Hire our management experts to produce top-quality projects and maintain high grades

Are you a Cost Accounting student and feeling overburdened by Cost Accounting assignments issued at college Are you looking for a good score in your Cost Accounting assignment,that would help improve your grade in the class Well, all you need to do is send your Cost Accounting assignments by filling up the cost accounting assignment help submission form to Total Assignment Help or send us the assignment documents via email. We will review the details and get back to you after which we will proceed and complete the solution well within the agreed deadline.

Definition of Cost Accounting assignment help: Cost accounting assignment help can be defined as the process of collecting, analyzing, summarizing and reporting the costs incurred by a business on products or services. The aim of the cost accounting is to manage direct and indirect costs linked to products and services so as to maximize profits and maintain market competitiveness. Detailed cost information is provided in Cost accounting and it is the duty of the management to use cost data to plan for the future improvement and expansion. Cost Accounting comes under the field of accounting and deals with the analysis of the fixed and variable costs incurred by the organization for products and services.

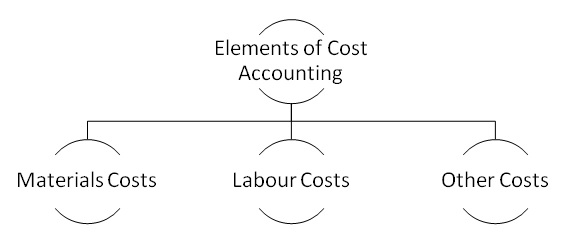

Elements of Cost Accounting: All businesses will have incurred cost elements falling under three categories namely Materials, Labor and Other Costs. Each of these is further broken down into sub-elements which include Direct and indirect costs associated with the particular element. Direct costs can allow the businesses to determine precise Direct element costs. On the other hand, indirect cost tends to fluctuate and cannot be defined and may vary depending on various reasons.

Material Costs: The majority of costs incurred by a business involve the procurement of raw materials used in the manufacturing process. For products, materials fall under the category of raw materials and resources whereas for services materials involve tools, equipment and time invested in education and learning a skill. Materials constitute the majority of costs incurred by a business for products and services and have a direct influence on the products or services costs. As per our cost accounting assignment help experts, they can be further broken down into sub-categories falling under material costs each catering to a unique form of the material cost incurred by a business. Good Cost Accounting Assignment Help Online services should be able to review the product and services to determine precise costs. Total Assignment help has a team of Cost accounting professionals who review the assignment to determine precise costs which must be addressed in each assignment. Below are some common forms of material costs taken into consideration while preparing your cost accounting assignments:

Raw materials and semi-finished products costs: Material constitutes to the majority of costs incurred during the manufacturing process but these materials also fall into two categories namely raw materials and semi furnished materials. The raw materials include basic materials needed for the production process without which the business cannot manufacture the product. Semi furnished materials include the materials required by the business to enhance or improve the raw materials quality before the manufacturing process. To demonstrate the difference, we will review the building and construction industry in which cement, gravel, and sand are basic requirements for mortar production but semi-finished products and cleansers like concrete waterproofing solution and power lime are also required to enhance the mortars quality. Cost accounting assignment help experts states that the waterproofing agent is not a necessity but enhances the raw material quality thus falls under the semi-finished product costs.

Fuel and energy costs: Most businesses depend on vehicles to transport the raw materials and finished products to the manufacturing unit as well as to the market. In addition to the transportation cost, many businesses also incur power back up fuel and energy costs to ensure continued production despite power outages. They also require transporting managers, supervisors and staff to and from raw material sites which all contribute to material costs.

Packaging costs: Packaging is a basic requirement for materials in both their raw state as well as a finished product. The most prominent and costly form of packaging is for finished products on which the business requires to involve graphic designers, quality control, and the sales and marketing teams to improve the products impression in the market. As claimed by cost accounting assignment help expert’s, the packaging also falls under the material costs since it involves the purchase of packaging materials which are specially designed to attract consumer attention towards the finished product.

Spare parts costs: The material collection, transportation, sorting, grading, processing, storage, and distribution all require mechanized equipment and tools. As equipment and tools operate they gradually degrade and likely to break down or fail which requires for the equipment and machinery to be repaired and damaged parts replaced. This makes spare parts a basic requirement for all businesses despite their operations since spare parts, repairs and maintenance costs are inevitable and the business will surely incur such expenses which fall under material costs.

Building materials costs:Each business has a set growth and development goal but this is not limited to only securing more orders, clients, and sales. It also involves expanding the businesses infrastructure. This makes it imperative for the business to invest in building materials to expand the infrastructure so as to cater to the expanding market needs. Building materials therefore also fall under material costs which are an important requirement business must cater to while preparing their development plans as claimed by cost accounting assignment help specialist.

Labor Costs: Labor is the second most costly expense incurred by a business during the manufacturing and service delivery process. This makes it imperative for labor costs to be managed effectively so as to reduce the costs incurred during manufacturing or service delivery. This is done in two main ways namely through automation and via maximizing labor productivity and performance. Labor contributes an important part in business performance thus labor costs must be understood in detail. Below are labor costs which Total Assignment Help experts take into consideration while preparing cost accounting assignment help. This cost applies to most businesses and have been discussed below in detail.

Basic Salaries: Each employee’s salary is broken down into different categories catering to different needs. The first category is the basic allowance offered to the employee for their services. The basic salary does not include human resource management, transportation, incentives or insurance coverage among other benefits.

HRA: This includes the payment for additional benefits that the employee can avail in case of accident or injury while working for the organization. HRA facilities cover benefits like insurance (health, dental, vision, life etc.), disability income protection, retirement benefits, daycare, tuition reimbursement, sick leave, vacation (paid and non-paid), funding of education, as well as flexible and alternative work arrangements. All these benefits fall under the labor cost umbrella and must, therefore, be included in the labor costs

Transportation: The demand for labor is increasing globally making it important for businesses to offer additional facilities to its staff so as to reduce employee turnover. To facilitate employee needs and keep them comfortable and happy, many businesses also offer transportation facilities and allowance to the employee’s salary packages. This delivers more benefits to the employees and also increases the staff’s salary packages which help improve the businesses operations and overall performance. It also helps reduce employee turnover rates which also contribute towards increasing business costs.

Incentives: Motivation plays an important role towards boosting employee focus and morale towards their work. Studies show that offering leave and allocating financial benefits as incentives have a direct effect on how employees perceive their work. Many well-established businesses, therefore, offer their employees incentives above their monthly salary. As per our cost accounting assignment help experts, it helps build their moral and focus towards working and allows them to be more productive and focused towards their work.

Leave: Each nations labor act has a defined number of leaves which are compulsory to issue to the staff and which must be paid for. When and if employees volunteer to work on those days they are also required to receive additional payment for the attendance. This leave costs also falls under the labor costs with additional over time and incentives falling into the indirect labor costs.

Housing and security: Certain businesses will also require offering housing to its staff and this is especially true for organizations which work in remote locations. In such a situation the housing costs are included in the HRA or the organization constructs housing quarters, which will be used by the organization's staff. Costs incurred to construct, pay rent or maintained the housing and security facilities also fall under the labor costs.

Food and Entertainment: Similar to housing and security, businesses may also need to provide the staff with food and entertainment. Again, if a staff member brings their own food the funds for food can be redirected to the allowances section of the salary break down. With regard to entertainment, many businesses will reward their employees for the hard work and good performance once or twice a year. Entertainment costs are borne directly by the organization and staff can access the entertainment if desired. This facility is not cashable and employees who do not participate in the entertainment do not receive any financial compensation for entertainment. As per our cost accounting assignment help experts, Entertainment is a direct labor management cost borne by the businesses and non-refundable.

Other Costs: Other Experiences refers to expenses which do have an effect on the production and service delivery costs but which are not fixed and may vary. It is important to understand these should not be confused for variable costs since the other expenses include cost necessary for production and service delivery but for which costs are not fixed. Cost such as electricity tends to fluctuate from season to season for every business making it a definite cost but one which will fluctuate from month to month depending on the season. It is also not possible to store the utility for future use thus resulting in it falling under other costs. Other costs incurred by businesses include Equipment depreciation, inflation, insurance, utilities, and maintenance. Each of these is inevitable for the business to incur but the duration, time and costs incurred cannot be predicted thus categorizing these expenses under other costs.

Cost accounting plays a crucial role towards any businesses growth and development making it an important topic for business students. Simply claiming to be good at a subject doesn’t really mean I am competent to do the cost accounting assignment questions. With 100% dedication towards the delivery of high-quality assignments we believe showing our capabilities to be more important. Our understanding of the topic improves the student’s ability to score high grades, so we aspire to demonstrate our skills rather than tell you about us. We believe a good brand sells itself, thus focus more attention towards demonstrating what a Cost Accounting Assignment Help Online service should deliver so as to win your confidence.

Getting Cost Accounting Assignment Help Online can be a tricky task especially for students who are new to the subject. Review the service providers reputation as well as their command over the subject before placing your order. For more details on Cost Accounting Assignment Help contact Total Assignment help Today.

Answer: In accounting, cost accounting is a vital part of the study. It handles different operating

costs of several commodities. However, completing a cost accounting assignment perfectly is

difficult for students. There are numerous reasons creating hurdles for students writing

assignments. The importance of cost accounting assignment help can be judged on the following

reasons:

Helps in gaining adequate knowledge about the subject

Helps in learning research skills

Helps in gaining writing skills

Clears concepts and theories related to the subject

Helps in understanding different referencing formats, such as APA, Chicago, Harvard,

MLA, AGLC, and many more

Helps in submitting plagiarism-free work

Helps in gaining good grades

Helps save time that can be utilized in other academic activities

Helps in maintaining a balance between study and personal time

Helps in gaining mental peace

The importance of cost accounting assignment help is recognized by several students when they

are asked to write theoretical assignments dealing with complex economic theories. At

TotalAssignment.com, students can get the ultimate solution to all cost accounting problems.

Our writers extend all types of accounting help.

You can get cost accounting assignment help in Australia from TotalAssignment.com

on all accounting topics. Many students fear mathematics, and when they get assignments

related to finance and accounting, they look for help. Our cost accounting writers can help such

students by effectively resolving their assignment-related problems. Our cost accounting writers

have addressed the following topics:

Risk and market analysis

Offshore operations

Budget analysis

Forecasting and projection

Target costing and pricing

Incentive compensation

Strategy making, execution and monitoring

Performance management

Cost measurement and cost control

Business process reengineering

Job costing

Throughput accounting

Tools for planning and control

Cost volume profit analysis

Activity-based costing

Master budgeting and responsibility accounting

Management control systems

Flexible budgeting and variance analysis

Life cycle costing

Pricing decisions

Inventory costing, management and capacity analysis

Cost allocation and revenues

Revenues and sales variances

Cost information for decision making

Do not stress yourself by reading the list of topics presented above; just connect with our chat

executives. They will note down the details and connect you with the best writers. In addition,

you can demand cost accounting assignment help in Australia from us on any topic.

Our professional writers write well-researched assignments on all types of cost

accounting. Let us know the type of cost accounting help you are looking for so writers can

extend their cost accounting assignment help online.

Standard cost accounting: In standard cost accounting, the cost of production is accounted for

by allotting overhead costs to the commodities. It allots fixed manufacturing costs to some

particular commodities. The idea behind this technique is to streamline the activity of allotting

costs and recognize areas requiring more resources.

Activity-based costing: In activity-based costing (ABC), the overhead costs are allocated to each

activity. After the costs have been allocated for each activity, costs can be allocated to the cost

objects using those activities. It is useful for reducing overhead costs.

Lean accounting: The application of lean principles, such as concentrating on delivering value to

the consumers and attempting waste removal to control financial transactions and processes, is

known as lean accounting. It helps align an organization's operational accounting activities with

its strategic goals.

Marginal costing: In accounting, marginal costing refers to an increase or decrease in the overall

cost of production because of a change in the number of desired outputs. It helps management

to make decisions related to assigning resources, production optimization, controlling

manufacturing costs, planning budgets, etc. For more information, refer to our cost accounting

assignment help online service.

According to the definition of cost accounting, it is a form of managerial accounting

whose objective is to record an organization’s complete cost of production by analyzing the

variable cost involved in the production process and the fixed costs. Rent, interest on loans,

depreciation and lease expenses are examples of cost accounting. Cost accounting helps to make

better decisions related to finances, budgets, expenses, etc., for an organization. It is the process

of ascertaining and controlling costs that arise by following the expenses and revenues or the

rules on which they are calculated. It ends with an assortment of periodical statements.

As per the definition of cost accounting, it is a quantitative method helping in gathering,

describing, summarizing and translating data for operation planning, costing, decision making

and controlling. It is generally the overall cost for an organization that helps to make sense of

where the organization is spending its money and how it can manage profits in the future.

At TotalAssignment.com, students can get the best cost accounting experts at nominal

rates. Cost accounting is considered one of the toughest areas of accounting, and assignments

related to it give nightmares to students. Can you do my cost accounting assignment at a

nominal rate Having us as your cost accounting helpers, you will never have to think about

rates. We have skilled and talented cost accounting writers extending their services at affordable

rates. They can instantly solve all accounting-related problems and queries of the students.

Our writers guarantee the best quality within the deadline when you ask to do my cost

accounting assignment at a nominal rate. The assignment solutions are easy to understand and

in detail, which helps students to grasp the content. You can chat with our executives to

understand how we price each assignment. If you want to know the accurate price of an

assignment, you need to contact the subject matter expert on our website. The price of the

assignments can be further reduced by applying discounts, offers, bonuses, etc.