics.com 2022-e)

The consumer price index in China was 101.40 in the last quarter of 2021 and 101.70 in the previous quarter of 2021 (tradingeconomics.com 2022-e). The above graph indicates that average spending power by the consumers is increased in the last quarter of 2021 compared to July 2021. It indicates the increasing rate of disposable income by the citizens.

Fig 5: Inflation rate of China

Source: (Statista. 2022-d)

The average inflation rate in China was around 0.9% in 2021 and it is expected to reach 1.82% in 2022 (Statista. 2022-d). However, the increasing rate of inflation indicates that it increases the prices of goods and services by the country. The average inflation rate should be below 2%. It indicates the monthly inflation rate in China is increased at a moderate level.

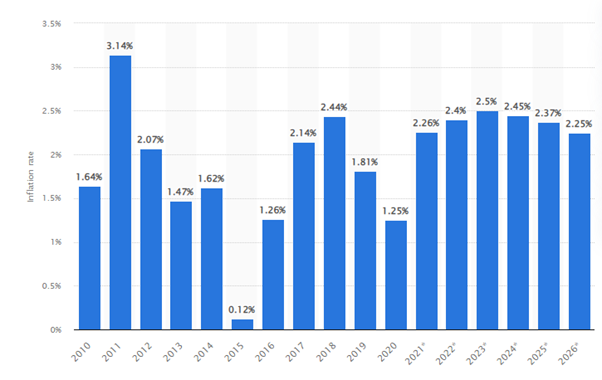

Fig 6: Inflation rate of United States

Source: (Statista. 2022-c)

The inflation rate of the United States was 2.26% in 2021 and it is expected to reach 2.4% in 2022. It indicates that the increasing rate of inflation will increase the price of goods and services offered in the US market (Statista. 2022-c). As a result, it will also create an impact on the prices of electronics products. As a result, it can also diminish the purchasing power of the citizens of the country can also damage the GDP growth rate of the country. Apple offers their products at high pricing ranges and the increasing inflation rate will also increase the price of Apple electronic goods.

The unemployment rate in the United States was around 6% in 2021. On the other hand, the unemployment rate in Hong Kong, China was around 9% in 2020, 3.8% in Taiwan, China and 2.6% in Macau, China in 2020 (ilostat.ilo.org 2022). Based on the unemployment rate of the USA and China measured by ILO indicates the increasing rate of unemployment weakens the purchasing power of high pricing and high standard electronics products by the population of the country. However, it can reduce the demand and sale of their products among the population of the country which may hamper the profitability percentage of the company (home.treasury.gov 2022). It can negatively influence the economic activity of Apple Inc.

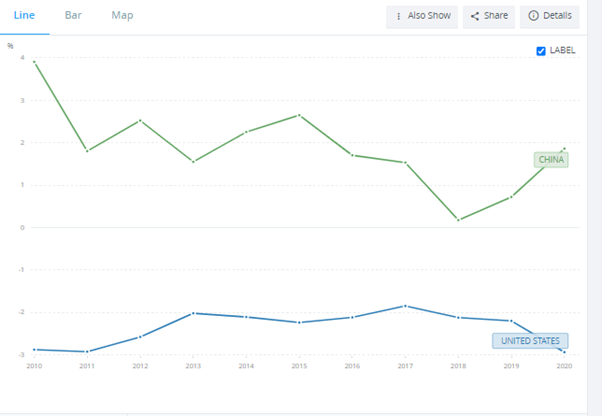

Fig 5: Balance of Payments percentage of GDP of the United States and China

Source: (data.worldbank.org 2022)

The Balance of Payments percentage of GDP of the United States was -2.9% in 2020 (tradingeconomics.com 2022-f). It indicates the country recording a current account deficit that indicates the country have strong imports, a high rate of personal consumption and a low saving rate as the percentage of the country’s disposable incomes. It increases the demand for foreign direct investments in the country. It clearly indicates that the demand for FDI increases the profit for business enterprises like Apple and it also increases labour productivity. The Balance of Payments percentage of GDP of China was 1.86% in 2021. It indicates that the economy of China highly depends on exports revenue with a high rate of savings but weak domestic demand. It increases the supply for the FDI.

Analysis of money supply and financial policy for USA and China and its impact on the business economy of Apple Inc.:

Monetary policy of the United States included the action related to Federal Reserve’s actions and positive and effective communication for promoting moderate and long-term interest rate, the maximum percentage of employment and stable prices. Based on the monetary policy of the United States, the three instruments of the Federal Reserve of monetary policy are the discount rate, operation of open market technique and reserve requirements. The open market operation policy of the US increases the buying of the securities and selling of government securities (itsuptous.org 2022). The open market policy is more flexible and it increases the reserves of commercial banks. It allows the banks of the country to increase their investments and loans and also increase the price of the country’s government securities. It helps in reducing the interest rate of the country and promoting investments in businesses (Erokhin, 2018). As a result, decreasing amount of interest rate of the country and the increasing amount of investment in businesses creates a positive impact on the economic activity of large organizations like Apple Inc. The U.S. Government follows the expansionary fiscal policy that increases the money supply by increasing the spending by the government and cutting taxes from people’s income (federalreserve.gov 2022). It is most effective for supporting stimulating a recessed or stagnant economy. It helps in reducing the poverty and promoting the living standard of the community. It increases employment opportunities, enhances economic growth and ensures sustainable development and growth of businesses. The average interest rate for business loans ranges from 2.54% to 7.02% based on the most recent data of the Federal Reserve (federalreserveeducation.org 2022). The average monetary policy rate of the US is 4.31% per annum.

The monetary policy of China's purpose is to keep the stable value of the RMB and increase the contribution to economic growth. The People’s Bank of China controls the entire money supply of China. The country follows a unique socialist open market economy. China follows an effective export-dependent system of economy. China manages its money supply policies by printing currency and controlling forex rates (Wang et al., 2022). The open market policy of China increases the money supply and attracted large scale foreign investors for the growth of the economy. China also embraced the use of expansionary financial policy in 2020 to support the slowing growth of the country’s economy (info.ceicdata.com 2022). Chinese Government now focuses on poverty alleviation projects, telecommunication projects for the growth of the digital economy, increasing investment in high tech industries for receiving more financial resources and investment in infrastructure projects (Wang et al., 2022). China managed the increasing rate of the money supply to keep the currency rate of china stable. With the help of the Chinese central bank and PBOC, the Chinese Government absorbs the large inflows of FDI from the trade surplus of China. PBOC purchases the foreign currency from the exporters and also issues local yuan currency. It helps in remaining the forex rates fixed in a tight range (Noland, 2018). China also used different sterilization actions to maintain the constant inflows and outflows of the capital. Chinese Government is lowering the business loan interest rate on 700 billion Yuan which is equal to the one-year medium-term business loans to 2.85% (bbc.com 2022).

Based on the analysis of both countries' monetary and fiscal policy and interest rates on business loans, it concluded that more investment in businesses helps in increasing the investment in research and development, workforce development, appropriate compensation and wages for employees and meeting the needs of the labour union (Clover, 2020). Moreover, lower interest rate reduces the operating cost of the organization that influences the positive and effective economic activity of the Apple Inc.

Analysis of foreign trade policy instruments for USA and China:

Based on the report by UNCTAD, due to a reduction in the reinvested earnings, FDI flows into the U.S. declined by approximately 40% from the amount of 261 billion USD in 2019 to the amount of 156 billion USD in 2020. The FDI stock of the U.S. reached USD 10802 billion in 2020. However, the U.S. is still now the largest FDI recipient in the world. A large population and customer base, highly advanced technological infrastructure, productive workforce and transparent justice system creates the biggest innovative environment for businesses (santandertrade.com 2022). The country also ranked 6th out of 190 countries in the Doing business report. The leading economic power and efficient business climate create a profitable business market for a multinational company like Apple Inc. (Lester et al., 2018). It directly enhances the business operations of the highly advanced technological organization Apple that helps the company to increase the sale of their high-quality electronic goods. The foreign exchange rate of USD in the respect of Euro is “1 USD equals to 0.92 Euro”.

The foreign trade policy between China and USA is the part of a complex economic relationship. U.S. and China signed and developed a bilateral trade agreement and developed diplomatic trade relations between them since 1979. It helps in the rapid growth of foreign trade transactions between these two nations USA and China from $4 billion in exports and imports trade transactions to more than $600 billion in 2017. U.S (guides.loc.gov 2022). goods trade and services trade transactions with China estimated the amount of $615.2 billion in 2020. The export transaction estimated an amount of $164.9 billion and the imports transaction estimated $450.4 billion (ustr.gov 2022). As Apple is an American multinational company, the foreign trade policy between US and China creates high impacts on the economic activity of Apple Inc.( Biden Jr, 2020).

Based on the Report by UNCTAD, the inflows of FDI increased by 6% in China in the year 2020. The FDI inflows increased from the amount of USD 141 billion in 2019 to the amount of USD 149 billion in the year 2020. Due to successful measures of pandemic containment and rapid recovery policy increased the stock of FDI and it reached USD 1918 billion in 2020 (santandertrade.com 2022-b). It directly creates an impact on the GDP growth of the country and the increasing rate of FDI accelerated the investments in technology-related industries. China is the second-largest FDI recipient after the United States in the world. China has also achieved the position of 31st out of 190th countries in 2020 doing a business report of the world bank. China now focuses on increasing the efficiency of business processes, trade with the facility of tariff cuts, reducing tax and barriers for the foreign investors (Morrison, 2019). The Foreign Exchange rate of the Yuan currency to U.S. Dollars is “1 Chinese Yuan equals 0.16 USD”. The country also reduces the import tariffs and increases the efficiency of the customs clearance process for increasing the FDI inflows. More FDI inflows are a good sign of the economic growth and lowering the labour costs that help the multinational company like Apple Inc. to successfully do their economic activity and business operations in China with lower operating cost.

Conclusion:

It concluded that macroeconomic elements of the business environment create both positive and negative impacts on the business operations of Apple Inc. The positive GDP growth rate enhances the economic growth of the entire country that helps in increasing the investment from foreign investors into the businesses. The growth of the inflation rate is also connected to the economic growth and unemployment rate of the country. The average growth of inflation rate and lower unemployment rate helps in engaging a more skilled and knowledgeable workforce in the organization for increasing innovativeness and creativity of Apple Inc. Expansionary fiscal policy of both countries also helps multinational organisations like Apple Inc. to deal with the slow economic growth of the country and develop the business strategy as per the economic condition of the entire country.

References:

Apple Statistics (2022). Retrieved 8 March 2022, from https://www.businessofapps.com/data/apple-statistics/ Apple Statistics (2022). (2022). Retrieved 8 March 2022, from https://www.businessofapps.com/data/apple-statistics/

Apple. (2022). Retrieved 8 March 2022, from https://www.apple.com/

bbc.com (2022). China cuts interest rates as economic growth slows. Retrieved 8 March 2022, from https://www.bbc.com/news/business-60019830#:~:text=To%20help%20boost%20the%20economy,such%20cut%20since%20April%202020.

Biden Jr, J. R. (2020). Why American Must Lead Again: Recusing US Foreign Policy after Trump. Foreign Aff., 99, 64. http://www.deutsch-chinesisches-forum.de/images/thinktank/20201114/Why%20America%20Must%20Lead%20Again.pdf

Clover, J., (2020). COVID-19 Coronavirus: Impact on Apple's iPhone, Mac and WWDC. Retrieved 8 March 2022, from https://www.macrumors.com/guide/covid-19-coronavirus/

counterpointresearch.com (2022). Apple Reaches its Highest Ever Market Share in China - Counterpoint Research. Retrieved 8 March 2022, from https://www.counterpointresearch.com/apple-reaches-highest-ever-market-share-china/#:~:text=Q4%202021%20also%20brought%20Apple,and%209%25%20YoY%2C%20respectively.

Erokhin, V. (2018). Contemporary Foreign Trade Policy of China in the Region of Central and Northeast Asia. Business economics assignment In Globalization and Trade Integration in Developing Countries (pp. 27-54). IGI Global. https://www.igi-global.com/chapter/contemporary-foreign-trade-policy-of-china-in-the-region-of-central-and-northeast-asia/203450

federalreserve.gov (2022). Federal Reserve Board - Review of Monetary Policy Strategy, Tools, and Communications. Retrieved 8 March 2022, from https://www.federalreserve.gov/monetarypolicy/review-of-monetary-policy-strategy-tools-and-communications.htm

federalreserveeducation.org (2022). Retrieved 8 March 2022, from https://www.federalreserveeducation.org/about-the-fed/structure-and-functions/monetary-policy

guides.loc.gov (2022). Research Guides: U.S. Trade with China: Selected Resources: Introduction. Retrieved 8 March 2022, from https://guides.loc.gov/us-trade-with-china#:~:text=The%20U.S.%20trade%20with%20China,over%20%24600%20billion%20in%202017.

Hajiyev, N., Mansura, M., Sverdlikova, E., Safronov, R., & Vityutina, T. (2021). Oligopoly Trends in Energy Markets: Causes, Crisis of Competition, and Sectoral Development Strategies. International Journal of Energy Economics and Policy, 11(6), 392. https://search.proquest.com/openview/2f77f81a3dc653eab648e0bcdedd36b3/1?pq-origsite=gscholar&cbl=816340

home.treasury.gov (2022). Economy Statement by Benjamin Harris, Assistant Secretary for Economy Policy, for the Treasury Borrowing Advisory Committee January 31, 2022. Retrieved 8 March 2022, from https://home.treasury.gov/news/press-releases/jy0574

ilostat.ilo.org (2022). Unemployment and labour underutilization - ILOSTAT. Retrieved 8 March 2022, from https://ilostat.ilo.org/topics/unemployment-and-labour-underutilization/

info.ceicdata.com (2022). COVID-19 vs China’s Fiscal Policy - The Challenges. Retrieved 8 March 2022, from https://info.ceicdata.com/covid-19-vs-china-fiscal-policy-the-challenges

itsuptous.org (2022). U.S Fiscal Policy: An Introduction To Our Fiscal Policy | 2020. Retrieved 8 March 2022, from https://www.itsuptous.org/US-fiscal-policy

Lester, S. E., Gentry, R. R., Kappel, C. V., White, C., & Gaines, S. D. (2018). Opinion: Offshore aquaculture in the United States: Untapped potential in need of smart policy. Proceedings of the National Academy of Sciences, 115(28), 7162-7165. https://www.pnas.org/content/pnas/115/28/7162.full.pdf

Morrison, W. M. (2019). China's economic rise: History, trends, challenges, and implications for the United States. Current Politics and Economics of Northern and Western Asia, 28(2/3), 189-242. https://www.proquest.com/openview/3af95d985e9356389332c19624b0214e/1?pq-origsite=gscholar&cbl=2034884

Noland, M. (2018). US trade policy in the Trump administration. Asian Economic Policy Review, 13(2), 262-278. https://onlinelibrary.wiley.com/doi/pdf/10.1111/aepr.12226

santandertrade.com (2022-a). Retrieved 8 March 2022, from https://santandertrade.com/en/portal/establish-overseas/united-states/foreign-investment

santandertrade.com (2022-b). Retrieved 8 March 2022, from https://santandertrade.com/en/portal/establish-overseas/china/foreign-investment#:~:text=According%20to%20the%202021%20World,containment%20

measures%20and%20rapid%20recovery.

Statista. (2022-a). United States - Gross domestic product (GDP) growth rate 2026 | Retrieved 8 March 2022, from https://www.statista.com/statistics/263614/gross-domestic-product-gdp-growth-rate-in-the-united-states/

Statista. (2022-b). China GDP growth rate 2011-2024 | Retrieved 8 March 2022, from https://www.statista.com/statistics/263616/gross-domestic-product-gdp-growth-rate-in-china/

Statista. (2022-c). U.S. - projected inflation rate 2008-2024 | Retrieved 8 March 2022, from https://www.statista.com/statistics/244983/projected-inflation-rate-in-the-united-states/

Statista. (2022-d). United States - monthly inflation rate January 2021/22 | Retrieved 8 March 2022, from https://www.statista.com/statistics/273418/unadjusted-monthly-inflation-rate-in-the-us

tradingeconomics.com (2022-a). United States GDP Constant Prices - 2021 Data - 2022 Forecast - 1950-2020 Historical. Retrieved 8 March 2022, from https://tradingeconomics.com/united-states/gdp-constant-prices

tradingeconomics.com (2022-b). China GDP per capita - 2021 Data - 2022 Forecast - 1960-2020 Historical - Chart - News. Retrieved 8 March 2022, from https://tradingeconomics.com/china/gdp-per-capita#:~:text=In%20the%20long%2Dterm%2C%20the,according%20to%20our%20

econometric%20models.&text=The%20GDP%20per%20capita%20is,inflation%2C%20by%20

the%20total%20population.

tradingeconomics.com (2022-c). United States Current Account to GDP - 2021 Data - 2022 Forecast. Retrieved 8 March 2022, from https://tradingeconomics.com/united-states/current-account-to-gdp#:~:text=Current%20Account%20to%20GDP%20in,percent%20of%20GDP%20in%202006.

tradingeconomics.com (2022-d). Country List Current Account to GDP. Retrieved 8 March 2022, from https://tradingeconomics.com/country-list/current-account-to-gdp

tradingeconomics.com (2022-e). China Consumer Price Index (CPI) - February 2022 Data - 2016-2021 Historical. Retrieved 8 March 2022, from https://tradingeconomics.com/china/consumer-price-index-cpi

tradingeconomics.com (2022-f). United States GDP Constant Prices - 2021 Data - 2022 Forecast - 1950-2020 Historical. Retrieved 8 March 2022, from https://tradingeconomics.com/united-states/gdp-constant-prices

ustr.gov (2022). The People's Republic of China. Retrieved 8 March 2022, from https://ustr.gov/countries-regions/china-mongolia-taiwan/peoples-republic-china

Wang, X., Yan, H., Huang, X., Wen, H., & Chen, Y. (2022). The Impact of Foreign Trade and Urbanization on Poverty Reduction: Empirical Evidence from China. Sustainability, 14(3), 1464.