Accounting Assignment: Analysing Contemporary Issues of Wesfarmers

Question

Task: This accounting assignment covers contemporary theoretical concepts with practical accounting task application based on the topics from the subject. This assignment requires students to access the Conceptual Framework of Accounting www.aasb.gov.au and select the conceptual framework tab. Students are them required to access paragraph 2.4 fundamental qualitative characteristics.

Students should:

1) Prepare a summary of the requirements for general-purpose financial reports with respect to these fundamental qualitative characteristics.

2) Select an ASX corporation and review general purpose financial report material with respect to the reporting of risk by the corporation.

3) Review the general-purpose financial reports, additional company media release, internet and other sources in relation to the reporting of risk by the corporation.

4) Prepare a comprehensive report directed to this research. The research extracted from the general-purpose financial report and additional material relevant to the analysis.

Answer

INTRODUCTION

The report would go through the Conceptual Framework of Accounting as prescribed by the Australian Accounting Standards Board (AASB) and its application in the business scenario of the Australian conglomerate, Wesfarmers Limited. Taking relevance of the AASB conceptual framework, the report would point out the fundamental qualitative characteristics of the financial statements of Wesfarmers along with its news and market information published. Wesfarmers Limited has its headquarter in Perth, Western Australia having a diversified portfolio ranging from apparel, departmental stores, office supplies, chemicals, fertilisers, and industrial safety products among others(wesfarmers, 2020).

Qualitative Characteristics of Financial Information

The AASB conceptual framework of accounting comes up with the qualitative characteristics of the relevant financial information that would be effective to get the attention of the investors both the existing and potential ones. The conceptual framework through various financial reportsshowstheeconomicconsequence of the organisation(Aasb.gov.au, 2020). The qualitative characteristics are significant as it provides the element of cost for its better management in the business scenario by undergoing the following fundamental qualitative characteristics:

Relevance –

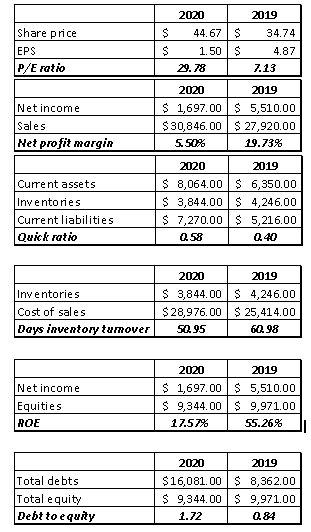

The AASB conceptual framework stands for the relevance of the financial information that would be suitable for financial decision making. The relevance proposition stands for the predictive proposition for Wesfarmers indicating the future outcomes for the conglomerate. It could be understood by working out the price-earnings (P/E) ratio as it shows the potentiality of the conglomerate to deliver an effective return in the upcoming future (Dekker, 2016). The graph below depicts that Wesfarmers had a P/E ratio of 7.13 in 2019 which increased to 29.78 in 2020. It indicates that the organisation has the potentiality to explore in the market that the investors could exploit by subscribing to its stocks. Reports suggest in the COVID-era, the online sales of Wesfarmers grew phenomenally by 89% and the trend continues to grow in 2021 as well(AFR, 2020). So the P/E ratio derived is relevant to undertake a positive business decision in accordance with its qualitative characteristics.

Faithful representation –

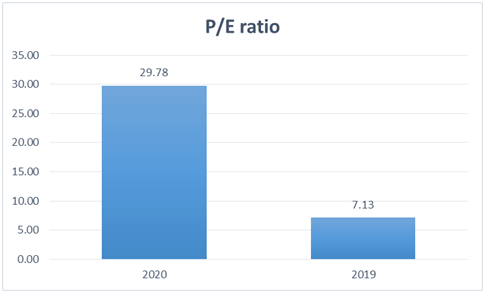

The financial reports showcase financial phenomenon in terms of numbers and facts which is legally accepted alongside being neural, accurate, and complete(Aasb.gov.au, 2015). The objective of the Wesfarmers Board would be to enhance these qualities to showcase the figures well and the same could be represented through the net profit margin of the conglomerate.

The above graph shows that the conglomerate suffered a decline in its profitability as its net margin reduced from 19.73% in 2019 to 5.5% in 2020(Wesfarmers.com.au, 2020). The figures shown depicts the faithful representation of qualitative characteristics of the financial information considering the sorts of available information required for presentation. This is the outcome of the entire group as the business suffered in the current year due to the lockdown as its activities got stalled(Ibisworld, 2020). The saviour was the retailing arm that experienced a fillip in online sales otherwise, other segments of the conglomerate suffered depicting the outcome.

Comparability –

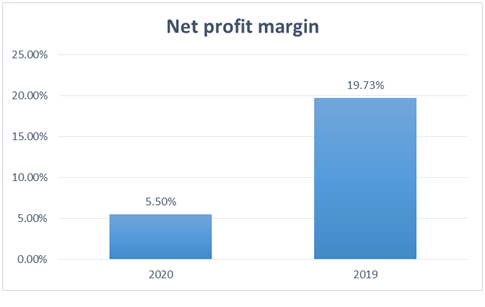

The qualitative characteristics of comparability are upheld to run a suitable comparison between the financial figures to havea faithful representation of the financial items of the business(Messier & Schmidt, 2018). This characteristic is useful to understand the similarities and differences of the financial figures across several years or in alignment with the industry standard. The aspect of comparability could be understood using the quick ratio of Wesfarmers.

The graph above shows the quick ratio of Wesfarmers which jumped from 0.40 in 2019 to 0.58 in 2020. So a comparison is done between the two years to show that Wesfarmers raised its liquidity in the current year against the previous year as felt suitable to safeguard itself from the bankruptcyrisk. The comparability element could also be stated through the industry standard of quick ratio at ‘1’ whereas the figures of Wesfarmers are at 0.4 and 0.58 respectively for 2019 and 2020(Aasb.gov.au, 2020). Therefore, the comparability characteristics stand for the conglomerate to modify its liquidity position and run the business operations effectively.

Verifiability –

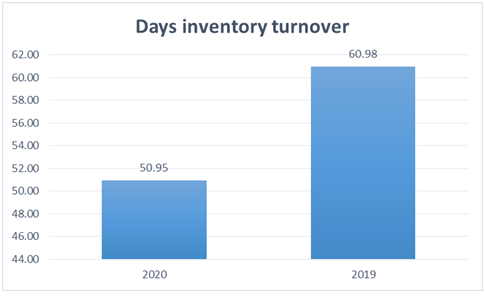

The qualitative characteristics of verifiability in the business process are required to represent the economic impact commendably. It shows that the faithful demonstration of the financial figures ought to be quantified and verified using the plausible amounts and verification of the related financial probabilities(Wang & Fargher, 2017). The verification aspect could be illustrated using the day’s inventory turnover ratio.

The day’s inventory turnover for Wesfarmers stood at 60.98 in 2019 which reduced to 50.95 in 2020. The same has been derived using a standardised formula that could be verified taking credentials of its peer organisations verifying that the measures adopted are standardised suitable to contemplate effective business decisions. The matter could be verified using the market reports that the inventory of Wesfarmers took less time in the current year owing to the hype in the market to hoard goods due to the lockdown phenomenon. Thus the retailing arm took less time to sell its inventories than the previous year(Reuters, 2020).

Timeliness –

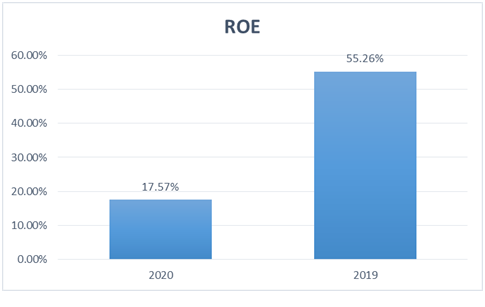

The phenomenon of timeliness shows that the information available to the decision-makers is adequate to anticipateapposite business decisions. In this case, latest the information is fit to bring into exercise and derive a strategic position for guiding it to the right pathway(Dekker, 2016). Such a phenomenon is useful to identify the business trend and evaluate it correctly.

The return on equity or ROE shows the capability of Wesfarmers in delivering an effective return to its investors and it is a declining trend. The graph shows that the ROE of the conglomerate reduced from 55.26% in 2019 to 17.57% in 2020 owing to a decline in its net profit(Wang & Fargher, 2017). The conglomerate suffered a decline due to the imposition of lockdown off COVID scare during the crucial phase of business leading to such a sorry state. This is despite that the online sales of its retailing arm received a massive response indicating the online trend to be prevalent in the market in the upcoming times (Reuters, 2020).

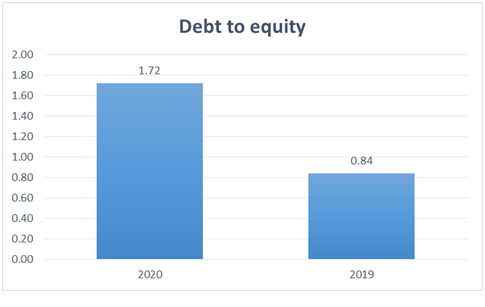

Understand-ability –

The conceptual framework of accounting designed the qualitative characteristics to depict a suitable understanding of the figures depicted through its workings(Messier & Schmidt, 2018). Such a phenomenon is responsible for having transparency in the organisational scenario and analyse the information meticulously that would lead to addressing the complex business scenarios. This particular qualitative characteristic could be depicted through the debt-to-equity ratio of the conglomerate, Wesfarmers. The graph shows that the figure increased from 0.84 in 2019 to 1.72 in 2020 indicating that the business is asking for more debts over equities to run its business(Aasb.gov.au, 2015). This sort of understanding is very necessary to understand why and how the organisation is bringing a change in its capital structure and its implication in the future. For instance, growing debts indicate higher interest costs affecting the organisational profitability.

Cost constraint on significant financial reporting

Cost stands as the universalrestrainton financial information aspointed out by various financial reports(Aasb.gov.au, 2020). Preparing the financial reports to require substantial cost as the financial accountant sources, process, verify, and categorise the financial information for the users of the financial statement to interpret and analyse the information therein. This sort of cost ought to be incurred by the business to point out the relevant financial information and faithfully showcase it to enable an effective business decision(Wang & Fargher, 2017). The conceptual framework of accounting as prescribed by AASB recommends the organisation to incur such costs to prepare the financial reports as it would enable the qualitative characteristics of the financial implications to prosper.

Risks to the business

The conceptual framework upholding the qualitative characteristics of financial reports is indicative that the costs incurred play a crucial role in having an appropriate financial juncture as seen in the caseof Wesfarmers. AASB mechanism has the apprehension that firms like Wesfarmers to save costs would not prepare the financial reports accordingly.It runs the risk of compromising the fundamental qualitative characteristics of the financial information(Messier & Schmidt, 2018).

CONCLUSION AND RECOMMENDATIONS

The report concludes that the fundamental qualitative characteristics of the financial information are crucial for its proper illustration. Elements like relevance strive to carry a predictive indication to show the direction in which Wesfarmers is heading which is rightly depicted through the P/E ratio. The aspect of faithful representation shown through the net profit margin stands for the accuracy of the financial information. The qualitative characteristic could be further enhanced through comparability to show the level of comparison as in the case of the quick ratio of Wesfarmers showing an increase in the figure to strengthen the liquidity. Verifiability shown through day’s inventory depicts that a standardised method is followed to derive the result and timeliness shows the business trend as affected by the market in contemporary times. Lastly, the aspect of cost is highlighted to acquire a quality financial report upholding its different qualitative characteristics for the business purpose.

Accordingly certain recommendations are suggested:

- AASB need to be vigil in the proper presentation of the incurred costs for preparing the financial reports.

- The same should be presented in the financial reports to create a transparent scenario.

- The cost angle needs to be properly dealt with for better representation and interpretation of the financial statements.

REFERENCES

Aasb.gov.au, 2015. Presentation of Financial Statements. [Online]

Available at: www.aasb.gov.au/admin/file/content105/c9/AASB101_07-15.

[Accessed 07 May 2019].

Aasb.gov.au, 2020. Conceptual framework. [Online] Available at: https://www.aasb.gov.au/Pronouncements/Conceptual-framework.aspx [Accessed 05 December 2020].

AFR, 2020. WES News, Analysis, Announcements & Results | Wesfarmers Limited | AFR. [Online]

Available at: https://www.afr.com/company/asx/wes Dekker, H., 2016. On the boundaries between intrafirm and interfirm management accounting research. Management Accounting Research, 31(2), pp. 86-99.

Ibisworld, 2020. IBISWorld - Industry Market Research, Reports, and Statistics. [Online]

Available at: https://www.ibisworld.com/au/company/wesfarmers-limited/69/ [Accessed 05 December 2020].

Messier, W. & Schmidt, M., 2018. Offsetting misstatements: the effect of misstatement distribution, quantitative materiality, and client pressure on auditors’ judgments. Accounting review, 93(4), pp. 335-357.

Reuters, 2020. BRIEF-Wesfarmers Says Financial Year To Date Total Online Sales Across Group Increased 60%. [Online]

Available at: https://in.reuters.com/article/brief-wesfarmers-says-financial-year-to/brief-wesfarmers-says-financial-year-to-date-total-online-sales-across-group-increased-60-idUSFWN2DL0XX

Reuters, 2020. UPDATE 1-Virus-driven lockdown bumps Wesfarmers online sales up 89%. [Online]

Available at: https://in.reuters.com/article/wesfarmers-outlook/update-1-virus-driven-lockdown-bumps-wesfarmers-online-sales-up-89-idINL4N2DL3TV Wang, I. & Fargher, N., 2017. The effects of tone at the top and coordination with external auditors on internal auditors’ fraud risk assessments. Accounting & Finance, 57(4), pp. 1177-1202.

Wesfarmers.com.au, 2020. Reports. [Online] Available at: https://www.wesfarmers.com.au/investor-centre/company-performance-news/reports wesfarmers, 2020. Our businesses. [Online]

Available at: https://www.wesfarmers.com.au/our-businesses/our-businesses [Accessed 04 August 2020].

APPENDIX