Student loans are available to those students who are planning to study abroad or overseas. In these past years, there is an increase in the number of students going for higher education abroad as well as the number of students taking an international educational loan to cover study expenses. So there are a lot of factors to consider before you take an international study loan.

The first thing you have to do is decide to which college you want to go and then do full research about it like the course fees and tuition fees of the college, the courses it offers, the cost of living in that location, getting a visa for that location, etc. The next thing to do is research about international study loans as the cost of living and other educational expenses are very high in foreign countries.

So it is very important to identify the loans and understand the terms and conditions linked to each one. There are many great countries to study like Australia, USA, Singapore, UK, etc. This article, we are going to focus on the Country of Kangaroos and beaches, Australia and how the vast majority of over 600,000 international students from more than 200-countries secure international student loan. International loans play an important role in enhancing the student’s educational experience but it’s important to manage the loans carefully to ensure they are replayed on a timely basis. Failing to manage international student loans can result in negatively affecting the student’s job prospects in future. A common challenge faced by International students getting jobs in Australia is a poor credit score. This occurs due to students failing to repay their student loans on time leading to long term credit score challenges which affect their reputation and ability to secure jobs.

Subscribe our YouTube channel for more related videos

Many students choose Australia to pursue a career or continue their higher studies due to the number of recognized universities, schools and colleges it has. Due to the increase in tuition fees, fluctuation of exchange rates and other living expenses, you may have to think of getting an international student loan. Australia International student loan can help higher education for foreign enrolled students.

This article will guide you about international study loan in Australia and how to get one.

Eligibility criteria to get an international study loan in Australia

There are some things to take care of to be eligible for an international student loan in Australia.

- Having a high school diploma or equivalent.

- The student has to be a citizen or an eligible non-citizen.

- Secured admission in one of the bank’s list approved universities.

- Financially strong so that the loan is repaid within the time.

- Australian Visa.

- Strong academic record.

- Must be above 18 years old otherwise your parents have to avail the loan.

- For graduation, the courses you choose should be job oriented because banks prefer courses that are job oriented.

- For post graduation courses like MBA, MCA, MS and other diplomas also which could be from foreign universities approved by central and state government.

- You have to provide security to the bank like public sector bonds or government securities, land or building, bank deposit in the name of parent or student or any other person with suitable margin.

- For, getting a loan from the university, the student has to be a full-time, the student has to proof his financial background, and the student has to clear all previous dues before applying for a loan.

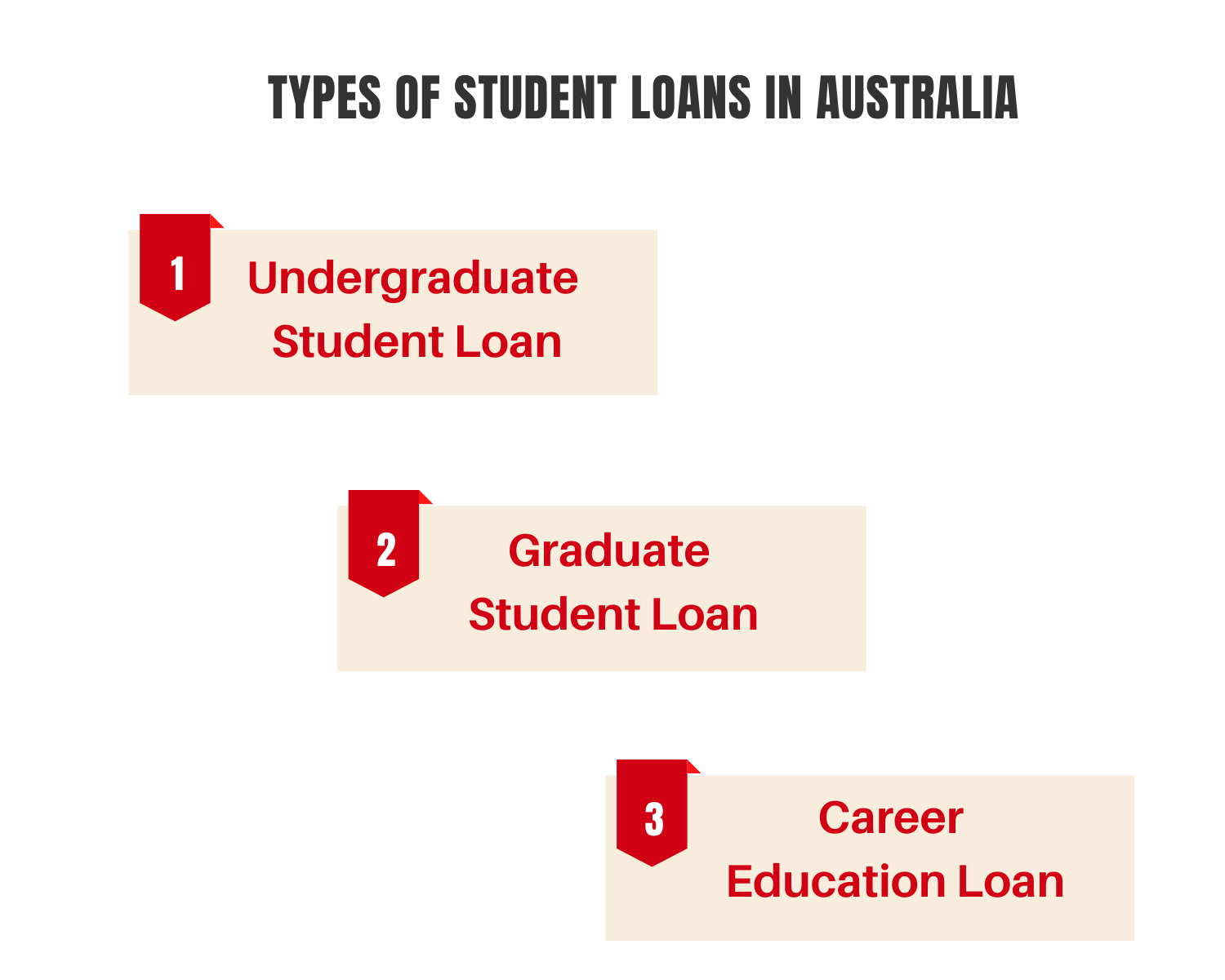

The types of educational loans available in Australia for a student

There are three types of educational loans for students in Australia depending upon the education eligibility.

- Undergraduate Student Loans –

These types of loans are for students who have finished their higher education and wanted to take an undergraduate course or diploma course to increase their opportunities in job fields. - Professional or graduate student loans –

These types of loans are available for those students who have a graduate degree want to pursue a higher degree at universities and colleges in Australia. This requires an undergraduate degree for the student to be eligible to apply for the loan. - Career education loan –

Students who want to pursue undergraduate career programs at trading and technical colleges in Australia can apply for these loans. The student must have high school equivalent degree.

Student loan plans offered by some top private banks

Numerous banks in Australia offer international student loan in Australia. To choose the right bank, the student has to take care of many things like interest rate, comparison rate, and fees. Some of the top private banks that offer international student loan in Australia are mentioned below.

- RateSetter –

It is a private bank that offers low rates for borrowers with good credit. The bank has an interest rate of 8.42% per annum; the comparison rate is 10.97% per annum based on $10,000 over three years with an application fee of $220 upfront and $5.00/ month. This is an unsecured personal loan. - Harmony –

This privately owned bank provides an unsecured personal loan up to $70,000 providing a very fast and easy online process. The good thing about the bank is that it doesn’t have any hidden fees or early repayment penalties. The bank has an interest rate of 6.99% to 26.95% per annum with a comparison rate of 7.69% to 28.21% per annum based on $30,000 over five years and has an application fee of $500 upfront and $0.00/ month. - HSBC –

The bank can provide unsecured personal loans starting from $5000 to $50,000 and has fixed monthly repayment terms. The bank has an interest rate of 9.50% to 15.99% per annum whereas the comparison rate is 10.06% per annum to 16.53% per annum based on $30,000 over five years with an application fee of $150 upfront and $5/ month. - ANZ unsecured personal loan –

The bank provides fixed personal loans up to $50,000 with terms from 1 to 7 years with a 60sec response time. The bank has an interest rate of 10.99% per annum with a comparison rate of 11.87% per annum based on $30,000 over five years and an application fees of $150 upfront and $10/ month. - Moneyplace –

Their service is 100% online with no hidden and monthly fees and providing some customers with $0 establishment fees. The bank has an interest rate of 7.65% to 21.00% per annum with a comparison rate of 7.65% to 23.5% based on $30,000 over five years with $0 application fees both upfront and monthly. - CUA Life rich banking –

The bank has $0 establishment fees for a limited time with conditions. It has no penalties for early payments or extra repayments and no monthly fees. The bank has a 10.89% per annum interest rate and 10.89% per annum comparison rate based on $30,000 over five years with $0 application fees.

Universities that offer international student loan in Australia

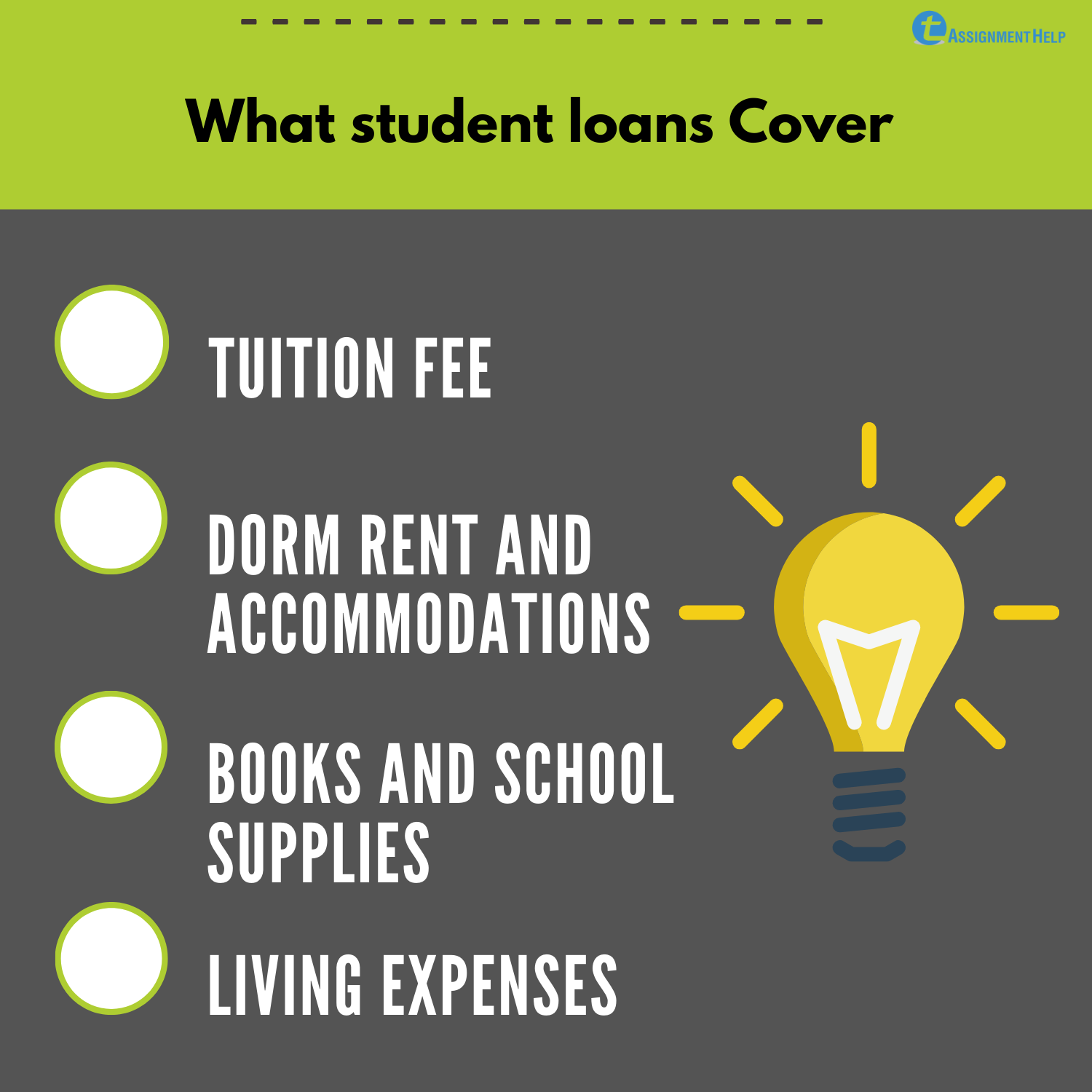

Many universities offer international student loan in Australia. The international student loan covers:

- Tuition.

- Room and board.

- Books and supplies.

- Living expenses.

The colleges or universities eligible for an international student loan are:

- Australian Catholic University.

- Australian National University.

- Avondale College.

- Bond University.

- Brisbane Institute of TAFE.

- Central Queensland University.

- Charles Sturt University.

- Curtin University of Technology.

- Deakin University.

- Flinders University of South Australia.

- Griffith University.

- James Cook University.

- La Trobe University

- MaxQuarie University.

- Monash University.

- Murdoch University.

- Royal Melbourne Institute of Technology.

- University of Melbourne.

- University of New South Wales.

- University of Newcastle.

- University of Queensland.

- University of Sydney.

- University of Tasmania.

- University of Tasmania.

- University of Tasmania.

- University of Western Sydney-Nepean.

- University of Wollongong.

These are the top colleges among all the colleges that international student loan:

- The University of Queensland –

The university has two types of Stafford loans to offer to students.- Subsidised Stafford Loans –

This loan is only for undergraduate students. To avail this loan the student must be studying at least half-time during the grace period and an authorized period of deferment. The repayment of the loan starts after six months of graduation or if you withdraw from study or if you drop below half-time enrolment. - Unsubsidised Stafford Loans –

This loan is available to all eligible students not based on financial need. In this type of loan, the student has to pay interests during all periods that start from the first disbursement. Repayments can be done by paying minimum monthly payment with interest while in school or paying when you enter the repayment period at which point interest is capitalized and may increase your monthly amounts for repayments.

Loan Limits- a dependent undergraduate student will receive an aggregate loan limit of $31,000 for per year whereas the independent undergraduate students will receive an aggregate loan limit of $57,000 per year. The graduate and professional students will receive an aggregate loan limit of $138,500 per year.

- Grad PLUS –

This loan is for graduate students that requires an eligible co-signer. The borrower is required to pass a credit check. The school first checks the eligibility of the student for the maximum loan amount. Repayment starts after six months of graduation or if the student drops or if the student drops below half-time enrolment. - Parent PLUS –

If a student is an undergraduate then he/she is dependent on parents, so this allows parents to take loans for the educational expenses of their undergraduate student.

Loan limits- for PLUS plans there are no aggregate loan limits, but the maximum PLUS loan amount you can borrow is the cost of attendance minus other financial help received such scholarships.

- Subsidised Stafford Loans –

- Murdoch University –

Murdoch University participates in financial aid programs of governments in other countries. Students of some specific countries like USA, Canada, Germany, Norway, Sweden, and Denmark can avail the international student loan. Students who are citizens of USA can take the help of programs like William D. Ford Direct Loans and U.S Department of Veteran Affair Loans. Canadian students can apply for Canadian student Loans or Grants.- William D. Ford Direct Loans –

It offers US citizens different types of loan programs like Direct Subsidised Loan, Direct Unsubsidised Loan, and Direct PLUS loan. - Canadian Student Loan –

It is available to students through either CSLP (Canada student loan program) or programs operated by territorial governments.

Other than this, Murdoch University also offers various kinds of scholarships categorized by discipline, undergraduate, honors, postgraduate, international, and study abroad.

- William D. Ford Direct Loans –

- The University of Melbourne –

The university considers the cases where financial conditions of the student are not good and might affect the student in participating in courses further. The university currently offers two types of loans- Short term loans –

It lets the student with short-term cash problems to borrow up to $10,000 for six months maximum. Repayments have to be done within November of the current year depending on the circumstances of the student. Appropriate terms are set by the advisor when the loan is approved. Students generally avail these loans to cover expenses such as rent in advance, winter fuel bills, accommodation costs, etc. There is no interest charged in this loan, and no guarantor is required. - Long-term loans –

A maximum of $5000 of long-term loans is available for newly recruited students to help with unexpected costs and study-related expenses. Other than students who are on leave or absence, all currently enrolled students of the University of Melbourne are eligible to avail this loan. Loans provided by the University of Melbourne are interest-free.

The loans provided by the University of Melbourne are for different purposes of the student like for basic living and study costs or cars because sometimes the student lives in places where public transport is not available or some other reason due to which student can’t use public transport, or even for travel.

- Short term loans –

- The University of Western Australia –

The university provides a loan to its eligible students through 4 schemes.- General purpose loan (Australian or International guarantor) –

The university provides loans up to $4,000 in an academic year, and for the full current course of study, it provides $8,000. Its purpose is to provide for students’ expenses such educational expenses or living costs. Repayments are started after two months of loan approval by paying $100 per month. The remaining amount on loans up to $4000 are to be paid within one year of cessation of the current course, and on loans up to $8,000, the remaining is to be paid within two years of cessation. - Emergency Australian Student loan (no guarantor) –

The loan amount provided by the university is up to $1,500. The purpose of this loan is to meet the students’ unexpected emergencies. Repayments for the first $500 are to be done within six months, and the remaining amount is to be cleared within one year by the agreed schedule for repayments. No interest is charged in this case until the student fails to pay the loan and an interest of 12% per annum will be charged until the amount is paid. - Short-term international student loan (no guarantor) –

An amount up to $1,500 is available for a student applying for this loan. This is available to international students to cover their urgent and unforeseen expenses. Repayment date starts after four weeks of the date of loan approval and has to be paid within two months. The loan is interest-free, but if not cleared in provided time, interest will increase at 2.5% per month. - Overseas study loan (Australian or International guarantor) –

The university provides up to the maximum of an equivalent OS-HELP loan and $12,000 in total for the whole course. If the duration of a course is greater than one semester, then the loan amount may increase. The purpose is to provide loans to the students who are not eligible for OS-HELP loan or where OS-HELP loan is unavailable. Repayments are to be done with a minimum of $100 per month immediately after completion of study period at overseas. The loan is interest-free during the study of current course. After the completion of the course, an interest of 12% will incur in the remaining amount.

These colleges and their schemes will help you in getting an international student loan Australia.

- General purpose loan (Australian or International guarantor) –

Repayment of the international student loan in Australia

The repayments have different methods and guidelines for different schemes. The most common repayment scheme for short-term loans is to pay within two months after loan approval date and for long terms the amount is to be paid after six months of commencement of loan with no interest if the loan is paid within the study of current course and after that, interest is added. The interest rate depends on the type of loan and the university or government providing it.

The repayment modes can include cash, check, draft, and online payment. The loans can be paid either monthly or quarterly in some schemes. Unlike university loans, bank loans can be started paying after completion of the course or even after one or two years of completion of course. Some banks don’t allow early payments and include penalties for early payment.

So this was all regarding availing an international student loan Australia, the process is complicated so choose wisely before applying for a loan using a respective scheme.