Accounting Assignment: How Medi Bank Implemented GAAP?

Question

Task:

Assessment criteria:

The quality of this essay will be assessed based on the following criteria:

- Identify the implementation of GAAP in Australia.

- Explain why GAAP is crucial for financial reporting and business practices.

- Provide one example to illustrate the implementation of GAAP in the financial reporting of an Australian company.

- Give one example when GAAP isn’t used by your chosen company and explain how this will impact on its performance from the perspective of investors.

- Use the annual report of your chosen company, Australian Conceptual Framework, AASB 101 Presentation of Financial Statements and AASB 15 Revenue from contracts with customers, or other relevant AASBs as guidelines to support your discussion if it is necessary.

- Demonstrate effective communication, logical presentation and integrated evaluation.

You are required to answer the following questions:

- Discuss the identification and composition of incomes of the chosen company. Introduce the recognition and measurement requirements of incomes used by the chosen company with supported documents.

- Explain what is GAAP and why GAAP is crucial for financial reporting and business practices in general.

- Provide one example to illustrate the implementation of GAAP in the annual report of your chosen company, and explain with supporting references.

- Give one example when GAAP isn’t used by your chosen company and explain how this will impact on the financial position, performance and valuation of the company from the perspective of investors.

Answer

Question 1

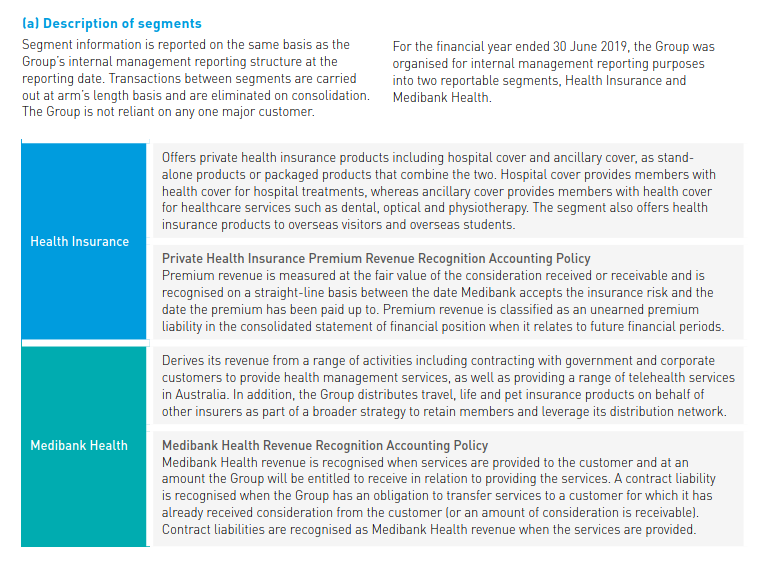

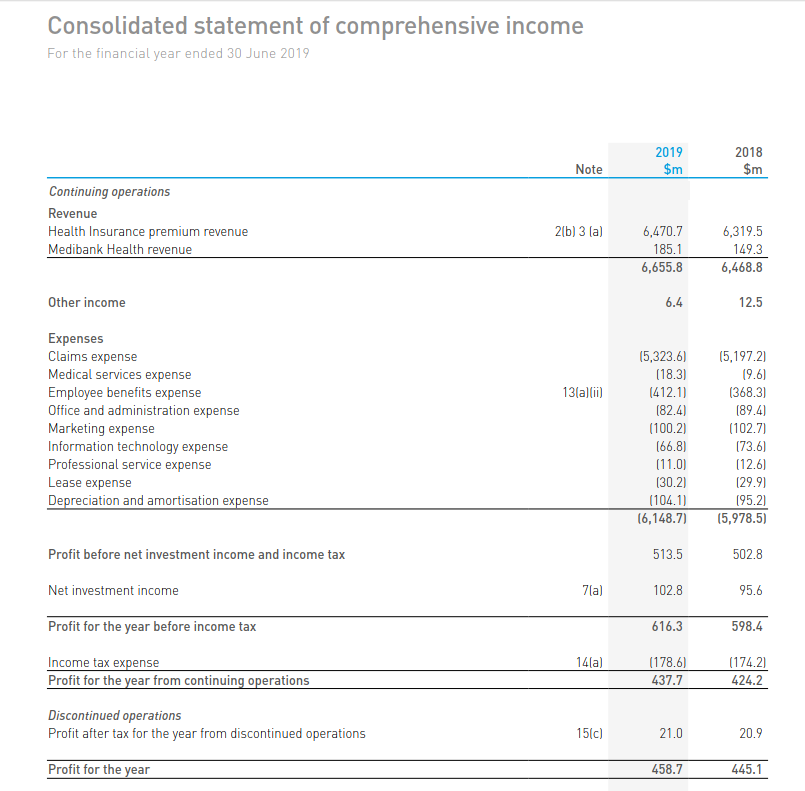

The company that has been selected for this accounting assignment is Medi Bank. Medi bank is an Australian private health insurance provider and the second largest company in this sector it is based in Australia and deals in providing insurance related services along with other consumer-based services. The company is listed on the Australian Stock Exchange and in the given accounting assignment we are discussing how the company is following GAAP while preparing its financial statements. The major income segments of the company include three major parts health insurance premium, Medibank Health Revenue. The revenue from these two sources are represented in two different segments repeatedly Health Insurance and Medi Bank Health. In case of health insurance, the premium that is received is valued at fair value and it is recorded based on straight line basis. Premium revenue is classified as unearned premium revenue when there is a contingency related to the future financial periods of the company (Alexander, 2016). It is recognised in the consolidated statement when the amount can be measured and there is a possibility that it can be earned in the future. In case of Medibank health revenue is incurred when the company provides some services to the consumer and receives some income in lieu of that. When the group is having a liability to transfer the services then same is recorded as contract liability. And these contract liabilities are recorded as income when the services are provided to the consumer. Thus, we see that the income of the company is recognised in the given manner under the given segments accordingly. A snippet from the annual statements of the company has been provided below within this accounting assignment showing the different forms of revenue and recording of the same is done accordingly (Deegan, 2014).

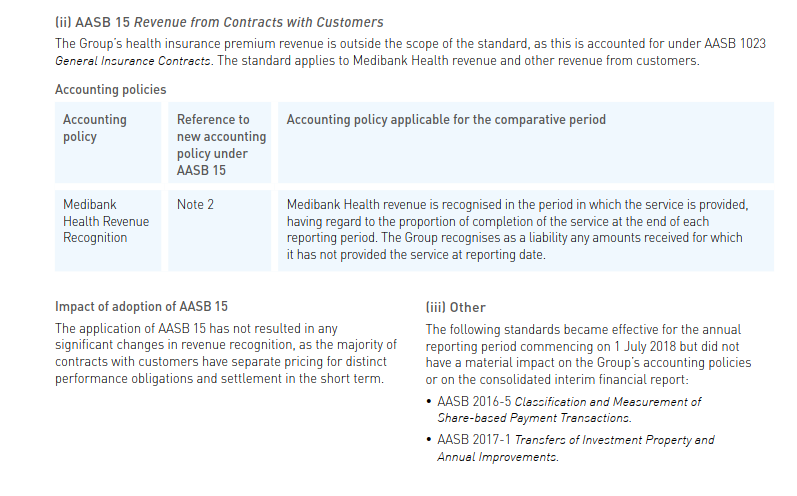

The new AASB15 illustrated herein accounting assignment that deals with revenue recognition is not applicable on Group’s health insurance premium that is covered under AASB 1023. The Medi Bank revenue is covered under AASB 15. In this case of accounting assignment the income is recognised in the period in which the service is provided by the company, subjected to the overall degree of completion in that period. For any amount received for which the service is not provided then that is recorded as a liability by the company and is later reversed (Heminway, 2017). There have been amendments in the new AASB 15, but that does not have major effect on the overall accounting done by the company. This is because most of the customers are having different pricing for performance obligation and settlement in the short term. The following standards provided herein accounting assignment become effective post July 1, 2018 but do not have impact on the groups accounting policies and the consolidated interim reports (Henderson, et al., 2017). A screenshot from the annual report of the company has been given below that shows how the new amended standards have been applied by the company and the impact of the same. The disclosures are provided by the company in the given notes to account.

Question 2

GAAP is Global Accepted Accounting Principles is a collection of accounting principles and rules that can be followed for financial reporting. It consists of principles and concepts definition and consists of specific rules for the industry. It helps in maintaining transparency in the books of account and helps in maintaining consistency in the financial reporting practices around the globe. It helps in providing standard methods by which events and actions that have an accounting impact can be easily recorded and can be taken care of. It is accepted all over the world for its feasibility and easy application. There are a lot of advantages as illustrated below within this accounting assignment that are associated with GAAP and why it is adopted for financial reporting practices world wide-

· Comparability – GAAP helps in setting standards and methods and hence increases the comparability of the financial statements at a standard level. It helps companies to make a comparison between the financial statements of different time periods and compare their data with other companies that are operating in the same industry. It also helps them in comparing their data with companies around the globe, as many companies are adopting GAAP for preparing and presenting their financial statements and books of account (ICAEW, 2011).

· Consistency – GAAP helps in improving the consistency and usability of the financial statements as same standards and principles are used in different time periods with the adoption of GAAP. For example, if a company uses FIFO method in one period and LIFO method in one period then there will be an inconsistency and same in case of using different methods of depreciation involved. Thus, it can be said that GAAP helps in bringing that consistency with regards to the preparation and presentation of the accounts and books of records. This consistency also helps the users in understanding the financial statements in a better way.

· Relevance – One of the major advantages explored in this aspect of accounting assignment is the Relevance. There are different events that have an impact on the overall financial position of the company and GAAP provides those methods by which these events can be reported in the books of account, hence it helps in making the books of account more relevant and effective (Marques, 2018). It provides the users with information that is more relevant and provides information about those incidents that have material impact on the company in some way or the other. It helps in filtering unnecessary data and providing that information which is more accurate for the users to be aware of.

· Reliability- GAAP can be easily understood by the users of the financial statements and hence if GAAP is applied the users know what methods of accounting and reporting the companies are following. These financial statements that are prepared based on GAAP can be easily audited by the auditors and thus it makes the information provided more reliable and easier to follow. It helps the management to take better decisions about organisational goals and the operational effectiveness is also improved. Thus, it also helps the investors when they are investing in the company as they can decide whether the financial position of the company is sound or not.

Question 3

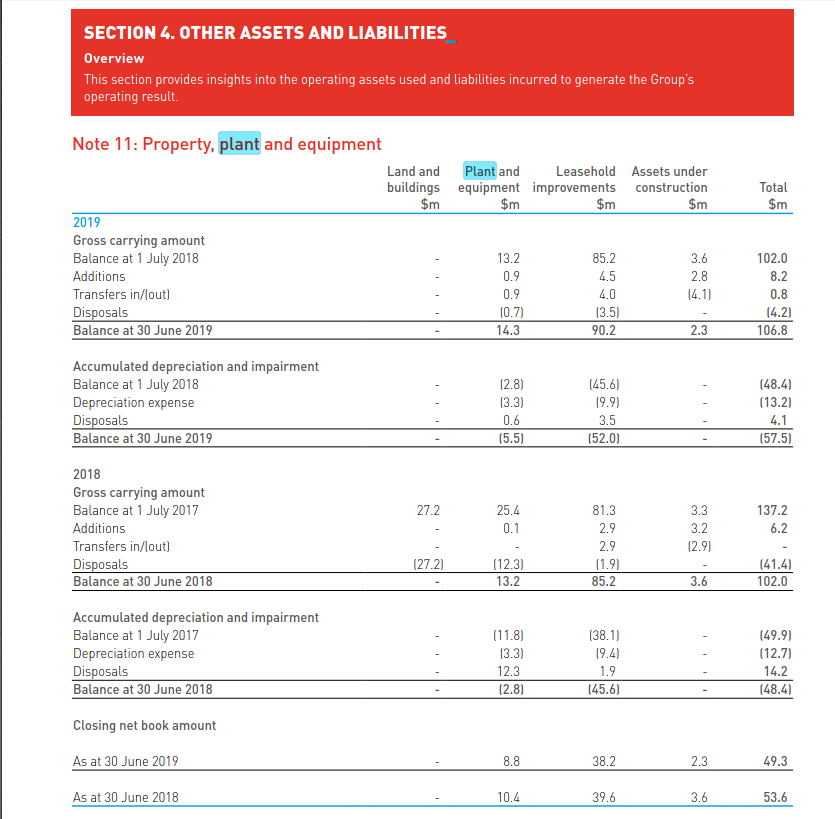

One implementation of the AASB principles that has been done by Medibank is in the case of Property Plant and Equipment that are assets of the company. These assets which include land and building are shown at fair values less the accumulated depreciation in case of the buildings. Other assets like property plant and equipment are shown at their historical cost less the overall depreciation. In case of these assets as discussed in the answer of accounting assignment, historical costs are those that are directly related to the acquisition of the assets by the company. This is as per IFRS IAS 16. It can also be seen that all kinds of repair and maintenance cost are directly charged to the subsequent comprehensive income that the company is reporting in that period. Any kind of increase in the carrying amount occurs when the assets are revalued, and that increase is recorded as an income net of tax in other comprehensive income during the time in which they had occurred. All the decrease and increase in the revalued amount is stated in the financials of the company in that comprehensive income statement. In case of depreciation it is calculated based on the straight-line method over the life of the asset or the term of the lease accordingly (Sithole, et al., 2017). Land is non-depreciable; other assets like assets under construction are also not depreciated. Buildings are depreciated over the useful life of 40 years. Plant and Equipment has a useful life term of 3-15 years and accordingly that is also depreciated. According to the research conducted on the accounting assignment it is clear that any kind of gain or loss in case of the asset is calculated as a difference between the carrying value of the asset and the net proceeds that the company got for the asset. These gain or losses are recorded in the comprehensive income statement of the company. As per this standard illustrated in the context of this accounting assignment, the company needs to transfer any income that it has in terms of the given asset to the retained earrings. An extract from the annual report of the company has been presented below that gives an overview on the assets of the company (Loftus, 2018).

Previously when the annual statements of the company as mentioned above within this accounting assignment where not prepared based on the US GAAP, it was seen that there was no consistency in the methods followed for the recording of the sale or purchase of the assets and the concept of historical cost and accumulated depreciation was not there. But with GAAP and implementation of the accounting standards these assets can be easily recognised and there is proper track of the gain and loss that the company incurs on the sale of these assets (Heminway, 2017). This helps in providing standardization for presentation of the long-term assets like land, plant and building and helps in providing uniformity and consistency to the books of account. It helps the investors in taking decision whether the assets are properly recorded or not and whether accounting of the same is done, whether proper methods of depreciation are followed or not and accordingly they can decide whether they want to invest in the company or not.

Question 4

One of the areas where the company has failed to implement GAAP mentioned in the accounting assignment is in case of leases where the management has still not applied the revised accounting standard on leases – AASB 16. This would be having a substantial impact on the result as well as the position of the company. In case the new accounting standard would have been applied, the operating lease commitments of $143.2 Mn which has been accounted as an expense in the balance sheet would have been reversed and the would have decreased the profit of the company. As per the new standard/ GAAP, the company is required to show the right to use asset amounting to $98 Mn and the liability of $133 Mn with the difference being recognised as retained earnings (Jones, 2015). As per the earlier standard, the onerous lease contracts were required to be recognised in the books which amounted to $3.9 Mn. The same will now be reversed in the books against the right to use asset. Furthermore, the lease incentives and payables which were recognised as operating leases as per the old standard will all now are recognised against the right to use asset. All in all, the total adjustment towards retained earnings would have been approximately $ 5m as per the revised standard.

From the perspective of the lessor accounting as well, the company explored in the context of accounting assignment would have to classify 2 out of 4 leases as the finance lease as the present value of lease payments are towards the major part of the economic life of the given asset held by the entity. As a result of this, the company would have to reverse $7 Mn as the right to use asset and recognise $ 10 Mn as the net investment in sub-lease. The net change of $ 3 Mn would be recognised as other income in the financial statement.

This would have a substantial impact on the valuation of the company as the balance sheet would be netted off and grossing up of the asset and liabilities would be avoided. The investors will get a true and fair view of the valuation of the company and it will help them to make informed decision making. With the old standard on leases, the companies had the flexibility of changing the categorization of the leases amongst the operating and the finance leases but with the new standard, this would be avoided, and the true classification of leases would be ensured based on their nature (Deegan, 2014).

There are several other changes that have been introduced by IASB w.r.t. Conceptual Framework as mentioned herein accounting assignment. The amendments include changes to IFRS 2, IFRS 14, IFRS 3, IAS 8, IAS 8, IAS 34, IAS 38, IFRIC 22, IFRIC 12, IFRIC 20 and SIC 18. Some of these changes will not have an impact on the definition of the standards but will bring about a change in the presentation of the financial statements.

References

Alexander, F., 2016. The Changing Face of Accountability. Accounting assignment The Journal of Higher Education, 71(4), pp. 411-431.

Deegan, C., 2014. Financial Accounting Theory. Australia: McGraw-Hill Education (Australia) Pty Ltd.

Heminway, J., 2017. Shareholder Wealth Maximization as a Function of Statutes, Decisional Law, and Organic Documents. SSRN, pp. 1-35.

Henderson, S. et al., 2017. Issues in financial accounting. 16th ed. Australia: Pearson.

ICAEW, 2011. Measurement of Financial Reporting. Financial Reporting Faculty, pp. 6-22.

Jones, S., 2015. The Routledge companion to financial accounting theory. 1st ed. London: Taylor and Francis.

Loftus, J., 2018. Financial Reporting. 2nd ed. Australia: Milton, QLD John Wiley and Sons Australia Ltd..

Marques, R. P. F., 2018. Continuous Assurance and the Use of Technology for Business Compliance. Encyclopedia of Information Science and Technology, pp. 820-830.

Sithole, S., Chandler, P., Abeysekera, I. & Paas, F., 2017. Benefits of guided self-management of attention on learning accounting. Accounting assignment Journal of Educational Psychology, 109(2), p. 220.