Critical Evaluation Of BHP Billiton Financial Report

Question

Task:

Select a company that is currently listed on the ASX.

Write a Financial Analysis Report using an essay structure to interpret a company’s most recent

annual report.

Assessment Description

Students will write a Financial Analysis Report for a stakeholder (external investor or internal

manager) that interprets the annual report of an Australian company. The Report will clearly state

recommendations about the company’s suitability for share investment or internal management.

The company should be listed on the ASX.

Students will be assessed on the thoroughness of the financial analysis. Thoroughness requires

a logical justification of why financial and non-financial performance indicators are included in the

analysis. The analysis will be formally written to meet the expectations of a stakeholder.

The report is limited to 1000 words, plus or minus 10%, excluding title page and bibliography.

Assessment Instructions

Select a company that is currently listed on the ASX.

Write a Financial Analysis Report that interprets the company’s most recent annual report. This

report will need to be written for a stakeholder (external investor or internal manager).

Research additional information beyond the annual report about the company’s performance.

Use the group financial results if the annual report presents financial results for the group and

parent company.

Justify the selection of financial and non-financial performance indicators that are relevant for

evaluating the company’s financial performance.

Use a formal language and structure of your report. Refer to Resource A below. Include relevant

non-financial analyses. Refer to Resource B below.

Resource A – Financial Analysis Report content

Executive summary

The executive summary should be approximately 10% of total word count.

It provides a background of the company chosen, the main business activities and the purpose of

the Financial Analysis Report.

Analysis

Analysis will present and discuss the financial results and performance indicators extracted from

the company’s annual report.

A concise commentary should explain the significant changes in the financial results.

Interpretation

The interpretation should be approximately 70% of total word count.

Interpret the causes of the changes in the company’s financial performance. Justify the inclusion

of financial and non-financial performance indicators in the Financial Analysis Report.

Research additional non-financial performance indicators from a wider range of sources beyond

the company’s own publications.

Discuss the company’s business activities and the financial implications of the activities. Apply

financial and non-financial performance indicators to explain trends and issues in the company’s

financial results.

Conclusion

The conclusion should be approximately 20% of total word count.

State a clear recommendation that addresses the decision-making needs of a stakeholder. For

example, recommend a decision to invest or not invest in the company if the Report is written for

a potential shareholder. Or, recommend a decision to improve the financial performance of the

company if the Report is written for an internal manager.

Justify recommendations by explaining how it will meet the needs of the stakeholder.

Bibliography and In-text Citations

The Academic Integrity and Conduct Policy requires the appropriate use of intext citations and

bibliography. You must cite all references (information sources) and comply with the expectations

for academic writing.

The bibliography and citations are excluded from total word count.

Resource B

Consider the following questions if they are relevant to the company’s financial performance.

• What are the core business area(s) and geographic locations in which the company

operates?

• How have specific financial results improved or changed?

• Is there evidence from other sources that can verify the trends for the industry?

• What are the company’s current business strategy or strategies and key points of

difference in the target market? Is there a specific skillset required of employees?

• What is the current and future market potential for the company? What influences have

recent global events apparently had on the company? In which specific areas?

• Identify strengths of the company’s management team and how these may benefit the

organisation in future financial years.

• What are the remuneration trends from last year to this year for the highest earners?

• Is there a difference in the wages that could be earned in a competitor’s business?

• What is the current management structure and ownership structure?

• Identify strengths of the company’s management team and how these may benefit the

organisation in future financial years.

• What are the remuneration trends from last year to this year for the highest earners?

• Are there other non-wage-related benefits?

Answer

Resource A

Executive Summary

The present study is based on the aspects of BHP Billiton financial report analysis. BHP Billiton Ltd is an Australian multinational company that deals in metals, petroleum and mining. The main business activity of BHP Billiton Groups involved in production, processing and exploration of minerals which includes iron, copper, manganese ore and coal along with production, refining and exploration of hydrocarbons. After analysing the consolidated income statement of BHP Billiton financial report, it has been evaluated that the company has generated a profit of 117 US Dollar as compared to its financial year 2018-2019. As per the view of Campbell et al., (2017), the main purpose of financial analysis report is to exhibit companies’ financial and operating performance, which can be compared for detecting profit and loss ratio fluctuation.

Analysis

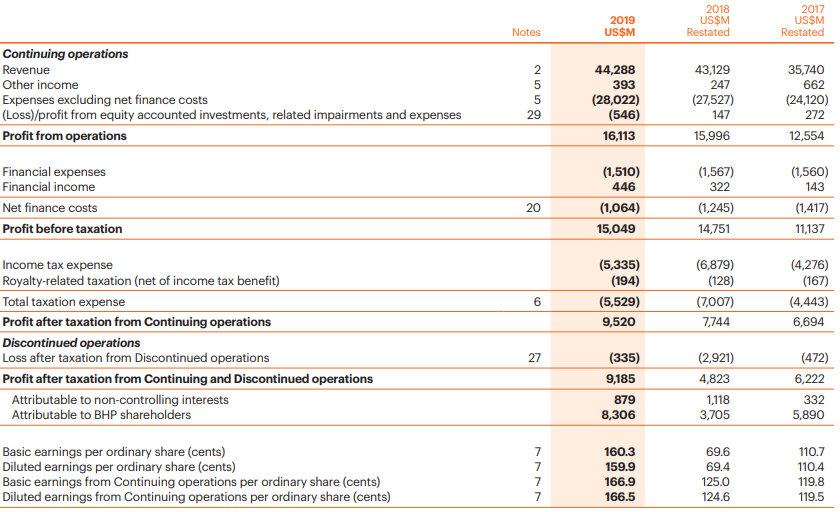

Figure 1: Consolidated Financial Statement of BHP BILLITON for the year ending 2019

(Source: BHP Billiton.com. 2020)

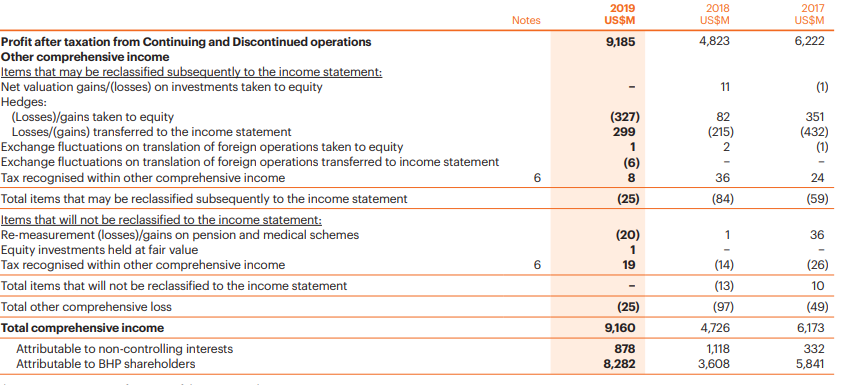

Figure 2: Consolidated Statement of comprehensive income for the year 2019

(Source: BHP Billiton.com. 2020)

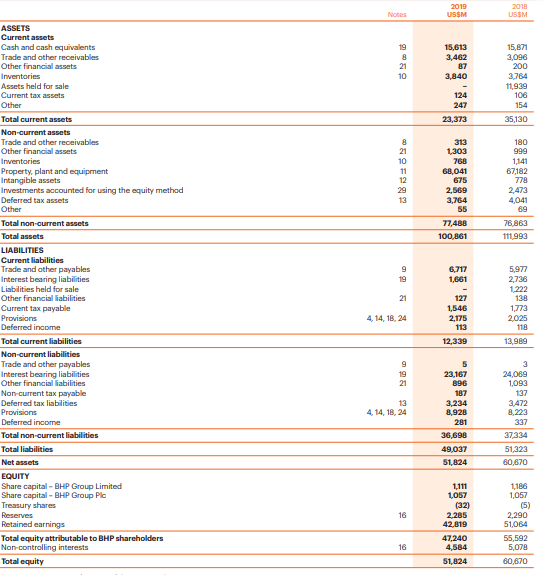

Figure 2: Consolidated Balance Sheet for the year 2019

(Source: BHP Billiton.com. 2020)

Interpretation

Interpretation of the causes of changes based on the company's financial performance

From the above-consolidated income statement of BHP Billiton financial report, it can be evaluated that the company has successfully reduced its net debt by 1719 US dollar. This exhibits that the financial condition of the company has improved which enabled it to pay off its debts in the market. Besides that, it has been determined that the revenue was increased by the US $ 1.2 billion that is 3% more in 2019 as compared to 2018. This improvement was primarily attributed to the high-realised price of metallurgical coal, petroleum and ore. However, slight changes have been noted as the company also encountered an increase in expenses by 2% that is 0.2 US$ due to its work in progress and changes in the inventory management process. The changes noticed in the statement of BHP Billiton financial report is also due to an increasing rate of government royalties, which has been increased by US$370 million due to high price of iron ore, which is mandatory for the company based on its operation management process. Government royalties are determined as non -financial performance, which is beyond the control of the company.

Calculating the variables of controllable cost from BHP Billiton financial report, the strategic management, and operations process that are incorporated by BHP Billiton has successfully allowed the company to reduce its outflow of cash with US$209 million. This reflects that the production volume of BHP Billiton has been improved with the strategic formulation. It has been evaluated that the earnings per share of BHP Billiton have increased from 8.3 US cent. This is because the marketing activity has been improved if the company leading to enhance brand awareness ads customers loyalty in the market. Hence, Shareholders and investors if they invest in the company, they are assumed to sustain relatively huge profit or dividend.

BHP Billiton is a multinational company that encountered issues related to the new establishment of jurisdiction by the community or laws, financial compensatory obligations, increasing production cost in the market along with industrial relation disputes. As opined by Spiegelhalter, (2017), all the above-identified issues related to the BHP Billiton financial report can be resolved if the company maintains a strong financial statement by exhibiting its financial position by maintaining transparency with its primary and external stakeholders. However, the fundamental strategy of BHP Billiton is to maximize its return and values to its stakeholders. To formulate this strategic aspect the company continuously focuses on reducing its financial expenses which hence can be noticed from the consolidated financial statement that the company has successfully reduced its financial expenses in 2019 from 57US$. However, it can be determined that the current liability of the company has been decreased by 1650US$. This explains that the company is not internally or externally depending on its stakeholders to clear its debts in the market. Hence, shareholders of the company would be free from any risk and burden if BHP Billiton encountered any sort of financial crisis. On the contrary, the total current assets of the company were analysed by considering the BHP Billiton financial report to have drastic variation in the negative aspect with UD$11757 less from its previous year. This explains that the working capital of the company is not accurate and requires great emphasis on the management system.

It can be evaluated from the BHP Billiton financial report that the share capital of BHP Billiton has decreased in 2019 as compared to 2018 with UD$75. However, it is a substantial decrease and is not any major decrease which cannot be focused by the time of financial planning of the stakeholders. From the consolidated cash flow statement of BHP Billiton, it can be determined that the net financing cash flow from the continuing operation is increased by US$9664. This explains that the company endeavours a good flow of cash to manage its operation management process. Besides, it can be determined that the company is greatly involved in a new production process to expand its business in the global market and improve the values of its shares. Shareholders of the company are assumed to gain huge benefits by the year 2022, it keeps investing in the BHP Billiton operating management process.

Conclusion

After analysing the financial statement from the BHP Billiton financial report it can be determined that due to its strategic management and operational structure, BHP Billiton successfully maintained a strong position in the mining market. From the perspective of internal stakeholders and external shareholders, it can be determined that the company is not dependent on any of its shareholders to clear its debts. Hence, stakeholders of the company are free from any risk associated with the company during the time it encountered any financial crisis in the market.

Recommendation

Based on the above discussion on BHP Billiton financial report analysis, it has been identified that the short-term solvency position of the company is not but the profit position is good. Hence, the company has a good revenue base and it has increased the growth of the company. Hence, shareholders can invest in the company but the internal management has to focus on the development of working capital position. The company has to maintain consistency in the profit position, it would enhance the growth of the company in the future, and share price would be increased more. Hence, the BHP Billiton group provides an effective return on investment to the shareholders.

Resource B

Core business area along with geographical locations where the company operates

The core business area is processing and production of minerals, which includes copper, nickel, titanium, uranium, manganese ore, iron, ore and coal. Besides, BHP Billiton is also engaged in refining, production and exploration of hydrocarbons. In the matter of geographical location, BHP Billiton operates in over 25 countries (BHP Billiton.com, 2020). The main headquarter of the company is in Melbourne, Australia. It has been evaluated from the BHP Billiton financial report that due to its global expansion strategy, BHP Billiton has successfully reached its potential customers from different locations. The business unit of the company is eventually huge, due to which the company is found to render huge contributions to economic growth in the country where its business units operate.

How have specific financial results improved or changed?

BHP Billiton has majorly emphasized to improve its operational management process by expanding its productivity. Besides, the company was involved in more financial transactions to improve its cash flow. From the consolidated income statement provided in the BHP Billiton financial report, it has been evaluated that the company gained US$298 more profit before tax as compared to 2018 financial year (BHP Billiton.com. 2020).

Is there evidence from other sources that can verify the trends for the industry?

From the consolidated statement of comprehensive income noted in the BHP Billiton financial report, it has been evaluated that the market value of the company shares has increased which has led to an increase in attributes to BHP Billiton shareholders with 4674US$ million. This shows that the company has successfully improved its brand awareness and customer’s loyalty in its respective market.

Current business strategy and key points of difference in the target market. Specific skill set required of employees

In the matter of business strategy, BHP Billiton provides competitive remuneration as a reward to its employees as their business strategy to sustain long-term success, growth and competitive edge in the targeted market. This enables the company to control the rate of employee retention and turnover while maintaining its commitment and loyalty towards the welfare of the company. Technical capability and critical skills are considered as the major skillsets that are demanded to hire a candidate in BHP Billiton (BHP Billiton.com. 2020). BHP Billiton tries to maintain a strong financial statement that exhibits comprehensive transparency related to the cash flow aspects and assets of the company. This would help the company improve its brand loyalty in the market and would help to attract more shareholders while exhibiting clear statements on its financial position. The company emphasizes its decision-making points critically to its nickel sulphides, copper and conventional oil as these areas assure huge profits as compared to its other business areas. Potash marketing for BHP Billiton is remarked as a long-term option that would help the company sustain a sustainable competitive edge in the global market. Collaborating with best assets, commodities and capabilities are also determined as BHP Billiton's strategy for sustainable future growth, high return along with the long-term value.

Current and future market potential for the company

The current market position is based on the shared values of the company, which in the case of BHP Billiton is found to be strong and stable. In the future, it has been evaluated that the market potential of the company is assumed to rise. Thus, considering the BHP Billiton financial report and comparing the revenue earned by the company in its financial year 2017, the company has increased its rate of revenue by US$8548, which is a drastic success and achievement of the company from its past 1 year (BHP Billiton.com. 2020). Hence, the market share of the company is assumed to be increased by the year 2022. The success of the company is determined due to its expansion of petroleum and coal mining. The capital allocation of the company observed in the BHP Billiton financial report is based on the strict capital allocation framework and strong balance sheet. This enables the financial department of the company to invest in the right assets and commodities at the tight time.

Strengths of the company’s management team

The strength of BHP Billiton is determined to be a management system along with its experts. With the skill sets and experts associated with BHP Billiton, the company is expected to meet its demands in future. Equity per share rate is also expected to increase for the betterment and welfare of the shareholders. Shareholders of the company are expected to gain more profit with a growth in their dividend along with consecutive ordinary dividends. This would help the company to sustain strong financial support from the market with which it can face any business contemporary issues that may create hinder by the time of the operation management process.

Remuneration trends from last year to this year for the highest earners

The CEO of the company earns the highest salary. In the case of BHP Billiton Base salary of BHP Billiton CEO is US$1.700 million per annum, which is not changeable.

Is there a difference in the wages observed in the BHP Billiton financial report that could be earned in a competitor’s business?

Australian Mining Metallurgy is found to be a competitor of BHP Billiton who offers $143,404 per year to its Chief executive offices (BHP Billiton.com. 2020). However, it can be determined that the salary that is offered by BHP Billiton to its CEO must be higher. The company is found to implement a competitive remuneration strategy in which the company ensures offering the best salary scale to all of its employees.

Current management structure and ownership structure

BHP Billiton operates under Dual Listed Company structure as the company renders two-parent Company BHP Billiton Groups Plc and BHP Billiton Groups Limited. Besides the company run by the support of unified management and Board of Directors that economically support company. The director of the company holds 25% of the company's shares that the major decision of the company is taken only by consulting with the directors of the company before executing them.

References

BHP Billiton.com. 2020. Available at: https://www.BHP Billiton.com/-/media/documents/investors/annual-reports/2019/BHP Billitonannualreport2019.pdf?la=en [Accessed 10 Feb. 2020].

Campbell, J.R., Fisher, J.D., Justiniano, A. and Melosi, L., 2017. Forward guidance and macroeconomic outcomes since the financial crisis. NBER Macroeconomics Annual, 31(1), pp.283-357.

Guo, W., Yu, T. and Gimeno, J., 2017. Language and competition: Communication vagueness, interpretation difficulties, and market entry. BHP Billiton financial report Academy of Management Journal, 60(6), pp.2073-2098.

Moessner, R., Jansen, D.J. and de Haan, J., 2017. Communication about future policy rates in theory and practice: A survey. Journal of Economic Surveys, 31(3), pp.678-711.

Spiegelhalter, D., 2017. Risk and uncertainty communication. Annual Review of Statistics and Its Application, 4, pp.31-60.