This finance calculator can be used to calculate the Weighted Average Cost of Capital (WACC), Yield to maturity (YTM), Net present value (NPV), future value (FV), interest rate (I/Y), number of compounding periods (N), and PV (Present Value). Each of the following tabs represents the parameters to be calculated.

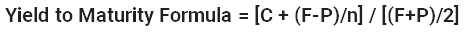

Yield to maturity, or YTM, is the expected total return on a bond if it is kept until it matures. Yield to maturity is a return on a long-term bond, but it is shown as an annual rate. In other words, it is the internal rate of return (IRR) of an investment in a bond if the investor holds the bond until maturity and reinvests all payments at the same rate.

Where

"Book yield" or "redemption yield" are other names for "yield to maturity."

The yield to maturity can be a good way to figure out if a bond is a good investment or not. An investor will decide on a needed return (the return on a bond that will make the bond worthwhile). Once an investor knows the YTM of a bond they want to buy, they can compare it to the required yield to see if the bond is a good buy or not.

Because YTM is always shown as an annual rate, it can be used to compare bonds with different terms to maturity and coupons because it shows the value of each bond in the same annual terms.

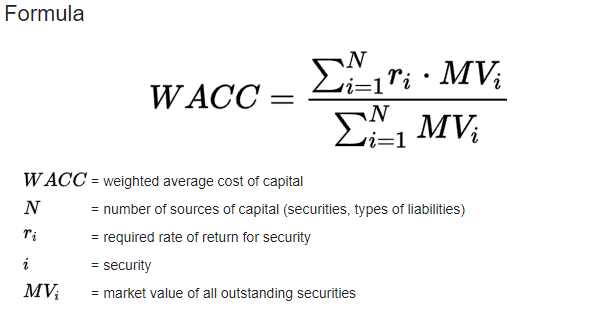

WACC is the average cost of a company's different sources of capital, like common stock, preferred stock, bonds, and other long-term debt, after taxes. In other words, WACC is the average rate that a company expects to pay to finance its assets.

Companies often use the money they get from different sources to run their business. They can get money by selling shares on the stock market (equity), issuing bonds with interest payments, or taking out commercial loans (debt). All of these types of capital have costs, and the costs for each type vary depending on where they come from.

Since most of a company's financing comes from two sources—debt and equity—WACC is the average cost of getting that money, which is calculated by dividing the total cost by the amount of money coming from each source.

WACC is a formula that shows how much interest a company has to pay on every dollar it borrows. Analysts use the WACC to figure out how much an investment is worth. In discounted cash flow (DCF) analysis, WACC is a key number. WACC numbers are also used by the management of a company as a hurdle rate when deciding which projects to take on. In the meantime, investors will use WACC to figure out if an investment is a good idea.

WACC is a standard that is used to decide whether or not to invest in a project or company. It's a way for a company to figure out what its cost of capital is. WACC can be used as the discount rate when calculating the time value of money, and it can also be used as the hurdle rate when calculating NPV or IRR for capital budgeting.

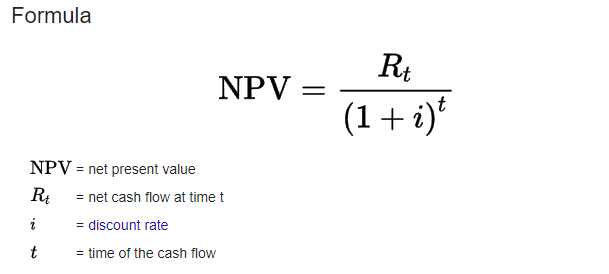

The present value of all of a project's future cash flows is called its net present value (NPV). Money is worth more now than it will be in the future, according to the time-value of money. This means that the value of a project is not just the sum of all future cash flows. These future cash flows must be discounted because money earned in the future is worth less now. To figure out NPV, we have to discount each future cash flow to figure out what its present value is. We then add up the present values for each time period.

You can quickly figure out the NPV of a project or investment with the help of the NPV calculator. But it's important to know how this NPV works and how the steps fit together. Let's write down some important things.

You can use the NPV calculator to figure out if an investment or project is worth it or not. Before making a final decision on a project, you need to look at more than just the net present value. That is what the NPV calculator is all about.

There are 3 possible results once the NPV has been determined.

Here are some of the common applications for NPV determined using the NPV Calculator.

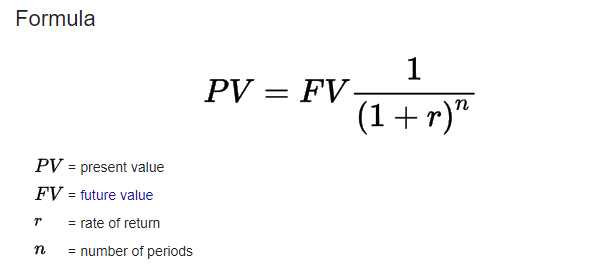

The worth of a sum of money in the present, as opposed to the value it will have in the future as a result of being invested and compounding at a specific rate, is known as its present value, or PV.

A present value calculator helps you figure out how much a stream of cash flows or a future payment is worth right now if you know its rate of return. Present value, which is also called present discounted value, is one of the most important financial concepts. It is used to price many things, such as mortgages, loans, bonds, stocks, and many, many more.

A lot of the world's economy is based on figuring out how much something will be worth in the future. Because it can be invested to earn a return, money is worth more now than it will be in the future.

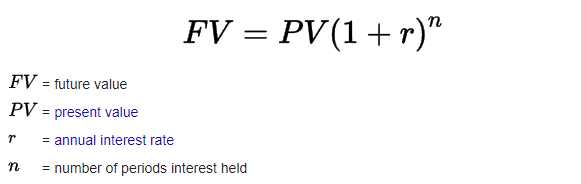

What money is expected to be worth in the future is called its future value, or FV. Most of the time, money in a savings account or a hold on a bond purchase earns compound interest, so its value changes in the future.

A good example of this kind of calculation is figuring out how much money will be in a savings account at a certain time in the future by looking at its future value. You can learn about this idea with the help of a calculator. Put in $10 (PV) at 6% (I/Y) for one year (N). We can just ignore PMT to keep things simple. When you press calculate, the FV will be $10.60. This means that if you save $10 today, it will be worth $10.60 a year from now.

Future value is the worth of an item or investment as of some future date. In other words, the future value is the sum of money that an investment will be worth, assuming a certain rate of return, after a specified amount of time (interest rate). Future value is emphasised by both investors and financial planners because it enables them to predict how much an investment will be valued in the future. Based on their financial goals, it helps investors make wise financial decisions. As a result, both enterprises and people need to be aware of the asset's potential worth. Utilizing a future value calculator is the most practical way to go about this.

The future value calculator simulates the future worth of an investment. It determines the value of your money in the future. Calculating the worth of any investment at a later time is made easier with the aid of a future value compound interest calculator. In the formula input box of the future value calculator, the initial investment, periodic investment, interest rate, and period number are entered. The future value calculator on the internet will demonstrate the value of your investment at the specified future date.

We offer a number tools and a plethora of academic resources to take your assignments to the next level! Make the best use of our essay typer, reference generator and paraphrasing tools to take your assignments to the next level!

Your search for great assignment work ends here, click on the below link to search your assignment from our huge database of work.

+61-8-9892-7777