Business Accounting Assignment: Innovation In Accounting

Question

Task:

Research Background

The proceedings and update in the process of communication and the information revolution have led to a big landmark for the accounting profession as a whole because accounting remained constant for many years as there was a lack of exchange of information with the users. Amongst the advances, the utilization of the internet has brought about significant changes that lead to the evaluation of information and virtual transmission. With the aid of the integrated network and internet, there is a big revolution in the information age. The new technologies have generated major structural changes in the company and this has led to a major influence on the cost of the company and restructuring of the processes of production making it more competitive in nature (Han et al. 2011). The implementation of accounting technology has played a significant role when it comes to the role of accountants. The advent of technology has brought different tools that help the accountants to perform their obligation with ease and flexibility. With the aid of accounting technology, the accountants are able to conduct the tasks in an efficient manner coupled with efficiency. Hence, accountants have assumed a place of special importance and occupy a place of advisor owing to the tool of technology present with them.

The global impact of technology helps to account and the competitive structure as technological advancements leads to major effectiveness in terms of accounting services. If the process of communication is fast in the accounting firms, it can lead to major productivity thereby permitting better commercial decision making and enhance the company’s expansion into new avenues because the presence of IT resources leads to competitive benefit over the competitor (Feller et al. 2011). The accounting profession can utilize information technology to create new services or enhance existing ones. The competitive environment needs an accounting organization to create value for its clients and differentiate that from its rivals. The technological advancements and process such as the internet, mobile accounting has changed the entire scenario. With the help of the internet, the accountant can check records, assess the entries, perform audit without being present physically (Feller et al. 2011). Hence, accounting professionals can perform different tasks simultaneously and without having a physical presence. Further, the development and presence of cloud computing have led to the storage of data online in an easier way and hence, the accountant can easily save their work irrespective of the location. Moreover, AI that is Artificial Intelligence has reformed the overall structure through the efficiency is improved and organizations experience a reduction in the operation cost. It has now been easier for the accountants to connect with any part of the world (Chen & Wu, 2011). Further, the presence of tax software has changed the scope of accounting. The presence of software has reduced the chances of mistake thereby ensuring improvement in the process of accuracy. Moreover, the presence of tax software has streamlined the process of audit and this ensures that the process remains effective and efficient. Thereby, it is clearly evident that accounting practices have undergone a major change with the help of technological updates. The implementation of accounting technology in the organization has transformed the overall work of the accountants.

Research question

How technology has impacted the accounting profession?

How the accounting profession is enriched with the help of technology?

What benefits does the technology provider to the accounting profession?

What are the challenges that the organization faces while utilizing information technology as their major tool?

Why does business need the implementation of technology?

What factors aid the use of technology in the business?

What are the changes in the accounting profession after the implementation of technology?

Research objectives

• Influence of technology in attaining the results in the accounting profession

• Assessing the benefits that accrued through the use and implementation of technology in the profession of accounting.

• To assess the changes brought about by technological inventions that have revolutionized the overall accounting process

• To evaluate the risks and benefits through the usage of technology in business

List of Keyword used for Literature Review

Artificial Intelligence, AI, storage of data (Chen & Wu, 2011)

Accounting technology, accountants, accounting firms and competitive benefit (Feller et al. 2011)

Accounting needs, ethical issues, financial reporting process, financial information, manipulations (Han et al. 2011)

Auditors and accountants, violation of privacy, IT system¸ technology (Sarokolaei et al. 2012)

Ethical consideration

The immense use of technology in the field of accounting for accounting needs has led to ethical issues. As a matter of fact, accuracy in accounting plays a predominant role. The financial reporting process and practices of accounting are concerned with projecting an authentic status. However, with the advent of technology, it has been noted that there is unauthorized access to the accounting information and hence misleading financial information (Han et al. 2011). Technology has given birth to manipulations and stealing critical data that causes a potent threat to the overall organization. There are many cases when the accountants fail to hide accounting information that is important and is prone to be at stake because the outsiders have access to it. With the aid of technology, accountants can have access to different accounting information thereby signifying the fact that the information can be accessed for personal use. Another major ethical consideration that comes in the way is the violation of privacy through the IT system. This leads to the collection, as well as dissemination of data by the auditors and accountants. The leakage of such information can turn out to be peril for the organization as a whole. It is important for the auditors and accountants to adhere to the policies of the organization and act in an ethical manner so that the financial information can be safeguarded and ensure that the information is not passed on to the third parties (Sarokolaei et al. 2012). There is a strong need that the accountants should act in the best interest of the company and observe certain professional ethical standards, proper financial management and enhanced quality of audit so the organization remains free from all negative implications.

Answer

Abstract

The research carried on the topic of business accounting assignment delves in the different technologies and IT tools used by businesses in accounting to empower daily execution of operations. The research goes one step further and investigates the costs and risks associated with the adoption of innovative IT tools in the business. The research questions and objectives are synthesised based on the topic. A descriptive approach will be implemented for establishing the relationship among the dependent and the independent variables. A literature review analyses the prior information available with respect to the research and conducts a critical evaluation. Surveys comprising of closed ended questions will be conducted among a part of the population selected by simple random sampling. Further to this quantitative analysis will be used in the context of business accounting assignment to draw succinct conclusions from the data gathered. The ethical considerations to be followed during the course of the research are further elaborated. An objective view will be taken of the technologies used in accounting and their impacts on the business operations. The research performed on the business accounting assignment strives to accentuate the knowledge regarding the implementation of software in the business. A systematic consecutive pattern is followed for better understanding.

1. Introduction

This research on business accounting assignment will focus on the impact of contemporary software in the domain of accounting. The study developed within the business accounting assignment reiterates the advantages gleaned by businesses due to the advances in the software. The free flow of information between the different components of business will be explored. The flexibility accomplished in the daily tasks associated with accounting due to incorporation of technology is explored. Alternately the study also assesses and presents the various additional costs incurred due to the introduction of advanced tools. The innovative tools have improved the execution of businesses but require adequate maintenance as well as protection from outside attacks. The different perspectives are elaborated.

1.1 Research Background

The research on business accounting assignment seeks to comprehend the various impacts of the innovative tools which are used in the business to facilitate the process of accounting (Quinlan et al. 2019). The reliance on IT systems which has enhanced the business activities as well as the security problems encountered will be explored in the research. The research presents an objective evaluation of the ERP and software tools used for accounting in business and the results are supported by relevant data. Often companies adopt IT accounting software desiring to enhance the business process. The research delves in the benefits as well as the risks and costs such that businesses are able to make better informed decisions.

Research question and objectives obtained in the business accounting assignment stating the vital issue explored in the research and in the following part, literature review assimilating the various literature available in the subject and performing a critical analysis of the same. In the next part, research design stating the type of the research conducted. Finally the ethical considerations to be made during the research are elaborated.

1.2 Research Questions and Research objectives

The research questions pertaining to this specific research on business accounting assignment are as follows:

RQ 1: How does the IT tools in accounting aid the contemporary businesses in accomplishing their objectives?

RQ 2: What are the difficulties encountered by the implementation of accounting software in the business process?

RQ 3: How innovative tools in accounting accentuate the decision making process of the business?

The objectives of the research on business accounting assignment are enunciated

- To establish how the internal and external operations of the business especially accounting are empowered by the advances in technology

- To discern the additional costs and difficulties as a result of the IT tools used in business

- To comprehend if the benefits of the technology surpass the risks and costs associated with it

2. Literature review

Accounting is acknowledged as the language of business. It relates to the act of recording, analysing and summarising remarkably and concerning currency, procedure and dealings that are monetary in nature. It can also be explained as an information mechanism that measures, evolves and interchanges fiscal inside story concerning an economic entity. The objective of this section of business accounting assignment is to elucidate the implications the technological invention has generated in accounting firms. Nowadays, accounting is considered as an escalator that facilitates an organisation moving ahead (Sarokolaei et al., 2012). Accounting endeavours to demonstrate a business entity's condition, by imparting Profit & Loss Account, Balance Sheet and several necessary data for the decision-makers.

2.1 Theoretical foundation:

Accounting and cutting-edge information technologies

The rapid advancement in the area of communication and revolution in information is considered a milestone for the accounting profession. It is relevant to point out that accounting remained stagnant for a number of years on account of its deficit position or for the dearth of exchanging necessary information with the users. Among these developments, evolution of internet deserves special mention that abets information monitoring and also virtual transmission (Manzaneque, Ramírez and Diéguez-Soto, 2017). The integrated utilisation of the internet and network computers have heralded a new era of information. Another significant innovation that has caused a number of enhancements for the accounting companies is the Public Fiscal Bookkeeping System (SPED) (SUHAIMI et al., 2016). The aim of the SPED outlined in the context of business accounting assignment is the standardisation of fiscal obligations. However, Schaltegger, Etxeberria and Ortas (2017) argues that the SPED mechanism has failed to generate satisfactory outcomes concerning productivity and agility as it requires huge execution cost and high implementation

The emergence of social platforms has entailed new customs and lifestyle for the accounting firms. da Silva Vicente et al. (2016) have explained the social platforms as groups, with the abetment of specific type of software that enables maintenance of profiles, with both specific and general information data, in an array of types and formats, that can be conveniently accessed by others from a number of varied settings. According to Smith, Loveland and Smith (2019), it has been noted herein business accounting assignment that social networks facilitate better communication among the entities, imparting an array benefits to the users. Contrarily, Pan and Seow (2016) argue that the difficulty of the firms in terms of dissuading their staffs from using social networks has been affecting the productivity of the employees exponentially.

Implications of technological innovation in accounting management

Over the last decade, technology has been evolving at an unbelievable rate. The advent of new and innovative technologies has resulted in structural transformations in business entities and these also impact the cost of the entities and the reorganisation of their method of production. According to Ghaffar et al. (2019), the era of technology in the domain of accounting has arrived, leaving an indelible mark on the industries. However, not all scholars observe technological implications as positive. Some consider the implications as neutral. Sinaga et al. (2019), for instance, have pointed out that the advent of new technology has transformed the approaches of accounting exponentially over the years, however, it is not very easy to explore if its implications were either positive or negative. Additionally, the authors have also mentioned within the business accounting assignment that some of the technological implications are neither ascribed as positive nor as negative. In their study concerning the implications of technology on information mechanism, Smark and Mir (2019) have observed only positive associations between the amount of information and level of technology. The authors have also opined that technology has resulted in exponential impacts, predominantly in the reliability and agility pertaining to the information mechanism utilised in the accounting firms. The main objective concerning to accounting information, in synchronisation with Smark and Mir (2019), is to abet its users in terms of making decisions, assessing that accounting is capable to produce necessary information for the articulation of strategic business and frameworks for efficient utilisation of resources and activity control within an organisation.

The business accounting assignment also examines the readings of Rahman, Yaacob and Radzi (2016) that one of the major advantage associated with the technology is the utilisation of various tools that enable accountants to carry out their activities in an agile manner. The global aspects associated with technology also make an effective contribution to accounting and also its competitiveness, as technological innovation exhibit more efficiency and speed for accounting services. Effective communication within an accounting firm is highly advantageous in terms of boosting up the productivity, making efficient commercial decision and abetting the expansion of the entity in new countries or region, as the incorporation of various IT resources enables the companies in terms of keeping up significant advantage in competition (Tajeddini, 2016). Furthermore, the concept of information technology outlined herein business accounting assignment can also be embraced by the accounting firms either for improving their existing services or for creating new services. According to VORONKOVA et al. (2017), one of the major demerits of technology is its reliance on human resources. Technology is regarded as a product of human inventions and, reiterates the human errors. This exhibits the fact that another demerit is the overdependence of professions on technology. Coyne, Coyne and Walker (2016), point out that information technology can affect the way managers make decisions to a great extent because it can result in a myriad of obstacles that affect the understanding and utilisation of financial statements produced by the accounting system.

Diffusion innovation theory associated with technology adoption in accounting

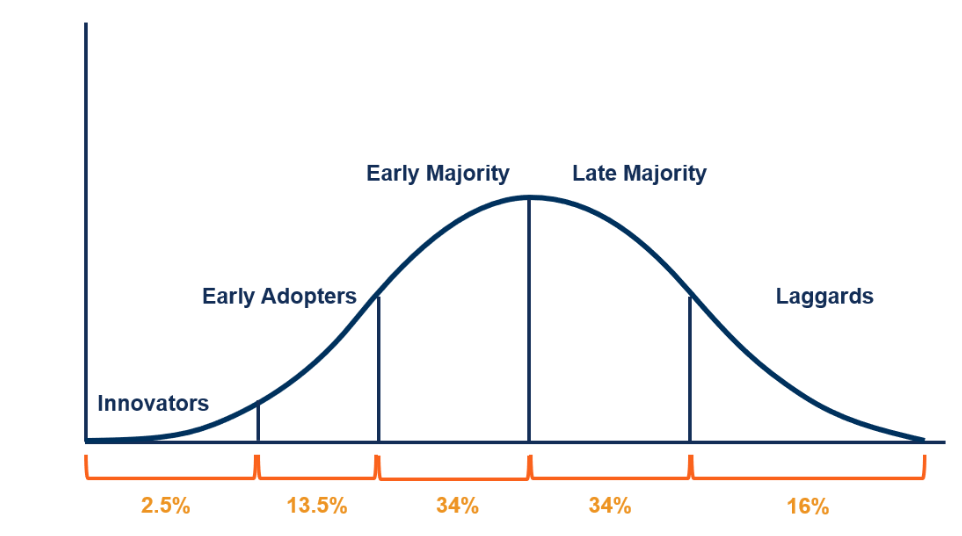

Diffusion innovation theory illustrated in this section of business accounting assignment relates to a hypothesis that emphasises on how new technologies and allied developments spread through cultures and societies, beginning from the introduction to full-scale adoptions. It has been popularised by eminent American sociologist and theorist Everett Rogers in the year of 1962. The diffusion innovation elucidates the rate at which innovative ideas and technology disseminate. The adoption of new service, product, and idea cannot be regarded as overnight phenomenon. The five adopter categories associated with the theory encompass innovators, early adopters, early majority, late majority and laggards. Among these five adopters, the first 2.5% has been represented by the innovators, 13.5 by early adopters, 34% by early majorities and late majorities and remaining 16 % by laggards.

Figures 1: Distribution of Five Adopters

(Source: Hale et al. 2017)

The business accounting assignment mentions that the diffusion innovation model can be used by the present-day accounting firms in terms of adopting cutting-edge technological solutions. In accounting, innovation may encompass transformation in reporting, controlling systems, and managing accounting tasks (Hale et al. 2017). The process of technology adoption can only be successful for a firm it its existing domains, cultures and boundaries remain unaffected by the adoption of technology. Therefore, the diffusion innovation model can facilitate the financial firms in terms of adopting new technologies successfully by creating awareness in the society. The model can prove to be highly effective in terms of mitigating the resistance from the accountants while incorporating new technology associated with accounting.

The implication of technology in accounting firms:

Development in technology and innovation can assist the accountants in a number of ways while accomplishing their tasks (Chen and Wu 2011). Cloud computing has ushered in a significant change in accounting, making the process of accounting more convenient for the present-day accountants. The monotonous tasks of the accountants have witnessed massive changes with the arrival of EPRS. It has transformed the perception of the accountants exponentially. Furthermore, as pointed out by Strobel and Kratzer (2017) in regards to the business accounting assignment, incorporation of Artificial Intelligence (AI) can abet the accountants in terms of accomplishing an array of accounting tasks, such as ascertaining various financial transactions, carrying out tax-related activities and so on.

In regards to accounting, IT can also play a critical role in the management procedure of a firm and also in performing activities associated with accounting. The most highlighted feature of IT concerning accounting illustrated within the business accounting assignment is that it speeds up the process of accounting unreliably. The incorporations of new IT solutions in financial firms has accelerated not only the management procedures, routines and control but also revolutionised the method of conducting business (Feller, Finnegan and Nilsson, 2011). It has also been transforming the nature of accounting and the accountants’ role and responsibilities. The highly competitive atmosphere makes it mandatory for the accounting firms possess the capability of setting up values for their clients and differentiaitng their firms from the rest of the players in the industry. Han, Hsieh and Li (2011) have pointed out that a well-crafted strategy, depending on investment in IT and other allied technology, can provide the accounting firms an array of advantages and favourable transformations when compared to their rivals.

2. 2 List of keywords utilised for reviewing literature:

While reviewing the literature, a number of keywords have been used. Artificial intelligence (AI) can be explained as a wide-ranging branch associated with computer science concerned with setting up smart machines for accomplishing an array of tasks that typically require human intelligence. According to Moll and Yigitbasioglu (2019), it is noted within the business accounting assignment that confronted with increasing demands from clients and stringent regulation, AI can facilitate the accounting forms performing time-consuming and complicated accounting tasks efficiently. Enterprise Resource Planning System (ERPS) is predominantly business process management software that offers the financial firms more flexibility in areas such as taxation, maintenance of financial records and accounting (Marshall and Lambert, 2018). SEPD aims to make the standardisation of fiscal constraints.

3. Research Design

3.1 Type of research

Research design encompasses the set of procedures deployed in collecting in assessing the variables which are specified in the issues and problems stated in the research (Wiek and Lang 2016, p.35). In this particular research on business accounting assignment the descriptive mode of research design will be used. The descriptive method comprises of observing and exploring the behaviour of a specific subject without impacting it any way. This is especially crucial in the research to be conducted which entails studying the impacts of IT innovative tools in accounting domain of business enteprises.

The research on business accounting assignment will focus on positive and negative effects of using various IT tools including block chain technology, artificial intelligence and ERP. The descriptive design is ideal since it delves into the research with an objective viewpoint. There are valuable guidelines with respect to the variables which are worth considering (Ørngreen and Levinsen 2017, p.76). The research which will concentrate on an impartial analysis will be effective if the descriptive design is used. Yet another factor discussed herein business accounting assignment is that the study of the subject under natural circumstances is rendered easier by the descriptive approach which is a vital aim of the research to be executed.

3.2 Research approach

The quantitative sort of research approach will be used in this research. The quantitative research approach is the systematic and empirical analysis of specific phenomena through computational or mathematical techniques. The numerical data collected via surveys and questionnaires are applied to the population in general.

The research on business accounting assignment will focus on the divergent innovations belonging to the field of accounting due to the application of iT tools and software as well as the impacts on the business. The research thus needs to infer specific conclusions based on hard data collected which will be possible through quantitative analysis. The relationship between an independent variable (the tools and innovation in accounting) and the dependent variable (the different aspects of business) will be established easily through the quantitative approach. The objective and logical stance required in the research will be accomplished through the quantitative analysis which will establish the objectives of the research on business accounting assignment. Also surveys conducted on the case scenario of business accounting assignment will be used in the research to collect pertinent data to address the questions of the research. The quantitative analysis which focuses on statistical methods to draw conclusions from the results of surveys will be beneficial for this specific research.

3.3 Type of data

The primary data constitutes of the data which is collected by the researcher for answering the questions addressed by the research. Alternately the secondary data comprises of the data collected by someone else but utilised by the researcher (Cuervo?Cazurra et al. 2017 p.237). The research in this case will use both secondary and primary data. For the primary data a set of closed ended questions will be used. The answers will be assessed in the context of business accounting assignment to reach specific inferences regarding the impacts of innovative tools in the divergent business processes (Almalki 2016 p.289). A random sampling approach will be applied to select the respondents which will comprise of employees working in the accounting and general operations departments. For secondary data books and journals will be accessed by the researcher. Business reports as well as journals capturing the latest tools used for improving the accounting process will be studied to understand their impacts upon the different accounting operations of a business. Furthermore comparison will be done with the prior findings to comprehend the actual progress charted by companies after using accounting software. The primary data collected through surveys will be used to comprehend the costs and cons incurred by the incorporation of accounting tools.

3.4 What are the data collection methods used in the business accounting assignment?

Surveys comprising of closed ended question will be used for assimilating the negative and postitive impacts of technological tools and software upon the different dimensions of accounting in business. The questions will aim to address the underlying reasons for the accounting tools being preferred and abhorred by different business. 15 questions will be asked through random sampling of employees belonging to the department so accounting, audits and IT. The questionnaire will be prepared using the Google Survey form and the questionnaire will be sent to the respondents. The researcher will take permission before sending the questionnaire to the respondents.

A total of 45 people will be queried to answer the closed ended questions to the survey. The 45 people will belong to different enterprises using a plethora of accounting software tools. A quantitative research method will be used to draw accurate and logical conclusions from the collated data.

3.5 Sampling plan

Sample population of the research on business accounting assignment will be IT and Finance sector employees. The IT and accounting employees of 5 different enterprises will be selected in a random manner. It will be ascertained that the 45 employees undertaking the surveys designed has intrinsic knowledge regarding the functioning’s and impacts of the accounting tools used in business. The respondents will be selected from the Facebook. In the Facebook, the respondents will be selected from IT and Finance Group. A random sampling technique will be used for conducting the research. The random sampling encompasses the selection technique in which the members answering the survey are selected by chance (Goldberg et al. 2017). The research will use a simple random sampling to cull a compressed sample size form the entire population. Every member of the population possesses similar probability of being chosen. The research will benefit due to the accuracy and ease which is associated with random sampling (Hickson et al. 2016 p.386). Any member having the possibility of being selected ensures able representation thus empowering the findings of the research to be executed.

|

Sample population |

Sample size |

Sampling technique |

Sample frame |

|

IT and Finance employees from the UK from 5 different enterprises |

45 |

Simple random sampling |

Google Survey form will be used |

3.6 Data analysis methods

Data collected from the specified people will be checked for discrepancies and completeness. As stated before the quantitative analysis will be performed to draw conclusions from the data. The quantitative approach will be critical in assessing the data collected from respondents and deriving specific conclusions from it (Tobi and Kampen 2018 p 1220). Numerical analysis will be conducted within this business accounting assignment to comprehend the impacts of using accounting software upon the entire business. Excel sheets will be used to interpret the data gathered. The interpretations inferred will be presented in a comprehensive format for enhanced understanding. The researcher will further discuss the conclusions and subsequent findings gathered from the data and will gain deeper knowledge with respect to the technologies being used in the accounting section of businesses. The quantitative data analysis will aid in establishing unambiguous derivations from the data collected (Aithal 2017 p 49). Statistical methods will be applied to study the respondents’ answers to the survey conducted. The analysis will be critical in addressing the pros as well as cons of the accounting tools of the business. The costs, advantages and the additional support required to maintain the software in the companies will be comprehended and presented in a lucid manner.

3.6 Ethical Consideration

The researcher will abide by the ethical considerations required for the research on business accounting assignment. Informed consent is a vital ethical consideration in a research. It entails that a person with full knowledge and sound intelligence has given his consent in a manifested clear manner (Alavi et al. 2018 p.539). The researcher will conduct a survey among 45 people belonging to different business enterprises to understand the implications of divergent accounting tools in a business. Permission will be taken prior to conducting the survey (Snyder 2019 p. 336) thus fulfilling the aspect of informed consent before the survey.

The subject of the survey will be communicated via appropriative channels for better participation. Integrity will be maintained at all levels through the supply of relevant information related to the research. The respondents will be shared the risks of the research.

The second ethical consideration of the research on business accounting assignment entails that the research is used for better serving the community instead of inflicting any harm (Basias and Pollalis 2018 p.92). The research will be based on collecting the divergent impacts of technology upon the accounting methods. The pros as well as cons assimilated will aid the businesses in taking enhanced and informed decisions while opting for technological tools in the accounting procedures.

The research on the business accounting assignment thus has the benefits of the society at its core with no aspects devoted to harming the society in any form. During the execution care will be taken such that no persons involved are harmed physically or mentally during the course of the research.

Maintaining the confidentiality and anonymity of the respondents is a critical aspect of the research (Taherdoost 2017 p4). This will be taken care of the researcher while circulating the survey and collecting the results. The identity and secrecy will be protected and not be divulged during any phase of the research. There will be absolute respect for the privacy of an individual whereby the any data or information collected will not be published or associated with the name of the person.

Any publishing of information will be done after collecting consent from the specific person. The research ethics of business accounting assignment also rules that vulnerable groups are not affected in a negative manner by the research conducted (Jennings, et al. 2018 p. 213). The researcher will take accurate measures to ensure that dignity of the vulnerable groups as well as the general population is not harmed during the course of the research.

Once the research is conducted on the case scenario of business accounting assignment, the researcher will destroy all the data which are collected for the research purpose. The research will also follow the Data Protection Act 1998 UK to maintain the privacy of the respondents.

Reference List

Aithal, P.S., 2017. ABCD Analysis as Research Methodology in Company Case Studies. Business accounting assignment International Journal of Management, Technology, and Social Sciences (IJMTS), 2(2), pp.40-54.

Alavi, M., Archibald, M., McMaster, R., Lopez, V. and Cleary, M., 2018.Aligning theory and methodology in mixed methods research: Before Design Theoretical Placement. International Journal of Social Research Methodology, 21(5), pp.527-540.

Almalki, S., 2016.Integrating Quantitative and Qualitative Data in Mixed Methods Research--Challenges and Benefits. Journal of education and learning, 5(3), pp.288-296.

Basias, N. and Pollalis, Y., 2018. Quantitative and qualitative research in business & technology: Justifying a suitable research methodology. Review of Integrative Business and Economics Research, 7, pp.91-105.

Chen, Y. C., and Wu, J. H., 2011, IT management capability and its impact on the performance of a CIO.Information & Management, [e-journal], 48, 145-156.

Coyne, J.G., Coyne, E.M. and Walker, K.B., 2016. A model to update accounting curricula for emerging technologies. Journal of Emerging Technologies in Accounting, 13(1), pp.161-169.

Cuervo?Cazurra, A., Mudambi, R., Pedersen, T. and Piscitello, L., 2017.Research methodology in global strategy research. Global Strategy Journal, 7(3), pp.233-240.

da Silva Vicente, C.C., Machado, M.J.C.V. and da Silva Laureano, R.M., 2016. Innovation in accounting tasks: empirical study in two professional groups. Business accounting assignment Business: Theory and Practice, 17(3), pp.270-279.

Feller, J., Finnegan, P., and Nilsson, O., 2011, Open Technological Innovation and public administration: transformational typologies and business model impacts. European Journal of Information Systems, [e-journal], 20, 358-374

Ghaffar, A.M., Mokhtar, M.Z., Ismail, W.N.S.W. and Othman, M.R., 2019.Determinant of e-accounting (EA) adoption among Malaysian maritime SMES. Business accounting assignment International Journal of Engineering & Technology, 8(1.8), pp.102-105.

Goldberg, S.B., Tucker, R.P., Greene, P.A., Simpson, T.L., Kearney, D.J. and Davidson, R.J., 2017. Is mindfulness research methodology improving over time? A systematic review. PloS one, 12(10).

Hale, D., Khan, S., Thakur, R. and Angriawan, A., 2017. Gifted Innovation: An Examination Using Different Business Theories. The Journal of Business Inquiry, 17(1), pp.4-22.

Han, C. C., Hsieh, F. L., and Li, X., 2011.Information technology investment and manufacturing worker productivity. Journal of Computer Information Systems, [e-journal], 52(2), 51-60

Hickson, H., 2016. Becoming a critical narrativist: Using critical reflection and narrative inquiry as research methodology. Qualitative social work, 15(3), pp.380-391.

Jennings, H., Slade, M., Bates, P., Munday, E. and Toney, R., 2018. Best practice framework for Patient and Public Involvement (PPI) in collaborative data analysis of qualitative mental health research: methodology development and refinement. BMC psychiatry, 18(1), p.213.

Manzaneque, M., Ramírez, Y. and Diéguez-Soto, J., 2017.Intellectual capital efficiency, technological innovation and family management. Innovation, 19(2), pp.167-188.

Marshall, T.E. and Lambert, S.L., 2018. Cloud-based intelligent accounting applications: accounting task automation using IBM watson cognitive computing. Journal of emerging technologies in accounting, 15(1), pp.199-215.

Moll, J. and Yigitbasioglu, O., 2019. The role of internet-related technologies in shaping the work of accountants: New directions for accounting research. Business accounting assignment The British Accounting Review, 51(6), p.100833.

Ørngreen, R. and Levinsen, K., 2017. Workshops as a Research Methodology. Electronic Journal of E-learning, 15(1), pp.70-81.

Pan, G. and Seow, P.S., 2016. Preparing accounting graduates for digital revolution: A critical review of information technology competencies and skills development. Business accounting assignment Journal of Education for Business, 91(3), pp.166-175.

Quinlan, C., Babin, B., Carr, J. and Griffin, M., 2019. Business research methods.South Western Cengage.

Rahman, N.A., Yaacob, Z. and Radzi, R.M., 2016. An overview of technological innovation on SME survival: A conceptual paper. Procedia-Social and Behavioral Sciences, 224, pp.508-515.

Sarokolaei, M. A., Bishak, M. J., Rahimipoor, A., and Sahabi, E., 2012. The effect of information technology on efficacy of the information of accounting system.International Conference on Economics, Trade and Development IPEDR, [e-journal] 36, 174-177.

Schaltegger, S., Etxeberria, I.Á. and Ortas, E., 2017. Innovating corporate accounting and reporting for sustainability–attributes and challenges. Sustainable Development, 25(2), pp.113-122.

Sinaga, O., Roespinoedji, D., Saudi, M.H.M. and Ghani, E.K., 2019. The Role of Management Accounting Systems, Energy Efficiency and Organisational Innovation in driving Competitive Advantage and Firm Performance. International Journal of Energy Economics and Policy, 9(3), p.395.

Smark, C. and Mir, M., 2019.Special Issues in the Australasian Accounting, Business and Finance Journal 2018 and 2019. Australasian Accounting Business & Finance Journal, 13(4).

Smith, K.T., Loveland, K.A. and Smith, L.M., 2019. SOCIAL MEDIA USAGE AND RELATIONSHIP TO REVENUE AMONG TECHNOLOGY FIRMS. GLOBAL JOURNAL OF ACCOUNTING AND FINANCE, 3(1), p.93.

Snyder, H., 2019. Literature review as a research methodology: An overview and guidelines. Business accounting assignment Journal of Business Research, 104, pp.333-339.

Strobel, N. and Kratzer, J., 2017. Obstacles to innovation for SMEs: Evidence from Germany. International Journal of Innovation Management, 21(03), p.1750030.

SUHAIMI, A., SYIDA, N., NAWAWI, A., SALIN, P. and AZLIN, A.S., 2016. Impact of Enterprise Resource Planning on Management Control System and Accountants’ Role. Business accounting assignment International Journal of Economics & Management, 10(1).

Taherdoost, H., 2017. Measurement and Scaling Techniques in Research Methodology; Survey/Questionnaire Development. International Journal of Academic Research in Management., 6(1), pp.1-5.

Tajeddini, K., 2016. Financial orientation, product innovation and firm performance—An empirical study in the Japanese SMEs. International Journal of Innovation and Technology Management, 13(03), p.1640005.

Tobi, H. and Kampen, J.K., 2018. Research design: the methodology for interdisciplinary research framework. Quality & quantity, 52(3), pp.1209-1225.

VORONKOVA, O.V., KUROCHKINA, A.A., FIROVA, I.P. and BIKEZINA, T.V., 2017. Implementation of an information management system for industrial enterprise resource planning. Business accounting assignment Revista ESPACIOS, 38(49).

Wiek, A. and Lang, D.J., 2016. Transformational sustainability research methodology.In Sustainability science (pp. 31-41).Springer, Dordrecht.

Appendix

Ethics Approval Form

|

Student Details |

||

|

Name |

: |

|

|

Student Number |

: |

|

|

|

: |

|

|

Subject (Code/Name) |

: |

|

|

Proposed Research Details: |

|

Topic: Innovation in accounting and its impact on business |

|

Summary of the proposed research project, including brief description of methodology The research will further collect relevant data for the research through surveys comprising of closed ended questions. Descriptive approach and quantitative analysis will be used for assessing the data. |

|

Ethics Checlist (Participants) |

|

How do you propose to select your participants? |

|

Will your research involve adults who might be identified by you or anyone else reading the research? (Yes/No). If yes, how will you obtain their consent? -Yes The research will require the consent of adults. A form specifically stating the objectives of the research and the knowing consent of the adults will be collected with signature. The terms and conditions of privacy will be stated in the form. |

|

Does your research involve children under eighteen years old? (Yes/No) - No |

|

Ethics Checlist (Participants) |

|

Will your research take place in an institution? (Yes/No) - Yes |

|

Are in a position of power over participants? (Yes/No), if yes, describe any ethical implication and how you deal with them - NO |

|

Describe any risk or harm to participants which might be associated with your research and how would you propose to minimise these risks. |

|

Privacy and Confidentiality |

|

How will you protect the confidentiality and privacy of your participants? |

|

Will it be possible to identify participants from published data? (Yes/No). -No |

|

Data Collection and Storage |

|

Who will have access to the data? Apart from the researcher the data can be accessed by the professor guiding the research. |

|

How will you store the data in order to ensure its security. |