Business Accounting Assignment: Financial Analysis Of Uber

Question

Task:

Consider the information provided in the link below and prepare a business accounting assignment addressing the following question:

https://dashboard.totalassignmenthelp.com/uploads/whitechat/uber-2020-1731729505_1346127259.pdf

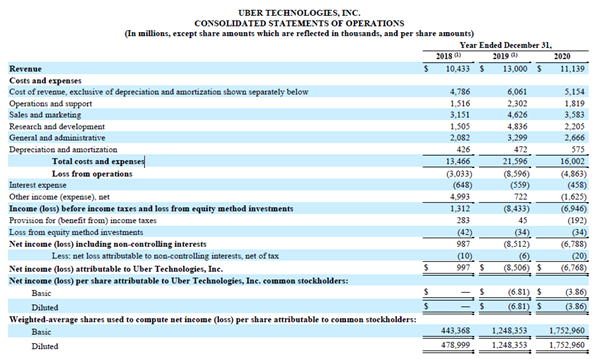

Uber’s financial statements for the year ended Dec 31 2020 showed a net loss of $6.788 billion on sales of 11.139 billion. Some analysts are quick to blame Covid-19 for this loss, but others pointed to bigger long-term issues and reminded investors that in 2019 (before Covid-19) Uber showed a loss of $8.512 billion on sales of 13.000 billion.

Assume the following cost structure:

Cost of Sales and Operations and support are all variable, and all of the other costs (Sales and Marketing, R+D all fixed, General and admin, Depreciation and Amortization) are all fixed.

For simplicity purposes, ignore items such as interest expense, other income/expenses, income taxes, gains/losses on equity method investments, and issues related to minority interests. This means that in 2018, 2019 and 2020 net income (loss) were (3,033), (8,596) and (4,863) respectively.

1. Redo the income statement for 2018, 2019 and 2020 in a format that shows variable costs, contribution margin and fixed costs.

2. Based on 2020 information on page 87 of the financial statements (provided with this assignment), how big would revenues have to have been in 2020 in order for Uber to reach the break-even point?

3. How much would sales have to grow (in percentage) in order for Uber to break even?

4. Do you think investors will ever see a return on their investment? Explain your answer.

Answer

1) Income statement:

Income statement for the year 2018, 2019, and 2020 shows variable costs, contribution margin, and fixed costs provided within this business accounting assignment as follow:

|

Particulars |

2018 |

2019 |

2020 |

|

Revenue |

10433 |

13000 |

11139 |

|

Variable cost |

|

|

|

|

Cost of revenue |

4786 |

6061 |

5154 |

|

Operations and support |

1516 |

2302 |

1819 |

|

Contribution |

4131 |

4637 |

4166 |

|

Contribution margin |

40% |

36% |

37% |

|

Fixed cost |

|

|

|

|

Sales and marketing |

3151 |

4626 |

3583 |

|

Research and development |

1505 |

4836 |

2205 |

|

General and administrative |

2082 |

3299 |

2666 |

|

Depreciation and amortization |

426 |

472 |

575 |

|

Total Fixed cost |

7164 |

13233 |

9029 |

|

Net Loss |

-3033 |

-8596 |

-4863 |

2) Break-even point:

Break-even point = Fixed cost / Contribution margin

Fixed cost in the year 2020 = $9029

Contribution margin = 37%

Break-even point = $9029 / 37% = $24142

3) Grow in sales:

Break-even point = $24142

Total sales in year 2020 = $11139

Increase in sales = ($24142 - $11139) / $11139 = 116.73%

4) Return on investment “explanation”:

Based on the financial statement for the year ended 31st December 2020 and analysis of the profitability of the company in the last 3 years it is found that the shareholders may have a negative return on investment or may loss of wealth. The company has a loss of $ 6.788 billion in the year 2020 over the sales of $11.139 billion as the shareholders consider it as the impact of COVID-19 while the company has lost in the earlier year also.

Based on the article, the application of Uber is highly used by wealthy people and the community based on income and level of education. The company is providing services in urban areas such as metro cities only and the services are mostly used by wealthy and well-educated people. The company has also offered discounts for attracting more and more customers due to which the company is not able to recover the cost of running the business operations. The company faces difficulties in setting business in the non-urban areas and small towns due to several restrictions such as the people are more comfortable with their vehicles, the attitude of drivers as they reject the trips for long-distance, network issues, and costs faced by the drivers for own vehicles.

The company has major risk factors as the company is highly affected by the impact of COVID-19 as struggling to maintain the reputation of the company and mitigate the impact of a pandemic on the business. The business is adversely affected by the drivers as the drivers are considered as employees or workers of the company in place of independent contractors or third parties. The company also faces high competition in the local market such as local companies based on the geographical region which provides low price services and also the local vehicle service providers which provide services at low cost based on the commission and other cost savings. The company has incurred major losses from the start of business in the US and other major market segments. The company is expecting that the operating expenses will increase in the future and the company may not able to achieve the profitability as desired.

The company has several stakeholders involved in the business as drivers, consumers, merchants, carriers, and shippers which may impact the business negatively or positively. The company has a major problem of maintaining and enhancing the reputation and brand image as the company has significantly received media coverage and negative publicity which impact the brand image and reputation and it will cause loss and suffering to the business. The company has a high risk of several factors such as cyber-attacks, phishing attacks, and spamming that can harm the reputation, business, and operation results of the company. The company may also face loss due to the action of drivers as the drivers take a ride and request to the consumer to cancel the ride due to which the drivers are not liable to pay commission to the company and the company may face loss. The company is also required to follow numerous regulatory and legal risks which may impact the business and prospects adversely.

Based on the above analysis and review of the market, it is found that it is difficult for investors to get an effective return on the investment. However, the company gets effective progress in the year 2021 after the impact of COVID-19 as the people get attracted towards the booking of vehicles online to avoid public transport and based on the trust that the drivers have adopted appropriate safety measures. The people also get motivated and get educated for online services and also adopted other facilities provided by the company such as supply and delivery of products and courier services. The company is working to enhance facilities for the people and approach for the non-urban sector also which helps in increase the market area for the company and increase in profitability. However, the company has high issues with returns and cost incurred hence for the investors there is a high risk to get a positive return on investments.

Bibliography

Kurmangaliyeva, Aizhan, AigerimKaumenova, and ZhanaraTastemirova. "Break-even Analysis of Industrial Enterprises in the Regions of Kazakhstan." In 3rd International Conference Spatial Development of Territories (SDT 2020), pp. 109-115.

Atlantis Press, 2021.

Ramanathan, Murali Krishna, Lazaro Clapp, RajkishoreBarik, and Manu Sridharan. "Piranha: Reducing feature flag debt at uber." business accounting assignment In Proceedings of the ACM/IEEE 42nd International Conference on Software Engineering: Software Engineering in Practice, pp. 221-230. 2020

Siddiqui, Faiz. "Coronavirus is forcing Uber to return to its start-up roots." Washington Post (2020).

Tinsley, Dillard, and Phil E. Stetz. "Contribution margin pricing for small businesses." In Association of Small Business and Entrepreneurship Conference. 2004.