Accounting Assignment Evaluating Advanced Level Financial Accounting Problems

Question

Task:

The questions to be answered in this accounting assignment are:

Week 1

The fundamental qualitative characteristics that financial information must possess to be useful to the primary users of general-purpose financial reports—identified in the Conceptual Framework are ‘relevance’ and ‘faithful representation’.

Required:

- Provide one example where information is relevant but not faithfully represented.

- Provide one example where information is not relevant but is faithfully represented.

- Provide one example where information is relevant and faithfully represented.

Week 2

- What is a social contract and how does it relate to organisational legitimacy?

- Explain two ways organisations can use corporate disclosure policy to maintain or regain organisational legitimacy?

Week 3

Diamond Ltd acquired an item of polishing equipment on 1 July 2015 for $440,000. The equipment is expected to have a useful life of 10 years and the straight-line method of depreciation is to be used. It has salvage value of $40,000. On 1 July 2017, the equipment is deemed to have a fair value of $424,000 and revaluation is undertaken in accordance with the Diamond Ltd policy of measuring property, plant and equipment at fair value. The asset is still usable for next 8 years but the salvage value is determined to be zero. The asset is sold for $356,000 on 1 July 2019.

Required: Provide the journal entries necessary at the following dates to account for the above transactions and events. (Ignore narrations). Show your working.

- 01/07/2015

- 01/07/2017

- 01/07/2019

Week 4

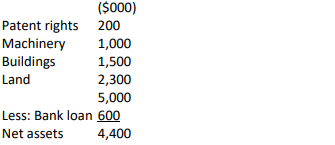

Snowy Ltd acquires Pax Ltd on 1 July 2018 for $5,000,000 being the fair value of the consideration transferred. At that date, Pax Ltd’s net identifiable assets have a fair value of $4,400,000. Goodwill of $600,000 is therefore the difference between the aggregate of the consideration transferred and the net identifiable assets acquired.

The fair value of the net identifiable assets of Pax Limited are determined as follows:

At the end of the reporting period of 30 June 2019, the management of Snowy Ltd determines that the recoverable amount of the cash-generating unit, which is considered to be Pax Ltd, totals $4,500,000. The carrying amount of the net identifiable assets of Pax Ltd, excluding goodwill, is unchanged and remains at $4,400,000.

Required:

- Prepare the journal entry to account for any impairment of goodwill.

- Assume instead that at the end of the reporting period the management of Snowy Ltd determines that the recoverable amount of the cash-generating unit, which is considered to be Pax Ltd, totals $4,200,000. Determine the impairment of goodwill amount. (No journal entries required)

Week 5

On 1 July 2019, Fisher Ltd decides to lease a cargo ship from XFinance Ltd. The term of the lease is 20 years. The implicit interest rate in the lease is 10 per cent. The fair value of the cargo ship at the commencement of the lease is $2,215,560. The lease is non-cancellable, and requires a lease payment of $300,000 on inception of the lease (on 1 July 2019) and lease payments of $250,000 on 30 June each year (starting 30 June 2020). Included within the $250,000 lease payments is an amount of $25,000 representing payment to the lessor for the insurance and maintenance of the cargo ship. There is no residual payment required. Annuity factor, n=20; r = 10% is 8.5136.

Required:

- Prove that the interest rate implicit in the lease is 10 per cent.

- Provide the entries for the lease in the books of Fisher Ltd as at 1 July 2019, and 30 June 2020.

- Provide the entries for the lease in the books of XFinance Ltd as at 1 July 2019, and 30 June 2020.

Answer

Week 1

- Information is relevant but not faithfully represented

An example of the aforesaid requirement taken in this accounting assignment as per the given data is that the profit that has been attained by an organization through non-operating sources are greater than those earned from operating sources but the non-operating income is being clubbed and combined with the organization’s operating income, thereby shedding light on the fact that hundred percent of the profits of such organization are being generated through its operating sources or activities. Hence, this information was relevant but not represented faithfully. - Information is not relevant and faithfully represented

An example of the aforesaid requirement as per the given data is that the salary of $1.2 million that has been offered to the son of the director is being disclosed in its Notes to Accounts forming part of its financial statement. However, the remuneration of director amounting to $12 million is not forming part of the Notes to Accounts segment of the financial statements. Hence, this information was not relevant but represented faithfully. - Information is relevant and faithfully represented

An example of the aforesaid requirement as per the given data is that the investment that has been expended by the company for building or construction of its factory and purchase of other equipments has amounted to a total loss owing to the fire issue. In relation to this, a loss of around $35 million was witnessed by the company and no insurance was being done on the acquired property. This information was appropriately informed by the directors in their financial statement so that the shareholders could be well-informed.

Week 2

- Social contract primarily deals with how an organization and its business interacts with the surrounding society (Deegan 2011). In simple words, social contract plays a vital role in reflecting the manner in which a corporate communicates or interacts with its society for their benefit. It is closely related to organisational legitimacy because of various reasons. Firstly, social contract is generally relatable to the explicit and implicit anticipations of the surrounding society. In other words, it means how shall an organization and its business function in order to secure its survival in the long-run. Further, there is no necessity of making any type of agreement with the business. Hence, social contract cannot be understood as a written agreement and instead, it is what the society expects from a business. Secondly, a social contract plays a key role in describing the interconnection betwixt the business and society. However, organisational legitimacy plays a role in reflecting the condition in which a company has adhered to the terms and conditions of the social contract (Deegan 2011). Hence, it is rightful to state that this can be regarded as the procedure by which the terms and conditions of a social contract can be maintained or enhanced on a whole.

- The ways by which corporates can use their disclosure policy to regain or maintain organisational legitimacy are as follows. Firstly, corporate organizations can play a vital role in attempting to alter the viewpoints or perceptions of the overall society. This does not mean that there must be a change in the behaviour for the same. Secondly, corporates can try to alter their overall anticipations or expectations of their performance so that they can maintain or gain organisational legitimacy. In both these strategies, corporate disclosure can be utilized as a tool wherein organizations can advertise actual alterations in their activities or performance (Graham & Smart 2012). This can play a key role in changing the expectations of their overall performance. They can also disclose further information to offset the negative details that are publicly available, thereby changing the perceptions of society but not actually changing their behaviour. Further, drawing attention towards strengths or downplaying data about negative aspects can also be used by the organizations to regain or maintain organisational legitimacy (Graham & Smart 2012). There are several other ways that can be used by corporates but these two strategies are the most widely used.

Week 3

|

Journal entries in the books of Diamond Ltd |

|||

|

Date |

Particulars |

Debit in $ |

Credit in $ |

|

01-Jul-15 |

Equipment Dr. |

4,40,000 |

|

|

|

To Cash |

|

4,40,000 |

|

|

|

|

|

|

30-Jun-16 |

Depreciation Dr. |

40,000 |

|

|

|

To Accumulated Depreciation |

|

40,000 |

|

|

{(440000-40000)/10 years} |

|

|

|

|

|

|

|

|

30-Jun-17 |

Depreciation Dr. |

40,000 |

|

|

|

To Accumulated Depreciation |

|

40,000 |

|

|

|

|

|

|

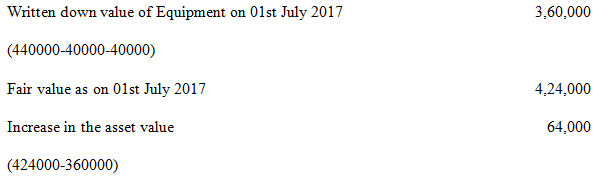

01-Jul-17 |

Equipment Dr. |

64,000 |

|

|

|

To Revaluation Reserve (Note-1) |

|

64,000 |

|

|

|

|

|

|

30-Jun-18 |

Depreciation Dr. |

53,000 |

|

|

|

To Accumulated Depreciation |

|

53,000 |

|

|

(424000/8 years) |

|

|

|

|

|

|

|

|

30-Jun-19 |

Depreciation Dr. |

53,000 |

|

|

|

To Accumulated Depreciation |

|

53,000 |

|

|

|

|

|

|

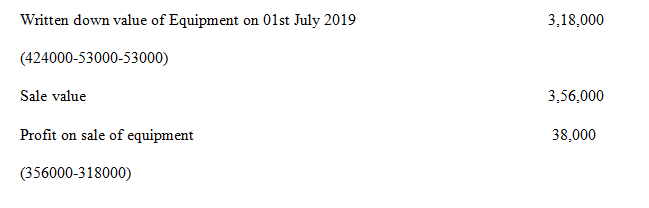

01-Jul-19 |

Cash Dr. |

3,56,000 |

|

|

|

To Equipment (Note-2) |

|

3,18,000 |

|

|

To Profit on sale of equipment |

|

38,000 |

Note-1

Note-2

Week 4

Answer to 4 (a)

|

Date |

Particulars |

Debit $ |

Credit $ |

|

30-Jun-2019 |

Loss on impairment of goodwill Dr. |

500,000 |

|

|

To Goodwill |

500,000 |

||

|

(Being loss recorded on impairment of goodwill) |

Answer to 4 (b)

Computation of impairment of Goodwill amount:

Part A

Value of Goodwill as on 1st July, 2018 stands at $ 600,000

The carrying values of all net identifiable assets of the company (exclusive of goodwill amount) = $ 44,00,000

The carrying value of the company’s cash generating unit (inclusive of goodwill amount) = $44,00,000 + $600,000= $50,00,000

The recoverable amount of the company’s cash generating unit = $45,00,000

Therefore, impairment loss = Carrying value of the company’s cash generating unit (inclusive of goodwill amount) less recoverable amount

= $50,00,000 - $45,00,000 = $500,000

Hence, impairment on goodwill = $500,000

Part B

The carrying value of the company’s cash generating unit (inclusive of goodwill amount) = $44,00,000 + $600,000 = $50,00,000

The recoverable amount of the company’s cash generating unit = $42,00,000

Therefore, impairment loss = Carrying value of the company’s cash generating unit (inclusive of goodwill amount) less recoverable amount

= $50,00,000 - $42,00,000 = $800,000

Impairment on goodwill = $800,000 (such loss of goodwill impairment has been restricted to its respective carrying value)

Note- The loss of impairment arising out of a cash generating unit (CGU) has been allocated first to the goodwill and thereafter, on a pro-rata basis towards the other assets forming part of such CGU or CGU’s to such extent that the loss of impairment surpasses the book value of the goodwill.

Week 5

Answer to 5 (a)

|

Calculation of fair value of Lease payment |

|||

|

Year |

Lease payment |

Discount Factor @ 10% |

Present value of lease |

|

0 |

$ 300,000 |

1 |

$ 300,000 |

|

1 |

$ 225,000 (250000-25000) |

0.909 |

$ 204,545 |

|

2 |

$ 225,000 |

0.826 |

$ 185,950 |

|

3 |

$ 225,000 |

0.751 |

$ 169,046 |

|

4 |

$ 225,000 |

0.683 |

$ 153,678 |

|

5 |

$ 225,000 |

0.621 |

$ 139,707 |

|

6 |

$ 225,000 |

0.564 |

$ 127,007 |

|

7 |

$ 225,000 |

0.513 |

$ 115,461 |

|

8 |

$ 225,000 |

0.467 |

$ 104,964 |

|

9 |

$ 225,000 |

0.424 |

$ 95,422 |

|

10 |

$ 225,000 |

0.386 |

$ 86,747 |

|

11 |

$ 225,000 |

0.35 |

$ 78,861 |

|

12 |

$ 225,000 |

0.319 |

$ 71,692 |

|

13 |

$ 225,000 |

0.29 |

$ 65,174 |

|

14 |

$ 225,000 |

0.263 |

$ 59,250 |

|

15 |

$ 225,000 |

0.239 |

$ 53,863 |

|

16 |

$ 225,000 |

0.218 |

$ 48,967 |

|

17 |

$ 225,000 |

0.198 |

$ 44,515 |

|

18 |

$ 225,000 |

0.18 |

$ 40,468 |

|

19 |

$ 225,000 |

0.164 |

$ 36,789 |

|

20 |

$ 225,000 |

0.149 |

$ 33,445 |

Therefore, present value of lease payment= $ 22,15,551

Answer to 5 (b)

|

Journal entries in the books of Fisher Limited |

|||

|

Date |

Particulars |

Debit in $ |

Credit in $ |

|

01-Jul-19 |

Leased assets Dr. |

22,15,560 |

|

|

|

To Lease Liability |

|

22,15,560 |

|

|

(Being lease identified) |

|

|

|

|

|

|

|

|

01-Jul-19 |

Leased Liability Dr. |

3,00,000 |

|

|

|

To Bank |

|

3,00,000 |

|

|

(Being payment for lease made) |

|

|

|

|

|

|

|

|

30-Jun-20 |

Leased Liability Dr. |

2,25,000 |

|

|

|

Leased Expenses Dr. |

25,000 |

|

|

|

To Bank |

|

2,50,000 |

|

|

(Being lease payment made) |

|

|

|

|

|

|

|

|

30-Jun-20 |

Interest Expense Dr. |

1,91,556 |

|

|

|

To Lease Liability |

|

1,91,556 |

|

|

{($ 22,15,560 - $300,000) * 10%} |

|

|

|

|

(Being interest expense recorded) |

|

|

Answer to 5 (c)

|

Journal entries in the books of X Finance Ltd. |

|||

|

Date |

Particulars |

Debit in $ |

Credit in $ |

|

01-Jul-19 |

Lease Receivable Dr. |

22,15,560 |

|

|

|

To Leased Asset |

|

22,15,560 |

|

|

(Being lease identified) |

|

|

|

|

|

|

|

|

01-Jul-19 |

Bank Dr. |

3,00,000 |

|

|

|

To Lease Liability |

|

3,00,000 |

|

|

(Being Lease income recorded) |

|

|

|

|

|

|

|

|

30-Jun-20 |

Bank Dr. |

2,50,000 |

|

|

|

To Fisher Limited |

|

25,000 |

|

|

To Lease receivable |

|

2,25,000 |

|

|

(Being Lease income recorded) |

|

|

|

|

|

|

|

|

30-Jun-20 |

Fisher Limited Dr. |

25,000 |

|

|

|

To Lease expense |

|

25,000 |

|

|

(Being amount transferred) |

|

|

|

|

|

|

|

|

30-Jun-20 |

Lease expense Dr. |

25,000 |

|

|

|

To Bank |

|

25,000 |

|

|

(Being amount paid by bank) |

|

|

|

|

|

|

|

|

30-Jun-20 |

Lease receivable Dr. |

1,91,556 |

|

|

|

To Interest Income |

|

1,91,556 |

|

|

{($ 22,15,560- $ 300,000) *10%} |

|

|

|

|

(Being Interest recorded) |

|

|

References

Deegan, C. M 2011, In Financial accounting theory, North Ryde, N.S.W: McGraw-Hill

Graham, J. and Smart, S 2012, Introduction to corporate finance, accounting assignment Australia: South-Western Cengage Learning.