Accounting Assignment: Case Analysis of BHP Billiton & TeaserMalt

Question

Task

The accounting assignment consists of two parts:

Part A: Critically analyze the environmental and social actions taken by BHP Billiton to decrease the negative impact on the business environment.

Part B: The second part of this accounting assignment would be based on a case study of ‘TeaserMalts’ Chocolate Ballsthat would require computation of various costing techniques.

Answer

Part A

Introduction

This report on accounting assignment would focus on the critical aspects of corporate social responsibility and how it helps the businesses all around the world to scale their products and services by maintaining a sustainable approach. The report would be classified into two distinct parts. The first part of the report would vividly bring out the environmental and social actions taken by BHP Billiton in order to decrease their negative impact on the environment. Thorough comparison of depth and quality of social and environmental performance information with other two competitive firms would be carried out through this paper. Then the activity of BHP reporting and ESG would be compared with the activity and reporting of Charles Sturt University and its CSU green divisions. Lastly a brief evaluation of widespread compliance with other templates would be compared. The second part of this accounting assignment would be based on a case study that would require computation of various costing techniques.

Overview of Environmental and Social Actions

As far as the disclosures of BHP’s annual report is concerned, the management keeps safety of their employees and overall surrounding as their top priority. It is committed towards their five-year target of maintaining total operational GHG emissions at or below FY2017 levels. The company is inclined towards all the necessary actions that are required to reduce the emission of greenhouse gases which is the major reason behind the increase in global warming and depletion of fossil fuels. For the year ending 2019, the GHG emissions of the company got reduced by 3% which was below their target baseline. The management is further trying to align its objective as per the agreement of Paris and aiming to reduce its emission to zero percent during the second half of 2019 (bhp.com | BHP. (2020).

In July 2019, the company had announced its investment of $400 Million on climate protection program in order to research and develop the best technology that would help the business in reaching its objective of zero GHG emission across their value chain. In 2020, BHP has successfully launched an action which further improved its water management within operations and contributed to more effective governance of water which is utilized within and beyond business.

As far as the social actions are concerned in the present context of accounting assignment, BHP considers its clients and employees as the most valuable assets for the business and hence invests considerable amount of money every year in order to provide better services and products to its end customers (bhp.com., 2020).

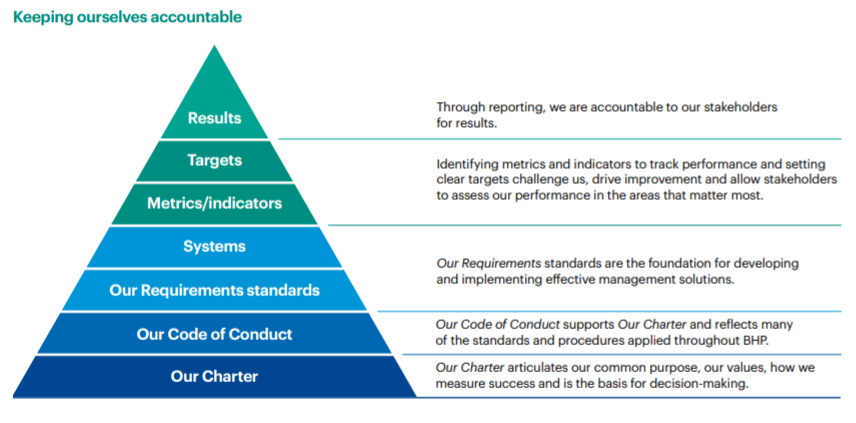

(Source: bhp.com., 2020)

The business as made considerable progress in meeting its objectives of five-year community target that tackle a number of sustainable development challenges. As a part of commitment to social value, the company effectively participated and showed their consent over the Uluru statement from the beginning of January, 2019 which demands a constitutional identification for the indigenous Australians. BHP has effectively collaborated with the traditional owners of the land on which the business operates. It is critical for the management of the business to maintain a peaceful relation with traditional owner and highlight the voice of the indigenous.

Comparison of Debt and Quality of Social and Environmental Performance with other two competitive firms

BHP is an Australian conglomerate of metal, mining and petroleum along with being a dual listed public firm headquartered in Australia. Two of the major competitors of the business are Santos and Rio Tinto which operates in the same industry and facilitate similar services to the consumers of Australia. The comparison of BHP’s sustainability report with its competitors is as below:

Santos Ltd: The sustainability report of the company considered in this section of accounting assignment is not very descriptive and rather has a straightforward and to the point aspects of operating its business in sustainable manner. It has given insight regarding every department of the company that is helping to create sustainable All critical details apart from financial growth has been provided in tabular format which even though helps in understanding in how the business is following the ethics of CSR, but fails to provide a detailed insight regarding the value it creates for the overall environment (Santos. 2019).

Rio Tinto: It is one of the most renowned energy businesses of Australia and is highlight inclined towards providing satisfaction to its customer by streamlining its operations in a way that would create better environment for the future and would help in saving exhaustible resources to considerable amount. All critical information regarding climate change, community and economic sustainability have been discussed in details and hence provide a very descriptive and elaborative narrations of its sustainability approach (Riotinto.com. 2019).

BHP Billiton: The sustainability report of the business is longer than Santos but relatively shorter than Rio Tinto. However, it effectively brings out the value that is being generated by the business by its sustainability measures and how the benefits are being obtained by the overall environment and society at large (bhp.com., 2020).

Comparison of ESG activities of BHP with Charles Sturt University and its CSU Green division

The comparison of CSR reporting between the two companies goes as follows:

|

Areas of Comparison |

BHP Billiton |

Charles Sturt University and its CSU Green division |

|

Approach |

The sustainability approach of BHP Billiton is straightforward and diverse in nature. It provides a vivid description of all the strategies and actions along with responses given by the management to issues such as public interest. It also discloses data regarding the health and safety of its workforce along with revealing the strategies that would help to combat all the problems that are hindering the objective of zero carbon emission (bhp.com., 2020). |

The management of the institute is committed towards infusing sustainability action within its operations and effectively utilizes the concept of integrating social, economic, and environmental considerations before taking any crucial decision regarding the business. The aim area of focus is to improve the quality of life for all citizens without increasing the consumption of natural resources (Csu.edu.au. 2019). |

|

Responsibility |

For BHP, putting safety and health first and conductively its operations are the first and foremost responsibility of the corporate. The well-being of people, community and environment is given high priority (bhp.com., 2020). |

It contributes to the objective of sustainability by building on connections to the global community and the shared knowledge gained from creative approach and research 9 Csu.edu.au. 2019). |

|

Commitment |

It is committed to its five-year target of maintaining total operational GHG emissions at or below FY2017 levels. The company is inclined towards all the necessary actions that are required to reduce the emission of greenhouse gases which is the major reason behind the increase in global warming and depletion of fossil fuels (bhp.com., 2020). |

The learning in future technique is adopted by the University as an index of a structured process for assessing the practices that help in identifying the strategies for improvement (Csu.edu.au. 2019). |

Critical Analysis of the Motivation that Drives HHP ESG Reporting

Sustainability practices and measures are important for BHP just like any other corporate who wants to thrive in the modern market. It helps in generating cleaner and renewable energy which in turn provides valuable services to the community at large (Hadjimanolis, 2017). The management is aware of the fact that in order to meet the demand of the future for the products of the business, it is critical to invest and recruit highly skillful and experienced workforce with sustainable practices. It also focuses on building trust and forging value that is generated together and is central to the shareholders of the business (de Jong and van der Meer, 2017). It targets to provide the best capabilities and culture in the best capabilities and culture in its commodities through best assets which is underpinned by strong financial statement and the process of capital allocation. The sustainability goal of UN are ambitious objectives to enhance the live style of present and future generations and hence BHP contributes towards achieving the SDGs through:

- Their business activities that are direct and products that are produced and the way to produce them.

- The royalties and taxes paid to the government and the indirect and direct employment opportunities that the company creates through its supply chain.

- Through the voluntary investment in society.

This approach suggests that the company can work in collaboration with others towards shared outcomes (Ali, Frynas and Mahmood, 2017).

An evaluation of whether widespread compliance with the templates such as UNSDG or GRI benefits current stakeholders and shareholders of business

The sustainability approach of BHP Billiton is majorly in line with the template provided by the UNSDG which helps in providing increased benefits to all its internal and external stakeholders. It is committed towards building a strong and reliable relationship with stakeholders to achieve long term social goals, economic outcome and environmental aims. At regional and global level, BHP actively participates in voluntary programs conducted by government consultancies and engage with the industrial association to support sustainable practices and positive changes. Locally, the owned assets of the business generate an indirect relationship with the communities with the aim of documenting and implementing approaches that would help in mass sustainment of society at large and increased engagement activities. The intrinsic part of the BHP is to bring its people closer together and to build a strong internal community. The findings identified in the discussion on accounting assignment signifies that this increases the overall productivity level and ensures that fixed assets are utilized to its full potential to provide maximum benefits to its internal and external stakeholders (bhp.com | BHP. (2020).

Part B

Likely impact of the changes on the cost and profit structure of TeaserMalts

From the computation file in excel, it is evident that if the production volume is increased from 30,000,000 to 60,000,000 then the retail price would increase to $4.95 due to increase in the overall expenses by 0.76. The total expenditure of the company would come around 0.65 per unit and the net revenue that TeaserMalt would be able to generate per volume is around $3.32 which would enhance its sales ratio and help to survive in the market of competition. Further, it can be noted that the margin after conversion from before and after budget have a slight increase and before the budget the MAC was 0.20 and after the budget it has become 0.22. However, it can further be noted that the increase in the total expenses would is amounting to be 30.77% whereas the rise in revenue is only 6.49% after implementing the changes as per strategic management to increase the sales of the TeaserMalts. Hence, it can be concluded that the business would not be able to generate the desired profit even though the volume of production is considerably increasing. It is due to the fact that with the increase in the production level, the overall expenses relating to the production of the TeaserMalts has increased to significant level which would drastically reduce the profits of the business in upcoming year (Ali, Frynas and Mahmood, 2017). The current sales of the business have been 30,000,000 whereas the projected sale is expected to be around 27,500,000 which would help in increasing the ROTA of the business to its desired rate and help in undercutting the margins of its competitors.

What are the most likely impacts of the changes on the cost and profit structure of ChockoBalls mentioned herein accounting assignment?

If the cost and profit structure of the Chockoballs is changed from what us currently prevailing in the market, it would significantly impact the sales of its competitors to a considerable extent. From the excel file, it is evident that if the variable price of the business is increased to $9,000,000 with decrease in the production of volume to 30,000,000 then the Chockoballs would have a proposed cost per pouch of $1.00 that would considerably decline when compared to previous cost. It would help in increasing the overall profit of the business to a significant extent and would enable the business to scale its product to larger extent (Said, 2017). Further, going by the method 2 of the cost analysis, it can be noted that the business not be able to improve or reduce its marginal cost if the proposed volume is increased to 37,500,000 as opposed to 30,000,000.

Conclusion and Recommendation

To conclude the above discussion on accounting assignment, it can be stated that the TeaserMalts would be able to improve its profit if the ROTA of the business is increased to 25% of the business which can be done by decreasing the cost of production. However, it would be recommended to the company that it should reduce its expenses to considerable extent without compromising on the quality of the product which can again affect the profitability of the business. It should have adequate focus on the response that TeaserMalts are getting after reducing the retail price of the unit. Overall, it is strongly recommended to go with the proposed strategic planning which have higher chances of scaling the business of TeaserMalts and again back customer that were previously lost to its competitor.

References

Ali, W., Frynas, J.G. and Mahmood, Z., 2017. Determinants of corporate social responsibility (CSR) disclosure in developed and developing countries: A literature review. Accounting assignment Corporate Social Responsibility and Environmental Management, 24(4), pp.273-294.

bhp.com | BHP. (2020). Retrieved 10 September 2020, from https://www.bhp.com/

Csu.edu.au. 2019. Home. [online] Available at:

de Jong, M.D. and van der Meer, M., 2017. How does it fit? Exploring the congruence between organizations and their corporate social responsibility (CSR) activities. Journal of business ethics, 143(1), pp.71-83.

Enyi, E.P., 2019. Joint Products CVP Analysis–Time for Methodical Review. Journal of Economics and Business, 2(4).

Hadjimanolis, A., 2017. A BARRIERS APPROACH TO CORPORATE SOCIAL RESPONSIBILITY (CSR) ADOPTION IN SMES. Contemporary Perspectives in Corporate Social Performance and Policy: The Middle Eastern Perspective, p.95.

Riotinto.com. 2019. Riotinto.Com. [online] Available at:

Said, H.A., 2017. USING DIFFERENT PROBABILITY DISTRIBUTIONS FOR MANAGERIAL ACCOUNTING TECHNIQUE: THE COST-VOLUME-PROFIT ANALYSIS. ASBBS Proceedings, 24(1), p.313.

Santos. 2019. Santos – An Australian Energy Pioneer. Accounting assignment [online] Available at: