Bega Cheese Case Study On Financial Analysis

Question

Task: Present a Bega Cheese case study exploring the financial statement analysis of several factors such including budgetary analysis, financial ratios, liquidity position and so on.

Answer

Introduction

The present Bega Cheese case study is discussing about the food industry which is the fastest growing industry at present. The food industry is dependent on several factors such as environmental factors, government regulations, etc. This Bega Cheese case study analyses the various aspects of Bega Cheese Food Company. In this Bega Cheese case study, several factors such as business strategy, financial ratios, liquidity position, budgetary analysis, etc. would be analysed.

A) Company background and mission

Bega Cheese is a diversified food company located in various sites in Australia. It is a public company and owns a 25% stake of Capitol Chilled Foods Ltd. The company is known for dairy food and grocery products (Begacheese.com.au, 2020). Currently Bega Cheese is one of the largest companies in the dairy industry of Australia with a base milk supply of 750 million litres. The mission of the company explored in the Bega Cheese case study is to become the icon for dairy products in the dairy industry of Australia. It aims to value the heritage it has created and the people (Begacheese.com.au, 2020). It serves for promoting the welfare of the community and continues with the development of quality food products. The company also embraces challenges and aims to expand across the sea.

B) Business strategy analysis on the scenario of Bega Cheese case study

Porter’s five-force analysis

|

Factor |

Analysis |

|

Threat of new entrants |

Bega Cheese can have a cost advantage as it can produce large amount of cheese and can help in its organisational development. Thus, threat of new entrants can be considered as a weak force. |

|

Bargaining power of buyers |

The number of buyers is more in the industry. The Australian community depend on dairy products and thus, Bega Cheese has plenty of customers to choose from within the industry. |

|

Bargaining power of suppliers |

The number of suppliers in the industry of Bega Cheese is high and can switch suppliers. According to Kharub, Mor and Sharma (2019), the suppliers are compelled to provide the products at substantial prices, which do not help in the development of the suppliers. |

|

Threat of substitutes |

The substitutes for Bega Cheese products are less. At the same time, the industry does not provide a huge profit margin, which makes it easier for Bega Cheese to operate without any possible substitutes. |

|

Threat of competitors |

With the threat of substitutes being low, the threat of competitors is also considered low for Bega Cheese. Thereby it provides the company with unlimited competitive advantage in the market to commence with its business (Schilling & Shankar, 2019). |

Cost leadership vs differentiation

In this Bega Cheese case study, cost leadership strategy allows Bega Cheese to expand its market share. At the same time, the application of the differentiation strategy can help Bega Cheese achieve its growth objectives by expanding its customer base. Thus, the application of both the strategies can help Bega Cheese to provide good quality materials at low cost while maintaining the profitability of the company. Hence, it helps in getting a competitive edge through decreasing costs (Kurt, 2016).

Sustainable competitive advantage

Thus, from the analysis it can be said that for Bega Cheese the cheese industry seems to be compatible and provide the customers with an opportunity to taste the best quality cheese in the country. According to Rothaermel (2016), it is noted in the Bega Cheese case study that the sustainable competitive advantage that the company has can be determined from the weak forces with which it needs to compete in the business. Bega Cheese can use its dominant power to introduce and innovate new products through expansion and ensue the sustainable competitive advantage can be gained for the company (Begacheese.com.au, 2020).

C) Accounting Analysis:-

The concept of accounting analysis presented in this Bega Cheese case study is a detailed process in which financial statements are examined carefully. Accounting analysis helped in the measurement of, how a particular account is performed. For checking the performance of any investments analyze the accounts of that investment is done. A financial statement is analyzed for decision-making purposes and for understanding the health of the organization. In cost accounting analysis is done to measure the cost of the firm.

Accounting analysis is also done is the banking sector. In the banking sector accounting analysis is done by an experienced accountant. The analysis is done as the personal savings account is received by the individual customer, but in the company it is done a larger level.

Accounting analysis is of two type’s horizontal and vertical analysis. The horizontal analysis acknowledges company dollar whereas vertical analysis known by common-size financial statement analysis. Line item means in case of income is the percentage of sales, while line item in case of a balance sheet is the percentage of total assets and liabilities

An analysis of the preliminary financial statements of the company June 2019 ended, it is observed that company EBIDTA is dropped by 3%, this also affects the EBIT of the company which is dropped by 36 %. Company PBT also reduces by 63%, pat reduces by 59%. This calculation done in the Bega Cheese case study is based on the consolidated financial statements of the company. In this results company analysis based on the statutory audit and normalized report. But more concentration is on the normalized report.

The Bega foods company acquires the Australian based food company. Now Bega international and Australian based food company peanut company is managed under the same management. The Bega foods also acquire Saputo’s dairy facility in western Victoria. If the analysis in a financial statement it is observed that Insurance premium also increased of the company by 66% in 2019, before the acquisition. Premium is increased because of high concern by the insurer of expanded polystyrene panel.

In analyzing the financial statement for the scenario of Bega Cheese case study it is observed that some material items also impact the group normalized results which are related to the current year and previous year. Legal and other expert advisory fees relating, to defending the case initiated by the Kraft foods brand company, Bega Company won the case unless not any type of further action taken by the Kraft foods company.

The Bega Cheese case study declared a dividend of 5.5 cents per share in august 2018. The company declared dividends in February 2019 5.5 cents per share of $11.7 million. Now the company is more concentrating on the group dividend reinvestment plan which is known as the DRP plan. The DRP plan which is optional offers ordinary shareholders in Australia and New Zealand, to acquire the ordinary shares without the transaction cost (Moreno, 2016). Another operation cost of $3.5 million also affects the financial statements of the company.

In accounting analysis it is observed that the company is following the normalized system of accounting. More Concentration of company is on a group task, so by this company profit after tax is reduced, in analysis further it is also observed that the company also facing some other litigation cases. Accounting analysis is an overall measure that analyzes the performance of the company with the help of the financial statements of the company. Accounting analysis just measures the policy and procedures used by the company.

D) Financial analysis

The procedure of assessing the projects, businesses and various projects to determine their performance and suitability. Financial analysis is also used to determine whether a particular entity is suitable for investment or not. Financial analysis is useful for both internal and external factors of the organization (Kolitz, 2016). Internally financial analysis is done by the business manager for taking the profitable decision for the organization. The internal analysis also had done to overview the history of the organization. External analysis is done by the investors whether a particular project or company is profitable or not. After the analysis investment is done by the investors.

Mainly financial analysis is of two type’s fundamental analysis, technical analysis. Technical analysis is focused on trends of security of a company over time. Fundamental analysis is focused on the analysis of ratios and financial statement data to determine the intrinsic value of shares of the company (Loughran & McDonald, 2016).

Financial analysis is also done for determining the economic policy for the Company examined in this Bega Cheese case study; set up the long term policy for the company, identifying the companies for the investment. Financial analysis is done through the income statement, cash flow statement, and Balance sheet. Financial analysis is done both in corporate finance and investment finance (Schroeder, Clark & Cathey, 2019).

The common method for financial analysis is calculating the ratios from the data in the financial statement. Other methods of financial analysis include calculating return on investment, which determine how the asset is used by the company.

Financial analysis is done with the help of important statements provided within this Bega Cheese case study:-

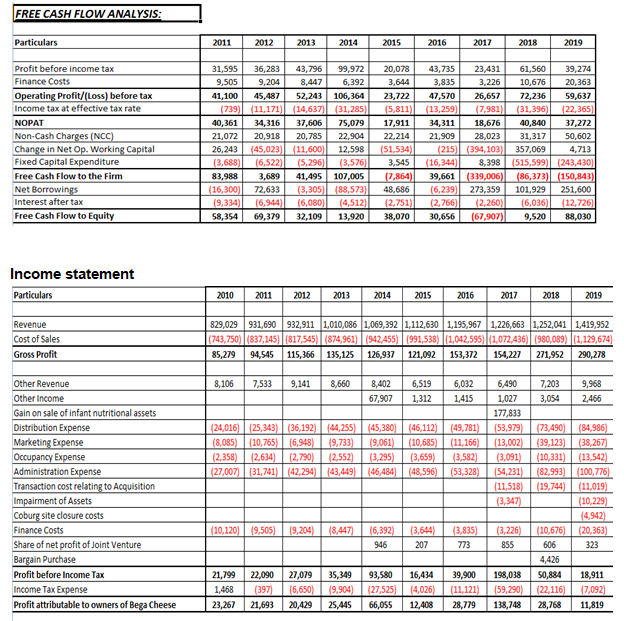

•Cash flow analysis

Cash flow analysis determines the inflow and outflow of cash. The cash flow statement is the overall observation of the use of cash and cash-generating activity of the organization. Bega foods net cash inflow from operating activity is $100.3 million as compared to $ 58.6 million in 2018. This is due to an increase in inventory, an increase in trade payables, etc.

Bega Company invested the amount of $ 322.9 Million in 2019, which includes acquiring the Koroit facility. The company also raises the additional funds under the institutional placements and share purchase plan.

• Common size and horizontal analysis

Horizontal financial analysis illustrated herein Bega Cheese case study is used to compare historical data, ratios over the period. It usually also depicts the same line items over some time. It can be manipulated to make the current period look better. The horizontal analysis not only improves the reviews of the company but also improves the comparability of the company to the competitors as well.

Common size or vertical analysis is the analysis of the data from the base year (Lessambo, 2018). A company can use this analysis on the balance sheet or income statement of the company. Bega Foods Company it is observed that company earning decreasing because company makes the consolidated statements, the company make more investment in other sectors.

• Liquidity analysis

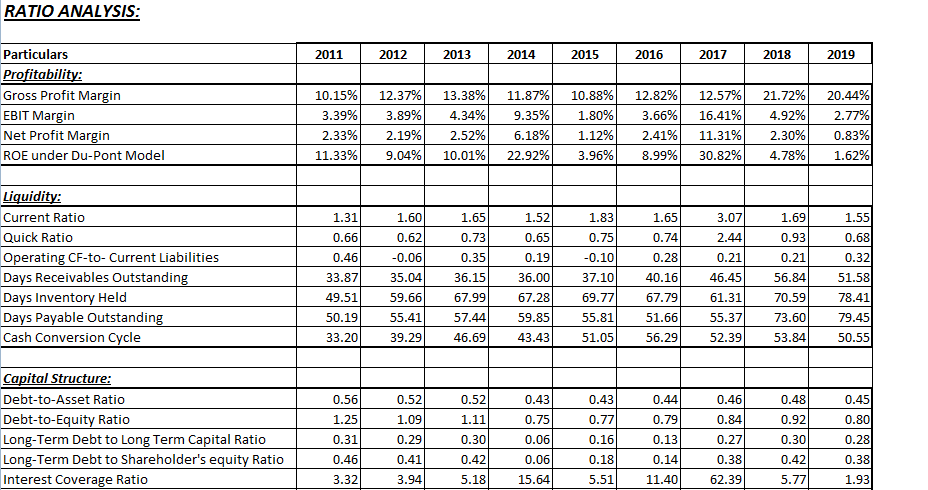

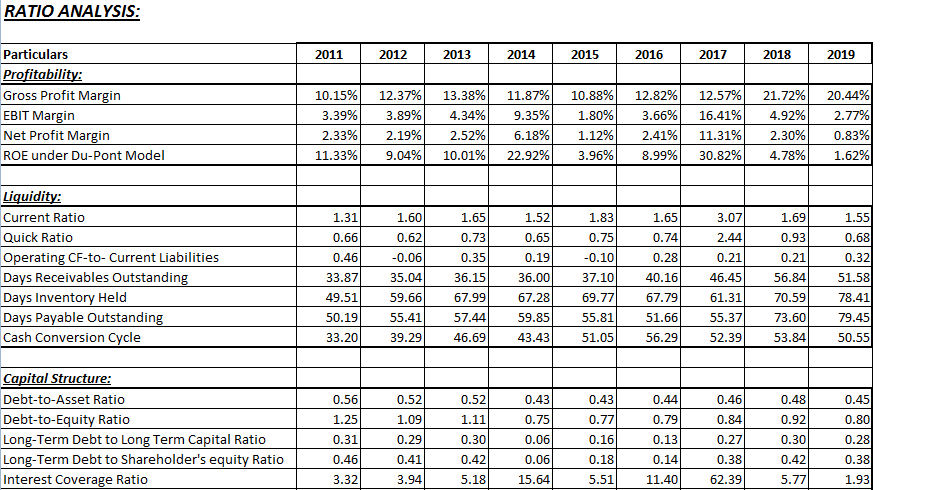

Liquidity analysis is done with the help of several ratios, which describes the ability of the firm to repayment its bills on time. Some ratios are used for calculating short term liquidity position. In this Bega Cheese case study, the Company also decide to invest excess liquidity. Bega Food Company’s current ratio is 1.55 in 2019 and the quick ratio is 0.68 in 2019 which is in a good position.

• Income analysis

Income analysis describes the income-generating capacity of the organization. In analyzing the gross profit of Bega Foods company gross profit increases by more than 200% percentage from 2011. Company net profit is reduced by 15% in 2019 as compared to 2011 because of the high transaction cost in 2019. Company impairment cost also increases in 2019 so the net profit decreases in 2019. Income analysis describes the investment decision of the company, whether profit is increased or not.

• Capital structure analysis

Capital structure analysis mentioned in the Bega Cheese case study describes the debt and equity portion in the capital of the company. Bega Food Company borrowing and equity sharing both increased but at a level company more dependency is on equity sharing. Company borrowing increased by 200% in 2019 as compared to 2011. Company equity sharing is increased by 1000 % in 2019 as compared to 2011.

•Coverage

Coverage means the repayment capability of interest liability. For this purpose the first important factor is calculated is the interest coverage ratio. Bega food Company interest coverage ratio is 1.93 in 2019 as compared to 3.32 in 2011. It means the company interest coverage ratio is reduced. The company is in a favourable situation when the company interest coverage ratio is increased. In this Bega Cheese case study, it reduces but at a point, still it is in a favourable condition.

• Growth and risk analysis

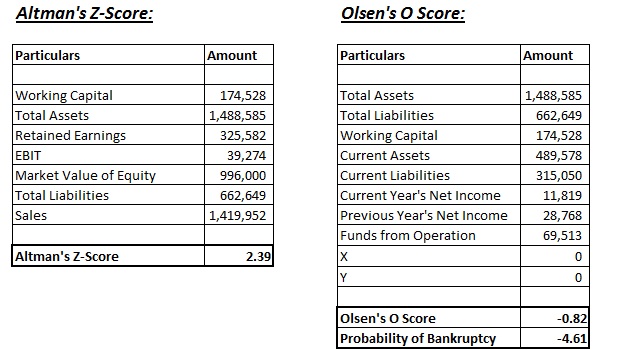

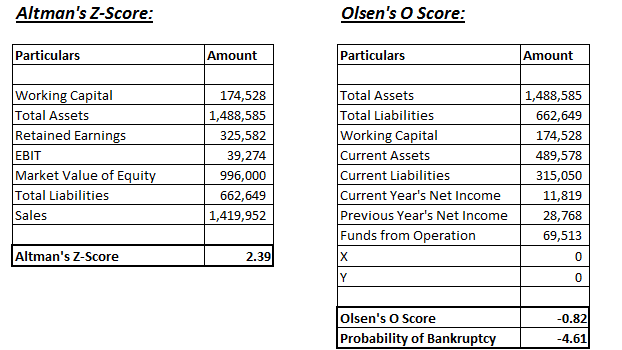

Risk analysis examined in this Bega Cheese case study means assessing the adverse events occurring within the organization. Risk analysis is done in two ways i.e. qualitative analysis and quantitative analysis. In quantitative analysis scenario analysis, sensitivity analysis is done by the company. For this purpose Monte Carlo simulation can be used to generate a range of possible outcomes. Qualitative analysis involves a written definition of uncertainties. In this risk, the tool includes SWOT analysis, decision matrix, game theory, etc. Bega Food Company as per Altman’s Z-score is 2.39, and as per Olsen’s, O score is -0.82. Both the risk analysis factors describe the good position of the company.

References

Begacheese.com.au (2020). Retrieved 20 May 2020, from https://www.begacheese.com.au/

Kharub, M., Mor, R. S., & Sharma, R. (2019). The relationship between cost leadership competitive strategy and firm performance. Journal of Manufacturing Technology Management.

Kolitz, D. (2016). Financial accounting: a concepts-based introduction. Taylor & Francis.

Kurt, A., & Zehir, C. (2016). The relationship between cost leadership strategy, total quality management applications and financial performance.

Lessambo, F. I. (2018). Financial Statements. Bega Cheese case study Springer Books.

Loughran, T., & McDonald, B. (2016). Textual analysis in accounting and finance: A survey. Journal of Accounting Research, 54(4), 1187-1230.

Rothaermel, F. T. (2016). Strategic management: concepts (Vol. 2). McGraw-Hill Education.

Schilling, M. A., & Shankar, R. (2019). Strategic management of technological innovation. McGraw-Hill Education.

Schroeder, R. G., Clark, M. W., & Cathey, J. M. (2019). Financial accounting theory and analysis: text and cases. John Wiley & Sons.

Appendices

Income statement