In-Depth Analysis On CSL Annual Report

Question

Task: Students are required to prepare a comprehensive report directed to an Australian ASX Top 100 listed corporation, CSL Ltd, detailing a critical analysis on CSL annual report to meet the obligations of the conceptual framework of accounting.

Answer

Executive Summary

The report aims to undertake the CSL annual report and assess the accounting framework that provides the desired set of information about the measurement, recognition, and disclosure of the information that helps the entity. For the study, CSL limited listed on the ASX is selected. The report initiates with the introduction followed by the critical analysis of the application of the general purpose financial reporting. It clarifies that though reporting process is complex and involved in a high rate of critical analysis

Introduction

The following study is based on the critical analysis of CSL annual report. As a business takes place, transactions are a means of exchange of money and goods or services between people. Accounting refers to the recording of every single business transaction as it conveys the financial health of the organization. Accounting also refers to the analysis of the business transactions and reporting the information in financial statements (Samaha & Dahaway 2010). Over the years, various accounting concepts have been developed to aid the preparation and projection of the financial statements. The aim of the implementation of these accounting standards, concepts, and principles is to make general purpose financial reporting more decision-useful and investor-oriented. The report undertakes the CSL annual report and is based upon the accounting theory concept and application of GPFR. To conduct the study, CSL Ltd listed on the ASX is considered for the evaluation.

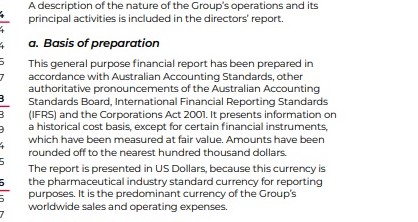

Analysis and theory

The company listed on ASX and selected for this report is CSL Limited. It is one of the Top 10 companies listed on the ASX. The CSL annual report for the year ended 30 June 2019 has been used as a base. The general purpose financial statements are prepared in conformity with the AAS and the same has been highlighted by the notes to the financial statements, International Financial Reporting Standards (IFRS) announcements, AASB and the Corporations Act, 2001. The figures appearing on the financial statements are disclosed on a historical cost concept basis except for a few financial instruments that has been done at fair values to comply with IFRS (CSL Limited 2019).

Thus the historical cost concept has been followed by the company but in a few areas, the figures are reported at fair value which is a controversial area. The accrual concept is the major accounting concept used by the business to prepare the financial statements (Lasher 2011). As per this concept the recognition of revenue is done when earned and recognition of expenses happens when an asset is consumed or the liability for payment becomes certain.

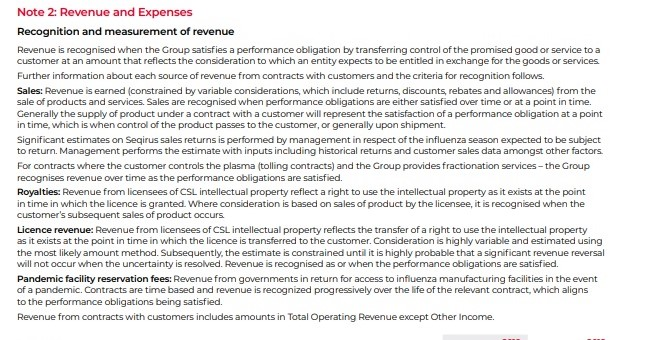

Recognition of Revenue basis the CSL annual report

Note 2 to the Financial Statements states that CSL Limited recognizes revenue when a performance obligation is being satisfied by the group by a transfer of the promised goods or services to the customer at a particular amount which is indicative of the entity consideration and is entitled to the exchange of goods and services (CSL Limited 2019). The recognition of sales revenue is done satisfaction of performance obligation is meet over some time. The supply of products under a contract represents the performance obligation satisfaction at such a point of time when the control of the product passes on to the customer, generally upon shipment. The critical analysis on the CSL annual report in this area is the calculation and management of sales returns. The Management performs estimates about the sales returns from the historical data available and customer sales data in addition to the other factors. In the case of contracts where plasma is controlled by the customer, fractionation services provided by the group, the recognition of revenue is done on the satisfaction of performance obligation. Thus significant estimates are to be made by the management in the influenza season which brings in a subjective aspect and the revenue figure cannot be deemed to be accurate to that extent.

(CSL 2019)

Revenue from the licensees

In the case of royalties, revenue from the licensees of CSL IP projects the power to utilize the IP as it is available at the time when the license is moved to the customer. However, in cases where the consideration is based on the sales of the product, the recognition of the same happens when the sales occur (CSL Limited 2019). The consideration in case of license revenue is highly variable and estimation is done as per the amount method. Thus this is yet another area of shortcoming when it comes to the adherence to the generally accepted accounting concepts. The critical analysis in such cases is that there appears a constraint on the estimation and it is certain that a major reversal of reversal will not happen. Hence, the occurrence or certainty of revenue does not come into consideration. Revenue is thus recognized as and when the obligations of performance are met. In the case of revenue from pandemic facility reservation fees, the contracts are time-based and the recognition of revenue is on a progressive basis over the lifespan of the contract (Petty et al 2012). This is in alignment with the performance obligations being satisfied. The critical analysis here in regards with the CSL annual report is that the occurrence of any specific event of a pandemic is uncertain, the time of happening and the volume of losses incurred is also uncertain which makes accounting far from reality. Further, it is one of the critical because, in 2018, there was a sharp surge in the pandemic stockpiling and reservation fees which cannot be certain every year.

Moving on to the recording of expenses, the accounting concepts states that expenses should be recorded when a certain asset is expensed off or the liability becomes certain. The finance costs which include interest costs are recorded on an accrual basis. When the finance costs are directly attributable to the acquisition of an asset, then it is capitalized and added to the cost of the specific asset.

Depreciation

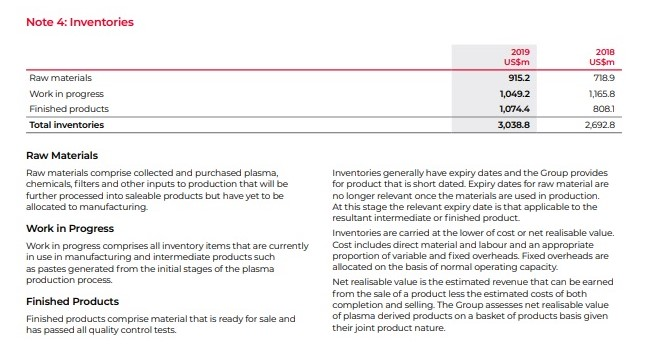

Depreciation of tangible assets and intangible assets amortization is done in line with the guidelines stated in the specific accounting standards. The write-down of inventory to net realizable value is included in the in the Statement of Comprehensive Income and projected by way of cost of sales.

Operating leases that form a significant part of the business are charged to the Income statement over the lease term on a SLM (Choudhary, Koester & Shevlin 2016).

Prudence concept requires that all known liabilities should be provided for. This concept is even termed as the conservatism principle and requires that the liabilities and expenses should be recorded when they happen but the revenues should be realized whey assured (Lasher 2011). By considering the CSL annual report, it is clear that Note 4 on Inventories states that inventories are projected at the lower of cost or net realizable value where the net realizable value is assessed by the group depending upon the product variety of the joint product nature (CSL Limited 2019). This is yet another grey area and attracts a difference of opinion. Employee costs include salaries and wages that include non-monetary benefits, annual service, and long service leaves. These are recognized and resented in different ways in the financial statements (CSL Limited 2019). The critical analysis in this area is that the ascertainment of particular employee benefit liabilities needs a fair estimate of the service period of the employees and the level of salary and other benefits. These assessments depend on the experience and anticipation of the future trends. The discount rates are matched with the expected dates of payment of the liabilities.

(CSL 2019)

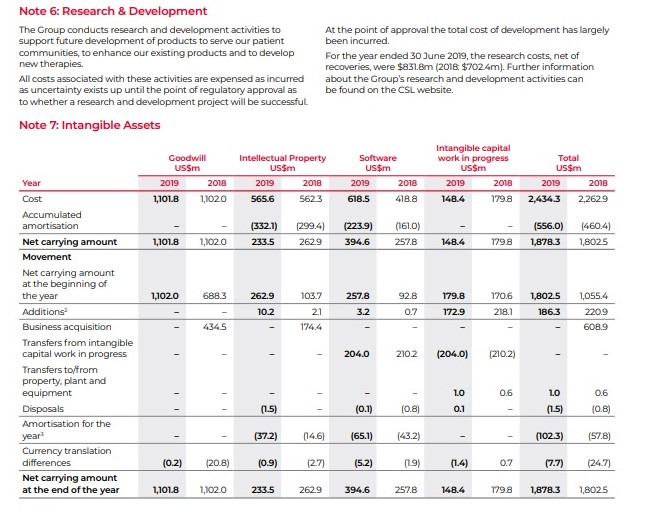

Expenses on Research and development

Expenses on Research and development are specially treated by the group. All the costs associated with R&D is expenses off as incurred as there is uncertainty about the success or failure of the specific research undertaken (Bellandi 2017). The critical analysis on the CSL annual report could be an alternate treatment of these costs by pooling the amounts in a separate account and then either capitalizing it or accounting it as expenses upon the success or failure of the project.

In the case of intangible assets like software, intellectual property rights, etc the estimation of useful lives is done by the management. The estimation needs projections of cash flow based on long term budgets, the judgment of the future demand of the company’s products, and changes in the price and cost of the products (CSL Limited 2019). All these are subjective measures and the basis of the same is subject to critical analysis and review on the CSL annual report.

(CSL 2019)

Recommendations and Conclusion

Going by the overall conduct of the study on CSL annual report, it can be commented that GPFR helps the organization to project all the requisite information that helps the stakeholders to get the desired information of the business. However, it would not be wrong to state that despite the adherence to the accounting concepts, standards, and principles, no company will be able to provide 100% accurate financial statements. It is thereby recommended that the company must abide by the regulations and ensure relevant disclosure that helps the stakeholders to understand the business. Further, the usage of historical cost principle is important in valuation and recommended that it must be used owing to the comparison with the market value and importance to the business. The report establishes that there is a certain area that comes attracts differences of opinion. It always attracts critical analysis due to the presence of certain assumptions and estimates that are made by the management for the preparation of the financial statements. By studying the matter from the CSL annual report, it can be commented that the company adhered to the desired information but certain occurrences led to a difference in the result. Thus on a reasonable basis, the informed stakeholders make useful decisions upon the interpretation of the financial statements.

References

Bellandi, F 2017, Materiality in financial reporting, CSL annual report Bingley: Emerald Publishing Limited.

Choudhary, P, Koester, A. and Shevlin, T 2016, Measuring Income, Tax Accrual Quality, 21(1), 89–139. doi: 10.1007/s11142-015-9336-9.

CSL Limited 2019, CSL 2019 report and accounts, viewed 27 April 2020, https://www.csl.com/investors/financial-results-and-information/annual-reports

Lasher, W.2011, Financial management: A practical approach.: South-Western.

Petty, J. W, Titman, S., Keown, A. J., Martin, J. D., Burrow, M. and Nguyen, H 2012, Financial Management: Principles and Applications, 6th ed. Australia: Pearson Education Australia.

Samaha, K. & Dahaway, K 2010, Factors influencing corporate disclosure transparency, in the active share trading firms: An Explanatory study. CSL annual reportResearch in Emerging Economies, 10, 87-118.