Accounting Assignment Evaluating Financial Data Of Businesses

Question

Task:

Answer the following questions through this accounting assignment:

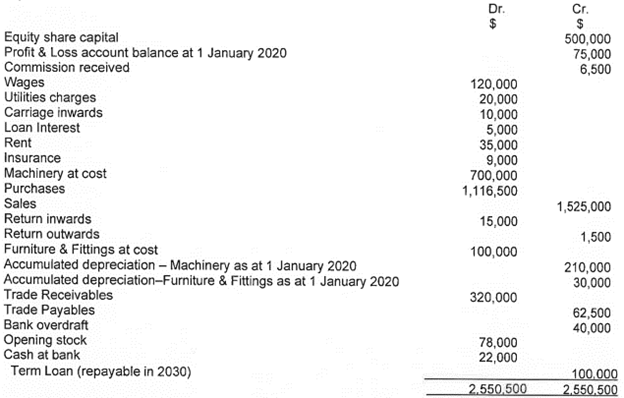

Question 1: Asian Corporation Pte Ltd provides the following balances which were from its books of accounts for the year ended 31st Dec 2020:

Additional information:

a) Depreciation is to be provided at 10% and 25% on the cost of Machinery and Furniture & Fittings respectively.

b) The closing stock as at 31 Dec 2020 was valued at $315,000.

c) Prepaid rent of $3,200 was included in rent.

d) Provide for irrecoverable debts on debtors at 1.5%

e) Accured wages $4,000

f) Provide for income tax @15%

Required:

a) Prepare the Statement of Profit or Loss for the year ended 31 December 2020

b) Prepare the Statement of Financial Position as at 31 Dec 2020

Question 2:

“There are definitely errors in the accounts if the Trail Balance is not balanced. However, a balanced Trial Balance does not necessarily mean that there are no errors.”

Citing examples, list and explain five errors not revealed by a Trial Balance.

Question 3:

“Ratio analysis reveals hidden facts” – Comment on this statement highlighting the merits and demerits of ratio analysis.

Question 4:

From the following information, you are required to classify the type of account whether it is as asset (capital expenditure) or an expense (revenue expenditure) and justify your classification with appropriate reasons:

i) Tyres and mirror purchased for motor vehicles

ii) Cost of additions and alternations to office building

iii) Legal costs incurred for purchase of building

iv) Purchases of good for resale

v) Sales promotion expenses to promote a new product

vi) Carriage inwards to bring the goods inside the factory

vii) Grading and Levelling costs incurred on a land meant for construction

viii) Enhancement of configuration to increase computer disc capacity

ix) Thumb drive for storage of accounting information

x) Stamp duty for purchase of new office premises

Answer

The trial balance of the Asian Corporation Pte Ltd before adjustments has been shown below in this accounting assignment:

|

Asian Corporation Pte Ltd |

||

|

Trial Balance as on 31st December 2020 |

||

|

|

Dr |

Cr |

|

Equity Share Capital |

|

500,000 |

|

Profit and Loss - Opening Balance |

|

75,000 |

|

Commission Received |

|

6,500 |

|

Wages |

120,000 |

|

|

Utilities Charges |

20,000 |

|

|

Carriage inwards |

10,000 |

|

|

Loan Interest |

5,000 |

|

|

Rent |

35,000 |

|

|

Insurance |

9,000 |

|

|

Machinery at cost |

700,000 |

|

|

Purchases |

1,116,500 |

|

|

Sales |

|

1,525,000 |

|

Return inwards |

15,000 |

|

|

Return outwards |

|

1,500 |

|

Furniture and Fittings at cost |

100,000 |

|

|

Acc. Depn - Machinery - Opening balance |

|

210,000 |

|

Acc. Depn - Furniture and Fittings - Opening balance |

|

30,000 |

|

Trade receivables |

320,000 |

|

|

Trade payables |

|

62,500 |

|

Bank overdraft |

|

40,000 |

|

Opening stock |

78,000 |

|

|

Cash at bank |

22,000 |

|

|

Term loan (repayable in 2030) |

|

100,000 |

|

|

2,550,500 |

2,550,500 |

|

|

|

|

The statement of profit and loss account for the year ended 31st December 2020 has been shown below:

|

Asian Corporation Pte Ltd |

||

|

Statement of Profit and Loss for year ended 31st December 2020 |

||

|

|

Amt.($) |

Amt.($) |

|

Sales |

1,525,000 |

|

|

Less: Return Inwards |

(15,000) |

1,510,000 |

|

Less: Cost of Goods Sold |

|

|

|

Opening Stock |

78,000 |

|

|

Add: Purchases |

1,116,500 |

|

|

Less: Closing Stock |

(315,000) |

|

|

|

879,500 |

|

|

Less: Return Outwards |

(1,500) |

878,000 |

|

Gross Profit |

|

632,000 |

|

|

|

|

|

Less: Other incomes and expenses |

|

|

|

Wages |

(124,000) |

|

|

Utilities Charges |

(20,000) |

|

|

Carriage inwards |

(10,000) |

|

|

Loan Interest |

(5,000) |

|

|

Rent |

(31,800) |

|

|

Insurance |

(9,000) |

|

|

Depreciation on Machinery |

(70,000) |

|

|

Depreciation on Furniture and Fittings |

(25,000) |

|

|

Commission Received |

6,500 |

|

|

Provision for Doubtful debts |

(4,800) |

(293,100) |

|

Profit before tax |

|

338,900 |

|

Less: Income tax @15% |

|

(50,835) |

|

Profit after tax |

|

288,065 |

|

|

|

|

The statement of financial position at on 31st December 2020 has been shown below:

|

Asian Corporation Pte Ltd |

|||

|

Statement of Financial Position as on 31st December 2020 |

|||

|

|

Amt.($) |

Amt.($) |

Amt.($) |

|

Assets |

|

|

|

|

Non-Current Assets |

|

|

|

|

Machinery at cost |

700,000 |

|

|

|

Less: Accumulated Depreciation |

(280,000) |

420,000 |

|

|

Furniture and Fittings at cost |

100,000 |

|

|

|

Less: Accumulated Depreciation |

(55,000) |

45,000 |

465,000 |

|

|

|

|

|

|

Current Assets |

|

|

|

|

Inventories in hand |

|

315,000 |

|

|

Trade receivables |

320,000 |

|

|

|

Less: Provision for doubtful debt |

(4,800) |

315,200 |

|

|

Cash at bank |

|

22,000 |

|

|

Prepaid Rent |

|

3,200 |

655,400 |

|

Total Assets |

|

|

1,120,400 |

|

|

|

|

|

|

Equity and Liabilities |

|

|

|

|

Non-Current Liabilities |

|

|

|

|

Term loan (repayable in 2030) |

|

100,000 |

100,000 |

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

Bank overdraft |

|

40,000 |

|

|

Trade payables |

|

62,500 |

|

|

Accrued Wages |

|

4,000 |

|

|

Income tax provision |

|

50,835 |

157,335 |

|

Total Liabilities |

|

|

257,335 |

|

|

|

|

|

|

Equity |

|

|

|

|

Equity Share Capital |

|

500,000 |

|

|

Retained earnings |

75,000 |

|

|

|

Add: Profit for the year |

288,065 |

363,065 |

863,065 |

|

Total Equity |

|

|

863,065 |

|

Total Equity and Liabilities |

|

|

1,120,400 |

|

|

|

|

|

Solution to Question 2

A balanced Trial Balance does not necessarily mean that there are no errors. The above statement is apt and appropriate considering that following errors might occur while preparation of trial balance even though the total of debits and credits might be matching.

1. Error of principle: There might be a fundamental error in recording of the transaction. For example, purchase of machinery may be recorded in the purchases account, amount spent on repairs of the building may be debited to building account instead of repairs and maintenance account (Nicholson, 1989).

2. Error of Omission: There may be times when the transaction has been completely omitted to be recorded in books. In such a scenario, the trial balance will still match as both the debit as well as the credit side would go unrecorded. For example, sales transaction unrecorded means it is omitted in both sales and accounts receivables account.

3. Posting to wrong account: The amounts may be recorded to wrong accounts but on correct side (debit or credit). For example, the amount due from John may be recorded in account of Kelly and the trial balance may not be able to identify it.

4. Error of amounts in original books: There may be an accounting error where $292 may be recorded as $929 in the books and the trial balance may still be matching as arithmetically it is correct but in fact, there is an error.

5. Compensating errors: In case in one of the ledgers is debited with $800 more and another ledger is credited with $800 more than both these errors cancel each other and hence it is compensating in nature. In such a case as well, the trial balance would be matching but still there is an error in it (Alexander, 2016).

Solution to Question 3

Ratio analysis is one of most powerful technique of doing fundamental analysis of any company. It does helps in revealing the hidden facts and also analyze the trend of the ratios over the period of time. For instance, in case the company’s sales as well as gross profit has increased in absolute terms, one may assume that the company is performing well until gross profit % which is one of the profitability ratios is calculated. There may be an instance that even though both sales and gross profit has increased in absolute terms but the margin has declined due to increase in cost of goods sold (Thanassoulis, 1996).

Hence the statement that “ratio analysis reveals hidden facts” is apt and appropriate.

Some of the merits of ratio analysis includes:

• It helps in establishing trend and thereby forecasting and planning purposes

• It provides comparison between two companies in same industry

• It helps in evaluating the liquidity and solvency position of the company

• It helps management in identifying the areas of improvement and where the efficiency needs to be built (Supriyanto & Darmawan, 2018).

• It helps different stakeholders in understanding the performance of the business over the years.

Some of the demerits of ratio analysis are mentioned below:

• Ratio analysis is generally based on the historical data whereas the stakeholders are more interested as how the company will perform in future.

• It ignores the changes in regulations, laws, market changes etc.

• Different industry may not be comparable via ratio analysis as different industries have different parameters (Edmister, 1972).

• The financial accounting data may be based on assumptions and hypothesis and ratio analysis ignores the same. It also ignores change in accounting policies and business conditions.

• It ignores the effect of inflation and changes in exchange rates.

Solution to Question 4

|

Sl. No. |

Description |

Revenue/ Capital Expenditure |

Justification |

|

i |

Tyres and mirror purchased for motor vehicles |

Capital |

The purchase of tyres is in nature of increasing the useful life of the motor vehicles and hence it should be capitalized. |

|

ii |

Cost of additions and alterations to office building |

Capital |

Since there is an addition to the office building besides alterations, this qualifies as capital expenditure as it will give future economic benefits to |

|

iii |

Legal costs incurred for purchase of building |

Capital |

This is allied cost which is usually capitalized in the asset cost at the time of purchase (Bromwich & Scapens, 2016) |

|

iv |

Purchases of goods for resale |

Revenue |

Purchase and sale of goods is in the usual course of operating business activity and finds place in profit and loss account |

|

v |

Sales promotion expenses to promote a new product |

Revenue |

This is in the nature of advertisement cost and hence should be charged off as revenue expenditure |

|

vi |

Carriage inwards to bring the goods inside the factory |

Revenue |

This is the freight cost incurred in the normal course of business which does not have future economic benefit and hence should be charged off as revenue expenditure |

|

vii |

Grading and levelling cost incurred on a land meant for construction |

Capital |

Since the land is meant for construction, so this expense would qualify as work in progress and hence capital expenditure (Sithole, Chandler, Abeysekera, & Paas, 2017) |

|

viii |

Enhancement of configuration to increase computer disc capacity |

Capital |

This is a capital expenditure as it increases the useful life or efficiency of the asset |

|

ix |

Thumb drive for storage of accounting information |

Revenue |

This is not leading to improvement in working efficiency of asset and hence should be treated as revenue expenditure |

|

x |

Stamp duty for purchase of new office premises |

Capital |

This is allied cost which is usually capitalized in the asset cost at the time of purchase |

References

Alexander, F. (2016). The Changing Face of Accountability. The Journal of Higher Education, 71(4), 411-431. Retrieved from https://doi.org/10.1080/00221546.2000.11778843

Bromwich, M., & Scapens, R. (2016). Management Accounting Research: 25 years on. Management Accounting Research, 31(1), 1-9. Retrieved from https://doi.org/10.1016/j.mar.2016.03.002

Edmister, R. O. (1972). An empirical test of financial ratio analysis for small business failure prediction. Journal of Financial and Quantitative analysis, 7(2), 1477-1493. Retrieved from https://doi.org/10.2307/2329929

Nicholson, M. (1989). Errors Not Affecting Trial Balance Agreement. Accounting assignment Accounting Skills, 246-255. Retrieved from https://doi.org/10.1007/978-1-349-10853-4_27

Sithole, S., Chandler, P., Abeysekera, I., & Paas, F. (2017). Benefits of guided self-management of attention on learning accounting. Journal of Educational Psychology, 109(2), 220. Retrieved from http://psycnet.apa.org/buy/2016-21263-001

Supriyanto, J., & Darmawan, A. (2018). The effect of financial ratio on financial distress in predicting bankruptcy. Journal of Applied Managerial Accounting, 2(1), 110-120. Retrieved from https://doi.org/10.30871/jama.v2i1.727

Thanassoulis, E. B. (1996). A comparison of data envelopment analysis and ratio analysis as tools for performance assessment. Omega, 24(3), 229-244. Retrieved from https://doi.org/10.1016/0305-0483(95)00060-7