Business Competency Simulation assignment – measuring a product/ services competency

Question

Task: How can business owners use Business Competency Simulation assignment research techniques to determine a product or services competency and consumer interest

Answer

Introduction

Here the primary purpose of this Business Competency Simulation assignmentclearly states the relevance of applying the business simulation experience to the reality of the chosen organisation, Volkswagen in Germany, effectively. The most significant factor associated with this consideration is to evaluate the usefulness of the Andrews business simulation market structure, its different segments of Strategies and tactics of success for real choice and Organisation Volkswagen. First, in this report, a competitive environment analysis of the entire organisation operating in Germany's market environment will be considered with the help of different theoretical frameworks. Both internal and external investigations of the organisation will be conducted by considering Porter's value chain analysis VRIO analysis in terms of company internal analysis and pistol analysis as seen in the external examination of the company Volkswagen. After successful accomplishment of business external and internal analysis within competitive property market competitive landscape analysis of Andrews, simulation organisation will be taken under consideration organisation market structure effectively. The study will target Gambia market in which Volkswagen is trying to enter to do business.

The primary purpose of this Business Competency Simulation assignment is to identify significant differences between the real competitive environment and the simulation environment, which will affect the strategies of the entire organisation Volkswagen in terms of adopting it. Identification of significant opportunities for the chosen Organisation, Volkswagen, to enter Gambian operating market which is desirable and has excellent market attractiveness will be taken on characteristics of that Gambian market and operating industry external and internal aspects effectively. Market structure of the simulation organisation and growth strategic aspect Ansoff matrix has been considered to approach comparative analysis between real Company Volkswagen. An Andrew simulation organisation effectively makes appropriate recommendations for chosen Organisation in terms of defining the right long-term success strategy for successfully entering Gambian market.

Part

I

INTRODUCTION TO GLOBAL DNA

Global DNA is a business simulation that focuses on global company strategy. To imitate the difficulties of worldwide business, it integrates geographic variation of regional client preferences, taxes, customs, and transportation expenses. Decision input comprises product design research and development for varied local demands, manufacturing and outsourcing, marketing and sales, and finance in a variety of regional locations.(Unforgettable Business Learning ® GDNA -MCR V.1.2, n.d.)

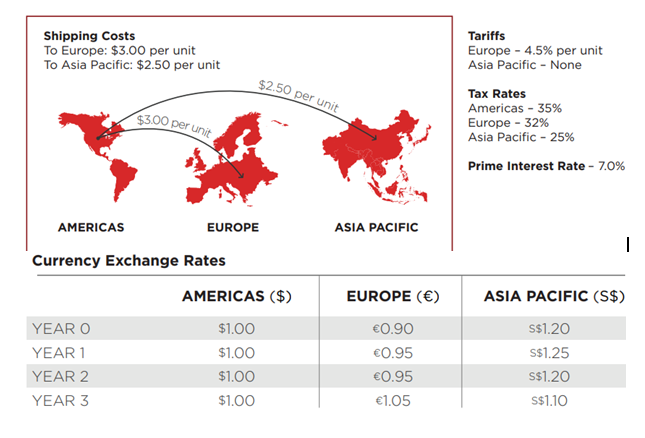

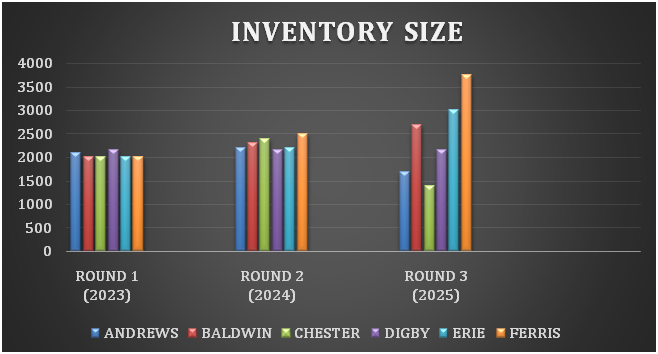

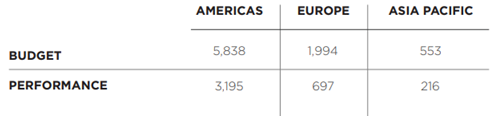

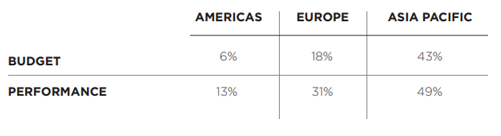

We started as Andrews team with other three human operated teams Baldwin, Chester, Digby and two computer operated team Erie and, Ferris. There were three regions in simulation identified on this Business Competency Simulationassignment namelyAmericas , Europe, and Asia pacific in which all the company stared from Americas as their home region and equally divided market share. Later in simulation every team have options to explore other regions. The operation cost varies for each geographical region and before making final decisions teams consider the regional currency exchange rates , shipping expanses and tariffs which updates after every round.

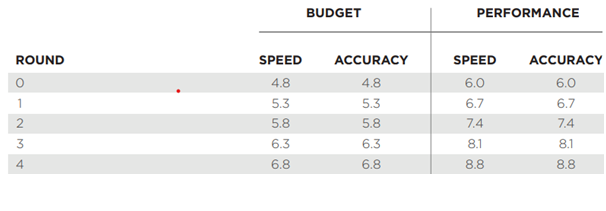

All companies selling genetic testing devices for main two different market segments, budget, and performance. Customers in each market group use various standards for evaluating sensors. Price , age, positioning, and service life of products which changes for both segment and after each round buying criteria upgrade. Segments have two main characteristics speed and accuracy , and demand for updated version increases after each round.

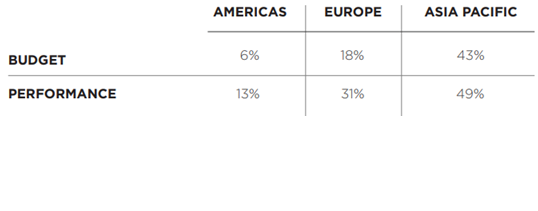

The Budget section sells more units than the Performance segment at the start of the simulation. As the company becomes increasingly worldwide, expected demand across the three areas by the ending of Round 0 is increasing.Throughout the simulation, each segment in every region will expand at a distinct rate. However, the growth rate of each sector will remain constant during the Business Competency Simulation assignmentexperiment.

COMPETITION ROUNDS

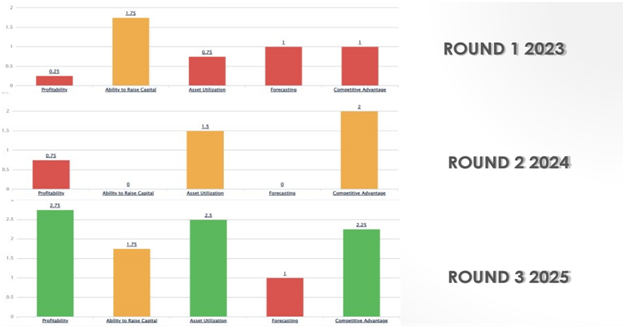

Following three practice rounds, three competitive rounds are in global DNA. In the first round, we offer our product, which is suitable for the budget market and has the parameters shown in the table. Adoption of a region kit has not been chosen because Andrews sells goods in the Americas and is entering a new market in Europe with Able. Because to team member absences and a lack of communication, Andrews limits the possibility of adjusting in the first round. If Andrew stayed in the budget sector, they would certainly penetrate Asia Pacific because it was a niche market for performance items.

|

ROUND 1 2023 |

ROUND 2 2024 |

ROUND 3 2025 |

|

|

SEGMENT |

Budget |

Performance |

Performance |

|

SPEED |

6.4 |

8.8 |

8.8 |

|

ACCURACY |

6.4 |

8.8 |

8.8 |

|

SERVICE LIFE |

21,000 |

18,500 |

18,500 |

|

AGE |

4.2 |

2.3 |

2.3 |

|

REGION KIT |

no |

Americas |

Americas |

|

|

|

|

|

Made by author

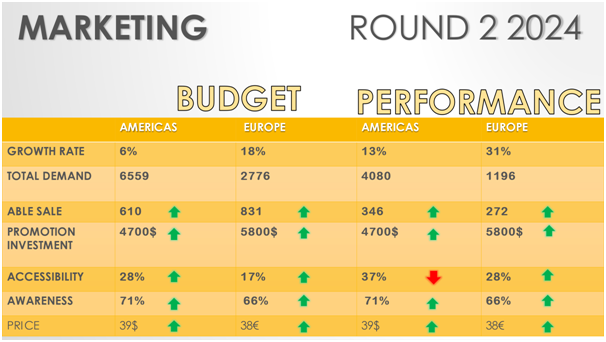

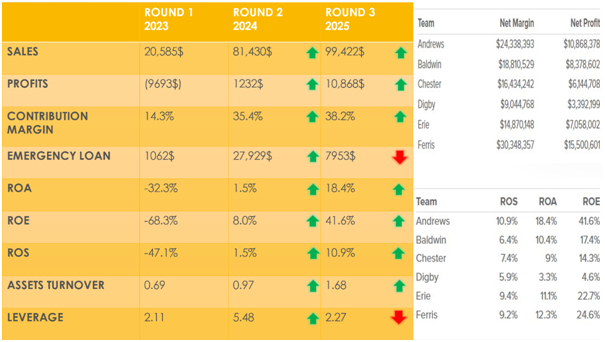

Andrews switched their product segment from budget to performance in the second round to recoup from losses caused by human error in the previous round. As demonstrated in the table, significant adjustments were made in product specifications to make the same product capable of high-end performance. The company made a significant investment in promotional operations in Europe using emergency loans to boost accessibility and knowledge of our product capability. Inventory size was also boosted to meet the possible selling objective.

In the third and final round, due to the high level of competition in the Americas area, a considerable quantity of goods was kept in inventory, and to lower that, a significant reduction in manufacturing operations aimed at stocking out items was implemented. Large demand and awareness in Europe helped to reduce the need for promotional spending, which contributed to Andrews' strong dominance in both market segments. A decrease in the amount of the inventory was done to boost income in the previous cycle to settle the debt and the emergency loan.

STRATEGY AND TACTICS

In the beginning, Andrews approach was to maintain a focus on the budget sector since that segment deals with a greater number of clients to sell items. At the same time, they explored operations in Europe to participate in unexplored markets. A big of prospective clients can be found in the untouched regions of Asia Pacific at the beginning stages of business in these areas. Unfortunately, human error prevented Andrews from making all the necessary adjustments to deliver effective outcomes in accordance with the strategic planning.

Segment Sizes by Region

Business Competency Simulation assignmentGrowth Rates (constant in all rounds)

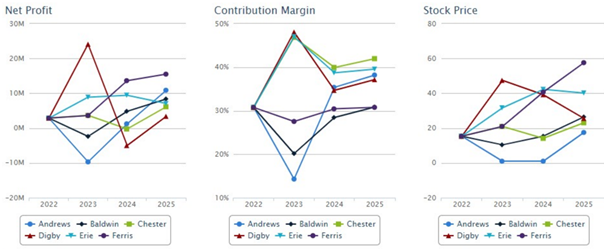

In the second round of the Business Competency Simulation assignment, Andrews changed to performance production with adjustments in the same product capabilities to make up for the losses that were incurred in the previous year. With a lower pricing and an enhanced offering, we were able to sell more than twice as much Able in the second round, making it the best-selling product in the Europe area. Customers in Europe benefited the most from increased accessibility and awareness because to the increased expenditure in promotional initiatives in Europe.

made by author

In the third and final round of the Business Competency Simulation assignment, Andrews concentrated on reducing the quantity of their inventory as well as selling off big amounts of inventory items to enhance their overall financial position at the end of the competition. For putting this plan into action, Andrews has ceased production of its products in large quantities and is instead trying to satisfy customer demand using units that are outsourced . Meanwhile, production in Europe has been kept to a minimum and the primary focus has been on offering products at deeply discounted prices. As a direct consequence of putting all these strategic plans into action, Andrews was able to reach their best position in the competition, as shown by having the best ROS, ROA, and ROE numbers (according to the table) out of all their rivals in the global DNA simulation.

Important Decisions

Here are the important decisions taken in global DNA simulation which made significant impact and helped Andrews to achieve positive results.

First round

• Being the first to market in Europe was the most significant step, resulting in a higher market share.

Second round

• Shift the focus from the budget to the performance component, which will guide the rest of the simulation plan.

• Investing in promotional activities to maintain a strong market share position while restricting outsourcing activities due to expensive tariffs.

Third round

• Increased investment in promotional efforts and discounted prices for items to sell out inventory in the Americas.

• Inventory size reduction to increase financial stability at the conclusion of the competition.

Beginning the simulation at a disadvantage because of errors and concluding the competition as the most improved firm demonstrates that most of the strategy and critical decisions produced a positive influence on the result. While simultaneously investing in new items and maintaining a strong position in market share, Andrews was able to achieve even stronger overall position.

Part II

Difference between Global DNA and Comp-XM

Global DNA

Global DNA is an internationalization simulation in which enterprises begin in the Americas and, depending on their strategic planning, can extend into two additional regions: Europe and Asia Pacific. Both areas have varied demand and features, with Europe favoring technological interest with stronger and more consistent economic growth. On the other side, Asia Pacific has the largest market for budget items where enterprises may expand using a low-cost strategy. Human-operated teams and computer-operated teams compete in three regions of the world map to develop a successful market share in two separate (budget and performance) segments.

At the start of the simulation, all teams had the same market share in the Americas, and teams may start with any section and expand into the other two areas from round one. This simulation gives all teams an equal opportunity and resources to establish a successful corporation. One of the most efficient features of this simulation is that teams are permitted to acquire inventory capacities that will link with their present inventory all in the same round, making it simple to design an expansion strategy. Global DNA features the most dynamic interface, where teams can review the company's current position in all areas while making decisions for the next round, making it easier to take strategic action. Andrews decision making is organized into four departments: research and development, production, marketing, and finance, where all decisions are taken manually from the start.

Comp-XM

The Business Competency Exam, Comp-XM®, is a tool for determining and demonstrating what participants have learnt through the Capsim® business simulation experience (GLOBAL DNA). The Comp-XM® examination procedure is unusual in that it consists of two parts: a business simulation that looks and feels the same as Foundation® and Capstone®, followed by a series of board enquiry questions based on the answers provided in prior simulation rounds, as opposed to Global DNA, which does not feature a quiz at the conclusion of each simulation round.

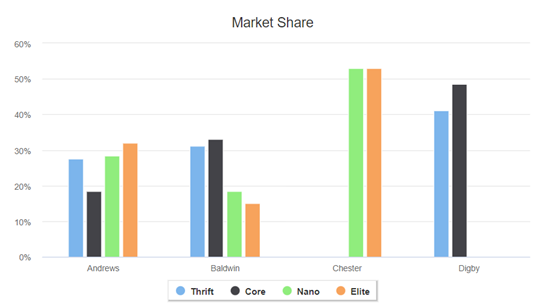

Comp-XM simulation exam done by individual person handling team Andrews with other computer operated three teams in nonregional divided map. Market share in Comp-XM is divided in strong favor to Andrew as they have better market and cash positions with leading market shares. Global DNA has two fundamental categories, whereas Comp-XM firms have four distinct segments, each with its own set of consumer expectations and features. Thrift, core, nano, and elite all have a single product recorded at the start of the simulation procedure. Comp-XM has additional decision-making divisions, including R&D, manufacturing, marketing, finance, human resources (HR), and total quantity management, where first decisions are made before student takeover. Inventory investment in the production department differs from Global DNA since the corporation must purchase inventory size in the prior round that will be allotted in the following year simulation. Because Comp-XM operates on a single geographical map, the firm does not need to worry about currency rates or tariffs operating in multiple locations. Comp-XM is not permitted to outsource manufacturing since it does not operate in a global setting. Whereas in Global DNA, investment in R&D and automation were few approaches to lower production costs, in Comp-XM, human resources and total quantity management activities aid to minimize product costs. At the end of the fourth round quiz, there are five rounds of questions concerning Capsim simulation and their method.

How Global DNA simulation assisted in Comp-XM Exam

Global DNA and Comp-XM simulation exam are distinct from others examined on this Business Competency Simulation assignment, but they share a number of commonalities, and Global DNA expertise was immensely helpful in passing the Comp-XM simulation exam.

In Global DNA, controlling two segments in distinct locations provides the confidence to manage several products in four distinct segments. The most important learning from Global DNA was how to manage with market rivalry, since in the Global DNA simulation, rivals are both humans and computers applying different strategies, where Andrews have to find a way to compete in different market segments. This expertise in a competitive environment assisted Comp-XM in surviving effectively and generating profits. Managing a financial department is difficult but working on finance in Global DNA teaches how to respond to various financial crises. For instance, how to prevent an emergency loan, how to keep shareholders satisfied, and how long term debt might give financial assistance to enhance business processes. Concisely, the simulation of Global DNA aided in achieving positive outcomes and inciting knowledge for a subsequent test by introducing a practical method.

How Global DNA experience maximize performance in Comp-XM

Global DNA provides experience in using various tactics with various segments. As shown in Part One, Andrews began with the budget segment but subsequently transformed into the performance segment to recoup from losses in a short amount of time. As a result, Comp-XM concentrated on elite and nano goods from the start, resulting in a strong position later in the categories.

Using long term debt to support the company's investment operations was learned from the Global DNA experience, which aided in managing financial activities in Comp-XM from round one. In Global DNA, Andrews concentrated on a single product and limited their progress in other segments; similarly, in Comp-XM, Andrews concentrated on the elite and nano segments while keeping a portion of their contribution in the thrift and core segments, which generated income from various products.

Part III

(NOTE: miscommunication to understand that reports cannot be downloaded after finishing simulation restrict from providing data. Although last round of simulation report datarecovered)

In the Comp-XM simulation section, Andrews already had one product designed for each market group, which were thrift, core, elite, and nano respectively. Andrews adopted a low cost approach for the thrift and core market segments, both of which include customers who are price conscious. Andrew chose a differentiation approach for customers in the elite and nano segments who were primarily concerned with the performance of the product.

Andrews made investments in the research and development department to ensure that their products were always up to date. This was one of their primary strategies, which was to lower the cost of their products and offer them at a high profit margin. Putting money into TQM (total quality management) operations is another way to cut beginning expenses, and it helps to do so further.

From the Business Competency Simulation assignmentresearch it is clear that Andrews attempted to make investments in growing inventory size and launch new items in the elite and nano segments, but was unable to grasp the workings of the simulation during the competition exam due to the fact that he had different experiences with past simulations (Global DNA).

Part IV

Overview of the company

Founded: 1937

Type: Brand

Area served: Global

Headquarters: Wolfsburg, Germany

Industry: Automotive

The Organisation Volkswagen is a very well-reputed organisation in Germany, and a well-esteemed motor vehicle organisation identified to be headquartered in Germany. According to multiple research studies, it has been determined that in the year 1937, the organisation was founded by the German labour front. Currently, Volkswagen is determined to be one of the biggest manufacturers of Automotive and has operations worldwide. As of now, it has been identified on this Business Competency Simulation assignmentthat the primary operating area of this organisation is in China, which measures to be a countable 40% of the organisation's sales and profit margin (Lee et al., 2021). The development of the brand name has a particular inner meaning as it has been derived from people's cars in response to Volkswagen. Currently, it has been identified that the entire market structure of the Organisation has changed drastically since 2017 as the company Volkswagen has announced to be giving much more focus on the manufacturing of electric vehicles as it is their primary goal by 2025 (Hassan, 2019). It has been identified that the company has aimed to launch approximately 13 new electric vehicle models into the German market to expand its sales volume up to 25%. It has been identified that the organisation has around 74000 employees, and the margin of the dealership the company has is beyond 7700, which is accountable for the organisation's market share above 20%. Even though it has been identified that the largest automobile manufacturer, Volkswagen, has maintained business operation and sustainability through the emission of new standards and sustainable initiatives for enhancing better sales volume in their core operating markets of China and Germany but still in Europe, the company has made some promising growth in terms of developing self-driving vehicles (Bai, 2021). The number of manufacturing facilities identified for the company books is in the United States, India, Brazil, Argentina, Mexico, Spain, South Africa, Kenya Slovakia, effectively. As a result of business globalisation and strategic design tactics of the organisation, the company has made it to the Forbes global 2000 list of 25 largest automotive companies.

Business Competency SimulationassignmentInternal analysis

In this Business Competency Simulation assignmentsection, an internal analysis of the organisation, Volkswagen, will be taken under consideration by effectively adopting the theoretical framework of porter's value chain analysis and VRIO analysis. It is to be expected that through internal analysis of resources, core competencies, and strategic capabilities in a competitive environment for ensuring expansion into Gambia can be distinguished for the chosen Organisation Volkswagen and also based on organisation competitive environment valuation strategic comparison with simulation organisation based on strategy responses can be determined significantly (Sergio and Rylova, 2018).

Porter's value chain analysis

The organisation works and is considered to be operating in a globally competitive market like Germany. Hence the complete value chain analysis of the company signifies Global operation activities evaluation with equal importance in the business strategy development process as in primary and secondary activities to justify responsibilities in the Service Delivery process (Scherpenzeel, 2021). In the following section, introductory and secondary activities of the organisation Volkswagen have been proposed.

Primary activities

Primary activities in response to business value chain services have been discussed in the following section for the company Volkswagen to reach better customer satisfaction in Germanyand a higher margin of competitive service operation.

Inbound logistics

According to multiple research studies, it has been identified that the organisation Volkswagen has faced considerable challenges in terms of the inbound Logistic Service Management process as in limitations towards product development process for electric vehicles and self-driving Cars while maintaining business sustainability application (Welch, 2019). However, with the help of the research and development process, the company is becoming more focused on the raw material transition into the final delivered product for better customer satisfaction and manufacturing inventory control.

Outbound Logistics

The outbound logistics activities for the company Volkswagen include product supply chain processes through different intermediates until reaching our final customer (Moreno Palma, 2022). Enterprise Resource Planning and inventory software have contributed to the company Volkswagen. Technology reduction of overall outbound operation, the lead time has been reduced to obtain extra sustained competitive advantages for business growth.

Operations

To maintain being one of the largest Automotive manufacturing organisations, business strategy Corporation management is necessary for which supply chain operation assembling testing of the vehicle repairing safeguarding applications raw material resources are the major operation associated with a higher margin of productivity improvement identified for the company Volkswagen (Gaultier and Marcello, 2021). Other than business marketing and sales application, operation activity management is essential as it is the main factor that right continuous improvement of Business Economics scale and profitability margin within operating market that enables higher competitive landscape of the organisation Volkswagen.

Marketing and sales

It has been identified on this Business Competency Simulation assignment that the most significant benefit adopted by the organisation Volkswagen is determined to be in the area of enhancing the sales volume of the company and adopting competitive advantages in the competitive business market by acknowledging affordable costing, differentiated products and high-quality service approaches (Lee, 2021). It acts as a vast sales and marketing opportunity for the company Volkswagen. To maintain sustainability in terms of marketing and sales operation of the company, the most predefined strategy approach adopted by the company Volkswagen is considered to be safe keeping of business commitment values, ethical consideration for production and customer service approaches by avoiding any possible disruption towards activities competitive dynamics and current positioning of the market.

Services

In the case of the organisation Volkswagen, the concern of Business pre-purchase and post-purchase evaluation management is considered highly crucial for maintaining a higher margin of customer satisfaction and loyalty to the business. It is also a significant driving element behind business marketing and word-of-mouth promotional activities (Gonçalves, 2019). The impoverished service area of an organisation can lead directly to damaging business reputation within the operating market and also cause a massive loss in sales services which is why the organisation Volkswagen has given much more focus on empowering marketing and promotional activities based on higher service activities from skilled employees within the business operation area for better customer satisfaction and loyalty to company services.

Secondary activities

Here in the following section, secondary activities of the organisation Volkswagen in response to business value chain activities have been distinguished to critically evaluate the support activities for the company to maintain productivity and operation efficiency within the competitive market of Germany alongside global market pressure.

Human Resource Management

The organisation Volkswagen leverages different margins of the Human Resource aspect to enhance business productivity and creativity for the new product development processes. In this context, it has been identified that the company has given much more input towards rewarding employees ' management, employee training process learning and development opportunity creation and employee performance management (Friesendorf and Uedelhoven, 2021). According to multiple Business Competency Simulation assignmentresearch studies, it has been identified that the company Volkswagen has been able to focus much on employee motivation, skills development and commitment to the company by reducing the margin of pressure and rigid work structure within the organisation culture. As a result, it has been identified that the company Wagon can achieve the objective of cost minimisation within employee recruitment and training costs as the company has distinguished better talent management opportunities.

Company Infrastructure

Under consideration with business multiple value chain activity, Organisation infrastructure management is identified as one of the most crucial elements that restore business success opportunity and competitive market positioning (Chodakowska, 2018). Strong control of the organisation towards business intellectual property protection quality management in Service Delivery financial performance management planning and business scientific management process research and development accounting financing supply chain management process has been maintained to strategically mitigate the possibility of overhead cost in terms of Management.

Procurement

In response to the procurement Management process, the company Volkswagen is identified to be utilising a wide range of raw materials and machinery supply to maintain service quality and product quality of the final offering within business value chain activities. It is identified to be solely related to the inbound Optimisation process for better customer value and business service approaches (Nguyen and Pham, 2022). Under this consideration, efficiency has been given much focus within the organisation's procurement process to reduce the overall inventory management cost within the company.

Technology development

In response to the digital business industry, most value chain activities depend solely on technology support in service and production areas. It has been determined that the organisation Volkswagen has made quite a firm grip in the technology development process within business support tactical design research with automation Technology data analytics and technology development activities for strategic distribution and business integration process (Sypko, 2022). The Business Competency Simulation assignmentresearch shows the company focuses on developing electric vehicle self-driving Cars, which depend entirely on innovative technology software and robotic Evolutions.

VRIO analysis

To strategically distinguish capabilities and resources of competitive advantages for the organisation, Volkswagen VRIO analysis has been taken into consideration. The organisation's extensive infrastructure for production is identified to be quite crucial for the organisation Volkswagen as it provides approximately 10.9 million of production capacity for the organisation and also acknowledges the Global production network of the company in 120 manufacturing facilities worldwide (Henry, 2021). According to multiple research studies, it has been identified that the organisation's major manufacturing facilities are in Europe, where enhanced levels of technology are taken under consideration in an aligned manner 2 control the consistency of the production network globally. Therefore, this factor is considered quite valuable and rare in nature within the competitive landscape. Business Global presence and brand recognition is another capability and resource identified that provide the organisation Volkswagen with great return in terms of business operational strength and new customer acquisition process (Hertenstein, 2019). Due to a better brand image, it has been identified that the Organisation has been able to obtain the largest Market around the World, such as the Asia Pacific and Europe. Extensive business supply chain operation is another capability identified for the organisation Volkswagen. Multiple studies indicate that the Organisation can make fast suppliers focusing on future advanced supply networks calibrated with Innovation and globalisation influences. A large business product portfolio is another major capability identified which is considered to be made up of 12 renowned brands such as Volkswagen, Audi, Bentley Lamborghini, Ducati, Porsche Volkswagen commercial vehicles resulting divorce margin of customer preferred vehicle options in response to different classes of consumers.

|

Resources Capabilities |

Valuable |

Rare |

Inimitable |

Organised |

Implication |

|

large business product portfolio |

YES |

YES |

YES |

YES |

Competitive advantage |

|

Business Competency Simulation assignment- fast suppliers |

YES |

YES |

YES |

YES |

Permanent Competitive advantage |

|

Extensive business supply chain operation |

YES |

NO |

YES |

NO |

Competitive advantage |

|

Business Global presence and brand recognition |

YES |

NO |

YES |

YES |

Permanent Competitive advantage |

|

large infrastructure for production |

YES |

YES |

YES |

YES |

Competitive advantage |

|

Global production network |

YES |

YES |

YES |

YES |

Sustainable Competitive advantage |

External analysis

In this section, an external analysis of the organisation, Volkswagen, will be taken under consideration with the help of approaching the PESTLE analysis theoretical framework effectively to identify business market opportunities and challenges in response to the competitive landscape.

Business Competency Simulation assignmentPESTLE analysis

|

Factors |

Description |

Impact |

|

Political |

Business trade Tariff regulations control is considered to be one of the essential political influences over the organisation Volkswagen in response to the competitive automotive industry (Van Assche and Gangnes, 2019). Serious complexities were identified in business trade regulations between Germany and the UK United States which severely impacted the business Service Management process for the company Volkswagen. Due to trade regulations, additional trade charges are identified to be made over the organisation of Volkswagen product vehicles. In response to certain studies, it has been determined that the Brexit impact greatly influences organisation trade and additional charges from the European Union. Hence it is identified to be quite a threat to the company Volkswagen. |

Very high |

|

Economical |

The most crucial economic influence on the organisation of Volkswagen's competitive operation management is identified to be the growing spending nature of consumers. From this evaluation, it has been determined that the overall trend for customer willingness to purchase innovative electronics and automobiles for luxury passes has increased radically (Gamble, Thompson and Peteraf, 2019). It is considered extremely beneficial for this automobile organisation, Volkswagen, to enhance business overall sales volume within multiple operating markets strategically. Therefore it is quite an opportunity for the company. |

Very high |

|

Social |

Mixing up brand perception is identified to be one of the most crucial social-cultural factors affecting the overall business operation of The large Large margin of the brand portfolio for Volkswagen group such as Porsche Lamborghini Audi creates confusion for appealing customers and also ca causes struggle for developing strategic recognition opportunities for luxury and additional advantages for innovative competitive strategy development process in comparison with other organisations such as Tesla and BMW (Gaim, Clegg and Cunha, 2021). Another essential social factor that drastically impacts the organisation of Volkswagen is the evolution of the mobility sharing industry, such as environmentally freeride-sharing sharing opportunities, for example, uber. It has been identified on this Business Competency Simulation assignment that current consumers are preparing for a ride opportunity rather than dealing with car ownership. This is creating a shift in the spending nature of consumers from vehicle ownership to mobility sharing. Hence it is quite a threat to the organisation. |

Very high |

|

Technological |

Green technologies are considered to be one of the severe influences that has been identified upon the organisation Volkswagen in response to autonomous functionalities of driving Technology, which imposes huge Technology challenges upon automatic organisation to become much more sustainable by having the ability to create environmentally friendly vehicle production (Li, Zhang and Huang, 2020). As a result of a continuous evolution towards green technology, opportunities are slowly coming into the Automotive business sector in the arms of the inclusion of electric motor hydros and fuel cells and batteries. It has been identified that the company works and can include battery-powered electric vehicles In response to different Porsche and Audi integrated vehicle models, which is quite desirable for young customers. It is quite an opportunity for the organisation. |

Very high |

|

Legal |

From a legal perspective, it has been identified that Volkswagen has been dealing with environmental protection related to multi-year candles due to emissions during testing. After Brexit, huge legal regulations, norms and protocols have been imposed on business outbound operation Service Management for Global Business operations, especially in the United States and Europe. Hence it is quite a threat to the organisation Volkswagen. |

|

|

Environmental |

Radical inclusion of Sustainable technology that has less carbon footprint, also known as a green technology, is identified to be helping out traditional automotive engine replacement with the improved throttle to maintain emissions and environmental concerns associated with Automotive industrial scale in terms of reducing the pollution level (Mallak et al., 2018). As a result of green technology inclusion, huge service and manufacturing shifts identified within the business sector greatly influence the organisation Volkswagen. It opens up Future sustainable opportunities for the business, and hence it is quite the opportunity for the company. |

high |

Competitive landscape Andrews simulation

In response to the Andrews business simulation, business oligopoly and monopolistic competition characteristics have been identified within the operating market. In response to the recognised fact based on business strategy approaches and the competitive landscape identified with simulation results, the theoretical framework of Porter's five forces has been taken under consideration to analyse the competitive landscape of Andrew's simulation effectively and strategically (Benzaghta et al., 2021). In this contact, strategic price-making power and interdependence of business organisation followed by product differentiation adopted by the organisation and simulation will be taken into consideration for acknowledging competitive barriers within the operating market.

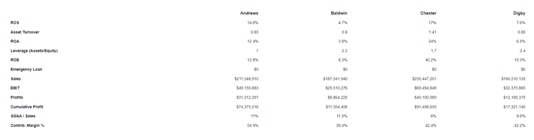

Figure 1: Financial statistics round 2

(Source: simulation)

Porter's five forces analysis

Bargaining power of suppliers: in response to the identified oligopoly characteristics of the organisation Andrew simulation context, it has been determined that the bargaining power of supply for this organisation is relatively low (Li, Zhang and Huang, 2020). As a result of the Business Competency Simulation assignment analysis, it is identified to be quite evident that each and every supplier within the operating market must acknowledge the business service regulations and code of conduct prepared by the organisation as it is to ensure a sustainable supplier organisation relationship effectively. It has given the organisation long-term opportunities to ensure higher product quality.

Bargaining power of customers: as a result of monopolistic characteristics for the organisation, Andrews simulation context, it has been identified that the customer bargaining power is quite marginal, and it is not termed to be the stronger force within the competitive landscape of the company. As the number of competitors available in this operating market is quite Limited, customers can also avail of Limited opportunities for seeking multiple options. It is the primary concern why the bargaining power is quite Limited. As a result, outstanding control of product cost management has been imposed on the organisation to reach out to target customers and their expectations.

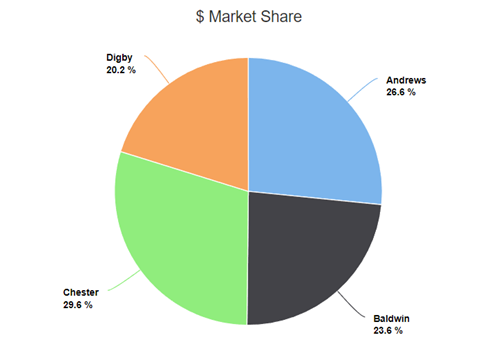

Threats of substitute products: in response to the financial statistics of the organisation Andrews, it has been identified that the company's overall profit margin is 18,266, 968 and the overall sales margin is determined to be 9.4%. In addition, the organisation's market share is the highest among all other competitors within the operating market, which is determined to be 31.3%. (Li, Zhang and Huang, 2020) The margin of alternative product options is quite Limited, which provides additional competitive opportunity for the organisation, Andrews, In response to competitors such as Digby, Chester, and Baldwin.

Threats of new entrants: In acknowledging monopolistic characteristics of the competitive market, it has been identified that the margin of new business entrants is quite low due to market monopoly.

Business intense rivalry: there are identified to be mainly three competitors for the organisation Andrews such as Digby, Chester, Baldwin, and the market share acquired for the organisation are 22%, 26% and 20.6%, which signifies that the margin of market share is higher for the organisation Andrews as it can capture 31.3% of market share which makes it one of the leading organisations within operating market. For this reason, the margin of intense rivalry is relatively low for the organisation Andrews simulation.

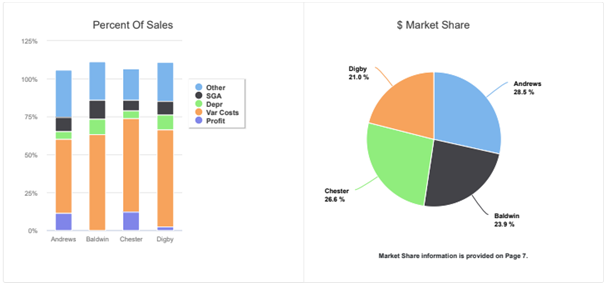

Market structure

Based on the Business Competency Simulation assignment result, it has been identified that in response to round one market share of the organisation Andrew, which was 31.3%, is reduced to 28.5% in round 3. The main concern is business in appropriate structure regarding the strategy development process for business growth. Consequently, in round 3, the market share of the organisation and rules is still lower than the previous year, which is 26.6%. However, the contribution margin is identified as 54.9% and feels 11%, whereas it for other competitors is determined as 11.5% for Baldwin. It signifies that the overall market structure imposes difficulties for Andrew's organisation.

Figure 2: Financial statistics round 3

(Source: simulation)

Under this consideration, it has been identified that the company is entirely focused on high specification and product quality of its product offerings by acknowledging price control measures. In this context, higher production opportunities and Supreme quality management process automation inclusion followed by research and development opportunities have been taken under consideration within the company's production facilities (Li, Zhang and Huang, 2020). In terms of oligopoly characteristics of the organisation higher margin of standardisation of products and a Service Management process, including Limited competition within the market, has been identified, which creates a robust opportunity for the organisation towards an intense growth strategy development process for Business expansion. In the following section, with the help of the Ansoff matrix, potential strategies that will make better growth options have been indicated.

Ansoff matrix

To effectively impose growth opportunities for the organisation, a new product development aspect has been taken under consideration which will create opportunities for the organisation to acquire diverse customers based on the premium product delivery process (Van Assche and Gangnes, 2019). New product development is the primary growth strategic option imposed for the organisation for embracing opportunities of market expansion in terms of business opportunities for making entry into the new market. In this context, Innovation and product differentiation are considered effective in the research and development process, followed by the additional contribution of skilled human resource management.

Comparative analysis

Sustainable technology's adoption of great business demand management and restructuring process for business service activities management is identified as primary competitive functions of the organisation Volkswagen. On the contrary, consistent service product delivery is recognised as the most significant feature of Andrews's organisation in response to monopolistic market characterisation. As the margin of competition for the organisation books Wagon within the operating market and Global Business Management is relatively high, that is why Innovation and Research and Development are identified to be one of the most significant assets of the brand to acknowledge the higher opportunity for marketing and additional competencies development for the competitive business landscape.

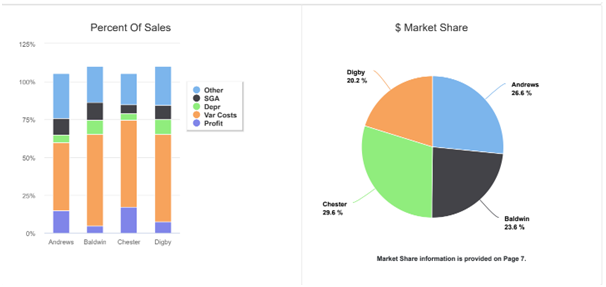

Figure 3: Financial statistics round 4

(Source: simulation)

The company focused on selling elite and Nano and put high specifications and prices into all the product offerings. Andrews made automation updates and research & development updates to keep production costs low and profit margin high. HR and TQM investments also help to keep the initial cost further low effectively (Van Assche and Gangnes, 2019). However, in this context for the organisation Volkswagen it has been identified that intense rivalry within the global operating market creates disruptions in the business expansion strategy development process as the dominant power is quite low in response to the organisation's business simulation Andrews effectively. The Business Competency Simulationassignment findings show The operating market of Volkswagen is not oligopoly in nature, and hence certain strategic implementations toward the business expansion into a new market have been adopted effectively. In response to the entire comparative analysis, it has been identified that the organisation Volkswagen can avail wholly owned subsidiaries method for making active entry into the newGambia market on the basis of product differentiation and new product development intensive growth strategy implementation process. In response to both internal and external analysis it has been identified that the organisation strong supply network fast suppliers and strong brand recognition is going to be extremely helpful for developing a whole new business subsidiary within the Gambian market automotive industry. Hence under this consideration the most significant strategic method that could be approached by the company Volkswagen are market penetration and new products development process-based cost effectiveness and inclusion of R&D as well. .In response to the strategic correspondence the large margin of business product portfolio the organisation Volkswagen can statically avail the opportunities towards providing customers higher margin of vehicle options. In addition to that it has been identified that higher margin of customer willingness has the ability to bring up additional opportunities for the company to acknowledge innovation and automation for luxury passes can be progressed effectively. From this context the inclusion of green technologies has the ability to help out organisation in selling elite and Nano with having higher margin of higher specifications and updated automation with low cost production as well. From this context with the help of new product development the company Volkswagen will be able to reach out new customers and along with that by availing green technologies the margin of new product develop will be widen up effectively.

Recommendations

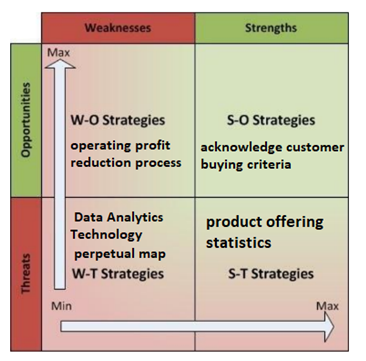

Here, in response to the entire competitive landscape for the business simulation organisation Andrew, it has been identified that the organisation has dominant power within the competitive market due to Limited bargaining power of suppliers and customers and Limited opportunity for new business Rivals, which has given the organisation Apple amount of opportunity towards new product development process as well as product differentiation strategy development process in terms of unique features distinctiveness higher margin of product quality price Management process for according different class of customers towards organisation products offering effectively. In response to this fact, it has been identified that the organisation books were the must work on operating profit reduction process so that better control on business governance and compliance issues can be mitigated to enhance the organisation's sales margin and contribution margin. Like the organisation Andrews, the company must acknowledge customer buying criteria by focusing on the product's price, offering reliability and the ideal product position to generate higher importance and expectations from customers effectively. A higher margin of Data Analytics Technology should be acknowledged for a better perpetual map development process alongside the thrift segment creation process for developing a strategic plan and customer expectations from the brand effectively, which will enhance Business expansion opportunities within new markets of foreign countries effectively. With the help of technology organisation Volkswagen must develop each and every product offering statistics to measure its unit demand, sales demand, and industries segment for acknowledging product segment-based growth rate, which will create a more significant opportunity for new market entry based on product offering or suitability and accessibility into the foreign market

Business Competency Simulation assignmentTOWS matrix

Figure 4: TOWS matrix

(Source: Van Assche and Gangnes, 2019)

Conclusion

In response to this entire assessment, it is concluded that as the margin of competition for the organisation books Wagon within the operating market and Global Business Management is quite high, that is why Innovation and Research and Development are identified to be one of the most significant assets of the brand to acknowledge the higher opportunity for marketing and additional competencies development for the competitive business landscape. Higher production opportunities and Supreme quality management process automation inclusion followed by research and development opportunities have been taken under consideration within the company's production facilities. The Business Competency Simulationassignment concludes that Green technology inclusion and huge service and manufacturing shifts identified within the business sector greatly influence the organisation Volkswagen, and it opens up Future sustainable opportunities for the business.

Reference List

Bai, Y., (2021), March. Analysis of Overseas Management Strategy of the Volkswagen Group. In 6th International Conference on Financial Innovation and Economic Development (ICFIED 2021) (pp. 229-234). Atlantis Press.Business Competency Simulation assignment https://www.atlantis-press.com/article/125954257.pdf

Benzaghta, M.A., Elwalda, A., Mousa, M.M., Erkan, I. and Rahman, M., (2021). SWOT analysis applications: An integrative literature review. Journal of Global Business Insights, 6(1), pp.55-73.https://digitalcommons.usf.edu/cgi/viewcontent.cgi article=1148&context=globe

Chodakowska, A., (2018). The mobility revolution in the automobile industry. Electric cars and battery management.https://www.theseus.fi/bitstream/handle/10024/150259/Thesis_Aneta_Chodakowska.pdf sequ

Friesendorf, C. and Uedelhoven, L., (2021). Macro-Environment of Mobility. In Mobility in Germany (pp. 11-17). Springer, Cham.https://link.springer.com/chapter/10.1007/978-3-030-71849-7_2

Gaim, M., Clegg, S. and Cunha, M.P.E., (2021). Managing impressions rather than emissions: Volkswagen and the false mastery of paradox. Organisation Studies,Business Competency Simulation assignment 42(6), pp.949-970.https://www.diva-portal.org/smash/get/diva2:1362459/FULLTEXT01.pdf

Gamble, J., Thompson Jr, A. and Peteraf, M., (2019). Essentials of Strategic Management: The Quest for Competitive Advantage, 6e.http://ecommerce-prod.mheducation.com.s3.amazonaws.com/unitas/highered/changes/gamble-ess-of-strategic-management-6e.pdf

Gaultier, C. and Marcello, K., (2021). VOLKSWAGEN GROUP SUPPLY CHAIN ANALYSIS IN EUROPE. African Journal of Emerging Issues, 3(8), pp.1-10.https://www.ajoeijournals.org/sys/index.php/ajoei/article/download/220/258

Gonçalves, R.E.M., (2019). Valuation of Volkswagen AG (Doctoral dissertation).https://repositorio.iscte-iul.pt/bitstream/10071/19658/1/master_ricardo_magalhaes_goncalves.pdf

Hassan, A.S., (2019). Evaluating the marketing communication strategy of Volkswagen in post-crisis period: application of image repair theory. International Journal of Marketing Studies, Business Competency Simulation assignment11(2), pp.87-101.https://pdfs.semanticscholar.org/98a7/a124af9d177bd5ef2dacbe9e5ebc9489705a.pdf

Henry, A., (2021). Understanding strategic management. Oxford University Press.https://books.google.com/bookshl=en&lr=&id=M7wyEAAAQBAJ&oi=fnd&pg=PP1&dq=VRIO+analysis+of+

volkswagen&ots=Z3y0pgcDCu&sig=GqmETzvKsJC_sLayD7cHpFXe7lw

Hertenstein, P., (2019). Multinationals, global value chains and governance: the mechanics of power in inter-firm relations. Routledge.https://books.google.com/books

hl=en&lr=&id=w5SpDwAAQBAJ&oi=fnd&pg=PT11&dq=value+chain+analysis+analysis+of+volkswagen&ots=

QG1RdCifC4&sig=Vn6ud_wu4RwOHMo5mCzolr_sS9c

Lee, J., Kim, J., Kim, J. and Choi, S., (2021). Why Localization Is Necessary as a Business Strategy in Emerging Markets: The Case Comparison of Hyundai and Volkswagen. Journal of Open Innovation: Technology, Market, and Complexity, 7(3), p.190.https://www.mdpi.com/2199-8531/7/3/190/pdf

Lee, J., Kim, J., Kim, J. and Choi, S., (2021). Why Localization Is Necessary as a Business Strategy in Emerging Markets: The Case Comparison of Hyundai and Volkswagen. Journal of Open Innovation: Technology, Market, and Complexity,Business Competency Simulation assignment 7(3), p.190.https://www.mdpi.com/2199-8531/7/3/190/pdf

Li, Q., Zhang, Y. and Huang, Y., (2020). The impacts of fairness concerns and different business objectives on the complexity of dual-channel value chains. Complexity, 2020.https://www.hindawi.com/journals/complexity/2020/1716084/

Mallak, S.K., Ishak, M.B., Mohamed, A.F. and Iranmanesh, M., (2018). Toward sustainable solid waste minimisation by manufacturing firms in Malaysia: Strengths and weaknesses. Environmental monitoring and assessment, 190(10), pp.1-16.https://link.springer.com/article/10.1007/s10661-018-6935-5

Moreno Palma, S., (2022). Del marketing verde al greenwashing: casos McDonald´ sy Grupo Volkswagen.https://uvadoc.uva.es/bitstream/handle/10324/53610/TFG-E-1389%20.pdf sequence=1

Nguyen, H. and Pham, L., (2022). Entering the Finnish car market: case: VinFast electric cars.https://www.theseus.fi/bitstream/handle/10024/755950/Nguyen_Pham.pdf sequence=2

Scherpenzeel, T., (2021). How an MNC's CSR-strategy is affected by CSiR A case-study into the CSR-strategy of Volkswagen AG after its involvement in the diesel emissions scandal.Business Competency Simulation assignment https://theses.ubn.ru.nl/handle/123456789/12078

Sergio, R.P. and Rylova, M., (2018). Employee engagement and empowerment as gateway towards retention: The case of Volkswagen group. Journal of Eastern European and Central Asian Research, 5(2).https://pdfs.semanticscholar.org/1442/b0aa183df2dab46c6c27dad7ac15df971acc.pdf

Sypko, D., (2022). Time-Based Competition in Tesla´ s Supply Chain in the Era of Industry 4.0.https://www.theseus.fi/bitstream/handle/10024/752197/Sypko_Daniel.pdf sequence=2

Van Assche, A. and Gangnes, B., (2019). Global value chains and the fragmentation of trade policy coalitions.

Transnational Corporations Journal, 26(1).https://unctad.org/en/PublicationsLibrary/diaeia2019d1_en.pdf#page=41

Welch, J., (2019). The Volkswagen recovery: leaving scandal in the dust. Journal of Business Strategy.Business Competency Simulation assignment https://www.researchgate.net/profile/James-Welch-4/publication/330527604_The_Volkswagen_recovery_leaving_scandal_in_the_dust/links/5c5ddf2192851c48

a9c33c91/The-Volkswagen-recovery-leaving-scandal-in-the-dust.pdf

Appendix