Auditing Assignment: Case Analysis Based on Audit, Assurance & Compliance

Question

Task:

The questions to be answered in this auditing assignment are:

Week 1

You are the audit manager of Overseas Explorer Ltd (OEL), which acquired the small proprietary company Local Pty Ltd (Local) on 30 June 2018. The price of the acquisition was agreed at $5 million, on the condition that OEL is satisfied with the financial records of Local. As Local is a small proprietary company, it has not prepared statutory financial reports or undergone an audit since its incorporation in 2016. However, Local has agreed to allow your firm, which is the auditor of OEL, to access its books and records. The CEO of OEL, Wendy Champion, has requested that your firm provide assurance on the following three items:

The management accounts for the year ended 30 June 2017

All transactions occurring from the date negotiations commenced until the settlement date, to ensure that all transactions were within the normal course of operations

The financial report prepared at the acquisition date of 30 June 2018

In order to clarify your responsibilities, you requested that OEL indicate the level of assurance that they require for each item. Wendy replied that the financial report as at acquisition date is very important, as are the transactions since negotiations commenced, but that she is willing to have less work done on the previous year’s management accounts.

Required:

Indicate the type of engagement that will most likely be undertaken for each of the three tasks and the level of assurance to be provided. Explain your selections.

Week 2

You have been the auditor of Data Ltd for two years. Your auditor’s report for Data for the year ended 30 June 2018 was unmodified, indicating that in your opinion the financial report gave a true and fair view. In August 2018, Data obtained a large loan from Better Bank Ltd, to provide additional working capital. Subsequently Data suffered severe trading difficulties and was placed into liquidation in late December 2018, with insufficient funds to repay the loan to Better Bank.

Required:

Outline a defense for your audit firm to any legal action taken by Better Bank to recover its loss.

Week 3

You are an audit manager at Hall & Associates, who have been approached to conduct the audit of Computer Games Ltd (CGL), a manufacturer of interactive computer games, for the year ended 30 June 2013.

Hall & Associates has not previously audited CGL’s financial report, although it has undertaken other types of engagements for CGL. Last year CGL hired Hall & Associates to assist in the redesign of CGL’s accounting software to ensure that internal controls over internet sales were adequate to ensure the confidentiality of customer data and accuracy of recording. The new software was implemented at the beginning of the current year and appears to be working satisfactorily. As part of this year’s audit, you expect to review the internal controls at CGL, including the controls within the IT systems.

As part of CGL’s financing arrangements with its bank, Easymoney Ltd, it has a loan covenant that stipulates that the quick asset ratio cannot be less than 1:1 or Easymoney Ltd has the right to withdraw all funding. The board has advised you that CGL’s quick asset ratio is currently at 0.9:1 due to industrial action holding up the sale of goods imported from overseas. The board has asked you to ignore this temporary breach of the loan covenant, explaining that CGL is a stable and financially sound company, and that the ratio will return to a positive level on resolution of the industrial dispute. The board has indicated that unnecessarily disclosing this within the audit report would force it to reconsider its plans to use your audit firm for other engagements.

As a result of CGL’s current cash flow difficulties, the board has requested that Hall & Associate’s audit fee for 2013 be paid in CGL shares. The board has indicated that the market value of the shares will equate to the value of the audit fee charged by Hall & Associates.

The management of CGL is currently reviewing the structure of its audit committee to ensure that it complies with the requirements of the ASX Corporate Governance Principles and Recommendations. However, the board is confused by the reference in the ASX Corporate Governance Principles and Recommendations to both independent directors and non-executive directors, as they thought that they were the same thing. As a result, they have sought your advice concerning the structure of their audit committee.

Required:

a) Identify and explain three separate key threats to Hall & Associates’ independence that may arise under APES 110.

b) For each independence threat identified in a) above, describe the course of action Hall & Associates needs to take to ensure compliance with APES 110.

Week 4

You are the audit senior responsible for the audit of Sampson Limited. You are currently planning the audit for the year ended 31 December 20X7. During your initial planning meeting held with the financial controller, he told you of the following changes in the company’s operations.

- Due to the financial controller’s workload, the company has employed a treasurer. The financial controller is excited about the appointment because in the two months that the treasurer has been with the company he has realised a small profit for the company through foreign-exchange transactions in yen.

- Sampson has planned to close an inefficient factory in country New South Wales before the end of 20X7. It is expected that the redeployment and disposal of the factory’s assets will not be completed until the end of the following year. However, the financial controller is confident that he will be able to determine reasonably accurate closure provisions.

- To help achieve the budgeted sales for the year, Sampson is about to introduce bonuses for its sales staff. The bonuses will be an increasing percentage of the gross sales made, by each salesperson, above certain monthly targets.

- The company is using a new general ledger software package. The financial controller is impressed with the new system, because management accounts are easily produced and allow detailed comparisons with budgets and prior-period figures across product lines and geographical areas. The conversion to the new system occurred with a minimum of fuss. As it is a popular computer package, it required only minor modifications.

- As part of the conversion, the position of systems administrator was created. This position is responsible for all systems maintenance, including data backups and modifications. These tasks were the responsibility of the accountant.

Required:

For each of the scenarios above, explain how the components of audit risk (inherent, control or detection risk) are affected.

Week 5

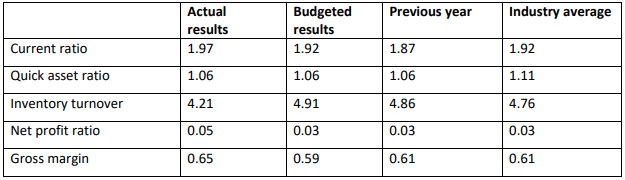

The following financial ratios have been calculated for Nova Ltd for the year ended 30 June 2008:

Required:

Provide four (4) possible explanations for the results for the various ratios for Solar Ltd and outline their implications for the audit.

Answer

Auditing Assignment Week 1

Assurance Engagement is bifurcated into Reasonable Assurance Engagement and Limited Assurance Engagement. In a Reasonable Assurance Engagement, the professional performs in-depth procedures and tests of controls to arrive at the assurance conclusion. This means that the level of assurance that he reports is quite high but it cannot be said to be absolute as well as the engagement risk is very low. Other reviews are also conducted by the professional which includes the going concern concept of the entity. The professional includes the maximum tests and procedures to arrive at an assured conclusion.

Another form of Assurance Engagement is Limited Assurance Engagement. The professional provides a moderate level of assurance in this type of engagement. The procedures performed are not in-depth but the professional tries to procure satisfactory audit evidence so that he can justify the reasons for his moderate assurance (Baldwin 2010). This engagement generally applies where there is limited information available to find sufficient audit evidence and the professional is not sure about the authenticity and complacence of the documents and information provided.

In the given case of OEL, the company has acquired a small proprietary company and it needs assurance services from a professional with regard to the information provided by the acquired company. Following are the types of assurance engagement that shall be provided for the cases given:

i. With regard to the management accounts provided by Local Pty Ltd. for the year ended 30th June 2017, the type of assurance engagement shall be Limited Assurance. The reason for limited assurance is that the company Local Pty Ltd. was a small proprietary company which was not under any compliance obligation of preparing financial reports statutorily. Also, the company did not get its accounts audited since its year of incorporation which was 2016. Hence, it will not be possible for the Assurance Practitioner to go in-depth in the financial reports provided which have not been checked by any professional earlier as it will not be possible to obtain sufficient audit evidence now.

ii. In the second case where the assurance is to be given regarding the deal of acquisition, the type of assurance that shall be given is Reasonable Assurance. The reason is that from the deal date to the settlement date of the deal, the documentation and all the information shall be provided by the acquiring company OEL. The professional will be able to do in-depth testing and also perform detailed procedures on the information and documents provided. Hence, he can conclude the completeness of accounts with precision and be satisfied with the report given. The relevant accounting standards shall also be applied by the professional to the information provided. Hence, he will be in a position to provide reasonable assurance.

iii. In the third case, where the assurance is to be given for the financial report prepared by the acquired company as on the date of acquisition which was 30th June 2018, the Assurance professional may provide Limited Assurance. The reason for the same is that the company accounts were not audited in any year after its incorporation. Even if there was no audit done, the company also did not perform any statutory reporting requirements. Hence, the professional may not be able to perform substantive audit procedures and may issue limited assurance. The financial statements of the acquired company may be materially misstated also and hence the professional cannot take risk of issuing reasonable assurance and he shall issue limited assurance.

Hence, reasonable assurance can be provided only when the professional is sure of the completeness, accuracy, and correctness of the books of accounts and other financial reports of the organization. Otherwise, he shall provide limited assurance.

WEEK 2

The audit report of Data Ltd has been showing an unmodified report that means the auditor is of the opinion that the books of account show true and fair views. This report has been issued after having reasonable assurance and auditing the financial statements of the company. The auditors and other assistants were independent on the performance of duty and proper documentation is done for each and every process and work performed for the audit.

The audit of the records shows that the books were kept and maintained as per applicable standards and regulations. The audit was performed as per the audit plan and the required man quantity and quality of manpower and proper supervision.

Since it has been two years when the audit has been done by our firm the last year's audit was also done by us so the verification of the opening balance was not required. The opening balance was verified with last year's closing audited balance sheet. The current year transactions were audited as per the norms and where required sampling was done. The process and results of the sampling were properly recorded and documented. The sample was selected in such a manner so that the reasonable assurance of the result of the population can be ascertained (Abdullah, R., Ismail & Smith 2018).

The primary objective of detecting fraud and error lies with the management and the auditors while conducting the audit if comes across any material fact or evidences which indicates the existence of some fraud and error than the auditor should proceed further with more evidences either to confirm the fraud or remove the doubt about the fraud. During the course of the audit, no such material evidence was received which would indicate the existence of any fraud by the management or the employees. Thus no requirement was there to report the same.

The firm was facing some financial crises due to poor market conditions and liquidity in the market. The operation of the company was regular and does not indicate the diversion from the regular activities. The company was planning to expand its operations in the new market for which various researches were conducted. This was normal as every year certain expense was conducted to expand and grow its business but no final decision was taken till then.

Since the sanction of the fund and its ultimate use started after the end of the audit period so as the auditors we are unable to provide exact reasons for the failure of the company. Thus the banks have provided working capital loans based on the last audited financial statements also as per the expected and estimated financial statements. The audit firm was in no way associated with working and approval of the projections of the financial statements. But as we are aware of the weakness and strength of the company and its internal control than if given the opportunity we shall conduct the audit for the current year and report the shortcomings of the company and reasons that have caused such trading difficulties and leading to the liquidation of the company. There were some minor issues in the internal control and some policies of the management but as it was not material at that time but the indication for the same has been given in our report along with our suggestions for the same. The previous auditor of the company has also not reported any adverse remarks to be taken care of by us. We have continuously worked for the improvement in the controls and management of the system.

Thus we are ready to provide all the necessary records and details required to prove that the opinion that the financial records show true and fair view was correct and the opinion should not have been modified.

WEEK 3

(a)

As per APES 110 basic principles of the auditors are integrity, objectivity, professional competence, confidentiality, and professional behavior. Thus all the principles are required in the auditor for the proper work and professional up-gradation of the auditors (Gay & Simnet 2018). The first principle is the integrity which means truthfulness. The auditor should not be associated with any report or information which is false or misleading. The auditor should be straightforward, honest, and sincere in its approach (National Audit Group 2020). There are certain activities that hamper the integrity of the auditors and thus should be avoided. The threats are divided into five major heads as self-interest, self-review, advocacy, and familiarity and intimidation threats.

The three key threats to Hall & Associates in the given case are as follows:

i. Self Review threat: The internal control accounting system was designed by the firm and in the current year the review of the same which will lead to reviewing the work done by it and thus the integrity may be affected (Geoffrey et al 2016)

ii. Intimidation Threats: The firm has been intimidated not to disclose the fall in the current ratio otherwise it will reconsider giving any further assignments to the firm. The firm should not be affected by this and should disclose the fall also provide the reasons for the same.

iii. Self Interest Threat: As per APES 110 the payment of fees in the form of shares of the company will lead to self-interest threat and thus the auditors should not accept the shares against the audit fees though the value is the same (APESB 2020).

(b) The audit firm should deal with each threat properly to ensure independence in giving its audit opinion on the financial records of the company.

The internal control system was designed and implemented by the firm so the review of the internal control including the IT system should be outsourced and some external auditor or expert must be appointed to review the same and based on the report the actions must be taken and if required any improvements should be done (Parker 2019). This will ensure the independent review of the control system and will make it effective and efficient. This will also lead to dependence on the result of the internal control and focus on other major areas of the audit.

i. The quick ratio required by the bank is 1:1 but the current ratio is 0.9:1 which should be reported as this is the financial data and material for the bank. The non-disclosure would lead to misleading information and raises the liability against the auditors. Though the company is of the view that this fall is temporary and industrial action will soon start but since predetermined assurance is not present and the chances that the action continues, thus the reporting is must and cannot be ignored (Hoffelder 2012).

ii. The company due to the cash flow crisis is offering the shares in the form of shares of the company which cannot be accepted by the company. The cash flow crisis may lead to a liquidity problem and the going concern assumption should be reviewed and proper disclosures are required to be done (Lapsley 2012). The investment in the shares of the client is not allowed as the interest in the affairs of the company is generated impacting the integrity of the auditors. The firm should convince the company to pay the audit fees in the regular term decided in the agreement. As per APES 110 any form of remuneration outside the monetary term is a threat and can lead to destruction of the independent judgment (APESB 2020).

iii. The audit committee as per the ASX guidelines should consist of a minimum of 3 members all of those should be nonexecutive directors and the majority being independent directors (Karaibrahimoglu & Kangarli 2016). There is a difference between both the directors as both are known executive but not independent directors. The independent directors cannot hold shares in the company nor have any monetary benefits from the company except its remuneration. The non-executive directors are the regular directors not having active control in the regular operations of the company. Thus the audit committee should be properly constituted as per compliance with the applicable laws.

The CGL should comply with all the necessary requirements and as an auditor should also not compromise and be honest in dealing with the company.

WEEK 4

Audit risk is the risk that there may be material misstatements in the financial statements of a company and such misstatements may be left undetected by the auditors during the audit (Livne 2015). There may be various types of audit risks such as inherent risks, detection risks, and control risks. Inherent risks are those which are inherent in the financial or overall system of the organization. Detection risk is that the material misstatement may not get detected by the auditors during the period of audit (Matthew 2015). Control risks are the risks that may arise due to the defect in internal controls of the company. Following are the interpretations for the given cases:

i. In the first case, where a treasurer has been appointed by the company to reduce the workload of the financial controller, the treasurer has entered into foreign transactions that involved foreign exchange. There are various statutory requirements to be followed in case of foreign transactions and the documentation requirement is also vast. These transactions were earlier being handled by the financial controller and in the mid-year, the same was handed over to the treasurer. Although, this led to profits the accountability for statutory requirements was also distributed. Due to this accountability distribution, there may arise the risk of non-detection of material misstatements which may arise in the data of foreign exchange transactions reflecting in financial statements (Niemi & Sundgren 2012).

ii. In the second case, the risk that the audit procedures are prone to be the detection risk as the details of transactions of assets disposal and the requisite regulatory requirements are not concrete and correct. The reason for the non- correctness of data is that till the end of the financial year which was under audit, the regulatory requirements and documentation of the transaction were not complete and the figures provided in the financial statements were only an estimation of the same. An auditor cannot express true & fair opinion based on mere estimation and due calculations and disclosures are necessary (Grayston 2019). Hence, there may be detection risks that may lead to material misstatements.

iii. In the third case, the audit may be prone to control risk as to the control mechanism over the sales done by the employees in the greed of bonuses, which may get failed. This means that the employees including sales executives, administrators, and others who have been offered bonuses to increase the percentage of sales, may indulge in manipulating sales figures. If the staff who is involved in the preparation of books for finalization of financial statements manipulates the sales figures, then it may be impossible to be detected by the management itself and the internal controls over them may fail.

iv. In the fourth case, the company has installed new general ledger software. In the companies where the data and transactions to be entered in the software are vast and numerous, there may errors while feeding the transactions which shall further affect the authenticity and correctness of the final output or data produced by the software (KMPG 2020). This is an inherent risk as it is included in a system of the company. Such inherent risks may not be detected by the auditors while performing audits as he may not be able to detect the flaws in entries done in software. So there are chances that the financial statements contain material misstatements.

v. In the fifth case, there is a control risk in terms of the audit. The reason is that the accountant is equipped with finance-related knowledge and any other mechanical work such as systems maintenance, taking data backups and other maintenance are not the forte of an accountant (Hay, Stewart & Botica 2017). These duties cannot be performed by an accountant and if this is done, there are immense chances of duplicacy of data, some financial data missing in backup, etc. All this may lead to material misstatements in the financial statements and other reports prepared as the data entered in the systems is the basis of financial reports preparation. Hence, there is internal control risk while conducting an audit as the auditor may not be able to find out material misstatements due to flaws in the backups and IT System of the company.

Week 5

The ratio is a potential indicator regarding the performance of the company and hence, the audit of the ratio and their movement can provide a better analysis of the business (Hoffelder 2012). The movement in the ratio number indicates whether the performance has enhanced or declined. In the case of a decline, the audit must be conducted on the same to understand the reason for the decline. This can further help in shaping the future of the organization.

- The current ratio is an indicator of whether the business has sufficient liquid assets to honor the obligations (Deegan 2016). In this scenario, the current ratio has increased marginally in comparison to the previous year and the ratio is almost the same to the industry average thereby depicting that the liquidity is in line with the standard. Hence, considering the same no audit is needed in this scenario because there is no adverse movement.

- The Quick assets are more powerful than the current ratio and project the ability of the organization to meet the obligations (Deegan 2016). In this scenario, the ratio is the same as the budgeted figure but lower than the industry average. This indicates that the performance has been lower in comparison to the industry as a whole. Thereby, an audit should be conducted to understand the deficit in the quick ratio that can be due to the mismanagement of the quick assets.

- The inventory turnover ratio depicts the number of times the inventory is sold. The actual result (4.21 times) is lower than the budgeted result and the industry average depicting the weakness in the ratio. Hence, the audit should be conducted to understand the stock movement and this can help the management to strengthen the ratio in the coming years.

- The profitability of the company is formidable and is depicted by the net profit margin and gross profit margin. Both the ratio has done exceedingly well in terms of numbers and is more than the budgeted results and the industry average. The reason for the good numbers can be attributed to the higher sales and better management of the expenses by the company. hence, an audit of the profitability of the company is not needed as it has outnumbered the industry average. This is a clear indication that the management has provided a better result in terms of profitability.

References

APESB. (2020). APES 110 Code of Ethics for Professional Accountants. Retrieved from: https://www.apesb.org.au/uploads/standards/apesb_standards/23072019055710_APES_110_Code_of_

Ethics_for_Professional_Accountants_December_2010_-_Final.pdf

Abdullah, R., Ismail, Z., & Smith, M. (2018). Audit committees' involvement and the effects of quality in the internal audit function on corporate governance. International Journal of Auditing, 22(3), 385–403.

Baldwin, S. (2010) Doing a content audit or inventory. Pearson Press.

Deegan, C. M. (2016) Financial accounting. North Ryde, N.S.W.: McGraw-Hill Education.

Gay, G. and Simnet, R. (2018) Auditing and Assurance Services. McGraw Hill

Geoffrey D. B, Joleen K, K. Kelli S. and David A. W. (2016) Attracting Applicants for In-House and Outsourced Internal Audit Positions: Views from External Auditors. Accounting Horizons, 30(1), pp. 143-156.

Grayston, C (2019) Audit quality: is it time for a different approach? Retrieved from: https://www.intheblack.com/articles/2019/02/01/audit-quality-time-for-new-approach

Hay, D., Stewart, J., & Botica R, N. (2017). The role of auditing in corporate governance in aAustralia and New zealand: a research synthesis. Australian Accounting Review, 27(4), 457–479.

Hoffelder, K. (2012) New Audit Standard Encourages More Talking. Harvard Press.

Karaibrahimoglu, Y. Z., & Cangarli, B. G. (2016). Do auditing and reporting standards affect firms' ethical behaviours? the moderating role of national culture. auditing assignment Journal of Business Ethics, 139(1), 55–75.

KMPG (2020) Regulatory Audit. Retrieved from: https://home.kpmg/au/en/home/services/audit/regulatory-audit.html

Lapsley, I. (2012) Commentary: Financial Accountability & Management. Qualitative Research in Accounting & Management. 9(3), pp. 291-292.

Livne, G. (2015) Threats to Auditor Independence and Possible Remedies. Retrieved from: http://www.financepractitioner.com/auditing-best-practice/threats-to-auditor-independence-and-possible-remedies?full

Matthew, S. E. (2015) Does Internal Audit Function Quality Deter Management Misconduct?. The Accounting Review. 90(2), pp. 495-527. Retrieved from: https://doi.org/10.2308/accr-50871

National Audit Group (2020) Latest News On Audit Inquiry – 8 Key Recommendations. Retrieved from: https://www.audits.com.au/2020/03/02/latest-news-on-audit-enquiry-8-key-recommendations

/Niemi, L., and Sundgren, S. (2012) Are modified audit opinions related to the availability of credit? Evidence from Finnish SMEs. European Accounting Review. 21(4), p. 767-796.

Parker, D (2019) Seeing audit quality in Australia in a new light. Retrieved from: https://www.intheblack.com/articles/2019/10/01/seeing-audit-quality-in-australia-in-a-new-light