Understanding the significance of the BCG matrix in business studies

The Boston Consulting Group in 1968 developed the BCG matrix to understand the growth-share matrix. The BCG matrix is an extremely successful tool for explaining an organization’s growth share. Allan Zakon, BCG’s CEO, and his colleagues designed the growth-share matrix. The founder of BCG addressed the effectiveness of the matrix and its usefulness, Bruce Henderson, in an essay in 1970, which led to its popularity.

Nearly all big organizations across different industries use the BCG matrix, and it is found that nearly all top 500 companies listed on the Fortune implement this matrix for business portfolio and resource management.

Do you know what makes the BCG matrix so effective? How to interpret it, and what are its characteristics? The blog will answer all your queries with detailed explanations and organizational examples.

Explaining BCG matrix

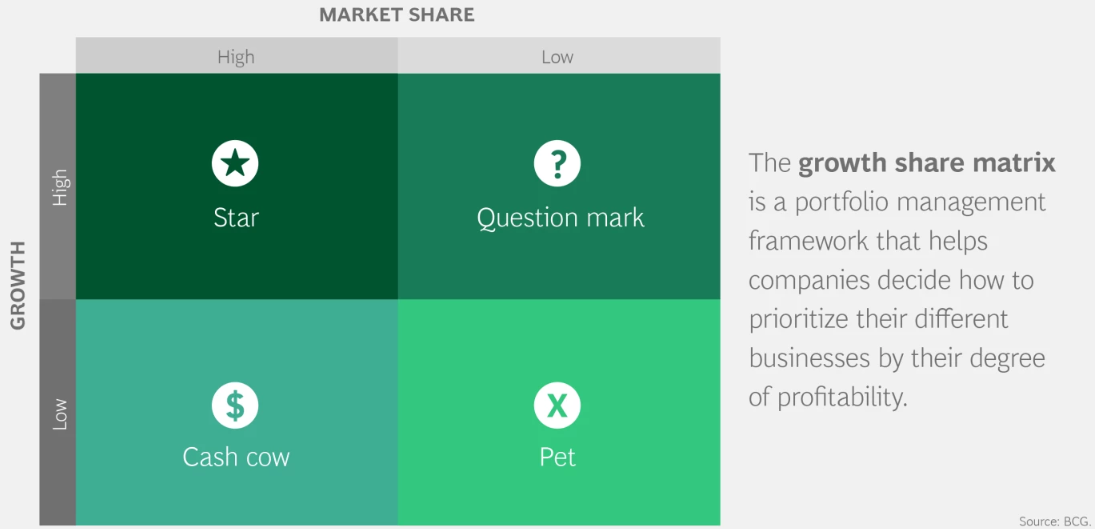

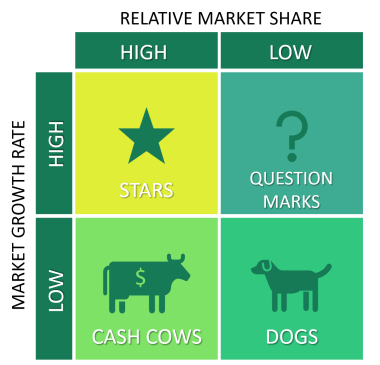

By definition, the BCG matrix is a high-powered framework for business portfolio management. Businesses can utilize the matrix to determine what is working and what is going against them. The things going against them can be reprioritized by making better decisions through investments and subsidiaries. One can gain crucial information by applying the BCG matrix about an investment, product/service, performance in the market, competitive position, etc. Basis the information, individuals can make better resource allocation, ROI, and strategies. The image below is a representation of the BCG matrix.

It can be seen that the matrix is split into four quadrants and has two referential axes. Market share is represented on the horizontal axis, and growth is indicated on the vertical axis.

- Cash cows indicate businesses with low growth and high market share. It is suggested by the Boston Consulting Group that businesses must milk these cash cows for money.

- Stars indicate business portfolios with high growth and high market share. According to the Group, these have immense prospects and are the business’s flagships.

- Question marks indicate subsidiaries with high growth rates and low market share. Their performance is not guaranteed, and the low market share and high competition can damage their growth. It is up to the business management to invest further or leave the question marks.

- Dogs indicate businesses with low market share and low growth. Such businesses deplete resources with no added returns. As per the BCG matrix, the businesses must divest, reposition, or liquidate such investments.

Elements of BCG matrix

We have already provided an overview of the quadrants of the BCG matrix; now, let us explain in detail each of them. Each has unique features, which will be discussed in this section.

Question marks: Products or services growing fast in the market are represented as question marks. But they are neither market leaders nor possess a large share. Application of correct strategies can help get over the competitors and hold a large share of the market. To do that, the business must invest greatly in its resources. Question marks are identical to wild cards; the business may determine whether to exploit or reject the high growth. In case the business chooses to invest, it must aim to take advantage of the high growth and seize major market share. Apple’s Apple TV and Google’s Drive and Workspace are good examples of this quadrant.

Pets: Products neither growing nor above the competition fall into the pet quadrant. They do not bring about much money, and if not looked after, can finish off resources without giving much return. They can lead to losses, so they must be given up quickly. Reduced market share and growth indicate lower profits, which reflects poor quality, high prices, and poor marketing.

Stars: Flagship products with large market share and continuous growth fall into the star quadrant. If the high market share is not maintained, it can become cash cows once the growth slows. Advancing through the competition in all aspects is vital and requires huge investments. Due to the high demand and rising popularity, the flagship product manufacturers have become market leaders. Maximum profits can be generated in this position, but it also requires heavy investments. To remain ahead of the competition, stars need strong support and resources.

Cash cows: Products with a large market share but a saturated market fall into the cash cows quadrant. The products have gone past the competition and delivered huge cash flows. Having a slow market, cash cows handle the most of it and create strong returns. They produce money in bulk as they become the kings of the market. Having a stable market, no major investments are required in this position. Cash flows are strong as profit margins are high. But, innovation is vital to continue huge market share.

Remember that the BCG matrix can only prescribe, not foretell. It informs businesses of the decisions to be taken, where to invest, divest, etc. However, it does not inform them about what might occur. The matrix is inconsiderate towards any swift market changes or major disruptions.

Interpretation of the BCG matrix

The concept and logic behind the matrix are clear: businesses that are market leaders have more returns. They enjoy huge market share and have a competitive advantage over their rivals, leading to high growth potential. The two key indicators of competitiveness and market attractiveness are relative market share and the growth rate.

Competitiveness: Business competitiveness is the capability of a business to produce more profits compared to its arch-rivals in the market.

Market attractiveness: It is the extent to which a market provides chances for a business to generate profit and maintain itself. The factor is considered contingent on total market share, competition, and growth rate.

Businesses or products that hold huge market share before slowing growth turn into cash cows. To achieve this, it must give higher quality-to-cost rations than its competitors. It can change into a cash cow if it can hold a bigger market share before slowing down.

Practically, growth in any sector will certainly slow down if the market saturates. Companies should set their sights on turning their questions and stars into cash cows. Cash cows’ money can change the question marks into stars and, thus, newer cash cows.

Steps to make a BCG matrix

To produce an accurate BCG matrix to ascertain the growth and share in the market, a company needs to conduct careful market research and analyze its products, services, subsidiaries, etc. What is the performance of the product? How is it positioned in the competition? How does the consumer perceive it?

By getting answers to all such questions, the company can begin the work on using the matrix in the following steps.

- Select a product: Select the product or service to be examined.

- Comprehend the market minutely: The biggest competitors, the factors impacting the growth, market size, trends, nature of consumers, economics, market features, etc., all these market features are crucial. Deep market analysis is extremely crucial to work out the BCG matrix. If the markets are incorrectly defined, it may lead to incorrect results.

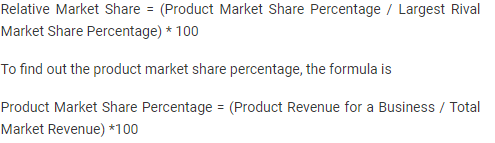

- Discover the relative market share: A company needs to conduct a market analysis if it wants to know a product’s share compared to rivals. Market share relative to the biggest competitor can be represented through a formula.

- Compute the market growth rate: The equation below can determine a company’s growth rate.

- Utilize data to put the product/service in the matrix: Many free online BCG matrix templates can be used to classify and place the products. A few of them can be found at TotalAssignment.com.

Applying the BCG matrix in the real world

BCG matrix is handy for a company that wants to take stock and reorganize its business structure. Thorough market research and evaluation of each item discloses the position of each related to others and rivals. The matrix helps to divide, prioritize, and make the best decisions. Look at the BCG matrix application by company giants Apple, Coca-Cola, Google, and Pepsi.

- When innovation and diversification are the focus, companies enhance investments in question marks and stars. It can grow the market share, assist new opportunities, and defeat competitors.

- At the time of a cash crisis, cash cows can provide rescue. Less effort is required to maintain the cash cows, but arrogance is a huge no-no. Any disruption and instant changes in the trend can emerge at any period.

Companies minimize investments in products that have been performing well for many years and have become market leaders. Examples of such companies are the primary soft drinks of Coca-Cola and the iPhone of Apple.

- Divesting money from pets and utilizing it at different places is a perfect strategy during a cash crisis.

- A company focuses on question marks if it is confident about a product and its opportunities. Putting money into such products leads to new tactics and strategies, more resources and development and marketing expenses, direct costs, heavy resource usage, etc.

- Concentrating on stars can increase cash flow and seize huge market share. However, increased investments and innovations are required to defeat competitors.

- BCG matrix recommends a better method to invest and divert. It can aid businesses in saving time, resources, and money. In these competitive and unstable times, the tool can be used differently for different businesses.

The dynamic nature of the markets and ever-changing consumer preferences make companies apply the BCG matrix. A company must conduct deep market research and revise its BCG matrices regularly.

Advantages and disadvantages of the matrix

Advantages:

- Simple and instinctive

- Permits swift screening of the ideal investment opportunities

- Assists in comprehending the largest and smallest sources of cash flow

- Determines comparative portfolio analysis

- A system of effective resource allocation

Disadvantages:

- Costs are not accounted

- Categories only based on market growth rate and relative market share

- Do not think about disruptions and market changes

- Incapable of telling about success or profitability

- Disregard relations and brand synergy

- Only considers fast-growing competitors and leaves the smaller one

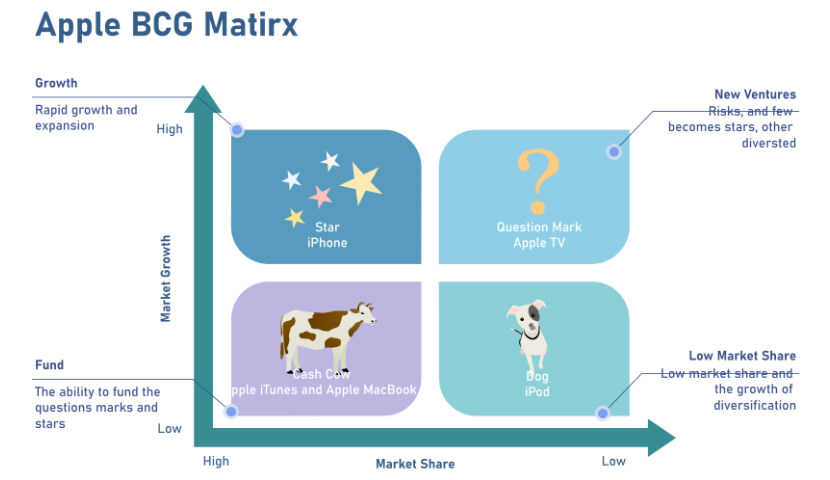

Considering tech giants Apple and Google to determine their growth with the aid of the BCG matrix

In this blog section, we have considered two tech giants, Apple and Google, to understand their usage of the BCG matrix.

Apple:

Star: The flagship of Apple is its iPhone, a rising star. The demand for the product is high among the elite and the rich, and there is no competition for the iPhone in this category. However, the luxury phone category is quite specific, and Samsung regularly develops its products to compete with Apple.

Cash cows: The successor of the Apple Computer, the Apple MacBook is widely recognized and has great sales. In the laptop market, it is considered a leader.

Question marks: There are major competitors in the digital appliances field, including the television. The Apple TV is not recognized as a market leader; it has fewer buyers, and Google Chromecast and Amazon’s Fire Stick are quite competitive in this area.

Pets: In the fiscal year 2022, the iPad, once a popular device, ranked lower compared to 2021. The tablet industry has steadily declined even before the advent of coronavirus in 2020.

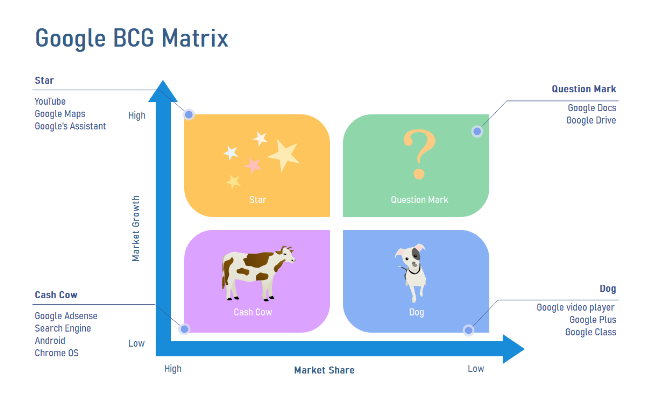

Google:

Cash cows: Android OS, Google Search, Google Advertising, and Google Chrome control their specific markets. Most of the market share has been consumed by these products of Google, which has driven them to a saturation point. If the products fail, Google Search will keep it as one of the top tech companies.

Stars: YouTube was so far a cash cow and a leader in the online streaming market; however, the advent of Netflix, Disney+, Amazon Prime, etc., increased competition and opportunities for such services. Though the competition has increased, YouTube remains the leader in this industry. Google Assistant is trying to compete with Amazon’s Alexa, Microsoft’s Cortana, and Apple’s Siri.

Question marks: In the digital workspace, Google Drive and Workspace enjoy the growing market’s benefits. However, Slack, Zoom, Dropbox, and Microsoft 365 hold a major market share.

Pets: Google introduced certain new products that did not take off, like Google Plus, Google Video Player, and Google Glass. To give competition to Facebook, Google + was developed, but it led to many questioning the strategies of the tech company.

Wrapping up

We hope that the blog was informative and interesting at the same time for our users who are quite new to the framework of the BCG matrix. You can check our sample BCG matrix for other big companies, such as Coca-Cola, Starbucks, Hyundai, General Motors, etc., on our website. The samples can be read and used for free, and in case you are looking for additional help, you can contact our subject matter experts.

Frequently asked questions

What does the BCG matrix represent?

BCG matrix represents business planning and prescriptive portfolio management techniques.

How does the BCG matrix help startups?

The matrix can help the investors of the startups to ascertain the areas for investment and disinvestment.

What is the market growth rate in the BCG matrix?

The market growth rate showcases the percentage of market growth in a particular period.

Total Assignment Help

Incase, you are looking for an opportunity to work from home and earn big money. TotalAssignmenthelp Affiliate program is the best choice for you.

Do visit :https://www.totalassignment.com/affiliate-program for more details

Total Assignment help is an assignment help Online service available in 9 countries. Our local operations span across Australia, US, UK, South east Asia and the Middle East. With extensive experience in academic writing, Total assignment help has a strong track record delivering quality writing at a nominal price that meet the unique needs of students in our local markets.

We have specialized network of highly trained writers, who can provide best possible assignment help solution for all your needs. Next time you are looking for assignment help, make sure to give us a try.